Professional Documents

Culture Documents

What Is Going Concern?: Key Takeaways

What Is Going Concern?: Key Takeaways

Uploaded by

Syaz0 ratings0% found this document useful (0 votes)

22 views3 pagesThe document defines and discusses the accounting concept of "going concern." A going concern is a company that is financially stable enough to meet its obligations and continue operating indefinitely into the future. Accountants assume companies are going concerns when preparing their financial reports, which allows certain expenses and assets to be deferred rather than reported at liquidation value. The document outlines factors that indicate a company may no longer be a going concern, such as continuous losses or an inability to pay debts without restructuring.

Original Description:

financial accounting

Original Title

What Is Going Concern

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines and discusses the accounting concept of "going concern." A going concern is a company that is financially stable enough to meet its obligations and continue operating indefinitely into the future. Accountants assume companies are going concerns when preparing their financial reports, which allows certain expenses and assets to be deferred rather than reported at liquidation value. The document outlines factors that indicate a company may no longer be a going concern, such as continuous losses or an inability to pay debts without restructuring.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

22 views3 pagesWhat Is Going Concern?: Key Takeaways

What Is Going Concern?: Key Takeaways

Uploaded by

SyazThe document defines and discusses the accounting concept of "going concern." A going concern is a company that is financially stable enough to meet its obligations and continue operating indefinitely into the future. Accountants assume companies are going concerns when preparing their financial reports, which allows certain expenses and assets to be deferred rather than reported at liquidation value. The document outlines factors that indicate a company may no longer be a going concern, such as continuous losses or an inability to pay debts without restructuring.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

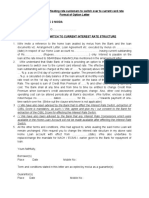

What Is Going Concern?

Going concern is an accounting term for a company that has the resources needed

to continue operating indefinitely until it provides evidence to the contrary. This term

also refers to a company's ability to make enough money to stay afloat or to

avoid bankruptcy. If a business is not a going concern, it means it's gone bankrupt

and its assets were liquidated. As an example, many dot-coms are no longer going

concern companies after the tech bust in the late 1990s.

KEY TAKEAWAYS

Going concern is an accounting term for a company that is financially

stable enough to meet its obligations and continue its business for the

foreseeable future.

Certain expenses and assets may be deferred in financial reports if a

company is assumed to be a going concern.

If a company is no longer a going concern, it must start reporting

certain information on its financial statements.

Negative trends that lead to no longer being a going concern include

denial of credit, continued losses, and lawsuits.

Understanding Going Concern

Accountants use going concern principles to decide what types of reporting should

appear on financial statements. Companies that are a going concern may defer

reporting long-term assets at current value or liquidating value, but rather at cost. A

company remains a going concern when the sale of assets does not impair its ability

to continue operation, such as the closure of a small branch office that reassigns the

employees to other departments within the company.

Accountants who view a company as a going concern generally believe a firm uses

its assets wisely and does not have to liquidate anything. Accountants may also

employ going concern principles to determine how a company should proceed with

any sales of assets, reduction of expenses, or shifts to other products.

Red Flags Indicating a Business Is Not a Going Concern

Certain red flags may appear on financial statements of publicly traded companies

that may indicate a business will not be a going concern in the future. Listing of

long-term assets normally does not appear in a company's quarterly statements or

as a line item on balance sheets. Listing the value of long-term assets may indicate

a company plans to sell these assets.

A firm's inability to meet its obligations without substantial restructuring or selling of

assets may also indicate it is not a going concern. If a company acquires assets

during a time of restructuring, it may plan to resell them later.

Going Concern Conditions

Accounting standards try to determine what a company should disclose on its

financial statements if there are doubts about its ability to continue as a going

concern. In May 2014, the Financial Accounting Standards Board determined

financial statements should reveal the conditions that support an entity's substantial

doubt that it can continue as a going concern. 2 Statements should also show

management's interpretation of the conditions and management's future plans.

In general, an auditor examines a company's financial statements to see if it can

continue as a going concern for one year following the time of an audit. Conditions

that lead to substantial doubt about a going concern include negative trends in

operating results, continuous losses from one period to the next, loan defaults,

lawsuits against a company, and denial of credit by suppliers.

Examples of Going Concern

XYZ Limited manufactures a special chemical that it then markets

and sells. Suddenly, the US government imposes a ban on the

manufacture, export, import, and sale of this special chemical in the

country. If this chemical is the only product that XYZ Limited

creates, then the company will no longer be a going concern.

A state-owned company is in a tough financial situation and is

struggling to pay its debt. The government gives the company a

bailout and guarantees all payments to its creditors. The state-

owned company is a going concern despite its poor financial

position.

Advantages of Going Concern Concept

There are several advantages of the going concern concept:

Companies undertake the substantial purchase of fixed assets in the

initial years which involve immediate expenditure, however, the

benefit of the asset is spread out throughout its life, which is usually

more than a year. The concept recognizes recording of such costs

over the life of the assets.

It accommodates bifurcation of assets and liabilities as short term,

12-month period, and long term, usually more than 12 months, also

ingraining confidence in the company that it will continue to

function in the future.

It is the basis on which income or profits are recorded over the

years in which they pertain to.

The assets and liabilities are recorded at cost in order to show the

security of the company and that it does not operate as a means to

liquidate its assets and liabilities but is committed to continuous

long-term growth and expansion.

Disadvantages of Going Concern Concept

The going concern concept does come with downsides and limitations:

The financial reports are prepared at cost and not at its current

market value. In the event of liquidation of the company due to any

unforeseen circumstance, the financial statements are then brought

to their current market value. However, these figures may differ

greatly from the ones prepared at cost.

In case of the business shutting down its operations, the financial

statements are drawn on-going concern basis. This may lead to

incorrect information being depicted and as a result, mislead all the

relevant stakeholders involved.

Any change in law may affect the business and the idea of going

concern may not be practical for the organization and would bring

about abrupt and prompt solutions when recording financial

transactions.

You might also like

- Moodys - Sample Questions 3Document16 pagesMoodys - Sample Questions 3ivaNo ratings yet

- BBA-101 (Fundamentals of Accounting)Document10 pagesBBA-101 (Fundamentals of Accounting)Muniba BatoolNo ratings yet

- Project Report of Business PlanDocument8 pagesProject Report of Business PlanRavi SatyapalNo ratings yet

- Revision Plan Final Far 2 Sir Adnan RaufDocument5 pagesRevision Plan Final Far 2 Sir Adnan RaufKh Tabish MajeedNo ratings yet

- Assignment Course Title (Financial Management)Document7 pagesAssignment Course Title (Financial Management)guptaanuja90No ratings yet

- Accounting PrincipalsDocument13 pagesAccounting PrincipalsMasood Ahmad AadamNo ratings yet

- Financial Management ABADDocument7 pagesFinancial Management ABADKumaingking Daniell AnthoineNo ratings yet

- Debt FinancingDocument8 pagesDebt FinancingZuhaib AhmedNo ratings yet

- Business Plan Financial Plan A. Financial Projections Sources of Funds The BusinessDocument7 pagesBusiness Plan Financial Plan A. Financial Projections Sources of Funds The BusinessPM WritersNo ratings yet

- Definition and ExplanationDocument2 pagesDefinition and ExplanationShukrani Msese JuniorNo ratings yet

- Assignment Unit VIDocument21 pagesAssignment Unit VIHạnh NguyễnNo ratings yet

- New Microsoft Word DocumentDocument4 pagesNew Microsoft Word DocumentMasudRanaNo ratings yet

- 2014 3a. Explain Why Operating Leverage Decreases As A Company Increases Sales and Shifts Away From The Break-Even PointDocument10 pages2014 3a. Explain Why Operating Leverage Decreases As A Company Increases Sales and Shifts Away From The Break-Even PointHiew fuxiangNo ratings yet

- AMARA RAJA POWER SYSTEMS-infinie SolutionsDocument51 pagesAMARA RAJA POWER SYSTEMS-infinie SolutionsInitz TechnologiesNo ratings yet

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Financially Troubled BusinessesDocument9 pagesFinancially Troubled BusinessesSIPHO TIMOTHY NGOVENINo ratings yet

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Business FailureDocument15 pagesBusiness FailureJay Kishan100% (1)

- Receivable ManagementDocument2 pagesReceivable ManagementR100% (1)

- Business Finance TADocument9 pagesBusiness Finance TAOlivier MNo ratings yet

- Amity AssignmentDocument4 pagesAmity Assignmentrakesh92joshiNo ratings yet

- Cas Ii Assignment ON Importance of Liquidity Ratios in The IndustryDocument7 pagesCas Ii Assignment ON Importance of Liquidity Ratios in The IndustrySanchali GoraiNo ratings yet

- ADL 03 Accounting For Managers V3Document21 pagesADL 03 Accounting For Managers V3Amit RaoNo ratings yet

- Ass Term PapperDocument11 pagesAss Term Papperabebe kumelaNo ratings yet

- 1cm8numoo 989138Document52 pages1cm8numoo 989138javed1204khanNo ratings yet

- Top 7 Biggest If Rs MistakesDocument18 pagesTop 7 Biggest If Rs MistakesKyleRodSimpsonNo ratings yet

- Unit II POEDocument36 pagesUnit II POErachuriharika.965No ratings yet

- Tema #5. Financiamiento Y Generación de Recursos "Con Qué" 5.1. Plan FinancieroDocument6 pagesTema #5. Financiamiento Y Generación de Recursos "Con Qué" 5.1. Plan FinancieroCatalina GómezNo ratings yet

- Corporate Finance Notes 2Document17 pagesCorporate Finance Notes 2ccapgomesNo ratings yet

- Net Working CapitalDocument10 pagesNet Working CapitalGambit BruNo ratings yet

- Going Concern Assumption DefinitionDocument3 pagesGoing Concern Assumption DefinitionKimNo ratings yet

- Predicting Corporate Failure - Business - ReorganizationDocument11 pagesPredicting Corporate Failure - Business - ReorganizationBob MarshellNo ratings yet

- Finance FunctionsDocument7 pagesFinance FunctionsTushar Mahmud SizanNo ratings yet

- CVS 465 - Chapter 6 - Project AccountingDocument10 pagesCVS 465 - Chapter 6 - Project AccountingOndari HesbonNo ratings yet

- Empirical Use of Financial LeverageDocument3 pagesEmpirical Use of Financial Leveragesam abbasNo ratings yet

- IGNOU MBA MS04 Solved Assignments Dec 2012Document10 pagesIGNOU MBA MS04 Solved Assignments Dec 2012Amit DungdungNo ratings yet

- Receivable Managemen1Document78 pagesReceivable Managemen1dileepkumarNo ratings yet

- LiquidityDocument5 pagesLiquidityMobin ShaleeNo ratings yet

- Higher Return of CapitalDocument10 pagesHigher Return of CapitalShesha Nimna GamageNo ratings yet

- Coperate FinanceDocument17 pagesCoperate Financegift lunguNo ratings yet

- The Other Questions 22052023Document33 pagesThe Other Questions 22052023Anjanee PersadNo ratings yet

- Project On Accounts ReceivableDocument61 pagesProject On Accounts ReceivableNilesh JhaNo ratings yet

- A STUDY ON LIQUIDITY - Docx (2) - 1Document111 pagesA STUDY ON LIQUIDITY - Docx (2) - 1Nirmal Raj100% (1)

- ADL 03 Accounting For Managers V3final PDFDocument22 pagesADL 03 Accounting For Managers V3final PDFgouravNo ratings yet

- 1PROJECT - REPORT On Working Capital ManagementDocument81 pages1PROJECT - REPORT On Working Capital ManagementSaaribh SinhaNo ratings yet

- Finance Compendium PartI DMS IIT DelhiDocument29 pagesFinance Compendium PartI DMS IIT Delhinikhilkp9718No ratings yet

- PDFDocument8 pagesPDFSamantha Marie ArevaloNo ratings yet

- Understanding The Balance SheetDocument11 pagesUnderstanding The Balance Sheetosuna.osiris100% (1)

- BREAKING DOWN 'Noncurrent Liabilities': Balance Sheet Lease Cash Flow Current Liabilities Accounts PayableDocument8 pagesBREAKING DOWN 'Noncurrent Liabilities': Balance Sheet Lease Cash Flow Current Liabilities Accounts PayableThalia Rhine AberteNo ratings yet

- Afm TheoryDocument4 pagesAfm TheoryMd YusufNo ratings yet

- Factors Determining Optimal Capital StructureDocument8 pagesFactors Determining Optimal Capital StructureArindam Mitra100% (8)

- MFRD EssayDocument6 pagesMFRD Essaydoll3kittenNo ratings yet

- Faca ShristiDocument11 pagesFaca Shristishristi BaglaNo ratings yet

- Financial RestructuringDocument5 pagesFinancial Restructuring9536909268No ratings yet

- Financial Leverage OverviewDocument10 pagesFinancial Leverage Overviewsvrohith29No ratings yet

- Air India Is The Flag Carrier Airline of India: Has Greater ImportanceDocument13 pagesAir India Is The Flag Carrier Airline of India: Has Greater ImportanceVidhuna SudheerNo ratings yet

- Acct 504 Exam Question GuideDocument15 pagesAcct 504 Exam Question Guideawallflower1100% (1)

- Topic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowingDocument8 pagesTopic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowinggeorgianaNo ratings yet

- Looking For Warning Signs Within The Financial StatementsDocument4 pagesLooking For Warning Signs Within The Financial StatementsShakeel IqbalNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Balance Sheet of Eicher Motors For MonicaDocument4 pagesBalance Sheet of Eicher Motors For MonicaBBA SFNo ratings yet

- Corporate Governance Failure in The Lehman Brothers CaseDocument6 pagesCorporate Governance Failure in The Lehman Brothers Caseranasanjeev0007No ratings yet

- Proposal MBSDocument15 pagesProposal MBSPrashun ShresthaNo ratings yet

- The Role of Financial Auditor in Detecting and Reporting Fraud and ErrorDocument10 pagesThe Role of Financial Auditor in Detecting and Reporting Fraud and ErrorSumayya SiddiquaNo ratings yet

- BIA Vs CCAADocument1 pageBIA Vs CCAAMike Ares LyonsNo ratings yet

- Money Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewDocument16 pagesMoney Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewyanaNo ratings yet

- Module No 1 Airline FinanceDocument14 pagesModule No 1 Airline Financeshaik akhilNo ratings yet

- Financial Ratios Analysis of NestleDocument17 pagesFinancial Ratios Analysis of NestleKAINAT MUSHTAQNo ratings yet

- DT Notes (Part I) For May & Nov 23Document246 pagesDT Notes (Part I) For May & Nov 23Tushar MalhotraNo ratings yet

- My Project SharekhanDocument154 pagesMy Project Sharekhankris_sone43% (7)

- Gmail - MOM For Plumeria Garden Estate - MyGateDocument1 pageGmail - MOM For Plumeria Garden Estate - MyGateAjit KumarNo ratings yet

- STRATEGIC COST MANAGEMENT Module 2Document2 pagesSTRATEGIC COST MANAGEMENT Module 2Mary Ann GurreaNo ratings yet

- Banking Extra PracticeDocument17 pagesBanking Extra PracticeSubham PatiNo ratings yet

- Moradabad HotelDocument3 pagesMoradabad Hotelsinghutkarsh3344No ratings yet

- Aliceblue Digital FormDocument29 pagesAliceblue Digital Formshemanth123No ratings yet

- Ikhwan Card Appform PDFDocument16 pagesIkhwan Card Appform PDFlongliferideNo ratings yet

- Export-Import Bank of India: An OverviewDocument19 pagesExport-Import Bank of India: An OverviewAmit KainthNo ratings yet

- New Operating AgreementDocument16 pagesNew Operating AgreementMichaelAllenCrainNo ratings yet

- Miga Professionals Program PDFDocument2 pagesMiga Professionals Program PDFPaul Ivan Beppe a Yombo Paul IvanNo ratings yet

- 2024 Bloomberg Market ConceptsDocument7 pages2024 Bloomberg Market Conceptsmilkah mwauraNo ratings yet

- Oxford Income Letter 0420 Sal93Document12 pagesOxford Income Letter 0420 Sal93Jeff SturgeonNo ratings yet

- Paper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedDocument19 pagesPaper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedHirak Jyoti Das100% (2)

- Accounting Nov 2017 MemoDocument14 pagesAccounting Nov 2017 Memokwanele andiswaNo ratings yet

- AD1101 AY15 - 16 Sem 1 Lecture 1Document21 pagesAD1101 AY15 - 16 Sem 1 Lecture 1weeeeeshNo ratings yet

- Wal-Mart Stores' Discount OperationsDocument5 pagesWal-Mart Stores' Discount Operationsgaurav sahuNo ratings yet

- Invoice: Ittrendex Oü Harju Maakond, Tallinn, Kesklinna Linna-Osa, Tuukri TN 19-315, 10152 EstoniaDocument2 pagesInvoice: Ittrendex Oü Harju Maakond, Tallinn, Kesklinna Linna-Osa, Tuukri TN 19-315, 10152 EstoniaАлена ВыдышNo ratings yet

- Switchover Application Revised - 16042022Document1 pageSwitchover Application Revised - 16042022khageshcode89No ratings yet

- EF3333 - Financial Systems, Markets and InstrumentsDocument13 pagesEF3333 - Financial Systems, Markets and InstrumentsLi Man KitNo ratings yet