Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsSummary

Summary

Uploaded by

sabahath samreenCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- Allied Banking Corporation v. Spouses Macam (Fausto)Document3 pagesAllied Banking Corporation v. Spouses Macam (Fausto)Bluei FaustoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1701A Annual Income Tax Return: (Add More... )Document1 page1701A Annual Income Tax Return: (Add More... )Karen Faye TorrecampoNo ratings yet

- Mauli Krishi Seva Kendra - KFSDocument4 pagesMauli Krishi Seva Kendra - KFSswapnilmaher43No ratings yet

- ASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Document1 pageASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)johariakNo ratings yet

- AMD AssignmentDocument4 pagesAMD Assignment234ss 567ppNo ratings yet

- StatementOfAccount 50456096257 16082023 141039Document186 pagesStatementOfAccount 50456096257 16082023 141039Praveen SainiNo ratings yet

- Julia King Credit ScoreDocument54 pagesJulia King Credit ScoreGregory SMithNo ratings yet

- Pawan TextilesDocument5 pagesPawan TextilesShaw PreetiNo ratings yet

- The Most Effective Credit Bureau Dispute LetterDocument16 pagesThe Most Effective Credit Bureau Dispute Lettercj100% (1)

- 26,2020 Junior CoOperative Inspector Kerala Khadi & Village IndustriesDocument15 pages26,2020 Junior CoOperative Inspector Kerala Khadi & Village IndustriesarjuwavaNo ratings yet

- Simple InterestDocument16 pagesSimple Interestmanistat1903No ratings yet

- Statement 10 2023Document1 pageStatement 10 2023tbf56jbcg7No ratings yet

- HjjjejdjsjsDocument1 pageHjjjejdjsjsRey CortesNo ratings yet

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANNo ratings yet

- American Express Bank Statement Cythel M GomaDocument4 pagesAmerican Express Bank Statement Cythel M Gomashirleysimone53No ratings yet

- CommentaryDocument6 pagesCommentarySachit KCNo ratings yet

- In Come Tax Withholding Assistant For Employers 2022 BDocument2 pagesIn Come Tax Withholding Assistant For Employers 2022 Badam smithNo ratings yet

- Yoseph H Simanjuntak: Account SummaryDocument5 pagesYoseph H Simanjuntak: Account SummaryPutra UtamaNo ratings yet

- Functions of MoneyDocument7 pagesFunctions of MoneyShayan YasirNo ratings yet

- Credit Card DetailsDocument2 pagesCredit Card Detailsipchunhei2999No ratings yet

- Sanchay Par Advantage Deffered IncomeDocument3 pagesSanchay Par Advantage Deffered IncomeTamil Vanan NNo ratings yet

- ABSNet GlossaryDocument37 pagesABSNet Glossaryapi-3778585No ratings yet

- Math108x - Document - w09GroupAssignment (7) - 1589530813Document10 pagesMath108x - Document - w09GroupAssignment (7) - 1589530813Poline Pauline KitiliNo ratings yet

- Money and Banking: Unit IIIDocument69 pagesMoney and Banking: Unit IIIBharti SutharNo ratings yet

- Internship Report On Credit Operations of Trust Bank LTDDocument52 pagesInternship Report On Credit Operations of Trust Bank LTDMd Tajwar Rashid TokyNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- English WorksheetDocument31 pagesEnglish WorksheetBinoy TrevadiaNo ratings yet

- CMA B4.8 FactoringDocument7 pagesCMA B4.8 FactoringZeinabNo ratings yet

- Finman Modules Chapter 5Document9 pagesFinman Modules Chapter 5Angel ColarteNo ratings yet

Summary

Summary

Uploaded by

sabahath samreen0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

summary

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesSummary

Summary

Uploaded by

sabahath samreenCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

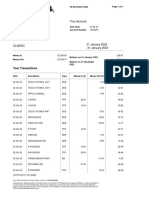

Calculation of Your Taxable Income

A. Gross Total Income V 9,51,296

Hide Details

Income Chargeable under the head ’Salaries’ V 7,97,528

Income Chargeable under the head ’House Property’ V0

Income Chargeable under the head ’Other Sources’ V 1,53,768

Gross Total Income V 9,51,296

B. Total Deductions V 1,51,828

Hide Details

80C - Life insurance premia, deferred annuity, contributions to provident fund, V 1,50,000

subscription to certain equity shares or debentures, etc under section 80C

80G - Donations to Certain Funds V 1,828

Total Deductions ( - ) V 1,51,828

C. Total Taxable Income (A-B) V 7,99,470

Calculation of Tax Payable

D. Total Tax, Fee and Interest V 78,236

Hide Details

Tax Payable on Total Income V 72,394

Rebate u/s 87A V0

Tax payable after rebate V 72,394

Health and Education Cess at 4% V 2,896

Total Tax & Cess V 75,290

Relief u/s 89 V0

Balance Tax After Relief V 75,290

Interest u/s 234A V0

Interest u/s 234B V 1,890

Interest u/s 234C V 1,056

Fees u/s 234F V0

Total Interest and Fee Payable V 2,946

Total Tax, Fee and Interest V 78,236

E. Total Tax Paid V 54,245

Hide Details

Tax Deducted at Source (TDS1) on Salary Income V 43,306

Tax Deducted at Source (TDS) from Income Other than Salary V 10,939

Tax Deducted at Source (TDS) as furnished by Payer(s) V0

Tax Collected at Source (TCS) V0

Advance Tax V0

Self Assessment Tax V0

Total Tax Paid V 54,245

Amount Payable V 23,990

Hide Details

Total Tax Liability V 78,236

Total Tax Paid V 54,245

Total Amount Payable V 23,990

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- Allied Banking Corporation v. Spouses Macam (Fausto)Document3 pagesAllied Banking Corporation v. Spouses Macam (Fausto)Bluei FaustoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1701A Annual Income Tax Return: (Add More... )Document1 page1701A Annual Income Tax Return: (Add More... )Karen Faye TorrecampoNo ratings yet

- Mauli Krishi Seva Kendra - KFSDocument4 pagesMauli Krishi Seva Kendra - KFSswapnilmaher43No ratings yet

- ASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Document1 pageASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)johariakNo ratings yet

- AMD AssignmentDocument4 pagesAMD Assignment234ss 567ppNo ratings yet

- StatementOfAccount 50456096257 16082023 141039Document186 pagesStatementOfAccount 50456096257 16082023 141039Praveen SainiNo ratings yet

- Julia King Credit ScoreDocument54 pagesJulia King Credit ScoreGregory SMithNo ratings yet

- Pawan TextilesDocument5 pagesPawan TextilesShaw PreetiNo ratings yet

- The Most Effective Credit Bureau Dispute LetterDocument16 pagesThe Most Effective Credit Bureau Dispute Lettercj100% (1)

- 26,2020 Junior CoOperative Inspector Kerala Khadi & Village IndustriesDocument15 pages26,2020 Junior CoOperative Inspector Kerala Khadi & Village IndustriesarjuwavaNo ratings yet

- Simple InterestDocument16 pagesSimple Interestmanistat1903No ratings yet

- Statement 10 2023Document1 pageStatement 10 2023tbf56jbcg7No ratings yet

- HjjjejdjsjsDocument1 pageHjjjejdjsjsRey CortesNo ratings yet

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANNo ratings yet

- American Express Bank Statement Cythel M GomaDocument4 pagesAmerican Express Bank Statement Cythel M Gomashirleysimone53No ratings yet

- CommentaryDocument6 pagesCommentarySachit KCNo ratings yet

- In Come Tax Withholding Assistant For Employers 2022 BDocument2 pagesIn Come Tax Withholding Assistant For Employers 2022 Badam smithNo ratings yet

- Yoseph H Simanjuntak: Account SummaryDocument5 pagesYoseph H Simanjuntak: Account SummaryPutra UtamaNo ratings yet

- Functions of MoneyDocument7 pagesFunctions of MoneyShayan YasirNo ratings yet

- Credit Card DetailsDocument2 pagesCredit Card Detailsipchunhei2999No ratings yet

- Sanchay Par Advantage Deffered IncomeDocument3 pagesSanchay Par Advantage Deffered IncomeTamil Vanan NNo ratings yet

- ABSNet GlossaryDocument37 pagesABSNet Glossaryapi-3778585No ratings yet

- Math108x - Document - w09GroupAssignment (7) - 1589530813Document10 pagesMath108x - Document - w09GroupAssignment (7) - 1589530813Poline Pauline KitiliNo ratings yet

- Money and Banking: Unit IIIDocument69 pagesMoney and Banking: Unit IIIBharti SutharNo ratings yet

- Internship Report On Credit Operations of Trust Bank LTDDocument52 pagesInternship Report On Credit Operations of Trust Bank LTDMd Tajwar Rashid TokyNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- English WorksheetDocument31 pagesEnglish WorksheetBinoy TrevadiaNo ratings yet

- CMA B4.8 FactoringDocument7 pagesCMA B4.8 FactoringZeinabNo ratings yet

- Finman Modules Chapter 5Document9 pagesFinman Modules Chapter 5Angel ColarteNo ratings yet