Professional Documents

Culture Documents

Standard Monthly Salary INR Earnings INR Deductions INR

Standard Monthly Salary INR Earnings INR Deductions INR

Uploaded by

Prashant Raj0 ratings0% found this document useful (0 votes)

92 views1 pageThis payslip summarizes Prashant Raj's earnings and deductions for November 2021. It shows he earned a basic salary of INR 6,429 along with DA of INR 2,143 and HRA of INR 7,467, for total earnings of INR 19,647. Provident fund and other statutory deductions totaled INR 1,126, leaving a net pay of INR 18,521. An income tax computation projects his annual salary and exemptions, finding no tax is currently due.

Original Description:

Released

Original Title

payslip

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis payslip summarizes Prashant Raj's earnings and deductions for November 2021. It shows he earned a basic salary of INR 6,429 along with DA of INR 2,143 and HRA of INR 7,467, for total earnings of INR 19,647. Provident fund and other statutory deductions totaled INR 1,126, leaving a net pay of INR 18,521. An income tax computation projects his annual salary and exemptions, finding no tax is currently due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

92 views1 pageStandard Monthly Salary INR Earnings INR Deductions INR

Standard Monthly Salary INR Earnings INR Deductions INR

Uploaded by

Prashant RajThis payslip summarizes Prashant Raj's earnings and deductions for November 2021. It shows he earned a basic salary of INR 6,429 along with DA of INR 2,143 and HRA of INR 7,467, for total earnings of INR 19,647. Provident fund and other statutory deductions totaled INR 1,126, leaving a net pay of INR 18,521. An income tax computation projects his annual salary and exemptions, finding no tax is currently due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

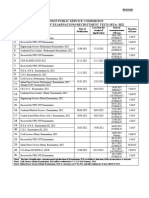

Salary Payslip for the Month of NOVEMBER-2021

Pay Period 01.11.2021 to 30.11.2021

PRASHANT RAJ

COMPANY : KENT CamEye

Employee Code : 1700620 Father's/ Husband's Name : VISHNU BHAGWAN

Gender : MALE Date Of Joining : 11.10.2021

Designation : EXECUTIVE Bank Name & Account No. : KOTAK MAHINDRA BANK 2911663428

Grade : E02 PF NO. & UAN : 100738868016

Department : CUSTOMER SERVICE Pan Card No. : DHWPR5804M

Location : NOIDA 62 ESI No :

Standard Monthly Salary INR Earnings INR Deductions INR

Basic 6,888.00 Basic 6429.00 Provident Fund 1126.00

DA 2,296.00 DA 2143.00 ESI Contribution 0.00

HRA 8,000.00 HRA 7467.00 Income Tax 0.00

Transport Allowance 0.00 Transport Allowance 0.00 Professional Tax 0.00

Special Allowance 866.00 Special Allowance 808.00 Advance / Imprest 0.00

Telephone allowance 0.00 Telephone allowance 0.00 Loan 0.00

Monthly Bonus 3000.00 Monthly Bonus 2800.00

Arrear 0.00

Incentive 0.00

Standard Salary 21,050.00 Gross Earning 19647.00 Gross Deductions 1126.00

Paid Days 28.00 Net Pay 18521.00

Income Tax Computation

Exempton U/S 10 Projected / Actual Taxable Salary Contribution under Chapter VI A Monthly Tax Deduction

Exemption 0.00 Months remaining till March 4 Provident Fund 6,599.00

Taxable Income till Previous Month 21,050.00 Voluntry PF 0.00

HRA Exemption Current Month Taxable Income 21,050.00 Payment towards Life Insurance Policy 0.00

Rent paid/Projected 0.00 Projected Standard Salary 84,200.00 Contribution to ULIP 0.00

HRA 48,000.00 Taxable Annual Perks 0.00 Tution Fee 0.00

Rent Paid-(minus)10% of basic 0.00 Annual Medical Exemption 0.00 Eductional Loan 0.00

Metro/Non-Metro exemption 0.00 Gross Salary 126,300.00 OCTOBER-2021 0.00

Exemption U/S 10 0.00 NOVEMBER-2021 0.00

Tax On Employment (Prof. Tax) 0.00 DECEMBER-2021 0.00

Income under Head Salary 126,300.00 JANUARY-2022 0.00

Interest on House Property 0.00 FEBRUARY-2022 0.00

Gross Total Income 126,300.00 MARCH-2022 0.00

Aggregate of Chapter VI 6,599.00

Total Income 119,701.00

Tax on Total Income 0.00

Tax Credit 0.00

Education Cess (On Net Tax) 0.00

Tax Payable 0.00

Tax deducted so far 0.00

Balance Tax 0.00

Total 6,599.00 Total 0.00

You might also like

- Releiving Letter - PreetiDocument1 pageReleiving Letter - PreetiPrashant RajNo ratings yet

- Ienergizer It Services Private Limited: A-37, Sector-60, Noida-201301Document1 pageIenergizer It Services Private Limited: A-37, Sector-60, Noida-201301Prashant RajNo ratings yet

- Symbiosis Institute of Health Sciences: ReceiptDocument1 pageSymbiosis Institute of Health Sciences: ReceiptAniket BhalekarNo ratings yet

- C231196 SalarySlipIncludeDocument1 pageC231196 SalarySlipIncludeSuhail KhanNo ratings yet

- Tata AIG Insurance Company Ltd. 5th 6th Floor, Peninsula TowersDocument1 pageTata AIG Insurance Company Ltd. 5th 6th Floor, Peninsula TowersCheryl StevensNo ratings yet

- Memorandum of Agreement IupowerDocument2 pagesMemorandum of Agreement IupowerMauren Nacion LicudineNo ratings yet

- FBTDocument5 pagesFBTKenneth Bryan Tegerero TegioNo ratings yet

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- Dr. Reddy's Laboratories Limited: June, 2018 Payslip For The MonthDocument1 pageDr. Reddy's Laboratories Limited: June, 2018 Payslip For The MonthKATLA RAMANJANEYA REDDYNo ratings yet

- Spice Mobile LimitedDocument1 pageSpice Mobile LimitedChristopher GarciaNo ratings yet

- F86407Document2 pagesF86407Abhishek PawarNo ratings yet

- March 2022Document1 pageMarch 2022Urmila UjgareNo ratings yet

- Acces 01 02Document2 pagesAcces 01 02sasirajareddyNo ratings yet

- Offer LetterDocument3 pagesOffer LetterrudraNo ratings yet

- Foray Software Private Limited: Payslip For The Month of July 2021Document1 pageForay Software Private Limited: Payslip For The Month of July 2021pavanhNo ratings yet

- SalaryDocument1 pageSalaryRanjith Kumar ANo ratings yet

- Rahul Gangarekar - Offer LetterDocument2 pagesRahul Gangarekar - Offer Letterrahul gangarekarNo ratings yet

- Ref No. - Review/2017/Apr/2013: Emp Id Name Grade Title Business Segment: TechnologyDocument2 pagesRef No. - Review/2017/Apr/2013: Emp Id Name Grade Title Business Segment: TechnologyDigvijay SharmaNo ratings yet

- Pay Slip (G8049)Document1 pagePay Slip (G8049)yaashNo ratings yet

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraNo ratings yet

- Feb2023 - Salary Slip PDFDocument1 pageFeb2023 - Salary Slip PDFOM SHARMANo ratings yet

- Quess Corp Limited Head Office 3/3/2, Amblipura, Bellandur Gate, Sarjapur Road, Bengaluru, Karnataka 560103Document1 pageQuess Corp Limited Head Office 3/3/2, Amblipura, Bellandur Gate, Sarjapur Road, Bengaluru, Karnataka 560103AnshumanNo ratings yet

- PAYSLIPDocument11 pagesPAYSLIPSaran ManiNo ratings yet

- Salary January2023Document1 pageSalary January2023AKM Enterprises Pvt LtdNo ratings yet

- Provisional Admission Letter: Chaudhary Devi Lal University Sirsa-125055, HaryanaDocument1 pageProvisional Admission Letter: Chaudhary Devi Lal University Sirsa-125055, HaryanaParvesh GoyalNo ratings yet

- Admin 48131116Document1 pageAdmin 48131116Manpreet KambojNo ratings yet

- July 23Document1 pageJuly 23Điwakar MudhirajNo ratings yet

- Pay - Slip (G1050) (1) JuneDocument1 pagePay - Slip (G1050) (1) Juneaamirkhan091184No ratings yet

- 731 Mitendra Pratap SinghDocument2 pages731 Mitendra Pratap Singhmitendra pratap singhNo ratings yet

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadNo ratings yet

- Salary SlipDocument1 pageSalary SlipAmmie LachicaNo ratings yet

- HikeDocument1 pageHikeB RameshNo ratings yet

- Virchow Petrochemical Private Limited: (C.Subbareddy) General ManagerDocument5 pagesVirchow Petrochemical Private Limited: (C.Subbareddy) General ManagerraajiNo ratings yet

- Symbiosis Institute of Health Sciences: ReceiptDocument1 pageSymbiosis Institute of Health Sciences: ReceiptAniket BhalekarNo ratings yet

- Gross Earning Gross DeductionDocument2 pagesGross Earning Gross Deductionavisinghoo7No ratings yet

- CTB Hike SDocument1 pageCTB Hike SSOGALA NAVEEN KUMAR YADAVNo ratings yet

- Murali Krishna Chollangi Payslip Nov 2022.PdfmDocument1 pageMurali Krishna Chollangi Payslip Nov 2022.Pdfmanuteck1No ratings yet

- G Hemanth KumarDocument1 pageG Hemanth Kumarrakesh nandipalliNo ratings yet

- JunDocument1 pageJunkallinath nrNo ratings yet

- Sandy Jan PayslipDocument1 pageSandy Jan PayslipJoginderNo ratings yet

- Jan 2023Document1 pageJan 2023Rishabh JethwaniNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279No ratings yet

- DIVAKAR - M - May 2021 - PayslipDocument1 pageDIVAKAR - M - May 2021 - PayslippandiyanNo ratings yet

- March 2023 CapgeminiDocument1 pageMarch 2023 CapgeminimanojkallemuchikkalNo ratings yet

- Offer Letter - Subhankar SahaDocument4 pagesOffer Letter - Subhankar SahaSUBHANKAR SAHANo ratings yet

- Apr PayslipDocument1 pageApr PayslipSidvik InfotechNo ratings yet

- Payslip: Madhya Pradesh Madhya Kshetra Vidyut Vitran Company LTDDocument2 pagesPayslip: Madhya Pradesh Madhya Kshetra Vidyut Vitran Company LTDRavi SahuNo ratings yet

- Offer Letter - PawanDocument5 pagesOffer Letter - PawanPawan YadavNo ratings yet

- DATA BI HikeDocument1 pageDATA BI HikehgfhfhgNo ratings yet

- AppraisalDocument3 pagesAppraisalAbhi RomanNo ratings yet

- d5eb67b6-6d69-484a-aa38-b800024e6693Document14 pagesd5eb67b6-6d69-484a-aa38-b800024e6693pixeljoyNo ratings yet

- Appraisal LetterDocument1 pageAppraisal LetterManeesh GuptaNo ratings yet

- Payslip For The Month of January 2018: Earnings DeductionsDocument1 pagePayslip For The Month of January 2018: Earnings DeductionsDevmalya ChandaNo ratings yet

- Atos SyntelDocument2 pagesAtos SyntelSharad MoreNo ratings yet

- Pay Slip - 604316 - Mar-22Document1 pagePay Slip - 604316 - Mar-22ArchanaNo ratings yet

- Mar 2024Document2 pagesMar 2024Tuneer SahaNo ratings yet

- Lobo Staffing Solutions Pvt. LTD.: 212,2nd Floor, Prabhadevi EstateDocument12 pagesLobo Staffing Solutions Pvt. LTD.: 212,2nd Floor, Prabhadevi EstateAmish ChunawalaNo ratings yet

- Rochak Agrawal-Offer PDFDocument4 pagesRochak Agrawal-Offer PDFrochak agrawalNo ratings yet

- DDICGDIAP72DINOV22Document1 pageDDICGDIAP72DINOV22raghav bharadwajNo ratings yet

- June 2022 - AjithkumarDocument1 pageJune 2022 - AjithkumarDharshan RajNo ratings yet

- OctDocument1 pageOctRamPrasadNo ratings yet

- Payslip For The Month of December 2022Document1 pagePayslip For The Month of December 2022B T MAHENDRANo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- PayslipEncrypted 024297 May2021Document1 pagePayslipEncrypted 024297 May2021Sarvesh KumarNo ratings yet

- PayslipDocument1 pagePayslipojhashivam1997No ratings yet

- 195422Document1 page195422Prashant RajNo ratings yet

- SIM AcknowlegementDocument1 pageSIM AcknowlegementPrashant RajNo ratings yet

- CombinedDocument2 pagesCombinedPrashant RajNo ratings yet

- Offer Letter Preeti Singh App9216368532450584 Version 1Document10 pagesOffer Letter Preeti Singh App9216368532450584 Version 1Prashant RajNo ratings yet

- UPSC Civil Services Exam 2022 Marks of The Selected CandidatesDocument41 pagesUPSC Civil Services Exam 2022 Marks of The Selected CandidatesPrashant RajNo ratings yet

- Revised AnnualProgExamsRTs 2022 221221 EnglDocument1 pageRevised AnnualProgExamsRTs 2022 221221 EnglPrashant RajNo ratings yet

- TAX4Document2 pagesTAX4kate trishaNo ratings yet

- Tabas VSDocument30 pagesTabas VSKristel YeenNo ratings yet

- Revised Car Scheme C1Document4 pagesRevised Car Scheme C1kapolaNo ratings yet

- Induction & OrientationDocument16 pagesInduction & OrientationNischalGNischalNo ratings yet

- IIPM CoursewareDocument58 pagesIIPM CoursewareRahul Jayanti JoshiNo ratings yet

- MGT501 Short NotesDocument78 pagesMGT501 Short NotesJibran HayatNo ratings yet

- Factors Affecting CompensationDocument13 pagesFactors Affecting Compensationkal200775100% (1)

- HRM 10 Ech 13Document44 pagesHRM 10 Ech 13denden007No ratings yet

- Employee BenefitsDocument4 pagesEmployee Benefitssachin-chandra-1572No ratings yet

- 7 PDFDocument25 pages7 PDFHarindra DunuwilaNo ratings yet

- Ethiopia Tax Guide Booklet 20201021 WebDocument52 pagesEthiopia Tax Guide Booklet 20201021 Webrozina seidNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- DPWH Department Order 72 Series of 2012 (ABC)Document6 pagesDPWH Department Order 72 Series of 2012 (ABC)Jayson Lupiba100% (3)

- Annual Leave Policy of University of YorkDocument15 pagesAnnual Leave Policy of University of YorkJohn Son100% (1)

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- Presentation (HCM Modules Business)Document23 pagesPresentation (HCM Modules Business)Abdalsalam AhmedNo ratings yet

- Income Tax DepartmentDocument22 pagesIncome Tax DepartmentAkash GuptaNo ratings yet

- Bus Math (Q2)Document121 pagesBus Math (Q2)Jacquiline FragataNo ratings yet

- Thesis On Fringe BenefitsDocument8 pagesThesis On Fringe Benefitstifqbfgig100% (3)

- Riverside Local Teachers Contract - Painesville, OhioDocument105 pagesRiverside Local Teachers Contract - Painesville, Ohiocarecommitteepac100% (7)

- SBL BPP Kit-2019 Copy 457Document1 pageSBL BPP Kit-2019 Copy 457Reever RiverNo ratings yet

- UserFile PDFDocument12 pagesUserFile PDFArjav Jain0% (1)

- Case Analysis On Welcome Aboard Group 8Document7 pagesCase Analysis On Welcome Aboard Group 8Aishwarya SolankiNo ratings yet

- Chapter 9 Compensation andDocument10 pagesChapter 9 Compensation andJonathan RieraNo ratings yet

- OverheadsDocument70 pagesOverheadsSiddharthaChowdaryNo ratings yet

- PUPUN01239050000041112 NewDocument2 pagesPUPUN01239050000041112 NewALLAM SWATHINo ratings yet