Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

26 viewsImcome Taxation

Imcome Taxation

Uploaded by

KD Stroker1) The Goods and Services Tax (GST) is an indirect tax applied on most goods and services. GST is paid by consumers but collected by the business selling the goods/services and remitted to the government.

2) India introduced a unified GST (UGST) in 2017, replacing existing indirect taxes levied by the central and state governments. Some countries have a dual GST system where both central and state governments levy GST.

3) Certain persons earning below a threshold or involved in exempt activities are not required to register under GST. Strict provisions exist to enforce GST collection and protect government revenue.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Hot Single DadDocument1 pageHot Single DadKD StrokerNo ratings yet

- Lakshit Shah, 3371, Consumer AffairsDocument9 pagesLakshit Shah, 3371, Consumer AffairsRitiksTvNo ratings yet

- Adobe Scan 16-Mar-2023Document14 pagesAdobe Scan 16-Mar-2023ranareslanr6No ratings yet

- ch6 Pol Sci-Notes 12thDocument11 pagesch6 Pol Sci-Notes 12thprachiNo ratings yet

- Management 1Document12 pagesManagement 1Akshatha m s Akshatha m sNo ratings yet

- BE AssignmentDocument23 pagesBE AssignmentchthakorNo ratings yet

- Industrial Training 2weekDocument12 pagesIndustrial Training 2weekSarfrazNo ratings yet

- D22mba111831 22odmbt612Document9 pagesD22mba111831 22odmbt612Javed AkhtarNo ratings yet

- Files 1 2020 November NotesHubDocument 1605715167Document13 pagesFiles 1 2020 November NotesHubDocument 1605715167Varinder KumarNo ratings yet

- (Honouzs Coulbe) 6emuste Umiqut Paber O: Jitlu PabehDocument6 pages(Honouzs Coulbe) 6emuste Umiqut Paber O: Jitlu Pabehanubhavgs1234No ratings yet

- Investigation in CRPCDocument9 pagesInvestigation in CRPCharsha8825No ratings yet

- Idt Test 1Document8 pagesIdt Test 1rnathNo ratings yet

- CPC 1Document25 pagesCPC 1Piyush KrantiNo ratings yet

- GST Unit 1Document13 pagesGST Unit 1SandhyaNo ratings yet

- Adobe Scan 03-Jun-2024Document12 pagesAdobe Scan 03-Jun-2024mx4ctdpyqgNo ratings yet

- CoiexamDocument14 pagesCoiexamVikram SinghNo ratings yet

- Labour Law Second Assingment On MBA 1961 (21 - 2404-22 24) PDFDocument11 pagesLabour Law Second Assingment On MBA 1961 (21 - 2404-22 24) PDFNEERAJ SHARMANo ratings yet

- Compatitive Development of India China and PakistanDocument21 pagesCompatitive Development of India China and PakistanRidzzNo ratings yet

- Assignment 1 CV 1301 Arghya Sharma 20102043Document11 pagesAssignment 1 CV 1301 Arghya Sharma 20102043Dheemant SharmaNo ratings yet

- Name of The Student-Adak Sinha: ObtainediDocument8 pagesName of The Student-Adak Sinha: ObtainediPalakNo ratings yet

- Memorandum of AssociationDocument22 pagesMemorandum of Associationmohitkhatri125No ratings yet

- Sol AnswerDocument3 pagesSol AnswerAbhishek SrivastavNo ratings yet

- Adobe Scan 02-Jun-2021Document6 pagesAdobe Scan 02-Jun-2021Somit AwasthiNo ratings yet

- Mbektnte: Xploln The Meauning M Humon Cabilail (MDocument8 pagesMbektnte: Xploln The Meauning M Humon Cabilail (MShivam SinghNo ratings yet

- b2055r10102026 (Arpit Upadhyay) (Basic Civil Engineering)Document15 pagesb2055r10102026 (Arpit Upadhyay) (Basic Civil Engineering)Abcd EfghNo ratings yet

- Civics Economics AnswersDocument4 pagesCivics Economics AnswersdevyanshgaulechhaNo ratings yet

- Essay Writing CompetitionDocument4 pagesEssay Writing CompetitionArti VermaNo ratings yet

- Adobe Scan 04 Sep 2023Document4 pagesAdobe Scan 04 Sep 2023Toufiq JamadarNo ratings yet

- Gmtsuodutton: AcknousladmantDocument20 pagesGmtsuodutton: AcknousladmantYäshwänt ShärmäNo ratings yet

- Som AssignmentDocument221 pagesSom AssignmentVivek MishraNo ratings yet

- 219SBEME30518 (Rolling Contact Bearing)Document9 pages219SBEME30518 (Rolling Contact Bearing)Jasmin YadavNo ratings yet

- Eco AssignmentDocument7 pagesEco Assignmentalphy bijuNo ratings yet

- Administrative Law 02Document8 pagesAdministrative Law 02samNo ratings yet

- Croulnioau0: Oeond EuioolicalnouuiralionDocument8 pagesCroulnioau0: Oeond EuioolicalnouuiralionRitik KumarNo ratings yet

- 12lact Clo Dou Imoes Dernd by Dihec Ho: 4 12120 (O3031o SO2-Tndihecta)Document18 pages12lact Clo Dou Imoes Dernd by Dihec Ho: 4 12120 (O3031o SO2-Tndihecta)Udit kothiwalaNo ratings yet

- Political ScienceDocument11 pagesPolitical ScienceSwastiNo ratings yet

- Chap1 ElectrostaticsDocument23 pagesChap1 ElectrostaticsLakshay GuptaNo ratings yet

- Environmental Assignment No. 02 (Rollno. - 32)Document13 pagesEnvironmental Assignment No. 02 (Rollno. - 32)viraj narkarNo ratings yet

- CC Assignment - 20051081Document4 pagesCC Assignment - 200510811081PARTH CHATTERJEENo ratings yet

- Major (Mba1950302) (MGT-9209)Document18 pagesMajor (Mba1950302) (MGT-9209)aryan singhNo ratings yet

- Financial ServicesDocument25 pagesFinancial ServicesSaurav PandeyNo ratings yet

- Qegalaton: Adil24GDocument8 pagesQegalaton: Adil24Gvishu1999No ratings yet

- Unit-1 (Part 1)Document25 pagesUnit-1 (Part 1)Subalakshmi PNo ratings yet

- Tax Capital Gain Exemption09-Nov-2021Document7 pagesTax Capital Gain Exemption09-Nov-2021Sadia HashamNo ratings yet

- Income Tax ExamDocument6 pagesIncome Tax ExamDheeraj PrajapatiNo ratings yet

- Copper and Its Alloys Brass Bronze and CupronickelDocument5 pagesCopper and Its Alloys Brass Bronze and CupronickelRaghul AravinthNo ratings yet

- Applicability of Accounting StandardsDocument9 pagesApplicability of Accounting Standardsjnaid kadriNo ratings yet

- Camination Oslo8 - 2021 Signatint D Skdent H S: Cution Papeu Ib Dah ofDocument17 pagesCamination Oslo8 - 2021 Signatint D Skdent H S: Cution Papeu Ib Dah ofShivam MishraNo ratings yet

- Durauon: H Actwdiy AuatDocument5 pagesDurauon: H Actwdiy AuatSimardeep KaurNo ratings yet

- All Accounting LawsDocument5 pagesAll Accounting LawsVivek Kumar ChourasiaNo ratings yet

- Class Test Schecked PapersDocument11 pagesClass Test Schecked PapersSiddharth PandeyNo ratings yet

- Vishal 3Document14 pagesVishal 3Mohan SinghNo ratings yet

- MacroeconomicsDocument7 pagesMacroeconomicsYäshwänt ShärmäNo ratings yet

- HR01 Unit - 1 CLG NotesDocument17 pagesHR01 Unit - 1 CLG NotesAshita SrivastavaNo ratings yet

- Adobe Scan 01-Jun-2021Document5 pagesAdobe Scan 01-Jun-2021Somit AwasthiNo ratings yet

- ADR Assignment 2Document9 pagesADR Assignment 2deepak sethiNo ratings yet

- Adobe Scan 21 Jun 2023Document11 pagesAdobe Scan 21 Jun 2023pradeepkumarsr kumarsrNo ratings yet

- English Icse Final TermDocument10 pagesEnglish Icse Final TermyuvarajgembaliNo ratings yet

- BiologyDocument4 pagesBiologySrusti SrujanikaNo ratings yet

- Rise of Modern West 1Document12 pagesRise of Modern West 1ritesh39986No ratings yet

- Business Succession Planning ArticleDocument1 pageBusiness Succession Planning ArticleKD StrokerNo ratings yet

- The Proposal - by MV KasiDocument1 pageThe Proposal - by MV KasiKD Stroker0% (1)

- FM Case StudyDocument8 pagesFM Case StudyKD StrokerNo ratings yet

- Enemy Boss - The Same Old LoveDocument2 pagesEnemy Boss - The Same Old LoveKD StrokerNo ratings yet

- The Captive by MV KasiDocument2 pagesThe Captive by MV KasiKD StrokerNo ratings yet

Imcome Taxation

Imcome Taxation

Uploaded by

KD Stroker0 ratings0% found this document useful (0 votes)

26 views8 pages1) The Goods and Services Tax (GST) is an indirect tax applied on most goods and services. GST is paid by consumers but collected by the business selling the goods/services and remitted to the government.

2) India introduced a unified GST (UGST) in 2017, replacing existing indirect taxes levied by the central and state governments. Some countries have a dual GST system where both central and state governments levy GST.

3) Certain persons earning below a threshold or involved in exempt activities are not required to register under GST. Strict provisions exist to enforce GST collection and protect government revenue.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The Goods and Services Tax (GST) is an indirect tax applied on most goods and services. GST is paid by consumers but collected by the business selling the goods/services and remitted to the government.

2) India introduced a unified GST (UGST) in 2017, replacing existing indirect taxes levied by the central and state governments. Some countries have a dual GST system where both central and state governments levy GST.

3) Certain persons earning below a threshold or involved in exempt activities are not required to register under GST. Strict provisions exist to enforce GST collection and protect government revenue.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

26 views8 pagesImcome Taxation

Imcome Taxation

Uploaded by

KD Stroker1) The Goods and Services Tax (GST) is an indirect tax applied on most goods and services. GST is paid by consumers but collected by the business selling the goods/services and remitted to the government.

2) India introduced a unified GST (UGST) in 2017, replacing existing indirect taxes levied by the central and state governments. Some countries have a dual GST system where both central and state governments levy GST.

3) Certain persons earning below a threshold or involved in exempt activities are not required to register under GST. Strict provisions exist to enforce GST collection and protect government revenue.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

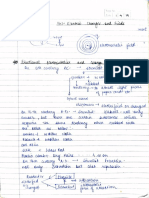

Nam- kaiuialya5 Sane

Rall Ao-32Ciante)

Sub Lndixeok rar

D Explain he ConeeptNeed (tendu d (tST

The 9pod seruine tax CCST) i ovalue addled

Auicol on mnlt 9codb 9eue) Sblol hok

olomoiti Conumptian.The tsI paiol by Cansuna

but it i omuttéol to he gouetnmment hi he

bulinaile) selling the good4 setukce

undetlandinq the tpadd 4setuies Tu CG1ST)

The good)4 setuine)Hax Cot51 i an indlitecbA

ecloxol Sales iap that i applieol othe colt o

Colaingocdl Sezuine) he bluiinal addl he

Co1ST tothe phie o the peoduot the Cuutomot

ho bluS the pkoduat poya he 5ale påine indutue

ohe CST The G1ST pEHon j Colleoted hu

the bulinel) ot seller hokLatoled do the

goueknmont. Ut 3 allo kekred -to a ualue

Acldeo AoR CUAT in some Counteio,

Hod the n o d setuines TUx CC1sT) Sytem

molt Countrio) ith the tuST aue o sine

uniteal Gt3T item, udhinh meani hat a

singie kale i amliecl heougbuA ne

COLLmtry A Cauntty udith a uuñeo) C15ST

platatm merge entta Axes ith slate

Jeueitax Colleati thom as che sirgle ax

Dual Ctoods 4 seruieel ran CCST) Suotute

a Canadg

only a handjau o Cotwntthes, u o h

0 0 i , haue a dial CST S1LuAbte.

Comp0ol o a AuniÄRo CST eoanomy cohere

He Colleatoo hy theedtal goRtnment4

Hhon dittibtuteol o the states, ioa dual

Sptem, +he tealora) Ci5T applieol in

additian o he tate Sale to

Nee o, the 61sST

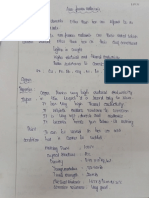

VAT ate) e9ulations diket om state

Ho 4tot_And IE hal aappen heen Obsetueal

tho State dten XOSOEE o aladhing thee

ate 02 atttaoting nueltotl.Thi tok

in Jos o tevenue g& baBh he centtal

abtueu a stae CouOXNmONnt.

on the 6het hanol U5T hin9 in uunikotm

de Jnu) alro) all the skate spaning

O0OL diuorse irdusbie

C15T nlloLE misseal 5evekal dediima) due to

disoqaeement Gmong manm tatej ajer cottaun

mpoi tom Iue on Jhe neud tax ke{otm

HoLdeuet, a pexlent per kelent 22p0,

C13T SChediuleol hot a nadinn-uuiole kollauk

on Apil 1, 20l6

LE has no been mote Hhan a deoade inde

the idea o natiora CtDnd 5etulce3 TON

CGiST)was motea hu kelkat t fokte in

Qo0L.

Psge

SuhbequenHthe union inande minilter

Shi.P chida mJbatom,uhile pelentimqthe

cental buolget C006-07),anmounded thtGi51

U0OAd be intoduoe Dm ApEilL Rolo

) b i enote on ) perbon moA uableo

Ojdrodion Compulsck keihotion.

2)

Peon nDt Jiahle Jsot Reaitration

40 23 o he CG1S1 at 2011 pleauiole +he

detailes J t o perhon> not Jiable ko ST

eoHYotinn. A pOr he soio 5eotion he

olloin ate the petans not liahleko

the 0itotion Junder 15T

DPeronengaggc eouiuely i Suppling

9pod ok Seine) ok bom niot Jiable per

perhan engaggd eoiveu in Supplyimo

9pod) o 5euit@ boh exempt om 1al

Aarioulturit engagec n supplu pecdue

Cultiuatea out lanal

1 Any cth perion asmay heniheol by

he opjeLnmont

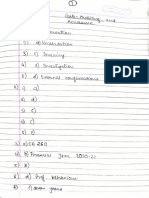

The kollaudin he potjonA euho t e not

Jioble koz tedLtration under C15T

perhon making intetktode sLpply o seruioe4

hauimg an a9Rgato Aunouet rot exeedirq

R5 20lálehs on al Lndio balis

2perLons who ae engaqd inmaluinq Suppl

tanable (uods ot SetukQel ok baBh

porionJ maiimg intorlade o supplied o

notikleol hanolinayt ttoocds hauing TunDUer

nat exoeeding RS 20lakhs on au Undia bal

4 Cabual teuahle petion malinq ntetitaie

euxahleSupply o, baved handiuat Guooolu

Compulboey Reoittation2

Notoihita ndin Gununimq tAmtaineo in

Suub seo C Doh Sed 23 he kallnuoing odegokie

aptlons Shalu be teqiteol to be ko9atorool

under tnid AcE iDepotiue o the cggegale

utnoUer

D Petbans maling auny inter-saie toxahle

npply

3)Caual Heuxable perons maJuno taMahll

Suppiy

3 potom JohD ake SeRQLiLeol to pu tox

undex esOtUe chaeg

LeleottoniCommetee cpeatnk

nUon-resicdent kuable p0kSons maling

eNable Supplu-

Gperlons aumo ake eQLÜteato oleduok tax

tuncler seo s 5wethet ok not SeparaH 2001uac

Under h i Ae

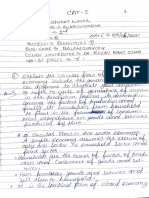

Dmput 6euae diittibutokwemet o not

3epataHy Legider udlet Hhis Act

95 ptouisionb to entotne Lndlixeot TUXOI U1ST

TT the tanouyo Cant pay all he C1sT

dua (Har inbelt 1 peraltiel in a wmLm

OR uihLn the stipuulatealdaBe, hen he can

e am applination to he Commilione

Loqueitimnq ko pay in indalumment.

when auuing in unshilmamu,hat kapayar

ha to &emember dhat.

LnitalummantA a t pruyabla euetY Jmonn

-onty a maximum 24 inktalUmOmtA axe

alloiikd

ntltei @18'muut be paid along ouih

the inilallmand.

AU be indallmont mult be poaid antme.

1tanit o) peorery to be uaid i hete

oXe 3T DUes

Jmade ot adeuate Conideration.

-

made in Qood jeith

h e 1eXORI had not reeeiueod any natine

RIakoling pendling ax duel ox pdceedlinga

paeuioLs petmiiwn o he peppet oHhiLe

ho hoen oblaimeal

etauikionaluy Ataohiung eoor to Pkodeot

Revenuo n Cerain Cou

-AsseMment oh tanpeyers not iing kekitn

Suummary AJAeLmont.

Unpeotion seatOh, 3eizut

Demand 4 eoery eoeeeclingA eaud

non aUd Cakel

ReCDuery eouiliDnJ

DThe due umA b ineXeaieo inthe appea

The due amt i oleoLLa MAa in he appoai

You might also like

- Hot Single DadDocument1 pageHot Single DadKD StrokerNo ratings yet

- Lakshit Shah, 3371, Consumer AffairsDocument9 pagesLakshit Shah, 3371, Consumer AffairsRitiksTvNo ratings yet

- Adobe Scan 16-Mar-2023Document14 pagesAdobe Scan 16-Mar-2023ranareslanr6No ratings yet

- ch6 Pol Sci-Notes 12thDocument11 pagesch6 Pol Sci-Notes 12thprachiNo ratings yet

- Management 1Document12 pagesManagement 1Akshatha m s Akshatha m sNo ratings yet

- BE AssignmentDocument23 pagesBE AssignmentchthakorNo ratings yet

- Industrial Training 2weekDocument12 pagesIndustrial Training 2weekSarfrazNo ratings yet

- D22mba111831 22odmbt612Document9 pagesD22mba111831 22odmbt612Javed AkhtarNo ratings yet

- Files 1 2020 November NotesHubDocument 1605715167Document13 pagesFiles 1 2020 November NotesHubDocument 1605715167Varinder KumarNo ratings yet

- (Honouzs Coulbe) 6emuste Umiqut Paber O: Jitlu PabehDocument6 pages(Honouzs Coulbe) 6emuste Umiqut Paber O: Jitlu Pabehanubhavgs1234No ratings yet

- Investigation in CRPCDocument9 pagesInvestigation in CRPCharsha8825No ratings yet

- Idt Test 1Document8 pagesIdt Test 1rnathNo ratings yet

- CPC 1Document25 pagesCPC 1Piyush KrantiNo ratings yet

- GST Unit 1Document13 pagesGST Unit 1SandhyaNo ratings yet

- Adobe Scan 03-Jun-2024Document12 pagesAdobe Scan 03-Jun-2024mx4ctdpyqgNo ratings yet

- CoiexamDocument14 pagesCoiexamVikram SinghNo ratings yet

- Labour Law Second Assingment On MBA 1961 (21 - 2404-22 24) PDFDocument11 pagesLabour Law Second Assingment On MBA 1961 (21 - 2404-22 24) PDFNEERAJ SHARMANo ratings yet

- Compatitive Development of India China and PakistanDocument21 pagesCompatitive Development of India China and PakistanRidzzNo ratings yet

- Assignment 1 CV 1301 Arghya Sharma 20102043Document11 pagesAssignment 1 CV 1301 Arghya Sharma 20102043Dheemant SharmaNo ratings yet

- Name of The Student-Adak Sinha: ObtainediDocument8 pagesName of The Student-Adak Sinha: ObtainediPalakNo ratings yet

- Memorandum of AssociationDocument22 pagesMemorandum of Associationmohitkhatri125No ratings yet

- Sol AnswerDocument3 pagesSol AnswerAbhishek SrivastavNo ratings yet

- Adobe Scan 02-Jun-2021Document6 pagesAdobe Scan 02-Jun-2021Somit AwasthiNo ratings yet

- Mbektnte: Xploln The Meauning M Humon Cabilail (MDocument8 pagesMbektnte: Xploln The Meauning M Humon Cabilail (MShivam SinghNo ratings yet

- b2055r10102026 (Arpit Upadhyay) (Basic Civil Engineering)Document15 pagesb2055r10102026 (Arpit Upadhyay) (Basic Civil Engineering)Abcd EfghNo ratings yet

- Civics Economics AnswersDocument4 pagesCivics Economics AnswersdevyanshgaulechhaNo ratings yet

- Essay Writing CompetitionDocument4 pagesEssay Writing CompetitionArti VermaNo ratings yet

- Adobe Scan 04 Sep 2023Document4 pagesAdobe Scan 04 Sep 2023Toufiq JamadarNo ratings yet

- Gmtsuodutton: AcknousladmantDocument20 pagesGmtsuodutton: AcknousladmantYäshwänt ShärmäNo ratings yet

- Som AssignmentDocument221 pagesSom AssignmentVivek MishraNo ratings yet

- 219SBEME30518 (Rolling Contact Bearing)Document9 pages219SBEME30518 (Rolling Contact Bearing)Jasmin YadavNo ratings yet

- Eco AssignmentDocument7 pagesEco Assignmentalphy bijuNo ratings yet

- Administrative Law 02Document8 pagesAdministrative Law 02samNo ratings yet

- Croulnioau0: Oeond EuioolicalnouuiralionDocument8 pagesCroulnioau0: Oeond EuioolicalnouuiralionRitik KumarNo ratings yet

- 12lact Clo Dou Imoes Dernd by Dihec Ho: 4 12120 (O3031o SO2-Tndihecta)Document18 pages12lact Clo Dou Imoes Dernd by Dihec Ho: 4 12120 (O3031o SO2-Tndihecta)Udit kothiwalaNo ratings yet

- Political ScienceDocument11 pagesPolitical ScienceSwastiNo ratings yet

- Chap1 ElectrostaticsDocument23 pagesChap1 ElectrostaticsLakshay GuptaNo ratings yet

- Environmental Assignment No. 02 (Rollno. - 32)Document13 pagesEnvironmental Assignment No. 02 (Rollno. - 32)viraj narkarNo ratings yet

- CC Assignment - 20051081Document4 pagesCC Assignment - 200510811081PARTH CHATTERJEENo ratings yet

- Major (Mba1950302) (MGT-9209)Document18 pagesMajor (Mba1950302) (MGT-9209)aryan singhNo ratings yet

- Financial ServicesDocument25 pagesFinancial ServicesSaurav PandeyNo ratings yet

- Qegalaton: Adil24GDocument8 pagesQegalaton: Adil24Gvishu1999No ratings yet

- Unit-1 (Part 1)Document25 pagesUnit-1 (Part 1)Subalakshmi PNo ratings yet

- Tax Capital Gain Exemption09-Nov-2021Document7 pagesTax Capital Gain Exemption09-Nov-2021Sadia HashamNo ratings yet

- Income Tax ExamDocument6 pagesIncome Tax ExamDheeraj PrajapatiNo ratings yet

- Copper and Its Alloys Brass Bronze and CupronickelDocument5 pagesCopper and Its Alloys Brass Bronze and CupronickelRaghul AravinthNo ratings yet

- Applicability of Accounting StandardsDocument9 pagesApplicability of Accounting Standardsjnaid kadriNo ratings yet

- Camination Oslo8 - 2021 Signatint D Skdent H S: Cution Papeu Ib Dah ofDocument17 pagesCamination Oslo8 - 2021 Signatint D Skdent H S: Cution Papeu Ib Dah ofShivam MishraNo ratings yet

- Durauon: H Actwdiy AuatDocument5 pagesDurauon: H Actwdiy AuatSimardeep KaurNo ratings yet

- All Accounting LawsDocument5 pagesAll Accounting LawsVivek Kumar ChourasiaNo ratings yet

- Class Test Schecked PapersDocument11 pagesClass Test Schecked PapersSiddharth PandeyNo ratings yet

- Vishal 3Document14 pagesVishal 3Mohan SinghNo ratings yet

- MacroeconomicsDocument7 pagesMacroeconomicsYäshwänt ShärmäNo ratings yet

- HR01 Unit - 1 CLG NotesDocument17 pagesHR01 Unit - 1 CLG NotesAshita SrivastavaNo ratings yet

- Adobe Scan 01-Jun-2021Document5 pagesAdobe Scan 01-Jun-2021Somit AwasthiNo ratings yet

- ADR Assignment 2Document9 pagesADR Assignment 2deepak sethiNo ratings yet

- Adobe Scan 21 Jun 2023Document11 pagesAdobe Scan 21 Jun 2023pradeepkumarsr kumarsrNo ratings yet

- English Icse Final TermDocument10 pagesEnglish Icse Final TermyuvarajgembaliNo ratings yet

- BiologyDocument4 pagesBiologySrusti SrujanikaNo ratings yet

- Rise of Modern West 1Document12 pagesRise of Modern West 1ritesh39986No ratings yet

- Business Succession Planning ArticleDocument1 pageBusiness Succession Planning ArticleKD StrokerNo ratings yet

- The Proposal - by MV KasiDocument1 pageThe Proposal - by MV KasiKD Stroker0% (1)

- FM Case StudyDocument8 pagesFM Case StudyKD StrokerNo ratings yet

- Enemy Boss - The Same Old LoveDocument2 pagesEnemy Boss - The Same Old LoveKD StrokerNo ratings yet

- The Captive by MV KasiDocument2 pagesThe Captive by MV KasiKD StrokerNo ratings yet