Professional Documents

Culture Documents

Liquidity and Manipulation

Liquidity and Manipulation

Uploaded by

Thero RaseasalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liquidity and Manipulation

Liquidity and Manipulation

Uploaded by

Thero RaseasalaCopyright:

Available Formats

Liquidity and Manipulation

Created July 17, 2021 146 AM

Tags

The markets need to generate liquidity in order to move, so if liquidity isn´t

already there, it will be created. So when new traders come in to forex and

learn about it for the first time, what they usually do is gonna be retail based

trading.

So support and resistance, chart patterns which are extremely popular in the

industry, and things of that nature.

So what some brokers do is they offer free education for their clients once we

start trading. Now this education will usually be retail methods support and

resistance.

So why is this?

Well its simple, they want to generate liquidity into the markets, because the

majority of traders are trading this way. So these retail methods are not

unknown to large banks, and people with large interests. Of course they are not

all this information is out there for free, for anyone to go and we know seach

up.

So if all this information is available for free don´t think its wise to assume that

these people with huge amounts of money, they are going to use it against the

majority of retail traders in order to manipulate the markets.

So when we dig deep into chart patterns like the double top, double bottom or

bull flag, bear flag, which we know retail traders absolutely love this patterns.

We need to understand they are all manipulated and they only they do work

but only when we really know what we are doing, and how we can trade around

the manipulation, because there is a few people who talk about math

psychology and as long as we know whats going on and the math psychology

behind this patterns, we can still trade them definitely.

So what trade is a tool is to sell at double tops, or buy at double bottoms.

Liquidity and Manipulation 1

If we know this and large banks know this, what does that

really mean?

Well its means that theres is a lot of liquidity above or below this areas. So

there is a lot of luquidity above we know a double top or triple top, quadruple,

whatever. And there is liquidity below double bottoms.

So that is why we know double tops as EQHs and double bottoms as EQLs. We

expect price to be manipulated at and around this areas.

All we need to do is go back and look at the data, because its all there. So once

we see large moves up, sell size liquidity will usually need to be swept or

generated beforehand. That allow that move to actually we know impulsively

move.

Its basically fueled the move.

The same goes for when we large down moves by side liquidity will usually

need to swept or taken out prior.

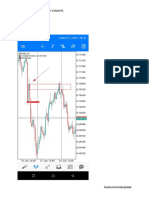

So now we have gone through that, what we wanna go through is this little

pattern, and what we can see from this pattern is price was pushing up, which

looks like and ascending channel, price then we had this high, we pushed

Liquidity and Manipulation 2

down, pulled back, pushed down, showing a little bit of a slow down in this

uptrend, and then price pushed down to this low.

So essentially we have a double bottom here, and price then pushes up to this

high, which is a double top.

Now a lot of people will be looking for sells from here, so if we know that. So

once we have a nice rejection from this double top and nice retrace, this looks

good for the majority of people, because price come up but we failed to break

above this DT or as we know a EQH.

We have got a nice retrace candle, which again retail love retrace candle,

because its showing potential move to the downside, and rejection from an

area.

So now that we have got a rejection from this DT, people are looking to sell

this, and when people are looking to sell at DT, where are their stop losses

going? Well they are going above the DT. But clearly they have going above the

DT.

Retail always put stops above DT or below DB, and then expect to move down.

So that is exactly why there is liquidity this areas. So that basically means that

a lot of stop losses are at this areas.

Liquidity and Manipulation 3

Now we can´t just be 100% positive that there is stop losses here, because we

don´t know, we just assuming but the data is there for anyone to go and see

how this works on the charts day in day out.

So once we get this, we know we are looking to enter now, and what we usually

see is price push down a little bit.

So we have this EQH and also got EQL. So we have got liquidity below here as

well, so whats likely to be going on here? Well we are likely to come back up.

Now from people who are in the sells, we know if they are well risk managed

then they may have moved to BE but its unlikely. This is whats gonna happen.

More times than not, be gonna come up, seek all of this liquidity, which

basically is just taking money from all of the people in the sells, which helps to

fuel any potential moves that are gonna happen in the future.

Which likely still gonna come down, but now that we have taken liquidity from

this wick, we have a reason for price to potentially come down.

Liquidity and Manipulation 4

Now what we also have with this breakout traders, who look to set an entry,

they look to set and entry on the breakout of a potential area. So we are

essentially grabbing sell side liquidity as well and buy side liquidity.

Liquidity and Manipulation 5

Now we will see this a lot, see how we got some really huge momentum after

that liquidity grab, this is not uncommon, and if we also see what happened

before price came up to take liquidity, we also have this EHL here and we can

see this spike low, so essentially we actually took liquidity from the sell side, for

anyone looking for sell on breakout in this double bottom here.

Liquidity and Manipulation 6

But if we also look left what we can see is what we will usually see on the

charts, is price breaking below a DB or EQL which is tapping into an OB which

is seen on when we look left with price section.

We can see we made BOS above this high, last down candle, price wicked in,

grab liquidity, mitigated, pushed up, grab liquidity, and then we have a reason

for price to move to the downside, as we can see.

So what I wanna do now is go EU and show exactly this thing, manipulation. So

we are on 1h, and if we look at current price, we can see we are clearly bullish,

and price is trading above this lows and make HHs.

Liquidity and Manipulation 7

So we have a high, now we can already see price starting to slow down, we are

ranging, we are staying within this high, and this most recent HL, but we are

clearly building liquidity, before the markets get manipulated.

So we have this high here, price come above it, but closed below, we have

wicked it. So we have a retrace candle priced in pushes down.

Liquidity and Manipulation 8

This is clearly ascending channel, we have this correction, we also have this

high price pushes down, a nice ascending corrective move back up to that DT.

Now we see a nice impulse down, and we see head and shoulders pattern

here, this would be the head, left shoulder and the right shoulder, and this is

Liquidity and Manipulation 9

the neckline, we have broken it, so traders will be looking for a break and

retest.

So if we just mark that on we have had a break of this trendline, a nice

impulsive break, and Im gonna mark on this as the clear break. So where would

entries be? We have had an impulsive move, maybe at this low here was enter.

Now this is clearly impulse down, head and shoulders, so people will look for

short from here.

Liquidity and Manipulation 10

So price pushes down, we push back up, so we had a break and a retest, stop

loss can be 20 pips, above that high, and we push down but then we get taken

out.

Liquidity and Manipulation 11

So this was a fake out, so as we just looked on the diagram, if we look left, we

can see we BOS, which as we know leaves behind an OB, which granted we did

wick below, but it was likely tapping into, maybe this wick, because we did BOS

here as well, last down candle.

So we would be noticing this down if we was looking to trade this.

Now we just gonna move this line along, because this would be an area of

resistance, we also had some support, that we could say from here, we broke

it, maybe its turned resistance, and this is the sort of idea what people are

trading.

Liquidity and Manipulation 12

Now price is tapping on resistance, and are people selling here, a lot. So we are

gonna come up and we are gonna take that liquidity from this highs. Grab that

money from stop losses and now price have reason to potentially move down,

and what do we know look? Look at that momentum.

The reason that we can see momentum like this is because we have fuel, after

grabbing all this liquidity from this area here.

Liquidity and Manipulation 13

Now at this area look how price broke, we broke here but we pulled back in,

people also selling here, we have breakout traders looking to go long, stop loss

back inside, and they get into profit and it flips on them.

So we are taking liquidity from both sides, buy and sell sides.

So whats likely to happen now?

Liquidity and Manipulation 14

Well, price has a reason to come down, but what can we look at for a potential

entry? Well we can look at what we have here, we have some untested areas,

we have this last down candle, so we have an OB that made BOS, and we also

have an area here as well, with OB that BOS impulsively, so this are areas

where price could actually react from.

Liquidity and Manipulation 15

So now we can see the momentum, we have a bit of correction here, but we

can see the overall momentum and its all down to the fact that we had this

liquidity sweep from here, which can feel the move down, breaking this lows

here and essentially tapping into an actual area where large institutions are

looking to get involved.

So we come in, and we can see how price has reacted, so this are areas where

SMC traders are looking at to get involved in the trade.

Liquidity and Manipulation 16

Now on this OB here, we ca see price tapped in, mitigated, and now this little

BOS are just mitigations on a LTF, so we will see this as BOS, mitigation, BOS,

mitigation, which we know we can get involved in this trades from down here

on a LTF, with stop losses really tight, with the expectation of essentially

targeting back up here, because there is no reason why a price won´t come up

here. We are still bullish, even though we have momentum here, but its about

looking at why momentum was caused, and what price has come into.

Now we granted we could potentially take some sells in here down to this areas

definitely, but the point is, price has now taken liquidity, tapped into a high level

of interest, so there is no reason why we can´t be targeting up here, and we

will see the momentum that kicks in now, because price has a reason to

actually move.

Liquidity and Manipulation 17

Now price continue up and we have a bit correction, but then we see some

heavy momentum, and if we just take this bit of price section, what we can see

is this is momentum, as we can see, which BOS, so we can note that is broken

that structure there.

And then leaves behind the last down candle but then we can take the candle

before the momentum which is here. So we can look to get long from here.

Now we expect price to come back down to fill the imbalance, mitigate this

move and then continue.

Liquidity and Manipulation 18

So price come down, and do a wick below. So we do have this wick before, so

this is just a LTF OB or POI that we can look at, so thats what price was doing,

mitigating that wick.

Liquidity and Manipulation 19

And price continues up like we expected, and make a momentum, because

price has a reason to move. And now we also BOS again to the upside, we had

this last down candle which granted is very large, but we can refine in a LTF.

Price respected it and then pushed up. But this is basically this is how we need

to be viewing the market as well.

Liquidity and Manipulation 20

You might also like

- BTMM Workbook PDFDocument146 pagesBTMM Workbook PDFAKINREMI AYODEJI92% (12)

- ZM Capitals Academy: Where Trading Is MadeDocument33 pagesZM Capitals Academy: Where Trading Is MadeStephane Marchands100% (18)

- Liquidity Inducement Trap Case StudyDocument4 pagesLiquidity Inducement Trap Case Studyyoussef marzak86% (7)

- LTI Smart MoneyDocument26 pagesLTI Smart Moneyy6bt25096% (53)

- Chart PatternsDocument55 pagesChart Patternsnidukinduwara100100% (2)

- Trading Hub 2.o-3Document10 pagesTrading Hub 2.o-3Reynor Alvin Caceres Garnica100% (4)

- Lower Timeframe Order Block RefinementDocument14 pagesLower Timeframe Order Block RefinementAtharva Sawant83% (12)

- Lower Timeframe Order Block RefinementDocument14 pagesLower Timeframe Order Block RefinementAtharva Sawant83% (12)

- 63e3d96ecd160 EbookDocument51 pages63e3d96ecd160 Ebookkhin khinsan100% (7)

- Supply and DemandDocument18 pagesSupply and DemandAtharva Sawant100% (5)

- Supply and DemandDocument18 pagesSupply and DemandAtharva Sawant100% (5)

- Understanding LiquidityDocument7 pagesUnderstanding LiquidityCrypto Bitcoin83% (24)

- Mitigation of Orders and Cause For PriceDocument10 pagesMitigation of Orders and Cause For PriceAtharva Sawant100% (2)

- Mitigation of Orders and Cause For PriceDocument10 pagesMitigation of Orders and Cause For PriceAtharva Sawant100% (2)

- WWA Market StructureDocument1 pageWWA Market StructureMus'ab Abdullahi BulaleNo ratings yet

- Flipping Markets: Trading PlanDocument28 pagesFlipping Markets: Trading PlanDario Anchava88% (8)

- Types of LiquidityDocument12 pagesTypes of LiquidityAtharva Sawant100% (9)

- Market StructureDocument21 pagesMarket StructureAtharva Sawant100% (10)

- Entry Types Continuation Part 1Document9 pagesEntry Types Continuation Part 1Atharva Sawant100% (3)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceAtharva Sawant100% (5)

- Market StructureDocument21 pagesMarket StructureAtharva Sawant100% (10)

- Types of LiquidityDocument12 pagesTypes of LiquidityAtharva Sawant100% (9)

- Entry Types Continuation Part 1Document9 pagesEntry Types Continuation Part 1Atharva Sawant100% (3)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceAtharva Sawant100% (5)

- Order Blocks: Supply & DemandDocument5 pagesOrder Blocks: Supply & DemandTradewith Dev100% (3)

- Liquidity Concepts by Victorious 5Document17 pagesLiquidity Concepts by Victorious 5zorronguyen100% (3)

- Ebook Basic TradesmartfxDocument47 pagesEbook Basic TradesmartfxDanny P100% (1)

- Trading Terminology and MeaningDocument2 pagesTrading Terminology and MeaningAtharva Sawant100% (1)

- Trading Terminology and MeaningDocument2 pagesTrading Terminology and MeaningAtharva Sawant100% (1)

- StopHunt Mastery PDFDocument115 pagesStopHunt Mastery PDFoli100% (11)

- Supply and Demand Trading 101 for BeginnersFrom EverandSupply and Demand Trading 101 for BeginnersRating: 2.5 out of 5 stars2.5/5 (2)

- Mastering The SetupDocument50 pagesMastering The SetupBrandon Velez100% (1)

- Forex Biginners Guide PDFDocument76 pagesForex Biginners Guide PDFfungai shoniwa50% (2)

- Equity Research - Banking SectorDocument89 pagesEquity Research - Banking Sectorsnfrh2188% (34)

- Snowflake2 @FOREXSyllabusDocument27 pagesSnowflake2 @FOREXSyllabusHamzah Ahmed100% (3)

- Forex Market - StructureDocument8 pagesForex Market - Structuredafx75% (4)

- Tradable Order BlocksDocument24 pagesTradable Order BlocksFelipe Silva93% (15)

- Lower - Timeframe - Bullish - Order - FlowDocument30 pagesLower - Timeframe - Bullish - Order - FlowAleepha Lelana100% (5)

- Flipping Markets: PDF Cheat SheetDocument59 pagesFlipping Markets: PDF Cheat SheetAsh Sam100% (9)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Trading Smart Way With The - NorthgodDocument17 pagesTrading Smart Way With The - NorthgodAndile100% (10)

- How To Use Reclaimed Order BlocksDocument11 pagesHow To Use Reclaimed Order BlocksMarvrickEml100% (1)

- Flipping Markets: Trading Plan 2.0Document51 pagesFlipping Markets: Trading Plan 2.0Frisella Tobing100% (4)

- GU Live Example The Markets Need That Fuel To MoveDocument3 pagesGU Live Example The Markets Need That Fuel To MoveAtharva Sawant100% (1)

- GU Live Example The Markets Need That Fuel To MoveDocument3 pagesGU Live Example The Markets Need That Fuel To MoveAtharva Sawant100% (1)

- Liquidity PrinciplesDocument21 pagesLiquidity PrinciplesAnurag Nauriyal94% (16)

- Liquidity: Quantum Stone CapitalDocument6 pagesLiquidity: Quantum Stone CapitalCapRa Xubo100% (5)

- 22template22 Backtest of Alex GU PDFDocument13 pages22template22 Backtest of Alex GU PDFjair100% (1)

- FTM Strategy Manual PDFDocument64 pagesFTM Strategy Manual PDFjair100% (5)

- Introduction to Basic Supply & Demand Trading for BeginnersFrom EverandIntroduction to Basic Supply & Demand Trading for BeginnersRating: 1 out of 5 stars1/5 (1)

- Understanding Impulsive and Corrective Price ActionDocument29 pagesUnderstanding Impulsive and Corrective Price ActionChuks Osagwu100% (1)

- Entry Types Continuations & Liquidity Part 2: Created TagsDocument7 pagesEntry Types Continuations & Liquidity Part 2: Created TagsThero Raseasala100% (1)

- Entry Types Continuations Liquidity Part 2Document7 pagesEntry Types Continuations Liquidity Part 2Crypto Bitcoin100% (1)

- What Is An Order BlockDocument16 pagesWhat Is An Order BlockLeonardo Caverzan100% (5)

- Bullish - Bearish - Order - BlocksDocument17 pagesBullish - Bearish - Order - BlocksAtharva Sawant100% (7)

- Liquidity GuideDocument20 pagesLiquidity Guide7q8jspp2sv100% (2)

- Market Structure MSDocument32 pagesMarket Structure MSadama kafando100% (1)

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- ResourcesDocument10 pagesResourcesAtharva Sawant50% (2)

- Understanding LiquiditiesDocument13 pagesUnderstanding LiquiditiesFrank83% (12)

- Safe - Target - and - LTF - Price - ActionDocument9 pagesSafe - Target - and - LTF - Price - ActionRui Almeida100% (2)

- Understanding LiquidityDocument7 pagesUnderstanding LiquidityNitesh Mistry80% (5)

- Tactical Trading Concepts Liquidity Pools and Stop OrdersDocument13 pagesTactical Trading Concepts Liquidity Pools and Stop OrdersHi27069325% (4)

- Precision Based Trading King. D Boateng IG@ KingboatengofficialDocument24 pagesPrecision Based Trading King. D Boateng IG@ Kingboatengofficialdjkunal100% (2)

- Inducement ICT Capital CompressedDocument232 pagesInducement ICT Capital CompressedLewis Mendez100% (1)

- Entry Criteria, Targets and Market DirectionDocument16 pagesEntry Criteria, Targets and Market DirectionRui Almeida100% (2)

- Our Free PDF!: Welcome ToDocument42 pagesOur Free PDF!: Welcome ToPragya Richhariya100% (4)

- Precision Based Trading King. D Boateng IG@kingboatengofficialDocument24 pagesPrecision Based Trading King. D Boateng IG@kingboatengofficialnicholasNo ratings yet

- Tradable Order BlocksDocument28 pagesTradable Order BlocksKaran Singh RanaNo ratings yet

- Illustration 3: Order Block-Smart Money ConceptsDocument5 pagesIllustration 3: Order Block-Smart Money ConceptsRobiyanto WedhaNo ratings yet

- Supply and Demand Trading Strategies for Commodities, Forex, Futures and StocksFrom EverandSupply and Demand Trading Strategies for Commodities, Forex, Futures and StocksRating: 3.5 out of 5 stars3.5/5 (4)

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- Tradingview Getting Started: Created TagsDocument8 pagesTradingview Getting Started: Created TagsAtharva Sawant100% (1)

- World Economic ForumDocument5 pagesWorld Economic ForumAtharva SawantNo ratings yet

- Bullish - Bearish - Order - BlocksDocument17 pagesBullish - Bearish - Order - BlocksAtharva Sawant100% (7)

- (Report Title) (2018) : (DATE)Document2 pages(Report Title) (2018) : (DATE)Atharva SawantNo ratings yet

- Name of Experiment:: Study of Logic GatesDocument7 pagesName of Experiment:: Study of Logic GatesAtharva SawantNo ratings yet

- ResourcesDocument10 pagesResourcesAtharva Sawant50% (2)

- Document 7Document4 pagesDocument 7Atharva SawantNo ratings yet

- Adsp - Exp 5Document3 pagesAdsp - Exp 5Atharva SawantNo ratings yet

- Name of Experiment:: Study of Logic GatesDocument6 pagesName of Experiment:: Study of Logic GatesAtharva SawantNo ratings yet

- Model Internship Guidelines ManualDocument44 pagesModel Internship Guidelines ManualAtharva SawantNo ratings yet

- Campus Schedule 16.8.2018Document2 pagesCampus Schedule 16.8.2018Atharva SawantNo ratings yet

- Yta School BookletDocument37 pagesYta School BookletAditi100% (1)

- Project ReportDocument48 pagesProject ReportPritish PopliNo ratings yet

- Chapter 12 Technical AnalysisDocument28 pagesChapter 12 Technical AnalysisceojiNo ratings yet

- The Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCDocument25 pagesThe Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCHulu LuluNo ratings yet

- Does The Head & Shoulders Formation Work?: Detecting Trend Changes?Document5 pagesDoes The Head & Shoulders Formation Work?: Detecting Trend Changes?satish sNo ratings yet

- How To Trade Chart Patterns With Target and SL@Document39 pagesHow To Trade Chart Patterns With Target and SL@millat hossain100% (1)

- 3 Chart Patterns Cheat SheetDocument7 pages3 Chart Patterns Cheat SheetAka Akou Jean-Jacques LouisNo ratings yet

- 3Document27 pages3Jorge NegreteNo ratings yet

- 3 Best Chart Patterns For Intraday Trading in ForexDocument15 pages3 Best Chart Patterns For Intraday Trading in ForexCheng80% (5)

- Line at Point S Is Followed by The Breaking of The Basic Up Trendline at PointDocument7 pagesLine at Point S Is Followed by The Breaking of The Basic Up Trendline at PointKim P. TranNo ratings yet

- Forex Patterns: The 28 Forex Patterns Complete Guide - Asia Forex MentorDocument22 pagesForex Patterns: The 28 Forex Patterns Complete Guide - Asia Forex Mentormohammed abdeenNo ratings yet

- How To Trade Chart Patterns With Target and SL - Forex GDP - Trade With ConfidenDocument40 pagesHow To Trade Chart Patterns With Target and SL - Forex GDP - Trade With Confidenshashikant jambagi100% (4)

- The Jeff Clark Trader Guide To Technical Analysis Mvo759Document19 pagesThe Jeff Clark Trader Guide To Technical Analysis Mvo759Ethan Dukes100% (1)

- Chart Petterns Ebook EnglishDocument48 pagesChart Petterns Ebook Englishharshmevada81150% (4)

- 5 Chart Patterns To Know PDFDocument15 pages5 Chart Patterns To Know PDFRenato100% (1)

- 3 Chart Patterns Cheat Sheet PDFDocument7 pages3 Chart Patterns Cheat Sheet PDFMaku100% (1)

- 3 Chart Patterns Cheat SheetDocument7 pages3 Chart Patterns Cheat SheetEmmanuel BoatengNo ratings yet

- Deep Learning in Pattern Recognition and Stock Forecasting: T U O ADocument54 pagesDeep Learning in Pattern Recognition and Stock Forecasting: T U O Apawir97576No ratings yet

- Cfa Level1 Juice NotesDocument27 pagesCfa Level1 Juice NotesVIPUL DHAGATNo ratings yet

- Smarter Trader Playbook Jeff Bishop PDFDocument37 pagesSmarter Trader Playbook Jeff Bishop PDFIsaac100% (4)

- Tech Analysis Presentation by Jose VistanDocument62 pagesTech Analysis Presentation by Jose VistanDaniel ValerianoNo ratings yet

- PinoyInvestor Academy - Technical Analysis Part 3Document18 pagesPinoyInvestor Academy - Technical Analysis Part 3Art JamesNo ratings yet

- Technical Analysis BookDocument95 pagesTechnical Analysis BookvhmuddyNo ratings yet