Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsCall Is Exercised When ST X

Call Is Exercised When ST X

Uploaded by

Shubham PariharThe document describes a call option contract between Komal and Shubh. Komal purchased a call option from Shubh to buy shares of Axis Bank at a predetermined strike price of Rs. 800 per share, expiring in September. If the stock price exceeds Rs. 800 at expiry, Komal can exercise the option to buy shares at Rs. 800 from Shubh. The payoff for Komal would be the difference between the stock price and strike price, while for Shubh it would be the negative of that amount. Various payoff scenarios are shown in a table for different stock prices at expiry. The document also briefly describes a put option contract between Adwait and Shashank on ONGC shares

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- CFA Level 2 2018 Mock Exam A Morning Session (With Solutions)Document47 pagesCFA Level 2 2018 Mock Exam A Morning Session (With Solutions)Vanyah86% (14)

- Pengantar AkunDocument2 pagesPengantar AkunNaurah Atika Dina100% (6)

- DT MCQs For June DecDocument208 pagesDT MCQs For June DecnaveedamurnaveedamurNo ratings yet

- The People of Praise 990 Tax DocumentsDocument211 pagesThe People of Praise 990 Tax DocumentsJohn Flaherty100% (2)

- 05 Option Investment StrategiesDocument39 pages05 Option Investment StrategiesAarju PoudelNo ratings yet

- PGJ TabelDocument2 pagesPGJ Tabelulfiahasan92No ratings yet

- Gr3 - Practice - Rounding - To - The - Nearest - 100Document2 pagesGr3 - Practice - Rounding - To - The - Nearest - 100jayendra.chouguleNo ratings yet

- Economics AssignmentDocument23 pagesEconomics AssignmentAqsa AnumNo ratings yet

- Online Activity Number 1Document4 pagesOnline Activity Number 1Danna Claire100% (3)

- Multiplicando X Multiplica Producto TablaDocument2 pagesMultiplicando X Multiplica Producto TablaTatiana BeltránNo ratings yet

- Commodities Market AssignmentDocument1 pageCommodities Market Assignmentharsha faraiyyaNo ratings yet

- Description: Tags: Ch4eDocument7 pagesDescription: Tags: Ch4eanon-353125No ratings yet

- CH 2Document7 pagesCH 2华邦盛No ratings yet

- Calculating Bulk Volumes Using Simpson Rule PDFDocument10 pagesCalculating Bulk Volumes Using Simpson Rule PDFEng Ravi Kant SharmaNo ratings yet

- DES-092B: Multiple of Long-Time PickupDocument1 pageDES-092B: Multiple of Long-Time PickupBen ClarkNo ratings yet

- 2023 4 Trial BalanceDocument4 pages2023 4 Trial BalanceAhmad SyafeiNo ratings yet

- Equilibrium at To Equilibrium at t1Document2 pagesEquilibrium at To Equilibrium at t1Dian Handayani PratiwiNo ratings yet

- 2Bhk Load Bearing Structure: X X TerraceDocument1 page2Bhk Load Bearing Structure: X X TerracePritam Waghmare0% (1)

- PDF Kunci Jawaban Ud Wilastri 1 - CompressDocument3 pagesPDF Kunci Jawaban Ud Wilastri 1 - CompressJajangNo ratings yet

- Business Maths AssignmentDocument3 pagesBusiness Maths AssignmentVishalkumar BhattNo ratings yet

- Nguyễn Thành Cao-20150310 - BTVNDocument6 pagesNguyễn Thành Cao-20150310 - BTVNOnePiece FanNo ratings yet

- Volume Galian Dan TimbunanDocument56 pagesVolume Galian Dan Timbunandinal031No ratings yet

- Research Methodology in Acc & Fin. - Practical ProblemsDocument8 pagesResearch Methodology in Acc & Fin. - Practical ProblemsPrince SharmaNo ratings yet

- UTS Pohon KeputusanDocument8 pagesUTS Pohon Keputusan038 Muhammad Dzaki Akbar RamadhanNo ratings yet

- Market Price Strike Price Premium Exercise/Expiry PNLDocument12 pagesMarket Price Strike Price Premium Exercise/Expiry PNLPrakharNo ratings yet

- Chart Title: Demand Schedule Supply Schedule Q 1300-20P Q 1800-20P Q 100 + 10P Demand Function Supply FunctionDocument3 pagesChart Title: Demand Schedule Supply Schedule Q 1300-20P Q 1800-20P Q 100 + 10P Demand Function Supply FunctionHarish BishnoiNo ratings yet

- Saving FunctionDocument7 pagesSaving FunctionManepalli YashwinNo ratings yet

- Titik Sudut Dalam Azimut JARAK (D) d.SIN d.COS: Colum NeDocument5 pagesTitik Sudut Dalam Azimut JARAK (D) d.SIN d.COS: Colum NeAngel LabolaangNo ratings yet

- 3Document1 page3Anchal MishraNo ratings yet

- Introduction To The Worksheet: Review QuestionsDocument16 pagesIntroduction To The Worksheet: Review Questionskkss_tt6528No ratings yet

- 1-2 Application ProblemDocument1 page1-2 Application ProblemGary LouperNo ratings yet

- Birthday EpensesDocument2 pagesBirthday EpensesAnonymous Koc2C4xNo ratings yet

- Rekod Sit inDocument1 pageRekod Sit inTheresa JackNo ratings yet

- ANOVA (Analysis of Variance) : NOVA ExampleDocument15 pagesANOVA (Analysis of Variance) : NOVA ExampleAyeah Metran EscoberNo ratings yet

- Dodoma DemDocument1 pageDodoma Demgman444No ratings yet

- DES-093B: Multiple of SensorDocument1 pageDES-093B: Multiple of SensorBen ClarkNo ratings yet

- A B C D E: Dormitorio 2 Dormitorio 1 Baño BañoDocument1 pageA B C D E: Dormitorio 2 Dormitorio 1 Baño Bañojhon cruz paucarNo ratings yet

- Primer NivelDocument1 pagePrimer Niveljhon cruz paucarNo ratings yet

- Primer NivelDocument1 pagePrimer Niveljhon cruz paucarNo ratings yet

- N0.3 % Konsentorasi Awal Dan Flow: WhileDocument9 pagesN0.3 % Konsentorasi Awal Dan Flow: WhileDefry AnantoNo ratings yet

- Eco ComicsDocument5 pagesEco ComicsHannah Alvarado BandolaNo ratings yet

- Description: Tags: 2004PaySchedDocument6 pagesDescription: Tags: 2004PaySchedanon-579857No ratings yet

- Gambar 2D Rumah MinimalisDocument1 pageGambar 2D Rumah Minimalisアダム フサイニーNo ratings yet

- Memomassa Ufu HorarioDocument1 pageMemomassa Ufu HorarioJoão Paulo Souza DiasNo ratings yet

- BhattuDocument1 pageBhattuPrabhat GautamNo ratings yet

- Tugas 3 Ekonomi MakroDocument2 pagesTugas 3 Ekonomi MakroMuhammad IrsyadNo ratings yet

- Description: Tags: p0003TableAFultimeDocument1 pageDescription: Tags: p0003TableAFultimeanon-994991No ratings yet

- San AntonioDocument1 pageSan AntonioDolo GarciaNo ratings yet

- Mcdonald Exercises, Chapter 3: Christophe DethierDocument20 pagesMcdonald Exercises, Chapter 3: Christophe DethierMichael AldifranNo ratings yet

- Macroeconomic ReviewDocument8 pagesMacroeconomic ReviewgithinjipattooNo ratings yet

- 12 Rules For Life An Antidote To ChaosDocument21 pages12 Rules For Life An Antidote To Chaosbastian_wolf0% (1)

- Walking PosterDocument1 pageWalking Posterdan paluskaNo ratings yet

- Acc 4 X Accounting EquationDocument5 pagesAcc 4 X Accounting Equationapi-341661305No ratings yet

- Options - Basics and StrategiesDocument45 pagesOptions - Basics and StrategiesAnurag ChaturvediNo ratings yet

- StraddleDocument1 pageStraddlefxn fndNo ratings yet

- Volume or AreaDocument24 pagesVolume or AreaJustin PabiloniaNo ratings yet

- Pulse Height Analysis PlotDocument1 pagePulse Height Analysis Plotfahrian05No ratings yet

- Papan Score Cerdas CermatDocument5 pagesPapan Score Cerdas CermatAULIA RAHMAN LUBISNo ratings yet

- Schedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07Document1 pageSchedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07christian de leonNo ratings yet

- EXERCISE 3 + SolutionsDocument5 pagesEXERCISE 3 + SolutionsEmmanuel WadiraNo ratings yet

- Minimum Operating Envelope 2 Inch 18ppg Trim ChokesDocument1 pageMinimum Operating Envelope 2 Inch 18ppg Trim Chokescarlos angelNo ratings yet

- TASK 1.9 To Task 1.13Document4 pagesTASK 1.9 To Task 1.13tavibez007No ratings yet

- JMC Guidelines and Template For Compendium 2Document63 pagesJMC Guidelines and Template For Compendium 2kingsters zabateNo ratings yet

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- A Comparative Study On Financial Performance of HINDLCO and NALCODocument9 pagesA Comparative Study On Financial Performance of HINDLCO and NALCOAMAL RAJNo ratings yet

- TRI DUNG Outline of ThesisDocument5 pagesTRI DUNG Outline of ThesisHuy Vu ChiNo ratings yet

- Chapter 13 Possible Industry Issues in Transfer PricingDocument104 pagesChapter 13 Possible Industry Issues in Transfer PricingMczoC.MczoNo ratings yet

- 2023 AgendaDocument3 pages2023 AgendaVictor SanchezNo ratings yet

- Kevin L Boyle ResumeDocument2 pagesKevin L Boyle ResumeKevin L. BoyleNo ratings yet

- Inter CA Auditing and AssuranceDocument689 pagesInter CA Auditing and AssurancePoonam JainNo ratings yet

- Accounting Information System: Semi-Finals ExaminationDocument10 pagesAccounting Information System: Semi-Finals ExaminationLaezelie SorianoNo ratings yet

- Interest Rates Structure, Determinants, Development of BLR and Its ComputationDocument21 pagesInterest Rates Structure, Determinants, Development of BLR and Its ComputationhanimudaNo ratings yet

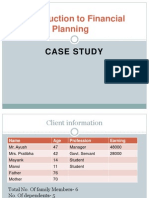

- Introduction To Financial Planning: Case StudyDocument15 pagesIntroduction To Financial Planning: Case StudyNilesh ChavanNo ratings yet

- "35" Short Questions and Answers-Plant Assets and DepreciationDocument5 pages"35" Short Questions and Answers-Plant Assets and DepreciationasfandiyarNo ratings yet

- Statement 517014 78338832 22 Dec 2023Document5 pagesStatement 517014 78338832 22 Dec 2023cressidafunkeadedareNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Axis Bank - Home-Loan-Dynamic-AgreementDocument21 pagesAxis Bank - Home-Loan-Dynamic-Agreementmadhukar sahayNo ratings yet

- Online Instructor's Manual: To AccompanyDocument6 pagesOnline Instructor's Manual: To AccompanyMamdouh MohamedNo ratings yet

- 172 Epp 2020 Annual Integrated ReportDocument204 pages172 Epp 2020 Annual Integrated ReportTorzky RoyNo ratings yet

- Tree Planting Concept NoteDocument4 pagesTree Planting Concept NoteshaneleemanzanaNo ratings yet

- RECEIPTSDocument6 pagesRECEIPTSLyka DanniellaNo ratings yet

- TRANSACTION COST THEORY CGDocument12 pagesTRANSACTION COST THEORY CGDevanshu YadavNo ratings yet

- Property InsuranceDocument42 pagesProperty InsuranceMuzammil HassanNo ratings yet

- Technical Guidance On Audit of NBFCDocument249 pagesTechnical Guidance On Audit of NBFCtulsisd67% (3)

- Country Research Paper SampleDocument7 pagesCountry Research Paper Samplesvfziasif100% (1)

- Robinhood Letter To DFS 101221Document2 pagesRobinhood Letter To DFS 101221Rachel SilbersteinNo ratings yet

- Finman2 Material1 MidtermsDocument8 pagesFinman2 Material1 MidtermsKimberly Laggui PonayoNo ratings yet

- Foreign Direct InvestmentDocument71 pagesForeign Direct InvestmentAkshay Dewlekar100% (2)

- Dr. Ahmed Tahiri JoutiDocument22 pagesDr. Ahmed Tahiri JoutiMohamedNo ratings yet

Call Is Exercised When ST X

Call Is Exercised When ST X

Uploaded by

Shubham Parihar0 ratings0% found this document useful (0 votes)

9 views2 pagesThe document describes a call option contract between Komal and Shubh. Komal purchased a call option from Shubh to buy shares of Axis Bank at a predetermined strike price of Rs. 800 per share, expiring in September. If the stock price exceeds Rs. 800 at expiry, Komal can exercise the option to buy shares at Rs. 800 from Shubh. The payoff for Komal would be the difference between the stock price and strike price, while for Shubh it would be the negative of that amount. Various payoff scenarios are shown in a table for different stock prices at expiry. The document also briefly describes a put option contract between Adwait and Shashank on ONGC shares

Original Description:

Original Title

Options Sep 01 2021

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document describes a call option contract between Komal and Shubh. Komal purchased a call option from Shubh to buy shares of Axis Bank at a predetermined strike price of Rs. 800 per share, expiring in September. If the stock price exceeds Rs. 800 at expiry, Komal can exercise the option to buy shares at Rs. 800 from Shubh. The payoff for Komal would be the difference between the stock price and strike price, while for Shubh it would be the negative of that amount. Various payoff scenarios are shown in a table for different stock prices at expiry. The document also briefly describes a put option contract between Adwait and Shashank on ONGC shares

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views2 pagesCall Is Exercised When ST X

Call Is Exercised When ST X

Uploaded by

Shubham PariharThe document describes a call option contract between Komal and Shubh. Komal purchased a call option from Shubh to buy shares of Axis Bank at a predetermined strike price of Rs. 800 per share, expiring in September. If the stock price exceeds Rs. 800 at expiry, Komal can exercise the option to buy shares at Rs. 800 from Shubh. The payoff for Komal would be the difference between the stock price and strike price, while for Shubh it would be the negative of that amount. Various payoff scenarios are shown in a table for different stock prices at expiry. The document also briefly describes a put option contract between Adwait and Shashank on ONGC shares

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Options

Call

U/L: Axis bank

Maturity: Sep = T

Predetermined price = Strike Price =X = K = 800

Today, Komal is buyer of call, Shubh is seller / writer, therefore Komal has right to buy and Shubh

has obligation to sell, Komal purchased at a premium.

At expiry, Axis bank price = 900, Exercise of option

At expiry, Axis bank price = 500, Not exercised

Call is exercised when ST>X,

Payoff to buyer / Long = Max(0, ST-X)

When ST = 900: = Max(0, 900-800)

= 100

When ST = 500: = Max(0, 500-800)

=0

Payoff to seller / Short / Writer = (Max(0, ST-X))*-1

When ST = 900: = (Max(0, 900-800))*-1

= -100

When ST = 500: = (Max(0, 500-800))*-1

=0

Pay off table for call buyer

ST Premium Payoff Net + / -

500 -100 Max(0, ST-X) -100

Max(0,500-1400) = 0

600 -100 Max(0,600-1400) = 0 -100

700 -100 0 -100

800 -100 0 -100

900 -100 0 -100

1000 -100 0 -100

1100 -100 0 -100

1200 -100 0 -100

1300 -100 0 -100

1400 -100 0 -100

1500 -100 100 0

1600 -100 200 100

1700 -100 300 200

1800 -100 400 300

1900 -100 500 400

2000 -100 600 500

Put option

Buyer / Adwait has right to sell U/L within maturity at a X price.

Seller / Shashank has obligation to buy U/L within maturity at a X price.

ONGC , X = 120

ST = 150, not exercised

ST = 100, exercised

Put is exercised when ST<X,

Payoff to buyer / Long = Max(0, X-ST)

Payoff to seller / Short = Max(0, X-ST)*-1

Adwait purchased 120 put @ Rs. 10 written on ONGC from Shashank. Show pay-off table and a

diagram for both.

You might also like

- CFA Level 2 2018 Mock Exam A Morning Session (With Solutions)Document47 pagesCFA Level 2 2018 Mock Exam A Morning Session (With Solutions)Vanyah86% (14)

- Pengantar AkunDocument2 pagesPengantar AkunNaurah Atika Dina100% (6)

- DT MCQs For June DecDocument208 pagesDT MCQs For June DecnaveedamurnaveedamurNo ratings yet

- The People of Praise 990 Tax DocumentsDocument211 pagesThe People of Praise 990 Tax DocumentsJohn Flaherty100% (2)

- 05 Option Investment StrategiesDocument39 pages05 Option Investment StrategiesAarju PoudelNo ratings yet

- PGJ TabelDocument2 pagesPGJ Tabelulfiahasan92No ratings yet

- Gr3 - Practice - Rounding - To - The - Nearest - 100Document2 pagesGr3 - Practice - Rounding - To - The - Nearest - 100jayendra.chouguleNo ratings yet

- Economics AssignmentDocument23 pagesEconomics AssignmentAqsa AnumNo ratings yet

- Online Activity Number 1Document4 pagesOnline Activity Number 1Danna Claire100% (3)

- Multiplicando X Multiplica Producto TablaDocument2 pagesMultiplicando X Multiplica Producto TablaTatiana BeltránNo ratings yet

- Commodities Market AssignmentDocument1 pageCommodities Market Assignmentharsha faraiyyaNo ratings yet

- Description: Tags: Ch4eDocument7 pagesDescription: Tags: Ch4eanon-353125No ratings yet

- CH 2Document7 pagesCH 2华邦盛No ratings yet

- Calculating Bulk Volumes Using Simpson Rule PDFDocument10 pagesCalculating Bulk Volumes Using Simpson Rule PDFEng Ravi Kant SharmaNo ratings yet

- DES-092B: Multiple of Long-Time PickupDocument1 pageDES-092B: Multiple of Long-Time PickupBen ClarkNo ratings yet

- 2023 4 Trial BalanceDocument4 pages2023 4 Trial BalanceAhmad SyafeiNo ratings yet

- Equilibrium at To Equilibrium at t1Document2 pagesEquilibrium at To Equilibrium at t1Dian Handayani PratiwiNo ratings yet

- 2Bhk Load Bearing Structure: X X TerraceDocument1 page2Bhk Load Bearing Structure: X X TerracePritam Waghmare0% (1)

- PDF Kunci Jawaban Ud Wilastri 1 - CompressDocument3 pagesPDF Kunci Jawaban Ud Wilastri 1 - CompressJajangNo ratings yet

- Business Maths AssignmentDocument3 pagesBusiness Maths AssignmentVishalkumar BhattNo ratings yet

- Nguyễn Thành Cao-20150310 - BTVNDocument6 pagesNguyễn Thành Cao-20150310 - BTVNOnePiece FanNo ratings yet

- Volume Galian Dan TimbunanDocument56 pagesVolume Galian Dan Timbunandinal031No ratings yet

- Research Methodology in Acc & Fin. - Practical ProblemsDocument8 pagesResearch Methodology in Acc & Fin. - Practical ProblemsPrince SharmaNo ratings yet

- UTS Pohon KeputusanDocument8 pagesUTS Pohon Keputusan038 Muhammad Dzaki Akbar RamadhanNo ratings yet

- Market Price Strike Price Premium Exercise/Expiry PNLDocument12 pagesMarket Price Strike Price Premium Exercise/Expiry PNLPrakharNo ratings yet

- Chart Title: Demand Schedule Supply Schedule Q 1300-20P Q 1800-20P Q 100 + 10P Demand Function Supply FunctionDocument3 pagesChart Title: Demand Schedule Supply Schedule Q 1300-20P Q 1800-20P Q 100 + 10P Demand Function Supply FunctionHarish BishnoiNo ratings yet

- Saving FunctionDocument7 pagesSaving FunctionManepalli YashwinNo ratings yet

- Titik Sudut Dalam Azimut JARAK (D) d.SIN d.COS: Colum NeDocument5 pagesTitik Sudut Dalam Azimut JARAK (D) d.SIN d.COS: Colum NeAngel LabolaangNo ratings yet

- 3Document1 page3Anchal MishraNo ratings yet

- Introduction To The Worksheet: Review QuestionsDocument16 pagesIntroduction To The Worksheet: Review Questionskkss_tt6528No ratings yet

- 1-2 Application ProblemDocument1 page1-2 Application ProblemGary LouperNo ratings yet

- Birthday EpensesDocument2 pagesBirthday EpensesAnonymous Koc2C4xNo ratings yet

- Rekod Sit inDocument1 pageRekod Sit inTheresa JackNo ratings yet

- ANOVA (Analysis of Variance) : NOVA ExampleDocument15 pagesANOVA (Analysis of Variance) : NOVA ExampleAyeah Metran EscoberNo ratings yet

- Dodoma DemDocument1 pageDodoma Demgman444No ratings yet

- DES-093B: Multiple of SensorDocument1 pageDES-093B: Multiple of SensorBen ClarkNo ratings yet

- A B C D E: Dormitorio 2 Dormitorio 1 Baño BañoDocument1 pageA B C D E: Dormitorio 2 Dormitorio 1 Baño Bañojhon cruz paucarNo ratings yet

- Primer NivelDocument1 pagePrimer Niveljhon cruz paucarNo ratings yet

- Primer NivelDocument1 pagePrimer Niveljhon cruz paucarNo ratings yet

- N0.3 % Konsentorasi Awal Dan Flow: WhileDocument9 pagesN0.3 % Konsentorasi Awal Dan Flow: WhileDefry AnantoNo ratings yet

- Eco ComicsDocument5 pagesEco ComicsHannah Alvarado BandolaNo ratings yet

- Description: Tags: 2004PaySchedDocument6 pagesDescription: Tags: 2004PaySchedanon-579857No ratings yet

- Gambar 2D Rumah MinimalisDocument1 pageGambar 2D Rumah Minimalisアダム フサイニーNo ratings yet

- Memomassa Ufu HorarioDocument1 pageMemomassa Ufu HorarioJoão Paulo Souza DiasNo ratings yet

- BhattuDocument1 pageBhattuPrabhat GautamNo ratings yet

- Tugas 3 Ekonomi MakroDocument2 pagesTugas 3 Ekonomi MakroMuhammad IrsyadNo ratings yet

- Description: Tags: p0003TableAFultimeDocument1 pageDescription: Tags: p0003TableAFultimeanon-994991No ratings yet

- San AntonioDocument1 pageSan AntonioDolo GarciaNo ratings yet

- Mcdonald Exercises, Chapter 3: Christophe DethierDocument20 pagesMcdonald Exercises, Chapter 3: Christophe DethierMichael AldifranNo ratings yet

- Macroeconomic ReviewDocument8 pagesMacroeconomic ReviewgithinjipattooNo ratings yet

- 12 Rules For Life An Antidote To ChaosDocument21 pages12 Rules For Life An Antidote To Chaosbastian_wolf0% (1)

- Walking PosterDocument1 pageWalking Posterdan paluskaNo ratings yet

- Acc 4 X Accounting EquationDocument5 pagesAcc 4 X Accounting Equationapi-341661305No ratings yet

- Options - Basics and StrategiesDocument45 pagesOptions - Basics and StrategiesAnurag ChaturvediNo ratings yet

- StraddleDocument1 pageStraddlefxn fndNo ratings yet

- Volume or AreaDocument24 pagesVolume or AreaJustin PabiloniaNo ratings yet

- Pulse Height Analysis PlotDocument1 pagePulse Height Analysis Plotfahrian05No ratings yet

- Papan Score Cerdas CermatDocument5 pagesPapan Score Cerdas CermatAULIA RAHMAN LUBISNo ratings yet

- Schedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07Document1 pageSchedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07christian de leonNo ratings yet

- EXERCISE 3 + SolutionsDocument5 pagesEXERCISE 3 + SolutionsEmmanuel WadiraNo ratings yet

- Minimum Operating Envelope 2 Inch 18ppg Trim ChokesDocument1 pageMinimum Operating Envelope 2 Inch 18ppg Trim Chokescarlos angelNo ratings yet

- TASK 1.9 To Task 1.13Document4 pagesTASK 1.9 To Task 1.13tavibez007No ratings yet

- JMC Guidelines and Template For Compendium 2Document63 pagesJMC Guidelines and Template For Compendium 2kingsters zabateNo ratings yet

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- A Comparative Study On Financial Performance of HINDLCO and NALCODocument9 pagesA Comparative Study On Financial Performance of HINDLCO and NALCOAMAL RAJNo ratings yet

- TRI DUNG Outline of ThesisDocument5 pagesTRI DUNG Outline of ThesisHuy Vu ChiNo ratings yet

- Chapter 13 Possible Industry Issues in Transfer PricingDocument104 pagesChapter 13 Possible Industry Issues in Transfer PricingMczoC.MczoNo ratings yet

- 2023 AgendaDocument3 pages2023 AgendaVictor SanchezNo ratings yet

- Kevin L Boyle ResumeDocument2 pagesKevin L Boyle ResumeKevin L. BoyleNo ratings yet

- Inter CA Auditing and AssuranceDocument689 pagesInter CA Auditing and AssurancePoonam JainNo ratings yet

- Accounting Information System: Semi-Finals ExaminationDocument10 pagesAccounting Information System: Semi-Finals ExaminationLaezelie SorianoNo ratings yet

- Interest Rates Structure, Determinants, Development of BLR and Its ComputationDocument21 pagesInterest Rates Structure, Determinants, Development of BLR and Its ComputationhanimudaNo ratings yet

- Introduction To Financial Planning: Case StudyDocument15 pagesIntroduction To Financial Planning: Case StudyNilesh ChavanNo ratings yet

- "35" Short Questions and Answers-Plant Assets and DepreciationDocument5 pages"35" Short Questions and Answers-Plant Assets and DepreciationasfandiyarNo ratings yet

- Statement 517014 78338832 22 Dec 2023Document5 pagesStatement 517014 78338832 22 Dec 2023cressidafunkeadedareNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Axis Bank - Home-Loan-Dynamic-AgreementDocument21 pagesAxis Bank - Home-Loan-Dynamic-Agreementmadhukar sahayNo ratings yet

- Online Instructor's Manual: To AccompanyDocument6 pagesOnline Instructor's Manual: To AccompanyMamdouh MohamedNo ratings yet

- 172 Epp 2020 Annual Integrated ReportDocument204 pages172 Epp 2020 Annual Integrated ReportTorzky RoyNo ratings yet

- Tree Planting Concept NoteDocument4 pagesTree Planting Concept NoteshaneleemanzanaNo ratings yet

- RECEIPTSDocument6 pagesRECEIPTSLyka DanniellaNo ratings yet

- TRANSACTION COST THEORY CGDocument12 pagesTRANSACTION COST THEORY CGDevanshu YadavNo ratings yet

- Property InsuranceDocument42 pagesProperty InsuranceMuzammil HassanNo ratings yet

- Technical Guidance On Audit of NBFCDocument249 pagesTechnical Guidance On Audit of NBFCtulsisd67% (3)

- Country Research Paper SampleDocument7 pagesCountry Research Paper Samplesvfziasif100% (1)

- Robinhood Letter To DFS 101221Document2 pagesRobinhood Letter To DFS 101221Rachel SilbersteinNo ratings yet

- Finman2 Material1 MidtermsDocument8 pagesFinman2 Material1 MidtermsKimberly Laggui PonayoNo ratings yet

- Foreign Direct InvestmentDocument71 pagesForeign Direct InvestmentAkshay Dewlekar100% (2)

- Dr. Ahmed Tahiri JoutiDocument22 pagesDr. Ahmed Tahiri JoutiMohamedNo ratings yet