Professional Documents

Culture Documents

Production Report - Team 2: GIGA MOTORS

Production Report - Team 2: GIGA MOTORS

Uploaded by

Nox LuxCopyright:

Available Formats

You might also like

- Tutorial 2 Week 4Document5 pagesTutorial 2 Week 4Chew Jin HaoNo ratings yet

- Amtrak PPT SolutionsDocument32 pagesAmtrak PPT SolutionsAngela Thornton67% (3)

- Comparative Analysis of Two Companies From FMCG SectorDocument17 pagesComparative Analysis of Two Companies From FMCG Sectorhonda5768100% (7)

- KAYI INVESTMENT CLUB. Constitution1Document32 pagesKAYI INVESTMENT CLUB. Constitution1Munguongeyo Ivan100% (1)

- Schedule - I Calculation of Sales RevenueDocument20 pagesSchedule - I Calculation of Sales RevenueRohitNo ratings yet

- Project Highlited:-: S.No Particular AmountDocument12 pagesProject Highlited:-: S.No Particular AmountkeyuraicarNo ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- Segment Reporting - ITC-2013Document2 pagesSegment Reporting - ITC-2013Ashis Kumar MuduliNo ratings yet

- Corporate Valuation: Tata Motors LTDDocument10 pagesCorporate Valuation: Tata Motors LTDUTKARSH PABALENo ratings yet

- Jhanvi Shah 2012 CF PresentationDocument12 pagesJhanvi Shah 2012 CF PresentationJhanvi ShahNo ratings yet

- Accltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. CroreDocument6 pagesAccltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- VIL Reg 33 Results Q4FY24Document10 pagesVIL Reg 33 Results Q4FY24Samim Al RashidNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsMuhammad AkbarNo ratings yet

- GroupNo 4Document6 pagesGroupNo 4aakash9117No ratings yet

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Foreign Owned Businesses 2000 01 and 2014 15 ComparisonDocument1 pageForeign Owned Businesses 2000 01 and 2014 15 ComparisonsawicNo ratings yet

- 8 - Tata MotorsDocument27 pages8 - Tata Motorspg23vishal.srivastavaNo ratings yet

- Pidilite Industries Limited BSE 500331 Financials Income StatementDocument4 pagesPidilite Industries Limited BSE 500331 Financials Income StatementRehan TyagiNo ratings yet

- GLO-BUS Decisions & ReportsDocument3 pagesGLO-BUS Decisions & ReportsthaoNo ratings yet

- Enterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13Document20 pagesEnterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13KabeerMalikNo ratings yet

- Baldwin Bicycle CompanyDocument7 pagesBaldwin Bicycle CompanyIndustry ReportNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Report Card: Attribute Value DateDocument20 pagesReport Card: Attribute Value DateMp SunilNo ratings yet

- Dion Global Solutions LimitedDocument10 pagesDion Global Solutions LimitedArthurNo ratings yet

- Devmeta Project Report CmaDocument9 pagesDevmeta Project Report CmaharshNo ratings yet

- 4th Floor - Cma1Document39 pages4th Floor - Cma1Giri SukumarNo ratings yet

- Acc 205 Ca1Document11 pagesAcc 205 Ca1Nidhi SharmaNo ratings yet

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- Worksheet 3 Strategic Corporate Finance (SCF), SBS & IB Finance: Batch 2018-20Document2 pagesWorksheet 3 Strategic Corporate Finance (SCF), SBS & IB Finance: Batch 2018-20Prabal SharmaNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Scenario A Sales Price Profit Margin Target Cost Actual Cost Cost Gap Expected Sales VolDocument12 pagesScenario A Sales Price Profit Margin Target Cost Actual Cost Cost Gap Expected Sales VolunveiledtopicsNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Financial Statements of FSDocument76 pagesFinancial Statements of FScarl fuerzasNo ratings yet

- 1q23 QuarterlyseriesDocument21 pages1q23 Quarterlyseriesmana manaNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- Accounts Assignement 21MBA0106Document4 pagesAccounts Assignement 21MBA0106TARVEEN DuraiNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financialsjayashankar4355No ratings yet

- Tata Motors PLDocument2 pagesTata Motors PLSravani BotchaNo ratings yet

- Lbo W DCF Model SampleDocument33 pagesLbo W DCF Model Samplejulita rachmadewiNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Bhel CompititorDocument3 pagesBhel CompititorabdulrahmanjameelNo ratings yet

- Mumbai, May 5: Its Now Official. Chinese Dragon Has Posed A Serious Challenge To The IndianDocument3 pagesMumbai, May 5: Its Now Official. Chinese Dragon Has Posed A Serious Challenge To The IndianabdulrahmanjameelNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Ymc Ar e 2021 6Document6 pagesYmc Ar e 2021 6Rafi ShahabNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Case IDocument20 pagesCase ICherry KanjanapornsinNo ratings yet

- Scrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Document3 pagesScrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Amruta TarmaleNo ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- Emami PNLDocument1 pageEmami PNLsZCCSZcNo ratings yet

- DG 135 Open DG 135 CanopyDocument1 pageDG 135 Open DG 135 CanopyMohamedNo ratings yet

- A Proposed Production of Massage Oil From Pandan Leaves Statement of Comprehensive Income For The Years Ended December 31 Scenario 1Document3 pagesA Proposed Production of Massage Oil From Pandan Leaves Statement of Comprehensive Income For The Years Ended December 31 Scenario 1'Mariciela LendioNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- Referensi Keuangan GreenfreshDocument5 pagesReferensi Keuangan GreenfreshTaufik HidayatNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- Company Ratio AnalysisDocument26 pagesCompany Ratio AnalysisNimisha darakNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- How To Prepare Projected Financial StatementsDocument4 pagesHow To Prepare Projected Financial StatementsNamy Lyn GumameraNo ratings yet

- Business FinanceDocument8 pagesBusiness FinanceChristine Marie ViscaynoNo ratings yet

- Kim Parag Parikh Tax Saver FundDocument27 pagesKim Parag Parikh Tax Saver FundIndra TripathiNo ratings yet

- TB 12Document47 pagesTB 12Asiong SalongaNo ratings yet

- CFA - Research Preparation - ULTJDocument177 pagesCFA - Research Preparation - ULTJYunita PutriNo ratings yet

- Stocks & BondsDocument23 pagesStocks & Bondschristian enriquezNo ratings yet

- Annual Shareholders' Meeting - 04.10.2012 - MinutesDocument9 pagesAnnual Shareholders' Meeting - 04.10.2012 - MinutesBVMF_RINo ratings yet

- Part I Financial StatementDocument18 pagesPart I Financial Statementbebe143No ratings yet

- Cambridge IGCSE: ACCOUNTING 0452/23Document20 pagesCambridge IGCSE: ACCOUNTING 0452/23minhajaf28No ratings yet

- DWWDocument2 pagesDWWFarah HNo ratings yet

- NISM Equity Derivatives Study Notes-Feb-2013Document26 pagesNISM Equity Derivatives Study Notes-Feb-2013Priyadarshini Sahoo100% (1)

- Chapter 2 (Exercises)Document10 pagesChapter 2 (Exercises)claudiazdeandresNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH03Document32 pagesRoss Fundamentals of Corporate Finance 13e CH03張浩琳No ratings yet

- Spice Jet Data For Business Analytics'Document47 pagesSpice Jet Data For Business Analytics'Namita BhattNo ratings yet

- Company Law Course Outline January 2024Document12 pagesCompany Law Course Outline January 2024Essay 360No ratings yet

- 6072 p4 Lembar Jawaban PT KURNIADocument38 pages6072 p4 Lembar Jawaban PT KURNIAEmeeNo ratings yet

- Chapter Twelve QuestionsDocument3 pagesChapter Twelve QuestionsabguyNo ratings yet

- Codes of Corporate Governance - Yale - 053112Document34 pagesCodes of Corporate Governance - Yale - 053112Arafatul Alam PatwaryNo ratings yet

- Assignment 1.2: Partneship Dissolution and Liquidation AnswerDocument17 pagesAssignment 1.2: Partneship Dissolution and Liquidation AnswerTricia Nicole DimaanoNo ratings yet

- Olam International Limited: Management Discussion and AnalysisDocument22 pagesOlam International Limited: Management Discussion and Analysisashokdb2kNo ratings yet

- Techniques of ValuationDocument2 pagesTechniques of ValuationrojaNo ratings yet

- Additional Topics - Business CombinationDocument39 pagesAdditional Topics - Business CombinationIan Pol FiestaNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeAbdulmajed Unda MimbantasNo ratings yet

- Capital GainsDocument48 pagesCapital GainsToofan KhanNo ratings yet

- Coroporate Tax Planning and Management: Neha Shivdayal GuptaDocument107 pagesCoroporate Tax Planning and Management: Neha Shivdayal Guptanitin0010No ratings yet

- BIR Ruling DA 509-06Document12 pagesBIR Ruling DA 509-06Harry Bill Dela FuenteNo ratings yet

- Quiz 5Document7 pagesQuiz 5Rauf pervaizNo ratings yet

Production Report - Team 2: GIGA MOTORS

Production Report - Team 2: GIGA MOTORS

Uploaded by

Nox LuxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Production Report - Team 2: GIGA MOTORS

Production Report - Team 2: GIGA MOTORS

Uploaded by

Nox LuxCopyright:

Available Formats

Executive Business Simulation Copyright (c) April Training Executive 2021

Exercise: Round 4

ld0474sem1clsgr22122

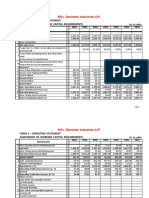

Production Report - Team 2 : GIGA MOTORS

Market Model Price Market

Model Name Produced Sold In Stock

Sector £ Share %

6 GMedium 125000 125000 0 27499.00 2.23

12 GLuxury 11150 11150 0 84499.00 1.48

7 GLarge 50000 51292 0 29999.00 1.76

8 GLuxuryE 8500 11303 0 87999.00 1.50

7 GLarge E 65000 42178 22822 37999.00 1.44

Design and

Market Model Materials Labour Gross

Workforce Options Productivity

Sector Name Cost £ Cost £ Margin %

Cost £

6 GMedium 1000 13212.16 5343.17 246.00 31.63 125.00

12 GLuxury 1180 38898.93 16327.13 3254.26 30.79 9.45

7 GLarge 350 17450.85 6727.50 215.25 18.69 142.86

8 GLuxuryE 970 38898.93 20134.37 3509.12 28.93 8.76

7 GLarge E 500 17450.85 9103.63 236.54 29.50 130.00

Potential Potential

Target Warranty Cost

Market Sector Model Name Productivity Productivity

Production per Car £

Cars/Worker/Year with Overtime

6 GMedium 125000 148.06 177.67 257.71

12 GLuxury 11150 10.86 13.03 767.03

7 GLarge 50000 282.28 338.73 492.19

8 GLuxuryE 8500 10.86 13.03 1020.36

7 GLarge E 65000 239.60 287.52 723.57

Workforce 4000

Strike Days 3

Productivity (cars/worker/year) 64.91

Productivity Index 1.99

Total Market (m) Small Medium Large Luxury

Size 6.41 5.61 2.92 0.75

:

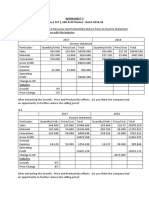

Team 2 : GIGA MOTORS

Profit and Loss Account - £m

Sales 8515.62

Cost of Sales* 6077.19

Gross Profit (Loss) 2438.43

Overheads

Fixed Overheads 560.10

Stock Upkeep Cost 29.05

Product Recall Cost

Promotion 522.00

Research and Development 12.63

Professional Charges 21.19

Warranty Claims 108.06

Training Cost 65.00

Extraordinary Events

Depreciation 155.34

Operating Profit (Loss) 965.05

Interest on Current Account 43.55

Interest on Loans

Cost of Redundancies

Factory Sale Loss

Pre Tax Profit (Loss) 1008.60

Tax 221.89

Post Tax Profit (Loss) 786.71

*Cost of Sales Breakdown

Opening Stock 193.68

plus Materials Costs 6371.93

plus Wages 123.00

minus Closing Stock 611.42

Cost of Sales 6077.19

:

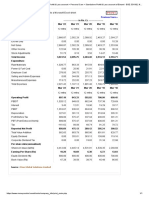

Balance Sheet £m - Team 2 : GIGA MOTORS

Fixed Assets

Cost 1,890.00

Depreciation -491.91

Book Value 1,398.09

Current Assets

Stock Value 611.42

Debtors 699.91

Bank Balance 1,573.57

Current Liabilities

Tax 221.89

Creditors 872.87

Overdraft

Net Current Assets (or Liabilities) 1,790.15

Total Assets Less Current Liabilities 3,188.24

Capital and Reserves

Share Equity 500.00

Retained Profit (Loss) 2,688.24

Total Subsidies

Total Shareholders Funds 3,188.24

Long Term Liabilities

Loan

Total Capital Employed 3,188.24

:

Cash Flow £m - Team 2 : GIGA MOTORS

Opening Bank Balance 1241.43

Revenue 8369.11

Corporate Subsidy

Government Subsidy

Insurance Claim

Factory Sale Income

Bank Interest 43.55

Extraordinary Events

Material Costs 6133.87

Wage Costs 123.00

Total Overheads 1318.04

Factory Cost

Redundancy Costs

Automation Expenditure 300.00

Loan Repayments

Tax Payments 205.62

Bank Interest

New Model Production Costs

Balance Before Loan 1573.57

New Loan

Closing Bank Balance 1573.57

:

You might also like

- Tutorial 2 Week 4Document5 pagesTutorial 2 Week 4Chew Jin HaoNo ratings yet

- Amtrak PPT SolutionsDocument32 pagesAmtrak PPT SolutionsAngela Thornton67% (3)

- Comparative Analysis of Two Companies From FMCG SectorDocument17 pagesComparative Analysis of Two Companies From FMCG Sectorhonda5768100% (7)

- KAYI INVESTMENT CLUB. Constitution1Document32 pagesKAYI INVESTMENT CLUB. Constitution1Munguongeyo Ivan100% (1)

- Schedule - I Calculation of Sales RevenueDocument20 pagesSchedule - I Calculation of Sales RevenueRohitNo ratings yet

- Project Highlited:-: S.No Particular AmountDocument12 pagesProject Highlited:-: S.No Particular AmountkeyuraicarNo ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- Segment Reporting - ITC-2013Document2 pagesSegment Reporting - ITC-2013Ashis Kumar MuduliNo ratings yet

- Corporate Valuation: Tata Motors LTDDocument10 pagesCorporate Valuation: Tata Motors LTDUTKARSH PABALENo ratings yet

- Jhanvi Shah 2012 CF PresentationDocument12 pagesJhanvi Shah 2012 CF PresentationJhanvi ShahNo ratings yet

- Accltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. CroreDocument6 pagesAccltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- VIL Reg 33 Results Q4FY24Document10 pagesVIL Reg 33 Results Q4FY24Samim Al RashidNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsMuhammad AkbarNo ratings yet

- GroupNo 4Document6 pagesGroupNo 4aakash9117No ratings yet

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Foreign Owned Businesses 2000 01 and 2014 15 ComparisonDocument1 pageForeign Owned Businesses 2000 01 and 2014 15 ComparisonsawicNo ratings yet

- 8 - Tata MotorsDocument27 pages8 - Tata Motorspg23vishal.srivastavaNo ratings yet

- Pidilite Industries Limited BSE 500331 Financials Income StatementDocument4 pagesPidilite Industries Limited BSE 500331 Financials Income StatementRehan TyagiNo ratings yet

- GLO-BUS Decisions & ReportsDocument3 pagesGLO-BUS Decisions & ReportsthaoNo ratings yet

- Enterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13Document20 pagesEnterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13KabeerMalikNo ratings yet

- Baldwin Bicycle CompanyDocument7 pagesBaldwin Bicycle CompanyIndustry ReportNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Report Card: Attribute Value DateDocument20 pagesReport Card: Attribute Value DateMp SunilNo ratings yet

- Dion Global Solutions LimitedDocument10 pagesDion Global Solutions LimitedArthurNo ratings yet

- Devmeta Project Report CmaDocument9 pagesDevmeta Project Report CmaharshNo ratings yet

- 4th Floor - Cma1Document39 pages4th Floor - Cma1Giri SukumarNo ratings yet

- Acc 205 Ca1Document11 pagesAcc 205 Ca1Nidhi SharmaNo ratings yet

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- Worksheet 3 Strategic Corporate Finance (SCF), SBS & IB Finance: Batch 2018-20Document2 pagesWorksheet 3 Strategic Corporate Finance (SCF), SBS & IB Finance: Batch 2018-20Prabal SharmaNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Scenario A Sales Price Profit Margin Target Cost Actual Cost Cost Gap Expected Sales VolDocument12 pagesScenario A Sales Price Profit Margin Target Cost Actual Cost Cost Gap Expected Sales VolunveiledtopicsNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Financial Statements of FSDocument76 pagesFinancial Statements of FScarl fuerzasNo ratings yet

- 1q23 QuarterlyseriesDocument21 pages1q23 Quarterlyseriesmana manaNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- Accounts Assignement 21MBA0106Document4 pagesAccounts Assignement 21MBA0106TARVEEN DuraiNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financialsjayashankar4355No ratings yet

- Tata Motors PLDocument2 pagesTata Motors PLSravani BotchaNo ratings yet

- Lbo W DCF Model SampleDocument33 pagesLbo W DCF Model Samplejulita rachmadewiNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Bhel CompititorDocument3 pagesBhel CompititorabdulrahmanjameelNo ratings yet

- Mumbai, May 5: Its Now Official. Chinese Dragon Has Posed A Serious Challenge To The IndianDocument3 pagesMumbai, May 5: Its Now Official. Chinese Dragon Has Posed A Serious Challenge To The IndianabdulrahmanjameelNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Ymc Ar e 2021 6Document6 pagesYmc Ar e 2021 6Rafi ShahabNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Case IDocument20 pagesCase ICherry KanjanapornsinNo ratings yet

- Scrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Document3 pagesScrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Amruta TarmaleNo ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- Emami PNLDocument1 pageEmami PNLsZCCSZcNo ratings yet

- DG 135 Open DG 135 CanopyDocument1 pageDG 135 Open DG 135 CanopyMohamedNo ratings yet

- A Proposed Production of Massage Oil From Pandan Leaves Statement of Comprehensive Income For The Years Ended December 31 Scenario 1Document3 pagesA Proposed Production of Massage Oil From Pandan Leaves Statement of Comprehensive Income For The Years Ended December 31 Scenario 1'Mariciela LendioNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- Referensi Keuangan GreenfreshDocument5 pagesReferensi Keuangan GreenfreshTaufik HidayatNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- Company Ratio AnalysisDocument26 pagesCompany Ratio AnalysisNimisha darakNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- How To Prepare Projected Financial StatementsDocument4 pagesHow To Prepare Projected Financial StatementsNamy Lyn GumameraNo ratings yet

- Business FinanceDocument8 pagesBusiness FinanceChristine Marie ViscaynoNo ratings yet

- Kim Parag Parikh Tax Saver FundDocument27 pagesKim Parag Parikh Tax Saver FundIndra TripathiNo ratings yet

- TB 12Document47 pagesTB 12Asiong SalongaNo ratings yet

- CFA - Research Preparation - ULTJDocument177 pagesCFA - Research Preparation - ULTJYunita PutriNo ratings yet

- Stocks & BondsDocument23 pagesStocks & Bondschristian enriquezNo ratings yet

- Annual Shareholders' Meeting - 04.10.2012 - MinutesDocument9 pagesAnnual Shareholders' Meeting - 04.10.2012 - MinutesBVMF_RINo ratings yet

- Part I Financial StatementDocument18 pagesPart I Financial Statementbebe143No ratings yet

- Cambridge IGCSE: ACCOUNTING 0452/23Document20 pagesCambridge IGCSE: ACCOUNTING 0452/23minhajaf28No ratings yet

- DWWDocument2 pagesDWWFarah HNo ratings yet

- NISM Equity Derivatives Study Notes-Feb-2013Document26 pagesNISM Equity Derivatives Study Notes-Feb-2013Priyadarshini Sahoo100% (1)

- Chapter 2 (Exercises)Document10 pagesChapter 2 (Exercises)claudiazdeandresNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH03Document32 pagesRoss Fundamentals of Corporate Finance 13e CH03張浩琳No ratings yet

- Spice Jet Data For Business Analytics'Document47 pagesSpice Jet Data For Business Analytics'Namita BhattNo ratings yet

- Company Law Course Outline January 2024Document12 pagesCompany Law Course Outline January 2024Essay 360No ratings yet

- 6072 p4 Lembar Jawaban PT KURNIADocument38 pages6072 p4 Lembar Jawaban PT KURNIAEmeeNo ratings yet

- Chapter Twelve QuestionsDocument3 pagesChapter Twelve QuestionsabguyNo ratings yet

- Codes of Corporate Governance - Yale - 053112Document34 pagesCodes of Corporate Governance - Yale - 053112Arafatul Alam PatwaryNo ratings yet

- Assignment 1.2: Partneship Dissolution and Liquidation AnswerDocument17 pagesAssignment 1.2: Partneship Dissolution and Liquidation AnswerTricia Nicole DimaanoNo ratings yet

- Olam International Limited: Management Discussion and AnalysisDocument22 pagesOlam International Limited: Management Discussion and Analysisashokdb2kNo ratings yet

- Techniques of ValuationDocument2 pagesTechniques of ValuationrojaNo ratings yet

- Additional Topics - Business CombinationDocument39 pagesAdditional Topics - Business CombinationIan Pol FiestaNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeAbdulmajed Unda MimbantasNo ratings yet

- Capital GainsDocument48 pagesCapital GainsToofan KhanNo ratings yet

- Coroporate Tax Planning and Management: Neha Shivdayal GuptaDocument107 pagesCoroporate Tax Planning and Management: Neha Shivdayal Guptanitin0010No ratings yet

- BIR Ruling DA 509-06Document12 pagesBIR Ruling DA 509-06Harry Bill Dela FuenteNo ratings yet

- Quiz 5Document7 pagesQuiz 5Rauf pervaizNo ratings yet