Professional Documents

Culture Documents

HRA at Capital Cost

HRA at Capital Cost

Uploaded by

sudhir mishra0 ratings0% found this document useful (0 votes)

735 views1 pageThis document recommends approving the payment of house rent allowance on a capital cost basis of Rs. 5,514 per month to Shri Sudhir Kumar Mishra, effective November 20, 2017. It provides computations to show that Shri Mishra owns a house in Vadodara worth Rs. 33,57,829 and is entitled to 150% of the HRA payable based on his basic salary, which amounts to Rs. 5,514 per month. The recommendation is to pay him this amount as his house rent allowance on a capital cost basis.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document recommends approving the payment of house rent allowance on a capital cost basis of Rs. 5,514 per month to Shri Sudhir Kumar Mishra, effective November 20, 2017. It provides computations to show that Shri Mishra owns a house in Vadodara worth Rs. 33,57,829 and is entitled to 150% of the HRA payable based on his basic salary, which amounts to Rs. 5,514 per month. The recommendation is to pay him this amount as his house rent allowance on a capital cost basis.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

735 views1 pageHRA at Capital Cost

HRA at Capital Cost

Uploaded by

sudhir mishraThis document recommends approving the payment of house rent allowance on a capital cost basis of Rs. 5,514 per month to Shri Sudhir Kumar Mishra, effective November 20, 2017. It provides computations to show that Shri Mishra owns a house in Vadodara worth Rs. 33,57,829 and is entitled to 150% of the HRA payable based on his basic salary, which amounts to Rs. 5,514 per month. The recommendation is to pay him this amount as his house rent allowance on a capital cost basis.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

SSISTANT GENERAL MANAGER (For approval)

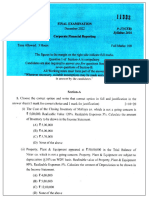

TAFFSUPERVISING: SHRI SUDHIRKUMAR MISHRA - MMGsII(PF NO, 5243418

AYMENT OF HOUSE RENT ALLoWANCE ON CAPITALCOST BASISW.E.F, 20/11/20L

ve officer, presently posted at our Natubhai Cricle branch as Manager (RMSE) has

Kumar Mishra is residing

hie yent of house rent allowance on capital cost basis. Shri Sudhir of 8 %% or

npasic

his pay

ownashouse at Vadodara Mishra is entitled to draw HRA @ 150%%

Shri Sudhir Kumar

applicable to Vadodara centre.

Sr. No. Amount

Particular

A

Computation of A

Total cost of the house 33,57,829.00

ii) 12% of the total cost 402939.00

ii) Annual Municipal Taxes, if any 3663.00

iv TOTAL of ii and ii 406602.00

v 1/12 of iv (notional rent p.m.) 33883.50

1.20 % of the 1st stage of basic

pay of the scale in which the officer is

Vi Substantively placed i.e. Rs. 42,020/ 504.24

(V-vi)

B Computation of B 33379.26

(Own House and not rented so not applicable)

One-twelfth of the annual rental value taken for 0.00

of the accommodation Municipal assessment

1.20% of the 1st

stage of basic pay of the scale in which the 0.00

i) substantively placed officer is

B

(i-i) 0.00

C

Computation of C 0.00

Higher of Aor B

D Computation of D 33379.26

150% of HRA

payable in terms of

13.2.1. Section

(8% of Basic Rs.45,950/-)

HRApayable on capital cost shall i.e.12%

be the lower of C or D 5514.00

We, therefore, recommend that 5514.00

cost basis of Rs.5,514/ wef Shri Sudhir Kumar Mishra

20/11/2017 may be paid house rent

allowance on capital

MANAGER (HR)

Date: 17/04/2018

CHIEF MANAGER (C&R)

Date:

You might also like

- Path-Pradarshak 2023-24 EnglishDocument157 pagesPath-Pradarshak 2023-24 Englishnutandevi913585No ratings yet

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Pre Feasibility Study Report Float Glass Manufacturing FacilityDocument33 pagesPre Feasibility Study Report Float Glass Manufacturing Facilitysurendar kumar100% (2)

- Companies Act - Imp SectionDocument5 pagesCompanies Act - Imp SectionShanu JainNo ratings yet

- Ready Reckoner For CADocument242 pagesReady Reckoner For CAManoj GoyalNo ratings yet

- Asset Monitoring CbsDocument14 pagesAsset Monitoring CbsSankara NarayananNo ratings yet

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- 166-2020 Roi PDFDocument47 pages166-2020 Roi PDFANJAN SINGH 3ANo ratings yet

- Pay Slip TemplateDocument3 pagesPay Slip TemplateSujee HnbaNo ratings yet

- 7 - Banking Case Study TwoDocument4 pages7 - Banking Case Study TwoAshish BnNo ratings yet

- HRA Calculation For Officers: I. Declaration BasisDocument3 pagesHRA Calculation For Officers: I. Declaration BasisKARTHIKNo ratings yet

- Indian Institute of Banking & FinanceDocument14 pagesIndian Institute of Banking & Financekarthik100% (1)

- Bcsbi PDFDocument284 pagesBcsbi PDFsimerjotkaur100% (3)

- ABFM - Course OutlineDocument3 pagesABFM - Course OutlinemuhammadannasNo ratings yet

- Recruitment Recruitment of Clerical Staff in Sbi (Advertisement No. Crpd/Cr/2009-10/04)Document4 pagesRecruitment Recruitment of Clerical Staff in Sbi (Advertisement No. Crpd/Cr/2009-10/04)netrakashyapNo ratings yet

- IIbf Prevntion of Cyber Crimes Syllbus PDFDocument6 pagesIIbf Prevntion of Cyber Crimes Syllbus PDFThebiryani CartNo ratings yet

- Indian Institute of Banking & Finance: Caiib-Elective SubjectsDocument12 pagesIndian Institute of Banking & Finance: Caiib-Elective SubjectsrahulNo ratings yet

- Certificate Examination In: Iibf & Nism AddaDocument72 pagesCertificate Examination In: Iibf & Nism AddaHarinder KumarNo ratings yet

- It Security 1 PDFDocument7 pagesIt Security 1 PDFPravin Bandale0% (1)

- Ethics E-LEARNING 25.03.19 PDFDocument5 pagesEthics E-LEARNING 25.03.19 PDFANITHA SNo ratings yet

- Indian Institute of Banking & Finance: Certificate Course in Digital BankingDocument6 pagesIndian Institute of Banking & Finance: Certificate Course in Digital BankingKay Aar Vee RajaNo ratings yet

- Details & Time Table of AML & KYC - IIBF ExaminationDocument1 pageDetails & Time Table of AML & KYC - IIBF Examinationupasana rajNo ratings yet

- Cbi BankDocument81 pagesCbi BankVaibhavKamble100% (1)

- Caiib DiscussionDocument13 pagesCaiib DiscussionRaviTuduNo ratings yet

- Msme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Document67 pagesMsme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Majhar HussainNo ratings yet

- Champaran Gurukul: Banking Made EasyDocument5 pagesChamparan Gurukul: Banking Made EasybiplabmajumderNo ratings yet

- Canara Bank Book Debt Statement Format PDFDocument77 pagesCanara Bank Book Debt Statement Format PDFMohamed YousufNo ratings yet

- Free Mock Test For Jaiib & CaiibDocument5 pagesFree Mock Test For Jaiib & CaiibBiswajit DasNo ratings yet

- JAIIB Exam June 2022 52 Days - 52 Class Very Important Question Class 25Document14 pagesJAIIB Exam June 2022 52 Days - 52 Class Very Important Question Class 25Sudhir Dehariya100% (1)

- MargdarshniDocument185 pagesMargdarshniRahul Singh100% (1)

- Study Material 2018 Czc-BhopalDocument233 pagesStudy Material 2018 Czc-BhopalCA Alpesh TatedNo ratings yet

- Sme Study Modules For Quick Reference PDFDocument180 pagesSme Study Modules For Quick Reference PDFNilima ChowdhuryNo ratings yet

- ABM-numerical With Solutions by Neeraj AgnihotriDocument23 pagesABM-numerical With Solutions by Neeraj AgnihotriMuralidhar Goli100% (6)

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Overview On FEMA PresentationDocument33 pagesOverview On FEMA Presentationshikhasharmajpr8146No ratings yet

- Vasanth ResumeDocument5 pagesVasanth Resumeapi-26928025No ratings yet

- Prom 158Document158 pagesProm 158Bibin PHNo ratings yet

- Punjab & Sind Bank Family Bonding SchemeDocument3 pagesPunjab & Sind Bank Family Bonding SchemeSreekar VappangiNo ratings yet

- Cost Vol 2Document450 pagesCost Vol 2Vijay RaghavanNo ratings yet

- New Leave Travel Concesssion (LTC) / Home Travel Concession (HTC) Scheme"Document35 pagesNew Leave Travel Concesssion (LTC) / Home Travel Concession (HTC) Scheme"jyottsna100% (1)

- Retail Loan User Manual-393Document41 pagesRetail Loan User Manual-393Arindam MukherjeeNo ratings yet

- NPA Management at SBI (2013-2023)Document31 pagesNPA Management at SBI (2013-2023)Tanistha Roy ChoudhuryNo ratings yet

- RSKMGT NIBM Module Operational Risk Under Basel IIIDocument6 pagesRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaNo ratings yet

- ITAT's Judgment On Penny StocksDocument20 pagesITAT's Judgment On Penny StocksLatest Laws TeamNo ratings yet

- Staff MattersDocument908 pagesStaff MattersPiyush BajpaiNo ratings yet

- RECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Document11 pagesRECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Arun PrakashNo ratings yet

- Sme Finance IibfDocument28 pagesSme Finance Iibftuniya4100% (4)

- Inter Audit MCQs - SKDocument68 pagesInter Audit MCQs - SKAswini NagajothiNo ratings yet

- CAIIB Question - TreasuryDocument12 pagesCAIIB Question - TreasuryDiwakar PasrichaNo ratings yet

- India Home Loans LTD Credit Policy of India Home Loans LTDDocument9 pagesIndia Home Loans LTD Credit Policy of India Home Loans LTDvinayak_cNo ratings yet

- CA Inter - EIS - Hemang DoshiDocument91 pagesCA Inter - EIS - Hemang Doshihemangdoshi99No ratings yet

- Caiib Rural Banking NotesDocument2 pagesCaiib Rural Banking NotesSatish O Manchodu100% (1)

- SBI CBO Banking Knowledge PDF by Ambitious BabaDocument91 pagesSBI CBO Banking Knowledge PDF by Ambitious Babaசிவா நடராஜன்No ratings yet

- Indian Construction Equipment and Infra Finance Sector OverviewDocument60 pagesIndian Construction Equipment and Infra Finance Sector Overviewsunleon31No ratings yet

- JIIB Test PpersDocument51 pagesJIIB Test PpersPriyanka LincolnNo ratings yet

- Strategy For SEBI Grade A and RBI Grade B by Tanmay Jaiswal, RankDocument29 pagesStrategy For SEBI Grade A and RBI Grade B by Tanmay Jaiswal, RankKaran DongreNo ratings yet

- Credit Monitoring Caselets by Baroda Academy Ahmedabad - Print - QuizizzDocument9 pagesCredit Monitoring Caselets by Baroda Academy Ahmedabad - Print - QuizizzShilpa JhaNo ratings yet

- Abfm Formula PDFDocument20 pagesAbfm Formula PDFSandeep KumarNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- TDS & TCSDocument11 pagesTDS & TCSKartikNo ratings yet

- P17Document21 pagesP17anandhan61No ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Part A General InformationDocument6 pagesItr-1 Sahaj Indian Income Tax Return: Part A General InformationRajatGuptaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21suhail amirNo ratings yet

- Promotion Year 2021-22 Promotion To The Grade Smgs-Iv: Candidates Will Submit To HR Department of Their VerticalDocument2 pagesPromotion Year 2021-22 Promotion To The Grade Smgs-Iv: Candidates Will Submit To HR Department of Their Verticalsudhir mishraNo ratings yet

- Adobe Scan 08 Jan 2021Document3 pagesAdobe Scan 08 Jan 2021sudhir mishraNo ratings yet

- Drgopaeesingifp: Dr. Abhishek Kumar Singh Meenakshi NetralayaDocument1 pageDrgopaeesingifp: Dr. Abhishek Kumar Singh Meenakshi Netralayasudhir mishraNo ratings yet

- Statement of Accouni: Uncleared AmountDocument3 pagesStatement of Accouni: Uncleared Amountsudhir mishraNo ratings yet

- Problem 11 - 5 Multiple Choice (AICPA Adapted)Document3 pagesProblem 11 - 5 Multiple Choice (AICPA Adapted)Mobi Dela CruzNo ratings yet

- Dirlist14 02700000 00400000Document208 pagesDirlist14 02700000 00400000Mahesh KumarNo ratings yet

- Creating Competitive Smes in India: Presented By: Dhariti Walia (10810021) Saryu Kamra (10810056) Yuki Jain (10810074)Document27 pagesCreating Competitive Smes in India: Presented By: Dhariti Walia (10810021) Saryu Kamra (10810056) Yuki Jain (10810074)Adr HRNo ratings yet

- Invoice 7218740Document2 pagesInvoice 7218740Johanny SantosNo ratings yet

- Tugas PiutangDocument6 pagesTugas Piutangmelvina siregarNo ratings yet

- Assignment 7 FinanceDocument3 pagesAssignment 7 FinanceAhmedNo ratings yet

- Graduate, Managerial and Professional Series: Numerical Reasoning 2 Question & AnswerDocument13 pagesGraduate, Managerial and Professional Series: Numerical Reasoning 2 Question & AnswerabdelrahmanNo ratings yet

- Iuri 173 Su 6.2 2Document17 pagesIuri 173 Su 6.2 2Chante HurterNo ratings yet

- Primer On Train LawDocument8 pagesPrimer On Train LawVeronica ChanNo ratings yet

- First Time Adoption of Ind As 101Document3 pagesFirst Time Adoption of Ind As 101vignesh_vikiNo ratings yet

- 2018 Form I Individual Income Tax Return 2017Document20 pages2018 Form I Individual Income Tax Return 2017KSeegurNo ratings yet

- Performing Credit Quarterly 3q2023Document17 pagesPerforming Credit Quarterly 3q2023zackzyp98No ratings yet

- Report On IMPACT OF GST ON REAL ESTATE INDUSTRYDocument31 pagesReport On IMPACT OF GST ON REAL ESTATE INDUSTRYsamNo ratings yet

- College Savings Plan ComparisonDocument2 pagesCollege Savings Plan Comparisoncharanmann9165No ratings yet

- Hunny Patel - 202004100710016 Jahanvi Bhalani - 202004100710020 Hani Patel - 202004100710024Document15 pagesHunny Patel - 202004100710016 Jahanvi Bhalani - 202004100710020 Hani Patel - 202004100710024Hani patelNo ratings yet

- Group 03 - Bajaj Auto LimitedDocument4 pagesGroup 03 - Bajaj Auto LimitedSumeet MadwaikarNo ratings yet

- Nominal and Real Interest RatesDocument6 pagesNominal and Real Interest RatesGeromeNo ratings yet

- Chapter 2 - An Introduction of Forward and OptionDocument38 pagesChapter 2 - An Introduction of Forward and Optioncalun12No ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- What Is Seed and Angel FundingDocument2 pagesWhat Is Seed and Angel FundingQueen ValleNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- Tax Planning Provision of Tax AdviceDocument82 pagesTax Planning Provision of Tax AdviceJeremiah NcubeNo ratings yet

- Exercise 1-10: Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Fifth Canadian EditionDocument5 pagesExercise 1-10: Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Fifth Canadian EditionjorwitzNo ratings yet

- Equity Research Interview Questions PDFDocument5 pagesEquity Research Interview Questions PDFAkanksha Ajit DarvatkarNo ratings yet

- Financial Results For The Quarter Ended 31st December, 2023Document15 pagesFinancial Results For The Quarter Ended 31st December, 2023Sarika ZNo ratings yet

- Barbazza Membership FormDocument4 pagesBarbazza Membership FormJugger AfrondozaNo ratings yet

- San Antonio Water System Memo of Record - Underwriter Proposal and PoolDocument2 pagesSan Antonio Water System Memo of Record - Underwriter Proposal and PoolTexas WatchdogNo ratings yet