Professional Documents

Culture Documents

Fintech Company:Paytm: 1.financial Statements and Records of Company

Fintech Company:Paytm: 1.financial Statements and Records of Company

Uploaded by

Ankita NighutOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fintech Company:Paytm: 1.financial Statements and Records of Company

Fintech Company:Paytm: 1.financial Statements and Records of Company

Uploaded by

Ankita NighutCopyright:

Available Formats

Fintech Company:Paytm

Source: https://in.images.search.yaho.com

Paytm is India's biggest versatile instalments, e-wallet, and business stage. Even

though it began as an energizing stage in 2010, Paytm has changed its plan of action to

become a commercial centre and a virtual bank model. It is likewise one of the pioneers of

the cashback plan of action. Paytm has changed itself into an Indian mammoth managing

versatile instalments, banking administrations, commercial centre, Paytm gold, energize and

charge instalments, Paytm wallet and many other provisions which serve around 100 million

enlisted clients. Paytm is accessible in 11 Indian dialects and offers online use-cases as

versatile energizes, service charge instalments, travel, motion pictures, and occasions

appointments.

In-store instalments at markets, leafy foods shops, cafés, stopping, tolls, drug

stores and instructive establishments can be accessed through the Paytm QR code.One 97

Communications, the parent company of Paytm, is all set to raise its capital target of over

₹16,600 crores through an IPO that it had filed earlier in July 2021. Paytm is seeking to

raise $25 billion to $30 billion valuation post this IPO.According to the organization, more

than 7 million traders crosswise over India utilize its QR code to acknowledge instalments

straightforwardly into their bank account. The organization uses commercials and pays a

special substance to produce income.

1.Financial Statements and Records of Company:

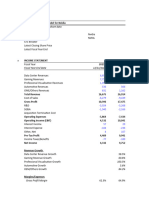

Income Statements:

Particulars 3/31/2021 3/31/2020 3/31/2019

Total Sales (or Revenue) 28,013 32,787 32,241

Cost of Goods Sold (COGS) 39,866 44,353 39,859

including Depreciation and Amortization

Gross Income -11,853 -11,566 -7,618

SG&A Excluding Other 6,940 15,998 36,434

Other Operating Expense 592 464 450

EBIT (Operating Income) -19,385 -28,028 -44,502

Non-Operating Income (Expense) 2,893 1,084 1,631

Interest Expense 377 536 374

Unusual Expense -626 1,542 -778

Pre-tax Income -16,243 -29,022 -42,467

Income Taxes 27 -158 -65

Equity in Earnings of Affiliates -740 -560 146

Income

Other After-Tax Adjustments - - -

Consolidated Net Income -17,010 -29,424 -42,256

Minority Interest Expense -49 -1,002 -493

Net Income from Continuing -16,961 -28,422 -41,763

Operations

Preferred Dividends - - -

Net Income Available to Common -16,961 -28,422 -41,816

EPS (Recurring) -28.9 -46.96 -75.53

EPS - Basic - Before Extraordinaries -28.17 -48.81 -74.55

EPS (Diluted) -28.17 -48.81 -74.55

EBITDA -17,600 -26,283 -43,386

Stock Option Compensation Expense 787.5 1,162.70 1,082.20

Operating Lease Expense 92 148 128

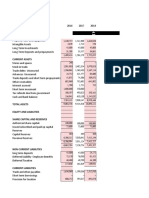

Balance Sheet:

Particulars 3/31/2021 3/31/2020 3/31/2019

Cash & Short-Term Investments 30,236 37,296 29,592

Short Term Receivables 35,338 18,992 26,779

Inventories - - -

Other Current Assets 8,424 8,069 10,338

Total Current Assets 73,998 64,357 66,709

Net Property, Plant & Equipment 4,662 5,474 5,283

Total Investments and Advances 5,164 19,023 3,543

Long-Term Note Receivable 1,365 7,758 2,415

Intangible Assets 666 661 3,707

Deferred Tax Assets 35 147 478

Other Assets 5,623 5,726 5,981

Total Assets 91,513 1,03,146 88,116

Short Term Debt (including Current 5,693 2,459 7,285

Portion of Long-Term Debt)

Accounts Payable 6,052 6,116 7,360

Income Tax Payable 8 24 8

Other Current Liabilities 9,799 8,061 12,566

Total Current Liabilities 21,552 16,660 27,219

Long Term Debt 427 1,822 2,038

Provision for Risks Charges 247 203 115

Deferred Tax Liabilities 6 126 633

Other Liabilities 4,119 3,423 -

Total Liabilities 26,351 22,234 30,005

Non-Equity Reserves - - -

Preferred Stock - Carrying Value - - -

Common Equity 65,348 81,052 57,249

Total Shareholders’ Equity 65,348 81,052 57,249

Accumulated Minority Interest -186 -140 862

Total Equity 65,162 80,912 58,111

Total Liabilities & Stockholders’ 91,513 1,03,146 88,116

Equity

Book Value Per Share 107.94 133.88 94.57

Tangible Book Value Per Share 106.84 132.79 88.44

3.Cash Flow

Particulars 3/31/2021 3/31/2020 3/31/2019

Net Income (Starting Line) -16,983 -29,582 -42,321

Depreciation 1,785 1,745 1,116

Deferred Taxes & Investment Tax - - -

Credit

Investment Tax Credits - - -

Other Funds (Non-Cash) 1,886 3,914 -1,909

Funds from Operations -13,312 -23,923 -43,114

Extraordinary Item - - -

Changes in Working Capital -6,902 68 -1,323

Income Taxes Payable - - -

Net Operating Cash Flow -20,214 -23,855 -44,437

Capital Expenditures -1,927 -1,907 -1,773

Net Assets from Acquisitions -63 -80 -383

Sale of Fixed Assets and Businesses 56 41 363

Purchase or Sale of Investments 21,822 -21,000 22,640

Purchase of Investments -89,089 -95,487 -35,743

Sale Or Maturity of Investments 1,10,911 74,487 58,383

Other Uses -1,608 - -2,742

Other Sources 5 2,522 -

Net Investing Cash Flow 18,285 -20,424 18,105

Cash Dividends Paid - - -

Common Dividends - - -

Preferred Dividends (Cash Flow) - - -

Change in Capital Stock 107 50,400 21,869

Repurchase of Common Pref Stock - - -

Sale of Common Pref Stock 107 50,400 21,869

Proceeds from Stock Options 107 50,400 21,869

Other Proceeds from Stock Options - - -

Issuance or Reduction of Debt, Net -1,582 2,040 -31

Change in Long - Term Debt - - -

Issuance of Long-Term Debt - - -

Reduction of Long-Term Debt - - -

Net Financing Active Other Cash 2 - -

Flow

Other Financing Activities Uses - - -

Net Financing Cash Flow -1,819 52,149 21,788

Exchange Rate Effect 40 -7 -54

Miscellaneous Funds - - -

Net Change in Cash -3,708 7,863 -4,598

Free Cash Flow -22,141 -25,762 -46,210

Increase in Loans - - -

Decrease in Loans - - -

Increase in Deposits - - -

Decrease in Deposits - - -

2.Funding of the Company with detail of investors with rounds of funding:

Date Round Amount Investor Valuation

Private

11-05-2021 Equity $1100M Aberdeen Standard Investments

Abu Dhabi Investment Authority

Corporate

27-10-2021 Minority $123M Swiss Reinsurance Company $534.78M

A) Funding:

B) Investors:

Last

First Funding Funding Investors Type City Round and Year

Asset/Investmen New York Private Equity

11-05-2021 11-05-2021 Black Rock t Management (2021)

1

Sovereign Private Equity

11-05-2021 11-05-2021 GIC Wealth Fund Singapore (2021)

1

CPP Private Equity

11-05-2021 11-05-2021 Investments Pension Fund Canada (2021)

Abu Dhabi 1

Investment United Arab Private Equity

11-05-2021 11-05-2021 Authority Private Equity Emirates (2021)

Aditya 1

Birla Sun Private Equity

11-05-2021 11-05-2021 Life AMC Mutual Fund India (2021)

Aberdeen 1

Standard Asset/Investmen United Private Equity

11-05-2021 11-05-2021 Investments t Management Kingdom (2021)

Governmen 1

t of Private Equity

11-05-2021 11-05-2021 Singapore Government Singapore (2021)

New York 1

City

Comptrolle Private Equity

11-05-2021 11-05-2021 r Government New York (2021)

Diversified 1

Fidelity Financial Massachusett Private Equity

11-05-2021 11-05-2021 Investments Services s (2021)

11-05-2021 11-05-2021 UBS Investment Switzerland 1

Private Equity

Bank (2021)

3.Key Product Offering and Market Segmentation:

Market Segmentation:

Market segmentation is the process through which marketing managers at Paytm Wallet

can divide the large market into smaller segments based on distinct needs, characteristics, or

consumer behaviour. Paytm Wallet can do segmentation based on following criteria –

geographic, demographic, usage, user status, income, lifestyle, value proposition priorities,

benefits sought, loyalty status, gender, social class, self-perception, psychographic factors,

and other attitudes.One of the most widely used multivariate segmentation system is –

PRIZM, developed by Clarita’s. It is widely used by various marketing and advertising

agencies. It comprises 68 customer segments based on the US Household Purchasing

Preferences data.

Kay product Offering:

1.paytm Payment bank:

Paytm received a license from Reserve Bank of India to launch the Paytm Payments

Bank as a separate entity. Founder Vijay Shekhar Sharma will hold 51% share, One97

Communications 39% and 10% will be held by a subsidiary of One97 and Sharma. The bank

was officially inaugurated in November 2017. Over 1,00,000 banking outlets across India by

the end of 2018. However, the bank's branches are yet to touch double digits.

The Bank has appointed veteran banker Satish Kumar Gupta as its new Managing

Director and CEO

2.Paytm Mall:

Paytm launched its Paytm Mall app, which allows consumers to shop from 1.4 lakh registered

sellers. Paytm Mall is a B2C model inspired by China's largest B2C retail platform Tall.

Sellers have to pass through Paytm-certified warehouses and channels to ensure consumer

trust.

4.Demography of Paytm:

As mentioned earlier, Paytm’s business model is B2B and B2B2C. The company caters

to Offline retailers and businessmen/women and small underserving merchants, Consumer

business and The Unity Small Finance Bank. And the business solutions provided by Bharat

are specifically designed to cater to the above-mentioned segments. started as an online

wallet, later transformed into a complete mall and brought a paradigm shift to the retail

industry.

Be it a prepaid mobile recharge, paying utility bills, booking train tickets or shopping

for clothes, this m-commerce store became the substitute for several apps. Users can recharge

their DTH, book movie tickets, pay insurance premiums, shopping bills, contribute to the

charity of your liking and get in the fast lane with Paytm Fasting. The M-commerce aspect of

the portal lets several merchants list their products.

5.Competition Matrix:

The two main competitors are Bartle and Phonepee:

Competition Matrix

Particulars Bharat Paytm Phonepayee

Funding $702.25M $2.5 B $1.2B

Bharat Paytm Bank, UPI Payments

, Insurance, Recharges,

Card, Wallet,

Investments

Product/ service Bharat Swipe, Recharge and

Bharat Bill services,

Loans Digital Gold

Though Though the

almost all merchant

features are transactions

same with done by

Bharat and Ponape of

Pat, like $1B surpass

provision of the

Through Unique loans to the transactions

QR code then users even done by

Comparison Paytm, Truecaller, they reach Bharat

Amzeon Pay, Gay transaction ($76M),

accepted it. limit. But Bharat is

Paytm is considered as

considered to better option

be better among both

company in because of its

terms of unique QR

provision of Payment

service system.

6.Relevance of Company in current Fintech Landscape:

News: Wells Fargo Looks to BaaS, A $26B Acquisition, Paytm’s $1B Raise.

Paytm is a payments company that offers multi-source and multi-destination payment

solutions. It offers comprehensive payment solutions to merchants and allows consumers to

make payments from any bank account to any bank account at a 0% fee.Instalment of Paytm

wallet another fintech give reliant change in fintech and banking industry.

As per EY report of innovation blockchain is important patty and it has advantage of

straightforwardness, changeless, audibity. Blockchain gives security to data. As Paytm is

digital Paytm app which secured Paytm using technology it gives more importance in today’s

covid era as a cashless transaction and put more relevance in business scenario. FinTech is

significantly innovated to money related concept, adjustment and strategies and Paytm is the

one of the leading fintech in term of digital payment gateway.

-----------------------------------------------------------

You might also like

- CH5 P1 Tesco SOLUTION - 4eDocument7 pagesCH5 P1 Tesco SOLUTION - 4eWagimin SendjajaNo ratings yet

- Petron Corp - Financial Analysis From 2014 - 2018Document4 pagesPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- Emaar MGF Land Limited DRHP FINAL PDFDocument851 pagesEmaar MGF Land Limited DRHP FINAL PDFsree24034354No ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- Globe Vertical AnalysisDocument22 pagesGlobe Vertical AnalysisArriana RefugioNo ratings yet

- ABSDocument8 pagesABSashwani singhaniaNo ratings yet

- BA Financial RatiosDocument7 pagesBA Financial RatiosRegen Mae OfiazaNo ratings yet

- Kamel Genuine Parts CompanyDocument4 pagesKamel Genuine Parts CompanyShamsher Ali KhanNo ratings yet

- PT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsDocument2 pagesPT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsAgil MahendraNo ratings yet

- Annexure 4116790Document31 pagesAnnexure 4116790ayesha ansariNo ratings yet

- NVDA DCFDocument7 pagesNVDA DCFSahand LaliNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)

- Exotic Living Limited: AssetsDocument6 pagesExotic Living Limited: Assetsvarun gudwaniNo ratings yet

- FMA Project (ITC Valuation DCF)Document40 pagesFMA Project (ITC Valuation DCF)Vishal NigamNo ratings yet

- Finance For Non-Finance: Ratios AppleDocument12 pagesFinance For Non-Finance: Ratios AppleAvinash GanesanNo ratings yet

- Anchor Compa CommonDocument14 pagesAnchor Compa CommonCY ParkNo ratings yet

- Annual Report - PadiniDocument23 pagesAnnual Report - PadiniCheng Chung leeNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Horizontal Analysis 2Document2 pagesHorizontal Analysis 2Mayolito WajeNo ratings yet

- Income StatementDocument44 pagesIncome Statementyariyevyusif07No ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- DG Khan Cement Financial StatementsDocument8 pagesDG Khan Cement Financial StatementsAsad BumbiaNo ratings yet

- Balance Sheet: 2016 2017 2018 Assets Non-Current AssetsDocument6 pagesBalance Sheet: 2016 2017 2018 Assets Non-Current AssetsAhsan KamranNo ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Estados Financieros Tesla 2022 ClaseDocument16 pagesEstados Financieros Tesla 2022 ClaseJorge MarioNo ratings yet

- Course: EAPM Group-2: Shambhavi Singh Hetvi Doshi Aarav JoshiDocument23 pagesCourse: EAPM Group-2: Shambhavi Singh Hetvi Doshi Aarav JoshiSHAMBHAVI SINGHNo ratings yet

- UAS ALK Ganjil 2018-2019 SulasDocument10 pagesUAS ALK Ganjil 2018-2019 SulasZulkarnainNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- TeslaDocument5 pagesTeslaRajib ChatterjeeNo ratings yet

- 4th Quarter Unaudited Report 2076-2077Document25 pages4th Quarter Unaudited Report 2076-2077Srijana DhunganaNo ratings yet

- MWJDocument5 pagesMWJMuhammad ZubairNo ratings yet

- Estimación - Taller - Del WACC - PVC BDocument4 pagesEstimación - Taller - Del WACC - PVC BSergio Andres Cortes ContrerasNo ratings yet

- National Foods Balance Sheet: 2013 2014 Assets Non-Current AssetsDocument8 pagesNational Foods Balance Sheet: 2013 2014 Assets Non-Current Assetsbakhoo12No ratings yet

- Axlm Consolidatedfs Q32023Document30 pagesAxlm Consolidatedfs Q32023alejandro.tayNo ratings yet

- Tugas (TM.5) Manajemen KeuanganDocument12 pagesTugas (TM.5) Manajemen KeuanganFranklyn DavidNo ratings yet

- BSIS Tesla 2017 2021Document10 pagesBSIS Tesla 2017 2021Minh PhuongNo ratings yet

- Non-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286Document8 pagesNon-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286shahzad khalidNo ratings yet

- FMOD PROJECT Ouijhggfffe5Document97 pagesFMOD PROJECT Ouijhggfffe5Omer CrestianiNo ratings yet

- Dmart 2228107Document30 pagesDmart 2228107Alkish AlexNo ratings yet

- INR Crore FY 16 FY 17 FY 18 FY 19 FY 20Document5 pagesINR Crore FY 16 FY 17 FY 18 FY 19 FY 20Shivani SinghNo ratings yet

- Final Report - Draft2Document32 pagesFinal Report - Draft2shyamagniNo ratings yet

- UnileverDocument5 pagesUnileverKevin PratamaNo ratings yet

- Suzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsDocument3 pagesSuzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsM Bilal KNo ratings yet

- Meta (FB) : Balance SheetDocument20 pagesMeta (FB) : Balance SheetRatul AhamedNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- Burshane LPG Ratio AnalysisDocument25 pagesBurshane LPG Ratio AnalysisCorolla GrandeNo ratings yet

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RNo ratings yet

- Purcari Lucru IndividualDocument7 pagesPurcari Lucru IndividualLenuța PapucNo ratings yet

- SGR Calculation Taking Base FY 2019Document17 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- Gul Ahmed Quiz 2 QuesDocument5 pagesGul Ahmed Quiz 2 QuesTehreem SirajNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- Balance Sheet SAB: of Which: Interest Expenses - 35.24 - 37.37 - 63.68Document13 pagesBalance Sheet SAB: of Which: Interest Expenses - 35.24 - 37.37 - 63.68Hoàng Ngọc OanhNo ratings yet

- FirstBank Unaudited Half Year Results For Period Ending June 2010Document1 pageFirstBank Unaudited Half Year Results For Period Ending June 2010Kunle AdegboyeNo ratings yet

- Excel Sheet - SAMPLE 2Document23 pagesExcel Sheet - SAMPLE 2Bhavdeep singh sidhuNo ratings yet

- Standardized Financial Statements - SolutionDocument25 pagesStandardized Financial Statements - SolutionanisaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Af102 AssignmentDocument5 pagesAf102 AssignmentRo Bola VaniqiNo ratings yet

- Synopsis - Banking FraudDocument27 pagesSynopsis - Banking Fraudha6820474No ratings yet

- LP02 Trade Vendor Form E379!1!1Document1 pageLP02 Trade Vendor Form E379!1!1juniyantiNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- BPP PDFDocument28 pagesBPP PDFLearn WellNo ratings yet

- Commercial: in LeonardoDocument14 pagesCommercial: in LeonardoKenette Diane CantubaNo ratings yet

- The Response of Life Insurance Pricing To Life SettlementsDocument24 pagesThe Response of Life Insurance Pricing To Life SettlementsNoura ShamseddineNo ratings yet

- Credit Crisis of 1772Document1 pageCredit Crisis of 1772Aflia SabrinaNo ratings yet

- Feedback Report - 24042023 - Randstad Corporate DevelopmentDocument12 pagesFeedback Report - 24042023 - Randstad Corporate DevelopmentTejas BNo ratings yet

- Ucbl Offshore Banking Internship ReportDocument37 pagesUcbl Offshore Banking Internship ReportMOHAMMAD MOHSIN100% (1)

- Chap 010Document22 pagesChap 010K59 Le Nhat ThanhNo ratings yet

- ACCOUNTING PRINCIPLES AND PRACTICES in INSURANCE COMPANIESDocument4 pagesACCOUNTING PRINCIPLES AND PRACTICES in INSURANCE COMPANIESSifat TarannumNo ratings yet

- Capital Structure MM ApproachDocument20 pagesCapital Structure MM ApproachHari chandanaNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Caro 2020 VS Caro 2016 PDFDocument5 pagesCaro 2020 VS Caro 2016 PDFViral DoshiNo ratings yet

- BBA 311-Financial Management Set 1Document10 pagesBBA 311-Financial Management Set 1Innocent BwalyaNo ratings yet

- Corporate Governance in State Bank of IndiaDocument8 pagesCorporate Governance in State Bank of Indiarahuln181No ratings yet

- Introduction To Indian Financial System: The Union Budget 2021 Has Announced The Privatisation of Two Public Sector BanksDocument6 pagesIntroduction To Indian Financial System: The Union Budget 2021 Has Announced The Privatisation of Two Public Sector BanksVidushi TandonNo ratings yet

- Middle Market Investment Banking GuideDocument234 pagesMiddle Market Investment Banking GuideAnonymous MZMEHGHB100% (1)

- Profitability Analysis of NMB Bank LimitedDocument9 pagesProfitability Analysis of NMB Bank LimitedRam Adhikary100% (2)

- 2016 Credit Policy Manual III EditedDocument99 pages2016 Credit Policy Manual III EditedBattogtokh AzjargalNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAyush kumarNo ratings yet

- SAP FICO Videos 2 5 GB Material 65 HoursDocument3 pagesSAP FICO Videos 2 5 GB Material 65 HoursBadr-Eddine BEN RAHOUNo ratings yet

- Axis Neft-Rtgs FormDocument3 pagesAxis Neft-Rtgs Formraghavjindal.spenzaNo ratings yet

- Ratio Calculator-1Document11 pagesRatio Calculator-1Gopal AggarwalNo ratings yet

- Mayo Ining Ans Sa PrelimsDocument8 pagesMayo Ining Ans Sa PrelimsMary Rose DacuroNo ratings yet

- Affby Vinod-MergedDocument29 pagesAffby Vinod-MergedAnush BasavarajuNo ratings yet

- LC Application FormDocument2 pagesLC Application FormchamsbritelNo ratings yet

- Power of Attorney & Instructions: BackgroundDocument4 pagesPower of Attorney & Instructions: BackgroundSwapnil MoreNo ratings yet