Professional Documents

Culture Documents

08042020-Auto Mitc New

08042020-Auto Mitc New

Uploaded by

Vijayendra Suryawanshi0 ratings0% found this document useful (0 votes)

10 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views2 pages08042020-Auto Mitc New

08042020-Auto Mitc New

Uploaded by

Vijayendra SuryawanshiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

ANNEXURE – 1

MOST IMPORTANT TERMS AND CONDITIONS : SBI – Auto Loan

MOST IMPORTANT TERMS AND CONDITIONS: SBI – Auto Inspection:

Loan MITC covers the following Loan Products: For Standard Asset accounts periodical inspections are waived after the

1. SBI Car Loan initial inspection. However, if there is a default of 1 monthly installment,

2. SBI Loyalty Car Loan inspection would be required.

3. SBI NRI Car Loan The inspection charges are to be recovered every time an inspection is

4. SBI Assured Car Loan carried out as per the laid down instructions. The inspection fee of Rs.

5. SBI Certified Pre-approved Car Loan 350/- + GST will be recovered by the inspecting branch by raising a debit

6. SBI Two-Wheeler Loan on the financing branch and credit it to its commission a/c.

7. SBI Super Bike loan Fees and charges:

Purpose for which Car loan can be availed: a. Processing fee:

The loan will be sanctioned for the purpose purchase of new For Car Loan on Fixed Rate of Interest: When loans are sanctioned:

Cars/used cars, Multi Utility Vehicles (MUVs) and Semi Utility @0.40% of the loan amount subject to minimum Rs. 1000/- +GST and

Vehicles (SUVs). Maximum of Rs. 7500/-+GST

Loan tenure: b. Foreclosure Charges: -

Maximum 84 months (Fixed Interest Rate). Foreclosure charges for Car Loan under Fixed rate of Interest will be

Loan to Value Ratio (LTV): recovered @3% on closure amount (plus GST) will be levied if foreclose

Maximum LTV ratio is 85% of ‘on road price’ of the car within 24 months from the disbursement of loan.

(Maximum Loan amount is 100%of ‘ex-showroom price). 3. Other Charges:

Rate of Interest: (a)All expenses like valuer’s fees, insurance premia, stamp duty,

SBI Car Loan (Fixed Interest Rate) registration charges, registration charges for CERSAI, hypothecation

Interest on the loan will be charged at the prevailing fixed rate verification charges on VAHAN Site, SMS and Tele-calling charges and

of interest on daily reducing balance at monthly rests. SBI may other incidental expenses incurred in connection with the loan are to be

at its discretion stipulate the periodicity of computation of borne by the borrower.

interest. (b) Other charges under SBI Car Loan

Interest Rates will be charged according to the CIC score of the (i) Vahan Search Charges: Rs 50 per instance+GST

customers at the time of sanction of Loan. (d)Cheque /ECS swap charges Rs.400/- per instance + GST

Calculation of Interest: -

Interest on the amount of the will be applied at the prevailing (ii)Amortization schedule charges Rs.100/- per instance+GST.

rate per annum on daily reducing balance with monthly rests. (e) Statement of account charges, monthly free, for duplicate

Penal interest: - Rs.112/- +GST

(iii) Pre-payment statement charges Rs.100/- +GST

(a)Penal interest will not be charged for loans up to Rs.25,000/-

(iv)Duplicate NOC charges Rs.300/- instance+GST.

. For Loans above Rs.25000/-, if the irregularity exceeds EMI or

(vi) NOC for conversion from Petrol to LPG/CNG Rs. 400/- per instance

Installment amount, for a period of one month, then penal

+GST

interest would be charged @2% p.m. (over and above the

(f)Revalidation of NOC charges Rs.400/- per instance +GST

applicable interest rate) on the overdue amount for the period of

default. (g)Loan re-scheduling charges Rs.500/- per instance+GST.

Bounced cheque/NACH or SI dishonors: -

A penalty of Rs 250/- + GST will be charged for every bounced

cheque/NACH or SI dishonors. The rate may vary from time to 4. State Bank of India retains the right to alter any charges or fees from

time. time to time or to introduce any new charges or fees, as it may deem

Repayment: appropriate, with due intimation to customer.

The repayment date to be fixed in succeeding month to coincide 5. Disbursement: The loan will be disbursed only on the following

with the date on which borrower’s major income flow happens. conditions:

Wherever NACH is available, the Bank may use the service for Loan Amount will be credited to the account of supplier/dealer by way

paperless debit of installments. of RTGS/NEFT facility or through CBS system for accounts maintained

Pre-Payment penalty: - with SBI.

Charges @1% on part payment amount (plus GST) will be All necessary statutory compliances are in place.

levied quarterly in Fixed Interest rate car loan if prepaid within The Bank reserves the right to collect any tax if levied by the

24 months from the date of disbursement. State/Central Government and/or other Authorities in respect of this

Security: transaction.

a) Borrower undertakes to get hypothecation to the Bank 6.KYC:

marked in Registration book of the vehicle immediately after All loans will be sanctioned after completion of KYC verification.

purchase of the vehicle. 7.CIBIL Disclosure:

b) Bank will verify the original RC book for noting down the The Borrower(s) hereby agree and give consent for disclosure by the

charges in favor of the Bank on submission by the customer Bank all or any (a) information and data relating to the Borrower(s) (b)

within 120 days of disbursement of loan from Vahan.nic.in. information or data relating to any credit facility availed or/to be availed

c) In the event of delay in submission of RC Book by the by the Borrower(s) and default, if any, committed by the Borrower(s) in

customer at the Bank after registration / noting the discharge of his/their such obligation as the Bank may deem appropriate

hypothecation lien of the Bank with the Registering Authority and necessary, to disclose and furnish to Credit Information Bureau

within 120 days from the date of disbursement, the Bank shall (India) Ltd. (CIBIL), and any other agency authorized in this behalf by

be entitled to charge Rs.2500/- + GST per month till the time of RBI

such registration/noting with the authority.

Insurance:

a. The vehicle purchased is to be kept comprehensively

insured for the market value or at least 10% above

the loan amount outstanding, whichever is higher,

and the Bank’s interest as a financer should be noted Disclosure:

in the Certificate of insurance and Insurance policy. State Bank of India is authorized to disclose from time to time any

The borrower must ensure that renewal of insurance information relating to the loan to any credit bureau (Existing or Future)

is done on the due dates and ensure a copy reaches

approved by Government of India and Reserve Bank of India without

the Bank for its record.

any notice to the borrower. State Bank of India is also authorized to

make inquiries with the Credit Information Bureau of India (CIBIL) and

b. The Borrower shall always be responsible to ensure

that the insurance policy in respect of the get the applicants Credit Information Report.

hypothecated assets remain valid till all the dues of 8.Default:

the bank are repaid and to keep such insurance policy In case of default i.e. if the amount due is not paid by due date, the

renewed each year. customer will be sent reminders from time to time for payment of any

outstanding on his loan account, by post, fax, telephone, email, SMS

c. The Bank shall not be liable for any consequences messaging and/or through third parties appointed for collection purpose

arising from non-renewal of insurance in any year, to remind, follow-up and collect dues.

even if the Bank has in any previous year renewed 9.TAT: The loan applications with complete information and required

the insurance of the hypothecated assets by debiting documents will be disposed within a period of 2 days at urban Centers

the borrower’s account for failure of the Borrower to and 4 days at Rural Centers.

renew such insurance policy. 10.Customer Service:

For any service related issue, customer can get in touch with SBI by:

Calling Customer helpline numbers

Contact Customer Grievance cell at our Local Head Offices

Write to Grievance cell at our Local Head Offices

(Details on helpline numbers and Grievance cell available on

www.sbi.co.in) In case a customer is not satisfied with the handling of

Grievance by the Local Head Office, a communication may be sent

(enclosing the message sent earlier to the Local Head Office) to the –

Deputy General manager (Customer Service), Customer Service

Dept, State Bank of India, State Bank Bhawan,4th floor, Madam

Cama Road, Mumbai-400021,

Telephone Number. (022) 22029456,

22029451,22740432,22740431,22740433 Fax No. (022) 22742431.

e-mail address: dgm.customer@sbi.co.in

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Certificate of Agreement For Coverage of Student LoanDocument4 pagesCertificate of Agreement For Coverage of Student LoanJohn BaileyNo ratings yet

- Introduction To Wireless Telecommunication Systems and Networks - MulletDocument226 pagesIntroduction To Wireless Telecommunication Systems and Networks - MulletVijayendra Suryawanshi90% (49)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- K 2 - Investment of Trusts - UpdatedDocument15 pagesK 2 - Investment of Trusts - Updatedstra100% (1)

- Draft 3 Amrapali Trilegal PresentationDocument16 pagesDraft 3 Amrapali Trilegal PresentationdivyaniNo ratings yet

- Gloria Arroyo GalvanDocument10 pagesGloria Arroyo GalvanDee GrayNo ratings yet

- Complete Guide To Becoming A Software ArchitectDocument1 pageComplete Guide To Becoming A Software ArchitectVijayendra SuryawanshiNo ratings yet

- Time Table VIII Sem 220311055740Document1 pageTime Table VIII Sem 220311055740Vijayendra SuryawanshiNo ratings yet

- National PollingDocument8 pagesNational PollingVijayendra SuryawanshiNo ratings yet

- IT 7 &8 Sem RGPV SyllabusDocument29 pagesIT 7 &8 Sem RGPV SyllabusVijayendra SuryawanshiNo ratings yet

- Seminar Outline 5Document16 pagesSeminar Outline 5cccqNo ratings yet

- Hong Leong BankDocument6 pagesHong Leong Bankfelicia kiuNo ratings yet

- Credit Cases - Chap. 1-2Document115 pagesCredit Cases - Chap. 1-2Trish VerzosaNo ratings yet

- Binder 7Document76 pagesBinder 7Tasmay EnterprisesNo ratings yet

- P-2 TheoryDocument72 pagesP-2 TheoryUdayan KachchhyNo ratings yet

- File Tinh Huong CLDocument23 pagesFile Tinh Huong CLltbtran010903No ratings yet

- Week 8: Quiz Instructions: Alice B. Habla HUMSS 11-9Document12 pagesWeek 8: Quiz Instructions: Alice B. Habla HUMSS 11-9Alice HablaNo ratings yet

- BCom Banking and InsuranceDocument106 pagesBCom Banking and InsuranceUtsav SinhaNo ratings yet

- (FM02) - Chapter 1 The Role and Environment of Financial ManagementDocument12 pages(FM02) - Chapter 1 The Role and Environment of Financial ManagementKenneth John TomasNo ratings yet

- Supreme StampDocument44 pagesSupreme StampJuliet LalonneNo ratings yet

- BusTax Chap 3Document16 pagesBusTax Chap 3Lisa ManobanNo ratings yet

- c914 - 2016 Updates On DOSRI Rule PDFDocument19 pagesc914 - 2016 Updates On DOSRI Rule PDFJoey SulteNo ratings yet

- Residential Mortgages Loan Level Data TemplateDocument10 pagesResidential Mortgages Loan Level Data TemplateRizki AgustiantoNo ratings yet

- Compendium Notebook School Law - Final ProjectDocument14 pagesCompendium Notebook School Law - Final Projectapi-188750263No ratings yet

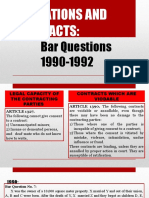

- Obligations and Contracts:: Bar Questions 1990-1992Document29 pagesObligations and Contracts:: Bar Questions 1990-1992poiuytrewq9115No ratings yet

- Modeling With Discrete Dynamical SystemsDocument34 pagesModeling With Discrete Dynamical SystemsLoka BagusNo ratings yet

- UCOA Version 3Document8 pagesUCOA Version 3ifyjoslynNo ratings yet

- 09 - Chapter 3Document34 pages09 - Chapter 3Aakash SonarNo ratings yet

- World Bank Project CycleDocument2 pagesWorld Bank Project CycleJan BakosNo ratings yet

- Assignment 3Document2 pagesAssignment 3Rotin ChamdalNo ratings yet

- 2013-Trujillo-Ponce-What Determines The Profitability of Banks-Evidence From Spain-Accounting & FinanceDocument26 pages2013-Trujillo-Ponce-What Determines The Profitability of Banks-Evidence From Spain-Accounting & Financewrecker_scorpionNo ratings yet

- Money and CreditDocument33 pagesMoney and CreditAnish TakshakNo ratings yet

- Capital Structure Analysis of Indian Oil Corporation Limited (IOCL)Document87 pagesCapital Structure Analysis of Indian Oil Corporation Limited (IOCL)MOHITKOLLINo ratings yet

- Credit Limit Inc ReqDocument2 pagesCredit Limit Inc Reqmatt luiNo ratings yet

- Agribusiness Economics and ManagementDocument37 pagesAgribusiness Economics and ManagementRomy SudiawanNo ratings yet

- Undergrad Review in Income TaxationDocument17 pagesUndergrad Review in Income TaxationJamesNo ratings yet