Professional Documents

Culture Documents

APJABSSv4i2July Dec18 - 86 99

APJABSSv4i2July Dec18 - 86 99

Uploaded by

Htet Lynn HtunCopyright:

Available Formats

You might also like

- Blackbook Project On Consumer Perception About Life Insurance PoliciesDocument80 pagesBlackbook Project On Consumer Perception About Life Insurance PoliciesMohit Kumar89% (28)

- IISTE Journal Publication May 2012 PDFDocument13 pagesIISTE Journal Publication May 2012 PDFDyenNo ratings yet

- Factors of Life Insurance at Household Level: A Case Study HTTPDocument14 pagesFactors of Life Insurance at Household Level: A Case Study HTTPijire publicationNo ratings yet

- The Demand For Insurance in United StatesDocument26 pagesThe Demand For Insurance in United StatesOwen OuyangNo ratings yet

- An Empirical Study On The Buying Motives of An Insurance Policy Holder and The Impact of Demography On The Insurance Buying Decision ProcessDocument12 pagesAn Empirical Study On The Buying Motives of An Insurance Policy Holder and The Impact of Demography On The Insurance Buying Decision ProcessSugan PragasamNo ratings yet

- Study of Factors Influencing Consumer Perception Towards Health Insurance Policies During COVID-19 PandemicDocument7 pagesStudy of Factors Influencing Consumer Perception Towards Health Insurance Policies During COVID-19 PandemicRAVI SONKARNo ratings yet

- Consumer BehaviourDocument5 pagesConsumer BehaviourClick PickNo ratings yet

- 06 Chapter 3Document8 pages06 Chapter 3Mohit BhatiaNo ratings yet

- Chapter 2Document16 pagesChapter 2Devi Bala JNo ratings yet

- Determinants of Demand For Life Insurance: The Case of CanadaDocument22 pagesDeterminants of Demand For Life Insurance: The Case of CanadaHtet Lynn HtunNo ratings yet

- Mitul Bhola Research Proposal 2019Document13 pagesMitul Bhola Research Proposal 2019Yajas BholaNo ratings yet

- Why Should One Invest in A Life Insurance Product? An Empirical StudyDocument10 pagesWhy Should One Invest in A Life Insurance Product? An Empirical StudyAtaye Waris KhanNo ratings yet

- Campbell 1980: Cagayan State University College of Business Entrepreneurship and AccountancyDocument8 pagesCampbell 1980: Cagayan State University College of Business Entrepreneurship and AccountancyJelly Mea VillenaNo ratings yet

- Factors Affecting Demand of Life Insurance in Developing CountriesDocument25 pagesFactors Affecting Demand of Life Insurance in Developing CountriesalizaNo ratings yet

- 04 PDFDocument8 pages04 PDFSurbhi AgrawalNo ratings yet

- Business Research MethodologyDocument34 pagesBusiness Research MethodologyDivine Truth Life MinistryNo ratings yet

- PROJECTDocument52 pagesPROJECTAghilaNo ratings yet

- Consumer Involvement and Perceived RiskDocument11 pagesConsumer Involvement and Perceived RiskSameer Singh FPM Student, Jaipuria LucknowNo ratings yet

- Effects of Household Characteristics On Demand For InsuranceDocument12 pagesEffects of Household Characteristics On Demand For InsuranceÂn NguyễnNo ratings yet

- Ijcs 1268111Document28 pagesIjcs 1268111rizalyncabahugNo ratings yet

- Dhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDocument14 pagesDhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDhrupit DNo ratings yet

- A E D L I: ErspectivesDocument33 pagesA E D L I: ErspectivesPreda AnaNo ratings yet

- Customers Perception For Taking Life Insurance: A Critical Analysis of Life Insurance Sector in Virudhunagar District Mrs.S.Jeyalakshmi & Dr.V.KanagavelDocument7 pagesCustomers Perception For Taking Life Insurance: A Critical Analysis of Life Insurance Sector in Virudhunagar District Mrs.S.Jeyalakshmi & Dr.V.KanagavelPARTH PATELNo ratings yet

- Thesis Insurance CompanyDocument6 pagesThesis Insurance Companypuzinasymyf3100% (1)

- 2013 ICERwp11 13Document31 pages2013 ICERwp11 13Enver MzadeNo ratings yet

- Dhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDocument15 pagesDhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDhrupit DNo ratings yet

- Nataniel,+A5 Violeta+Paper Vol.+7+ (DEC,+No.+2) ,+2020Document24 pagesNataniel,+A5 Violeta+Paper Vol.+7+ (DEC,+No.+2) ,+2020vjpyeojdgwkvqgasioNo ratings yet

- 157 379 1 PB PDFDocument7 pages157 379 1 PB PDFVishal YadavNo ratings yet

- Review On Life InsuranceDocument37 pagesReview On Life Insuranceradhika jagtapNo ratings yet

- Shradha Ins.Document48 pagesShradha Ins.yesh cyberNo ratings yet

- Chapter-Ii Review of Literature and Research MethodologyDocument30 pagesChapter-Ii Review of Literature and Research MethodologyRidhima KatiyarNo ratings yet

- Initial Pages Black BookDocument95 pagesInitial Pages Black Bookmehul guptaNo ratings yet

- A Study On Demographic Factors Influencing Purchasing Decision of Life Insurance PolicyDocument11 pagesA Study On Demographic Factors Influencing Purchasing Decision of Life Insurance PolicyAbhijit BoraNo ratings yet

- Shotick 2014Document5 pagesShotick 2014Zorobabel AzondogaNo ratings yet

- 9297-Article Text-18221-1-10-20210714Document8 pages9297-Article Text-18221-1-10-20210714Gunjan sharmaNo ratings yet

- An Analysis of The Quality of Online Calculators in Calculating Life Insurance RecommendationsDocument12 pagesAn Analysis of The Quality of Online Calculators in Calculating Life Insurance RecommendationsRuby KhanNo ratings yet

- Life InsuranceDocument11 pagesLife InsuranceHarsh ChouhanNo ratings yet

- A Study On Perception of Investors Investing in LiDocument3 pagesA Study On Perception of Investors Investing in Lirutujadikule718No ratings yet

- Asymmetric Information in Health Insurance: Evidence From The National Medical Expenditure SurveyDocument26 pagesAsymmetric Information in Health Insurance: Evidence From The National Medical Expenditure SurveyVamsi Pratap KNo ratings yet

- Demand Analysis For Life Insurance in India: Some Empirical ObservationsDocument11 pagesDemand Analysis For Life Insurance in India: Some Empirical ObservationsImam AshrafNo ratings yet

- Things Not Included in Updtd ResDocument2 pagesThings Not Included in Updtd ResRakesh YadavNo ratings yet

- Research 1Document90 pagesResearch 1Eugenie DimagibaNo ratings yet

- A Study of Factors Influencing Consumer Choice ofDocument12 pagesA Study of Factors Influencing Consumer Choice ofgraphixstudio77No ratings yet

- P304 311 PDFDocument8 pagesP304 311 PDFJadwani IndustriesNo ratings yet

- Cognition and Wealth: The Importance of Probabilistic ThinkingDocument45 pagesCognition and Wealth: The Importance of Probabilistic ThinkingJohn TurnerNo ratings yet

- Economic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesDocument52 pagesEconomic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesAchmad McFauzanNo ratings yet

- Blackbook - Project - On - Consumer - Perception - About - Life - Insurance - Policies - Roll No 10Document97 pagesBlackbook - Project - On - Consumer - Perception - About - Life - Insurance - Policies - Roll No 10Niyati Sandis100% (1)

- A Study On Factors Influencing of Women Policyholder's Investment Decision Towards Life Insurance Corporation of India Policies in ChennaiDocument6 pagesA Study On Factors Influencing of Women Policyholder's Investment Decision Towards Life Insurance Corporation of India Policies in ChennaiarcherselevatorsNo ratings yet

- Life Insurance ThesisDocument6 pagesLife Insurance Thesisdnnpkqzw100% (2)

- Factors Influencing People's Purchasing of Life InsuranceDocument5 pagesFactors Influencing People's Purchasing of Life InsuranceAbdullah Hill NahianNo ratings yet

- L ReviewDocument18 pagesL ReviewMia SmithNo ratings yet

- Consumers' Insurance Literacy: Literature Review, Conceptual Definition, and Approach For A Measurement InstrumentDocument18 pagesConsumers' Insurance Literacy: Literature Review, Conceptual Definition, and Approach For A Measurement InstrumentKrutika sutarNo ratings yet

- "The Factors Affecting Consumer Buying Decision On Insurance" A. Background of The StudyDocument9 pages"The Factors Affecting Consumer Buying Decision On Insurance" A. Background of The StudyAlice StarNo ratings yet

- Nagpur - City PDFDocument4 pagesNagpur - City PDFRohan VidhateNo ratings yet

- Actitud AseguradorDocument19 pagesActitud AseguradorNicolás Martínez RamosNo ratings yet

- Health InsuranceDocument8 pagesHealth Insurancesuhitaa sridharNo ratings yet

- Competition, Regulation, and the Public Interest in Nonlife InsuranceFrom EverandCompetition, Regulation, and the Public Interest in Nonlife InsuranceNo ratings yet

- American Healthcare & the Consumer Experience: Four ScenariosFrom EverandAmerican Healthcare & the Consumer Experience: Four ScenariosNo ratings yet

- MSI Reproductive Choices Medical Officer Social Media and Contact Center 9th May 2022Document2 pagesMSI Reproductive Choices Medical Officer Social Media and Contact Center 9th May 2022Htet Lynn HtunNo ratings yet

- Vacancy Announcement (/2021 Advertisement) - Reannouncement!Document7 pagesVacancy Announcement (/2021 Advertisement) - Reannouncement!Htet Lynn HtunNo ratings yet

- AVE HE Hildren International Vacancy Announcement: For Myanmar National OnlyDocument4 pagesAVE HE Hildren International Vacancy Announcement: For Myanmar National OnlyHtet Lynn HtunNo ratings yet

- Medical Doctor: Première Urgence Internationale (PUI)Document3 pagesMedical Doctor: Première Urgence Internationale (PUI)Htet Lynn HtunNo ratings yet

- 2071 Solvency Margin Directive For Non Life Insurer 1Document9 pages2071 Solvency Margin Directive For Non Life Insurer 1Htet Lynn HtunNo ratings yet

- Myanmar Red Cross Society: HR-Field VA No. 003.01 - Medical DoctorDocument6 pagesMyanmar Red Cross Society: HR-Field VA No. 003.01 - Medical DoctorHtet Lynn HtunNo ratings yet

- Vacancy Announcement (61/2022 Advertisement)Document3 pagesVacancy Announcement (61/2022 Advertisement)Htet Lynn HtunNo ratings yet

- Dosage Chart For Treatment of P.vivax MalariaDocument1 pageDosage Chart For Treatment of P.vivax MalariaHtet Lynn HtunNo ratings yet

- Agency Management System in A Malaysia Life Insurance CompanyDocument24 pagesAgency Management System in A Malaysia Life Insurance CompanyHtet Lynn HtunNo ratings yet

- Use of Medical Big Data To Enhance Life Insurance Business: Takahide Shinge Yuji Kamata Takanobu Osaki Hirofumi KondoDocument6 pagesUse of Medical Big Data To Enhance Life Insurance Business: Takahide Shinge Yuji Kamata Takanobu Osaki Hirofumi KondoHtet Lynn HtunNo ratings yet

- 300 Years of Data AnalyticsDocument18 pages300 Years of Data AnalyticsHtet Lynn HtunNo ratings yet

- The Analytical Life Insurer: Profitable Analytic Strategies For Life and Annuity CarriersDocument12 pagesThe Analytical Life Insurer: Profitable Analytic Strategies For Life and Annuity CarriersHtet Lynn HtunNo ratings yet

- Statistical Compilation of Annual Statement Information For Health Insurance Companies in 2018Document181 pagesStatistical Compilation of Annual Statement Information For Health Insurance Companies in 2018Htet Lynn HtunNo ratings yet

- ISSA - Prevention of Occupational Risk in Health ServiceDocument21 pagesISSA - Prevention of Occupational Risk in Health ServiceHtet Lynn HtunNo ratings yet

- Myanmar Okkar Thiri CRRDocument24 pagesMyanmar Okkar Thiri CRRHtet Lynn HtunNo ratings yet

- Research in Life InsuranceDocument6 pagesResearch in Life InsuranceHtet Lynn HtunNo ratings yet

- Research and Development Activities of Life Insurance CompaniesDocument15 pagesResearch and Development Activities of Life Insurance CompaniesHtet Lynn HtunNo ratings yet

- Lic Edms RFPDocument124 pagesLic Edms RFPHtet Lynn HtunNo ratings yet

- SwissRe Life Risk Selection 2011Document41 pagesSwissRe Life Risk Selection 2011Htet Lynn HtunNo ratings yet

- Statistical Methods and Applications in Insurance and Finance - CIMPA School, Marrakech and El Kelaa M'gouna, Morocco, April 2013 (PDFDrive)Document228 pagesStatistical Methods and Applications in Insurance and Finance - CIMPA School, Marrakech and El Kelaa M'gouna, Morocco, April 2013 (PDFDrive)Htet Lynn HtunNo ratings yet

- Third Party Liability Law - PADocument4 pagesThird Party Liability Law - PAHtet Lynn HtunNo ratings yet

- Quick Survey - Data AnalysisDocument2 pagesQuick Survey - Data AnalysisHtet Lynn HtunNo ratings yet

- Health Insurance in Myanmar The Views and PerceptiDocument14 pagesHealth Insurance in Myanmar The Views and PerceptiHtet Lynn HtunNo ratings yet

- Research 2011 Medical MarkersDocument93 pagesResearch 2011 Medical MarkersHtet Lynn HtunNo ratings yet

- Life Insurance Illustrations Practice Note Feb 2018Document113 pagesLife Insurance Illustrations Practice Note Feb 2018Htet Lynn HtunNo ratings yet

- Description of Statistical ReportsDocument4 pagesDescription of Statistical ReportsHtet Lynn HtunNo ratings yet

- The Determinants of Life Insurance Demand in UkraineDocument56 pagesThe Determinants of Life Insurance Demand in UkraineHtet Lynn HtunNo ratings yet

- Data-Driven Pricing: Opportunities in The Non-Life Insurance MarketDocument4 pagesData-Driven Pricing: Opportunities in The Non-Life Insurance MarketHtet Lynn HtunNo ratings yet

- Basics of InsuranceDocument20 pagesBasics of InsuranceSunny RajNo ratings yet

- Analysis of Consumer Behavior and Decision-Making Variables About Life Insurance PoliciesDocument9 pagesAnalysis of Consumer Behavior and Decision-Making Variables About Life Insurance PoliciesPriyanka AggarwalNo ratings yet

- Insurance Midterms ReviewerDocument7 pagesInsurance Midterms ReviewerangelicaNo ratings yet

- Ilovepdf Merged 4Document223 pagesIlovepdf Merged 4Dani ShaNo ratings yet

- BPI Vs POsadasDocument1 pageBPI Vs POsadasEmjie KingNo ratings yet

- State Life InsuranceDocument79 pagesState Life Insuranceqadirqadil100% (2)

- Pakistan Ordinance of Zakat and UshrDocument43 pagesPakistan Ordinance of Zakat and UshrSyed Asghar AliNo ratings yet

- Reliance General Vs ShashiDocument13 pagesReliance General Vs ShashiDSB 444No ratings yet

- GSAA Home Equity Trust 2005-15, Tranche 2A3 Sold To Govt As Part of Maiden Lane IIDocument79 pagesGSAA Home Equity Trust 2005-15, Tranche 2A3 Sold To Govt As Part of Maiden Lane IITim Bryant100% (1)

- Claim Settlement (SecsDocument13 pagesClaim Settlement (SecsAlexPamintuanAbitanNo ratings yet

- Annexure - Additional - Withdrawal - Details 3.0Document2 pagesAnnexure - Additional - Withdrawal - Details 3.0Vinod NairNo ratings yet

- A Project Report On AN Impact OF Celebrity Endorsement in InsuranceDocument29 pagesA Project Report On AN Impact OF Celebrity Endorsement in Insurancemegha mishraNo ratings yet

- Revised Insurance Act 2015 of Laws o Kenya PDFDocument350 pagesRevised Insurance Act 2015 of Laws o Kenya PDFsaNo ratings yet

- Financial Statement Analysis of TCS and INFOSYSDocument43 pagesFinancial Statement Analysis of TCS and INFOSYSRitwik Subudhi100% (1)

- IALM - Mortality Tables (2006-08) UltDocument7 pagesIALM - Mortality Tables (2006-08) UltSimran SachdevaNo ratings yet

- The Gazette of India Extraordinary Part Iii - Section 4.: Insurance Regulatory and Development Authority, New DelhiDocument33 pagesThe Gazette of India Extraordinary Part Iii - Section 4.: Insurance Regulatory and Development Authority, New DelhiAanchal AggarwalNo ratings yet

- Annuitypricing PDFDocument144 pagesAnnuitypricing PDFmirando93No ratings yet

- Sample Parenting Agreement Between Mother and Father Who Are Both Biological ParentsDocument7 pagesSample Parenting Agreement Between Mother and Father Who Are Both Biological ParentsyotatNo ratings yet

- A Comparative Study and Analysis of Unit Linked: Insurance Plans (Ulips) - An Idbi Fortis PerspectiveDocument81 pagesA Comparative Study and Analysis of Unit Linked: Insurance Plans (Ulips) - An Idbi Fortis PerspectiveDIWAKAR SHARMANo ratings yet

- Income Tax Deductions.Document22 pagesIncome Tax Deductions.Dhruv BrahmbhattNo ratings yet

- Kotak E-Term PlanDocument9 pagesKotak E-Term Planriya sethNo ratings yet

- Customer Relationship Management in Reliance Life InsuranceDocument93 pagesCustomer Relationship Management in Reliance Life InsuranceSuresh Babu Reddy50% (2)

- RA 8291 GSIS ActDocument19 pagesRA 8291 GSIS ActAicing Namingit-VelascoNo ratings yet

- Philippine Health Care V CIR G.R. No. 167330 September 18, 2009Document7 pagesPhilippine Health Care V CIR G.R. No. 167330 September 18, 2009Harry PeterNo ratings yet

- Iiz BrochureDocument2 pagesIiz BrochuremthokozisiNo ratings yet

- TAL Accelerated Protection PDSDocument44 pagesTAL Accelerated Protection PDSLife Insurance AustraliaNo ratings yet

- Case Study - RamDocument5 pagesCase Study - RamswathyNo ratings yet

- Insurance Law OutlineDocument8 pagesInsurance Law OutlineChe Poblete Cardenas100% (1)

- S&P Industry Surveys: Insurance - Life & HealthDocument42 pagesS&P Industry Surveys: Insurance - Life & Healthdell1888100% (1)

- Income Under The Head SalaryDocument56 pagesIncome Under The Head Salaryjyoti_yadavNo ratings yet

APJABSSv4i2July Dec18 - 86 99

APJABSSv4i2July Dec18 - 86 99

Uploaded by

Htet Lynn HtunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

APJABSSv4i2July Dec18 - 86 99

APJABSSv4i2July Dec18 - 86 99

Uploaded by

Htet Lynn HtunCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/327135901

DETERMINANTS OF LIFE INSURANCE DEMAND: EVIDENCES FROM INDIA

Article · August 2018

DOI: 10.25275/apjabssv4i2bus10

CITATIONS READS

3 2,742

1 author:

Ganesh Dash

Saudi Electronic University

26 PUBLICATIONS 40 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Marketing 4.0 View project

All content following this page was uploaded by Ganesh Dash on 21 August 2018.

The user has requested enhancement of the downloaded file.

DETERMINANTS OF LIFE INSURANCE DEMAND:

EVIDENCES FROM INDIA

Ganesh Dash

IM, JK Lakshmipat University, Jaipur, India

Corresponding Email: ganeshdash@hotmail.com

Abstract

Post- IRDA Indian life insurance sector has become highly competitive and innovative. Every

life insurer is trying to find out those demographic and socio-economic characteristics of the

potential customers responsible for influencing their decisions to buy a life insurance policy.

This study has discussed numerous variables associated with the customers such as: age,

gender, marital status, occupation, education, family size and annual income and their

impact on their buying behaviours. It also included residing locality, selling company and

annual premium amount (price) along with these variables. The study was conducted in

rural Odisha with a sample of more than 400 life insurance policy holders. To find out

significant variations and relationships among these different categories, one-way ANOVA

test and correlation analysis was applied. Further, factor analysis (EFA and CFA) and linear

multiple regression were used to find out significance. This study is going to help the life

insurers understand the various factors involved in influencing the prospective customers to

choose a policy.

Keywords: Demand, Demographic, Socio-Economic, Determinant, Indian, Life Insurance

1. Introduction

The marketers in life insurance business always have a question in their mind. Various

demographic and socio-economic relative indicators are responsible for the final purchase

decision. Numerous theoretical frameworks and models were developed to analyse the

demand for life insurance in the second half of 20th century. These earlier models developed

by the authors who believed life insurance as a solution to minimise the uncertainties in the

income patterns of a family when the head of the family dies. This school of thought had

Yaari (1965); Fischer (1973); Pissarides (1980); Lewis (1989); Bernheim (1991) as the

proponents. But, Lewis had a major difference from others by mentioning his objective of the

study as meeting the survivors’ needs, i.e. maximising the beneficiaries’ lifetime utility

(expected) whereas the others had believed in maximisation of the policy holder’s expected

lifetime utility. After formulating a model to explain the factors responsible for rise in

consumption of life insurance, he found that life insurance consumption increases with

increase in the probability of the death of insured. Further, if the insured survives the

stipulated term, then the current consumption value of all the survivors is positively

correlated with the life insurance consumption. Again, policy price and wealth of the

86

household affect the life insurance consumption adversely, whereas the household’s

willingness to avoid risk creates more demand for life insurance cover. Basically, the old

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

school1 had always considered premium payments as the measure of life insurance

consumption due to the easy availability of data and helpful in comparative analysis with

previous studies. But, the aggregate value of the policies is a better tool to assess the

consumption level; because it calculates the protection level if the insured dies within the

term of policy.

Various marketers have put forward their theories and models regarding to the determinants

of life insurance demand. This study tries to assess the same and to validate or to negate the

propositions. The same has been done with the help of an empirical data which can be

generalised with a very few assumptions. Ultimately, every marketer wants to enhance the

end product based on the specific determinants of the demand.

2. Review of Existing Studies

Hammond et al (1967) established through household survey that life insurance

consumption is hugely influenced by family life cycle, income, net worth, education standard

and respective occupations of the customers. Similarly, according to Mantis & Farmer

(1968), demand for life insurance is dependent on income, birth rate, population, policy

pricing and employment. Hammond et al (1967) and Lewis (1989) outlined the major cause

of buying a life insurance policy was to help the survivors with economic gains if the insured

dies before the end of the term stipulated. The number of dependents of the policy holder

positively influences the consumption of life insurance (Beenstock et al, 1986). But, few

studies, namely, Ferber & Lee (1980) and Goldsmith (1983) have found this relationship as

negative. Numerous studies have proved that income of the insured positively affects the

demand for life insurance. Hakansson (1969) and Campbell (1980) along with Lewis have

derived a positive correlation between income and life insurance purchasing decision. Duker

(1969) made a case for family with working wife. He found that working –wife families buy

less life insurance products than the families with house wives. He stressed on the need to

focus on the working- wife families. Age, family size and birth rate significantly influence the

customers to buy life insurance cover (Berekson, 1972). Cummins (1973) analysed the impact

of various macroeconomic factors on the life insurance sector of the USA. This study outlined

the various factors responsible for causing fluctuations in the demand for life insurance

products. The results of the study made a great contribution in understanding the demand

for a life insurance product better.

It was found that life insurance along with pension reserves (insured) are positively

correlated with Gross National Product and income (permanent). According to Fortune

(1973), income, net worth and the customer’s confidence influence the consumption of life

insurance. Customer emotions, savings and policy price play a major role in determining the

consumption level of life insurance (Headen & Lee, 1974). Normally, inflation has a negative

impact on the demand for life insurance due to loss of value of the investment (to some

extent) (Fortune, 1974). The amount of inflation expected by the customers is totally

dependent on the rate of inflation in the previous years (Choate & Archer, 1975). While

considering the time lag involved in purchase time and realisation time, inflation is a very

important factor influencing the customers to rethink about the purchasing decision.

Therefore, inflation plays a major role in creating demand for life insurance (Babbel, 1981).

Greene (1954) also found that insurance lacks protection against inflation. Similarly,

Neumann (1969) outlined that there is almost zero relationship between the expected prices

87

and life insurance consumption. But some studies have found a relationship between

Page

inflation and demand for life insurance. These studies included Hofflaner & Duvall (1967)

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

and Fortune (1972). Fortune has found a positive relationship between inflation and the

demand for life insurance. Anderson & Nevin (1975) made a survey of young married couples

and outlined that current income, expected income; husband’s education, net worth and the

wife’s income (pre-marriage) are the factors which decide the level of demand for life

insurance. Various traits of the customer affect his/ her decision to buy life insurance.

Psychological traits such as fatalism, socialising, religious beliefs, old work ethics and

assertiveness are responsible in fixing the demand level foe life insurance. Similarly,

demographic traits such as education, income and family size influence the customer to buy

a life insurance product. People moving frequently between places possess less number of

life insurance (Burnett & Palmer, 1984). Zeilzer (1979) believed that religion has created a

negative perception about life insurance since long time. Religious people, especially,

Catholics, Muslims and a few other sects oppose life insurance coverage, proposing that it is

an insult to the God’s power of protection. Religion and culture can affect a person’s

perception on risk aversion which results in less demand for life insurance (Douglas &

Wildavsky, 1982). Miller (1985) has found that working people have more number of policies

than retired people (same age) because of the employer’s cost-cutting operation and absence

of government’s recognition of life insurance coverage for retired employee. Higher interest

rates (more influential) and increased life expectancy (less influential) basically negatively

affect the life insurance demand (Williams, 1986).

Fitzerald (1987) categorised positive and negative determinants of life insurance

consumption. Positive determinants were husband’s future income (expected) and wife’s

income (expected). Similarly, a negative determinant was the benefits expected at the

husband’s survival of the stipulated term. Age, education and income positively influence the

demand for life insurance (Truett& Truett, 1990). Wealth has a huge positive influence on

the purchase of life insurance (Benheim, 1991).

It depends on a variety of factors to get in to a customer’s investment portfolio. Dependency

ratio, religion, income, social security, expected inflation rate, average life expectancy,

education and policy loading charges are the few factors which affect the demand for a life

insurance product (Browne & Kim, 1993). They put the relationship (both positive and

negative) of the factors in the following equation:

1og (Yi) =β0 + β1log (DEPi) + β2MUSi + β3log (INCi) + β41og (SSEi) + β51og (INFi) + β6 log

(EDUCi) + β71og (LEi) + β8 log (Pi) + ei,

where, Yi = life insurance per capita in country i, DEPi = dependency ratio in country i

(positive), INCi = income per capita in country I (positive) as a replacement for disposable

personal income for which the data is never available, SSEi = social security expenditures per

capita in country i (uncertain), INFi = expected inflation rate in country i (calculated average

of last eight years’ inflation rate) (negative), Pi = insurance loading charge in country i , i.e.

the policy price (negative), EDUCi = rate of third-level education in country i (positive), LEi

= Life expectancy in country i (the probability of death) (negative), MUSi = Classification

variable which takes the value of 1 if country i's population is predominantly Islamic and 0

otherwise (negative), and ei = the random error term.

Age, income, number of family member with income and family size have a positive

relationship between themselves where as there is a negative relationship between age and

88

demand for insurance, family size and insurance demand as well as income and number of

earners (Showers & Shotick, 1994). Hau (2000) noted that wealth and net worth influence

Page

the customers positively to buy life insurance whereas demographic variables have less

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

impact on the customer’s decision to buy a policy. Zietz (2003) went through an extensive

collection and review of literature to find the determinants of life insurance demand. He

reviewed almost every literature available that deal with life insurance demand in last fifty

years. Various demographic and economic factors responsible for affecting the demand for

life insurance as well as the environmental factors were discussed. Though there were

numerous studies conducted to find out the determinants of demand for life insurance, many

of them had conflicting results. The relationship between various factors life insurance

demand varied from study to study. In this study, an attempt was made to ascertain the

factors responsible for increase in demand for life insurance.

The proposed hypothesis based on global trends is given below:

Life Insurance Demand = ƒ {Income (+ve), Financial Development (+ve), Rate of Interest (of

alternate products) (-ve), Inflation (-ve), Education (+ve), Life Expectancy (+ve),

Urbanisation (+ve)}, which can also be expressed as:

L = ƒ [I+ F.D. - R.I. - INF. + L.E. + EDU. +URB.]

To test the hypothesis, the authors have taken data from the annual data series for the post-

IRDA period, i.e. from 1999 to 2008. After a thorough empirical analysis, they found that

among economic variables, income and financial development are the most positive and

important determinants of life insurance consumption in India. But, inflation was also found

to be important and positively correlated to demand negating the worldwide trend whereas

interest rate negatively influences the customers to buy life insurance. Among non-economic

factors, education was found to be the most important and positively correlated to life

insurance demand in India.

3. Objectives

The sole objective of this study was to find out the various demographic and socio-economic

factors (of the life insurance consumers) responsible for influencing their policy purchasing

decision. For this purpose, the various factors discussed in this study are outlined as: age,

gender, education, marital status, family size, income, occupation, choice of selling company

(public or private), annual premiums (price) and residing locality. The dependent factor was

established as the number of policy purchased by the customers (keeping the minimum

policy premium at Rupees Five Thousands per annum). Hence, the research question was

outlined as: Which demographic and socio-economic characteristics (of the customers)

influence the customers most in buying a life insurance policy?

4. Research Methodology

Research Design

For this study, the descriptive approach was adopted rather than experimental research

method because the theme of this study was on analysing the perception of the customers

regarding the given demographic and socio-economic variables with respect to their policy

buying behaviour which can be better assessed through descriptive research methods.

Organisation wise, LIC2 (1 public life insurer) and 4 private life insurers were included in this

study (not the sample size, see sample design). It also investigates the socio-economic status

and the life insurance policy buying behaviour of the targeted population in the study area.

Data Collection

This study was conducted in south Odisha (Eastern India) which is pre-dominantly rural in

89

nature. The data collection zone was limited to two districts of this region, namely, Ganjam

Page

and Gajapati. It consists of two towns with more than one hundred thousand populations

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

and rest of the area is semi-urban and rural. The data collection method was basically

primary on the basis of a sampling design consisting both convenient and quota sampling

strategies. The data collection period was between July and August of 2017. The required

information was obtained through a structured questionnaire (with personal presence)

containing all the above discussed variables derived from the review of literature.

Sample Design and Selection

The study area in question has three major branches of LIC and 11 major branches of the

private life insurers. The population is defined as follows: “customer” means people who

have bought a policy in the last quarter (3 months) and “executive” means people who have

sold a policy in the last quarter (3 months). It was found that more than 30,000 people have

bought life insurance policiees in the last quarter whereas more than 900 executives have

sold at least one policy. An item-respondent ratio of 1:6 was recommended by Hinkin (1995)

and Heir et al (2006) suggest a higher ratio of 1:5. Though, the ratio of 1:10 is a standard

accepted worldwide, an item:respondent ratio of more than 1:10 was adopted for this study.

Due to time constraint, the sample size for the customers was limited to 405. Out of the 14

branches, 6 branches were included in this study (LIC (2) and private (4)). Out of 405

customers, 201 belonged to LIC and 204 belonged to the private insurers take together.

5. Results and Discussions

The data collected were coded and datasheets for customers are prepared for analysis using

SPSS 18. For modelling, AMOS 18 was used. After getting the required data, various

statistical tools such as percentage, cross tabulation, mean and variance were applied to find

any variation among the different classes of customers (based on their demographic/ socio-

economic characteristics) with regard to their policy buying behaviour (the amount of

policies purchased by them). Further, to find out significant variation among these different

types of customers, one-way ANOVA was applied. Correlation analysis was also carried out

to analyse the relationship between a few demographic characteristics (with similar

categorisation- incremental) of the customers. Further, EFA & CFA were conducted to test

the multicollinearity found in correlation. With the help of AMOS, CFA was prepared along

with linear multiple regression.

ANOVA (one- way) Results

Table-1

One-Way ANOVA Analysis for Age-Wise Analysis of the Policy Holders

Age (Years)

Sign.

Less Than 35 35-50 Above 50 F-Value

Variable

N=237+3 N=153 N=12 Level

Mean S.D. Mean S.D. Mean S.D.

Number of Policy Purchased 1.303 .560 1.470 .726 1.583 .792 2.936 .033*

*significant at 5% level

Age: as it can be seen from the table -1, the number of policy purchased goes up with the

age. People try to buy more number of policies with the advanced age. Further, the resultant

90

F- value (ANOVA) proved that age has a significant impact on the customers’ life insurance

policy buying decision.

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

Gender: both male and female customers possess almost same number of policies (though

the female customers are slightly ahead). The following F- value proved this notion (see

table-2).

Table-2

One-Way ANOVA Analysis for Gender-Wise Analysis of the Policy

Holders

Variable Gender

Male Female F-Value

Sign. Level

N=265 N=140

Mean S.D. Mean S.D.

Number of Policy

1.358 .648 1.4 .620 .387 .534

Purchased

*significant at 5% level

Marital status: Further discussing about the impact of marriage on the policy purchasing

decision, it was found that marriage has almost no impact on this aspect, although married

people seemed to have slightly more number of policies than unmarried people. The

corresponding F- value justified the finding (see table-3).

Table-3

One-Way ANOVA Analysis for Marital Status-Wise Analysis of the Policy

Holders

Variable Marital Status

Married Unmarried F-Value

Sign. Level

N=280 N=125

Mean S.D. Mean S.D.

Number of Policy

1.378 .649 1.36 .614 .073 .787

Purchased

*significant at 5% level

Selling company: as it can be seen from the table-4, it was found that selling company has

almost no impact on the customers’ buying decision although customers of private insurers

seemed to possess more number of policies than those of LIC. This result was strengthened

by the following ANOVA test.

Table-4

One-Way ANOVA Analysis for Company-Wise Analysis of the Policy

Holders

Variable Company

LICI Private F-Value

Sign. Level

N=201 N=204

Mean S.D. Mean S.D.

Number of Policy

1.348 .669 1.397 .607 .591 .443

91

Purchased

*significant at 5% level

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

Locality: Again, discussing about the impact of residing locality (urban or rural) on the

policy purchasing decision of the customers, it was found that it has almost no impact on this

aspect although urban customers seemed to have bought more number of policies than rural

customers. The following F-value proved this notion (see table-5).

Table-5

One-Way ANOVA Analysis for Locality-Wise Analysis of the Policy

Holders

Variable Locality

Urban Rural F-Value

Sign. Level

N=163 N=242

Mean S.D. Mean S.D.

Number of Policy

1.411 .682 1.34 .607 .977 .324

Purchased

*significant at 5% level

Occupation: As seen in table- 6, that occupation has a significant impact on the customers’

buying decision. Government employees have much more number of policies followed by

the self-employed/ business category customers whereas private employees and the others

have fewer policies. To test these variations, one- way ANOVA test was carried out and it was

found that the difference was highly significant.

Table-6

One-Way ANOVA Analysis for Occupation-Wise Analysis of the Policy Holders

Occupation

Govt. Pvt. Employee Business/Self- Others Sign.

Variable

Employee

N=104 N=90 Employed

N=167 N=41 F-Value level

Mean S.D. Mean S.D. Mean S.D. Mean S.D.

Number

of Policy 1.865 .859 1.155 .394 1.251 .448 1.122 .399 35.288 .000**

Purchased

**significant at 1% level

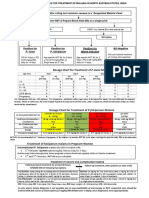

EFA & CFA

From the correlation table, it was found that educational qualifications, yearly premiums

paid and annual income are having a strong correlation among themselves. This is a case for

multi-collinearity. Hence, these variables can be put under a single factor. For the same, EFA

as well as CFA was conducted (Table-7 & Figure-1 respectively). First of all, KMO &

Bartlett’s Test of sphericity were measured which were found to be satisfactory. The rotated

factor matrix has proved the assumption of multi-collinearity between theses variables.

These three variables are grouped under Factor F1 whereas family size is another factor. The

same was confirmed by the CFA.

92

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

Table-7 EFA

KMO and Bartlett's Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. .707

Bartlett's Test of Sphericity Approx. Chi-Square 419.313

Df 6

Sig. .000

Rotated Component Matrixa

Component

1 2

EDUQLFN .714 -.153

FAMILYSIZE -.023 .987

YRLYPREM .868 .148

ANNINCOME .903 -.036

Figure-1 CFA

Regression

Furthermore, we have conducted a linear multiple regression between the number of policies

(depndent), F1 (independent) and Family Size (independent) (Table-8 & Figure-2

respectively). The model was found to be significant as seen form the ANOVA results.

Further, R2 was found to be 0.7 which is a good measure. Speaking of individual impact, F1

has a beta value of 0.64 which is significant whereas the impact of family size is not

significant and is also negligible. The same is depicted by the model developed in the

following figure.

Table-8

Regression

Std. Error

R Adjusted of the

Model R Square R Square Estimate

93

1 .837a .700 .696 .49341

ANOVAa

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

Model Sum of Squares Df Mean Square F Sig.

1 Regression 66.832 2 33.416 137.257 .000b

Residual 97.869 402 .243

Total 164.701 404

a. Dependent Variable: NOPOLICY

b. Predictors: (Constant), F1, FAMILYSIZE

Coefficientsa

Standardized

Unstandardized Coefficients Coefficients

Model B Std. Error Beta T Sig.

1 (Constant) -.002 .097 -.017 .987

.014 .015 .036 .942 .347

FAMILYSIZE

F1 .624 .038 .637 16.562 .000

a. Dependent Variable: NOPOLICY

Figure-2 Regression

After summarising the findings, the results needed to be discussed in detail. For this

purpose, the results of earlier studies (wherever available and/or applicable) were taken in to

consideration.Demand for life insurance is positively influenced by age, income and

education whereas price/ cost (premiums) negatively affects the demand. Type of occupation

also affects the demand for life insurance. But, gender, marital status, selling company,

locality and family size have no impact on the demand for life insurance product.

As the review of earlier literatures showed that these results differ from lot of studies’

findings, the factors responsible for creating demand for life insurance should be studied in

detail.This study has found that age has a positive relationship with life insurance demand

which is supported by Berekson (1972) and Truett& Truett (1990). But, Showers & Shotick

(1994) had found that age has a negative impact on life insurance demand. Browne & Kim

(1993) had found that age is insignificant for the demand of life insurance product. This

study has found that income positively influence the demand for life insurance. This finding

is generally supported by all the earlier studies reviewed in this study. All the researchers

mentioned in this study have found a positive relationship between income and the life

insurance demand. Yaari (1965); Hakansson (1969); Fischer (1973); Campbell (1980);

94

Beenstock et al (1986); Browne & Kim (1993); Outtreville (1996); Enz (2000) and Hwang &

Page

Greenford (2005) are a few authors who support this finding.

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

Now coming to level of education of the customers, the life insurance demand is positively

affected by this criterion. Beenstock et al (1986); Truett& Truett (1990); Outtreville (1996);

and Beck & Web (2003) have found the same relationship. But, Browne & Kim (1993) had

found that education is insignificant for life insurance demand.

Price, i.e. the premiums cost of the life insurance negatively influence the demand for life

insurance. This study has found that though the amount of premiums goes up with the

number of policies, (as sheer numerical relationship) the real demand goes down with more

amount of premiums asked by the life insurers. This finding is in line with the outcomes of

the studies done byBabble (1981), Beenstock et al (1986); Browne& Kim (1993) and Lim &

Hiberman (2004). But, two studies namely, Outtreville (1996) and Ward & Zurbruegg

(2002) had found a positive relationship between price and life insurance demand. But,

Hwang & Greenford (2005) say that price has no impact on life insurance demand.

Additionally, the Type of occupation has a positive impact on the life insurance demand. It

was found that government servants were buying more life insurance policies than others.

Hammond et al (1967); Mantis & Farmer (1968); Anderson & Nevin (1975) had and Miller

(1985) established a positive relationship between occupation/ employment and life

insurance demand.Gender has no influence on the demand for life insurance. There was no

mention about gender in any of the earlier studies. Similarly, marital status has no impact on

the demand for life insurance. Anderson & Nevin (1975) had mentioned about the positive

impact of marriage on life insurance demand. This study has found that the impact of family

size on life insurance demand as insignificant. But, almost the entire old school had

mentioned this criterion as the most important factor in creating life insurance demand.

Hammond et al (1967); Mantis & Farmer (1968); Berekson (1972); Beenstock et al (1986)

and Lewis (1989) had also supported this view. But, Ferber & Lee (1980) and Goldsmith

(1983) have found this relationship as negative.

This study has found that urbanisation (locality) has no impact on the demand for life

insurance. But, almost all studies had found that it has a positive effect on the life insurance

demand. Outtreville (1996); Beck & Web (2003) and Hwang & Greenford (2005) were

among this theory’s proponents.

Conclusion

After discussing about the various determinants of life insurance demand, the final

relationship between the life insurance demand and the variables discussed in this study can

be outlined as below:

Life Insurance Demand = ƒ {Age *(+), Gender (N), Marriage (N), Company (N), Locality

(N), Occupation** (+), Income** (+), Family Size (N), Education* (+), Price** (-)},

[Relationship signs can be read as: + = positive, – = negative, N= Neutral] (* means

significant at 5% and ** means significant at 1%)

Based on the findings, a few suggestions can be made. It was found that younger customers

possess less number of policies and therefore, life insurers should redesign their products

targeting this segment. As the life expectancy of this group is very high, survival/ maturity

benefits have to be given a thrust rather than post- death benefits. The policy tenure should

be curtailed to make it look like any other investment plans. In rural India, the average life

95

expectancy of a female is more than a male. Specific policies targeted at the female

Page

customers, especially single mothers and widows, should be encouraged to cater to this

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

population. Attractive plans and packages, particularly health related products should be

created to attract a huge market of single (both unmarried and widowers) male customers.

The Most important aspect of Indian life insurance sector is it is evenly divided between the

LIC and the private insurers as a whole. There is a wide- spread belief is that the private

companies are giving a tough fight to the LIC (leading now) in urban area, but leaving the

entire rural market to the public sector to monopolise. This scenario must be changed to

remove the gap between urban and rural markets as India is pre-dominantly rural.

Furthermore, compared to government employees, private employees and others are buying

less number of policies which demonstrates the life insurers are more interested in salaries

and guaranteed regular income groups who can pay the premiums regularly. This aspect can

be changed with more single-term plans to target the business/ self-employed groups.

Similarly, products with flexible premium payment options should be created to attract the

private employees. An ideal mix of medium to high net worth individuals with high income

levels (with more disposable income) should be targeted. Specific policies to augment their

wealth along with adequate risk coverage should be promoted. Similarly, people with lower

incomes should be given low premium flexible plans. Prospective customers who are highly

educated can be sold the policies by providing a rational and tangible reason to buy a life

insurance product. But, for customers with less/ no education, the front line executives have

to make an extra effort with the help of incentives and/ or discounts.

Policy pricing is another important factor to affect the prospective customers’ psyche to buy

a policy. The price level should be well within the affordability level of the customer.

Flexibility and convenience of terms of payment must be followed as per the requirements of

the potential customer. The life insurance companies must ensure that the price of the policy

should not exceed its worth as anticipated by the buyer. Again, a transparent comparison

with the price levels of similar policies provided by the rival companies should be made

before the prospective buyers. A clear and simple price structure should be provided by the

selling companies to the customer that can be understood easily by a lay man. Further,

discounts and incentives should be included in the pricing structure in order to attract

buyers. Though the present situation is unstable and turbulent due the recessional effect felt

world-wide, the overall scenario for the Indian life insurance sector seems very rosy aided by

the fact that the life insurance penetration rate remains very low, as well as the huge

potential of the rural sector which still remains untapped.

96

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

References

i. Anderson, D. R. and Nevin, J. R., 1975. Determinants of Young Marrieds’ Life Insurance

Purchasing Behavior: An Empirical Investigation. Journal of Risk and Insurance, Volume 42, pp.

375- 387.

ii. Babbel, D. F., 1981. Inflation, Indexation and Life Insurance Sales in Brazil. Journal of Risk and

Insurance, Volume 48, pp. 115-135.

iii. Beck T. and Webb I., 2003. Economic, Demographic and Institutional Determinants of Life

Insurance Consumption across Countries, Working Paper.s.l.: World Bank And International

Insurance Foundation.

iv. Beenstock M., Dickinson G. and Khajuria S.,1988. The Relationship Between Property- Liability

Insurance Premiums And Income: An International Analysis. The Journal of Risk and

Insurance, 55 (2), pp. 259-272

v. Berekson, L. L., 1972. Birth Order, Anxiety, Affiliation and the Purchase of Life Insurance.

Journal of Risk and Insurance, Volume 39, pp. 93-108.

vi. Bernheim, B. Douglas, 1991. How Strong Are Bequest Motives? Evidence Based on Estimates of

the Demand for Life Insurance and Annuities. Journal of Political Economy, Volume 99, pp.

899-927.

vii. Browne, Mark J. and Kim, Kihong, 1993. An International Analysis of Life Insurance Demand.

The Journal of Risk and Insurance, 60 (4), pp. 616-634.

viii. Burnett, J. J., and Palmer, B. A., 1984. Examining Life Insurance Ownership Through

Demographic and Psychographic Characteristics. Journal of Risk and Insurance, Volume 51, pp.

453- 467.

ix. Campbell, R. A., 1980. The Demand for Life Insurance: An Application of the Economics of

Uncertainty. Journal of Finance, Volume 35, pp. 1155-1172.

x. Choate, C. M. and Archer, S., 1975. Irving Fisher, Inflation and the Nominal Rate of Interest.

Journal of Financial and Quantitative Analysis, Volume 4, pp. 675-685.

xi. Cummins, J. David, 1973. An Econometric Model of the Life Insurance Sector of the U.S.

Economy. Journal of Risk and Insurance, Volume 40, pp. 533-554.

xii. Douglas, Mary and Wildavsky, Aaron, 1982.Risk and Culture. Berkeley: University of California

Press.

xiii. Duker, J. M., 1969. Expenditures for Life Insurance Among Working-Wife Families. Journal of

Risk and Insurance, Volume 36, pp. 525-533.

xiv. Enz R., 2000. The S-Curve Relation Between Per Capita Income and Insurance Penetration. The

Geneva Papers On Risk And Insurance: Issues And Practice, 25 (3), pp. 393-406.

xv. Ferber, Robert and Lee, Lucy Chao, 1980. Acquisition and Accumulation of Life Insurance in

Early Married Life. Journal of Risk and Insurance, Volume 47, pp. 713-729.

xvi. Fischer, Stanley, 1973. A Life Cycle Model of Life Insurance Purchases, International Economic

Review, Volume 14, pp. 132-152.

xvii. Fitzgerald, J., 1987. The Effects of Social Security on Life Insurance Demand by Married Couples.

Journal of Risk and Insurance, Volume 54, pp. 86-99.

xviii. Fortune, P., 1972. Inflation and Saving Through Life Insurance: Comment. Journal of Risk and

Insurance, Volume 39, pp. 317-326.

xix. Fortune, P., 1973. A Theory of Optimal Life Insurance: Development and Test, Journal of

Finance, Volume 27, pp. 587-600.

97

xx. Goldsmith, Art, 1983. Household Life Cycle Protection: Human Capital versus Life Insurance.

Page

Journal of Risk and Insurance, Volume 50, pp. 33-44.

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

xxi. Greene, M. R., 1954. Life Insurance Buying in Inflation. Journal of the American Association of

University Teachers of Insurance, Volume 21, pp. 99-113.

xxii. Hakansson, N. H., 1969. Optimal Investment and Consumption Strategies Under Risk, and

Uncertain Lifetime and Insurance. International Economic Review, Volume 10, pp. 443-466.

xxiii. Hammond, J. D., Houston, David B. and Melander, Eugene R., 1967. Determinants of Household

Life Insurance Premium Expenditure: An Empirical Investigation. Journal of Risk and

Insurance, Volume 34, pp. 397-408.

xxiv. Hau, A., 2000. Liquidity, Estate Liquidation, Charitable Motives, and Life Insurance Demand by

Retired Singles. Journal of Risk and Insurance, Volume 67, pp. 123-141.

xxv. Headen, R. S., and Lee, J. F., 1974. Life Insurance Demand and Household Portfolio Behavior.

Journal of Risk and Insurance, Volume 41, pp. 685-698.

xxvi. Heir, Anderson, Tatham & Black, 2006.Multivariate Data Analysis. New Delhi: Pearson

Education.

xxvii. Hinkin, T. R., 1995. A review of scale development practices in the study of organizations.

Journal of Management, 21(5), pp. 967-988.

xxviii. Hofflander, A. E., and Duvall, R. M., 1967. Inflation and the Sales of Life Insurance, Journal of

Risk and Insurance, Volume 34, pp. 355-361.

xxix. Hwang T. And Greenford B., 2005. A Cross-Section Analysis of the Determinants of Life

Insurance Consumption in Mainland China, Hong Kong and Taiwan. Risk Management And

Insurance Review, 8 (1), pp. 103-125.

xxx. Lewis, Frank D.,1989. Dependents and the Demand for Life Insurance, American Economic

Review, Volume 79, pp. 452-466.

xxxi. Lim C.C. and Haberman S., 2004.Modelling Life Insurance Demand from a Macroeconomic

Perspective: The Malaysian Case. Rome: Paper Presented at The 8th International Congress of

Insurance.

xxxii. Mantis, G., and Farmer, R., 1968. Demand for Life Insurance. Journal of Risk and Insurance,

Volume 35, pp. 247-256.

xxxiii. Miller, M. A., 1985. Age-Related Reductions in Workers’ Life Insurance. Monthly Labor Review

Volume 9, pp. 29-34.

xxxiv. Neumann, S., 1969. Inflation and Saving Through Life Insurance. Journal of Risk and Insurance,

Volume 36, pp. 567-582.

xxxv. Outtreville J.F., 1996. Life Insurance Markets in Developing Countries. The Journal of Risk and

Insurance, 63 (2), pp. 263-278.

xxxvi. Pissarides, C. A.,1980. The Wealth-Age Relation with Life Insurance. Economica, Volume 47, pp.

451-457.

xxxvii. Showers, V. E., and Shotick J. A., 1994. The Effects of Household Characteristics on Demand for

Insurance: A Tobit Analysis. Journal of Risk and Insurance, Volume 61, pp. 492- 502.

xxxviii. Truett, D. B., and Truett, L. J., 1990. The Demand for Life Insurance in Mexico and the United

States: A Comparative Study. Journal of Risk and Insurance, Volume 57, pp. 321-328.

xxxix. Ward, D. And Zubruegg, R., 2002. Law, Politics and Life Insurance Consumption in Asia. The

Geneva Papers On Risk And Insurance: Issues And Practice, Volume 27, pp. 395-412.

xl. Williams, A., 1986. Higher Interest Rates, Longer Lifetimes, and the Demand for Life Annuities.

Journal of Risk and Insurance, Volume 53, pp. 164-171.

xli. Yaari, Menahem E., 1965. Uncertain Lifetime, Life Insurance, and the Theory of the Consumer.

98

Review of Economic Studies, Volume 32, pp. 137-150.

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

xlii. Zelizer, Vivan R., 1979.Morals and Markets: The Development of Life Insurance in the United

States. New York: Columbia University Press.

xliii. Zietz, Emily Norman, 2003.An Examination of the Demand for Life Insurance. Risk

Management and Insurance Review, 6 (2), pp. 159-191.

99

Page

Asia Pacific Institute of Advanced Research (APIAR) DOI : 10.25275/apjabssv4i2bus10

View publication stats

You might also like

- Blackbook Project On Consumer Perception About Life Insurance PoliciesDocument80 pagesBlackbook Project On Consumer Perception About Life Insurance PoliciesMohit Kumar89% (28)

- IISTE Journal Publication May 2012 PDFDocument13 pagesIISTE Journal Publication May 2012 PDFDyenNo ratings yet

- Factors of Life Insurance at Household Level: A Case Study HTTPDocument14 pagesFactors of Life Insurance at Household Level: A Case Study HTTPijire publicationNo ratings yet

- The Demand For Insurance in United StatesDocument26 pagesThe Demand For Insurance in United StatesOwen OuyangNo ratings yet

- An Empirical Study On The Buying Motives of An Insurance Policy Holder and The Impact of Demography On The Insurance Buying Decision ProcessDocument12 pagesAn Empirical Study On The Buying Motives of An Insurance Policy Holder and The Impact of Demography On The Insurance Buying Decision ProcessSugan PragasamNo ratings yet

- Study of Factors Influencing Consumer Perception Towards Health Insurance Policies During COVID-19 PandemicDocument7 pagesStudy of Factors Influencing Consumer Perception Towards Health Insurance Policies During COVID-19 PandemicRAVI SONKARNo ratings yet

- Consumer BehaviourDocument5 pagesConsumer BehaviourClick PickNo ratings yet

- 06 Chapter 3Document8 pages06 Chapter 3Mohit BhatiaNo ratings yet

- Chapter 2Document16 pagesChapter 2Devi Bala JNo ratings yet

- Determinants of Demand For Life Insurance: The Case of CanadaDocument22 pagesDeterminants of Demand For Life Insurance: The Case of CanadaHtet Lynn HtunNo ratings yet

- Mitul Bhola Research Proposal 2019Document13 pagesMitul Bhola Research Proposal 2019Yajas BholaNo ratings yet

- Why Should One Invest in A Life Insurance Product? An Empirical StudyDocument10 pagesWhy Should One Invest in A Life Insurance Product? An Empirical StudyAtaye Waris KhanNo ratings yet

- Campbell 1980: Cagayan State University College of Business Entrepreneurship and AccountancyDocument8 pagesCampbell 1980: Cagayan State University College of Business Entrepreneurship and AccountancyJelly Mea VillenaNo ratings yet

- Factors Affecting Demand of Life Insurance in Developing CountriesDocument25 pagesFactors Affecting Demand of Life Insurance in Developing CountriesalizaNo ratings yet

- 04 PDFDocument8 pages04 PDFSurbhi AgrawalNo ratings yet

- Business Research MethodologyDocument34 pagesBusiness Research MethodologyDivine Truth Life MinistryNo ratings yet

- PROJECTDocument52 pagesPROJECTAghilaNo ratings yet

- Consumer Involvement and Perceived RiskDocument11 pagesConsumer Involvement and Perceived RiskSameer Singh FPM Student, Jaipuria LucknowNo ratings yet

- Effects of Household Characteristics On Demand For InsuranceDocument12 pagesEffects of Household Characteristics On Demand For InsuranceÂn NguyễnNo ratings yet

- Ijcs 1268111Document28 pagesIjcs 1268111rizalyncabahugNo ratings yet

- Dhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDocument14 pagesDhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDhrupit DNo ratings yet

- A E D L I: ErspectivesDocument33 pagesA E D L I: ErspectivesPreda AnaNo ratings yet

- Customers Perception For Taking Life Insurance: A Critical Analysis of Life Insurance Sector in Virudhunagar District Mrs.S.Jeyalakshmi & Dr.V.KanagavelDocument7 pagesCustomers Perception For Taking Life Insurance: A Critical Analysis of Life Insurance Sector in Virudhunagar District Mrs.S.Jeyalakshmi & Dr.V.KanagavelPARTH PATELNo ratings yet

- Thesis Insurance CompanyDocument6 pagesThesis Insurance Companypuzinasymyf3100% (1)

- 2013 ICERwp11 13Document31 pages2013 ICERwp11 13Enver MzadeNo ratings yet

- Dhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDocument15 pagesDhrupit - Factors - Influencing - Consumer - Buying - Life Insurance - ProductsDhrupit DNo ratings yet

- Nataniel,+A5 Violeta+Paper Vol.+7+ (DEC,+No.+2) ,+2020Document24 pagesNataniel,+A5 Violeta+Paper Vol.+7+ (DEC,+No.+2) ,+2020vjpyeojdgwkvqgasioNo ratings yet

- 157 379 1 PB PDFDocument7 pages157 379 1 PB PDFVishal YadavNo ratings yet

- Review On Life InsuranceDocument37 pagesReview On Life Insuranceradhika jagtapNo ratings yet

- Shradha Ins.Document48 pagesShradha Ins.yesh cyberNo ratings yet

- Chapter-Ii Review of Literature and Research MethodologyDocument30 pagesChapter-Ii Review of Literature and Research MethodologyRidhima KatiyarNo ratings yet

- Initial Pages Black BookDocument95 pagesInitial Pages Black Bookmehul guptaNo ratings yet

- A Study On Demographic Factors Influencing Purchasing Decision of Life Insurance PolicyDocument11 pagesA Study On Demographic Factors Influencing Purchasing Decision of Life Insurance PolicyAbhijit BoraNo ratings yet

- Shotick 2014Document5 pagesShotick 2014Zorobabel AzondogaNo ratings yet

- 9297-Article Text-18221-1-10-20210714Document8 pages9297-Article Text-18221-1-10-20210714Gunjan sharmaNo ratings yet

- An Analysis of The Quality of Online Calculators in Calculating Life Insurance RecommendationsDocument12 pagesAn Analysis of The Quality of Online Calculators in Calculating Life Insurance RecommendationsRuby KhanNo ratings yet

- Life InsuranceDocument11 pagesLife InsuranceHarsh ChouhanNo ratings yet

- A Study On Perception of Investors Investing in LiDocument3 pagesA Study On Perception of Investors Investing in Lirutujadikule718No ratings yet

- Asymmetric Information in Health Insurance: Evidence From The National Medical Expenditure SurveyDocument26 pagesAsymmetric Information in Health Insurance: Evidence From The National Medical Expenditure SurveyVamsi Pratap KNo ratings yet

- Demand Analysis For Life Insurance in India: Some Empirical ObservationsDocument11 pagesDemand Analysis For Life Insurance in India: Some Empirical ObservationsImam AshrafNo ratings yet

- Things Not Included in Updtd ResDocument2 pagesThings Not Included in Updtd ResRakesh YadavNo ratings yet

- Research 1Document90 pagesResearch 1Eugenie DimagibaNo ratings yet

- A Study of Factors Influencing Consumer Choice ofDocument12 pagesA Study of Factors Influencing Consumer Choice ofgraphixstudio77No ratings yet

- P304 311 PDFDocument8 pagesP304 311 PDFJadwani IndustriesNo ratings yet

- Cognition and Wealth: The Importance of Probabilistic ThinkingDocument45 pagesCognition and Wealth: The Importance of Probabilistic ThinkingJohn TurnerNo ratings yet

- Economic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesDocument52 pagesEconomic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesAchmad McFauzanNo ratings yet

- Blackbook - Project - On - Consumer - Perception - About - Life - Insurance - Policies - Roll No 10Document97 pagesBlackbook - Project - On - Consumer - Perception - About - Life - Insurance - Policies - Roll No 10Niyati Sandis100% (1)

- A Study On Factors Influencing of Women Policyholder's Investment Decision Towards Life Insurance Corporation of India Policies in ChennaiDocument6 pagesA Study On Factors Influencing of Women Policyholder's Investment Decision Towards Life Insurance Corporation of India Policies in ChennaiarcherselevatorsNo ratings yet

- Life Insurance ThesisDocument6 pagesLife Insurance Thesisdnnpkqzw100% (2)

- Factors Influencing People's Purchasing of Life InsuranceDocument5 pagesFactors Influencing People's Purchasing of Life InsuranceAbdullah Hill NahianNo ratings yet

- L ReviewDocument18 pagesL ReviewMia SmithNo ratings yet

- Consumers' Insurance Literacy: Literature Review, Conceptual Definition, and Approach For A Measurement InstrumentDocument18 pagesConsumers' Insurance Literacy: Literature Review, Conceptual Definition, and Approach For A Measurement InstrumentKrutika sutarNo ratings yet

- "The Factors Affecting Consumer Buying Decision On Insurance" A. Background of The StudyDocument9 pages"The Factors Affecting Consumer Buying Decision On Insurance" A. Background of The StudyAlice StarNo ratings yet

- Nagpur - City PDFDocument4 pagesNagpur - City PDFRohan VidhateNo ratings yet

- Actitud AseguradorDocument19 pagesActitud AseguradorNicolás Martínez RamosNo ratings yet

- Health InsuranceDocument8 pagesHealth Insurancesuhitaa sridharNo ratings yet

- Competition, Regulation, and the Public Interest in Nonlife InsuranceFrom EverandCompetition, Regulation, and the Public Interest in Nonlife InsuranceNo ratings yet

- American Healthcare & the Consumer Experience: Four ScenariosFrom EverandAmerican Healthcare & the Consumer Experience: Four ScenariosNo ratings yet

- MSI Reproductive Choices Medical Officer Social Media and Contact Center 9th May 2022Document2 pagesMSI Reproductive Choices Medical Officer Social Media and Contact Center 9th May 2022Htet Lynn HtunNo ratings yet

- Vacancy Announcement (/2021 Advertisement) - Reannouncement!Document7 pagesVacancy Announcement (/2021 Advertisement) - Reannouncement!Htet Lynn HtunNo ratings yet

- AVE HE Hildren International Vacancy Announcement: For Myanmar National OnlyDocument4 pagesAVE HE Hildren International Vacancy Announcement: For Myanmar National OnlyHtet Lynn HtunNo ratings yet

- Medical Doctor: Première Urgence Internationale (PUI)Document3 pagesMedical Doctor: Première Urgence Internationale (PUI)Htet Lynn HtunNo ratings yet

- 2071 Solvency Margin Directive For Non Life Insurer 1Document9 pages2071 Solvency Margin Directive For Non Life Insurer 1Htet Lynn HtunNo ratings yet

- Myanmar Red Cross Society: HR-Field VA No. 003.01 - Medical DoctorDocument6 pagesMyanmar Red Cross Society: HR-Field VA No. 003.01 - Medical DoctorHtet Lynn HtunNo ratings yet

- Vacancy Announcement (61/2022 Advertisement)Document3 pagesVacancy Announcement (61/2022 Advertisement)Htet Lynn HtunNo ratings yet

- Dosage Chart For Treatment of P.vivax MalariaDocument1 pageDosage Chart For Treatment of P.vivax MalariaHtet Lynn HtunNo ratings yet

- Agency Management System in A Malaysia Life Insurance CompanyDocument24 pagesAgency Management System in A Malaysia Life Insurance CompanyHtet Lynn HtunNo ratings yet

- Use of Medical Big Data To Enhance Life Insurance Business: Takahide Shinge Yuji Kamata Takanobu Osaki Hirofumi KondoDocument6 pagesUse of Medical Big Data To Enhance Life Insurance Business: Takahide Shinge Yuji Kamata Takanobu Osaki Hirofumi KondoHtet Lynn HtunNo ratings yet

- 300 Years of Data AnalyticsDocument18 pages300 Years of Data AnalyticsHtet Lynn HtunNo ratings yet

- The Analytical Life Insurer: Profitable Analytic Strategies For Life and Annuity CarriersDocument12 pagesThe Analytical Life Insurer: Profitable Analytic Strategies For Life and Annuity CarriersHtet Lynn HtunNo ratings yet

- Statistical Compilation of Annual Statement Information For Health Insurance Companies in 2018Document181 pagesStatistical Compilation of Annual Statement Information For Health Insurance Companies in 2018Htet Lynn HtunNo ratings yet

- ISSA - Prevention of Occupational Risk in Health ServiceDocument21 pagesISSA - Prevention of Occupational Risk in Health ServiceHtet Lynn HtunNo ratings yet

- Myanmar Okkar Thiri CRRDocument24 pagesMyanmar Okkar Thiri CRRHtet Lynn HtunNo ratings yet

- Research in Life InsuranceDocument6 pagesResearch in Life InsuranceHtet Lynn HtunNo ratings yet

- Research and Development Activities of Life Insurance CompaniesDocument15 pagesResearch and Development Activities of Life Insurance CompaniesHtet Lynn HtunNo ratings yet

- Lic Edms RFPDocument124 pagesLic Edms RFPHtet Lynn HtunNo ratings yet

- SwissRe Life Risk Selection 2011Document41 pagesSwissRe Life Risk Selection 2011Htet Lynn HtunNo ratings yet

- Statistical Methods and Applications in Insurance and Finance - CIMPA School, Marrakech and El Kelaa M'gouna, Morocco, April 2013 (PDFDrive)Document228 pagesStatistical Methods and Applications in Insurance and Finance - CIMPA School, Marrakech and El Kelaa M'gouna, Morocco, April 2013 (PDFDrive)Htet Lynn HtunNo ratings yet

- Third Party Liability Law - PADocument4 pagesThird Party Liability Law - PAHtet Lynn HtunNo ratings yet

- Quick Survey - Data AnalysisDocument2 pagesQuick Survey - Data AnalysisHtet Lynn HtunNo ratings yet

- Health Insurance in Myanmar The Views and PerceptiDocument14 pagesHealth Insurance in Myanmar The Views and PerceptiHtet Lynn HtunNo ratings yet

- Research 2011 Medical MarkersDocument93 pagesResearch 2011 Medical MarkersHtet Lynn HtunNo ratings yet

- Life Insurance Illustrations Practice Note Feb 2018Document113 pagesLife Insurance Illustrations Practice Note Feb 2018Htet Lynn HtunNo ratings yet

- Description of Statistical ReportsDocument4 pagesDescription of Statistical ReportsHtet Lynn HtunNo ratings yet

- The Determinants of Life Insurance Demand in UkraineDocument56 pagesThe Determinants of Life Insurance Demand in UkraineHtet Lynn HtunNo ratings yet

- Data-Driven Pricing: Opportunities in The Non-Life Insurance MarketDocument4 pagesData-Driven Pricing: Opportunities in The Non-Life Insurance MarketHtet Lynn HtunNo ratings yet

- Basics of InsuranceDocument20 pagesBasics of InsuranceSunny RajNo ratings yet

- Analysis of Consumer Behavior and Decision-Making Variables About Life Insurance PoliciesDocument9 pagesAnalysis of Consumer Behavior and Decision-Making Variables About Life Insurance PoliciesPriyanka AggarwalNo ratings yet

- Insurance Midterms ReviewerDocument7 pagesInsurance Midterms ReviewerangelicaNo ratings yet

- Ilovepdf Merged 4Document223 pagesIlovepdf Merged 4Dani ShaNo ratings yet

- BPI Vs POsadasDocument1 pageBPI Vs POsadasEmjie KingNo ratings yet

- State Life InsuranceDocument79 pagesState Life Insuranceqadirqadil100% (2)

- Pakistan Ordinance of Zakat and UshrDocument43 pagesPakistan Ordinance of Zakat and UshrSyed Asghar AliNo ratings yet

- Reliance General Vs ShashiDocument13 pagesReliance General Vs ShashiDSB 444No ratings yet

- GSAA Home Equity Trust 2005-15, Tranche 2A3 Sold To Govt As Part of Maiden Lane IIDocument79 pagesGSAA Home Equity Trust 2005-15, Tranche 2A3 Sold To Govt As Part of Maiden Lane IITim Bryant100% (1)

- Claim Settlement (SecsDocument13 pagesClaim Settlement (SecsAlexPamintuanAbitanNo ratings yet

- Annexure - Additional - Withdrawal - Details 3.0Document2 pagesAnnexure - Additional - Withdrawal - Details 3.0Vinod NairNo ratings yet

- A Project Report On AN Impact OF Celebrity Endorsement in InsuranceDocument29 pagesA Project Report On AN Impact OF Celebrity Endorsement in Insurancemegha mishraNo ratings yet

- Revised Insurance Act 2015 of Laws o Kenya PDFDocument350 pagesRevised Insurance Act 2015 of Laws o Kenya PDFsaNo ratings yet

- Financial Statement Analysis of TCS and INFOSYSDocument43 pagesFinancial Statement Analysis of TCS and INFOSYSRitwik Subudhi100% (1)

- IALM - Mortality Tables (2006-08) UltDocument7 pagesIALM - Mortality Tables (2006-08) UltSimran SachdevaNo ratings yet

- The Gazette of India Extraordinary Part Iii - Section 4.: Insurance Regulatory and Development Authority, New DelhiDocument33 pagesThe Gazette of India Extraordinary Part Iii - Section 4.: Insurance Regulatory and Development Authority, New DelhiAanchal AggarwalNo ratings yet

- Annuitypricing PDFDocument144 pagesAnnuitypricing PDFmirando93No ratings yet

- Sample Parenting Agreement Between Mother and Father Who Are Both Biological ParentsDocument7 pagesSample Parenting Agreement Between Mother and Father Who Are Both Biological ParentsyotatNo ratings yet

- A Comparative Study and Analysis of Unit Linked: Insurance Plans (Ulips) - An Idbi Fortis PerspectiveDocument81 pagesA Comparative Study and Analysis of Unit Linked: Insurance Plans (Ulips) - An Idbi Fortis PerspectiveDIWAKAR SHARMANo ratings yet

- Income Tax Deductions.Document22 pagesIncome Tax Deductions.Dhruv BrahmbhattNo ratings yet

- Kotak E-Term PlanDocument9 pagesKotak E-Term Planriya sethNo ratings yet

- Customer Relationship Management in Reliance Life InsuranceDocument93 pagesCustomer Relationship Management in Reliance Life InsuranceSuresh Babu Reddy50% (2)

- RA 8291 GSIS ActDocument19 pagesRA 8291 GSIS ActAicing Namingit-VelascoNo ratings yet

- Philippine Health Care V CIR G.R. No. 167330 September 18, 2009Document7 pagesPhilippine Health Care V CIR G.R. No. 167330 September 18, 2009Harry PeterNo ratings yet

- Iiz BrochureDocument2 pagesIiz BrochuremthokozisiNo ratings yet

- TAL Accelerated Protection PDSDocument44 pagesTAL Accelerated Protection PDSLife Insurance AustraliaNo ratings yet

- Case Study - RamDocument5 pagesCase Study - RamswathyNo ratings yet

- Insurance Law OutlineDocument8 pagesInsurance Law OutlineChe Poblete Cardenas100% (1)

- S&P Industry Surveys: Insurance - Life & HealthDocument42 pagesS&P Industry Surveys: Insurance - Life & Healthdell1888100% (1)

- Income Under The Head SalaryDocument56 pagesIncome Under The Head Salaryjyoti_yadavNo ratings yet