Professional Documents

Culture Documents

Question Paper 2010: Punjab University

Question Paper 2010: Punjab University

Uploaded by

Sajid YaqoobOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question Paper 2010: Punjab University

Question Paper 2010: Punjab University

Uploaded by

Sajid YaqoobCopyright:

Available Formats

Business Taxation Past Papers B.

Com Part 2 2010

Punjab University

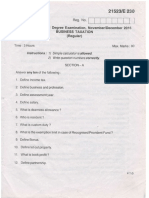

QUESTION PAPER 2010

Time Allowed: 3 hours Max. Marks: 100

Attempt any FIVE questions including Question No. 8, which is compulsory.

All questions carry equals marks.

Q.1 Define and explain the following terms with reference to Income Tax Ordinance 2001:

(a) Income (b) Person

(c) Speculation business (d) Tax year

Q.2 briefly explain the following with reference to Sales Tax Act, 1990.

(a) Procedure of registration (b) De-registration

(c) Black listing and suspension of registration

Q.3 discuss at least ten allowable deductions under the head “Income from business” or profession

“Under section 20 of the Income Tax Ordinance 2001”.

Q.4 Discuss the powers and functions of regional commissioner of income tax.

Q.5 Discuss the various types of assessment made by the commissioner of Income Tax /

Commissioner inland revenue.

Q.6 What penalties can be imposed in the following cases under Income Tax Law?

(a) Non-payment of tax

(b) Non-compliance with notice

(c) Making false and misleading statements

(d) Failure to furnish statements

Q.7 Mr. Muhammad Shan is a registered manufacturer. Data regarding his business for the

month of August 2009 is as follows.

(1) Taxable turnover to registered person on credit basis Rs. 3,500,000

(2) Taxable turnover to non-registered persons

(Including the Amount of sales tax) Rs. 250,000

(3) Sales to retailers Rs. 150,000

(4) Exempted sales Rs. 600,000

(5) Supplies to DTRE registered person Rs. 400,000

(6) Zero rated supply Rs. 900,000

(7) Supplies made for personal use

(including the amount of sales tax) Rs. 120,000

(8) Taxable purchases from registered persons on credit basis Rs. 300,000

(9) Exempted Purchases Rs. 250,000

(10) Imported goods Rs. 150,000

www.paksights.com fb.com/bcomstudymaterial 0302-5148843

Business Taxation Past Papers B.Com Part 2 2010

Punjab University

(11) Acquisition of fixed assets purchased from non-

registered persons Rs. 800,000

(12) Sales tax paid on gas bill consumed in residential colonies. Rs. 20,000

(13) Sales tax paid on electricity bills.

(Sales tax registration number is printed on bills) Rs. 50,000

(14) Sales tax paid on telephone bills

(Sales tax registration number is printed on bills) Rs. 50,000

Sales tax credit Rs. 20,000

Required Calculate sales tax payable.

Q.8 Mr. Younas is director of ABC Limited (engaged in transport business). The following

information is available on his record for the tax year ended 30th June 2009:

Salary Rs. 350,000

Free furnished accommodation provided by the employer.

Accommodation allowance Rs. 80,000 if this

accommodation was not provided to him.

Free transport facility to the employee's family Rs. 10,000

Electricity, gas and water charges paid by the company Rs. 6,350

Bonus Rs. 50,000

Senior post allowance Rs. 12,000

Wages of watchman, gardener and sweeper at house

paid by the company Rs. 5,000

Interest free loan obtained from the employer Rs. 120,000

Income from property Rs. 180,000

Un-adjustable advance rent received Rs. 120,000

Rent of furniture and fittings Rs. 14,000

Share from AOP Rs. 100,000

Investment in shares of listed companies Rs. 28,900

Donation to University of the Punjab Rs. 8,000

Payment to workers welfare fund Rs. 29,000

www.paksights.com fb.com/bcomstudymaterial 0302-5148843

You might also like

- 4995628Document5 pages4995628mohitgaba19100% (1)

- Wiley - Research Methods For Business - A Skill Building Approach, 7th Edition - 978!1!119-26684-6Document2 pagesWiley - Research Methods For Business - A Skill Building Approach, 7th Edition - 978!1!119-26684-6Sajid Yaqoob33% (3)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Audit Reconsideration Memorandum Baker SCRIBDDocument7 pagesAudit Reconsideration Memorandum Baker SCRIBDMichael AlaoNo ratings yet

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityDocument3 pagesBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedNo ratings yet

- Business Taxation Past Paper 2016 B.com Part 2 Punjab UniversityDocument3 pagesBusiness Taxation Past Paper 2016 B.com Part 2 Punjab UniversityMy OfficialNo ratings yet

- Business Taxation Past Paper 2019Document2 pagesBusiness Taxation Past Paper 2019Adeel AhmedNo ratings yet

- Business Taxation Past Paper 2019 PDFDocument2 pagesBusiness Taxation Past Paper 2019 PDFNouman BaigNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Css Accountancy2 2018 PDFDocument2 pagesCss Accountancy2 2018 PDFMaria NazNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- Income Tax Compulsory Paper-3: AHK/KW/19/4101Document6 pagesIncome Tax Compulsory Paper-3: AHK/KW/19/4101Deepak ThomasNo ratings yet

- Business Taxation Past Paper 2016 B Com Part 2Document3 pagesBusiness Taxation Past Paper 2016 B Com Part 2dilbaz karim0% (1)

- Karthik Single EntryDocument4 pagesKarthik Single EntryAMIN BUHARI ABDUL KHADERNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- FMP PDFDocument2 pagesFMP PDFDhaval PadhiyarNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- BC 405 PII Past PapersDocument22 pagesBC 405 PII Past PapersRaza Ali SoomroNo ratings yet

- BC 405 PII Past PapersDocument24 pagesBC 405 PII Past PapersArbaz KhanNo ratings yet

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-ADocument9 pagesMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurNo ratings yet

- Taxation: The Institute of Chartered Accountants of PakistanDocument4 pagesTaxation: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Government College University, FaisalabadDocument1 pageGovernment College University, FaisalabadLadla AnsariNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- SFS U.G. B.com. Income TaxDocument3 pagesSFS U.G. B.com. Income TaxAbinash VeeraragavanNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- Test 9Document4 pagesTest 9lalshahbaz57No ratings yet

- Ty BcomDocument7 pagesTy BcomGhanshyam LakhaniNo ratings yet

- Tutorial 1 - QuestionsDocument4 pagesTutorial 1 - QuestionsRed HongNo ratings yet

- 0456Document4 pages0456Usman Shaukat Khan100% (1)

- Company Final Accounts: Debit Rs. Credit RsDocument5 pagesCompany Final Accounts: Debit Rs. Credit RsDebaditya SenguptaNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- Assignment-2 - Mid Term Paxi Ko AssignmentDocument5 pagesAssignment-2 - Mid Term Paxi Ko Assignmenty.yubaraj001No ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Practice Session - PLDocument9 pagesPractice Session - PLDivyansh PandeyNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Financial Accounting Punjab University: Question Paper 2009Document5 pagesFinancial Accounting Punjab University: Question Paper 2009Abrar AliNo ratings yet

- Business TaxationDocument4 pagesBusiness Taxationshejal naikNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- QB - Indirect Tax - Mcom Sem 4Document5 pagesQB - Indirect Tax - Mcom Sem 4Prathmesh KadamNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Acc.2023 Practical Exam Sample QN - PaperDocument5 pagesAcc.2023 Practical Exam Sample QN - PaperMidhun PerozhiNo ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- AfB1 Tutorial Questions For Week 3Document3 pagesAfB1 Tutorial Questions For Week 3zhaok0610No ratings yet

- Pakistan Institute of Public Finance Accountants: TaxationDocument3 pagesPakistan Institute of Public Finance Accountants: TaxationAzfar AliNo ratings yet

- Assignment Financial AccountingDocument4 pagesAssignment Financial AccountingJatin SinghalNo ratings yet

- Trial Balance As On 31Document3 pagesTrial Balance As On 31Lipson ThomasNo ratings yet

- CAC1201201008 Financial Accounting 1BDocument6 pagesCAC1201201008 Financial Accounting 1Bnyasha gundaniNo ratings yet

- Problems On Profits and Gains of Business and ProfessionDocument11 pagesProblems On Profits and Gains of Business and ProfessionNikithaNo ratings yet

- C.A. Foundation Final Accounts For Sole Proprietorship QuestionsDocument2 pagesC.A. Foundation Final Accounts For Sole Proprietorship Questionsgpgaming1693No ratings yet

- Tally With GST - 231003 - 111251Document4 pagesTally With GST - 231003 - 111251Gargi BhardwajNo ratings yet

- 2017 S2 (final) (尊孔)Document5 pages2017 S2 (final) (尊孔)Khor Xing TienNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Document10 pagesReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNo ratings yet

- Financial Accounting 2015 B Com Part 1 PDocument5 pagesFinancial Accounting 2015 B Com Part 1 PPraver MalhotraNo ratings yet

- Past Paper 2015 BCom Part 2 Business Taxation PDFDocument3 pagesPast Paper 2015 BCom Part 2 Business Taxation PDFdilbaz karimNo ratings yet

- Eng Mock3 FinalDocument7 pagesEng Mock3 FinalSajid YaqoobNo ratings yet

- 21 - MCQ Set Off and Carry ForwardDocument9 pages21 - MCQ Set Off and Carry ForwardSajid YaqoobNo ratings yet

- PAC English Book WWW - Mhkorai.blogspotDocument217 pagesPAC English Book WWW - Mhkorai.blogspotSajid YaqoobNo ratings yet

- Network Panel Hospital - Updated 26 - 10 - 2020Document6 pagesNetwork Panel Hospital - Updated 26 - 10 - 2020Sajid YaqoobNo ratings yet

- IND 13 CHP 14 8B Class Text HW Problems SolutionsDocument6 pagesIND 13 CHP 14 8B Class Text HW Problems SolutionsRespect InfinityNo ratings yet

- Tax 06 Capital Gains Taxation Part 4Document7 pagesTax 06 Capital Gains Taxation Part 4Panda CocoNo ratings yet

- Factors Influencing Monthly Rental Income Tax Compliance From Residential Property Owners in Nairobi South District.Document87 pagesFactors Influencing Monthly Rental Income Tax Compliance From Residential Property Owners in Nairobi South District.lumumba kuyelaNo ratings yet

- IDBI Bank LTD.: Application Print E-Receipt Print Tax InvoiceDocument1 pageIDBI Bank LTD.: Application Print E-Receipt Print Tax InvoicePratik DalwadiNo ratings yet

- Assignment Accounting Merchendising #2Document1 pageAssignment Accounting Merchendising #2NELVA QABLINANo ratings yet

- RR 2-2010 Salient Points - Aug.2016Document2 pagesRR 2-2010 Salient Points - Aug.2016Emmanuel C. DumayasNo ratings yet

- Income TaxDocument74 pagesIncome Taxhemanshi07soniNo ratings yet

- Tax Lec 2Document14 pagesTax Lec 2Yousef Waleed100% (1)

- Form W-9 and Instructions Request For Taxpayer Identification Number andDocument20 pagesForm W-9 and Instructions Request For Taxpayer Identification Number andnormlegerNo ratings yet

- Tax Invoice: Gstin PAN Drug Licence No FssaiDocument1 pageTax Invoice: Gstin PAN Drug Licence No FssaiAayush SinghNo ratings yet

- Mandate of GST CouncilDocument4 pagesMandate of GST CouncilDevil DemonNo ratings yet

- E-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)Document7 pagesE-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)NISHA GHODAKENo ratings yet

- CashDocument3 pagesCashDahirNo ratings yet

- Problem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseDocument4 pagesProblem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseSamerNo ratings yet

- Residency Final / On Account WHT Tax Code Rate %Document3 pagesResidency Final / On Account WHT Tax Code Rate %wilberforceNo ratings yet

- Annex-7-Barangay-Financial-Report CARUANDocument2 pagesAnnex-7-Barangay-Financial-Report CARUANRomulo Sierra Jr.67% (3)

- 5KW With BatteryDocument1 page5KW With BatteryKidzee KidzeeNo ratings yet

- International JVs Feb 2010Document96 pagesInternational JVs Feb 2010International Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument8 pagesRequest For Taxpayer Identification Number and Certificationxintong liuNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasRheamel RhamzNo ratings yet

- House No. 123-A,, Street No. 12, Lane # 4, Chaklala Scheme 3, Rawalpindi, Cantonement. Adnan AhmedDocument4 pagesHouse No. 123-A,, Street No. 12, Lane # 4, Chaklala Scheme 3, Rawalpindi, Cantonement. Adnan AhmedAdnan AfridiNo ratings yet

- Taxation FinalDocument8 pagesTaxation Finalnigus100% (5)

- G.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentDocument39 pagesG.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentMadel PresquitoNo ratings yet

- Taxation - DPP 9.1 - (CDS - 2 Viraat 2023)Document4 pagesTaxation - DPP 9.1 - (CDS - 2 Viraat 2023)tanwar9780No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)NAVEEN ROYNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Invoice: Venture Accounting Pte LTD # VA211344Document2 pagesInvoice: Venture Accounting Pte LTD # VA211344isty5nntNo ratings yet

- 2304Document4 pages2304fatmaaleahNo ratings yet