Professional Documents

Culture Documents

Union Bank of India (Tarnaka) : Signature Not Verified

Union Bank of India (Tarnaka) : Signature Not Verified

Uploaded by

Anil AsangiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Union Bank of India (Tarnaka) : Signature Not Verified

Union Bank of India (Tarnaka) : Signature Not Verified

Uploaded by

Anil AsangiCopyright:

Available Formats

Page : 1 Of 3

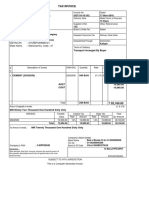

TAX INVOICE

(Rule 46, Section 31 of The Central Goods and Services Act, 2017)

ORIGINAL FOR RECIPIENT

Seller: Forbes Marshall (Hyd) Pvt. Ltd. Buyer: 27670

PLOT NO A-19/2 & T-4/2 VK TYRE INDIA LTD.

I.D.A NACHARAM BEHIND SYBLY INDUSTRIAL LTD.

HYDERABAD 500076 PAWANPURI INDISTRIAL AREA

Telangana,India PAWANPURI

MURADNAGAR,DISTT. GHAZIABAD

TEHSIL MODINAGAR 201206

Uttar Pradesh

India

KIND ATTENTION : PRASHANT DHINGRA

PAN No : AAECV8813F

GSTIN : 09AAECV8813F1Z4

GSTIN. : 36AAACF3055F1ZZ PLACE OF SUPPLY : Uttar Pradesh

STATE CODE : 36 STATE CODE : 09

OUR PAN. : AAACF3055F

BANK NAME : UNION BANK OF INDIA(TARNAKA)

BANK ACCOUNT NO : 510101000804346

BANK ADDRESS : STREET NO 1,TARNAKA,

12-13, 483/33, PLOT NO-3,

SECUNDERABAD-500017,TELANGANA

IFSC CODE : UBIN0906239

TAX INVOICE NO. : 902501313 DATED : 16-SEP-2021 HYD Standard Invoice

OUR OA NO. : 902100948 DATED : 06-AUG-2021 H4H Standard

YOUR PO NO. : 0017VKT/FORBES/21-22 DATED : 04-AUG-2021

DELIVERY NO. : 6308648

SHIP TO

VK TYRE INDIA LTD. PAN No : AAECV8813F

BEHIND SYBLY INDUSTRIAL LTD. GSTIN : 09AAECV8813F1Z4

PAWANPURI INDISTRIAL AREA STATE : Uttar Pradesh

PAWANPURI STATE CODE : 09

MURADNAGAR,DISTT. GHAZIABAD

TEHSIL MODINAGAR 201206

Uttar Pradesh

India

PRASHANT DHINGRA

346261

PAYMENT TERM : COD100%

All payment advices / intimations should be sent to collections@forbesmarshall.com

BANK :

BRANCH :

ADDRESS :

SHIPPING INSTRUCTIONS : DOOR DELIVERY

TRANSPORTER :

LR/DOCKET NO. : DATED :

FREIGHT TERM :

INSURANCE BY : By Us INSURANCE POLICY :Transit Policy number 0830015522

DETAILS valid from 1 April 2021 to 31 March

2022, TATA AIG General Insurance

Company Limited

EWAYBILL :

CORRESPONDENCE : MORADABAD

ADDRESS

DOCUMENTATION : MR.PRASHANT

DETAILS

PACKING DETAILS : 2 CB

NET WEIGHT : 44 GROSS WEIGHT : 50

**** FULL SUPPLY ****

INV SR NO DESCRIPTION OF GOODS/SERVICES UOM QTY Price Amount

PO SR NO Rs. Rs.

1 GPD3AACBD-0011 EA 36 800.00 28,800.00

GP,63 MM,CENTER BACK,1/4",NPT (M),0 + 7.0/0 + 100,DS

KG/SQ.CM /

PSI,CASE-SS304,INT-SS316,MOV-SS304,MICROMETER,TOUG

HENED. GLASS,1.6% OF FS,IP 67,GLY,3 PT. CAL

Signature Not Verified

Digitally Signed By:

DS FORBES MARSHALL HYDERABAD PRIVATE LIMITED 1

Thu 16-Sep-2021 15:48:34 IST

Approved: Trinath Botcha

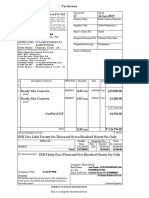

Page : 2 Of 3

TAX INVOICE

(Rule 46, Section 31 of The Central Goods and Services Act, 2017)

TAX INVOICE NO. : 902501313 DATED : 16-SEP-2021 HYD Standard Invoice

OUR OA NO. : 902100948 DATED : 06-AUG-2021 H4H Standard

YOUR PO NO. : 0017VKT/FORBES/21-22 DATED : 04-AUG-2021

DELIVERY NO. : 6308648

1 TAG No. : 4H21054201 TO 4H21054236

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

2 SPE2BAAHA-0381 EA 8 950.00 7,600.00

2

SP,100 MM,LOWER BACK,3/8",NPT (M),0 +

10,KG/SQ.CM,CASE-SS304,INT-SS316L,MOV-SS304,MICROME

TER,TOUGHENED GLASS,1% FS,130% OF FS,IP 68,GLY,3 PT.

CAL.

TAG No. : 4H21054237 TO 4H21054244

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

3 SPG2BAAKA-0381 EA 6 3,800.00 22,800.00

3

SP,200 MM,LOWER BACK,3/8",NPT (M),0 +

40,KG/SQ.CM,CASE-SS304,INT-SS316L,MOV-SS304,MICROME

TER,TOUGHENED GLASS,1% FS,130% OF FS,IP 68,GLY,3 PT.

CAL.

TAG No. : 4H21054245 TO 4H21054250

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

4 SPH1BAAJA-0380 EA 4 3,920.00 15,680.00

4

SP,250 MM,DIRECT BTM,3/8",NPT (M),0 +

25,KG/SQ.CM,CASE-SS304,INT-SS316L,MOV-SS304,MICROME

TER,SAFETY GLASS,1% FS,130% OF FS,IP 68,GLY,3 PT. CAL.

TAG No. : 4H21054251 TO 4H21054254

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

Net Sales 74,880.00

Tax Type Taxable Amount Rate(%) Tax Amount

Rs. Rs.

IGST 74,880 18% 13,478

GST is not payable on reverse charge basis

GROSS AMOUNT 88,358

AMOUNT (IN WORDS) Indian Rupees Eighty Eight Thousand Three Hundred Fifty Eight Only

NET AMOUNT 88,358

AMOUNT (IN WORDS) Indian Rupees Eighty Eight Thousand Three Hundred Fifty Eight Only

Payment Schedule Amount

Rs.

Amount Due (Inclusive of Taxes) 0

Due on/before 16-OCT-2021 88,358

Total : 88,358

TERMS AND CONDITIONS:

This Invoice shall be construed and governed in accordance with the "Standard Terms and Conditions of Sale of Goods / Services" annexed with the above

referred Sales Order Acceptance (Our OA No. 902100948 dated 06-AUG-2021)

GST Declaration : We hereby confirm that the particulars given in this Tax Invoice are true and that the amount mentioned in this Tax Invoice represent the

price actually charged to the Buyer and that there is no flow of additional consideration, directly or indirectly, from the Buyer.

Signature Not Verified

Digitally Signed By:

DS FORBES MARSHALL HYDERABAD PRIVATE LIMITED 1

Thu 16-Sep-2021 15:48:34 IST

Approved: Trinath Botcha

Page : 3 Of 3

TAX INVOICE

(Rule 46, Section 31 of The Central Goods and Services Act, 2017)

TAX INVOICE NO. : 902501313 DATED : 16-SEP-2021 HYD Standard Invoice

OUR OA NO. : 902100948 DATED : 06-AUG-2021 H4H Standard

YOUR PO NO. : 0017VKT/FORBES/21-22 DATED : 04-AUG-2021

DELIVERY NO. : 6308648

"Any damages, shortages, wrong supply or excess deliveries in respect of the goods supplied shall be reported to us within 30 days from the date of delivery

of the goods as per the agreed delivery terms and where insurance is in our scope. Once the 30 day period lapses, the goods will be deemed to have been

received in a good condition and in correct quantity and any such claims reported thereafter will not be accepted."

"The Seller shall be entitled to charge interest on overdue payments from the due date till the date of payment at a rate of 18 % (Eighteen per cent only) per

annum"

This document is digitally signed by the Company Forbes

Marshall (Hyd) Pvt. Ltd.

Signature Not Verified

Digitally Signed By:

DS FORBES MARSHALL HYDERABAD PRIVATE LIMITED 1

Thu 16-Sep-2021 15:48:34 IST

Approved: Trinath Botcha

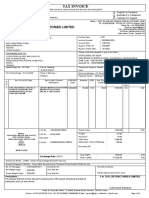

Page : 1 Of 3

TAX INVOICE

(Rule 46, Section 31 of The Central Goods and Services Act, 2017)

DUPLICATE FOR TRANSPORTER

Seller: Forbes Marshall (Hyd) Pvt. Ltd. Buyer: 27670

PLOT NO A-19/2 & T-4/2 VK TYRE INDIA LTD.

I.D.A NACHARAM BEHIND SYBLY INDUSTRIAL LTD.

HYDERABAD 500076 PAWANPURI INDISTRIAL AREA

Telangana,India PAWANPURI

MURADNAGAR,DISTT. GHAZIABAD

TEHSIL MODINAGAR 201206

Uttar Pradesh

India

KIND ATTENTION : PRASHANT DHINGRA

PAN No : AAECV8813F

GSTIN : 09AAECV8813F1Z4

GSTIN. : 36AAACF3055F1ZZ PLACE OF SUPPLY : Uttar Pradesh

STATE CODE : 36 STATE CODE : 09

OUR PAN. : AAACF3055F

BANK NAME : UNION BANK OF INDIA(TARNAKA)

BANK ACCOUNT NO : 510101000804346

BANK ADDRESS : STREET NO 1,TARNAKA,

12-13, 483/33, PLOT NO-3,

SECUNDERABAD-500017,TELANGANA

IFSC CODE : UBIN0906239

TAX INVOICE NO. : 902501313 DATED : 16-SEP-2021 HYD Standard Invoice

OUR OA NO. : 902100948 DATED : 06-AUG-2021 H4H Standard

YOUR PO NO. : 0017VKT/FORBES/21-22 DATED : 04-AUG-2021

DELIVERY NO. : 6308648

SHIP TO

VK TYRE INDIA LTD. PAN No : AAECV8813F

BEHIND SYBLY INDUSTRIAL LTD. GSTIN : 09AAECV8813F1Z4

PAWANPURI INDISTRIAL AREA STATE : Uttar Pradesh

PAWANPURI STATE CODE : 09

MURADNAGAR,DISTT. GHAZIABAD

TEHSIL MODINAGAR 201206

Uttar Pradesh

India

PRASHANT DHINGRA

346261

PAYMENT TERM : COD100%

All payment advices / intimations should be sent to collections@forbesmarshall.com

BANK :

BRANCH :

ADDRESS :

SHIPPING INSTRUCTIONS : DOOR DELIVERY

TRANSPORTER :

LR/DOCKET NO. : DATED :

FREIGHT TERM :

INSURANCE BY : By Us INSURANCE POLICY :Transit Policy number 0830015522

DETAILS valid from 1 April 2021 to 31 March

2022, TATA AIG General Insurance

Company Limited

EWAYBILL :

CORRESPONDENCE : MORADABAD

ADDRESS

DOCUMENTATION : MR.PRASHANT

DETAILS

PACKING DETAILS : 2 CB

NET WEIGHT : 44 GROSS WEIGHT : 50

**** FULL SUPPLY ****

INV SR NO DESCRIPTION OF GOODS/SERVICES UOM QTY Price Amount

PO SR NO Rs. Rs.

1 GPD3AACBD-0011 EA 36 800.00 28,800.00

GP,63 MM,CENTER BACK,1/4",NPT (M),0 + 7.0/0 + 100,DS

KG/SQ.CM /

PSI,CASE-SS304,INT-SS316,MOV-SS304,MICROMETER,TOUG

HENED. GLASS,1.6% OF FS,IP 67,GLY,3 PT. CAL

Signature Not Verified

Digitally Signed By:

DS FORBES MARSHALL HYDERABAD PRIVATE LIMITED 1

Thu 16-Sep-2021 15:48:34 IST

Approved: Trinath Botcha

Page : 2 Of 3

TAX INVOICE

(Rule 46, Section 31 of The Central Goods and Services Act, 2017)

TAX INVOICE NO. : 902501313 DATED : 16-SEP-2021 HYD Standard Invoice

OUR OA NO. : 902100948 DATED : 06-AUG-2021 H4H Standard

YOUR PO NO. : 0017VKT/FORBES/21-22 DATED : 04-AUG-2021

DELIVERY NO. : 6308648

1 TAG No. : 4H21054201 TO 4H21054236

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

2 SPE2BAAHA-0381 EA 8 950.00 7,600.00

2

SP,100 MM,LOWER BACK,3/8",NPT (M),0 +

10,KG/SQ.CM,CASE-SS304,INT-SS316L,MOV-SS304,MICROME

TER,TOUGHENED GLASS,1% FS,130% OF FS,IP 68,GLY,3 PT.

CAL.

TAG No. : 4H21054237 TO 4H21054244

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

3 SPG2BAAKA-0381 EA 6 3,800.00 22,800.00

3

SP,200 MM,LOWER BACK,3/8",NPT (M),0 +

40,KG/SQ.CM,CASE-SS304,INT-SS316L,MOV-SS304,MICROME

TER,TOUGHENED GLASS,1% FS,130% OF FS,IP 68,GLY,3 PT.

CAL.

TAG No. : 4H21054245 TO 4H21054250

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

4 SPH1BAAJA-0380 EA 4 3,920.00 15,680.00

4

SP,250 MM,DIRECT BTM,3/8",NPT (M),0 +

25,KG/SQ.CM,CASE-SS304,INT-SS316L,MOV-SS304,MICROME

TER,SAFETY GLASS,1% FS,130% OF FS,IP 68,GLY,3 PT. CAL.

TAG No. : 4H21054251 TO 4H21054254

IBR SERIAL NO. :

IBR CERT. NO. :

PRODUCT SERIAL NO :

HSN No: 90262000

Net Sales 74,880.00

Tax Type Taxable Amount Rate(%) Tax Amount

Rs. Rs.

IGST 74,880 18% 13,478

GST is not payable on reverse charge basis

GROSS AMOUNT 88,358

AMOUNT (IN WORDS) Indian Rupees Eighty Eight Thousand Three Hundred Fifty Eight Only

NET AMOUNT 88,358

AMOUNT (IN WORDS) Indian Rupees Eighty Eight Thousand Three Hundred Fifty Eight Only

Payment Schedule Amount

Rs.

Amount Due (Inclusive of Taxes) 0

Due on/before 16-OCT-2021 88,358

Total : 88,358

TERMS AND CONDITIONS:

This Invoice shall be construed and governed in accordance with the "Standard Terms and Conditions of Sale of Goods / Services" annexed with the above

referred Sales Order Acceptance (Our OA No. 902100948 dated 06-AUG-2021)

GST Declaration : We hereby confirm that the particulars given in this Tax Invoice are true and that the amount mentioned in this Tax Invoice represent the

price actually charged to the Buyer and that there is no flow of additional consideration, directly or indirectly, from the Buyer.

Signature Not Verified

Digitally Signed By:

DS FORBES MARSHALL HYDERABAD PRIVATE LIMITED 1

Thu 16-Sep-2021 15:48:34 IST

Approved: Trinath Botcha

Page : 3 Of 3

TAX INVOICE

(Rule 46, Section 31 of The Central Goods and Services Act, 2017)

TAX INVOICE NO. : 902501313 DATED : 16-SEP-2021 HYD Standard Invoice

OUR OA NO. : 902100948 DATED : 06-AUG-2021 H4H Standard

YOUR PO NO. : 0017VKT/FORBES/21-22 DATED : 04-AUG-2021

DELIVERY NO. : 6308648

"Any damages, shortages, wrong supply or excess deliveries in respect of the goods supplied shall be reported to us within 30 days from the date of delivery

of the goods as per the agreed delivery terms and where insurance is in our scope. Once the 30 day period lapses, the goods will be deemed to have been

received in a good condition and in correct quantity and any such claims reported thereafter will not be accepted."

"The Seller shall be entitled to charge interest on overdue payments from the due date till the date of payment at a rate of 18 % (Eighteen per cent only) per

annum"

This document is digitally signed by the Company Forbes

Marshall (Hyd) Pvt. Ltd.

Signature Not Verified

Digitally Signed By:

DS FORBES MARSHALL HYDERABAD PRIVATE LIMITED 1

Thu 16-Sep-2021 15:48:34 IST

Approved: Trinath Botcha

You might also like

- GTC Naturz Resources Pvt. LTD.: Bill of SupplyDocument1 pageGTC Naturz Resources Pvt. LTD.: Bill of SupplyGTC NaturzNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Prabhakar Reddy BokkaNo ratings yet

- Business InvoiceDocument1 pageBusiness InvoicexincubeNo ratings yet

- A Learning Plan in Grade 8 PersuasiveDocument6 pagesA Learning Plan in Grade 8 PersuasiveYannah Jovido50% (2)

- Hydrolysis of Nucleic AcidsDocument7 pagesHydrolysis of Nucleic Acidskeepersake81% (16)

- 146Document2 pages146Krishna TiwariNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherUttam PurohitNo ratings yet

- Sh05 Export InvoiceDocument1 pageSh05 Export InvoiceGanesh BharaneNo ratings yet

- Invoice OD111025894559836000Document1 pageInvoice OD111025894559836000Husen GhoriNo ratings yet

- 9019100097Document1 page9019100097ramanNo ratings yet

- Tax Invoice: G-One Enterprises 31-Mar-22Document2 pagesTax Invoice: G-One Enterprises 31-Mar-22LAKSHAY JAINNo ratings yet

- Commercial Invoice: Shipper / Exportir / Manufacturers / BeneficiaryDocument1 pageCommercial Invoice: Shipper / Exportir / Manufacturers / BeneficiaryAlif RiskyNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mohit SharmaNo ratings yet

- Blue Ocean InvoiceDocument1 pageBlue Ocean InvoiceArsalan FerozNo ratings yet

- RIL Tax InvoiceDocument2 pagesRIL Tax InvoiceD K YadavNo ratings yet

- Retail Invoices/Bill: Grand TotalDocument1 pageRetail Invoices/Bill: Grand TotalDhruv RathodNo ratings yet

- Policy SofyDocument2 pagesPolicy SofySaranshChaudharyNo ratings yet

- Club Tax Invoice JULY 2021: Rotary International South Asia OfficeDocument1 pageClub Tax Invoice JULY 2021: Rotary International South Asia OfficeAnnopNo ratings yet

- Invoice NoDocument2 pagesInvoice Nodhiec100% (1)

- Installation ChargesVDocument1 pageInstallation ChargesVbaby yodaNo ratings yet

- InvoiceDocument2 pagesInvoicedebanwitaNo ratings yet

- InvoiceDocument1 pageInvoiceRPGERNo ratings yet

- B No17 PDFDocument1 pageB No17 PDFFSPL HSENo ratings yet

- InvoiceDocument1 pageInvoiceDaniel Saúl OtinianoNo ratings yet

- Tax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratDocument1 pageTax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratGaurav ChaudharyNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shyam SundarNo ratings yet

- Safari Invoice PDFDocument1 pageSafari Invoice PDFSarahBradfordNo ratings yet

- E InvoiceDocument5 pagesE InvoiceVinodh KannaNo ratings yet

- Tax Invoice: Original For RecipientDocument6 pagesTax Invoice: Original For RecipientHarshal KolheNo ratings yet

- Tax Invoice: AB Cartridge Private LimitedDocument1 pageTax Invoice: AB Cartridge Private LimitedSunil PatelNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisJAGO TRADINGNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)yashaswi rajNo ratings yet

- Tax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandDocument1 pageTax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandSANJAY PRAKASHNo ratings yet

- CustomInvoice 2488574255Document1 pageCustomInvoice 2488574255Man Hok WaiNo ratings yet

- InvoiceDocument1 pageInvoiceShreyas RajNo ratings yet

- Stationary Invoice-5080 PaidDocument2 pagesStationary Invoice-5080 PaidAnkur Agarwal100% (1)

- Invoice TNTDocument1 pageInvoice TNTAbas AbasariNo ratings yet

- Invoice OD121103752274883000Document1 pageInvoice OD121103752274883000Rahul DeyNo ratings yet

- Statement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitDocument3 pagesStatement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitKumar ManojNo ratings yet

- InvoiceDocument1 pageInvoiceSudipta DeNo ratings yet

- Tax Invoice: Billing Address: Shipping AddressDocument7 pagesTax Invoice: Billing Address: Shipping AddressAnkit JainNo ratings yet

- 642 GST AR Invoice Items Export - IEL - Nov18Document1 page642 GST AR Invoice Items Export - IEL - Nov18SoyabSuriyaNo ratings yet

- HDFC ERGO General Insurance Company Limited: Claim Form - Part ADocument7 pagesHDFC ERGO General Insurance Company Limited: Claim Form - Part AchakshuNo ratings yet

- InvoiceDocument1 pageInvoiceSri WatsonNo ratings yet

- InvoiceDocument2 pagesInvoiceRaghu GunasekaranNo ratings yet

- Commercial Invoice: AWB No: 9621523435 Invoice Date: 2022-01-15 Invoice No: 693JF721F000070 - 16Document1 pageCommercial Invoice: AWB No: 9621523435 Invoice Date: 2022-01-15 Invoice No: 693JF721F000070 - 16Mr JackNo ratings yet

- Eurofreight Invoice Trasporto Cebos 14 10 2014Document1 pageEurofreight Invoice Trasporto Cebos 14 10 2014Giuseppe VichiNo ratings yet

- InvoiceDocument1 pageInvoiceKidambi SureshNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceEr.Ramesh GuptaNo ratings yet

- Ars International, Bill No. 880, DT., 17.12.2021Document1 pageArs International, Bill No. 880, DT., 17.12.2021Ars InternationalNo ratings yet

- Billing Invoice TemplateDocument8 pagesBilling Invoice TemplateNagesh KumarNo ratings yet

- Iris - RuckusDocument1 pageIris - RuckusSwagBeast SKJJNo ratings yet

- GoodDocument1 pageGoodEntertain with musicNo ratings yet

- Tax Invoice: M/S. Panakala & Co., Chartered Accountants Prop.: C.A K Panakala Rao Indian Bank-Bill ToDocument1 pageTax Invoice: M/S. Panakala & Co., Chartered Accountants Prop.: C.A K Panakala Rao Indian Bank-Bill Tomanoj mohanNo ratings yet

- Tax Invoice: United ShuttersDocument2 pagesTax Invoice: United Shuttersmohammad yasirNo ratings yet

- Seller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceDocument1 pageSeller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceNitinKumarNo ratings yet

- Invoice 400283 20210427Document2 pagesInvoice 400283 20210427Juan Pablo NietoNo ratings yet

- Act Madhu BillDocument2 pagesAct Madhu BillMadhuNo ratings yet

- InvoiceDocument1 pageInvoiceDevendra Pratap SinghNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFKrishan Kumar Fatepuriya FatepuriyaNo ratings yet

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- Cma2616 6000247712Document1 pageCma2616 6000247712y8jkfz98m9No ratings yet

- Sd10 Forecasting Free CashflowsDocument8 pagesSd10 Forecasting Free CashflowsDemi Tugano BernardinoNo ratings yet

- Bcsbi Pictorial BookDocument24 pagesBcsbi Pictorial BookMALAYADRI DUARINo ratings yet

- Rahmania Tbi 6 D Soe...Document9 pagesRahmania Tbi 6 D Soe...Rahmania Aulia PurwagunifaNo ratings yet

- WhatsApp v. Union of India Filing VersionDocument224 pagesWhatsApp v. Union of India Filing VersionVinayNo ratings yet

- The Laws On Local Governments SyllabusDocument4 pagesThe Laws On Local Governments SyllabusJohn Kevin ArtuzNo ratings yet

- (Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodDocument21 pages(Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodSilvia Devi Eka PutriNo ratings yet

- Uji Chi SquareDocument5 pagesUji Chi Squareeldiya yuliSNo ratings yet

- J.the Reproduction and Husbandry of The Water Monitor Varanus Salvator at The Gladys Porter Zoo, BrownsvilleDocument7 pagesJ.the Reproduction and Husbandry of The Water Monitor Varanus Salvator at The Gladys Porter Zoo, BrownsvilleAhmad MigifatoniNo ratings yet

- Western Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterDocument4 pagesWestern Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterMaria Julia DenustaNo ratings yet

- Shareholder Value Analysis FrameworkDocument9 pagesShareholder Value Analysis Frameworkashish.the7353No ratings yet

- Working Capital Management: Summer Training Project Report ONDocument102 pagesWorking Capital Management: Summer Training Project Report ONSHASHANKNo ratings yet

- Pre-Lab: Microscopes II: Plant Cells and OsmosisDocument2 pagesPre-Lab: Microscopes II: Plant Cells and Osmosisapi-234540318No ratings yet

- Create Database Taller-AdalbertoDocument2 pagesCreate Database Taller-AdalbertoAdalberto GonzalezNo ratings yet

- 3I Grading Rubric For Output PresentationDocument2 pages3I Grading Rubric For Output PresentationBinibining Michelle CenizaNo ratings yet

- Whittaker Dynamics 17Document442 pagesWhittaker Dynamics 17Mahmoud Ahmed 202201238No ratings yet

- EPRI Automated Analysis of Bobbin CoilProbe Eddy Current DataDocument97 pagesEPRI Automated Analysis of Bobbin CoilProbe Eddy Current DataaldeanucuNo ratings yet

- Beginner's Guide To SoloDocument12 pagesBeginner's Guide To SoloTiurNo ratings yet

- Support/downloads or Scan Above QR Code For Detailed Policy WordingDocument10 pagesSupport/downloads or Scan Above QR Code For Detailed Policy Wordingraj VenkateshNo ratings yet

- Steffes 5100 Tech Data SheetDocument4 pagesSteffes 5100 Tech Data SheetcringsredNo ratings yet

- Testbank: Applying Ifrs Standards 4eDocument11 pagesTestbank: Applying Ifrs Standards 4eSyed Bilal AliNo ratings yet

- MTCNA Lab Guide INTRA 1st Edition - Id.en PDFDocument87 pagesMTCNA Lab Guide INTRA 1st Edition - Id.en PDFreyandyNo ratings yet

- Comparative Investment ReportDocument8 pagesComparative Investment ReportNelby Actub MacalaguingNo ratings yet

- Piping Stress AnalysisDocument10 pagesPiping Stress AnalysisM Alim Ur Rahman100% (1)

- Stream User-ManualDocument36 pagesStream User-ManualSreekanth NakkaNo ratings yet

- PLC - HMI Lab #4 22W1Document2 pagesPLC - HMI Lab #4 22W1crazyjmprNo ratings yet

- Sebp7383 05 00 Allcd - 9Document837 pagesSebp7383 05 00 Allcd - 9Roland Culla100% (1)

- FACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksDocument3 pagesFACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksHasaan HussainNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument13 pagesSummary of Current Charges (RS) : Talk To Us SMSBrandon FloresNo ratings yet