Professional Documents

Culture Documents

Market Notes May 10 Tuesday

Market Notes May 10 Tuesday

Uploaded by

JC CalaycayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Notes May 10 Tuesday

Market Notes May 10 Tuesday

Uploaded by

JC CalaycayCopyright:

Available Formats

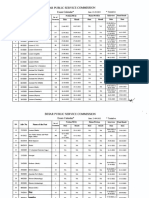

ACCORD CAPITAL EQUITIES CORPORATION

GF EC-058B East Tower, PSE Center, Exchange Road, Ortigas Center, Pasig City, PHILIPPINES 1605 (632)687-5071 (trunk)

MARKET NOTES_Week 19_TD90_May 10, 2011_Tuesday

source: www.pse.com.ph

DISCLOSURES:

ABOITIZ POWER CORPORAITON [pse: AP]

Disc. No. 2011-3497 COMPROMISE AGREEMENT ON BAKUN HYDRO PLANT

AP's wholly-owned subsidiary, Aboitiz Renewables, Inc (ARI) has entered into a Compromise Agreement with Pacific Hydro Bakun, Inc

(PHBI), putting an end to a shareholders' dispute that arose from the pubic bidding of the 70MW Bakun Hydropower Plant IPP

Administration contract, following the satisfaction of certain conditions pursuant to a Memorandum of Agreement entered into by both

parties last March 31, 2011. The MOA gave ARI full ownership over Luzon Hydro Corporation, formerly a joint venture between ARI

and PHBI and which owns and operates the Bakun plant. PHBI is a wholly-owned unit of Pacific Hydro Pty Ltd. of Australia. The

transfer of ownership was valued at approximately USD30 million. ARI thus assumes full ownership of the subject power plant located

in Ilocos Sur.

Lower average selling prices, lower net generation and depressed demand pulled the Company's consolidated net income -34% lower

to php5.1 billion. The main drag was posed by the power generation business whose income contribution dropped to -35% to php4.9

billion. Netting out non-recurring incomes, the number drops

further to php4.4 billion compared to php7.1 billion for the

same period last year. Nevertheless, the power distribution

segment more than doubled its income contribution to php454

million, albeit accounting for only 8.9% of the pie. On the

balance sheet side, the Company remains healthy with assets

expanding 4% from end-2010 levels. It likewise remains very

solvent with current ratio improving to 3.3x from 2.6x and net-

debt-to-equity marginally lightening to 0.7x from 0.8x, both

compared to end-2010 numbers.

AP share price last topped at php31.80 less than a week prior

to the release of its Q1 earnings. It has since dropped to a low

of php29.95, before staging a modicum of a rebound in the two

sessions this week. The recent pick-up in price may have been

induced by technically oversold conditions after STO(14,3,3) fell

to as low as 5.51 on the same session it hit the earlier

mentioned low. Although the accumulation-distribution line has

yet to show a significant reversal signal from its distributive

trend, there are early suggestions from other measures of a

possible sustained push north. STO has crossed over the

trigger line simultaneously emerging from oversold territory.

MACD(12,26,9) spread has leveled off in the two sessions

accompanying the +1.20% price action, indicating, at the very

least, a possible support at the php29.25-mark. Nevertheless,

we do not discount a further fall towards the major support line

represented by the 150pdEMA at php28.1502, thereabouts.

ACCUMULATE [BUY & HOLD: Entry Range @ php28.00-

29.25

PHILIPPINE LONG DISTANCE TELEPHONE CO. [pse: TEL/ nyse: PHI]

Disc. No. 2011-3485 Q1 2011 RESULTS

The Company's consolidated net income slid -6% year-on-year in Q1 2011 to php10.7 billion as service revenues fell -4% to php34.6

billion, -php1.4 billion compared to Q1 2010. The drops however resulted mainly from foreign exchange translations with the local

currency strengthening between 4.0% and 5.0% over the

comparative periods. Had the peso been stable, core net income

would've expanded 3.0%, instead of only 1.0%. Note that 28% of

the company's revenue are dollar-denominated. Furthermore,

the core figures was depressed by the php300 million difference

between Meralco's core and reported net incomes. Revenues

from traditional streams dragged positive contributions from

newer counterparts. Nevertheless, effective cost and expense

controls translated to a two-percentage point widening in

EBITDA margins. This despite a 1.0% narrowing in nominal

EBITDA to php21 billion. Holding promise for the Company's

forward prospects is the continued growth trajectory of its DSL,

Broadband and Internet Service Revenue, which now accounts

for 13% of the total.

At Tuesday's action, TEL shares extended its romp to a second

day, adding 3.1% (php74.00) to Monday's 2.5% (php58.00) rise.

More importantly, the stock has risen above the 10pdEMA,

which in turn has sustained levels above both the 50pdEMA and

150pdEMA (both flat), indicating a possible breach of the

php2,500-2,520 resistance, carried over by positive momentum.

STO(14,3,3) has breached the trigger line upwards, and we can

fairly expect the MACD line to do the same relative to its signal line. MOMENTUM BUY

itsDISCLAIMER: THE MATERIAL CONTAINED IN THIS PUBLICATION IS FOR INFORMATION PURPOSES ONLY. IT IS NOT TO BE REPRODUCED OR COPIED OR MADE

AVAILABLE TO OTHERS. UNDER NO CIRCUMSTANCES IS IT TO BE CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION TO BUY ANY SECURITY. WHILE THE

INFORMATION HEREIN IS FROM SOURCES WE BELIEVE RELIABLE, WE DO NOT REPRESENT THAT IT IS ACCURATE OR CO MPLETE AND IT SHOULD NOT BE RELIED UPON

AS SUCH. IN ADDITION, WE SHALL NOT BE RESPONSIBLE FOR AMENDING, CORRECTING OR UPDATING ANY INFORMATION OR OPINIONS CONTAINED HEREIN. SOME OF

THE VIEWS EXPRESSED IN THIS REPORT ARE NOT NECESSARILY OPINIONS OF ACCORD CAPITAL EQUITIES CORPORATION ON THE CREDIT-WORTHINESS OR

INVESTMENT PROFILE OF THE COMPANY OR THE INDUSTRIES MENTIONED.

DAILY Report Page 1 of 1

You might also like

- Week 46 - Disclosures Update - November 17, 2010Document2 pagesWeek 46 - Disclosures Update - November 17, 2010JC CalaycayNo ratings yet

- Market Notes May 3 TuesdayDocument2 pagesMarket Notes May 3 TuesdayJC CalaycayNo ratings yet

- DISCLOSURES February 7 MondayDocument2 pagesDISCLOSURES February 7 MondayJC CalaycayNo ratings yet

- Disclosures Summary March 14 MondayDocument3 pagesDisclosures Summary March 14 MondayJC CalaycayNo ratings yet

- February 17-18, 2011 - UpdateDocument3 pagesFebruary 17-18, 2011 - UpdateJC CalaycayNo ratings yet

- DAILY - June 14-15, 2011Document2 pagesDAILY - June 14-15, 2011JC CalaycayNo ratings yet

- WEEK 42 Additional Notes To DAILY For October 20, 2010Document1 pageWEEK 42 Additional Notes To DAILY For October 20, 2010JC CalaycayNo ratings yet

- Disclosures REVIEW For Period December 2 and 3, 2010Document2 pagesDisclosures REVIEW For Period December 2 and 3, 2010JC CalaycayNo ratings yet

- Market Notes June 22 WednesdayDocument2 pagesMarket Notes June 22 WednesdayJC CalaycayNo ratings yet

- Market Notes April 12 TuesdayDocument1 pageMarket Notes April 12 TuesdayJC CalaycayNo ratings yet

- Market Notes May 16 MondayDocument1 pageMarket Notes May 16 MondayJC CalaycayNo ratings yet

- Market Notes Mining atDocument2 pagesMarket Notes Mining atJC CalaycayNo ratings yet

- Market Monitor Week Ending July 15 2011Document5 pagesMarket Monitor Week Ending July 15 2011Empire OneoneNo ratings yet

- Market Notes July 22 FridayDocument1 pageMarket Notes July 22 FridayJC CalaycayNo ratings yet

- DISCLOSURES January 3, 2011 - MondayDocument2 pagesDISCLOSURES January 3, 2011 - MondayJC CalaycayNo ratings yet

- Week 41 - Daily For Friday - October 15, 2010 - UpdatesDocument2 pagesWeek 41 - Daily For Friday - October 15, 2010 - UpdatesJC CalaycayNo ratings yet

- SELECTED DISCLOSURES From December 1, 2010 - WednesdayDocument2 pagesSELECTED DISCLOSURES From December 1, 2010 - WednesdayJC CalaycayNo ratings yet

- Accord Capital Equities Corporation: DISCLOSURES UPDATE November 19, 2010 - FridayDocument4 pagesAccord Capital Equities Corporation: DISCLOSURES UPDATE November 19, 2010 - FridayJC CalaycayNo ratings yet

- Market Notes April 28 ThursdayDocument3 pagesMarket Notes April 28 ThursdayJC CalaycayNo ratings yet

- Market Notes April 15 FridayDocument1 pageMarket Notes April 15 FridayJC CalaycayNo ratings yet

- Market Notes April 20 WednesdayDocument3 pagesMarket Notes April 20 WednesdayJC CalaycayNo ratings yet

- Weekly Xxviii - July 11 To 15, 2011Document2 pagesWeekly Xxviii - July 11 To 15, 2011JC CalaycayNo ratings yet

- Market Notes - Food SroDocument2 pagesMarket Notes - Food SroJC CalaycayNo ratings yet

- Officium Special Situations Fund: FundsDocument1 pageOfficium Special Situations Fund: Fundsqweasd222No ratings yet

- WEEK 38 - Daily For September 21, 2010Document1 pageWEEK 38 - Daily For September 21, 2010JC CalaycayNo ratings yet

- Market Notes April 26 TuesdayDocument1 pageMarket Notes April 26 TuesdayJC CalaycayNo ratings yet

- Week 45 - Corporate Developments - Novmeber 11, 2010Document2 pagesWeek 45 - Corporate Developments - Novmeber 11, 2010JC CalaycayNo ratings yet

- Market Notes April 19 TuesdayDocument1 pageMarket Notes April 19 TuesdayJC CalaycayNo ratings yet

- November 12 Friday - Corporate UpdatesDocument3 pagesNovember 12 Friday - Corporate UpdatesJC CalaycayNo ratings yet

- Week 41 - Daily For Tuesday - October 12, 2010Document2 pagesWeek 41 - Daily For Tuesday - October 12, 2010JC CalaycayNo ratings yet

- Ing Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)Document1 pageIng Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)sunjun79No ratings yet

- Disclosures November 9, 2010Document2 pagesDisclosures November 9, 2010JC CalaycayNo ratings yet

- Disclosures Review For December 28, 2010 - TuesdayDocument2 pagesDisclosures Review For December 28, 2010 - TuesdayJC CalaycayNo ratings yet

- Market Balance - Daily For August 11, 2011Document3 pagesMarket Balance - Daily For August 11, 2011JC CalaycayNo ratings yet

- Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118Document2 pagesAccord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118JC CalaycayNo ratings yet

- Accord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122Document3 pagesAccord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122JC CalaycayNo ratings yet

- WEEK 39 - September 27 To October 1, 2010Document2 pagesWEEK 39 - September 27 To October 1, 2010JC CalaycayNo ratings yet

- MARKET OUTLOOK WEEK 36 Sept 6 To 9, 2010Document3 pagesMARKET OUTLOOK WEEK 36 Sept 6 To 9, 2010JC CalaycayNo ratings yet

- Annual Report: March 31, 2011Document23 pagesAnnual Report: March 31, 2011VALUEWALK LLCNo ratings yet

- Disclosures Review For December 14, 2010 - TuesdayDocument2 pagesDisclosures Review For December 14, 2010 - TuesdayJC CalaycayNo ratings yet

- December 9, 2010 - Thursday - Disclosures SummaryDocument1 pageDecember 9, 2010 - Thursday - Disclosures SummaryJC CalaycayNo ratings yet

- Market Analysis August 2021Document19 pagesMarket Analysis August 2021Thanh Trịnh BáNo ratings yet

- DISCLOSURES REVIEW For December 17, 2010 - FridayDocument2 pagesDISCLOSURES REVIEW For December 17, 2010 - FridayJC CalaycayNo ratings yet

- Cash Flow News ArticlesDocument17 pagesCash Flow News ArticlesHari PrasadNo ratings yet

- Alert: First Gen Corporation: FGEN Post US$29.4Mil Net Loss in 2Q11 On EDC's Northern Negros Plant ImpairmentDocument2 pagesAlert: First Gen Corporation: FGEN Post US$29.4Mil Net Loss in 2Q11 On EDC's Northern Negros Plant ImpairmentMater DeiNo ratings yet

- TELUS Corporation: Dividend Policy: Canadian Telecommunication IndustryDocument7 pagesTELUS Corporation: Dividend Policy: Canadian Telecommunication Industrymalaika12No ratings yet

- Financial Analysis of PTCLDocument30 pagesFinancial Analysis of PTCLmeherNo ratings yet

- Market Notes April 25 MondayDocument1 pageMarket Notes April 25 MondayJC CalaycayNo ratings yet

- Market Notes MwideDocument2 pagesMarket Notes MwideJC CalaycayNo ratings yet

- Weekly Xxvix - July 18 To 22, 2011Document2 pagesWeekly Xxvix - July 18 To 22, 2011JC CalaycayNo ratings yet

- LPZ 17A Jun2013Document199 pagesLPZ 17A Jun2013Ryan Samuel C. CervasNo ratings yet

- Stock Market Daily For August 17, 2010Document1 pageStock Market Daily For August 17, 2010JC CalaycayNo ratings yet

- Tamim Australianallcap April 2019Document5 pagesTamim Australianallcap April 2019dkatzNo ratings yet

- 18 Share Tips - 12 April 2021Document13 pages18 Share Tips - 12 April 2021FrankNo ratings yet

- Brenner West - 2010 Fourth Quarter LetterDocument4 pagesBrenner West - 2010 Fourth Quarter LettergatzbpNo ratings yet

- Finance EeeeeDocument11 pagesFinance EeeeeJendeukkieNo ratings yet

- Corsair Capital Q3 2010Document5 pagesCorsair Capital Q3 2010tigerjcNo ratings yet

- WEEK 39 - Daily For September 28, 2010 - TuesdayDocument2 pagesWEEK 39 - Daily For September 28, 2010 - TuesdayJC CalaycayNo ratings yet

- Weekly Xxxi - August 1 To 5, 2011Document2 pagesWeekly Xxxi - August 1 To 5, 2011JC CalaycayNo ratings yet

- Market Balance - Daily For August 11, 2011Document3 pagesMarket Balance - Daily For August 11, 2011JC CalaycayNo ratings yet

- Market Balance - Daily For August 10, 2011Document2 pagesMarket Balance - Daily For August 10, 2011JC CalaycayNo ratings yet

- DAILY - July 22-25, 2011Document1 pageDAILY - July 22-25, 2011JC CalaycayNo ratings yet

- Market Notes Mining atDocument2 pagesMarket Notes Mining atJC CalaycayNo ratings yet

- Weekly Xxvix - July 18 To 22, 2011Document2 pagesWeekly Xxvix - July 18 To 22, 2011JC CalaycayNo ratings yet

- Weekly Xxviii - July 11 To 15, 2011Document2 pagesWeekly Xxviii - July 11 To 15, 2011JC CalaycayNo ratings yet

- Market Notes July 22 FridayDocument1 pageMarket Notes July 22 FridayJC CalaycayNo ratings yet

- DAILY - June 22-23, 2011Document1 pageDAILY - June 22-23, 2011JC CalaycayNo ratings yet

- Market Notes MwideDocument2 pagesMarket Notes MwideJC CalaycayNo ratings yet

- Accord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122Document3 pagesAccord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122JC CalaycayNo ratings yet

- DAILY - June 21-22, 2011Document1 pageDAILY - June 21-22, 2011JC CalaycayNo ratings yet

- Market Notes June 22 WednesdayDocument2 pagesMarket Notes June 22 WednesdayJC CalaycayNo ratings yet

- DAILY - May 16-17, 2011Document1 pageDAILY - May 16-17, 2011JC CalaycayNo ratings yet

- DAILY - June 16-17, 2011Document1 pageDAILY - June 16-17, 2011JC CalaycayNo ratings yet

- Market Notes - Food SroDocument2 pagesMarket Notes - Food SroJC CalaycayNo ratings yet

- DAILY - June 14-15, 2011Document2 pagesDAILY - June 14-15, 2011JC CalaycayNo ratings yet

- Weekly Report - June 6-10, 2011Document2 pagesWeekly Report - June 6-10, 2011JC CalaycayNo ratings yet

- Market Notes June 17 FridayDocument1 pageMarket Notes June 17 FridayJC CalaycayNo ratings yet

- Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118Document2 pagesAccord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118JC CalaycayNo ratings yet

- Market Notes May 17 TuesdayDocument2 pagesMarket Notes May 17 TuesdayJC CalaycayNo ratings yet

- DAILY - May 17-18, 2011Document2 pagesDAILY - May 17-18, 2011JC CalaycayNo ratings yet

- Weekly Report - Xxi - May 23 To 27, 2011Document3 pagesWeekly Report - Xxi - May 23 To 27, 2011JC CalaycayNo ratings yet

- Daily - June 7-8, 2011Document3 pagesDaily - June 7-8, 2011JC CalaycayNo ratings yet

- Market Notes - June 6, 2011 - MondayDocument2 pagesMarket Notes - June 6, 2011 - MondayJC CalaycayNo ratings yet

- Daily - May 13, 2011 - End of WeekDocument2 pagesDaily - May 13, 2011 - End of WeekJC CalaycayNo ratings yet

- Market Notes May 16 MondayDocument1 pageMarket Notes May 16 MondayJC CalaycayNo ratings yet

- Market Notes May 13 FridayDocument3 pagesMarket Notes May 13 FridayJC CalaycayNo ratings yet

- DAILY - May 12-13, 2011Document2 pagesDAILY - May 12-13, 2011JC CalaycayNo ratings yet

- DAILY - May 11-12, 2011Document1 pageDAILY - May 11-12, 2011JC CalaycayNo ratings yet

- Bus 201Document28 pagesBus 201offjaNo ratings yet

- Bussey y Bandura (1992)Document16 pagesBussey y Bandura (1992)Lorena AyusoNo ratings yet

- ProphetessDocument134 pagesProphetessMarvin Naeto CMNo ratings yet

- Risk For Fluid VolumeDocument1 pageRisk For Fluid VolumeMariella BadongenNo ratings yet

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Chapter-2: Basic LawsDocument58 pagesChapter-2: Basic Lawsbashirahmed bashirahmedNo ratings yet

- Chem Mock Test IG A Paper I (2023)Document18 pagesChem Mock Test IG A Paper I (2023)pyae157163No ratings yet

- Arko Jyoti Mitra - Service Learning AssignmentDocument56 pagesArko Jyoti Mitra - Service Learning Assignmentjyotiarko1122No ratings yet

- Literature Review Checklist PDFDocument6 pagesLiterature Review Checklist PDFaflswnfej100% (1)

- UNITAS 91 1 Bayani Santos Translating Banaag at Sikat PDFDocument24 pagesUNITAS 91 1 Bayani Santos Translating Banaag at Sikat PDFCharles DoradoNo ratings yet

- Designer Profile For Jonathan IveDocument6 pagesDesigner Profile For Jonathan IveJaneNo ratings yet

- DEVELOPMENT BANK OF RIZAL vs. SIMA WEIDocument2 pagesDEVELOPMENT BANK OF RIZAL vs. SIMA WEIelaine bercenioNo ratings yet

- File Test 9Document7 pagesFile Test 9fortiz241079No ratings yet

- (Blackwell Handbooks in Linguistics) Melissa A. Redford - The Handbook of Speech Production (2015, Wiley-Blackwell)Document6 pages(Blackwell Handbooks in Linguistics) Melissa A. Redford - The Handbook of Speech Production (2015, Wiley-Blackwell)Akbar Pandu SetiawanNo ratings yet

- 2nd Person StoryDocument1 page2nd Person Storynya.cooktillettNo ratings yet

- Natural Products Chemistry. The Isolation of Trimyristin From NutmegDocument8 pagesNatural Products Chemistry. The Isolation of Trimyristin From NutmegIván CruzNo ratings yet

- Examination Calendar 2022 23Document4 pagesExamination Calendar 2022 23shital yadavNo ratings yet

- Orion Vs KaflamDocument4 pagesOrion Vs KaflamAdrian HilarioNo ratings yet

- Section Viii Div 1 Div 2 Div ComparisonDocument2 pagesSection Viii Div 1 Div 2 Div Comparisonapparaokr100% (5)

- UG First Year SyllabusDocument264 pagesUG First Year SyllabusAnwesh ShettyNo ratings yet

- Afante Louie Anne E. Budgeting ProblemsDocument4 pagesAfante Louie Anne E. Budgeting ProblemsKyla Kim AriasNo ratings yet

- Travel in MichiganDocument3 pagesTravel in Michiganricetech100% (4)

- English To Telugu Vegetables NamesDocument6 pagesEnglish To Telugu Vegetables NamesUbed Ahmed73% (15)

- Prospectus 375 Park AvenueDocument321 pagesProspectus 375 Park AvenueJagadeesh YathirajulaNo ratings yet

- 중3 동아 윤정미 7과Document97 pages중3 동아 윤정미 7과Ито ХиробумиNo ratings yet

- FPEMDocument5 pagesFPEMJaya Chandra ReddyNo ratings yet

- Stryker L9000 LED Light Source User Manual PDFDocument34 pagesStryker L9000 LED Light Source User Manual PDFGonzalo MoncadaNo ratings yet

- Davis HabitabilidadDocument62 pagesDavis HabitabilidadchiodesantiagoNo ratings yet

- The Development of The Horror Genre FinalDocument6 pagesThe Development of The Horror Genre Finalapi-289624692No ratings yet

- Ketlie Augustin, A097 199 166 (BIA March 17, 2017)Document2 pagesKetlie Augustin, A097 199 166 (BIA March 17, 2017)Immigrant & Refugee Appellate Center, LLC0% (1)