Professional Documents

Culture Documents

Income From Profits and Gains of Business and Profession

Income From Profits and Gains of Business and Profession

Uploaded by

Shinam JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income From Profits and Gains of Business and Profession

Income From Profits and Gains of Business and Profession

Uploaded by

Shinam JainCopyright:

Available Formats

theintactone !

MENU

Read MBA, BBA, B.COM Notes

Income from profits

and gains of business

and profession

In view of Section 2(13), business includes any:

(a) Trade

(b) Commerce

(c) Manufacture

(d) Any adventure or concern in the nature of

trade, commerce or manufacture. It covers every

facet of an occupation carried on by a person

with a view to earning profit.

The word “business” is one of large and

indefinite import and connotes

something which occupies attention

and labour of a person for the purpose

of profit.

Business arises out of commercial

transactions between two or more

persons. One cannot enter into a

business transaction with oneself.

As per section 2(36), profession includes

vocation. As profits and gains of a business,

profession or vocation are chargeable to tax

under the head “Profits and gains of business or

profession”, distinction between “business”,

“profession” and “vocation” does not have any

material significance while computing taxable

income. What does not amount to “profession”

may amount to “business” and what does not

amount to “business” may amount to

“vocation”.

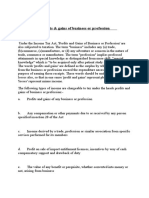

1. Business Incomes Taxable

under the head of ‘Profit

and Gains of Business or

Profession’ (Section 28).

Under section 28, the following income is

chargeable to tax under the head “Profits and

gains of business or profession”:

Profits and gains of any business or

profession;

Any compensation or other payments

due to or received by any person

specified in section 28(ii);

Income derived by a trade, professional

or similar association from specific

services performed for its members;

The value of any benefit or perquisite,

whether convertible into money or not,

arising from business or the exercise of

a profession;

Any profit on transfer of the Duty

Entitlement Pass Book Scheme;

Any profit on the transfer of the duty

free replenishment certificate;

Export incentive available to exporters;

Any interest, salary, bonus,

commission or remuneration received

by a partner from firm;

Any sum received for not carrying out

any activity in relation to any business

or profession or not to share any know-

how, patent, copyright, trademark,

etc.;

fair market value of inventory as on the

date on which it is converted into, or

treated as, a capital asset determined

in the prescribed manner;

Any sum received under a Keyman

insurance policy including bonus;

any sum received (or receivable) in cash

or kind, on account of any capital asset

(other than land or goodwill or financial

instrument) being demolished,

destroyed, discarded or transferred, if

the whole of the expenditure on such

capital asset has been allowed as a

deduction under section 35AD;

Income from speculative transaction.

2. Business Income Not

Taxable under the head

‘Profit and Gains of

Business or Profession’

In the following cases, income from trading or

business is not taxable under section 28, under

the head “Profits and gains of business or

profession”:

Rental income in the case of Dealer in

Property:

Rent of house property is taxable under section

22 under the head “Income from house

property”, even if property constitutes stock-

in-trade of recipient of rent or the recipient of

rent is engaged in the business of letting

properties on rent.

Dividend on Shares in the case of a Dealer-in-

Shares:

Dividends on shares are taxable under section

56(2)(i), under the head “Income from case of a

dealer-in-shares other sources”, even if they

are derived from shares held as stock-in-trade

or the recipient of dividends is a dealer-in-

shares. Dividend received from an Indian

company is not chargeable to tax in the hands of

shareholders (this rule is subject to a few

exceptions).

Winnings from Lotteries, etc.

Winnings from lotteries, races, etc., are taxable

under the head “Income from other sources”

etc. (even if derived as a regular business

activity).

Interest received on Compensation or

Enhanced Compensation:

Such interest is always taxable in the year of

receipt under the head “Income from other

sources” (even if it pertains to a regular business

activity). A deduction of 50 % is allowed and

e#ectively only 50 % of such interest is taxable

under the head “Income from other sources”.

Profits derived from the aforesaid business

activities are not taxable under section 28,

under the head “Profits and gains of business or

profession”. Profits and gains of any other

business are taxable under section 28, unless

such profits are exempt under sections 10 to 13A.

3. Mode of Taxation on

Certain Incomes (Section

145B)

Section 145B has been inserted by the Finance

Act, 2018. It is applicable from the assessment

year 2017-18 onwards. It provides mode of

taxation of the following incomes:

1. Interest received by an assessee on

compensation or on enhanced

compensation, shall be deemed to be

the income of the year in which it is

received (however, it is taxable under

section 56 under the head “Income

from other sources”).

2. The claim for escalation of price in a

contract or export incentives shall be

deemed to be the income of the

previous year in which reasonable

certainty of its realization is achieved.

3. Assistance in the form of subsidy (or

grant or cash incentive or duty

drawback or waiver or concession or

reimbursement) as referred to in

section 2(24)(xviii) shall be deemed to

be the income of the previous year in

which it is received, if not charged to

income tax for any earlier previous

year.

4. Basic Principles for

computing income Taxable

under the head ‘Profit and

Gains of Business or

Profession’

1. Business or profession carried on by

the assessee:

Business or profession should be carried on by

the assessee.

2. Business or profession should be

carried on during the previous year:

Income from business or profession is

chargeable to tax under this head only if the

business or profession is carried on by the

assessee at any time during the previous year

(not necessarily throughout the previous year).

There are a few exceptions to this rule.

3. Income of previous year is taxable

during the following assessment

year:

Income of business or profession carried on by

the assessee during the previous year is

chargeable to tax in the next following

assessment year. There are, however, certain

exceptions to this rule.

4. Tax incidence arises in respect of all

businesses or professions:

Profits and gains of di#erent businesses or

professions carried on by the assessee are not

separately chargeable to tax. Tax incidence

arises on aggregate income from all businesses

or professions carried on by the assessee. If,

therefore, an assessee earns profit in one

business and sustains loss in another business,

income chargeable to tax is the net balance after

setting o# loss against income. However, profits

and losses of a speculative business are kept

separately.

5. Legal ownership vs. beneficial

ownership:

Under section 28, it is not only the legal

ownership but also the beneficial ownership

that has to be considered. The courts can go into

the question of beneficial ownership and decide

who should be held liable for the tax after taking

into account the question as to who is, in fact, in

receipt of the income which is going to be taxed.

6. Real profit vs. anticipated profit:

Anticipated or potential profits or losses, which

may occur in future, are not considered for

arriving at taxable income of a previous year.

This rule is, however, subject to one exception:

stock-in-trade may be valued on the basis of

cost or market value, whichever is lower.

7. Real profit vs. Notional profit:

The profits which are taxed under section 28 are

the real profits and not notional profits. For

instance, no person can make profit by trading

with himself in another capacity.

8. Recovery of sum already allowed as

deduction:

Any sum recovered by the assessee during the

previous year in respect of an amount or

expenditure which was earlier allowed as

deduction, is taxable as business income of the

year in which it is recovered.

9. Mode of book entries not relevant:

The mode or system of book-keeping cannot

override the substantial character of a

transaction.

10. illegal business:

The income-tax law is not concerned with the

legality or illegality of a business or profession. It

can, therefore, be said that income of illegal

business or profession is not exempt from tax.

Share this:

! Twitter " Facebook # Telegram

$ WhatsApp % Email & LinkedIn

' Reddit ( Tumblr ) Pinterest * Pocket

+ Skype

Like this:

Loading...

Related

Guru Gobind Singh Dr. APJ Abdul Kalam

Indraprastha Technical University

University (MBA) MBA Notes (KMBN,

Notes KMB & RMB Series

Read MBA Syllabus Notes)

wise notes of Read MBA Syllabus

GGSIPU,New Delhi wise notes of

20 Dec 2018 AKTU,LUCKNOW

In "GGSIPU MBA 8 Dec 2018

NOTES" In "AKTU MBA NOTES"

Maharshi Dayanand

University (MDU) BBA

Notes

Read BBA Syllabus

wise notes of

MDU,HARYANA

6 Apr 2019

In "MDU BBA NOTES"

PREVIOUS POST NEXT POST

Income exempted Income from

from Tax House Property

YOU MIGHT ALSO LIKE

Characteristics of Internet: email

! 12 Jan 2020

Developing talent in transnational

Enterprise

! 9 Feb 2019

GST offences

! 4 Sep 2019

5 thoughts on “Income from profits

and gains of business and

profession”

Pingback: BBAN601 Income

Tax – READ BBA & MBA NOTES

Pingback: GGSIPU (BBA301)

Income Tax Laws And Practice

– HOME | BBA & MBA NOTES

Pingback: KMBFM02 Tax

Planning & Management –

HOME | MANAGEMENT NOTES

Pingback: CCSU(BBA) 504

Income Tax Law And Accounts

– HOME | MANAGEMENT

NOTES

Pingback: CCSU(B.COM) C-

204 Income Tax – Home |

Management

Leave a Reply

Enter your comment here...

Enter your comment here...

!"#$%&'(()*#+,&-.,+/0

!"#"$%$&"'()'*+#,-.

#&/'0$12,$&234

!5-675.

8-$6#-#",(&.'()

9,'*22(5&".

:((7.'#&/

:$2;&,<5$.'()

=#&#>$%$&"

*22(5&",&>

??*@ABC'D&2(%$

:#E

8-$6#-#",(&'()'F(."

!;$$"'#&/

!"#"$%$&"'()'F(."

Search … SEARCH

CHANGE LANGUAGE

Select Language

Powered by Translate

Copyright ©theintactone Powered by and Bam.

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Tax Management NotesDocument21 pagesTax Management NotesChetan GKNo ratings yet

- ACCT 3326 Tax II Cengage CH 2 199ADocument6 pagesACCT 3326 Tax II Cengage CH 2 199Abarlie3824No ratings yet

- Visa VIS Specification 15 - May - 2009Document558 pagesVisa VIS Specification 15 - May - 2009latfall588092% (13)

- United Pass Travel Guide 2015 - Edited July 2015Document4 pagesUnited Pass Travel Guide 2015 - Edited July 2015taptico100% (2)

- Income From Profits and Gains of Business and Profession: (A) (B) (C) (D)Document9 pagesIncome From Profits and Gains of Business and Profession: (A) (B) (C) (D)Harshit YNo ratings yet

- Profits and Gains of Business or ProfessionDocument74 pagesProfits and Gains of Business or ProfessionDevil GamerNo ratings yet

- Bcom 06 Block 03Document108 pagesBcom 06 Block 03Prabhu SahuNo ratings yet

- Profits and Gains of Business or ProfessionDocument18 pagesProfits and Gains of Business or ProfessionSurya MuruganNo ratings yet

- Profits and Gains of Business or Profession.Document79 pagesProfits and Gains of Business or Profession.Mandira PriyaNo ratings yet

- Business & Profession Theory-AY0910Document52 pagesBusiness & Profession Theory-AY0910Vijaya MandalNo ratings yet

- Direct Taxation: Topic:-"Profit and Gain From Business and Profession"Document12 pagesDirect Taxation: Topic:-"Profit and Gain From Business and Profession"Rajat MishraNo ratings yet

- Learning Outcomes: After Studying This Chapter, You Would Be Able ToDocument153 pagesLearning Outcomes: After Studying This Chapter, You Would Be Able ToAnshul KhinchiNo ratings yet

- Bos 54380 CP 6Document198 pagesBos 54380 CP 6Sourabh YadavNo ratings yet

- Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToDocument214 pagesProfits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToPragasNo ratings yet

- 3.PGBP Business TaxationDocument202 pages3.PGBP Business TaxationPrashant DNo ratings yet

- Business and ProfessionDocument6 pagesBusiness and ProfessionSakshi JainNo ratings yet

- Corpoate Taxation: Income From Profits and Gains of Business or ProfessionDocument13 pagesCorpoate Taxation: Income From Profits and Gains of Business or ProfessionGanesh ChindanuruNo ratings yet

- Basics of Income From Business & ProfessionDocument30 pagesBasics of Income From Business & ProfessionKiran BendeNo ratings yet

- 76320bos61648 cp3Document222 pages76320bos61648 cp3DS NicknameNo ratings yet

- Noor Assigment Taxation LawDocument11 pagesNoor Assigment Taxation LawMukul KumarNo ratings yet

- Income Tax 2 NotesDocument11 pagesIncome Tax 2 NotessagarasbushisNo ratings yet

- Profits and Gains of Business or ProfessionDocument148 pagesProfits and Gains of Business or ProfessionSuvadip PalNo ratings yet

- Course Material Development of Corporate Taxation: Prof. Deepak Sanghvi Mr. Rajesh Ganatra Ms. Bhoomi ParekhDocument41 pagesCourse Material Development of Corporate Taxation: Prof. Deepak Sanghvi Mr. Rajesh Ganatra Ms. Bhoomi ParekhbharatishethNo ratings yet

- Accounting ExamplesDocument124 pagesAccounting ExamplesGirish KhareNo ratings yet

- Presentation Taxation LawsDocument8 pagesPresentation Taxation LawsVineet GuptaNo ratings yet

- Unit 5 Profits and Gains of Business or Profession StructureDocument31 pagesUnit 5 Profits and Gains of Business or Profession StructuredeepaksinghalNo ratings yet

- Prefits and Gains-7Document52 pagesPrefits and Gains-7s4sahithNo ratings yet

- Chapter 3 Profits and Gains of Business or ProfessionDocument221 pagesChapter 3 Profits and Gains of Business or Professionrachitaggarwal.rnmNo ratings yet

- PGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)Document130 pagesPGBP Chapter - Ay 2021-22 (May & Nov 2021 Exam)hgoyal1998No ratings yet

- Chapter 5 and 6 (PaPoT)Document41 pagesChapter 5 and 6 (PaPoT)dua tanveerNo ratings yet

- Unit 4 Profits and Gains of Business or ProfessionDocument119 pagesUnit 4 Profits and Gains of Business or ProfessionRishikaysh KaakandikarNo ratings yet

- Business and ProfessionDocument21 pagesBusiness and ProfessionKailash MotwaniNo ratings yet

- dt7 PDFDocument215 pagesdt7 PDFAnkitaNo ratings yet

- Income From Business/ProfessionDocument3 pagesIncome From Business/Professionubaid7491No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPHarsiddhi KotilaNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPJuhi MarmatNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPAchut GoreNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPalex v.m.No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPDhandu RanjithNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPdeepajagadishgowda532003No ratings yet

- Unit I: Income From Profits and Gains of Business or Profession'Document20 pagesUnit I: Income From Profits and Gains of Business or Profession'anuNo ratings yet

- Taxtion of Sole TradersDocument9 pagesTaxtion of Sole TradersAnaemesiobi DukeNo ratings yet

- Profits and Gains From Business or Profession Notes 1Document42 pagesProfits and Gains From Business or Profession Notes 1Kr KvNo ratings yet

- Unit 2 - Income From Business or ProfessionDocument13 pagesUnit 2 - Income From Business or ProfessionRakhi DhamijaNo ratings yet

- S - Viii: Bba - LL.B (Hons) Corporate LawsDocument20 pagesS - Viii: Bba - LL.B (Hons) Corporate LawsSalonee NayakNo ratings yet

- PGBP, Ifos, Deduction, Nti Ay 2018-19-1Document38 pagesPGBP, Ifos, Deduction, Nti Ay 2018-19-1Anonymous ckTjn7RCq80% (1)

- Incomes Chageable As Profits and Gains of Business and ProfessionDocument11 pagesIncomes Chageable As Profits and Gains of Business and ProfessionRishikesh KumarNo ratings yet

- INCOME FROM BUSINESSDocument5 pagesINCOME FROM BUSINESSNadeem BalochNo ratings yet

- Income Tax Module 2Document29 pagesIncome Tax Module 2Ramya GowdaNo ratings yet

- Profit Gains of Business and Profession PDFDocument43 pagesProfit Gains of Business and Profession PDFYogita VishwakarmaNo ratings yet

- UntitledDocument12 pagesUntitledsuyash dugarNo ratings yet

- Unit 3 Income From PGBP NotesDocument10 pagesUnit 3 Income From PGBP NotesKhushi SinghNo ratings yet

- TM 07Document31 pagesTM 07Rohan KawaleNo ratings yet

- Applicability: Business Organisation Types of IncomeDocument3 pagesApplicability: Business Organisation Types of Incomegaurav069No ratings yet

- Income Form Other Sources-9Document10 pagesIncome Form Other Sources-9s4sahith50% (2)

- 1 Income From PGBPDocument20 pages1 Income From PGBPIshani MukherjeeNo ratings yet

- Unit - 3: Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToDocument166 pagesUnit - 3: Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToSakshi SharmaNo ratings yet

- Income From Other SourcesDocument5 pagesIncome From Other SourcesGovarthanan NarasimhanNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Classification of Assets: Leave A ReplyDocument1 pageClassification of Assets: Leave A ReplyShinam JainNo ratings yet

- Retirement Planning ProcessDocument1 pageRetirement Planning ProcessShinam JainNo ratings yet

- Set Off and Carry Forward of LossesDocument1 pageSet Off and Carry Forward of LossesShinam JainNo ratings yet

- Items Classified As Income From Other SourcesDocument1 pageItems Classified As Income From Other SourcesShinam JainNo ratings yet

- Income Exempted From Tax: Provident Fund (Sec. 10 (11) )Document1 pageIncome Exempted From Tax: Provident Fund (Sec. 10 (11) )Shinam JainNo ratings yet

- MANAGEMENT AND CORPORATE FINANCE (Final)Document95 pagesMANAGEMENT AND CORPORATE FINANCE (Final)Shinam Jain100% (1)

- Mba Sem 3Document10 pagesMba Sem 3Shinam JainNo ratings yet

- Prachi Raj ResumeDocument1 pagePrachi Raj ResumeShinam JainNo ratings yet

- ESSO v. CIR, 175 SCRA 149 (1989)Document13 pagesESSO v. CIR, 175 SCRA 149 (1989)citizenNo ratings yet

- Statement 1567186512100 PDFDocument2 pagesStatement 1567186512100 PDFMánøjNo ratings yet

- Chapter 5 - 10Document28 pagesChapter 5 - 10PdNo ratings yet

- Jan 2020 WMTDocument1 pageJan 2020 WMTMr RaiNo ratings yet

- MVL0004BDocument1 pageMVL0004BnobuhleNo ratings yet

- Statement of Income 2017-2021Document5 pagesStatement of Income 2017-2021Lailani KatoNo ratings yet

- Winet Services: QuotationDocument1 pageWinet Services: QuotationAnusia ThevendaranNo ratings yet

- The Good, The Bad, and The UglyDocument13 pagesThe Good, The Bad, and The UglyTanvir AhmedNo ratings yet

- Types of Accounts in A Bank: BY Abdul Qadir BhamaniDocument23 pagesTypes of Accounts in A Bank: BY Abdul Qadir Bhamaniafzaal khanNo ratings yet

- E-Italian Tax Booklet 2018Document17 pagesE-Italian Tax Booklet 2018Sander Van RansbeeckNo ratings yet

- Nutriarc: Tax InvoiceDocument1 pageNutriarc: Tax InvoiceARC FitnessNo ratings yet

- Account Statement 010420 310321Document31 pagesAccount Statement 010420 310321Amu KumarNo ratings yet

- Suggested Answers For Quiz 1 - Tax 101Document3 pagesSuggested Answers For Quiz 1 - Tax 101yanaNo ratings yet

- Estmt 01 26 2012Document3 pagesEstmt 01 26 2012Sundeep NukarajuNo ratings yet

- FESCO ONLINE BILL - CompressedDocument1 pageFESCO ONLINE BILL - CompressedInternal Audit FESCONo ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument2 pagesReliance Retail Limited Tax Invoice: Original For RecipientMainpal YadavNo ratings yet

- Cash Flow 1st QuarterDocument3 pagesCash Flow 1st Quarterslipjay16No ratings yet

- Tax Review Notes 2014Document80 pagesTax Review Notes 2014Marianne Therese MalanNo ratings yet

- 22-23 Olp 604674Document1 page22-23 Olp 604674HehshsNo ratings yet

- Estmt - 2024 03 29Document44 pagesEstmt - 2024 03 29Julio Ortiz lopezNo ratings yet

- Questions and Answers On Philippine Donor S TaxDocument3 pagesQuestions and Answers On Philippine Donor S TaxMariela LiganadNo ratings yet

- Basic Concept of Income Tax (ICAI Material Updated) PDFDocument29 pagesBasic Concept of Income Tax (ICAI Material Updated) PDFshubhangNo ratings yet

- MC 3 Topic 4 Def Tax Question A232Document4 pagesMC 3 Topic 4 Def Tax Question A232thanusri0103No ratings yet

- TAX - BIR Ruling 32-98 and ImperialDocument1 pageTAX - BIR Ruling 32-98 and ImperialChynah Marie MonzonNo ratings yet

- Data PDFDocument14 pagesData PDFmeer_123No ratings yet

- Booking Invoice M06ai24i15923749Document1 pageBooking Invoice M06ai24i15923749manjuhm1707licNo ratings yet

- G.R. No. 197117. April 10, 2013.: Somera, Penano & Associates Office of The Solicitor GeneralDocument7 pagesG.R. No. 197117. April 10, 2013.: Somera, Penano & Associates Office of The Solicitor GeneralJuris FormaranNo ratings yet

- Ril Capex SBLC Format PerformanceDocument4 pagesRil Capex SBLC Format PerformanceR R ThakurNo ratings yet