Professional Documents

Culture Documents

Final Semester Examination: (March 2011 Session)

Final Semester Examination: (March 2011 Session)

Uploaded by

unknown gtrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Semester Examination: (March 2011 Session)

Final Semester Examination: (March 2011 Session)

Uploaded by

unknown gtrCopyright:

Available Formats

FINAL SEMESTER EXAMINATION

(MARCH 2011 SESSION)

INTRODUCTION TO FINANCIAL ACCOUNTING

DAC1043

LECTURER :……………………………………………………………………………

MATRIC NO : …………………………………………. PROGRAMME : ..……………………………………

VENUE : ………………………………………….

MAY 2011 DURATION : 3 HOURS

INSTRUCTIONS:

1. Candidates must read all questions carefully.

2. The examination script consists of FIVE (5) questions.

3. Answer ALL questions in the answer booklet provided.

THIS EXAMINATION SCRIPT CONTAINS 6 PAGES INCLUDING THE FRONT COVER

DO NOT OPEN THE EXAMINATION SCRIPT UNTIL FURTHER INSTRUCTION

CONFIDENTIAL DAC1043

(100 marks)

Time : 3 hours

INSTRUCTION

Answer ALL questions. Use the answer booklets provided.

1. (a) Briefly explain the following users of accounting information:

i. Investors

(2 marks)

ii. Governmental agencies

(2 marks)

(b) Briefly explain TWO (2) characteristics of the following business

organizations:

i. Sole trader

(2 marks)

ii. Company

(2 marks)

(c) Define the meaning of accrued expenses.

(2 marks)

2. Asmara, a sole trader, started his business on 1 January 2011 under the name of

Asmara Enterprise. The following are his business transactions for the month of

January. All cash transactions refer to cash at bank.

January Transactions RM

1 Started business with cash at bank. 80,000

5 Purchased goods on credit from Zaliya Enteprise. 6,500

10 The owner brought in motor vehicle for business use. 23,000

13 Sold goods to Melati on credit. 6,000

18 Sold goods for cash. 2,000

21 Purchased goods by cheque. 1,500

25 Paid telephone bill by cash. 250

26 Melati returned some of the goods she bought. 800

27 Asmara paid personal house electricity bill by cheque. 500

28 Paid Zaliya Enteprise by cheque. 3,500

30 Received cheque from Melati. 3,000

Required:

(a) Record the above transactions into the relevant accounts in the general

ledger and balance of all the accounts.

(8 marks)

(b) Prepare a Trial Balance as at 31 January 2011.

(7 marks)

DAC1043 INTRODUCTION TO FINANCIAL ACCOUNTING 1/5

CONFIDENTIAL DAC1043

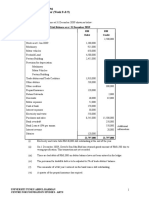

3. Tom, Jerry and Spike are in partnership sharing profit and losses in the ratio of 1:2:2.

The following trial balance was extracted from the accounts of partnership as at 31

December 2010.

Debit Credit

RM RM

Bank 76,160

Debtors 32,010

Creditors 25,300

Inventory (as at 1 January 2010) 18,400

Motor vehicles 85,000

Building 103,000

Land 370,000

5% loan from CIMB Finance 250,000

Sales and purchases 79,060 175,000

Returns outwards 1,060

Carriage inwards 1,100

Advertising 650

Maintenance expenses 230

Rent received 17,500

Discounts 210 450

Salaries and wages 8,500

Electricity, water and telephone expenses 1,250

Miscellaneous expenses 1,800

Petrol 200

Stationery 80

Accumulated depreciation:

- Motor vehicles 5,000

- Building 8,000

Capital accounts:

- Tom 80,000

- Jerry 100,000

- Spike 90,000

Current accounts (as at 1 January 2010)

- Tom 18,340

- Jerry 8,000

- Spike 15,000

Drawing (withdrawn on 1 January 2010)

- Tom 4,000

- Jerry 3,000

- Spike 4,000

Loan from Tom 11,000

796,650 796,650

Prior to the commencement of the business, they have agreed upon the following

matters:

(i) Interest on capital is to be allowed to all partners at 5% per annum.

(ii) Interest is to be charged on all drawings at 5% per annum.

DAC1043 INTRODUCTION TO FINANCIAL ACCOUNTING 2/5

CONFIDENTIAL DAC1043

(iii) Salaries for each partner are as follows:

Tom RM12,000 per annum

Jerry RM10,000 per annum

Spike RM10,000 per annum

(iv) Interest on loan of 10% per annum.

Additional information:

(i) Inventory as at 31 December 2010 is RM15,500.

(ii) The amount of rent received is for 14 months to February 2011.

(iii) Advanced salary paid to the staff amounting of RM500.

(iv) Interest on bank loan from CIMB Finance was not paid yet.

(v) Included in carriage inwards is an amount of RM200 which represent carriage

of goods to customers.

(vi) Depreciation was provided by using the rates as follows:

Motor vehicle 5% (on net book value)

Building 10% (on cost)

Required:

(a) Prepare the Statement of Comprehensive Income and Profit and Loss

Appropriation for the year ended 31 December 2010 (show all workings).

(27 marks)

(b) Prepare the Current Account of the partners in a columnar form.

(8 marks)

(c) Prepare the Statement of Financial Position as at 31 December 2010 (show

all workings).

(14 marks)

DAC1043 INTRODUCTION TO FINANCIAL ACCOUNTING 3/5

CONFIDENTIAL DAC1043

4. The following are the bank account and bank statement of Mickey Enterprise for the

month of January 2011.

Bank Account

January 2011 RM January 2011 RM

1 Balance b/f 5,030 7 Jane - 230075 1000

4 Miney - 230074 520 23 Smith - 230076 440

6 Haikal - 258787 600 29 Jack - 230078 100

14 James - 280217 2,000 30 Matt - 230079 650

22 Jennifer - 000414 360 31 Balance c/f 6,520

29 Whitney - 444600 200

8,710 8,710

Maybank Bank

Bank Statement for the month of 31 January 2011

Date Particular Debit Credit Balance

RM RM RM

Jan 1 Balance b/f 5,030 5,030

5 Cheque - 230074 520 4,510

6 Cheque - 258787 800 5,310

8 Bank charges 50 5,260

10 Cheque - 230075 1,000 4,260

15 Credit transfer 1,900 6,160

18 Standing order 150 6,010

24 Cheque - 000414 360 6,370

30 Cheque - 230078 100 6,270

31 Balance c/f 6,270

Note:

(i) Cheque no. 230074 paid to Miney for RM520 had been wrongly entered in

the cash account as a receipt instead of a payment.

(ii) Cheque no. 258787 received from Haikal amounted RM800 had been

wrongly recorded in the cash account as RM600.

Required:

(a) Prepare the Adjusted Bank Account as a 31 January 2011.

(6 marks)

(b) Prepare the Bank Reconciliation Statement as at 31 January 2011.

(5 marks)

DAC1043 INTRODUCTION TO FINANCIAL ACCOUNTING 4/5

CONFIDENTIAL DAC1043

5. The following information is related to Woody Enterprise for the accounting period

ended 30 April 2011:

RM

Sales 200,000

Cost of goods sold 100,000

Total expenses 55,000

Total income 40,000

Opening inventory 15,000

Closing inventory 19,500

Total Non-Current Asset 380,000

Debtors 30,000

Total Asset 450,000

Total Equity 250,000

Total Non-Current Liabilities 150,000

Calculate and explain the following ratios:

(a) Gross profit margin.

(3 marks)

(b) Net profit margin.

(3 marks)

(c) Current ratio.

(3 marks)

(d) Acid test ratio.

(3 marks)

(e) Debtors’ collection period.

(3 marks)

END OF QUESTION PAPER

DAC1043 INTRODUCTION TO FINANCIAL ACCOUNTING 5/5

You might also like

- Cmfas m1b Part 2 (80 Question)Document15 pagesCmfas m1b Part 2 (80 Question)Megan Pang0% (1)

- MYOB Sample QuestionsDocument10 pagesMYOB Sample QuestionsKay BMNo ratings yet

- Topic 4 Class ExerciseDocument5 pagesTopic 4 Class ExerciseAzim OthmanNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- BSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester IiDocument8 pagesBSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester Iipriyadarshini212007No ratings yet

- Acc Mba Int - 1 Dec 2022Document3 pagesAcc Mba Int - 1 Dec 2022Hema LathaNo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- Institute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Document5 pagesInstitute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Mr V. Phaninder ReddyNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- FMA Question PackDocument67 pagesFMA Question PackAhamed NabeelNo ratings yet

- Acc3201 (F) Aug2014Document5 pagesAcc3201 (F) Aug2014natlyhNo ratings yet

- Osa Jan24 s1 Adbm Business Finance FinalDocument13 pagesOsa Jan24 s1 Adbm Business Finance FinalpzrgftctbxNo ratings yet

- Adam's Learning Centre, Lahore: Simple Final AccountsDocument10 pagesAdam's Learning Centre, Lahore: Simple Final AccountsMasood Ahmad AadamNo ratings yet

- Grade 10 Provincial Case Study QP 2023Document5 pagesGrade 10 Provincial Case Study QP 2023kwazy dlaminiNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- 2023 EACC 1614 - Test 2Document8 pages2023 EACC 1614 - Test 2asandantlumayo77No ratings yet

- Assignment 2 (PJ)Document2 pagesAssignment 2 (PJ)Nabila Abu BakarNo ratings yet

- BAAB1014 Assignment EliteDocument5 pagesBAAB1014 Assignment Elitejinosini ramadasNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- Financial Accounting QPDocument12 pagesFinancial Accounting QPsinan007.othayiNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Question PaperDocument12 pages2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Question PaperChantelle IsaksNo ratings yet

- Accounting I Mar 2022Document4 pagesAccounting I Mar 2022Ishmaal KhanNo ratings yet

- Maf5101 Financial Accounting I Eve SuppDocument6 pagesMaf5101 Financial Accounting I Eve Suppshobasabria187No ratings yet

- Accounting I December 2020Document5 pagesAccounting I December 2020faraz hassanNo ratings yet

- Final Exam (E)Document5 pagesFinal Exam (E)Аяя АяяNo ratings yet

- School of Business (SBC) : Module's InformationDocument3 pagesSchool of Business (SBC) : Module's InformationEinNo ratings yet

- GP Accounting Grade 11 June 2023 P1 and MemoDocument28 pagesGP Accounting Grade 11 June 2023 P1 and Memompho99988No ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- Lecture 4 Part 1 - Exercises - QuestionDocument10 pagesLecture 4 Part 1 - Exercises - QuestionIsyraf Hatim Mohd TamizamNo ratings yet

- CSE FmgACC Mid CompreDocument3 pagesCSE FmgACC Mid CompreArif MannanNo ratings yet

- Poa T - 11Document5 pagesPoa T - 11SHEVENA A/P VIJIANNo ratings yet

- Exercise (11) : Answer: A. Net Profit RM1,793 B. RM63,340Document3 pagesExercise (11) : Answer: A. Net Profit RM1,793 B. RM63,340S1X 32 許詠棋 KohYongKeeNo ratings yet

- Question Bbaw2103 Financial AccountingDocument9 pagesQuestion Bbaw2103 Financial AccountingZakey Zainal0% (1)

- Rv101 June 2022 Exam QuestionDocument9 pagesRv101 June 2022 Exam QuestionpartlinemokhothuNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Question April-2010Document51 pagesQuestion April-2010zia4000100% (1)

- 4120504Document3 pages4120504m_gadhvi6840No ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Business Information Systems-DCSD 104: Page 1 of 8Document8 pagesBusiness Information Systems-DCSD 104: Page 1 of 8HarNo ratings yet

- Acc Nov2012 P2Document13 pagesAcc Nov2012 P2gibbamanjexNo ratings yet

- Company Final Accounts: Rashna Company Ltd. at 31 December, 200ADocument2 pagesCompany Final Accounts: Rashna Company Ltd. at 31 December, 200AIsteehad RobinNo ratings yet

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- AccountingDocument3 pagesAccountingAtiya IftikharNo ratings yet

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Document5 pagesIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- Reg. No.Document4 pagesReg. No.madhumithaNo ratings yet

- Test 2 Acc117 Q Sem Mar 2022 Am1103bDocument6 pagesTest 2 Acc117 Q Sem Mar 2022 Am1103bHUMAIRA LIYANA FARISHA JAFRINo ratings yet

- Sample QuestionsDocument3 pagesSample QuestionstulikaNo ratings yet

- Accounts QP 3Document9 pagesAccounts QP 3Sarun ChhetriNo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Week 2 C31FF TUTORIAL QUESTIONS - 1414040219Document2 pagesWeek 2 C31FF TUTORIAL QUESTIONS - 1414040219Bilal AliNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Final Semester Examination: (MAY 2011 SESSION)Document3 pagesFinal Semester Examination: (MAY 2011 SESSION)unknown gtrNo ratings yet

- Final Semester Examination: (March 2011 Session)Document7 pagesFinal Semester Examination: (March 2011 Session)unknown gtrNo ratings yet

- Final Semester Examination: (March 2011 Session)Document8 pagesFinal Semester Examination: (March 2011 Session)unknown gtrNo ratings yet

- Ded 0023Document4 pagesDed 0023unknown gtrNo ratings yet

- Turcotte de Bellefeuille Den Hond 2007Document16 pagesTurcotte de Bellefeuille Den Hond 2007fleursinga16No ratings yet

- Advantages of The Product Life CycleDocument5 pagesAdvantages of The Product Life CycleMunotidaishe TaziwaNo ratings yet

- NIDHI-EIR GuidelineDocument15 pagesNIDHI-EIR GuidelineAdarsh KumarNo ratings yet

- Trademark NotesDocument19 pagesTrademark NotesKUSHAL RNo ratings yet

- Understanding The MarketDocument49 pagesUnderstanding The MarketMonria FernandoNo ratings yet

- Nickels10ce Enhanced PPT Ch03Document39 pagesNickels10ce Enhanced PPT Ch03Ishaan NasitNo ratings yet

- Improvement GE235 - A - B (MAH - BUS) - Mid - Question - Summer - 21Document3 pagesImprovement GE235 - A - B (MAH - BUS) - Mid - Question - Summer - 21NN NNNo ratings yet

- Cost 1-72Document72 pagesCost 1-72Junaid AhmedNo ratings yet

- Dyal Singh Evening College: Submitted by Imran Roll No. 28D Bcom (Prog)Document7 pagesDyal Singh Evening College: Submitted by Imran Roll No. 28D Bcom (Prog)Muskan mehta D 31No ratings yet

- Varun BeveragesDocument10 pagesVarun Beveragesramsharma692000No ratings yet

- Labor Project Final Term PaperDocument11 pagesLabor Project Final Term PaperEdris Abdella NuureNo ratings yet

- Assignment-7 Assignment-7 MB4706Document4 pagesAssignment-7 Assignment-7 MB4706efraimjeferson1010No ratings yet

- Customer Relationship On Business Model DesignDocument31 pagesCustomer Relationship On Business Model DesignInacio LourdesNo ratings yet

- Chapter 1 Overview of Business Process Outsourcing (BPO)Document17 pagesChapter 1 Overview of Business Process Outsourcing (BPO)Syrill CayetanoNo ratings yet

- Contract II Notes PDFDocument3 pagesContract II Notes PDFSiddharth Jain PatniNo ratings yet

- 2017 Myceb Annual ReportDocument23 pages2017 Myceb Annual ReportMohamad Zaki AhmadNo ratings yet

- Consumer Perception Towards HDFC BankDocument55 pagesConsumer Perception Towards HDFC BankMohammad KhadeerNo ratings yet

- Presentación de RainTree Febrero de 2023Document3 pagesPresentación de RainTree Febrero de 2023La Silla VacíaNo ratings yet

- Annualreport-PttAR2019en 20marchDocument229 pagesAnnualreport-PttAR2019en 20marchDarryl Farhan WidyawanNo ratings yet

- Merchant Rates 2019 2020 Oct 2019Document11 pagesMerchant Rates 2019 2020 Oct 2019rh007No ratings yet

- Pilgrim Bank ADocument5 pagesPilgrim Bank ANoora BlueNo ratings yet

- Financial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFDocument67 pagesFinancial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFphongtuanfhep4u100% (12)

- Buyback of Shares As Poison PillDocument17 pagesBuyback of Shares As Poison PillupendraNo ratings yet

- Atul M Jadia 48, Sham Sadam, A Wing 2nd FLOR, Bajaj Road Opp Amrut Baug Vile-Parle (WEST) Mumbai, Maharashtra 400056 Phone: 9821116842Document2 pagesAtul M Jadia 48, Sham Sadam, A Wing 2nd FLOR, Bajaj Road Opp Amrut Baug Vile-Parle (WEST) Mumbai, Maharashtra 400056 Phone: 9821116842Dinesh DhawanNo ratings yet

- History of Pepsico ColaDocument4 pagesHistory of Pepsico ColaMadiha NayyerNo ratings yet

- Practical Research 1 SLHT Week 2Document9 pagesPractical Research 1 SLHT Week 2Ceyah KirstenNo ratings yet

- Advertising Strategy MaiharDocument65 pagesAdvertising Strategy Maiharvickram jainNo ratings yet

- Course: HRM 121 Events Management Topic: Lesson 5: Who Are The Industry Suppliers?Document4 pagesCourse: HRM 121 Events Management Topic: Lesson 5: Who Are The Industry Suppliers?Cindy Ortiz Gaston100% (1)

- Bai BaoDocument16 pagesBai BaoBao TruongNo ratings yet