Professional Documents

Culture Documents

Worksheet 3 - Solutions: Topic: Cash Book & Bank Reconciliation

Worksheet 3 - Solutions: Topic: Cash Book & Bank Reconciliation

Uploaded by

vipulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet 3 - Solutions: Topic: Cash Book & Bank Reconciliation

Worksheet 3 - Solutions: Topic: Cash Book & Bank Reconciliation

Uploaded by

vipulCopyright:

Available Formats

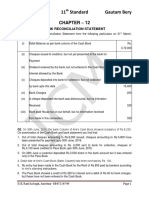

Worksheet 3 - Solutions

Topic : Cash Book & Bank Reconciliation

1. Enter the following transactions in the Double Column Cash Book of M/s. NatwarLal Store:

2. On 30th June 2017, bank column of the Cash Book of M/s. Banwari Lal showed balance of Rs.12,000

but the Pass Book showed a different balance due to the following reasons :

a. Cheques paid into the bank Rs.8,000 but out of these only cheques of Rs.6,500 credited by

bankers.

b. The receipt column of Cash Book undercast by Rs.200

c. On 29th June, a customer deposited Rs.3,000 directly in the Bank Account but it was entered in

the Pass Book only.

d. Cheques of Rs.9,200 were issued of which Rs.2,200 were presented for payment on 15th July.

e. Pass Book shows a credit of Rs.330 as interest and a debit of Rs.60 as bank charges.

Prepare the Bank Reconciliation Statement as on 30th June 2017.

3. Prepare the Bank Reconciliation Statement for Sundar Enterprises from the following particulars on

31st July 2017

a. Balance as per Pass Book Rs.50,000

b. Three cheques for Rs.6,000, Rs.3,937 and Rs.1,525 issued in the last week of July 2017 were

presented for payment to the bank in August, 2017.

c. Two cheques of Rs.500 & Rs.650 sent to the bank for collection were not entered in the pass

book by 31st July 2017

d. The bank charged Rs.460 for its commission and allowed interest of Rs.100 which were not

mentioned in the Bank Column of the Cash Book.

4. On 1st January 2018, Ramesh had an overdraft of Rs. 40,000 as shown by his Cash Book in the bank

column. Cheques amounting Rs.10,000 had been deposited by him but were not collected by the

bank by 1st January 2018. He issued cheques of Rs.7,000 which were not presented to the bank for

payment up to that day. There was also a debit of Rs.600 for interest in the pass book and Rs.500 for

bank charges.

CA Akanksha Nair - 9930893951

5. On 31st March 2018, Pass Book of Shri Lal Bahadur shows a debit balance of Rs.10,000. From the

following particulars, prepare the Bank Reconciliation Statement.

a. Cheques amounting to Rs.8,000 drawn on 25th March of which cheques of Rs.5,000 cashed in

April 2018

b. Cheques paid into the bank for collection of Rs.5,000 but cheques of Rs.2,200 only could be

collected in March 2018

c. Bank Charges Rs.25 and dividend of Rs.350 on investment collected by bank could not be shown

in the Cash Book.

d. A cheque of Rs.600 debited in the Cash Book omitted to be banked.

e. Bill of Rs.5,000 discounted with the Bank but was not recorded in the Cash Book.

CA Akanksha Nair - 9930893951

You might also like

- Notes To Be Sent by Registered Post: Request CN 17Document2 pagesNotes To Be Sent by Registered Post: Request CN 17Cristian Trochez100% (2)

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Ch-3 BRSDocument8 pagesCh-3 BRSAFTAB KHANNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- BRSDocument29 pagesBRSBaskar ANgadeNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- BRS Practice QuestionsDocument2 pagesBRS Practice Questionssyed ali raza kazmiNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- QuestionsDocument9 pagesQuestionsCfa Deepti BindalNo ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Financial AccountingDocument19 pagesFinancial Accountingshankar1287No ratings yet

- 11 PaperDocument2 pages11 PaperSomesh DhingraNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Cash Book ProblemsDocument6 pagesCash Book Problemsshahid sjNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocument6 pagesAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanNo ratings yet

- Practice Set BRSDocument15 pagesPractice Set BRSvishwajeetnmoreNo ratings yet

- Accounting RevisionDocument8 pagesAccounting RevisionAnish KanthetiNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- QUES19Document2 pagesQUES19Manish Saini0% (1)

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- Guess PaperDocument17 pagesGuess PaperVinay ChawlaNo ratings yet

- Assignment ProblemsDocument7 pagesAssignment ProblemsLowzil AJIMNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Assets:: 2008 Cash in Hand Rs 2,000, Cash at Bank RS, 68,000, Stock of Goods RsDocument3 pagesAssets:: 2008 Cash in Hand Rs 2,000, Cash at Bank RS, 68,000, Stock of Goods RsPrem PatelNo ratings yet

- BPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommerceDocument53 pagesBPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommercelembdaNo ratings yet

- Accountancy Worksheet PracticeDocument4 pagesAccountancy Worksheet PracticeChandni JeswaniNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- Cash Book ExeDocument1 pageCash Book ExeChristianNo ratings yet

- Brs Practise SheetDocument1 pageBrs Practise Sheetapi-252642432No ratings yet

- Bank Reconciliation QuestionDocument2 pagesBank Reconciliation QuestionFinnNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- Mid Term Accounts - SubjectiveDocument4 pagesMid Term Accounts - Subjectivekarishma prabagaranNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- OSRL UNDP Webinar On Oil Spill Mitigation and Management NTTDocument13 pagesOSRL UNDP Webinar On Oil Spill Mitigation and Management NTTBUMI ManilapaiNo ratings yet

- Fce TestsDocument5 pagesFce TestsKimLiênNguyễn100% (1)

- EnlightenmentDocument12 pagesEnlightenmentemilylovesflowers100% (2)

- Week 13 15Document14 pagesWeek 13 15Marjorie QuitorNo ratings yet

- NSTP 2 Chapter 3 Community ImmersionDocument23 pagesNSTP 2 Chapter 3 Community ImmersionDaniel Corpus AntonioNo ratings yet

- American Securities-Backed Prince International To Acquire Ferro For $2.1 BillionDocument3 pagesAmerican Securities-Backed Prince International To Acquire Ferro For $2.1 BillionCDI Global IndiaNo ratings yet

- M W Patterson - The Church of EnglandDocument464 pagesM W Patterson - The Church of Englandds1112225198No ratings yet

- Wealth InequalityDocument35 pagesWealth Inequalityahmad100% (1)

- Personal Brand PaperDocument9 pagesPersonal Brand PaperAntonio BonansingaNo ratings yet

- 500 Words EssayDocument2 pages500 Words EssayEskit Godalle NosidalNo ratings yet

- SDGS and 7th Five Year PlanDocument32 pagesSDGS and 7th Five Year PlanMahmuda BegumNo ratings yet

- Chen References 2023Document12 pagesChen References 2023phoenix.beronioNo ratings yet

- A Political History of The Kingdom of Kazembe (Zambia) : Giacomo MacolaDocument256 pagesA Political History of The Kingdom of Kazembe (Zambia) : Giacomo Macolatemborhodah45No ratings yet

- GLOBAL PRACTICE OF ARCHITECTURE The Impacts of Globalization of The Architectural PracticeDocument1 pageGLOBAL PRACTICE OF ARCHITECTURE The Impacts of Globalization of The Architectural PracticeMark Russell DimayugaNo ratings yet

- (Chris Horrocks, Zoran Jevtic) Introducing Foucaul PDFDocument91 pages(Chris Horrocks, Zoran Jevtic) Introducing Foucaul PDFJeronimo Amaral de CarvalhoNo ratings yet

- 0419236201Document222 pages0419236201Andrei TodeNo ratings yet

- CH 1 IntroDocument5 pagesCH 1 IntroJawad AhmadNo ratings yet

- CTA Case No. 10063Document16 pagesCTA Case No. 10063Karen Joy JavierNo ratings yet

- Special Operations ExecutiveDocument15 pagesSpecial Operations ExecutiveSadiq KerkerooNo ratings yet

- LF1SLD48B TechdataDocument2 pagesLF1SLD48B TechdataNitesh Kumar SinghNo ratings yet

- FORD Final SlideDocument12 pagesFORD Final SlideJubayed Hossain ChowdhuryNo ratings yet

- "PROJECT K" MEETS "PROJECT A" - 2005 - The Arizona Project, Don Bolles and Bob Greene, Meets Project Klebnikov (By Richard Behar)Document15 pages"PROJECT K" MEETS "PROJECT A" - 2005 - The Arizona Project, Don Bolles and Bob Greene, Meets Project Klebnikov (By Richard Behar)Richard BeharNo ratings yet

- 2016-06-30 Flanges Petition Volume IDocument144 pages2016-06-30 Flanges Petition Volume ICapitalTradeNo ratings yet

- Hostel Fees Structure 2020-21Document1 pageHostel Fees Structure 2020-21James SudhakarNo ratings yet

- Ra 7353Document15 pagesRa 7353John Byron Jakes LasamNo ratings yet

- Tieng Anh 10 Friends Global - Unit 5&6 - Test 2Document6 pagesTieng Anh 10 Friends Global - Unit 5&6 - Test 2nguyenhoangminh0325No ratings yet

- Amended Motion To Dismiss Illinois Eavesdropping CaseDocument155 pagesAmended Motion To Dismiss Illinois Eavesdropping Caseanacondakay044100% (1)

- Andaya, A History of Malaysia.Document24 pagesAndaya, A History of Malaysia.CQOT92No ratings yet

- MOL Pakistan - CORA DirectorateDocument18 pagesMOL Pakistan - CORA DirectorateAsad IrfanNo ratings yet