Professional Documents

Culture Documents

Form 44 (See Rule 104) (Commutation of N. A. Assessment Certificate)

Form 44 (See Rule 104) (Commutation of N. A. Assessment Certificate)

Uploaded by

Shobhna0 ratings0% found this document useful (0 votes)

57 views1 pageThis document certifies that an individual paid 5 times the annual non-agricultural assessment for a plot of land to the government of Karnataka. This payment allows the individual to commute (change) the annual assessment on the land to exempt it from any future non-agricultural assessments according to the provisions of the Karnataka Land Revenue Act of 1964. The document provides details of the land survey number, village, taluk and district where the land is located and the amount paid.

Original Description:

Original Title

Form 44

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document certifies that an individual paid 5 times the annual non-agricultural assessment for a plot of land to the government of Karnataka. This payment allows the individual to commute (change) the annual assessment on the land to exempt it from any future non-agricultural assessments according to the provisions of the Karnataka Land Revenue Act of 1964. The document provides details of the land survey number, village, taluk and district where the land is located and the amount paid.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

57 views1 pageForm 44 (See Rule 104) (Commutation of N. A. Assessment Certificate)

Form 44 (See Rule 104) (Commutation of N. A. Assessment Certificate)

Uploaded by

ShobhnaThis document certifies that an individual paid 5 times the annual non-agricultural assessment for a plot of land to the government of Karnataka. This payment allows the individual to commute (change) the annual assessment on the land to exempt it from any future non-agricultural assessments according to the provisions of the Karnataka Land Revenue Act of 1964. The document provides details of the land survey number, village, taluk and district where the land is located and the amount paid.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

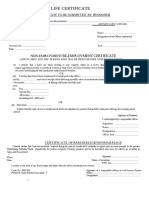

FORM 44

(See Rule 104)

(Commutation of N. A. Assessment Certificate)

This is to certify that in consideration of an amount of Rs........................ which is equal to five

times the annual non agricultural assessment of Rs...... levied or leviable in respect of the land in

Survey No.........................Village ..................................Hobli/Circle,

Taluk....................District.....................in revenue year prior to 1st April 1964 on which date he

Karnataka Land Revenue Act, 1964 came into force, having been paid to the Government of

Karnataka State under sub-section (4) of Section 83 of the said Act,

by.........................of ...........Taluk.....;...............of District.....................the Government of

Karnataka has been pleased to commute the aforesaid annual non-agricultural assessment in

respect of the said land pursuant to the Order No.....passed by the Deputy Commissioner

of..................on.................... day of.......and that on account of such commutation, the said land

shall be exempt from any non-agricultural assessment as from the revenue year, 19............in

accordance with the said provisions of the said Act.

This certificate is executed on behalf of the Government of Karnataka by the Deputy Commissioner

of.....................this...............day of.......................

19...............

Seal of the Deputy Commissioner

Deputy Commissioner

You might also like

- 510 Ontario Lease Agreement - Long FormDocument4 pages510 Ontario Lease Agreement - Long FormAyahsooNo ratings yet

- Stage Certificates For BanksDocument3 pagesStage Certificates For Bankserattakoya100% (3)

- Form 10FDocument2 pagesForm 10FRajeev AttriNo ratings yet

- Format For Utilisation CertificateDocument1 pageFormat For Utilisation CertificateSrivatsava BodapatiNo ratings yet

- Form-I TaxDocument3 pagesForm-I TaxNGL VenturesNo ratings yet

- Revenu DepositsDocument2 pagesRevenu DepositsSimply ScribbledNo ratings yet

- Application For Refund of Deposit Made Under Section 144 of Kerala Panchayat Raj Act, 1994/201 of Kerala Municipality Act, 1994Document1 pageApplication For Refund of Deposit Made Under Section 144 of Kerala Panchayat Raj Act, 1994/201 of Kerala Municipality Act, 1994Fasil ParuvanathNo ratings yet

- Contingent Bill of The ................................................................ DepartmentDocument1 pageContingent Bill of The ................................................................ DepartmentrhengongNo ratings yet

- Form 21Document1 pageForm 21computeroboNo ratings yet

- Assignment of Agreement of Purchase and Sale: Form 145Document9 pagesAssignment of Agreement of Purchase and Sale: Form 145Maha MateenNo ratings yet

- Gar - 6 Receipt ReceiptDocument3 pagesGar - 6 Receipt Receiptrfvz6sNo ratings yet

- Agreement With ANERTDocument2 pagesAgreement With ANERTmohanamal9No ratings yet

- The Assam Value Added Tax Rules, 2005 FORM-16 (See Rule 18 (1) Notice For Forfeiture and Imposition of PenaltyDocument1 pageThe Assam Value Added Tax Rules, 2005 FORM-16 (See Rule 18 (1) Notice For Forfeiture and Imposition of PenaltyVenugopal BandaNo ratings yet

- India Patent Form 15Document1 pageIndia Patent Form 15adityakochharNo ratings yet

- Travelling Allowance Bill For Non Gazatted Establishment: See Rule 178Document4 pagesTravelling Allowance Bill For Non Gazatted Establishment: See Rule 178Manoj SankaranarayanaNo ratings yet

- Prize Bond Claim Form PDFDocument2 pagesPrize Bond Claim Form PDFmhaseeb359081No ratings yet

- Public Notice Under Rule 93: Form - S (See Rule 85 (5) )Document2 pagesPublic Notice Under Rule 93: Form - S (See Rule 85 (5) )VeenaNo ratings yet

- Form 27Document1 pageForm 27JORDANNo ratings yet

- Form 19 EnglishDocument2 pagesForm 19 EnglishSachi SivamNo ratings yet

- Lease Agreement Dows & 1034371 Ontario Inc.Document2 pagesLease Agreement Dows & 1034371 Ontario Inc.Betty Blair FannonNo ratings yet

- 400 Agreement To Lease - Residential - OrEA TRREBDocument6 pages400 Agreement To Lease - Residential - OrEA TRREBm.n.ahmadzai34No ratings yet

- Form 27Document2 pagesForm 27ozzwinNo ratings yet

- Form GFR-22Document7 pagesForm GFR-22sanjaymeenadjbNo ratings yet

- Form No 30Document1 pageForm No 30JayNo ratings yet

- Notice Under Section 80, Code of Civil ProcedureDocument3 pagesNotice Under Section 80, Code of Civil ProcedurePradyumn SinghNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay CertificateJayaprakash Vayakkoth Madham100% (3)

- FR From 1Document1 pageFR From 1Bhaskar Jyoti NathNo ratings yet

- Remuneration ProformaDocument1 pageRemuneration Proformagirdhargopal87No ratings yet

- Remuneration ProformaDocument1 pageRemuneration ProformaManminder KaurNo ratings yet

- Notice To Debtor To Pay DebtDocument3 pagesNotice To Debtor To Pay DebtyewtwqNo ratings yet

- Petition For Annulment of AdjudicationDocument1 pagePetition For Annulment of AdjudicationSathya MandyaNo ratings yet

- Notice of Transfer of Ownership of A Motor Vehicle: Office EndorsementDocument1 pageNotice of Transfer of Ownership of A Motor Vehicle: Office Endorsementarindamkar247No ratings yet

- Name of The Executant (Vendor) :-Sri/Smt. ...................... Son/daughter/wife Of......................, Aged AboutDocument5 pagesName of The Executant (Vendor) :-Sri/Smt. ...................... Son/daughter/wife Of......................, Aged Aboutthe creationNo ratings yet

- Money Receipt 0Document2 pagesMoney Receipt 0TechnomartNo ratings yet

- Lok Sabha Secretariat Co-Operative Thrift & Credit Society LTD., New Delhi Loan Application FormDocument2 pagesLok Sabha Secretariat Co-Operative Thrift & Credit Society LTD., New Delhi Loan Application FormMurali Krishna RNo ratings yet

- Individual Claim Bill Form (Editable)Document1 pageIndividual Claim Bill Form (Editable)ezazpsychologistNo ratings yet

- Mou Draft For PropertyDocument4 pagesMou Draft For Propertyabp csNo ratings yet

- 06 Single Dog FormDocument2 pages06 Single Dog FormPargunan BabuNo ratings yet

- GFR 12Document1 pageGFR 12Suanthansang suantakNo ratings yet

- MC FormDocument3 pagesMC FormSreeraj B PillaiNo ratings yet

- .................................. Apartments Owners' AssociationDocument1 page.................................. Apartments Owners' Associationmohan krishnaNo ratings yet

- Form PDocument1 pageForm PAwais MalikNo ratings yet

- Motion and Order For Expungement and Destruction of Juvenile RecordsDocument1 pageMotion and Order For Expungement and Destruction of Juvenile RecordsJuan PortilloNo ratings yet

- FbsDocument2 pagesFbsManoj SankaranarayanaNo ratings yet

- Blackmoney Form2Document2 pagesBlackmoney Form2Geetha SoundaryaNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay CertificateMuhammad Ramzan BurfatNo ratings yet

- Last Pay Certificate: Period Rate AmountDocument2 pagesLast Pay Certificate: Period Rate AmountAnwar NadeemNo ratings yet

- New Document (35) 05-Jul-2023 10-03-03Document2 pagesNew Document (35) 05-Jul-2023 10-03-03Ihsan UllahNo ratings yet

- Declaration of Income FormDocument1 pageDeclaration of Income FormTasha Dilbert-BennettNo ratings yet

- Maturity Discharge Form No.3825Document2 pagesMaturity Discharge Form No.3825ranju ramachandranNo ratings yet

- Land Form19 Freehold OfferDocument2 pagesLand Form19 Freehold OfferSepuuya AlexNo ratings yet

- (Rule 14) : FORM-19Document1 page(Rule 14) : FORM-19Ashish TelmasareNo ratings yet

- Form MDocument2 pagesForm Msalmanitrat0% (1)

- Proxy Form: Sonam Heights A-Wing, New Golden Nest Phase XV, Bhayander (East) Thane 401105Document1 pageProxy Form: Sonam Heights A-Wing, New Golden Nest Phase XV, Bhayander (East) Thane 401105mangeshsutarNo ratings yet

- Tender IC Vol1Document57 pagesTender IC Vol1ABSSBY Beneficiary AuditNo ratings yet

- Sale Deed EngDocument2 pagesSale Deed EngSureshNo ratings yet

- Annex UreDocument12 pagesAnnex UreNewspaper boyNo ratings yet

- Office of The Tahasildar, Bellaguntha, Ganjam: Misc. Case No......................Document3 pagesOffice of The Tahasildar, Bellaguntha, Ganjam: Misc. Case No......................DIPTIMAYEE BEHERANo ratings yet

- Life CertificateDocument1 pageLife CertificateParamjit Saha100% (1)

- TOEFL Vocabulary Builder: Ace the TOEFL with 500+ Essential Vocab WordsFrom EverandTOEFL Vocabulary Builder: Ace the TOEFL with 500+ Essential Vocab WordsNo ratings yet

- Volume 7 Vol07 20 Shobhnalochan Studentslsheduin 20230331 123007 1 34Document34 pagesVolume 7 Vol07 20 Shobhnalochan Studentslsheduin 20230331 123007 1 34ShobhnaNo ratings yet

- Form 51Document2 pagesForm 51Shobhna0% (1)

- Form 49 (See Rule 149-B) Summons For Appearance or For Production of DocumentsDocument1 pageForm 49 (See Rule 149-B) Summons For Appearance or For Production of DocumentsShobhnaNo ratings yet

- (FORM 53 (See Sub-Rule (1) of Rule 108-CC) Application For Grant of Land Unauthorisedly OccupiedDocument3 pages(FORM 53 (See Sub-Rule (1) of Rule 108-CC) Application For Grant of Land Unauthorisedly OccupiedShobhnaNo ratings yet

- (FORM 46 (See Rule 150-A) Form of Warrant To Be Issued Under Section 22Document1 page(FORM 46 (See Rule 150-A) Form of Warrant To Be Issued Under Section 22ShobhnaNo ratings yet

- (FORM 52 (See Rule 108-D) Notice: 1. Forms 52 Inserted by Notification No. RD 13 LGP 9, Dated 9-4-1991 W.E.F 9-4-1991Document1 page(FORM 52 (See Rule 108-D) Notice: 1. Forms 52 Inserted by Notification No. RD 13 LGP 9, Dated 9-4-1991 W.E.F 9-4-1991ShobhnaNo ratings yet

- Form 43Document1 pageForm 43ShobhnaNo ratings yet

- (FORM 50 (See Rule 150-B) (Application For Constructing The Water Course)Document4 pages(FORM 50 (See Rule 150-B) (Application For Constructing The Water Course)ShobhnaNo ratings yet

- Form 54 (See Sub-Rule (1) of Rule 108-CC) NoticeDocument1 pageForm 54 (See Sub-Rule (1) of Rule 108-CC) NoticeShobhnaNo ratings yet

- Abdullah Group ProjectDocument3 pagesAbdullah Group ProjectShobhnaNo ratings yet