Professional Documents

Culture Documents

Profile

Profile

Uploaded by

Jagmeet BadeshaCopyright:

Available Formats

You might also like

- BSBOPS503 Student Project Portfolio-3Document14 pagesBSBOPS503 Student Project Portfolio-3Bui AnNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- New QuoteDocument13 pagesNew QuoteAnkita ReddyNo ratings yet

- Strategic Management Report On Bank of Punjab LTDDocument17 pagesStrategic Management Report On Bank of Punjab LTDimranrajput100% (2)

- Oracle Project AccountingDocument13 pagesOracle Project Accountingmohanivar77100% (2)

- Marketing Strategic Plan: Teacher Jose Eduardo Lievano CastiblancoDocument29 pagesMarketing Strategic Plan: Teacher Jose Eduardo Lievano Castiblancoborrasnicolas100% (1)

- BPR - PNBDocument12 pagesBPR - PNBPravah ShuklaNo ratings yet

- About PNB VisionDocument4 pagesAbout PNB Visionsrfriend_1234No ratings yet

- SagarPadaki MMS CompanyAnanlysisDocument12 pagesSagarPadaki MMS CompanyAnanlysisPrasad PatilNo ratings yet

- Company Profile BoiDocument29 pagesCompany Profile BoiPrince Satish ReddyNo ratings yet

- Yes BankDocument30 pagesYes BankVivek PrakashNo ratings yet

- Absenteeism ProjectDocument82 pagesAbsenteeism ProjectNisha SharmaNo ratings yet

- Int RepDocument13 pagesInt RepUman MushtaqNo ratings yet

- Final Internship Report On Bop New 2003Document65 pagesFinal Internship Report On Bop New 2003Saba RiazNo ratings yet

- Employee Job Satisfaction OF THE City Bank LimitedDocument35 pagesEmployee Job Satisfaction OF THE City Bank LimitedRidwan Ferdous100% (1)

- Business OperationsDocument27 pagesBusiness Operationsluckyhappy786No ratings yet

- Internship ReportDocument17 pagesInternship ReportAsad AliNo ratings yet

- Xecutive SummaryDocument21 pagesXecutive SummaryAli ImranNo ratings yet

- Global Ime Bank 2013Document34 pagesGlobal Ime Bank 2013Keshab PandeyNo ratings yet

- Banking and Insurance Project Topic-Comparision Between P.N.B and Axis BankDocument21 pagesBanking and Insurance Project Topic-Comparision Between P.N.B and Axis Bankhatimezzy523492No ratings yet

- Allied Bank LimitedDocument6 pagesAllied Bank LimitedWafa AliNo ratings yet

- SIP ProjectDocument84 pagesSIP Projectraviims87No ratings yet

- Term End Project: G Siva Prasad 10MBA0105Document10 pagesTerm End Project: G Siva Prasad 10MBA0105Johnson YathamNo ratings yet

- Objective of The StudyDocument25 pagesObjective of The StudyNizam JewelNo ratings yet

- ICICI-Bank Strategic ImplementationDocument52 pagesICICI-Bank Strategic ImplementationJazz KhannaNo ratings yet

- CC CC: CC C C CC C CC !C!C!Document30 pagesCC CC: CC C C CC C CC !C!C!usmanmasoodkhanNo ratings yet

- MCBDocument31 pagesMCBkinza buttNo ratings yet

- Service Quality Gap Analysis in State Bank of IndiaDocument26 pagesService Quality Gap Analysis in State Bank of IndiaArun Koshy Thomas100% (22)

- Prime BankDocument24 pagesPrime BankNazmulHasanNo ratings yet

- Himalayan Bank LimitedDocument3 pagesHimalayan Bank LimitedBishal BagaleNo ratings yet

- Punjab National Bank 1-Amit Kumar SrivastavaDocument66 pagesPunjab National Bank 1-Amit Kumar SrivastavaAwanish Kumar MauryaNo ratings yet

- CRM in PNBDocument7 pagesCRM in PNBastha_c0% (1)

- Bank of Maharashtra PDFDocument76 pagesBank of Maharashtra PDFPRATIK BhosaleNo ratings yet

- Banking Industry OverviewDocument59 pagesBanking Industry OverviewNiyas NeoNo ratings yet

- Initiating Coverage On UBI LTDDocument16 pagesInitiating Coverage On UBI LTDpriyankachibchibNo ratings yet

- Internship ReportDocument159 pagesInternship ReportSufi ShahNo ratings yet

- UBI Summer RepotDocument58 pagesUBI Summer RepotAkanksha Pamnani100% (1)

- FS Complete 31 12 2007Document160 pagesFS Complete 31 12 2007ishfaq_tasleemNo ratings yet

- Dena BankDocument25 pagesDena BankJaved ShaikhNo ratings yet

- Swot AnalysisDocument6 pagesSwot Analysisbegaduhmetal100% (2)

- Introduction To Banking SectorDocument6 pagesIntroduction To Banking Sectorshweta khamarNo ratings yet

- The Bank of Punjab Latest Internship Report With Three Years Financial DataDocument23 pagesThe Bank of Punjab Latest Internship Report With Three Years Financial DataMuhammad Taif KhanNo ratings yet

- Mini Project SM B35Document18 pagesMini Project SM B35yash bajajNo ratings yet

- Can Press Release Mar 08Document8 pagesCan Press Release Mar 08Priyatharsini NaiduNo ratings yet

- Promotion March2016 Final Updated Upto 24-02-2016Document147 pagesPromotion March2016 Final Updated Upto 24-02-2016pankaj gargNo ratings yet

- Internship Report On Prime Bank LTD BDDocument87 pagesInternship Report On Prime Bank LTD BDthreeinvestigators0% (2)

- Financial Statement Analysis Internship Report Format Sample PDF FilesDocument4 pagesFinancial Statement Analysis Internship Report Format Sample PDF FilesPik PokNo ratings yet

- Role of Banking Sector in Secondary MarketDocument82 pagesRole of Banking Sector in Secondary MarketvishritiNo ratings yet

- HRM370-CASE 1-NCC BankDocument16 pagesHRM370-CASE 1-NCC BankOishee AhmedNo ratings yet

- Ratio Analysis of The Annual Report On Standard BankDocument15 pagesRatio Analysis of The Annual Report On Standard BankShopno Konna Sarah80% (5)

- Summer Internship Report On DIGITAL BANKING - HDFC Bank Ltd.Document24 pagesSummer Internship Report On DIGITAL BANKING - HDFC Bank Ltd.Nayana ChuriwalaNo ratings yet

- Investment EXIM RZVDocument70 pagesInvestment EXIM RZVZahid RizvyNo ratings yet

- Report Submission Finance (Noboni)Document20 pagesReport Submission Finance (Noboni)Afrid KhanNo ratings yet

- Can Press Release Mar 08Document7 pagesCan Press Release Mar 08Divya GanesanNo ratings yet

- Project On Summit BankDocument17 pagesProject On Summit BankTakhleeq AkhterNo ratings yet

- AU SMALL FINANCE Bank LTD PDFDocument7 pagesAU SMALL FINANCE Bank LTD PDFqvdghqhjbdcNo ratings yet

- Bank AsiaDocument17 pagesBank AsiaShahriar KabirNo ratings yet

- CRDB Bank PLC - Press Release 2Document5 pagesCRDB Bank PLC - Press Release 2Anonymous FnM14a0No ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisNo ratings yet

- Public Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectiveNo ratings yet

- Longriver - Quarterly Letter - 24 Q1Document6 pagesLongriver - Quarterly Letter - 24 Q1MadaNo ratings yet

- TDS UK Spenax Rings and Fasteners Jun13Document1 pageTDS UK Spenax Rings and Fasteners Jun13Peter TNo ratings yet

- Letter of Indeminity Kadir Yusuf SayedDocument2 pagesLetter of Indeminity Kadir Yusuf SayedDayashankar TiwariNo ratings yet

- Existing Relays and Spare Relays RequiredDocument4 pagesExisting Relays and Spare Relays RequiredADE MRTNo ratings yet

- CRM Metrics:: Customer RelationshipDocument3 pagesCRM Metrics:: Customer RelationshipmamallandNo ratings yet

- Test Far570 Feb2021 - SsDocument4 pagesTest Far570 Feb2021 - SsPutri Naajihah 4GNo ratings yet

- IWMP IDC - Inception Report - ENG - Clean - V4 - FINAL - 20230630 EbDocument71 pagesIWMP IDC - Inception Report - ENG - Clean - V4 - FINAL - 20230630 EbCastleKGNo ratings yet

- Ax2012 Enus Fa 04Document60 pagesAx2012 Enus Fa 04asifNo ratings yet

- Esb 003Document142 pagesEsb 003JunnoKaiserNo ratings yet

- History of Pharmaceutical Development in Nepal: Review ArticleDocument8 pagesHistory of Pharmaceutical Development in Nepal: Review ArticleDinesh Kumar YadavNo ratings yet

- Hrma 30013 Administrative Office Management Prof Ma. Joecelyn GuevarraDocument109 pagesHrma 30013 Administrative Office Management Prof Ma. Joecelyn GuevarraSkyler FaithNo ratings yet

- AFA Animal Production 9 Quarter 4 Module 7Document16 pagesAFA Animal Production 9 Quarter 4 Module 7Claes TrinioNo ratings yet

- MKT 202 Mid Group Assignment Spring 2021Document4 pagesMKT 202 Mid Group Assignment Spring 2021Tanvir Hasan KhanNo ratings yet

- WB Tenancy Act 1997Document29 pagesWB Tenancy Act 1997Shankha Shubhra ChakrabartyNo ratings yet

- Btec Unit 2 Task 1 Assignment Bu Jude 10-ADocument97 pagesBtec Unit 2 Task 1 Assignment Bu Jude 10-AJudes EditsNo ratings yet

- Analysis On The E-Commerce Situation in The Republic of MacedoniaDocument34 pagesAnalysis On The E-Commerce Situation in The Republic of MacedoniaRohan GuptaNo ratings yet

- Infographic Globalization in The Contemporary World PDFDocument1 pageInfographic Globalization in The Contemporary World PDFGelo MoloNo ratings yet

- Let' S WeldDocument52 pagesLet' S Welddavid vieyraNo ratings yet

- HR Building My Personal BrandDocument17 pagesHR Building My Personal BrandDAMNTHEMANNo ratings yet

- Macn+r000130746 - Affidavit of Universal Commerical Code 1 Financing Statement (USDA)Document7 pagesMacn+r000130746 - Affidavit of Universal Commerical Code 1 Financing Statement (USDA)theodore moses antoine beyNo ratings yet

- NCCB Securities and Financial Services LTD.: Portfolio StatementDocument1 pageNCCB Securities and Financial Services LTD.: Portfolio StatementAfsana TasnimNo ratings yet

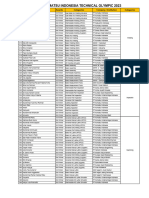

- 12th All Komatsu Indonesia Technical Olympic 2022 Official ResultDocument2 pages12th All Komatsu Indonesia Technical Olympic 2022 Official ResultMarchal KawengianNo ratings yet

- Does Gender Diversity Influence Business E An Analysis From The Social Perspective of CSRDocument18 pagesDoes Gender Diversity Influence Business E An Analysis From The Social Perspective of CSRsita deliyana FirmialyNo ratings yet

- Synopsis of Hospital Management SystemDocument17 pagesSynopsis of Hospital Management SystemShivraj Cyber100% (1)

- CivPro Atty. Custodio Case DigestsDocument12 pagesCivPro Atty. Custodio Case DigestsRachel CayangaoNo ratings yet

- Storage For Z L1 Seller PresentationDocument69 pagesStorage For Z L1 Seller PresentationElisa GarciaRNo ratings yet

Profile

Profile

Uploaded by

Jagmeet BadeshaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profile

Profile

Uploaded by

Jagmeet BadeshaCopyright:

Available Formats

Profile:

With over 56 million satisfied customers and 5002 offices including 5 overseas

branches, PNB has continued to retain its leadership position amongst the

nationalized banks. The bank enjoys strong fundamentals, large franchise value

and good brand image. Besides being ranked as one of India's top service

brands, PNB has remained fully committed to its guiding principles of sound

and prudent banking. Apart from offering banking products, the bank has also

entered the credit card, debit card; bullion business; life and non-life insurance;

Gold coins & asset management business, etc.

Since its humble beginning in 1895 with the distinction of being the first

Swadeshi Bank to have been started with Indian capital, PNB has achieved

significant growth in business which at the end of March 2010 amounted to Rs

435931 crore. PNB is ranked as the 2nd largest bank in the country after SBI in

terms of branch network, business and many other parameters. During the FY

2009-10, with 40.85% share of CASA deposits, the Bank achieved a net profit

of Rs 3905 crore. Bank has a strong capital base with capital adequacy ratio of

14.16% as on Mar’10 as per Basel II with Tier I and Tier II capital ratio at

9.15% and 5.01% respectively. As on March’10, the Bank has the Gross and

Net NPA ratio of 1.71% and 0.53% respectively. During the FY 2009-10, its

ratio of Priority Sector Credit to Adjusted Net Bank Credit at 40.5% &

Agriculture Credit to Adjusted Net Bank Credit at 19.7% was also higher than

the stipulated requirement of 40% & 18% respectively.

The Bank has been able to maintain its stakeholders’ interest by posting an

improved NIM of 3.57% in Mar’10 (3.52% Mar’09) and a Return on Assets of

1.44% (1.39% Mar’09). The Earning per Share improved to Rs 123.98 (Rs

98.03 Mar’09) while the Book value per share improved to Rs 514.77 (Rs

416.74 Mar’09). Punjab National Bank continues to maintain its frontline

position in the Indian banking industry. In particular, the bank has retained its

NUMBER ONE position among the nationalized banks in terms of number of

branches, Deposit, Advances, total Business, Assets, Operating and Net profit

in the year 2009-10. The impressive operational and financial performance has

been brought about by Bank’s focus on customer based business with thrust on

CASA deposits, Retail, SME & Agri Advances and with more inclusive

approach to banking; better asset liability management; improved margin

management, thrust on recovery and increased efficiency in core operations of

the Bank. The performance highlights of the bank in terms of business and

profit are shown below:

Rs in Crore

Parameters Mar'08 Mar'09 Mar'10 CAGR (%)

Operating Profit 4006 5690 7326 22.29

Net Profit 2049 3091 3905 23.98

Deposit 166457 209760 249330 14.42

Advance 119502 154703 186601 16.01

Total Business 285959 364463 435931 15.09

PNB has always looked at technology as a key facilitator to provide better

customer service and ensured that its ‘IT strategy’ follows the ‘Business

strategy’ so as to arrive at “Best Fit”. The Bank has made rapid strides in this

direction. All branches of the Bank are under Core Banking Solution (CBS)

since Dec’08, thus covering 100% of its business and providing ‘Anytime

Anywhere’ banking facility to all customers including customers of more than

3000 rural & semi urban branches. The Bank has also been offering Internet

banking services to its customers which also enables on line booking of rail

tickets, payment of utilities bills, purchase of airline tickets, etc. Towards

developing a cost effective alternative channels of delivery, the Bank with

more than 3700 ATMs has the largest ATM network amongst Nationalized

Banks.

With the help of advanced technology, the Bank has been a frontrunner in the

industry so far as the initiatives for Financial Inclusion is concerned. With its

policy of inclusive growth, the Bank’s mission is “Banking for Unbanked”. The

Bank has launched a drive for biometric smart card based technology enabled

Financial Inclusion with the help of Business Correspondents/Business

Facilitators (BC/BF) so as to reach out to the last mile customer. The Bank has

started several innovative initiatives for marginal groups like rickshaw pullers,

vegetable vendors, dairy farmers, construction workers, etc. Under Branchless

Banking model, the Bank is implementing 40 projects in 16 States.

Backed by strong domestic performance, the Bank is planning to realize its

global aspirations. Bank continues its selective foray in international markets

with presence in 9 countries, with 2 branches at Hongkong, 1 each at Kabul and

Dubai; representative offices at Almaty, Dubai, Shanghai and Oslo; a wholly

owned subsidiary in UK; a joint venture with Everest Bank Ltd. Nepal and a JV

banking subsidiary “DRUK PNB Bank Ltd.” in Bhutan. Bank is pursuing

upgradation of its representative offices in China & Norway and is in the

process of setting up a representative office in Sydney, Australia and taking

controlling stake in JSC Dana Bank in Kazakhastan.

You might also like

- BSBOPS503 Student Project Portfolio-3Document14 pagesBSBOPS503 Student Project Portfolio-3Bui AnNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- New QuoteDocument13 pagesNew QuoteAnkita ReddyNo ratings yet

- Strategic Management Report On Bank of Punjab LTDDocument17 pagesStrategic Management Report On Bank of Punjab LTDimranrajput100% (2)

- Oracle Project AccountingDocument13 pagesOracle Project Accountingmohanivar77100% (2)

- Marketing Strategic Plan: Teacher Jose Eduardo Lievano CastiblancoDocument29 pagesMarketing Strategic Plan: Teacher Jose Eduardo Lievano Castiblancoborrasnicolas100% (1)

- BPR - PNBDocument12 pagesBPR - PNBPravah ShuklaNo ratings yet

- About PNB VisionDocument4 pagesAbout PNB Visionsrfriend_1234No ratings yet

- SagarPadaki MMS CompanyAnanlysisDocument12 pagesSagarPadaki MMS CompanyAnanlysisPrasad PatilNo ratings yet

- Company Profile BoiDocument29 pagesCompany Profile BoiPrince Satish ReddyNo ratings yet

- Yes BankDocument30 pagesYes BankVivek PrakashNo ratings yet

- Absenteeism ProjectDocument82 pagesAbsenteeism ProjectNisha SharmaNo ratings yet

- Int RepDocument13 pagesInt RepUman MushtaqNo ratings yet

- Final Internship Report On Bop New 2003Document65 pagesFinal Internship Report On Bop New 2003Saba RiazNo ratings yet

- Employee Job Satisfaction OF THE City Bank LimitedDocument35 pagesEmployee Job Satisfaction OF THE City Bank LimitedRidwan Ferdous100% (1)

- Business OperationsDocument27 pagesBusiness Operationsluckyhappy786No ratings yet

- Internship ReportDocument17 pagesInternship ReportAsad AliNo ratings yet

- Xecutive SummaryDocument21 pagesXecutive SummaryAli ImranNo ratings yet

- Global Ime Bank 2013Document34 pagesGlobal Ime Bank 2013Keshab PandeyNo ratings yet

- Banking and Insurance Project Topic-Comparision Between P.N.B and Axis BankDocument21 pagesBanking and Insurance Project Topic-Comparision Between P.N.B and Axis Bankhatimezzy523492No ratings yet

- Allied Bank LimitedDocument6 pagesAllied Bank LimitedWafa AliNo ratings yet

- SIP ProjectDocument84 pagesSIP Projectraviims87No ratings yet

- Term End Project: G Siva Prasad 10MBA0105Document10 pagesTerm End Project: G Siva Prasad 10MBA0105Johnson YathamNo ratings yet

- Objective of The StudyDocument25 pagesObjective of The StudyNizam JewelNo ratings yet

- ICICI-Bank Strategic ImplementationDocument52 pagesICICI-Bank Strategic ImplementationJazz KhannaNo ratings yet

- CC CC: CC C C CC C CC !C!C!Document30 pagesCC CC: CC C C CC C CC !C!C!usmanmasoodkhanNo ratings yet

- MCBDocument31 pagesMCBkinza buttNo ratings yet

- Service Quality Gap Analysis in State Bank of IndiaDocument26 pagesService Quality Gap Analysis in State Bank of IndiaArun Koshy Thomas100% (22)

- Prime BankDocument24 pagesPrime BankNazmulHasanNo ratings yet

- Himalayan Bank LimitedDocument3 pagesHimalayan Bank LimitedBishal BagaleNo ratings yet

- Punjab National Bank 1-Amit Kumar SrivastavaDocument66 pagesPunjab National Bank 1-Amit Kumar SrivastavaAwanish Kumar MauryaNo ratings yet

- CRM in PNBDocument7 pagesCRM in PNBastha_c0% (1)

- Bank of Maharashtra PDFDocument76 pagesBank of Maharashtra PDFPRATIK BhosaleNo ratings yet

- Banking Industry OverviewDocument59 pagesBanking Industry OverviewNiyas NeoNo ratings yet

- Initiating Coverage On UBI LTDDocument16 pagesInitiating Coverage On UBI LTDpriyankachibchibNo ratings yet

- Internship ReportDocument159 pagesInternship ReportSufi ShahNo ratings yet

- UBI Summer RepotDocument58 pagesUBI Summer RepotAkanksha Pamnani100% (1)

- FS Complete 31 12 2007Document160 pagesFS Complete 31 12 2007ishfaq_tasleemNo ratings yet

- Dena BankDocument25 pagesDena BankJaved ShaikhNo ratings yet

- Swot AnalysisDocument6 pagesSwot Analysisbegaduhmetal100% (2)

- Introduction To Banking SectorDocument6 pagesIntroduction To Banking Sectorshweta khamarNo ratings yet

- The Bank of Punjab Latest Internship Report With Three Years Financial DataDocument23 pagesThe Bank of Punjab Latest Internship Report With Three Years Financial DataMuhammad Taif KhanNo ratings yet

- Mini Project SM B35Document18 pagesMini Project SM B35yash bajajNo ratings yet

- Can Press Release Mar 08Document8 pagesCan Press Release Mar 08Priyatharsini NaiduNo ratings yet

- Promotion March2016 Final Updated Upto 24-02-2016Document147 pagesPromotion March2016 Final Updated Upto 24-02-2016pankaj gargNo ratings yet

- Internship Report On Prime Bank LTD BDDocument87 pagesInternship Report On Prime Bank LTD BDthreeinvestigators0% (2)

- Financial Statement Analysis Internship Report Format Sample PDF FilesDocument4 pagesFinancial Statement Analysis Internship Report Format Sample PDF FilesPik PokNo ratings yet

- Role of Banking Sector in Secondary MarketDocument82 pagesRole of Banking Sector in Secondary MarketvishritiNo ratings yet

- HRM370-CASE 1-NCC BankDocument16 pagesHRM370-CASE 1-NCC BankOishee AhmedNo ratings yet

- Ratio Analysis of The Annual Report On Standard BankDocument15 pagesRatio Analysis of The Annual Report On Standard BankShopno Konna Sarah80% (5)

- Summer Internship Report On DIGITAL BANKING - HDFC Bank Ltd.Document24 pagesSummer Internship Report On DIGITAL BANKING - HDFC Bank Ltd.Nayana ChuriwalaNo ratings yet

- Investment EXIM RZVDocument70 pagesInvestment EXIM RZVZahid RizvyNo ratings yet

- Report Submission Finance (Noboni)Document20 pagesReport Submission Finance (Noboni)Afrid KhanNo ratings yet

- Can Press Release Mar 08Document7 pagesCan Press Release Mar 08Divya GanesanNo ratings yet

- Project On Summit BankDocument17 pagesProject On Summit BankTakhleeq AkhterNo ratings yet

- AU SMALL FINANCE Bank LTD PDFDocument7 pagesAU SMALL FINANCE Bank LTD PDFqvdghqhjbdcNo ratings yet

- Bank AsiaDocument17 pagesBank AsiaShahriar KabirNo ratings yet

- CRDB Bank PLC - Press Release 2Document5 pagesCRDB Bank PLC - Press Release 2Anonymous FnM14a0No ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisNo ratings yet

- Public Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectiveNo ratings yet

- Longriver - Quarterly Letter - 24 Q1Document6 pagesLongriver - Quarterly Letter - 24 Q1MadaNo ratings yet

- TDS UK Spenax Rings and Fasteners Jun13Document1 pageTDS UK Spenax Rings and Fasteners Jun13Peter TNo ratings yet

- Letter of Indeminity Kadir Yusuf SayedDocument2 pagesLetter of Indeminity Kadir Yusuf SayedDayashankar TiwariNo ratings yet

- Existing Relays and Spare Relays RequiredDocument4 pagesExisting Relays and Spare Relays RequiredADE MRTNo ratings yet

- CRM Metrics:: Customer RelationshipDocument3 pagesCRM Metrics:: Customer RelationshipmamallandNo ratings yet

- Test Far570 Feb2021 - SsDocument4 pagesTest Far570 Feb2021 - SsPutri Naajihah 4GNo ratings yet

- IWMP IDC - Inception Report - ENG - Clean - V4 - FINAL - 20230630 EbDocument71 pagesIWMP IDC - Inception Report - ENG - Clean - V4 - FINAL - 20230630 EbCastleKGNo ratings yet

- Ax2012 Enus Fa 04Document60 pagesAx2012 Enus Fa 04asifNo ratings yet

- Esb 003Document142 pagesEsb 003JunnoKaiserNo ratings yet

- History of Pharmaceutical Development in Nepal: Review ArticleDocument8 pagesHistory of Pharmaceutical Development in Nepal: Review ArticleDinesh Kumar YadavNo ratings yet

- Hrma 30013 Administrative Office Management Prof Ma. Joecelyn GuevarraDocument109 pagesHrma 30013 Administrative Office Management Prof Ma. Joecelyn GuevarraSkyler FaithNo ratings yet

- AFA Animal Production 9 Quarter 4 Module 7Document16 pagesAFA Animal Production 9 Quarter 4 Module 7Claes TrinioNo ratings yet

- MKT 202 Mid Group Assignment Spring 2021Document4 pagesMKT 202 Mid Group Assignment Spring 2021Tanvir Hasan KhanNo ratings yet

- WB Tenancy Act 1997Document29 pagesWB Tenancy Act 1997Shankha Shubhra ChakrabartyNo ratings yet

- Btec Unit 2 Task 1 Assignment Bu Jude 10-ADocument97 pagesBtec Unit 2 Task 1 Assignment Bu Jude 10-AJudes EditsNo ratings yet

- Analysis On The E-Commerce Situation in The Republic of MacedoniaDocument34 pagesAnalysis On The E-Commerce Situation in The Republic of MacedoniaRohan GuptaNo ratings yet

- Infographic Globalization in The Contemporary World PDFDocument1 pageInfographic Globalization in The Contemporary World PDFGelo MoloNo ratings yet

- Let' S WeldDocument52 pagesLet' S Welddavid vieyraNo ratings yet

- HR Building My Personal BrandDocument17 pagesHR Building My Personal BrandDAMNTHEMANNo ratings yet

- Macn+r000130746 - Affidavit of Universal Commerical Code 1 Financing Statement (USDA)Document7 pagesMacn+r000130746 - Affidavit of Universal Commerical Code 1 Financing Statement (USDA)theodore moses antoine beyNo ratings yet

- NCCB Securities and Financial Services LTD.: Portfolio StatementDocument1 pageNCCB Securities and Financial Services LTD.: Portfolio StatementAfsana TasnimNo ratings yet

- 12th All Komatsu Indonesia Technical Olympic 2022 Official ResultDocument2 pages12th All Komatsu Indonesia Technical Olympic 2022 Official ResultMarchal KawengianNo ratings yet

- Does Gender Diversity Influence Business E An Analysis From The Social Perspective of CSRDocument18 pagesDoes Gender Diversity Influence Business E An Analysis From The Social Perspective of CSRsita deliyana FirmialyNo ratings yet

- Synopsis of Hospital Management SystemDocument17 pagesSynopsis of Hospital Management SystemShivraj Cyber100% (1)

- CivPro Atty. Custodio Case DigestsDocument12 pagesCivPro Atty. Custodio Case DigestsRachel CayangaoNo ratings yet

- Storage For Z L1 Seller PresentationDocument69 pagesStorage For Z L1 Seller PresentationElisa GarciaRNo ratings yet