Professional Documents

Culture Documents

1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00

1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00

Uploaded by

Vikram MaanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00

1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00

Uploaded by

Vikram MaanCopyright:

Available Formats

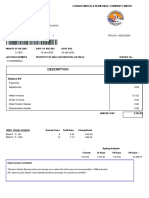

Tax Invoice

RECTUS INDIA 2021-2022 Invoice No. Dated

3RD FLOOR, FLAT NO 31, SATKAR BUILDING RI/G/21-22/14161 13-Dec-2021

BUILDING NO-79-80,NEHRU PLACE Delivery Note Mode/Terms of Payment

NEW DELHI-110019 Advance

GSTIN/UIN: 07AAQFR5353R1Z8

State Name : Delhi, Code : 07 Supplier’s Ref. Other Reference(s)

E-Mail : sales@rectusindia.com Chanky

Buyer’s Order No. Dated

Consignee

SHIV ENTERPRISES Despatch Document No. Delivery Note Date

HOUSE NO.-122, WARD NO.-5, BASRA

HISAR-125001 Despatched through Destination

MOB.-9468092880 By Hand Hisar

GSTIN/UIN : 06ESUPK0850C2ZP

State Name : Haryana, Code : 06 Terms of Delivery

Immediate

Buyer (if other than consignee)

SHIV ENTERPRISES

HOUSE NO.-122, WARD NO.-5, BASRA

HISAR-125001

MOB.-9468092880

GSTIN/UIN : 06ESUPK0850C2ZP

State Name : Haryana, Code : 06

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 FG-702 GXWONT 85176950 20 Nos 1,550.00 Nos 31,000.00

2 FG-SPLT-1X2 85176950 5 Nos 170.00 Nos 850.00

3 FG-SPLT-1X4 85176950 5 Nos 180.00 Nos 900.00

4 Big JC Box 4 Way 853690 10 Nos 60.00 Nos 600.00

5 FG-FTTH BOX 853690 20 Nos 32.00 Nos 640.00

33,990.00

IGST@18% 18 % 6,118.20

Less : Rounding Off (-)0.20

Total 60 Nos In 40,108.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Forty Thousand One Hundred Eight Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

85176950 32,750.00 18% 5,895.00 5,895.00

853690 1,240.00 18% 223.20 223.20

Total 33,990.00 6,118.20 6,118.20

Tax Amount (in words) : Indian Rupees Six Thousand One Hundred Eighteen and Twenty paise Only

Company’s PAN : AAQFR5353R

Declaration

1.We hereby declare that our organization is registered under Company’s Bank Details

Goods and Service Tax Bank Name : HDFC BANK OD ACCOUNT

2.Goods sold will not be taken back. A/c No. : 50200050406540

3.Goods remain property of Rectus India, till the Invoice is Branch & IFS Code : SECTOR-16, NOIDA & HDFC0001351

fully paid.

4.All disputes subject to Delhi Jurisdiction. for RECTUS INDIA 2021-2022

5.Interest @24% will be charged for the delayed payments.

6.Warranty: standard as per the Manufacturer.

Authorised Signatory

This is a Computer Generated Invoice

You might also like

- Behind The DreamDocument1 pageBehind The Dreamclwaei552550% (2)

- Description: Lusaka Water & Sewerage Company LimitedDocument1 pageDescription: Lusaka Water & Sewerage Company Limitedpasyani nyirendaNo ratings yet

- Receipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Document6 pagesReceipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Jenipher Carlos HosannaNo ratings yet

- All Crane ChartsDocument49 pagesAll Crane ChartsTanCM100% (2)

- Sba Form 413Document2 pagesSba Form 413David WaringNo ratings yet

- Richards v. Tower LoanDocument8 pagesRichards v. Tower LoanSteve QuinlivanNo ratings yet

- InvoiceDocument1 pageInvoiceshabadNo ratings yet

- Invoices 2393974Document1 pageInvoices 2393974KkNo ratings yet

- WS Retail Services Pvt. LTD.Document1 pageWS Retail Services Pvt. LTD.Umesh SiddarthNo ratings yet

- Invoices 1Document1 pageInvoices 1api-351788692No ratings yet

- Hotel - Office 8thDocument3 pagesHotel - Office 8thamit_1979kNo ratings yet

- CRN 6861569880Document3 pagesCRN 6861569880Vikas BhatejaNo ratings yet

- Invoice Gu 035 JD PDFDocument2 pagesInvoice Gu 035 JD PDFViktorNo ratings yet

- InvoiceDocument2 pagesInvoiceRK userNo ratings yet

- Badmaash 978Document1 pageBadmaash 978OL RentNo ratings yet

- We Have Received Your Premium: Rahul PahadeDocument1 pageWe Have Received Your Premium: Rahul PahaderahulpahadeNo ratings yet

- Invoice 282012Document1 pageInvoice 282012Shah Fakhrul Islam AlokNo ratings yet

- Ride Details Bill Details: Thanks For Traveling With Us, AlthafDocument3 pagesRide Details Bill Details: Thanks For Traveling With Us, AlthafMoham'medAlthafAs'lamNo ratings yet

- Original For RecipientDocument1 pageOriginal For RecipientGururaj AnnigeriNo ratings yet

- Sample Invoice A PDFDocument1 pageSample Invoice A PDFSirliindaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Nitin KumarNo ratings yet

- DP3T9313-2nd Fit InvoiceDocument1 pageDP3T9313-2nd Fit InvoiceNamul Haque RemonNo ratings yet

- Receipt and Expences M4Document6 pagesReceipt and Expences M4Eric Melchor RoyolNo ratings yet

- Store Bill To Ship To: Sterling Book House Sanooj NJ Kurup Sanooj NJ KurupDocument1 pageStore Bill To Ship To: Sterling Book House Sanooj NJ Kurup Sanooj NJ KurupSanooj N J KurupNo ratings yet

- SAMSUNG Galaxy F41 (Fusion Green, 128 GB) : Grand Total 15499.00Document1 pageSAMSUNG Galaxy F41 (Fusion Green, 128 GB) : Grand Total 15499.00Campy ExNo ratings yet

- Click Here To Manage Your Invoices in Smartsheet: InvoiceDocument1 pageClick Here To Manage Your Invoices in Smartsheet: InvoiceMohammed azharuddinNo ratings yet

- InvoiceDocument2 pagesInvoiceHarshavardhan SappatiNo ratings yet

- CRN7119836032 (2305843009213960675)Document4 pagesCRN7119836032 (2305843009213960675)vikramNo ratings yet

- AbunawasDocument2 pagesAbunawasDania KartikaNo ratings yet

- Chhatrapati Shivaji Road, Dahisar (East), Mumbai - 400 068Document2 pagesChhatrapati Shivaji Road, Dahisar (East), Mumbai - 400 068nilay parlikarNo ratings yet

- Rent Receipt: January 2017Document2 pagesRent Receipt: January 2017Amit KumarNo ratings yet

- InvoiceDocument1 pageInvoiceAbhay Pratap SinghNo ratings yet

- GD InvoiceDocument2 pagesGD Invoicepawan upadhyayNo ratings yet

- Statement I Broad Details of Revenue ReceiptsDocument1 pageStatement I Broad Details of Revenue ReceiptsAtm AdnanNo ratings yet

- OD326980049969629100Document3 pagesOD326980049969629100Anant KumarNo ratings yet

- Description Amount: Parts, and Then Click Receipt Slips (3 Per Page) in The Quick Parts Drop Down MenuDocument2 pagesDescription Amount: Parts, and Then Click Receipt Slips (3 Per Page) in The Quick Parts Drop Down MenuUsman QurayshiNo ratings yet

- Cash Receipts JournalDocument1 pageCash Receipts Journalarul umamNo ratings yet

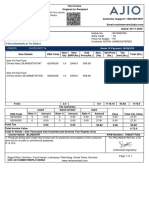

- Ajio 1671590426092Document1 pageAjio 1671590426092NaveenNo ratings yet

- InvoiceDocument1 pageInvoicesainathNo ratings yet

- InvoiceDocument1 pageInvoiceSasi KNo ratings yet

- 3rd Floor, No - AK-2, RBN Tower Fourth Avenue, Shanthi Colony Chennai - 600 040 GSTN Num - 33AAACL2937J1ZLDocument1 page3rd Floor, No - AK-2, RBN Tower Fourth Avenue, Shanthi Colony Chennai - 600 040 GSTN Num - 33AAACL2937J1ZLcharliNo ratings yet

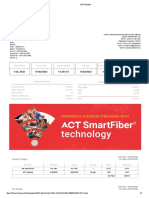

- ACT Invoice Feb2022Document1 pageACT Invoice Feb2022VinuNo ratings yet

- Invoice INV/2019/0001: Invoice Date: Due Date: SourceDocument1 pageInvoice INV/2019/0001: Invoice Date: Due Date: SourcevinaysgvNo ratings yet

- 107 181 1548850925963 InvoiceDocument1 page107 181 1548850925963 InvoiceRupesh SinghNo ratings yet

- Nairendrapal Sharma GST InvoiceDocument1 pageNairendrapal Sharma GST InvoiceDrv LimtedNo ratings yet

- Invoice A2H 1937698Document1 pageInvoice A2H 1937698Robert AlvaradoNo ratings yet

- Invoice - 1599221529948 - FHSL Gurgaon PDFDocument1 pageInvoice - 1599221529948 - FHSL Gurgaon PDFAmar ChauhanNo ratings yet

- Invoice 191Document1 pageInvoice 191Ayan SinhaNo ratings yet

- InvoiceDocument1 pageInvoiceDakoji LaxmiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)vishal raiNo ratings yet

- Suraj Technologies: Tax InvoiceDocument1 pageSuraj Technologies: Tax InvoiceRanjit SinghNo ratings yet

- Invoice # 0547 PDFDocument1 pageInvoice # 0547 PDFshafiqrehman7No ratings yet

- InvoiceDocument1 pageInvoiceHope NotNo ratings yet

- Cw-Invoices Invoice 6730051 CWI1903736 Gif4us PDFDocument1 pageCw-Invoices Invoice 6730051 CWI1903736 Gif4us PDFManav SpoliaNo ratings yet

- SGHN2456014QLD Logistics Invoice 1560316148514Document1 pageSGHN2456014QLD Logistics Invoice 1560316148514MananNo ratings yet

- Details of Quarterly Receipt of Foreign Contribution: Charities Aid FoundationDocument2 pagesDetails of Quarterly Receipt of Foreign Contribution: Charities Aid FoundationSaurabh SinhaNo ratings yet

- Commercial in VoiceDocument1 pageCommercial in Voicegomez johnNo ratings yet

- My InvoiceDocument2 pagesMy InvoiceAchintyaNo ratings yet

- Receipts ListDocument86 pagesReceipts ListRaquel Dacup GarciaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Preetam SundarayNo ratings yet

- InvoiceDocument1 pageInvoiceAɓʜɩ's Fɭʌsʜ GʌɱɩŋgNo ratings yet

- Sean Flight ReceiptsDocument5 pagesSean Flight ReceiptsKim ChanNo ratings yet

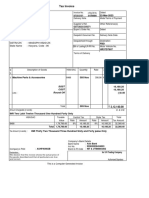

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- Ars International, Bill No. 880, DT., 17.12.2021Document1 pageArs International, Bill No. 880, DT., 17.12.2021Ars InternationalNo ratings yet

- CCS Haryana Agricultural University: Name: SANJU Roll No.: 21596 Registration No.: 231681445Document1 pageCCS Haryana Agricultural University: Name: SANJU Roll No.: 21596 Registration No.: 231681445Vikram MaanNo ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- Final Result With SDDocument4 pagesFinal Result With SDVikram MaanNo ratings yet

- DR D Meena Itax 2020-21 (2 Files Merged)Document2 pagesDR D Meena Itax 2020-21 (2 Files Merged)Vikram MaanNo ratings yet

- Ethical Issues in International BusinessesDocument13 pagesEthical Issues in International BusinessesNaveen Pal100% (1)

- Imbong vs. OchoaDocument3 pagesImbong vs. OchoaNovah Merill Comillor VenezuelaNo ratings yet

- Commissioner of Internal Revenue Vs CoaDocument4 pagesCommissioner of Internal Revenue Vs CoaAb Castil100% (1)

- Revised Penal Code Book 1 by ReyesDocument941 pagesRevised Penal Code Book 1 by ReyesErickaMae CleofeNo ratings yet

- ا Author's IntroductionDocument15 pagesا Author's IntroductionBirungo HusseinNo ratings yet

- PCI DSS v4 0 Hierachy 1648839354Document2 pagesPCI DSS v4 0 Hierachy 1648839354Darni BtmuchsinNo ratings yet

- ES17986417Document1 pageES17986417mother22ggNo ratings yet

- Basic Financial StatementsDocument16 pagesBasic Financial StatementsiqraNo ratings yet

- Accounting Principles 10th Chapter 1Document48 pagesAccounting Principles 10th Chapter 1Osama Alvi100% (1)

- Republic of Indonesia Ministry of Transportation: Moored Balloons, Kites, Unmanned Rockets and Unmanned Free BalloonsDocument12 pagesRepublic of Indonesia Ministry of Transportation: Moored Balloons, Kites, Unmanned Rockets and Unmanned Free BalloonsastriwiditakNo ratings yet

- TIS Consultant Classification PDFDocument2 pagesTIS Consultant Classification PDFAbdullah Abdel-MaksoudNo ratings yet

- Zappa, Frank - Echidna's Arf (Of You)Document7 pagesZappa, Frank - Echidna's Arf (Of You)NilsAnderssonNo ratings yet

- CicDocument25 pagesCicjunjie buliganNo ratings yet

- MDP 39015032263579-1485016992Document59 pagesMDP 39015032263579-1485016992Isa AlmisryNo ratings yet

- America Is in The Heart: TitleDocument5 pagesAmerica Is in The Heart: TitleMark Paul Santin GanzalinoNo ratings yet

- CSS Business Administration MCQsDocument9 pagesCSS Business Administration MCQsMuhammad YouneebNo ratings yet

- ParkerVYahoo 09 25 08Document8 pagesParkerVYahoo 09 25 08Legal Writer100% (1)

- Temporary Registration Requirements / Guidance Notes: Introduction / Statutory ProvisionsDocument5 pagesTemporary Registration Requirements / Guidance Notes: Introduction / Statutory ProvisionsismailNo ratings yet

- Narrative Report On NCST CultureDocument8 pagesNarrative Report On NCST CultureVarenLagartoNo ratings yet

- Reso-Waiting Shade VendorsDocument2 pagesReso-Waiting Shade VendorsEduardo RetiradoNo ratings yet

- Sinumerik 828DDocument11 pagesSinumerik 828Dshri mayuramNo ratings yet

- Islaw Bar QuestionsDocument3 pagesIslaw Bar QuestionsAce GonzalesNo ratings yet

- Teroson RB 3203-EnDocument2 pagesTeroson RB 3203-EnAlbNo ratings yet

- St. Luke's Medical Center, Inc. vs. SanchezDocument15 pagesSt. Luke's Medical Center, Inc. vs. Sanchezad infinitumNo ratings yet

- Open SystemDocument38 pagesOpen System@vadirajNo ratings yet

- Articles of Incorporation of Stock CorporationDocument4 pagesArticles of Incorporation of Stock CorporationInnoKalNo ratings yet