Professional Documents

Culture Documents

May 19 LIDi Napoli Event One Page

May 19 LIDi Napoli Event One Page

Uploaded by

Elizabeth BenjaminOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

May 19 LIDi Napoli Event One Page

May 19 LIDi Napoli Event One Page

Uploaded by

Elizabeth BenjaminCopyright:

Available Formats

Long Island Cocktails in Honor of

New York State Comptroller Tom DiNapoli

Thursday, May 19th, 2011

6:00 - 8:00pm Reception

The Woodlands • One Southwoods Road• Woodbury, New York

_____HOST $1,000 _____CO-HOST $500

_____SPONSOR $250 _____FRIEND $100 (1 Ticket, Min)

I can not attend but would like to support Tom with a contribution of $______________

Please charge $_____________________ to my: ___ Visa ___ MasterCard ___ American Express

Account#______________________________________________________Exp.____________________

Signature_______________________________________________________________

Name on card_______________________________________________________________

Contributor Name_______________________________________________________________

PAC, Part., or LLC Name(if applicable)__________________________________________________

Address__________________________________________________________________

City, State, Zip________________________________________________________________

Occupation__________________________________Employer__________________________

Phone______________________________________Fax____________________________

Email____________________________________________________________________!

!

Please make checks payable to “DiNapoli 2014” and mail to:

DiNapoli 2014

c/o Peggy May• P.O. Box 1776 Mineola, NY 11501

or you may fax this form to (516) 873.9524

For more information or to RSVP, please contact Amy Dowell at

(917) 288-7929 or email amy@dowellconsultingllc.com.

CONTRIBUTION DISCLAIMER:

Contributor’s Confirmation – DiNapoli 2014 does not accept contributions from any contributor: (1) who is employed by the Office of

State Comptroller; (2) that responds to a request for proposals (“RFP”) for investment or legal business with the New York State

Common Retirement Fund (the “Fund”) (this restriction applies from the date the RFP is issued through date the initial contract is

signed, and continues in effect through the ninetieth day thereafter with respect to the person or firm awarded the contract); or (3) that

is acting as a placement agent in an investment transaction with the Fund or acted as a placement agent in an investment transaction

that closed with the Fund in the preceding twelve months. I hereby confirm that this contribution was made from the contributor’s own

funds, is not being reimbursed in any manner, and is not in any of the three prohibited categories (1) – (3) listed above.

Signature Required___________________________________ Print Name______________________________________________

Pursuant to Executive Order of the State Comptroller, effective November 7, 2009, the Fund is prohibited from engaging an

investment adviser: (1) for two years after the investment adviser or covered associate makes a contribution in connection with any

election for State Comptroller (other than contributions by a covered associate, who is a natural person entitled to vote in New York

State at the time of the contribution, of up to $250 per election); or (2) if the investment advisor or covered associate coordinates or

solicits any person or political action committee to make contribution in connection with any election for State Comptroller.

Contributions to DiNapoli 2014 are not deductible for federal income tax purposes. The maximum permissible contribution is

$55,900. Partnerships that make contributions exceeding $2,500 will be required to specifically identify the partners responsible for

the contribution, and that amount will be counted against each partner’s individual contribution limit. Total contributions from a

corporation may not exceed $5,000 per calendar year to all New York state and local political committees. Corporations, other entities

and individuals are strictly prohibited from reimbursing another person or entity for making a contribution. All contributors must be

US citizens or permanent resident aliens (green card holder). Paid for by DiNapoli 2014.

You might also like

- PJP BC Registered Bond - Word97Document2 pagesPJP BC Registered Bond - Word97Osei Tutu Agyarko100% (6)

- Syllabus of BSC Nursing, Kathmandu UniversityDocument191 pagesSyllabus of BSC Nursing, Kathmandu UniversityKamal Raj Chapagain94% (18)

- Ambicare PresentationDocument24 pagesAmbicare PresentationNicole ModigaNo ratings yet

- Crab House InviteDocument2 pagesCrab House InviteQueens CrapperNo ratings yet

- Taxpayers Event 4 11 12Document1 pageTaxpayers Event 4 11 12ahawkins8223No ratings yet

- Cuomo Hamptons Memo-1Document2 pagesCuomo Hamptons Memo-1Lauren AndersonNo ratings yet

- Obama 2011 04 27 Dinner InviteDocument2 pagesObama 2011 04 27 Dinner InvitedfreedlanderNo ratings yet

- Cuomo Fundraiser Complete InviteDocument3 pagesCuomo Fundraiser Complete InviteElizabeth BenjaminNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Reception For O'Malley For PresidentDocument2 pagesReception For O'Malley For PresidentSunlight FoundationNo ratings yet

- Fish FryDocument2 pagesFish FrySunlight FoundationNo ratings yet

- Doheny FundraiserDocument1 pageDoheny FundraiserBrian J. AmaralNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Evening ReceptionDocument3 pagesEvening ReceptionSunlight FoundationNo ratings yet

- ReceptionDocument1 pageReceptionSunlight FoundationNo ratings yet

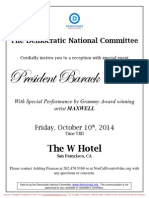

- Reception With Barack Obama For Democratic National CommitteeDocument2 pagesReception With Barack Obama For Democratic National CommitteeSunlight FoundationNo ratings yet

- Lunch CruiseDocument2 pagesLunch CruiseSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Senator Bill Nelson: Invite You To A Breakfast HonoringDocument3 pagesSenator Bill Nelson: Invite You To A Breakfast HonoringSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- BreakfastDocument2 pagesBreakfastSunlight FoundationNo ratings yet

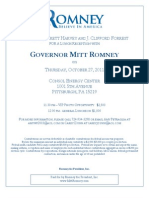

- Romney Pittsburgh Save The DateDocument2 pagesRomney Pittsburgh Save The Datetmcnulty8452No ratings yet

- BreakfastDocument3 pagesBreakfastSunlight FoundationNo ratings yet

- Birthday LunchDocument2 pagesBirthday LunchSunlight FoundationNo ratings yet

- Reception With Speaker of The House John Boehner For Judy BiggertDocument2 pagesReception With Speaker of The House John Boehner For Judy BiggertSunlight FoundationNo ratings yet

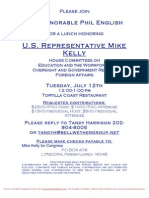

- U.S. Representative Mike Kelly: The Honorable Phil EnglishDocument3 pagesU.S. Representative Mike Kelly: The Honorable Phil EnglishSunlight FoundationNo ratings yet

- An Afternoon of BoatingDocument2 pagesAn Afternoon of BoatingSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- BreakfastDocument2 pagesBreakfastSunlight FoundationNo ratings yet

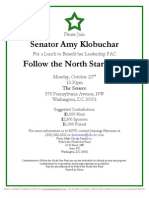

- Lunch With Sen. Amy Klobuchar For Follow The North Star FundDocument2 pagesLunch With Sen. Amy Klobuchar For Follow The North Star FundSunlight FoundationNo ratings yet

- BreakfastDocument2 pagesBreakfastSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

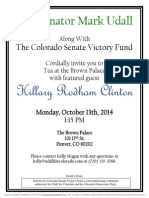

- Tea at The Brown Palace For Mark Udall, Colorado Democratic PartyDocument2 pagesTea at The Brown Palace For Mark Udall, Colorado Democratic PartySunlight FoundationNo ratings yet

- Paul Ryan RoundtableDocument2 pagesPaul Ryan RoundtableSunlight FoundationNo ratings yet

- Breakfast For Paul HodesDocument4 pagesBreakfast For Paul HodesSunlight FoundationNo ratings yet

- Romney InviteDocument2 pagesRomney InviteDavid SidersNo ratings yet

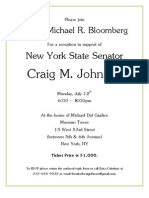

- 7-12-10 Craig Johnson Bloomberg InviteDocument2 pages7-12-10 Craig Johnson Bloomberg InviteElizabeth BenjaminNo ratings yet

- Cocktail ReceptionDocument2 pagesCocktail ReceptionSunlight FoundationNo ratings yet

- Lake County WeekendDocument3 pagesLake County WeekendSunlight FoundationNo ratings yet

- BreakfastDocument2 pagesBreakfastSunlight FoundationNo ratings yet

- Afternoon ReceptionDocument2 pagesAfternoon ReceptionSunlight FoundationNo ratings yet

- First Lady Michelle Obama For A Family Reception For Obama Victory FundDocument1 pageFirst Lady Michelle Obama For A Family Reception For Obama Victory FundSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Peter Kinder Event - Lafayette CountyDocument2 pagesPeter Kinder Event - Lafayette CountyMolly TeichmanNo ratings yet

- Senator Dianne Feinstein: Greg Farmer Jean Marie Neal Holly FechnerDocument4 pagesSenator Dianne Feinstein: Greg Farmer Jean Marie Neal Holly FechnerSunlight FoundationNo ratings yet

- 2014 Boehner Backyard BBQ For John BoehnerDocument3 pages2014 Boehner Backyard BBQ For John BoehnerSunlight FoundationNo ratings yet

- Reception For Tom CrossDocument1 pageReception For Tom CrossSunlight FoundationNo ratings yet

- Cocktail ReceptionDocument2 pagesCocktail ReceptionSunlight FoundationNo ratings yet

- Oct 23rd Norfolk EventDocument2 pagesOct 23rd Norfolk EventSusan Browndorf HirschbielNo ratings yet

- Reception For Carly FiorinaDocument2 pagesReception For Carly FiorinaSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- Lunch For Doug OseDocument1 pageLunch For Doug OseSunlight FoundationNo ratings yet

- 07 23 12 Jax Event Invite 3Document1 page07 23 12 Jax Event Invite 3Matt DixonNo ratings yet

- Reception With Ann Romney For Romney For PresidentDocument2 pagesReception With Ann Romney For Romney For PresidentSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- Reception For Free and Strong America PACDocument2 pagesReception For Free and Strong America PACSunlight FoundationNo ratings yet

- Rubio 9/10 InvitationDocument2 pagesRubio 9/10 InvitationdhmontgomeryNo ratings yet

- Durbin-Booker Fundraising FlyerDocument2 pagesDurbin-Booker Fundraising FlyerChadMerdaNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- ULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”From EverandULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”No ratings yet

- The Encyclopedia of Real Estate Forms & Agreements: A Complete Kit of Ready-to-Use Checklists, Worksheets, Forms, and ContractsFrom EverandThe Encyclopedia of Real Estate Forms & Agreements: A Complete Kit of Ready-to-Use Checklists, Worksheets, Forms, and ContractsNo ratings yet

- RJC Koch MedresDocument2 pagesRJC Koch MedresElizabeth BenjaminNo ratings yet

- NY CD 09 - Exec. SummaryDocument2 pagesNY CD 09 - Exec. SummaryElizabeth BenjaminNo ratings yet

- Capital Region: County Structurally Deficient BridgesDocument4 pagesCapital Region: County Structurally Deficient BridgesElizabeth BenjaminNo ratings yet

- Calling All PEF ProudDocument1 pageCalling All PEF ProudElizabeth BenjaminNo ratings yet

- 8.22.11 Press ReleaseDocument1 page8.22.11 Press ReleaseElizabeth BenjaminNo ratings yet

- Jesus Gonzalez Giving Voters A Real ChoiceDocument3 pagesJesus Gonzalez Giving Voters A Real ChoiceElizabeth BenjaminNo ratings yet

- PR11 07 067Document3 pagesPR11 07 067Elizabeth BenjaminNo ratings yet

- Meet Jesus GonzálezDocument1 pageMeet Jesus GonzálezElizabeth BenjaminNo ratings yet

- 8.2.11 A4ATL Press Release and Fact SheetDocument4 pages8.2.11 A4ATL Press Release and Fact SheetMicah KellnerNo ratings yet

- Zadroga CancerDocument2 pagesZadroga CancerElizabeth BenjaminNo ratings yet

- Release 2011-07-27 2012 Budget and Capital ProgramDocument3 pagesRelease 2011-07-27 2012 Budget and Capital ProgramElizabeth BenjaminNo ratings yet

- Calendar For IND NOM PETS - 9 CD & 23,27,54 & 73 AD SP Elects On 91311-070111Document2 pagesCalendar For IND NOM PETS - 9 CD & 23,27,54 & 73 AD SP Elects On 91311-070111Elizabeth BenjaminNo ratings yet

- Accelerate Upstate: News ReleaseDocument6 pagesAccelerate Upstate: News ReleaseElizabeth BenjaminNo ratings yet

- New York Clerk Accommodation MemoDocument5 pagesNew York Clerk Accommodation MemoG-A-YNo ratings yet

- 34-11 (Letter To The President)Document2 pages34-11 (Letter To The President)Elizabeth BenjaminNo ratings yet

- DS-2CD2620F-IZ (S) 2.0MP 1/2.7" CMOS ICR Bullet Network CameraDocument4 pagesDS-2CD2620F-IZ (S) 2.0MP 1/2.7" CMOS ICR Bullet Network CameraArun.V1984No ratings yet

- Activity Performance Task in Eced 1Document2 pagesActivity Performance Task in Eced 1Angel Diane TalabisNo ratings yet

- Medical Picture Mnemonics PDFDocument28 pagesMedical Picture Mnemonics PDFAntoine JusticeNo ratings yet

- L&T Process Ball Valves PDFDocument16 pagesL&T Process Ball Valves PDFUnna MalaiNo ratings yet

- 5G TransportDocument42 pages5G TransportDaniel Cafu100% (1)

- Organization: Genius Professionals Investment Club (GENPRO) Contact Persons DetailsDocument3 pagesOrganization: Genius Professionals Investment Club (GENPRO) Contact Persons DetailsDaniel TwiteNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (August) 2012 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Spring (August) 2012 ExaminationsAmmar KashanNo ratings yet

- Perchloroethylene MSDSDocument7 pagesPerchloroethylene MSDSWeston DoucetteNo ratings yet

- Computer Requirements: La NWM InstallationDocument8 pagesComputer Requirements: La NWM InstallationJorge EstradaNo ratings yet

- Yearly PlanDocument36 pagesYearly Planapi-542955727No ratings yet

- Modbus TableDocument67 pagesModbus TableNutchaiSaengsurathamNo ratings yet

- Bagong Pag-Asa, Samar, Housing Project 2018Document5 pagesBagong Pag-Asa, Samar, Housing Project 2018edroselloNo ratings yet

- Shortcut KeysDocument4 pagesShortcut KeysFawad AfzalNo ratings yet

- HPM and H and B - Daryl E. CandoDocument41 pagesHPM and H and B - Daryl E. CandoDaryl CandoNo ratings yet

- Microsoft Office Telemetry: Analysis ReportDocument29 pagesMicrosoft Office Telemetry: Analysis ReportdanmierlutNo ratings yet

- Bla BlaDocument8 pagesBla BladharwinNo ratings yet

- Heat Treatment Manual Part IIDocument21 pagesHeat Treatment Manual Part IIAnonymous lmCR3SkPrK100% (3)

- Configuring IP Office 500 For SIPDocument5 pagesConfiguring IP Office 500 For SIPPhillip CasalegnoNo ratings yet

- Aritificial Vision YOLOV2 Part2Document9 pagesAritificial Vision YOLOV2 Part2David BenavidesNo ratings yet

- B&W DM601and2 S2 User ManualDocument20 pagesB&W DM601and2 S2 User Manualjeanmarc100% (1)

- 07-09-14 EditionDocument28 pages07-09-14 EditionSan Mateo Daily JournalNo ratings yet

- International Marketing Literature ReviewDocument7 pagesInternational Marketing Literature Reviewea20cqyt100% (1)

- MSBP Logbook1Document3 pagesMSBP Logbook1Dat HoangNo ratings yet

- Testbank ProblemsDocument47 pagesTestbank Problemss.gallur.gwynethNo ratings yet

- Location Decisions: Revision AnswersDocument4 pagesLocation Decisions: Revision AnswersZakir HalilovNo ratings yet

- Excel CRM TemplateDocument6 pagesExcel CRM TemplateRafeykShefaNo ratings yet

- Is 9815 - 1994 - Reff2019 - Servo STBLZRDocument9 pagesIs 9815 - 1994 - Reff2019 - Servo STBLZRsrbh1977No ratings yet

- Republic of The Philippines: Kalinga State UniversityDocument5 pagesRepublic of The Philippines: Kalinga State UniversityJoan AntonioNo ratings yet