Professional Documents

Culture Documents

Bachelor of Business Administration

Bachelor of Business Administration

Uploaded by

Wang Hon YuenCopyright:

Available Formats

You might also like

- Financial AccountingandAnalysisJan18 FJ5qQXjrmwDocument384 pagesFinancial AccountingandAnalysisJan18 FJ5qQXjrmwShubham Raghav100% (2)

- Stephanie Bank StatementDocument14 pagesStephanie Bank StatementAnonymous SZFPoV100% (4)

- 2016-2017-New Trends and New Information technologies-Jean-Patrick ThevenyDocument4 pages2016-2017-New Trends and New Information technologies-Jean-Patrick Thevenyyat3nfk0No ratings yet

- Planning For Differentiated LearningDocument4 pagesPlanning For Differentiated LearningLoeyNo ratings yet

- Chapter 10 - Solution ManualDocument27 pagesChapter 10 - Solution Manualjuan100% (1)

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- Syllabus ECEN3008Document2 pagesSyllabus ECEN3008tiNo ratings yet

- Syllabus ECEN3007Document2 pagesSyllabus ECEN3007tiNo ratings yet

- ACCTG032 WLAP Module 5-1Document1 pageACCTG032 WLAP Module 5-1nicolaus copernicusNo ratings yet

- Career Coaching Process MapDocument4 pagesCareer Coaching Process Mapblessy jonesNo ratings yet

- MPL HandbookDocument13 pagesMPL HandbookAntonia D QuashieNo ratings yet

- Table 3: Summary of Information On Each Course/ModuleDocument4 pagesTable 3: Summary of Information On Each Course/Moduleewan_0306No ratings yet

- MGC4013 Synopsis 2017Document4 pagesMGC4013 Synopsis 2017hisyamstarkNo ratings yet

- Requirements KOM1259M Networking in Global Business Environment 4Document4 pagesRequirements KOM1259M Networking in Global Business Environment 4shafnarafeek71No ratings yet

- Lyceum-Northwestern University: L-NU AA - 1 - 03-05 - 17 17Document6 pagesLyceum-Northwestern University: L-NU AA - 1 - 03-05 - 17 17jolinaNo ratings yet

- Department of Accounting Faculty of Economics and Business Universitas Muhammadiyah YogyakartaDocument5 pagesDepartment of Accounting Faculty of Economics and Business Universitas Muhammadiyah YogyakartaSafira SilmiyaNo ratings yet

- 5.syllabus - Deb1053 - Electronic WorkshopDocument8 pages5.syllabus - Deb1053 - Electronic WorkshopadibNo ratings yet

- ACCTG032 WLAP Module 4Document1 pageACCTG032 WLAP Module 4nicolaus copernicusNo ratings yet

- LASTDocument8 pagesLASTZea Maize CaluyaNo ratings yet

- Rencana Pembelajaran SemesterDocument3 pagesRencana Pembelajaran SemesterAtul LailatulNo ratings yet

- Assessing Student Learning OutcomesDocument27 pagesAssessing Student Learning OutcomesDan DanNo ratings yet

- Business and Ethics Outline 2020Document4 pagesBusiness and Ethics Outline 2020Shabana NaveedNo ratings yet

- Learning and Teaching Program Year 9 - Office TechnologyDocument8 pagesLearning and Teaching Program Year 9 - Office TechnologyJulie DauruaNo ratings yet

- MIT4203 Core: Total Learning Hour (TLH) : 120Document5 pagesMIT4203 Core: Total Learning Hour (TLH) : 120Dr S B GoyalNo ratings yet

- ACCTG032 WLAP Module 1 AND 2Document1 pageACCTG032 WLAP Module 1 AND 2agparcoNo ratings yet

- Advanced Communication Skills LabDocument112 pagesAdvanced Communication Skills LabMadhu PantNo ratings yet

- EoT1 G08 Adv Science InspireDocument1 pageEoT1 G08 Adv Science InspirehessaalmzrouiNo ratings yet

- DR Azlin - Edu 6001 (KT)Document6 pagesDR Azlin - Edu 6001 (KT)NeinPolystania100% (1)

- 教學計劃表 Syllabus: 學年/學期 Academic Year/SemesterDocument3 pages教學計劃表 Syllabus: 學年/學期 Academic Year/SemesterNatalia LapshinaNo ratings yet

- Summary of Information (RMK) On TSLB3163 Curriculum Studies (Students' Version)Document4 pagesSummary of Information (RMK) On TSLB3163 Curriculum Studies (Students' Version)WCKelvin100% (1)

- PR101 OBE SyllabusDocument4 pagesPR101 OBE Syllabusromnick g. cantaNo ratings yet

- Lesson Plan Business EnvironmentDocument2 pagesLesson Plan Business EnvironmentShrividhya Venkata PrasathNo ratings yet

- ACCTG032 WLAP Module 6Document1 pageACCTG032 WLAP Module 6agparcoNo ratings yet

- Syllabus SeminaronProjectDocument6 pagesSyllabus SeminaronProjectMichel Llavado ImperialNo ratings yet

- Course Outline MBA 2022Document5 pagesCourse Outline MBA 2022wasif ahmedNo ratings yet

- PIM-NMB40103 - Course Learning Plan-Jan 2017Document5 pagesPIM-NMB40103 - Course Learning Plan-Jan 2017FirzanNo ratings yet

- Lovely Professional University, Punjab: Format For Instruction Plan (For Courses With Lectures and Tutorials)Document9 pagesLovely Professional University, Punjab: Format For Instruction Plan (For Courses With Lectures and Tutorials)Shivani SharmaNo ratings yet

- Dea 1343 SyllabusDocument10 pagesDea 1343 SyllabusRoger JohnNo ratings yet

- Daily Planning Template2Document7 pagesDaily Planning Template2taniaj18No ratings yet

- Needs Analysis For Elementary StudentsDocument1 pageNeeds Analysis For Elementary StudentsSergio Ricaurte VargasNo ratings yet

- PHD Course WorkDocument34 pagesPHD Course WorkVivek SharmaNo ratings yet

- Academic and Professional Development L1 2021-22Document16 pagesAcademic and Professional Development L1 2021-22trangNo ratings yet

- Business and Ethics Outline On WebsiteDocument3 pagesBusiness and Ethics Outline On WebsiteShabana NaveedNo ratings yet

- End 870Document12 pagesEnd 870Goh Cai YuNo ratings yet

- Fundacion Universidad Autonoma de Colombia Diplomado Ingles Iv-VDocument5 pagesFundacion Universidad Autonoma de Colombia Diplomado Ingles Iv-VKAREN SOFIA CAMARGO REYESNo ratings yet

- ITE2204 Course StructureDocument2 pagesITE2204 Course StructureMing Zhi EditNo ratings yet

- IT Systems in ManagementDocument5 pagesIT Systems in ManagementMohammed Gouse GaletyNo ratings yet

- FINS3625 Course OutlineDocument19 pagesFINS3625 Course Outlinetim lNo ratings yet

- Course Outline: International Islamic University MalaysiaDocument12 pagesCourse Outline: International Islamic University MalaysiaRANDAN SADIQNo ratings yet

- CM 1002AF 教學計畫Document3 pagesCM 1002AF 教學計畫余思懷No ratings yet

- Integrative Theme Community BuilderDocument1 pageIntegrative Theme Community Builderapi-438312545No ratings yet

- OBE Awareness: PM Ir. Dr. Mohd Shukry Bin Abdul Majid Universiti Malaysia PerlisDocument72 pagesOBE Awareness: PM Ir. Dr. Mohd Shukry Bin Abdul Majid Universiti Malaysia PerlisHtet lin AgNo ratings yet

- Coursework: 70% Examination: 30%: Kanak-Kanak Dan LiterasiDocument4 pagesCoursework: 70% Examination: 30%: Kanak-Kanak Dan LiterasiNICOLE LEENo ratings yet

- Student Portfolio SummaryDocument2 pagesStudent Portfolio SummaryMarielle JecielNo ratings yet

- EC - - 34360 - 教學計畫Document3 pagesEC - - 34360 - 教學計畫余思懷No ratings yet

- Table 4 Latest GT00703 Sem 2 2019.2020Document3 pagesTable 4 Latest GT00703 Sem 2 2019.2020Nur Shahirah AzmanNo ratings yet

- Year_4_Science_Portfolio_SatisfactoryDocument28 pagesYear_4_Science_Portfolio_SatisfactoryYoga HariprasathNo ratings yet

- Introduction (Engagement) : Rcillpzmaxw-Qapdn0-D84Rp9Document1 pageIntroduction (Engagement) : Rcillpzmaxw-Qapdn0-D84Rp9api-369907424No ratings yet

- Portfolio DRSHDocument12 pagesPortfolio DRSHKyaw SwaNo ratings yet

- CLP Inb21703Document4 pagesCLP Inb21703Zahirah ZairulNo ratings yet

- Scenario-based e-Learning: Evidence-Based Guidelines for Online Workforce LearningFrom EverandScenario-based e-Learning: Evidence-Based Guidelines for Online Workforce LearningRating: 4 out of 5 stars4/5 (2)

- Annual Report 2019 EngDocument104 pagesAnnual Report 2019 EngWang Hon YuenNo ratings yet

- Acting For: The ProfessionDocument27 pagesActing For: The ProfessionWang Hon YuenNo ratings yet

- Annual Report 2015 EngDocument100 pagesAnnual Report 2015 EngWang Hon YuenNo ratings yet

- 15 International Financial CentreDocument26 pages15 International Financial CentreWang Hon YuenNo ratings yet

- Annual Report 2016 EngDocument104 pagesAnnual Report 2016 EngWang Hon YuenNo ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- 16 Reserves ManagementDocument8 pages16 Reserves ManagementWang Hon YuenNo ratings yet

- Annual Report 2020 - EngDocument116 pagesAnnual Report 2020 - EngWang Hon YuenNo ratings yet

- 17 Corporate FunctionsDocument18 pages17 Corporate FunctionsWang Hon YuenNo ratings yet

- Eng Annual Report 2021Document124 pagesEng Annual Report 2021Wang Hon YuenNo ratings yet

- 18 Corporate Social ResponsibilityDocument19 pages18 Corporate Social ResponsibilityWang Hon YuenNo ratings yet

- Annual Report 2017 EngDocument104 pagesAnnual Report 2017 EngWang Hon YuenNo ratings yet

- Commissioner's Foreword: Annual Report 2020-21Document3 pagesCommissioner's Foreword: Annual Report 2020-21Wang Hon YuenNo ratings yet

- E - 2019 Interim Report - Pdf.coredownloadDocument64 pagesE - 2019 Interim Report - Pdf.coredownloadWang Hon YuenNo ratings yet

- Annex and Tables: Annual Report 2020Document20 pagesAnnex and Tables: Annual Report 2020Wang Hon YuenNo ratings yet

- E - 1st Quarterly Statement (Announcement Version) (20190506) .PDF - CoredownloadDocument2 pagesE - 1st Quarterly Statement (Announcement Version) (20190506) .PDF - CoredownloadWang Hon YuenNo ratings yet

- Po RT 2 0 1 6Document46 pagesPo RT 2 0 1 6Wang Hon YuenNo ratings yet

- E - 1st Quarterly Statement (Announcement Version) (20170510) .PDF - CoredownloadDocument2 pagesE - 1st Quarterly Statement (Announcement Version) (20170510) .PDF - CoredownloadWang Hon YuenNo ratings yet

- 07 About HKMADocument2 pages07 About HKMAWang Hon YuenNo ratings yet

- 14 Banking StabilityDocument40 pages14 Banking StabilityWang Hon YuenNo ratings yet

- Highlights of 2020: Economic & Financial EnvironmentDocument4 pagesHighlights of 2020: Economic & Financial EnvironmentWang Hon YuenNo ratings yet

- 19 ExchangeFundDocument109 pages19 ExchangeFundWang Hon YuenNo ratings yet

- E - 3rd Quarterly Statement (Announcement Version) (20161019) .PDF - CoredownloadDocument2 pagesE - 3rd Quarterly Statement (Announcement Version) (20161019) .PDF - CoredownloadWang Hon YuenNo ratings yet

- E - 2017 Interim Report - Pdf.coredownloadDocument64 pagesE - 2017 Interim Report - Pdf.coredownloadWang Hon YuenNo ratings yet

- E - 3rd Quarterly Statement (Announcement Version) (20191017) .PDF - CoredownloadDocument2 pagesE - 3rd Quarterly Statement (Announcement Version) (20191017) .PDF - CoredownloadWang Hon YuenNo ratings yet

- E - 3rd Quarterly Statement (2018) (Final) .PDF - CoredownloadDocument2 pagesE - 3rd Quarterly Statement (2018) (Final) .PDF - CoredownloadWang Hon YuenNo ratings yet

- Quarterly Statement 2021 (January - March) : 中電控股有限公司 CLP Holdings LimitedDocument2 pagesQuarterly Statement 2021 (January - March) : 中電控股有限公司 CLP Holdings LimitedWang Hon YuenNo ratings yet

- E00002 PDF CoredownloadDocument2 pagesE00002 PDF CoredownloadWang Hon YuenNo ratings yet

- E - 1st Quarterly Statement (Announcement Version) (20200508) .PDF - CoredownloadDocument2 pagesE - 1st Quarterly Statement (Announcement Version) (20200508) .PDF - CoredownloadWang Hon YuenNo ratings yet

- Reviewer For 2nd Eval Auditing Theory Answer KeyDocument11 pagesReviewer For 2nd Eval Auditing Theory Answer KeyadssdasdsadNo ratings yet

- Wealth-Insight - Apr 2021 PDFDocument64 pagesWealth-Insight - Apr 2021 PDFGanshNo ratings yet

- Non Banking Financial InstitutionDocument5 pagesNon Banking Financial InstitutionRehan BalochNo ratings yet

- Nse-Ncfm-Financial Markets A Beginners ModuleDocument99 pagesNse-Ncfm-Financial Markets A Beginners ModuleJyoti SukhijaNo ratings yet

- Risk Identification&analysisDocument15 pagesRisk Identification&analysisAesthetic GirlNo ratings yet

- 2 BHK Price List & Floor PlanDocument1 page2 BHK Price List & Floor PlanRajesh K SinghNo ratings yet

- Evaluation and Selection of Strategies Revision NotesDocument5 pagesEvaluation and Selection of Strategies Revision NotesDave Dearing100% (1)

- Second Installment Payment Relief - MBAMSc - 2021Document9 pagesSecond Installment Payment Relief - MBAMSc - 2021Chalitha DhananjaniNo ratings yet

- Chapter 008Document25 pagesChapter 008Muhammad Bilal TariqNo ratings yet

- Jackson Banking Supplement II - As Sent - 2Document7 pagesJackson Banking Supplement II - As Sent - 2AlejandroCervantesNo ratings yet

- Taxation: The Institute of Chartered Accountants of PakistanDocument4 pagesTaxation: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Risk Management in Banking Salman IciciDocument19 pagesRisk Management in Banking Salman IcicisallurocksNo ratings yet

- Problem 14-4 (IAA)Document8 pagesProblem 14-4 (IAA)NIMOTHI LASE0% (1)

- Fiscal PolicyDocument2 pagesFiscal PolicymunnabetaNo ratings yet

- Journal Entry VoucherDocument2 pagesJournal Entry VoucherCristina MelloriaNo ratings yet

- The Financial Statements of Banks and Their Principal CompetitorsDocument30 pagesThe Financial Statements of Banks and Their Principal CompetitorsMahmudur Rahman100% (4)

- Module 27 - Impairment of AssetsDocument76 pagesModule 27 - Impairment of AssetsGrace GabrielNo ratings yet

- Law On Credit TransactionDocument48 pagesLaw On Credit TransactionDesiree Sogo-an PolicarpioNo ratings yet

- EmGoldex Et Al Complaint Docket No 2014 0056Document41 pagesEmGoldex Et Al Complaint Docket No 2014 0056jmaglich1No ratings yet

- Value at Risk and Expected Shortfall: Risk Management and Financial Institutions 4e by John C. HullDocument23 pagesValue at Risk and Expected Shortfall: Risk Management and Financial Institutions 4e by John C. HullPhương KiềuNo ratings yet

- Black Money of Bangladesh EconomyDocument7 pagesBlack Money of Bangladesh Economyঘুমন্ত বালক100% (1)

- Corporation vs. PartnershipDocument4 pagesCorporation vs. PartnershipPau Che100% (1)

- Presentation HDFC Mutual Fund - Product Suite - Oct 18Document57 pagesPresentation HDFC Mutual Fund - Product Suite - Oct 18ritik bumbakNo ratings yet

- Words Related With Business AdministrationDocument181 pagesWords Related With Business AdministrationRamazan MaçinNo ratings yet

- Can Alpha Be Captured by Risk Premia PublicDocument25 pagesCan Alpha Be Captured by Risk Premia PublicDerek FultonNo ratings yet

- 9.30.16 SFBO (With Nominal)Document5 pages9.30.16 SFBO (With Nominal)Vincent TayagNo ratings yet

Bachelor of Business Administration

Bachelor of Business Administration

Uploaded by

Wang Hon YuenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bachelor of Business Administration

Bachelor of Business Administration

Uploaded by

Wang Hon YuenCopyright:

Available Formats

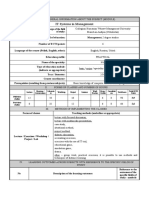

Hong Kong Baptist University

School of Business

Programme: Bachelor of Business Administration

Department: Finance and Decision Sciences

Course Code: FINE3005 Level: III

Course Title: Investment Management

FINE2005 Financial Management or

Prerequisites:

FINE2007 Principles of Financial Management

Duration: 40 hours Units: 3 (3, 3, 0)

This course examines the investment environment in Hong Kong, the basic principles of

Course Description: valuation of financial assets, and the development of portfolio and capital market theories.

The purpose is to offer students guidance in the management of financial investments.

1. Alexander, G. J., Sharpe, W. F., & Bailey, J. V. (2001). Fundamentals of Investments (3rd ed.).

Upper Saddle River, NJ: Prentice Hall.

2. Bodie, Z., Kane, A., & Marcus, A. J. (2018). Investments (11th ed.). Boston: McGraw-

Hill/Irwin.

3. Haugen, R. A. (2000). Modern Investment Theory (5th ed.). Upper Saddle River, NJ: Prentice

Hall.

4. Reilly, F. K., & Norton, E. A. (2005). Investments (7th ed.). Mason, Ohio: Thomson/South-

Texts & References: Western.

(* recommended Relevant Websites:

textbook(s)) 1. Hong Kong Stock Exchange http://www.hkex.com.hk

2. Hong Kong Securities Institute: http://www.hksi.org

3. Securities and Futures Commission : http://www.hkfsc.org.hk

4. Institute of Financial Planners of Hong Kong : http://www.ifphk.org

5. Hong Kong Institute of Bankers : http://www.hkib.org

6. Hong Kong Institute of Investors : http://www.hkii.org

7. Quam Net : http://www.quamnet.com

Upon completion of this course, students should be able to:

1. Evaluate the investment environment of Hong Kong.

2. Understand the risk and return trade off.

Learning Outcomes:

3. Estimate the fair value of stock investment.

4. Apply portfolio theory and Capital Asset Pricing Model in asset valuation and

performance evaluation.

Learning Outcome Learning Outcome

addressed: addressed:

1 2 3 4 1 2 3 4

Lecture Services Learning

Guest speakers Internship

Teaching & Learning Case Study Field study

Activities: Role playing Company visits

Student presentation e-learning

Project Independent study

Simulation game Others

Exercises and problems

BBA – FINE3005 (2013/14 AY)

9/D25

Case Study

Written examination

Learning Outcome addressed

Role Playing

Student Presentation

Oral examination

project/paper

Group

Simulation Game

Individual project/paper

Exercises & problems

Service learning

Internship

Field Study

Company visits

Major Assessment

Methods:

For each Major Assessment

Method below, please

indicate the specific

pedagogical /assessment

methods involved (by

putting a in the relevant

box(es) on the right-hand

side).

Class Participation/

Discussion (20%) 1-,4

Assignment(s) (20%) 3,4

Test(s) (20%) 1-4

Examination (40%) 1-4

Others (please specify)

____________ ( %)

Course templates are available at BU eLearning (formerly called “BU Moodle”), programme

Course Web:

website and Staff Area in School website (for staff only).

Course Content: Hours Learning

Outcome

no.

I. Introduction 2 1

Basic concepts and the securities markets

II. Investment Environment of Hong Kong 3 1

A. The stock exchange of Hong Kong

B. The securities and futures commission

C. The stock indexes

III. Modern Portfolio Theory and Asset Pricing 13 2, 4

A. Portfolio diversification

B. Efficient frontier

C. Capital asset pricing model

D. Arbitrage pricing theory

IV. Security Analysis 12 3, 4

A. Fundamental analysis

B. Technical analysis

C. Market efficiency

V. Portfolio Management 10 2, 4

A. International investment environment

B. International diversification

C. Performance measurement

D. Selection, allocation and timing

BBA – FINE3005 (2013/14 AY)

9/D26

E. Fiduciary duties and ethical issues

Total 40 hrs.

to cultivate academic curiosity, integrity and leadership potential

Contribution to the to enhance all-rounded training

to develop consciousness of values and social responsibility

Mission of the

to disseminate contemporary knowledge

School: to disseminate the research findings of faculty members in the School

to develop awareness in public policy

Learning Goals (LG) of BBA Programme

LG1: Students will have the fundamental knowledge and skills required for managing a

business.

LG2: Students will have an in-depth understanding of an area of specialization such as

accounting, economics, global and China business, finance, human resources

management, information systems management, and marketing

Contribution to the LG3: Students will have the oral and written communication skills and information

technology skills necessary for working in a business environment.

Learning Goals of the LG4: Students will be analytical and critical thinkers able to solve real-world business

Programme: problems.

LG5: Students will have a solid understanding of

(a) how business is influenced by its environment, including economic, social-

cultural, legal-political, technological, and other general conditions, as well as

by an organization’s stakeholders;

(b) the global nature of contemporary business; and

(c) the value of business ethics and good corporate governance.

LG6: Students will have a broad exposure to non-business disciplines.

Course Co-ordinator: Dr. Billy Mak

BBA – FINE3005 (2013/14 AY)

9/D27

You might also like

- Financial AccountingandAnalysisJan18 FJ5qQXjrmwDocument384 pagesFinancial AccountingandAnalysisJan18 FJ5qQXjrmwShubham Raghav100% (2)

- Stephanie Bank StatementDocument14 pagesStephanie Bank StatementAnonymous SZFPoV100% (4)

- 2016-2017-New Trends and New Information technologies-Jean-Patrick ThevenyDocument4 pages2016-2017-New Trends and New Information technologies-Jean-Patrick Thevenyyat3nfk0No ratings yet

- Planning For Differentiated LearningDocument4 pagesPlanning For Differentiated LearningLoeyNo ratings yet

- Chapter 10 - Solution ManualDocument27 pagesChapter 10 - Solution Manualjuan100% (1)

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- Syllabus ECEN3008Document2 pagesSyllabus ECEN3008tiNo ratings yet

- Syllabus ECEN3007Document2 pagesSyllabus ECEN3007tiNo ratings yet

- ACCTG032 WLAP Module 5-1Document1 pageACCTG032 WLAP Module 5-1nicolaus copernicusNo ratings yet

- Career Coaching Process MapDocument4 pagesCareer Coaching Process Mapblessy jonesNo ratings yet

- MPL HandbookDocument13 pagesMPL HandbookAntonia D QuashieNo ratings yet

- Table 3: Summary of Information On Each Course/ModuleDocument4 pagesTable 3: Summary of Information On Each Course/Moduleewan_0306No ratings yet

- MGC4013 Synopsis 2017Document4 pagesMGC4013 Synopsis 2017hisyamstarkNo ratings yet

- Requirements KOM1259M Networking in Global Business Environment 4Document4 pagesRequirements KOM1259M Networking in Global Business Environment 4shafnarafeek71No ratings yet

- Lyceum-Northwestern University: L-NU AA - 1 - 03-05 - 17 17Document6 pagesLyceum-Northwestern University: L-NU AA - 1 - 03-05 - 17 17jolinaNo ratings yet

- Department of Accounting Faculty of Economics and Business Universitas Muhammadiyah YogyakartaDocument5 pagesDepartment of Accounting Faculty of Economics and Business Universitas Muhammadiyah YogyakartaSafira SilmiyaNo ratings yet

- 5.syllabus - Deb1053 - Electronic WorkshopDocument8 pages5.syllabus - Deb1053 - Electronic WorkshopadibNo ratings yet

- ACCTG032 WLAP Module 4Document1 pageACCTG032 WLAP Module 4nicolaus copernicusNo ratings yet

- LASTDocument8 pagesLASTZea Maize CaluyaNo ratings yet

- Rencana Pembelajaran SemesterDocument3 pagesRencana Pembelajaran SemesterAtul LailatulNo ratings yet

- Assessing Student Learning OutcomesDocument27 pagesAssessing Student Learning OutcomesDan DanNo ratings yet

- Business and Ethics Outline 2020Document4 pagesBusiness and Ethics Outline 2020Shabana NaveedNo ratings yet

- Learning and Teaching Program Year 9 - Office TechnologyDocument8 pagesLearning and Teaching Program Year 9 - Office TechnologyJulie DauruaNo ratings yet

- MIT4203 Core: Total Learning Hour (TLH) : 120Document5 pagesMIT4203 Core: Total Learning Hour (TLH) : 120Dr S B GoyalNo ratings yet

- ACCTG032 WLAP Module 1 AND 2Document1 pageACCTG032 WLAP Module 1 AND 2agparcoNo ratings yet

- Advanced Communication Skills LabDocument112 pagesAdvanced Communication Skills LabMadhu PantNo ratings yet

- EoT1 G08 Adv Science InspireDocument1 pageEoT1 G08 Adv Science InspirehessaalmzrouiNo ratings yet

- DR Azlin - Edu 6001 (KT)Document6 pagesDR Azlin - Edu 6001 (KT)NeinPolystania100% (1)

- 教學計劃表 Syllabus: 學年/學期 Academic Year/SemesterDocument3 pages教學計劃表 Syllabus: 學年/學期 Academic Year/SemesterNatalia LapshinaNo ratings yet

- Summary of Information (RMK) On TSLB3163 Curriculum Studies (Students' Version)Document4 pagesSummary of Information (RMK) On TSLB3163 Curriculum Studies (Students' Version)WCKelvin100% (1)

- PR101 OBE SyllabusDocument4 pagesPR101 OBE Syllabusromnick g. cantaNo ratings yet

- Lesson Plan Business EnvironmentDocument2 pagesLesson Plan Business EnvironmentShrividhya Venkata PrasathNo ratings yet

- ACCTG032 WLAP Module 6Document1 pageACCTG032 WLAP Module 6agparcoNo ratings yet

- Syllabus SeminaronProjectDocument6 pagesSyllabus SeminaronProjectMichel Llavado ImperialNo ratings yet

- Course Outline MBA 2022Document5 pagesCourse Outline MBA 2022wasif ahmedNo ratings yet

- PIM-NMB40103 - Course Learning Plan-Jan 2017Document5 pagesPIM-NMB40103 - Course Learning Plan-Jan 2017FirzanNo ratings yet

- Lovely Professional University, Punjab: Format For Instruction Plan (For Courses With Lectures and Tutorials)Document9 pagesLovely Professional University, Punjab: Format For Instruction Plan (For Courses With Lectures and Tutorials)Shivani SharmaNo ratings yet

- Dea 1343 SyllabusDocument10 pagesDea 1343 SyllabusRoger JohnNo ratings yet

- Daily Planning Template2Document7 pagesDaily Planning Template2taniaj18No ratings yet

- Needs Analysis For Elementary StudentsDocument1 pageNeeds Analysis For Elementary StudentsSergio Ricaurte VargasNo ratings yet

- PHD Course WorkDocument34 pagesPHD Course WorkVivek SharmaNo ratings yet

- Academic and Professional Development L1 2021-22Document16 pagesAcademic and Professional Development L1 2021-22trangNo ratings yet

- Business and Ethics Outline On WebsiteDocument3 pagesBusiness and Ethics Outline On WebsiteShabana NaveedNo ratings yet

- End 870Document12 pagesEnd 870Goh Cai YuNo ratings yet

- Fundacion Universidad Autonoma de Colombia Diplomado Ingles Iv-VDocument5 pagesFundacion Universidad Autonoma de Colombia Diplomado Ingles Iv-VKAREN SOFIA CAMARGO REYESNo ratings yet

- ITE2204 Course StructureDocument2 pagesITE2204 Course StructureMing Zhi EditNo ratings yet

- IT Systems in ManagementDocument5 pagesIT Systems in ManagementMohammed Gouse GaletyNo ratings yet

- FINS3625 Course OutlineDocument19 pagesFINS3625 Course Outlinetim lNo ratings yet

- Course Outline: International Islamic University MalaysiaDocument12 pagesCourse Outline: International Islamic University MalaysiaRANDAN SADIQNo ratings yet

- CM 1002AF 教學計畫Document3 pagesCM 1002AF 教學計畫余思懷No ratings yet

- Integrative Theme Community BuilderDocument1 pageIntegrative Theme Community Builderapi-438312545No ratings yet

- OBE Awareness: PM Ir. Dr. Mohd Shukry Bin Abdul Majid Universiti Malaysia PerlisDocument72 pagesOBE Awareness: PM Ir. Dr. Mohd Shukry Bin Abdul Majid Universiti Malaysia PerlisHtet lin AgNo ratings yet

- Coursework: 70% Examination: 30%: Kanak-Kanak Dan LiterasiDocument4 pagesCoursework: 70% Examination: 30%: Kanak-Kanak Dan LiterasiNICOLE LEENo ratings yet

- Student Portfolio SummaryDocument2 pagesStudent Portfolio SummaryMarielle JecielNo ratings yet

- EC - - 34360 - 教學計畫Document3 pagesEC - - 34360 - 教學計畫余思懷No ratings yet

- Table 4 Latest GT00703 Sem 2 2019.2020Document3 pagesTable 4 Latest GT00703 Sem 2 2019.2020Nur Shahirah AzmanNo ratings yet

- Year_4_Science_Portfolio_SatisfactoryDocument28 pagesYear_4_Science_Portfolio_SatisfactoryYoga HariprasathNo ratings yet

- Introduction (Engagement) : Rcillpzmaxw-Qapdn0-D84Rp9Document1 pageIntroduction (Engagement) : Rcillpzmaxw-Qapdn0-D84Rp9api-369907424No ratings yet

- Portfolio DRSHDocument12 pagesPortfolio DRSHKyaw SwaNo ratings yet

- CLP Inb21703Document4 pagesCLP Inb21703Zahirah ZairulNo ratings yet

- Scenario-based e-Learning: Evidence-Based Guidelines for Online Workforce LearningFrom EverandScenario-based e-Learning: Evidence-Based Guidelines for Online Workforce LearningRating: 4 out of 5 stars4/5 (2)

- Annual Report 2019 EngDocument104 pagesAnnual Report 2019 EngWang Hon YuenNo ratings yet

- Acting For: The ProfessionDocument27 pagesActing For: The ProfessionWang Hon YuenNo ratings yet

- Annual Report 2015 EngDocument100 pagesAnnual Report 2015 EngWang Hon YuenNo ratings yet

- 15 International Financial CentreDocument26 pages15 International Financial CentreWang Hon YuenNo ratings yet

- Annual Report 2016 EngDocument104 pagesAnnual Report 2016 EngWang Hon YuenNo ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- 16 Reserves ManagementDocument8 pages16 Reserves ManagementWang Hon YuenNo ratings yet

- Annual Report 2020 - EngDocument116 pagesAnnual Report 2020 - EngWang Hon YuenNo ratings yet

- 17 Corporate FunctionsDocument18 pages17 Corporate FunctionsWang Hon YuenNo ratings yet

- Eng Annual Report 2021Document124 pagesEng Annual Report 2021Wang Hon YuenNo ratings yet

- 18 Corporate Social ResponsibilityDocument19 pages18 Corporate Social ResponsibilityWang Hon YuenNo ratings yet

- Annual Report 2017 EngDocument104 pagesAnnual Report 2017 EngWang Hon YuenNo ratings yet

- Commissioner's Foreword: Annual Report 2020-21Document3 pagesCommissioner's Foreword: Annual Report 2020-21Wang Hon YuenNo ratings yet

- E - 2019 Interim Report - Pdf.coredownloadDocument64 pagesE - 2019 Interim Report - Pdf.coredownloadWang Hon YuenNo ratings yet

- Annex and Tables: Annual Report 2020Document20 pagesAnnex and Tables: Annual Report 2020Wang Hon YuenNo ratings yet

- E - 1st Quarterly Statement (Announcement Version) (20190506) .PDF - CoredownloadDocument2 pagesE - 1st Quarterly Statement (Announcement Version) (20190506) .PDF - CoredownloadWang Hon YuenNo ratings yet

- Po RT 2 0 1 6Document46 pagesPo RT 2 0 1 6Wang Hon YuenNo ratings yet

- E - 1st Quarterly Statement (Announcement Version) (20170510) .PDF - CoredownloadDocument2 pagesE - 1st Quarterly Statement (Announcement Version) (20170510) .PDF - CoredownloadWang Hon YuenNo ratings yet

- 07 About HKMADocument2 pages07 About HKMAWang Hon YuenNo ratings yet

- 14 Banking StabilityDocument40 pages14 Banking StabilityWang Hon YuenNo ratings yet

- Highlights of 2020: Economic & Financial EnvironmentDocument4 pagesHighlights of 2020: Economic & Financial EnvironmentWang Hon YuenNo ratings yet

- 19 ExchangeFundDocument109 pages19 ExchangeFundWang Hon YuenNo ratings yet

- E - 3rd Quarterly Statement (Announcement Version) (20161019) .PDF - CoredownloadDocument2 pagesE - 3rd Quarterly Statement (Announcement Version) (20161019) .PDF - CoredownloadWang Hon YuenNo ratings yet

- E - 2017 Interim Report - Pdf.coredownloadDocument64 pagesE - 2017 Interim Report - Pdf.coredownloadWang Hon YuenNo ratings yet

- E - 3rd Quarterly Statement (Announcement Version) (20191017) .PDF - CoredownloadDocument2 pagesE - 3rd Quarterly Statement (Announcement Version) (20191017) .PDF - CoredownloadWang Hon YuenNo ratings yet

- E - 3rd Quarterly Statement (2018) (Final) .PDF - CoredownloadDocument2 pagesE - 3rd Quarterly Statement (2018) (Final) .PDF - CoredownloadWang Hon YuenNo ratings yet

- Quarterly Statement 2021 (January - March) : 中電控股有限公司 CLP Holdings LimitedDocument2 pagesQuarterly Statement 2021 (January - March) : 中電控股有限公司 CLP Holdings LimitedWang Hon YuenNo ratings yet

- E00002 PDF CoredownloadDocument2 pagesE00002 PDF CoredownloadWang Hon YuenNo ratings yet

- E - 1st Quarterly Statement (Announcement Version) (20200508) .PDF - CoredownloadDocument2 pagesE - 1st Quarterly Statement (Announcement Version) (20200508) .PDF - CoredownloadWang Hon YuenNo ratings yet

- Reviewer For 2nd Eval Auditing Theory Answer KeyDocument11 pagesReviewer For 2nd Eval Auditing Theory Answer KeyadssdasdsadNo ratings yet

- Wealth-Insight - Apr 2021 PDFDocument64 pagesWealth-Insight - Apr 2021 PDFGanshNo ratings yet

- Non Banking Financial InstitutionDocument5 pagesNon Banking Financial InstitutionRehan BalochNo ratings yet

- Nse-Ncfm-Financial Markets A Beginners ModuleDocument99 pagesNse-Ncfm-Financial Markets A Beginners ModuleJyoti SukhijaNo ratings yet

- Risk Identification&analysisDocument15 pagesRisk Identification&analysisAesthetic GirlNo ratings yet

- 2 BHK Price List & Floor PlanDocument1 page2 BHK Price List & Floor PlanRajesh K SinghNo ratings yet

- Evaluation and Selection of Strategies Revision NotesDocument5 pagesEvaluation and Selection of Strategies Revision NotesDave Dearing100% (1)

- Second Installment Payment Relief - MBAMSc - 2021Document9 pagesSecond Installment Payment Relief - MBAMSc - 2021Chalitha DhananjaniNo ratings yet

- Chapter 008Document25 pagesChapter 008Muhammad Bilal TariqNo ratings yet

- Jackson Banking Supplement II - As Sent - 2Document7 pagesJackson Banking Supplement II - As Sent - 2AlejandroCervantesNo ratings yet

- Taxation: The Institute of Chartered Accountants of PakistanDocument4 pagesTaxation: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Risk Management in Banking Salman IciciDocument19 pagesRisk Management in Banking Salman IcicisallurocksNo ratings yet

- Problem 14-4 (IAA)Document8 pagesProblem 14-4 (IAA)NIMOTHI LASE0% (1)

- Fiscal PolicyDocument2 pagesFiscal PolicymunnabetaNo ratings yet

- Journal Entry VoucherDocument2 pagesJournal Entry VoucherCristina MelloriaNo ratings yet

- The Financial Statements of Banks and Their Principal CompetitorsDocument30 pagesThe Financial Statements of Banks and Their Principal CompetitorsMahmudur Rahman100% (4)

- Module 27 - Impairment of AssetsDocument76 pagesModule 27 - Impairment of AssetsGrace GabrielNo ratings yet

- Law On Credit TransactionDocument48 pagesLaw On Credit TransactionDesiree Sogo-an PolicarpioNo ratings yet

- EmGoldex Et Al Complaint Docket No 2014 0056Document41 pagesEmGoldex Et Al Complaint Docket No 2014 0056jmaglich1No ratings yet

- Value at Risk and Expected Shortfall: Risk Management and Financial Institutions 4e by John C. HullDocument23 pagesValue at Risk and Expected Shortfall: Risk Management and Financial Institutions 4e by John C. HullPhương KiềuNo ratings yet

- Black Money of Bangladesh EconomyDocument7 pagesBlack Money of Bangladesh Economyঘুমন্ত বালক100% (1)

- Corporation vs. PartnershipDocument4 pagesCorporation vs. PartnershipPau Che100% (1)

- Presentation HDFC Mutual Fund - Product Suite - Oct 18Document57 pagesPresentation HDFC Mutual Fund - Product Suite - Oct 18ritik bumbakNo ratings yet

- Words Related With Business AdministrationDocument181 pagesWords Related With Business AdministrationRamazan MaçinNo ratings yet

- Can Alpha Be Captured by Risk Premia PublicDocument25 pagesCan Alpha Be Captured by Risk Premia PublicDerek FultonNo ratings yet

- 9.30.16 SFBO (With Nominal)Document5 pages9.30.16 SFBO (With Nominal)Vincent TayagNo ratings yet