Professional Documents

Culture Documents

Jumboloan 9526 PWD GMOH9526

Jumboloan 9526 PWD GMOH9526

Uploaded by

Nizamuddin GhouseCopyright:

Available Formats

You might also like

- Reborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)Document515 pagesReborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)julian vegaNo ratings yet

- Astm C469 - C469M - 14Document5 pagesAstm C469 - C469M - 14adil Rahman hassoon100% (1)

- Capter 2Document5 pagesCapter 2DiwakarNo ratings yet

- Credit Card EMI 3501 PDFDocument3 pagesCredit Card EMI 3501 PDFVijay ParmarNo ratings yet

- IT IC54232M Malanaruna@Gmail - Com 13-04-2023Document4 pagesIT IC54232M Malanaruna@Gmail - Com 13-04-2023malanarunaNo ratings yet

- 031221ER20570060Document2 pages031221ER20570060Aklesh kumarNo ratings yet

- Zest MoneyDocument9 pagesZest Moneysan_sam3No ratings yet

- Ledger AA696562Document33 pagesLedger AA696562Vicky MishraNo ratings yet

- In SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredDocument7 pagesIn SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredPrerna AroraNo ratings yet

- FM ProjectDocument12 pagesFM ProjectRahul RoyNo ratings yet

- Chart 100078979Document5 pagesChart 100078979Huy ĐoànNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument1 pageStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceMallela JyothiNo ratings yet

- Sbi CC StatementDocument1 pageSbi CC StatementBHASKAR pNo ratings yet

- Tata BAF - 6%Document1 pageTata BAF - 6%Samrat FuriaNo ratings yet

- ASB CalculationDocument4 pagesASB CalculationMat Zaid MamatNo ratings yet

- Repayment Schedule - 230307100013643Document2 pagesRepayment Schedule - 230307100013643manammadhuNo ratings yet

- Repayment Schedule - 230307100013643Document2 pagesRepayment Schedule - 230307100013643manammadhuNo ratings yet

- Compound Plan For Binary FriendsDocument1 pageCompound Plan For Binary FriendsMahesh AraNo ratings yet

- Statement of Axis Account No:923010003432065 For The Period (From: 01-08-2023 To: 26-01-2024)Document2 pagesStatement of Axis Account No:923010003432065 For The Period (From: 01-08-2023 To: 26-01-2024)siddharthasampathNo ratings yet

- Amort Chart 1Document5 pagesAmort Chart 1Vinayak KarmalkarNo ratings yet

- Sr. No EMI Dates Opening Principal EMI Interest ClosingDocument2 pagesSr. No EMI Dates Opening Principal EMI Interest ClosingAllanoor KhiljiNo ratings yet

- Mutual Fund SWP Calculator Plan 1Document8 pagesMutual Fund SWP Calculator Plan 1Yada GiriNo ratings yet

- PMAIZMTUSDMDocument2 pagesPMAIZMTUSDMLinh TranNo ratings yet

- Statement of Axis Account No:918010050126397 For The Period (From: 01-04-2022 To: 31-03-2023)Document2 pagesStatement of Axis Account No:918010050126397 For The Period (From: 01-04-2022 To: 31-03-2023)seervisupremeNo ratings yet

- OpTransactionHistoryUX3 - PDF04 05 2024Document4 pagesOpTransactionHistoryUX3 - PDF04 05 2024optimus sales distributionNo ratings yet

- Subsistance Allowance Consilidated March 2023Document2 pagesSubsistance Allowance Consilidated March 2023bteuNo ratings yet

- Dinesh KumarDocument3 pagesDinesh KumarHeri kimNo ratings yet

- 2023 19 12 17 34 59 ITCertificateDocument2 pages2023 19 12 17 34 59 ITCertificateAman ShabaNo ratings yet

- 20210128-Forms-Enhanced Pension Loan ApplicationDocument2 pages20210128-Forms-Enhanced Pension Loan ApplicationReverencio B. GaborNo ratings yet

- IIFL - SL5134283 - Welcome LetterDocument3 pagesIIFL - SL5134283 - Welcome LetteriiflfincopltdNo ratings yet

- Other STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksDocument4 pagesOther STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksAman SinghNo ratings yet

- HDFC Bank LTD Mumbai Repayment Schedule: Date: 14/05/2021Document5 pagesHDFC Bank LTD Mumbai Repayment Schedule: Date: 14/05/2021Rajesh AdluriNo ratings yet

- Repayment Schedule-PHR290407545232Document15 pagesRepayment Schedule-PHR290407545232suvai79No ratings yet

- VaR Calculation ModelDocument9 pagesVaR Calculation ModelatpugajoopNo ratings yet

- O/RMS Accountant Question Paper 2016 UP Circle Held On 22.05.2016Document21 pagesO/RMS Accountant Question Paper 2016 UP Circle Held On 22.05.2016CJ MazualaNo ratings yet

- PLKND2312130005Document2 pagesPLKND2312130005malarkurinji78No ratings yet

- Welcome Letter PG 0224 F 17 000038 2018 12 25 15 51 40Document7 pagesWelcome Letter PG 0224 F 17 000038 2018 12 25 15 51 40manavsingh34No ratings yet

- Clix REPAYMENT - SCHEDULE - REPORT AC2019091353787Document1 pageClix REPAYMENT - SCHEDULE - REPORT AC2019091353787Manohar ChaudharyNo ratings yet

- New Microsoft Ex5y56ytg6tcel WorksheetDocument9 pagesNew Microsoft Ex5y56ytg6tcel WorksheetNikhita ShajiNo ratings yet

- RAK Ceramics: Balance SheetDocument16 pagesRAK Ceramics: Balance SheetMd Borhan Uddin 2035097660No ratings yet

- 4 Template BL ProbDocument16 pages4 Template BL ProbShreyash TiwariNo ratings yet

- Bus485 LifeDocument4 pagesBus485 LifeF.T. BhuiyanNo ratings yet

- Assignment of FMDocument11 pagesAssignment of FMAbhishek kumar sittuNo ratings yet

- Histórico Do EmpregadorDocument2 pagesHistórico Do EmpregadorgiselesalesnNo ratings yet

- Repayment LetterDocument3 pagesRepayment Lettersunil kr verma100% (1)

- Statement of Axis Account No:911010036952533 For The Period (From: 13-05-2020 To: 11-06-2021)Document2 pagesStatement of Axis Account No:911010036952533 For The Period (From: 13-05-2020 To: 11-06-2021)srinu katamsNo ratings yet

- LIC SWP CalculationDocument4 pagesLIC SWP Calculationsushil kumarNo ratings yet

- Cashlite TNC Oct2018 EnbmDocument15 pagesCashlite TNC Oct2018 EnbmPokya SgNo ratings yet

- PIA MateDocument5 pagesPIA MateGildardo LongoriaNo ratings yet

- Natwarlal Jesaramji RawalDocument4 pagesNatwarlal Jesaramji Rawalsunil jadhavNo ratings yet

- Data TTNNDocument4 pagesData TTNNân ânNo ratings yet

- Repayment Schedule Report Ac2020092465227Document1 pageRepayment Schedule Report Ac2020092465227Manohar ChaudharyNo ratings yet

- Clix Capital REPAYMENT - SCHEDULE - REPORT AC2020092465227Document1 pageClix Capital REPAYMENT - SCHEDULE - REPORT AC2020092465227Manohar Chaudhary100% (2)

- Datos Panelejercicio ClaseDocument10 pagesDatos Panelejercicio ClaseSarahi MorenoNo ratings yet

- Ribka Septiani Natty - Financial Distress Altman Z-ScoreDocument2 pagesRibka Septiani Natty - Financial Distress Altman Z-ScoreRibka SeptianiNo ratings yet

- Other STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksDocument4 pagesOther STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksAman SinghNo ratings yet

- CorpDocument106 pagesCorpEspace NuvemNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument25 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureConverse CareersNo ratings yet

- Data Angin DibalikDocument3,917 pagesData Angin DibalikSandyNo ratings yet

- Sss ReportDocument3 pagesSss ReportSumit Kumar SahuNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- CVE 202 Lecture - 28062021Document11 pagesCVE 202 Lecture - 28062021odubade opeyemiNo ratings yet

- 11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFDocument3 pages11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFaaditya chopadeNo ratings yet

- Analgesics in ObstetricsDocument33 pagesAnalgesics in ObstetricsVeena KaNo ratings yet

- Frizzell, 1987. Stress Orientation Determined From Fault Slip Data in Hampel Wash Area NevadaDocument10 pagesFrizzell, 1987. Stress Orientation Determined From Fault Slip Data in Hampel Wash Area Nevada黃詠晴No ratings yet

- Cleopatra Wall Tiles CatalogueDocument151 pagesCleopatra Wall Tiles CatalogueHussain ElarabiNo ratings yet

- The Great Gatsby (1925)Document100 pagesThe Great Gatsby (1925)Radu-Alexandru BulaiNo ratings yet

- Universidad Emiliano Zapata Período Enero-Abril 2022 English IiDocument3 pagesUniversidad Emiliano Zapata Período Enero-Abril 2022 English IiJorge Alberto Salas MuñozNo ratings yet

- Bearing Inspection SOPDocument7 pagesBearing Inspection SOPRianAwangga100% (1)

- Numerical Methods For Partial Differential Equations: CAAM 452 Spring 2005 Instructor: Tim WarburtonDocument26 pagesNumerical Methods For Partial Differential Equations: CAAM 452 Spring 2005 Instructor: Tim WarburtonAqib SiddiqueNo ratings yet

- Light and Geometric OpticsDocument53 pagesLight and Geometric OpticsLeah May Tamayo ManayonNo ratings yet

- Codex: Night LordsDocument5 pagesCodex: Night LordsM. WoodsNo ratings yet

- Lymphoproliferative DisordersDocument36 pagesLymphoproliferative DisordersBrett FieldsNo ratings yet

- Clsi Astnewsupdate January2020ddddddpmDocument15 pagesClsi Astnewsupdate January2020ddddddpmRenato DesideriNo ratings yet

- CochinBase Tender E 13042021detailDocument27 pagesCochinBase Tender E 13042021detailisan.structural TjsvgalavanNo ratings yet

- The Best Classical Music For New YearDocument10 pagesThe Best Classical Music For New Yeardane franolicNo ratings yet

- केन्द्रीय विद्यालय संगठन, कोलकाता संभाग Kendriya Vidyalaya Sangathan, Kolkata RegionDocument5 pagesकेन्द्रीय विद्यालय संगठन, कोलकाता संभाग Kendriya Vidyalaya Sangathan, Kolkata RegionMuskan MangarajNo ratings yet

- Trophy Urban Core Property: Houston, TexasDocument25 pagesTrophy Urban Core Property: Houston, Texasbella grandeNo ratings yet

- AJODO-90 Petrovic Et Al Role of The Lateral Pterigoid Muscle and Menisco Temporomandibular...Document12 pagesAJODO-90 Petrovic Et Al Role of The Lateral Pterigoid Muscle and Menisco Temporomandibular...ortodoncia 2018No ratings yet

- Short Notes For Heat Transfer - Docx 97.docx 93Document18 pagesShort Notes For Heat Transfer - Docx 97.docx 93kumarsumit1942No ratings yet

- GrandStream GXV-3175 - User Manual EnglishDocument130 pagesGrandStream GXV-3175 - User Manual Englishซิสทูยู ออนไลน์No ratings yet

- اول 4 وحدات من مذكرة كونكت 4 مستر محمد جاد ترم اول 2022Document112 pagesاول 4 وحدات من مذكرة كونكت 4 مستر محمد جاد ترم اول 2022Sameh IbrahimNo ratings yet

- Written Theory Sample12Document1 pageWritten Theory Sample12John SmithNo ratings yet

- PDF PMP Exam Quick Reference GuideDocument8 pagesPDF PMP Exam Quick Reference GuideNantha KumarNo ratings yet

- Bca 2sem SyDocument10 pagesBca 2sem SyRounakNo ratings yet

- Order Flow AnalysisDocument6 pagesOrder Flow AnalysisSumit SinghNo ratings yet

- Topic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaDocument29 pagesTopic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaAzhar SabriNo ratings yet

- JM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270Document1 pageJM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270michael jan tubongbanuaNo ratings yet

- Hardtimes Analysis PDFDocument30 pagesHardtimes Analysis PDFV LkvNo ratings yet

Jumboloan 9526 PWD GMOH9526

Jumboloan 9526 PWD GMOH9526

Uploaded by

Nizamuddin GhouseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jumboloan 9526 PWD GMOH9526

Jumboloan 9526 PWD GMOH9526

Uploaded by

Nizamuddin GhouseCopyright:

Available Formats

06-Sep-2021

Mr./Ms. G MOHAMMED NIZAMUDDIN

#28 S1 THANSIYA AVENUE 2FLR

BALARAMAN AVENUE PONNAMALLEE

NR SUNDAR MATRICULATION SCHOOL

CHENNAI 600056

Dear Customer,

Subject: Insta Jumbo Loan Account: 1019010012882821 ( mention this number for any query/

payments in regards to your Insta Jumbo Loan)

We are pleased to grant you Insta Jumbo loan as per the details stated below. The loan amount would

be disbursed to you as per your request.

Insta Jumbo card no. 434677XXXXXX9526

Loan no. 0000000000071568630

Unsecured Loan Type Insta Jumbo Loan

Amount Rs.500000.00

Fixed Interest Rate 1.46% p.m.

Tenure 48 Months

EMI Rs.14562.39

Processing Fee Rs.250.00

Preclosure charges 3% (of principal outstanding at the time of closure) + GST @ 18%

For the First EMI, the Interest will be calculated from the loan booking date till the payment due

date.This is effective only for loans booked from September 5th, 2018 onwards.

In case you require any further assistance, please contact PhoneBanking within 7 days of

receiving this letter.

Most important Terms &Conditions

Please note that physical statement will not be sent for Insta Jumbo Loan account. The billing cycle date

&payment due date will be the same as your credit card account.Loan amount will be credited to your

savings account and reflect in your account balance post any applicable debits (negative balance if any) on the

respective account. EMI will be billed in the monthly Jumbo Loan statement starting from the immediate billing

cycle date.If loan has been disbursed to HDFC Bank Savings A/c, AutoPay will be activated within 7 days

from the date of loan booking. Your savings bank account will be debited for auto pay on the monthly EMI

amount due within 5 working days from the payment due date (PDD) as indicated in the loan account

monthly statement. If the savings account does not have sufficient funds, you will be liable to pay

applicable charges as indicated in the loan account statement. Auto Debit return penal interest 2% on

payment amount subject to minimum Rs.300 will be levied. If loan has been disbursed through Demand

Draft (DD), please make separate payment for Total Amount Due as per Jumbo Loan Statement to Jumbo

Loan Card Number (mentioned above) in addition to payment for your credit card before the payment due

date.Prior to completion of the Loan / Pre-Closure whichever is earlier, you cannot withdraw / cancel auto debit

instruction on your loan. Non-payment or partial payment of EMI outstanding will attract late payment penalty of

Rs.500 plus GST irrespective of EMI amount outstanding. No finance charge will be levied on non-payment or

partial payment of EMI outstanding. GST @ 18% are applicable on: (i) Processing fee (ii) Pre-closure charges.

Processing fee amount will get levied during the immediate billing cycle post loan booking. Partial pre payment or

partial closure is not permitted on this loan. The loan can be pre closed any time during the tenure. In case of pre-

closure of the loan, a charge, currently 3% of the balance principal outstanding plus GST @ 18% will be

applicable As the pre-closure charge is subject to change, we request you to contact PhoneBanking for the

applicable charge if you decide to pre-close the Loan. HDFC Bank reserves the right to revise the pre-closure

penalty at its discretion. Additional interest if any on the principal outstanding from last statement date till date of

loan pre closure need to be paid by customer.

The loan amount should not be re-invested in stock markets, mutual funds or any speculative purpose. Only 2

Insta Jumbo Loans can be active at any point of time. The loan once approved and processed cannot be

cancelled. Tenure confirmed at the time of booking cannot be changed. If your HDFC Bank Credit Card get closed

before all the installments have been charged, the loan outstanding will get debited to your card account. In case

of default in payment of EMI on the Due date, your loan account services shall be suspended and could further be

terminated. Notwithstanding anything stated above, the continuation of the loan shall be at the sole discretion of

the bank and outstanding will be payable to the bank on demand. GST will not be reversed under any

circumstances. Processing fee will not be reversed under any circumstances.

HDFC Bank reserves the right at any time, without previous notice, to add, alter, modify, change or vary all or any

of these terms and conditions or to replace wholly or in part this scheme by another offer, whether similar to the

offer or not, or to withdraw it all together. You will not hold HDFC Bank responsible for, or liable for, any actions,

claims, demands, losses, damages, costs, charges, expenses, which a participant may suffer, sustain or incur by

the Offer. All disputes, if any, arising out of or in connection with or as a result of the Offer or otherwise relating

hereto shall be subject to the exclusive jurisdiction of the competent Courts/Tribunals in Chennai only. The terms

and conditions contained in the Card member Agreement apply over and above the terms and conditions for this

Loan.

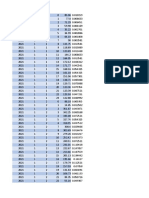

Enclosed Amortization schedule of Loan Number 0000000000071568630 for loan Amount 500000.00 (*GST

@ 18% extra). You can also view the amortization schedule by logging into NetBanking >Cards> Credit

cards >Enquire >Loan Details

No Statement Principal Interest Balance No Statement Principal Interest Balance

Date Amount (excluding Date Amount (excluding

GST*) GST*)

1 16-08-2021 7262.39 7786.70 492737.61 25 16-08-2023 10283.86 4278.53 282766.14

2 16-09-2021 7368.42 7193.97 485369.19 26 16-09-2023 10434.00 4128.39 272332.14

3 16-10-2021 7476.00 7086.39 477893.19 27 16-10-2023 10586.34 3976.05 261745.80

4 16-11-2021 7585.15 6977.24 470308.04 28 16-11-2023 10740.90 3821.49 251004.90

5 16-12-2021 7695.89 6866.50 462612.15 29 16-12-2023 10897.72 3664.67 240107.18

6 16-01-2022 7808.25 6754.14 454803.90 30 16-01-2024 11056.83 3505.56 229050.35

7 16-02-2022 7922.25 6640.14 446881.65 31 16-02-2024 11218.25 3344.14 217832.10

8 16-03-2022 8037.92 6524.47 438843.73 32 16-03-2024 11382.04 3180.35 206450.06

9 16-04-2022 8155.27 6407.12 430688.46 33 16-04-2024 11548.22 3014.17 194901.84

10 16-05-2022 8274.34 6288.05 422414.12 34 16-05-2024 11716.82 2845.57 183185.02

11 16-06-2022 8395.14 6167.25 414018.98 35 16-06-2024 11887.89 2674.50 171297.13

12 16-07-2022 8517.71 6044.68 405501.27 36 16-07-2024 12061.45 2500.94 159235.68

13 16-08-2022 8642.07 5920.32 396859.20 37 16-08-2024 12237.55 2324.84 146998.13

14 16-09-2022 8768.25 5794.14 388090.95 38 16-09-2024 12416.22 2146.17 134581.91

15 16-10-2022 8896.26 5666.13 379194.69 39 16-10-2024 12597.49 1964.90 121984.42

16 16-11-2022 9026.15 5536.24 370168.54 40 16-11-2024 12781.42 1780.97 109203.00

17 16-12-2022 9157.93 5404.46 361010.61 41 16-12-2024 12968.03 1594.36 96234.97

18 16-01-2023 9291.64 5270.75 351718.97 42 16-01-2025 13157.36 1405.03 83077.61

19 16-02-2023 9427.29 5135.10 342291.68 43 16-02-2025 13349.46 1212.93 69728.15

20 16-03-2023 9564.93 4997.46 332726.75 44 16-03-2025 13544.36 1018.03 56183.79

21 16-04-2023 9704.58 4857.81 323022.17 45 16-04-2025 13742.11 820.28 42441.68

22 16-05-2023 9846.27 4716.12 313175.90 46 16-05-2025 13942.74 619.65 28498.94

23 16-06-2023 9990.02 4572.37 303185.88 47 16-06-2025 14146.31 416.08 14352.63

24 16-07-2023 10135.88 4426.51 293050.00 48 16-07-2025 14352.63 209.55 0.00

This is a computer generated letter and does not require a signature.

You might also like

- Reborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)Document515 pagesReborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)julian vegaNo ratings yet

- Astm C469 - C469M - 14Document5 pagesAstm C469 - C469M - 14adil Rahman hassoon100% (1)

- Capter 2Document5 pagesCapter 2DiwakarNo ratings yet

- Credit Card EMI 3501 PDFDocument3 pagesCredit Card EMI 3501 PDFVijay ParmarNo ratings yet

- IT IC54232M Malanaruna@Gmail - Com 13-04-2023Document4 pagesIT IC54232M Malanaruna@Gmail - Com 13-04-2023malanarunaNo ratings yet

- 031221ER20570060Document2 pages031221ER20570060Aklesh kumarNo ratings yet

- Zest MoneyDocument9 pagesZest Moneysan_sam3No ratings yet

- Ledger AA696562Document33 pagesLedger AA696562Vicky MishraNo ratings yet

- In SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredDocument7 pagesIn SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredPrerna AroraNo ratings yet

- FM ProjectDocument12 pagesFM ProjectRahul RoyNo ratings yet

- Chart 100078979Document5 pagesChart 100078979Huy ĐoànNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument1 pageStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceMallela JyothiNo ratings yet

- Sbi CC StatementDocument1 pageSbi CC StatementBHASKAR pNo ratings yet

- Tata BAF - 6%Document1 pageTata BAF - 6%Samrat FuriaNo ratings yet

- ASB CalculationDocument4 pagesASB CalculationMat Zaid MamatNo ratings yet

- Repayment Schedule - 230307100013643Document2 pagesRepayment Schedule - 230307100013643manammadhuNo ratings yet

- Repayment Schedule - 230307100013643Document2 pagesRepayment Schedule - 230307100013643manammadhuNo ratings yet

- Compound Plan For Binary FriendsDocument1 pageCompound Plan For Binary FriendsMahesh AraNo ratings yet

- Statement of Axis Account No:923010003432065 For The Period (From: 01-08-2023 To: 26-01-2024)Document2 pagesStatement of Axis Account No:923010003432065 For The Period (From: 01-08-2023 To: 26-01-2024)siddharthasampathNo ratings yet

- Amort Chart 1Document5 pagesAmort Chart 1Vinayak KarmalkarNo ratings yet

- Sr. No EMI Dates Opening Principal EMI Interest ClosingDocument2 pagesSr. No EMI Dates Opening Principal EMI Interest ClosingAllanoor KhiljiNo ratings yet

- Mutual Fund SWP Calculator Plan 1Document8 pagesMutual Fund SWP Calculator Plan 1Yada GiriNo ratings yet

- PMAIZMTUSDMDocument2 pagesPMAIZMTUSDMLinh TranNo ratings yet

- Statement of Axis Account No:918010050126397 For The Period (From: 01-04-2022 To: 31-03-2023)Document2 pagesStatement of Axis Account No:918010050126397 For The Period (From: 01-04-2022 To: 31-03-2023)seervisupremeNo ratings yet

- OpTransactionHistoryUX3 - PDF04 05 2024Document4 pagesOpTransactionHistoryUX3 - PDF04 05 2024optimus sales distributionNo ratings yet

- Subsistance Allowance Consilidated March 2023Document2 pagesSubsistance Allowance Consilidated March 2023bteuNo ratings yet

- Dinesh KumarDocument3 pagesDinesh KumarHeri kimNo ratings yet

- 2023 19 12 17 34 59 ITCertificateDocument2 pages2023 19 12 17 34 59 ITCertificateAman ShabaNo ratings yet

- 20210128-Forms-Enhanced Pension Loan ApplicationDocument2 pages20210128-Forms-Enhanced Pension Loan ApplicationReverencio B. GaborNo ratings yet

- IIFL - SL5134283 - Welcome LetterDocument3 pagesIIFL - SL5134283 - Welcome LetteriiflfincopltdNo ratings yet

- Other STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksDocument4 pagesOther STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksAman SinghNo ratings yet

- HDFC Bank LTD Mumbai Repayment Schedule: Date: 14/05/2021Document5 pagesHDFC Bank LTD Mumbai Repayment Schedule: Date: 14/05/2021Rajesh AdluriNo ratings yet

- Repayment Schedule-PHR290407545232Document15 pagesRepayment Schedule-PHR290407545232suvai79No ratings yet

- VaR Calculation ModelDocument9 pagesVaR Calculation ModelatpugajoopNo ratings yet

- O/RMS Accountant Question Paper 2016 UP Circle Held On 22.05.2016Document21 pagesO/RMS Accountant Question Paper 2016 UP Circle Held On 22.05.2016CJ MazualaNo ratings yet

- PLKND2312130005Document2 pagesPLKND2312130005malarkurinji78No ratings yet

- Welcome Letter PG 0224 F 17 000038 2018 12 25 15 51 40Document7 pagesWelcome Letter PG 0224 F 17 000038 2018 12 25 15 51 40manavsingh34No ratings yet

- Clix REPAYMENT - SCHEDULE - REPORT AC2019091353787Document1 pageClix REPAYMENT - SCHEDULE - REPORT AC2019091353787Manohar ChaudharyNo ratings yet

- New Microsoft Ex5y56ytg6tcel WorksheetDocument9 pagesNew Microsoft Ex5y56ytg6tcel WorksheetNikhita ShajiNo ratings yet

- RAK Ceramics: Balance SheetDocument16 pagesRAK Ceramics: Balance SheetMd Borhan Uddin 2035097660No ratings yet

- 4 Template BL ProbDocument16 pages4 Template BL ProbShreyash TiwariNo ratings yet

- Bus485 LifeDocument4 pagesBus485 LifeF.T. BhuiyanNo ratings yet

- Assignment of FMDocument11 pagesAssignment of FMAbhishek kumar sittuNo ratings yet

- Histórico Do EmpregadorDocument2 pagesHistórico Do EmpregadorgiselesalesnNo ratings yet

- Repayment LetterDocument3 pagesRepayment Lettersunil kr verma100% (1)

- Statement of Axis Account No:911010036952533 For The Period (From: 13-05-2020 To: 11-06-2021)Document2 pagesStatement of Axis Account No:911010036952533 For The Period (From: 13-05-2020 To: 11-06-2021)srinu katamsNo ratings yet

- LIC SWP CalculationDocument4 pagesLIC SWP Calculationsushil kumarNo ratings yet

- Cashlite TNC Oct2018 EnbmDocument15 pagesCashlite TNC Oct2018 EnbmPokya SgNo ratings yet

- PIA MateDocument5 pagesPIA MateGildardo LongoriaNo ratings yet

- Natwarlal Jesaramji RawalDocument4 pagesNatwarlal Jesaramji Rawalsunil jadhavNo ratings yet

- Data TTNNDocument4 pagesData TTNNân ânNo ratings yet

- Repayment Schedule Report Ac2020092465227Document1 pageRepayment Schedule Report Ac2020092465227Manohar ChaudharyNo ratings yet

- Clix Capital REPAYMENT - SCHEDULE - REPORT AC2020092465227Document1 pageClix Capital REPAYMENT - SCHEDULE - REPORT AC2020092465227Manohar Chaudhary100% (2)

- Datos Panelejercicio ClaseDocument10 pagesDatos Panelejercicio ClaseSarahi MorenoNo ratings yet

- Ribka Septiani Natty - Financial Distress Altman Z-ScoreDocument2 pagesRibka Septiani Natty - Financial Distress Altman Z-ScoreRibka SeptianiNo ratings yet

- Other STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksDocument4 pagesOther STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksAman SinghNo ratings yet

- CorpDocument106 pagesCorpEspace NuvemNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument25 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureConverse CareersNo ratings yet

- Data Angin DibalikDocument3,917 pagesData Angin DibalikSandyNo ratings yet

- Sss ReportDocument3 pagesSss ReportSumit Kumar SahuNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- CVE 202 Lecture - 28062021Document11 pagesCVE 202 Lecture - 28062021odubade opeyemiNo ratings yet

- 11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFDocument3 pages11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFaaditya chopadeNo ratings yet

- Analgesics in ObstetricsDocument33 pagesAnalgesics in ObstetricsVeena KaNo ratings yet

- Frizzell, 1987. Stress Orientation Determined From Fault Slip Data in Hampel Wash Area NevadaDocument10 pagesFrizzell, 1987. Stress Orientation Determined From Fault Slip Data in Hampel Wash Area Nevada黃詠晴No ratings yet

- Cleopatra Wall Tiles CatalogueDocument151 pagesCleopatra Wall Tiles CatalogueHussain ElarabiNo ratings yet

- The Great Gatsby (1925)Document100 pagesThe Great Gatsby (1925)Radu-Alexandru BulaiNo ratings yet

- Universidad Emiliano Zapata Período Enero-Abril 2022 English IiDocument3 pagesUniversidad Emiliano Zapata Período Enero-Abril 2022 English IiJorge Alberto Salas MuñozNo ratings yet

- Bearing Inspection SOPDocument7 pagesBearing Inspection SOPRianAwangga100% (1)

- Numerical Methods For Partial Differential Equations: CAAM 452 Spring 2005 Instructor: Tim WarburtonDocument26 pagesNumerical Methods For Partial Differential Equations: CAAM 452 Spring 2005 Instructor: Tim WarburtonAqib SiddiqueNo ratings yet

- Light and Geometric OpticsDocument53 pagesLight and Geometric OpticsLeah May Tamayo ManayonNo ratings yet

- Codex: Night LordsDocument5 pagesCodex: Night LordsM. WoodsNo ratings yet

- Lymphoproliferative DisordersDocument36 pagesLymphoproliferative DisordersBrett FieldsNo ratings yet

- Clsi Astnewsupdate January2020ddddddpmDocument15 pagesClsi Astnewsupdate January2020ddddddpmRenato DesideriNo ratings yet

- CochinBase Tender E 13042021detailDocument27 pagesCochinBase Tender E 13042021detailisan.structural TjsvgalavanNo ratings yet

- The Best Classical Music For New YearDocument10 pagesThe Best Classical Music For New Yeardane franolicNo ratings yet

- केन्द्रीय विद्यालय संगठन, कोलकाता संभाग Kendriya Vidyalaya Sangathan, Kolkata RegionDocument5 pagesकेन्द्रीय विद्यालय संगठन, कोलकाता संभाग Kendriya Vidyalaya Sangathan, Kolkata RegionMuskan MangarajNo ratings yet

- Trophy Urban Core Property: Houston, TexasDocument25 pagesTrophy Urban Core Property: Houston, Texasbella grandeNo ratings yet

- AJODO-90 Petrovic Et Al Role of The Lateral Pterigoid Muscle and Menisco Temporomandibular...Document12 pagesAJODO-90 Petrovic Et Al Role of The Lateral Pterigoid Muscle and Menisco Temporomandibular...ortodoncia 2018No ratings yet

- Short Notes For Heat Transfer - Docx 97.docx 93Document18 pagesShort Notes For Heat Transfer - Docx 97.docx 93kumarsumit1942No ratings yet

- GrandStream GXV-3175 - User Manual EnglishDocument130 pagesGrandStream GXV-3175 - User Manual Englishซิสทูยู ออนไลน์No ratings yet

- اول 4 وحدات من مذكرة كونكت 4 مستر محمد جاد ترم اول 2022Document112 pagesاول 4 وحدات من مذكرة كونكت 4 مستر محمد جاد ترم اول 2022Sameh IbrahimNo ratings yet

- Written Theory Sample12Document1 pageWritten Theory Sample12John SmithNo ratings yet

- PDF PMP Exam Quick Reference GuideDocument8 pagesPDF PMP Exam Quick Reference GuideNantha KumarNo ratings yet

- Bca 2sem SyDocument10 pagesBca 2sem SyRounakNo ratings yet

- Order Flow AnalysisDocument6 pagesOrder Flow AnalysisSumit SinghNo ratings yet

- Topic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaDocument29 pagesTopic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaAzhar SabriNo ratings yet

- JM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270Document1 pageJM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270michael jan tubongbanuaNo ratings yet

- Hardtimes Analysis PDFDocument30 pagesHardtimes Analysis PDFV LkvNo ratings yet