Professional Documents

Culture Documents

Rashmi Delhi ALAPR1485M

Rashmi Delhi ALAPR1485M

Uploaded by

commission sompoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rashmi Delhi ALAPR1485M

Rashmi Delhi ALAPR1485M

Uploaded by

commission sompoCopyright:

Available Formats

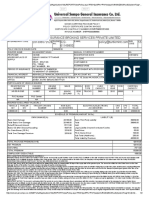

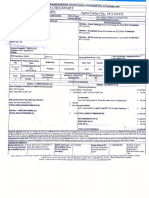

STANDALONE OWN DAMAGE POLICY- PRIVATE CAR

POLICY SCHEDULE CUM TAX INVOICE

CERTIFICATE CUM POLICY NUMBER: M00085324

Important: 1) The validity of this certificate of Insurance cum policy is subject to realization by the company of the premium cheque paid by the Insured.

INSURED NAME MR. RANA PARWEEN SIDDIQUI PHONE NO 9871045900 E-MAIL lalabhai.mk@gmail.com

POLICY/INVOICE ISSUED DATE 16/01/2021

GEOGRAPHICAL AREA INDIA REGISTRATION DATE 16/01/2019

PROPOSER ADDRESS 29 1ST FLOOR PARK END, VIKAS MARG SHAKAR RTO ZONE NEW DELHI TILAK MARG / IP

PUR BARAMAD EAST, SHAKARPUR SO, NEW CUSTOMER ID DEPOT

DELHI, DELHI, INDIA, 110092 181606

NOMINEE NAME

RELATIONSHIP WITH PROPOSER NA

NOMINEE AGE NA

APPOINTEE / GUARDIAN NAME NA

NA

PERIOD OF INSURANCE 16/01/2021 17:03 To 15/01/2022 23:59 APPOINTEE / GUARDIAN NA

RELATIONSHIP

FINANCIER DETAIL NA

POLICY ISSUANCE OFFICE NOIDA,UTTAR PRADESH EIA ACCOUNT NO NA

PARTICULARS OF VEHICLE INSURED

REGISTRATION NUMBER DL-02-FBR-0055 MANUFACTURING YEAR / MONTH 2018 / 01

MAKE MARUTI SUZUKI MODEL / VARIANT CIAZ ALPHA 1.5 AT

ENGINE NUMBER K15BN1025092 CHASSIS NUMBER MA3EXGL1S00376145

CUBIC CAPACITY 1462 CARRY CAPACITY 5

FUEL TYPE PETROL

TP POLICY DETAILS

TP POLICY NUMBER 201120010118700434100000 INSURER NAME LIBERTY GENERAL INSURANCE

LTD.

TP POLICY START DATE 16/01/2019 00:00 TP POLICY END DATE 15/01/2022 23:59

INSURED'S DECLARED VALUE (Rs.)

VEHICLE IDV TRAILER IDV NON-ELEC ELECTRICAL/ELE CNG KIT LPG KIT TOTAL VALUE

ACCESSORIES ACCESSORIES

800000.00 0 0 0 0 0 800000.00

SCHEDULE OF PREMIUM (AMOUNT IN Rs.)

Own Damage

Own Damage Premium 5253.00

Bi- fuel Kit (LPG/ CNG) 0

Electrical or Electronic accessories 0

Non-Electrical Accessories 0

Geographic Extension (OD) 0

Glass Fuel Tank 0

Voluntary Deductible 0

Own Damage Premium before NCB 5253.00

NCB (20%) -1050.60

Add On(s) Opted:

Zero Depreciation ( Count Of Claim : >2) 2400.00

Consumable Expenses 800.00

Total Add-on(s) Premium: 3200.00

TOTAL OWN DAMAGE PREMIUM 7402.00

NET PREMIUM 7402.00

IGST(%)

SGST(%)

CGST(%) 667

UGST(%) 667

KERALA CESS(%) 0

TOTAL TAX PAYABLE 1334

TOTAL PREMIUM 8735

Policy subject to the following IMT(s) : 22

DEDUCTIBLE UNDER SECTION - I :(i) Compulsory deductible Rs 1000/- for vehicle not exceeding 1500 CC and Rs 2000/- for vehicle exceeding 1500 CC.

(ii) Voluntary deductible Rs 0/-.

INTERMEDIARY CODE / NAME 1000944 / Rashmi Delhi

INTERMEDIARY CONTACT NUMBER 8471003314

INTERMEDIARY EMAIL ID shalinisikarwar2@gmail.com

POINT OF SALE PERSON NAME RASHMI DELHI

PAN NUMBER ALAPR1485M

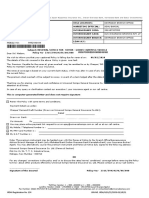

LIMITATIONS AS TO USE : The Policy covers use of the vehicle for any purpose other than: (a) Hire or Reward (b) Carriage of goods (other than samples or

personal luggage) (c) Organized racing (d) Pace making (e) Speed Testing (f) Reliability trials (g) Any purpose in connection with Motor Trade.

DRIVER’S CLAUSE: Any person including the Insured provided that a person driving holds a valid driving license at the time of the accident and is not

disqualified from holding or obtaining such a license. Provided also that the person holding a valid Learner's License may also drive the vehicle** and

that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989.

For RAHEJA QBE GENERAL INSURANCE COMPANY LIMITED

IMPORTANT : In case of payment by cheque, in the event of dishonor of cheque for any reason whatsoever, insurance cover provided under this

document automatically stands cancelled from inception

We hereby certify that the Policy to which this Certificate relates as well as this Certificate of Insurance is issued in accordance with the provisions of Chapter X and

Chapter XI of the Motor Vehicle Act 1988

IMPORTANT NOTICE: The insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this schedule. Any payment

made by the company by reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act, 1988, is recoverable from the

insured. See the clause headed “AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY”.

NO CLAIM BONUS:

The insured is entitled for a No Claim Bonus (NCB) on the Own Damage Section of the policy, if no claim is made or pending during the preceding

year(s) as per the following table.

% of Discount on Own Damage Premium

Period of Insurance % of NCB on OD Premium

The Preceding Year 20%

Preceding Two Consecutive Years 25%

Preceding Three Consecutive Years 35%

Preceding Four Consecutive Years 45%

Preceding Five Consecutive Years 50%

"It is hereby declared and agreed that all pre-existing damages to the vehicle having occurred prior to the commencement of cover are excluded from

the scope of the policy".

The policy wording with detailed terms, conditions and exclusions are available on our website www.rahejaqbe.com

Statutory Provisions:

"As per Section 146 of the Motor Vehicle Act, 1988 it is Mandatory to have your vehicle insured against third party risk.

I/We hereby certify that the Policy to which the certificate relates as well as this certificate of insurance are issued in accordance with the provision of

Chapter X and Chapter XI of M.V. Act, 1988.

*Except as provided in GR 27 Rule (g) of IMT i.e. Sale of Vehicle, No NCB will be allowed, when a policy is not renewed within 90 days of the expiry.

Note: In the event of dishonor of cheque, this policy document automatically stands cancelled from inception irrespective of whether a separate

communication is sent or not. The policy has been issued based on the information provided by you and the policy is not valid if any of the information

provided is incorrect, subject otherwise to the terms, conditions and exclusions of the Private Car Standalone Own Damage Policy Schedule. In witness

whereof this Policy has been signed at Mumbai on policy start date in lieu of Proposal/Cover note No. as mentioned in the policy.

Updating Registration Number of vehicles within 15 days of policy inception is MANDATORY as per IRDAI. Kindly provide the same to your Agent/Our

Call centre/Policy issuing Branch (Applicable for policies issued without Registration No of vehicles).

IMPORTANT NOTICE:

The insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made by the Company by

reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act, 1988 is recoverable from the Insured. See the clause

headed 'AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY'. For legal interpretation, English version will hold good.

It is warranted that the insured named herein/owner of the vehicle holds valid Pollution Under Control (PUC) Certificate and/or valid/fitness certificate as

applicable on the date of commencement of the policy and undertakes to maintain and renew a valid and effective PUC and/or fitness certificate, as

applicable during the subsistence of the Policy. Further, the company reserves the right to iniate/take any/all appropriate action in case of any

discrepancy in the PUC and/or fitness certificate.

Note: Kindly acknowledge the receipt of this policy. In case you find any variations against your proposal or any discrepancy in the policy, kindly

contact us immediately on customercare@rahejaqbe.com. In the unfortunate event of a claim, please call quoting your Policy No.on Toll Free No : 1800

102 7723 (9 am to 8 pm, Monday to Saturday) and register your claim immediately within 7days from the date of loss. You can also reach us at

customercare@rahejaqbe.com.

UIN : IRDAN141RP0001V01201920

Raheja QBE General Insurance Company Limited, IRDAI Registration Number – 141.

P & G Plaza, Ground Floor, Cardinal Gracious Rd, Chakala, Andheri East, Mumbai - 400099.

Telephone : +91 22 4231 3888 Facismile : +91 224231 3777

Invoice No:M00085324 Date:16/01/2021 Branch GST:09AADCR7145R1ZL

Place of Supply:NOIDA,UTTAR PRADESH Description of Service: Motor Insurance Service

GST:Service Code : 997134 CIN :U66030MH2007PLC173129 Client GSTN :

TOLL FREE NUMBER: 1800 - 102 - 7723

(9 am to 8 pm, Monday to Saturday)

You might also like

- AP37TB9107 Reliance Commercial VehiclesDocument2 pagesAP37TB9107 Reliance Commercial Vehiclessarath potnuriNo ratings yet

- 0195Document2 pages0195anshi75% (4)

- KulbirDocument2 pagesKulbiranshi33% (3)

- TRACTOR T&T Singal PageDocument1 pageTRACTOR T&T Singal Pagesarath potnuriNo ratings yet

- Elm04 10solutions - Doc 0Document13 pagesElm04 10solutions - Doc 0venkatvarsha100% (2)

- Direct Business 18001027723: Intermediary Code / Name Intermediary Contact Number Intermediary Email IdDocument2 pagesDirect Business 18001027723: Intermediary Code / Name Intermediary Contact Number Intermediary Email IdHarish GhorpadeNo ratings yet

- Prev Copy INS Page1 E01a769427Document2 pagesPrev Copy INS Page1 E01a769427Akhand SinghNo ratings yet

- Transit of Planets On Thy Birth ChartDocument2 pagesTransit of Planets On Thy Birth Chartanshi0% (1)

- Welcome To The ICICI Lombard Family!: Dear Mrs Rashmi Choudhury, We Hope This Communication Finds You in Good HealthDocument4 pagesWelcome To The ICICI Lombard Family!: Dear Mrs Rashmi Choudhury, We Hope This Communication Finds You in Good HealthSanjay SharmaNo ratings yet

- A Joint Venture Between Indian Bank, Sompo Japan Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument3 pagesA Joint Venture Between Indian Bank, Sompo Japan Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsanshiNo ratings yet

- Activa Insurance DocumentDocument6 pagesActiva Insurance DocumentthakuryaNo ratings yet

- Om PrakashDocument2 pagesOm Prakashanshi100% (1)

- PolicySchedule 421095216Document2 pagesPolicySchedule 421095216anjan gowdaNo ratings yet

- Reliance General Insurance Company Limited: Policy Number: 920222123112042463 Proposal/Covernote No: R08102128923Document11 pagesReliance General Insurance Company Limited: Policy Number: 920222123112042463 Proposal/Covernote No: R08102128923Rishab ManochaNo ratings yet

- Policy DocumentDocument11 pagesPolicy DocumentAdish BhagwatNo ratings yet

- Magma HDI General Insurance Co. Ltd.Document1 pageMagma HDI General Insurance Co. Ltd.sarath potnuriNo ratings yet

- PolicySchedule 520543185Document2 pagesPolicySchedule 520543185ratneshsrivastava7No ratings yet

- Avo 2374 10347066Document4 pagesAvo 2374 10347066MurugananthamjkNo ratings yet

- Agent Name Khivraj Motors Agent Code MIS1000132 Agent Contact No 9108694880Document2 pagesAgent Name Khivraj Motors Agent Code MIS1000132 Agent Contact No 9108694880SanthoshNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- Limite D: Reliance Private Car Package Policy-ScheduleDocument9 pagesLimite D: Reliance Private Car Package Policy-Schedulesukhpreet singhNo ratings yet

- Policy - Car Insurance SwiftDocument11 pagesPolicy - Car Insurance Swiftavanthi.surNo ratings yet

- New 1Document1 pageNew 1ss9324490794No ratings yet

- Wb40au7913 PolicyDocument1 pageWb40au7913 Policyzaid AhmedNo ratings yet

- Og 25 9910 1870 00007954Document4 pagesOg 25 9910 1870 00007954Arjun BhatiaNo ratings yet

- Liberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationDocument1 pageLiberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationSwornamayee SethiNo ratings yet

- I20 2023 PolicyDocument2 pagesI20 2023 PolicyMohammed AthiNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- FRM Policy Schedule Motor ColourDocument3 pagesFRM Policy Schedule Motor ColourMukeshVeshnevNo ratings yet

- 59424276Document2 pages59424276anshiNo ratings yet

- Mycar PolicDocument11 pagesMycar Polickeshva klNo ratings yet

- Policy 468140003 1899483072595Document1 pagePolicy 468140003 1899483072595Ishan AnandNo ratings yet

- Vehicle Policy 22-23Document2 pagesVehicle Policy 22-23Sahana SatishNo ratings yet

- Policy Number: 131522223110108340 Proposal/Covernote No: R05062214100Document11 pagesPolicy Number: 131522223110108340 Proposal/Covernote No: R05062214100Akhand SinghNo ratings yet

- Sample Reliance PolicyDocument11 pagesSample Reliance Policyinsurance advisorNo ratings yet

- TN3008TW0058012 1 I3980088 PDFDocument1 pageTN3008TW0058012 1 I3980088 PDFhaja immranNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931MuraliMohanNo ratings yet

- Motor Private Car Package Policy Schedule Cum Certificate of InsuranceDocument2 pagesMotor Private Car Package Policy Schedule Cum Certificate of InsuranceDhashana MoorthyNo ratings yet

- Mr. SHAKTI SINGH DEORADocument3 pagesMr. SHAKTI SINGH DEORAbhopaldeora001No ratings yet

- Motorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleDocument2 pagesMotorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleVeer SinghNo ratings yet

- Two Wheeler Policy-Bundled - 5 Year Act Only and 1 Year Own Damage Endorsed Certificate of Insurance Cum Schedule /TAX INVOICEDocument2 pagesTwo Wheeler Policy-Bundled - 5 Year Act Only and 1 Year Own Damage Endorsed Certificate of Insurance Cum Schedule /TAX INVOICEAltamash ShaikhNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Sunil DubeyNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- 17-11-2022 Policy DocDocument1 page17-11-2022 Policy DocOfficial Sumit SafeshopNo ratings yet

- 59428283Document2 pages59428283anshiNo ratings yet

- Mr. PRAGEESH PDocument2 pagesMr. PRAGEESH Ppp.prathyushNo ratings yet

- Dear M/S Life Line FoundationDocument4 pagesDear M/S Life Line FoundationGovind RamNo ratings yet

- Shatadru DeyDocument1 pageShatadru DeyDev JyotiNo ratings yet

- Agent Agent License Code: AIG3142D : Name: Agent Contact No.: 9413101976Document2 pagesAgent Agent License Code: AIG3142D : Name: Agent Contact No.: 9413101976श्री बालाजी मोबाइल रिपेयरिंग एंड ट्रेनिंग सेंटरNo ratings yet

- PolicySchedule 550093640Document2 pagesPolicySchedule 550093640Abhiroop AwasthiNo ratings yet

- Liberty General Insurance Limited: Insured Motor Vehicle DetailsDocument3 pagesLiberty General Insurance Limited: Insured Motor Vehicle DetailsAkash BidhuriNo ratings yet

- USGI PULZ App - One Stop Solution For All Your Insurance Needs. Now Enjoy Below Complimentary Value Added Benefits With Our AppDocument3 pagesUSGI PULZ App - One Stop Solution For All Your Insurance Needs. Now Enjoy Below Complimentary Value Added Benefits With Our AppKunal VermaNo ratings yet

- RELIANCE Auto - Removed AZ0001Document2 pagesRELIANCE Auto - Removed AZ0001sarath potnuriNo ratings yet

- TW Niapolicyschedulecirtificatetw 82178650Document3 pagesTW Niapolicyschedulecirtificatetw 82178650pp.prathyushNo ratings yet

- Avo 2371 10104031Document4 pagesAvo 2371 10104031Bhavya chandraNo ratings yet

- Agent Name Policybazaar Insurance Wa PVT LTD Agent Code Imd1046412Document1 pageAgent Name Policybazaar Insurance Wa PVT LTD Agent Code Imd1046412Prakash Reddy100% (1)

- 8491 CarDocument2 pages8491 Carvaishu2488No ratings yet

- Dear Exotic India .Document5 pagesDear Exotic India .sandip kajaleNo ratings yet

- Quotation: Customer DetailsDocument1 pageQuotation: Customer DetailsRamesh GuptaNo ratings yet

- Tata Ace Magic RelianceDocument2 pagesTata Ace Magic Reliancesarath potnuriNo ratings yet

- Electric Motorcycle Charging Infrastructure Road Map for IndonesiaFrom EverandElectric Motorcycle Charging Infrastructure Road Map for IndonesiaNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- Improving Communication With Face Masks: White PaperDocument9 pagesImproving Communication With Face Masks: White Papercommission sompoNo ratings yet

- Liberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationDocument3 pagesLiberty General Insurance Limited: Insured Motor Vehicle Details and Premium Computationcommission sompoNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)commission sompoNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- GST Registration CertificateDocument3 pagesGST Registration Certificatecommission sompo0% (1)

- KA02 AG 1986 InsuranceDocument2 pagesKA02 AG 1986 Insurancecommission sompoNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- Harbir 0382 PypDocument1 pageHarbir 0382 Pypcommission sompoNo ratings yet

- 2491Document2 pages2491commission sompoNo ratings yet

- 3001 154792170 00 000 PyDocument2 pages3001 154792170 00 000 Pycommission sompoNo ratings yet

- Cal - of HarbirDocument1 pageCal - of Harbircommission sompoNo ratings yet

- Adroit Inspection Services PVT - LTD.: Ghaziabad Tel: - Fax: Email: Mail@adroitauto - in Website: WWW - Adroitauto.inDocument1 pageAdroit Inspection Services PVT - LTD.: Ghaziabad Tel: - Fax: Email: Mail@adroitauto - in Website: WWW - Adroitauto.incommission sompoNo ratings yet

- ShikopurDocument2 pagesShikopurcommission sompoNo ratings yet

- Truck Public Old ID 1Document1 pageTruck Public Old ID 1commission sompoNo ratings yet

- Javed AhmadDocument3 pagesJaved Ahmadcommission sompoNo ratings yet

- Branch: Civil Engineering: Time: 3 Hours GATE Full Length Mock Test - C Marks: 100Document12 pagesBranch: Civil Engineering: Time: 3 Hours GATE Full Length Mock Test - C Marks: 100Tarun BisenNo ratings yet

- Jaipur Rajasthan, India. 16bar1081 Simran DeoDocument25 pagesJaipur Rajasthan, India. 16bar1081 Simran Deosimran deo100% (1)

- Looping: Array Operators Example Name ResultDocument3 pagesLooping: Array Operators Example Name Resultjeremy PerezNo ratings yet

- Technical SubmittalDocument121 pagesTechnical SubmittalSyed Sabir Ahmed100% (1)

- Biology WaterDocument22 pagesBiology WaternurhanisahmohamadnorNo ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- De Thi Thu TN THPT 2024 Tieng Anh So GD Ha NoiDocument23 pagesDe Thi Thu TN THPT 2024 Tieng Anh So GD Ha NoiQuang Lê Hồ DuyNo ratings yet

- Consultants/Contractors Confirmation Check List: Consultant/Contractor UndertakingDocument1 pageConsultants/Contractors Confirmation Check List: Consultant/Contractor Undertakingfishy18No ratings yet

- Medium Power Film Capacitor AvxDocument70 pagesMedium Power Film Capacitor AvxPeio GilNo ratings yet

- Understanding Market Channels and Alternatives For Commercial Catfish Farmers (PDFDrive)Document95 pagesUnderstanding Market Channels and Alternatives For Commercial Catfish Farmers (PDFDrive)AmiibahNo ratings yet

- Flight InstrumentsDocument42 pagesFlight InstrumentsShiwani HoodaNo ratings yet

- UGCNETDEC AdmitCardDocument1 pageUGCNETDEC AdmitCardAkshay RajNo ratings yet

- First QuizDocument11 pagesFirst QuizAreej AlmalkiNo ratings yet

- Module 3 - AmcmlDocument3 pagesModule 3 - AmcmlAmotsik GolezNo ratings yet

- Strategic ManagementDocument37 pagesStrategic ManagementreezmanNo ratings yet

- Mechanical Vibrations by V.P. Singh PDFDocument131 pagesMechanical Vibrations by V.P. Singh PDFmayilsvhec70% (10)

- Product Portfolio Systems and Solutions GuideDocument44 pagesProduct Portfolio Systems and Solutions GuideChris MedeirosNo ratings yet

- CAEG Question Bank With SolutionsDocument24 pagesCAEG Question Bank With Solutionssksnjgaming100% (1)

- Lymphoproliferative DisordersDocument36 pagesLymphoproliferative DisordersBrett FieldsNo ratings yet

- Machine Spindle Noses: 6 Bison - Bial S. ADocument2 pagesMachine Spindle Noses: 6 Bison - Bial S. AshanehatfieldNo ratings yet

- A Comprehensive Review On Chanting of Sacred Sound Om (Aum) As A Healing PracticeDocument6 pagesA Comprehensive Review On Chanting of Sacred Sound Om (Aum) As A Healing Practicejayesh rajputNo ratings yet

- Table Box TitleDocument53 pagesTable Box TitleRoland Calubiran MayaNo ratings yet

- I) H3C - MSR3600 - Datasheet PDFDocument15 pagesI) H3C - MSR3600 - Datasheet PDFSON DANG LAMNo ratings yet

- RelativityDocument9 pagesRelativity0hitk0No ratings yet

- Frizzell, 1987. Stress Orientation Determined From Fault Slip Data in Hampel Wash Area NevadaDocument10 pagesFrizzell, 1987. Stress Orientation Determined From Fault Slip Data in Hampel Wash Area Nevada黃詠晴No ratings yet

- Broan RM52000Document2 pagesBroan RM52000PurcellMurrayNo ratings yet

- Distance Learning Programme: Pre-Medical: Leader Test Series / Joint Package CourseDocument8 pagesDistance Learning Programme: Pre-Medical: Leader Test Series / Joint Package CourseGames MinixNo ratings yet

- Partial Differential Equations PDFDocument126 pagesPartial Differential Equations PDFManoj Bisht100% (1)

- Mba Master Business Administration PDFDocument3 pagesMba Master Business Administration PDFdanielrubarajNo ratings yet