Professional Documents

Culture Documents

Documentation Export TBSL

Documentation Export TBSL

Uploaded by

vinayCopyright:

Available Formats

You might also like

- Shipper' S Letter of InstructionsDocument4 pagesShipper' S Letter of Instructionsmanvendra singhNo ratings yet

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- ScrewsDocument35 pagesScrewsRodel Marata100% (3)

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- PMDC Indexed JournalsDocument2 pagesPMDC Indexed JournalsOmair Riaz100% (1)

- FinalDocument1 pageFinalvinovionNo ratings yet

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikNo ratings yet

- Documents For ExportDocument26 pagesDocuments For Exportnatrajang100% (1)

- Adittional Info:-: in Short:-In Above Both Payment Term, Bank Intervention Requires in Documents ProcessDocument2 pagesAdittional Info:-: in Short:-In Above Both Payment Term, Bank Intervention Requires in Documents Processsanraaj66No ratings yet

- EOU Write UpDocument5 pagesEOU Write Upsrajan7309No ratings yet

- CEPT-Form DDocument10 pagesCEPT-Form DHery MulyanaNo ratings yet

- Export DocumentationDocument54 pagesExport DocumentationmaninderwazirNo ratings yet

- CHB ImportDocument3 pagesCHB ImportShivaji DadgeNo ratings yet

- UD Service: Utilization DeclarationDocument7 pagesUD Service: Utilization DeclarationFaruk AhmedNo ratings yet

- Certificates of Origin (Non-Preferential) - GuidelinesDocument4 pagesCertificates of Origin (Non-Preferential) - GuidelinessrinivaskirankumarNo ratings yet

- Week 2 - Costome ProcessDocument8 pagesWeek 2 - Costome Processreme moNo ratings yet

- Revised OCP Form EDocument11 pagesRevised OCP Form EDio MaulanaNo ratings yet

- FinalDocument14 pagesFinalnitishNo ratings yet

- Import DocumentDocument11 pagesImport DocumentChristopher BrowningNo ratings yet

- Export Documentation: Dr. Anuj Sharma Bimtech Greater NoidaDocument50 pagesExport Documentation: Dr. Anuj Sharma Bimtech Greater NoidaUpasanaSinghNo ratings yet

- Import Export ProcedureDocument13 pagesImport Export ProcedureManinder SinghNo ratings yet

- Road Permits State WiseDocument16 pagesRoad Permits State WiseSanjay MehtaNo ratings yet

- Shippers Letter of InstructionsDocument1 pageShippers Letter of InstructionsDipesh JainNo ratings yet

- Exporting To JapanDocument10 pagesExporting To JapanHinaNo ratings yet

- Too Karaganda Soft OfferDocument3 pagesToo Karaganda Soft OffersalesNo ratings yet

- Urs For Export DocumentationDocument14 pagesUrs For Export DocumentationSubhash ReddyNo ratings yet

- Swift Society for Worldwide Interbank Financial Telecommunication 環球銀行財務電信協會Document7 pagesSwift Society for Worldwide Interbank Financial Telecommunication 環球銀行財務電信協會Florencia PaisNo ratings yet

- Export Import Procedures Part 2Document18 pagesExport Import Procedures Part 2neelonNo ratings yet

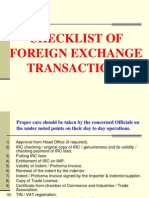

- Check List of Foreign Exchange Transaction in BankDocument20 pagesCheck List of Foreign Exchange Transaction in BankMohammad RokunuzzamanNo ratings yet

- Import Documentation - Do & DontDocument7 pagesImport Documentation - Do & DontAvinashNo ratings yet

- ASEAN China Free Trade Agreement 2010 2nd Amendment of The Agreement On Trade in GoodsDocument21 pagesASEAN China Free Trade Agreement 2010 2nd Amendment of The Agreement On Trade in GoodszeferinoNo ratings yet

- Air Export CustomsDocument7 pagesAir Export CustomsDivyabhan SinghNo ratings yet

- D en 14 320 Application Nop Import CertificateDocument4 pagesD en 14 320 Application Nop Import CertificateOscar Wong FungNo ratings yet

- Certificate of Origin: INDIA .Document2 pagesCertificate of Origin: INDIA .Moges TolchaNo ratings yet

- Bluedart Express LTD - Customs-Country Information-IndiaDocument6 pagesBluedart Express LTD - Customs-Country Information-Indiaad2avNo ratings yet

- Export Documentation (Translate)Document13 pagesExport Documentation (Translate)LisaNo ratings yet

- 5 2 1 2 - enDocument4 pages5 2 1 2 - enDimple EstacioNo ratings yet

- En590 Cif BlgDocument3 pagesEn590 Cif BlgblgtedarikNo ratings yet

- Export ProceduresDocument13 pagesExport ProceduresghirenvNo ratings yet

- PPR 5Document30 pagesPPR 5Mayur santNo ratings yet

- Export Documentation: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeDocument12 pagesExport Documentation: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign Tradeimad100% (2)

- Bullion 191113Document4 pagesBullion 191113hari ramNo ratings yet

- Sco e&j Oil Rwa Buyers p July 3 2024Document8 pagesSco e&j Oil Rwa Buyers p July 3 2024kilakituNo ratings yet

- Public Notice 59Document16 pagesPublic Notice 59Shreyansh ShreyNo ratings yet

- Customs ProcessDocument9 pagesCustoms ProcesssolorajaNo ratings yet

- Chapter 2 - QTXNKDocument32 pagesChapter 2 - QTXNKNgọc Hương NguyễnNo ratings yet

- Export DocumentationDocument28 pagesExport DocumentationMahavir GawareNo ratings yet

- GARMENTEXDocument3 pagesGARMENTEXMirza AsadNo ratings yet

- Cif Standard Transaction Procedure (DLC/SBLC Payment Method)Document2 pagesCif Standard Transaction Procedure (DLC/SBLC Payment Method)Michel KlunzingerNo ratings yet

- Sco Fob for En590 & Jet a1Document9 pagesSco Fob for En590 & Jet a1diogobilicNo ratings yet

- Agreement Establishing The Asean - Australia-New Zealand Free Trade Area (Aanzfta)Document2 pagesAgreement Establishing The Asean - Australia-New Zealand Free Trade Area (Aanzfta)Purwanti PNo ratings yet

- Annex 8Document13 pagesAnnex 8Kristal TagleNo ratings yet

- " Iecm": Shipping Instructions & Handling TariffDocument15 pages" Iecm": Shipping Instructions & Handling TariffArafathNo ratings yet

- Sale - Purchase Contract H P Đ NG Thương M I: THE SELLER (Ngư I Bán B) : Avnet Asia Pte LTDDocument4 pagesSale - Purchase Contract H P Đ NG Thương M I: THE SELLER (Ngư I Bán B) : Avnet Asia Pte LTDMinh TriNo ratings yet

- 5 NhapkhauFCA ContractDocument4 pages5 NhapkhauFCA ContractMinh TriNo ratings yet

- Buổi 7. Chứng Từ Và Quy Trình Làm Việc Của Hãng TàuDocument51 pagesBuổi 7. Chứng Từ Và Quy Trình Làm Việc Của Hãng TàuHa DoNo ratings yet

- Letter of Credit ExportDocument3 pagesLetter of Credit ExportMakrand SableNo ratings yet

- Master DocumentsDocument13 pagesMaster DocumentsNishant RajaNo ratings yet

- Letter of Credit ModelDocument5 pagesLetter of Credit ModelScribdTranslationsNo ratings yet

- Qatar Import RulesDocument10 pagesQatar Import RulesSakib AyubNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Export Transaction CostDocument5 pagesExport Transaction CostvinayNo ratings yet

- Bill of Entry - Cargo DeclarationDocument29 pagesBill of Entry - Cargo DeclarationvinayNo ratings yet

- A Case Study of Transaction Cost of Export Business of The Indian ExporterDocument4 pagesA Case Study of Transaction Cost of Export Business of The Indian ExportervinayNo ratings yet

- Who Am I?: © 2017, Jerson James/ Citruslearning. All Rights ReservedDocument9 pagesWho Am I?: © 2017, Jerson James/ Citruslearning. All Rights ReservedvinayNo ratings yet

- 11 Indian TruckingDocument76 pages11 Indian TruckingvinayNo ratings yet

- 0590company Under Consideration042Document8 pages0590company Under Consideration042vinayNo ratings yet

- EthicsDocument1 pageEthicsvinayNo ratings yet

- Truck Costing Model Mpc03-152Document61 pagesTruck Costing Model Mpc03-152vinayNo ratings yet

- Ob Description: Head Logistic/SCM For Chemical IndustryDocument2 pagesOb Description: Head Logistic/SCM For Chemical IndustryvinayNo ratings yet

- The Distribution of Cement To The End User From The Manufacturer Is A Major Cost Factor inDocument1 pageThe Distribution of Cement To The End User From The Manufacturer Is A Major Cost Factor invinayNo ratings yet

- IT and ERPDocument1 pageIT and ERPvinayNo ratings yet

- BCA-IDA Green Mark For Existing Data Centres Version EDC/1.0Document16 pagesBCA-IDA Green Mark For Existing Data Centres Version EDC/1.0SIM BOON KENG MBS201186No ratings yet

- Universal Health Coverage in The Philippines: How Far Have We Gone?Document20 pagesUniversal Health Coverage in The Philippines: How Far Have We Gone?ADBI Events100% (1)

- Practice ExerciseDocument8 pagesPractice ExerciseHassan LatifNo ratings yet

- Siddharth Group of Institutions:: Puttur: Unit - IDocument6 pagesSiddharth Group of Institutions:: Puttur: Unit - Ikrishnareddy_chintalaNo ratings yet

- American Cookery CookbookDocument48 pagesAmerican Cookery CookbookDonald MitchellNo ratings yet

- Hipertec Wall DetailsDocument1 pageHipertec Wall Detailsamadeus_x64No ratings yet

- MIMS Doctor 0820 ID PDFDocument51 pagesMIMS Doctor 0820 ID PDFGATOT WIDYATMO PRINGGODIGDONo ratings yet

- LDocument8 pagesLTamara Monsalve100% (1)

- Validation and Qualification of Heating, Ventilation, Air ConDocument18 pagesValidation and Qualification of Heating, Ventilation, Air ConJai MurugeshNo ratings yet

- Plumbing Sewerage - Drainage Swms 10Document26 pagesPlumbing Sewerage - Drainage Swms 10Shahrin KamaruzamanNo ratings yet

- SSDK Mine Basic InformationDocument2 pagesSSDK Mine Basic InformationAchmad Doanx100% (1)

- Bio Psychology Lecture Notes Chapter 6 The Visual SystemDocument7 pagesBio Psychology Lecture Notes Chapter 6 The Visual SystemGeneric_Persona50% (2)

- Usg Sheetrock® Brand Mold Tough® Firecode® XDocument3 pagesUsg Sheetrock® Brand Mold Tough® Firecode® XHoracio PadillaNo ratings yet

- LU 3 - Crimes Against Life & Bodily Integrity.Document77 pagesLU 3 - Crimes Against Life & Bodily Integrity.Mbalenhle NdlovuNo ratings yet

- Minority Elite Continuity and Identity PDocument121 pagesMinority Elite Continuity and Identity PEvandro MonteiroNo ratings yet

- Republic Act No 10121Document23 pagesRepublic Act No 10121Mark AlanNo ratings yet

- Electrical Conductivity of Carbon Blacks Under CompressionDocument7 pagesElectrical Conductivity of Carbon Blacks Under CompressionМирослав Кузишин100% (1)

- Geotechnical Applications of Waste Materials PDFDocument5 pagesGeotechnical Applications of Waste Materials PDFG. SASIDHARA KURUPNo ratings yet

- Leni Robredo CredentialsDocument2 pagesLeni Robredo CredentialsJhelliene Rose V. De CastroNo ratings yet

- 2AS Exam EARTHQUAKEDocument2 pages2AS Exam EARTHQUAKEmaian saja100% (3)

- 3blocks - IFRS 17 PDFDocument131 pages3blocks - IFRS 17 PDFDurgaprasad VelamalaNo ratings yet

- EN ISO 11064-3 - Ergonomic Design of Control Centres - Part 3: Control Room LayoutDocument4 pagesEN ISO 11064-3 - Ergonomic Design of Control Centres - Part 3: Control Room Layoutsoares_alexNo ratings yet

- Clisis 14Document18 pagesClisis 14fortroniNo ratings yet

- Minnesota Multiphasic Personality Inventory TestDocument26 pagesMinnesota Multiphasic Personality Inventory TestGicu BelicuNo ratings yet

- TVL Cookery - Q1 - M2Document16 pagesTVL Cookery - Q1 - M2Jovelyn AvilaNo ratings yet

- Development and Evolution of Nursing Education in IndiaDocument6 pagesDevelopment and Evolution of Nursing Education in Indiasteffy sojan100% (1)

- Tutorial 1Document2 pagesTutorial 1SITI NADHIRAH AzmiNo ratings yet

Documentation Export TBSL

Documentation Export TBSL

Uploaded by

vinayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Documentation Export TBSL

Documentation Export TBSL

Uploaded by

vinayCopyright:

Available Formats

Pre-Shipment DOCUMENTATION FOR GENERAL SHIPMENTS :

INVOICE (10 COPIES)

PACKING LIST (10COPIES) needed only for multiple package and items. kind

of items in the shipment to indicate which item is present in which box

ANNEXURES A OR B DEPENDING UPON SHIPMENT

SDF (SHIPPER DECLARATION FORMAT) 02 COPIES, should be preferably

on the exporter’s letterhead.

EDI SHIPPING BILL COPY Of the Exporter of previous shipment if New

exporter for the UPS.

For generating a SHIPPING BILL, below mentioned ANNEXURES are

required which are to be filed, SIGNED & STAMPED by the EXPORTER.

ANNEXURE A FOR DUTYFREE

DEPB

100 % EOU

DEEC

•

ANNEXURE B FOR DRAWBACK

Electrical / Electronic & Mechanical (Machinery parts)

Chemical

INVOICE (10 COPIES)

PACKING LIST (10COPIES) needed only for multiple package and items. kind

of items

in the shipment to indicate which item is present in which box

ANNEXURES A OR B DEPENDING UPON SHIPMENT

SDF (SHIPPER DECLARATION FORMAT) 02 COPIES, should be preferably

on the

exporter’s letterhead.

EDI SHIPPING BILL COPY Of the Exporter of previous shipment if New

exporter for the

Proper Material Safety Data Sheet (MSDS) with all details.

NON DGR declaration on shipper’s letterhead.

Package should be in Airworthy condition.

GARMENTS

INVOICE (10 COPIES)

One copy of INVOICE Endorsed by AEPC for Custom Procedure

ANNEXURES A OR B DEPENDING UPON SHIPMENT

SDF (SHIPPER DECLARATION FORMAT) 02 COPIES, should be preferably

on the

exporter’s letterhead.

EDI SHIPPING BILL COPY Of the Exporter of previous shipment if New

exporter

FABRICS

INVOICE (10 COPIES)

One copy of INVOICE Endorsed by CTEPC / SRTPC / WWPEC for Custom

Procedure

ANNEXURES A OR B DEPENDING UPON SHIPMENT

SDF (SHIPPER DECLARATION FORMAT) 02 COPIES, should be preferably

on the

exporter’s letterhead.

EDI SHIPPING BILL COPY Of the Exporter of previous shipment if New

exporter

DRUGS & PHARMA PRODUCTS

ØINVOICE (10 COPIES)

Ø ANNEXURES A OR B DEPENDING UPON SHIPMENT

Ø SDF (SHIPPER DECLARATION FORMAT) 02 COPIES, should be preferably on the

exporter’s letterhead.

Ø EDI SHIPPING BILL COPY Of the Exporter of previous shipment if New exporter

Ø COPY OF DRUG LICENCE AND PRODUCT LIST

(product list should feature the product for which the shipper is permitted

to export,both drug license and product list should be valid for that year)

Ø FORM 20B 21B (PHOTOCOPY)

Ø LABELS Featuring the PRODUCT NAME, MFG. DATE, EXPIRY DATE , BATCH NO. &

LIC NO. (2 copies extra for obtaining ADC NOC (Asst..Drug Controller)

Ø MSDS & NON DGR CERTFICATE

RE EXPORT CASES ( REPAIR & RETURN)

EXPORT INVOICES (10COPIES)

CUSTOMS ATTESTED TRPILICATE COPY OF Import BILL OF ENTRY(ORIGINAL)

CUSTOMS ATTESTED IMPORT INVOICES(ORIGIN)

ORG DUTY PAID (TR6 CERTFICATE)

Correspondence BETWEEN SHIPPER AND CNEE Wherein the Consignee at

Destination has confirmed to send the shipment for repairs.

CERTIFICATE From the SHIPPER’S BANK Stating that No Commercial

VALUE is involved

Letter Addressed to ASST COMMISIONER OF CUSTOMS Seeking

Permission TO RE EXPORT the same (this letter should be on the

letterhead of the shipper)

SERIAL No, PART No./MODEL No. Mentioned on the shipment should be

EMBOSSED or PRINTED. (HANDWRITTEN OR STICKERS will not be

accepted by the customs.These should also appear on Export Invoice, Customs

attested IMPORT Invoice for identification as a proof of Import.)

On completion of the above, he will call his CHA to collect the

shipment & documents. Generally, CHA will arrange for preparing

Shipping Bill from the information contained in Shippers Instruction

Form. SB is of different types –

1. White SB (for duty free goods to be exported)

2. Yellow SB(for dutiable goods)

3. Green SB(for goods under duty drawback)

4. Blue SB(for goods under DEPB Scheme)

Under EDI system, the CHA will submit the declarations in prescribed

format along with the copy of invoice at the Custom Service Station.

After data entry, SB will be processed and a checklist will be

generated & handed over to CHA. He will present this check list to

the Custom Officer along with all original documents & the goods

will be inspected. After the Appraiser is satisfied, “Let Export” order

will be issued & SB will be printed. This SB will be signed by CHA,

Appraiser & Examiner respectively.

In turn, the CHA will submit SDF in duplicate to the Custom

Commissioner along with SB. After verifying & authenticating the

declarations made in SDF, the Custom Commissioner will hand over to

CHA, one copy of SB marked “Exchange Control Copy” in which

SDF has been appended for being submitted to AD within 21 days

from the date of export.

It is to be noted here that, the CHA can also submit declarations

through RES (Remote EDI System) without going to Custom Service

Station. However, it is yet to be started at Kolkata Customs.

Note : The Exporter/CHA must take every care while preparing pre-

shipment docs and should confirm that these are properly signed,

stamped.

Post shipment Documents :

Once shipment is Exported following documents are returned back to

Exporter:

Customs Attested Invoice.

Packing List.

SDF

Exchange Control Copy

Master AWB copy.

House AWB copy.

EP copy.

DOCUMENTS SUBMISSION TO AD

Now its time for exporter to prepare documents towards submission to

his banker through which he has received/has to receive the payment

of export in order to enable his banker to release GR/SDF form. The

documents must be submitted within 21 days from the date of export

along with a covering letter with a request to release the paid SDF

Form (in case of advance payment) or to collect bill otherwise.

The standard set of post-shipment docs are as follows :-

Invoice (Custom Signed) 3 Copies

Packing List (Custom Signed) 3 Copies

GR/SDF 2 Copies

Transport Documents 3 Copies

SB (Exchange Control Copy) 1 Copy

Order Copy 1 Copy

GSP Certificate 2nd

L/C Original

Insurance Cover 1 Set

F.I.R.C. (if payment received) 1 Copy

Bill of Exchange (for collection of Bill) 2 copies

Documents for Destination :

CERTIFICATE OF ORIGIN : To establish the origin of goods

imported into any country and is of 2 types:

A. Preferential : India is receiving tariff concessions under the

following preferential schemes : GSP (Generalised System of

Preference ), GSTP (Global System of Trade Preference),

SAPTA (SAARC Preferential Trade Agreement), Bangkok

Agreement and Indo-Srilanka Free Trade Agreement.

B. Non-Preferential : Only to evidence the origin of goods

You might also like

- Shipper' S Letter of InstructionsDocument4 pagesShipper' S Letter of Instructionsmanvendra singhNo ratings yet

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- ScrewsDocument35 pagesScrewsRodel Marata100% (3)

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- PMDC Indexed JournalsDocument2 pagesPMDC Indexed JournalsOmair Riaz100% (1)

- FinalDocument1 pageFinalvinovionNo ratings yet

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikNo ratings yet

- Documents For ExportDocument26 pagesDocuments For Exportnatrajang100% (1)

- Adittional Info:-: in Short:-In Above Both Payment Term, Bank Intervention Requires in Documents ProcessDocument2 pagesAdittional Info:-: in Short:-In Above Both Payment Term, Bank Intervention Requires in Documents Processsanraaj66No ratings yet

- EOU Write UpDocument5 pagesEOU Write Upsrajan7309No ratings yet

- CEPT-Form DDocument10 pagesCEPT-Form DHery MulyanaNo ratings yet

- Export DocumentationDocument54 pagesExport DocumentationmaninderwazirNo ratings yet

- CHB ImportDocument3 pagesCHB ImportShivaji DadgeNo ratings yet

- UD Service: Utilization DeclarationDocument7 pagesUD Service: Utilization DeclarationFaruk AhmedNo ratings yet

- Certificates of Origin (Non-Preferential) - GuidelinesDocument4 pagesCertificates of Origin (Non-Preferential) - GuidelinessrinivaskirankumarNo ratings yet

- Week 2 - Costome ProcessDocument8 pagesWeek 2 - Costome Processreme moNo ratings yet

- Revised OCP Form EDocument11 pagesRevised OCP Form EDio MaulanaNo ratings yet

- FinalDocument14 pagesFinalnitishNo ratings yet

- Import DocumentDocument11 pagesImport DocumentChristopher BrowningNo ratings yet

- Export Documentation: Dr. Anuj Sharma Bimtech Greater NoidaDocument50 pagesExport Documentation: Dr. Anuj Sharma Bimtech Greater NoidaUpasanaSinghNo ratings yet

- Import Export ProcedureDocument13 pagesImport Export ProcedureManinder SinghNo ratings yet

- Road Permits State WiseDocument16 pagesRoad Permits State WiseSanjay MehtaNo ratings yet

- Shippers Letter of InstructionsDocument1 pageShippers Letter of InstructionsDipesh JainNo ratings yet

- Exporting To JapanDocument10 pagesExporting To JapanHinaNo ratings yet

- Too Karaganda Soft OfferDocument3 pagesToo Karaganda Soft OffersalesNo ratings yet

- Urs For Export DocumentationDocument14 pagesUrs For Export DocumentationSubhash ReddyNo ratings yet

- Swift Society for Worldwide Interbank Financial Telecommunication 環球銀行財務電信協會Document7 pagesSwift Society for Worldwide Interbank Financial Telecommunication 環球銀行財務電信協會Florencia PaisNo ratings yet

- Export Import Procedures Part 2Document18 pagesExport Import Procedures Part 2neelonNo ratings yet

- Check List of Foreign Exchange Transaction in BankDocument20 pagesCheck List of Foreign Exchange Transaction in BankMohammad RokunuzzamanNo ratings yet

- Import Documentation - Do & DontDocument7 pagesImport Documentation - Do & DontAvinashNo ratings yet

- ASEAN China Free Trade Agreement 2010 2nd Amendment of The Agreement On Trade in GoodsDocument21 pagesASEAN China Free Trade Agreement 2010 2nd Amendment of The Agreement On Trade in GoodszeferinoNo ratings yet

- Air Export CustomsDocument7 pagesAir Export CustomsDivyabhan SinghNo ratings yet

- D en 14 320 Application Nop Import CertificateDocument4 pagesD en 14 320 Application Nop Import CertificateOscar Wong FungNo ratings yet

- Certificate of Origin: INDIA .Document2 pagesCertificate of Origin: INDIA .Moges TolchaNo ratings yet

- Bluedart Express LTD - Customs-Country Information-IndiaDocument6 pagesBluedart Express LTD - Customs-Country Information-Indiaad2avNo ratings yet

- Export Documentation (Translate)Document13 pagesExport Documentation (Translate)LisaNo ratings yet

- 5 2 1 2 - enDocument4 pages5 2 1 2 - enDimple EstacioNo ratings yet

- En590 Cif BlgDocument3 pagesEn590 Cif BlgblgtedarikNo ratings yet

- Export ProceduresDocument13 pagesExport ProceduresghirenvNo ratings yet

- PPR 5Document30 pagesPPR 5Mayur santNo ratings yet

- Export Documentation: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeDocument12 pagesExport Documentation: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign Tradeimad100% (2)

- Bullion 191113Document4 pagesBullion 191113hari ramNo ratings yet

- Sco e&j Oil Rwa Buyers p July 3 2024Document8 pagesSco e&j Oil Rwa Buyers p July 3 2024kilakituNo ratings yet

- Public Notice 59Document16 pagesPublic Notice 59Shreyansh ShreyNo ratings yet

- Customs ProcessDocument9 pagesCustoms ProcesssolorajaNo ratings yet

- Chapter 2 - QTXNKDocument32 pagesChapter 2 - QTXNKNgọc Hương NguyễnNo ratings yet

- Export DocumentationDocument28 pagesExport DocumentationMahavir GawareNo ratings yet

- GARMENTEXDocument3 pagesGARMENTEXMirza AsadNo ratings yet

- Cif Standard Transaction Procedure (DLC/SBLC Payment Method)Document2 pagesCif Standard Transaction Procedure (DLC/SBLC Payment Method)Michel KlunzingerNo ratings yet

- Sco Fob for En590 & Jet a1Document9 pagesSco Fob for En590 & Jet a1diogobilicNo ratings yet

- Agreement Establishing The Asean - Australia-New Zealand Free Trade Area (Aanzfta)Document2 pagesAgreement Establishing The Asean - Australia-New Zealand Free Trade Area (Aanzfta)Purwanti PNo ratings yet

- Annex 8Document13 pagesAnnex 8Kristal TagleNo ratings yet

- " Iecm": Shipping Instructions & Handling TariffDocument15 pages" Iecm": Shipping Instructions & Handling TariffArafathNo ratings yet

- Sale - Purchase Contract H P Đ NG Thương M I: THE SELLER (Ngư I Bán B) : Avnet Asia Pte LTDDocument4 pagesSale - Purchase Contract H P Đ NG Thương M I: THE SELLER (Ngư I Bán B) : Avnet Asia Pte LTDMinh TriNo ratings yet

- 5 NhapkhauFCA ContractDocument4 pages5 NhapkhauFCA ContractMinh TriNo ratings yet

- Buổi 7. Chứng Từ Và Quy Trình Làm Việc Của Hãng TàuDocument51 pagesBuổi 7. Chứng Từ Và Quy Trình Làm Việc Của Hãng TàuHa DoNo ratings yet

- Letter of Credit ExportDocument3 pagesLetter of Credit ExportMakrand SableNo ratings yet

- Master DocumentsDocument13 pagesMaster DocumentsNishant RajaNo ratings yet

- Letter of Credit ModelDocument5 pagesLetter of Credit ModelScribdTranslationsNo ratings yet

- Qatar Import RulesDocument10 pagesQatar Import RulesSakib AyubNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Export Transaction CostDocument5 pagesExport Transaction CostvinayNo ratings yet

- Bill of Entry - Cargo DeclarationDocument29 pagesBill of Entry - Cargo DeclarationvinayNo ratings yet

- A Case Study of Transaction Cost of Export Business of The Indian ExporterDocument4 pagesA Case Study of Transaction Cost of Export Business of The Indian ExportervinayNo ratings yet

- Who Am I?: © 2017, Jerson James/ Citruslearning. All Rights ReservedDocument9 pagesWho Am I?: © 2017, Jerson James/ Citruslearning. All Rights ReservedvinayNo ratings yet

- 11 Indian TruckingDocument76 pages11 Indian TruckingvinayNo ratings yet

- 0590company Under Consideration042Document8 pages0590company Under Consideration042vinayNo ratings yet

- EthicsDocument1 pageEthicsvinayNo ratings yet

- Truck Costing Model Mpc03-152Document61 pagesTruck Costing Model Mpc03-152vinayNo ratings yet

- Ob Description: Head Logistic/SCM For Chemical IndustryDocument2 pagesOb Description: Head Logistic/SCM For Chemical IndustryvinayNo ratings yet

- The Distribution of Cement To The End User From The Manufacturer Is A Major Cost Factor inDocument1 pageThe Distribution of Cement To The End User From The Manufacturer Is A Major Cost Factor invinayNo ratings yet

- IT and ERPDocument1 pageIT and ERPvinayNo ratings yet

- BCA-IDA Green Mark For Existing Data Centres Version EDC/1.0Document16 pagesBCA-IDA Green Mark For Existing Data Centres Version EDC/1.0SIM BOON KENG MBS201186No ratings yet

- Universal Health Coverage in The Philippines: How Far Have We Gone?Document20 pagesUniversal Health Coverage in The Philippines: How Far Have We Gone?ADBI Events100% (1)

- Practice ExerciseDocument8 pagesPractice ExerciseHassan LatifNo ratings yet

- Siddharth Group of Institutions:: Puttur: Unit - IDocument6 pagesSiddharth Group of Institutions:: Puttur: Unit - Ikrishnareddy_chintalaNo ratings yet

- American Cookery CookbookDocument48 pagesAmerican Cookery CookbookDonald MitchellNo ratings yet

- Hipertec Wall DetailsDocument1 pageHipertec Wall Detailsamadeus_x64No ratings yet

- MIMS Doctor 0820 ID PDFDocument51 pagesMIMS Doctor 0820 ID PDFGATOT WIDYATMO PRINGGODIGDONo ratings yet

- LDocument8 pagesLTamara Monsalve100% (1)

- Validation and Qualification of Heating, Ventilation, Air ConDocument18 pagesValidation and Qualification of Heating, Ventilation, Air ConJai MurugeshNo ratings yet

- Plumbing Sewerage - Drainage Swms 10Document26 pagesPlumbing Sewerage - Drainage Swms 10Shahrin KamaruzamanNo ratings yet

- SSDK Mine Basic InformationDocument2 pagesSSDK Mine Basic InformationAchmad Doanx100% (1)

- Bio Psychology Lecture Notes Chapter 6 The Visual SystemDocument7 pagesBio Psychology Lecture Notes Chapter 6 The Visual SystemGeneric_Persona50% (2)

- Usg Sheetrock® Brand Mold Tough® Firecode® XDocument3 pagesUsg Sheetrock® Brand Mold Tough® Firecode® XHoracio PadillaNo ratings yet

- LU 3 - Crimes Against Life & Bodily Integrity.Document77 pagesLU 3 - Crimes Against Life & Bodily Integrity.Mbalenhle NdlovuNo ratings yet

- Minority Elite Continuity and Identity PDocument121 pagesMinority Elite Continuity and Identity PEvandro MonteiroNo ratings yet

- Republic Act No 10121Document23 pagesRepublic Act No 10121Mark AlanNo ratings yet

- Electrical Conductivity of Carbon Blacks Under CompressionDocument7 pagesElectrical Conductivity of Carbon Blacks Under CompressionМирослав Кузишин100% (1)

- Geotechnical Applications of Waste Materials PDFDocument5 pagesGeotechnical Applications of Waste Materials PDFG. SASIDHARA KURUPNo ratings yet

- Leni Robredo CredentialsDocument2 pagesLeni Robredo CredentialsJhelliene Rose V. De CastroNo ratings yet

- 2AS Exam EARTHQUAKEDocument2 pages2AS Exam EARTHQUAKEmaian saja100% (3)

- 3blocks - IFRS 17 PDFDocument131 pages3blocks - IFRS 17 PDFDurgaprasad VelamalaNo ratings yet

- EN ISO 11064-3 - Ergonomic Design of Control Centres - Part 3: Control Room LayoutDocument4 pagesEN ISO 11064-3 - Ergonomic Design of Control Centres - Part 3: Control Room Layoutsoares_alexNo ratings yet

- Clisis 14Document18 pagesClisis 14fortroniNo ratings yet

- Minnesota Multiphasic Personality Inventory TestDocument26 pagesMinnesota Multiphasic Personality Inventory TestGicu BelicuNo ratings yet

- TVL Cookery - Q1 - M2Document16 pagesTVL Cookery - Q1 - M2Jovelyn AvilaNo ratings yet

- Development and Evolution of Nursing Education in IndiaDocument6 pagesDevelopment and Evolution of Nursing Education in Indiasteffy sojan100% (1)

- Tutorial 1Document2 pagesTutorial 1SITI NADHIRAH AzmiNo ratings yet