Professional Documents

Culture Documents

Wash Workers' Compensation Brief

Wash Workers' Compensation Brief

Uploaded by

Patti TomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wash Workers' Compensation Brief

Wash Workers' Compensation Brief

Uploaded by

Patti TomCopyright:

Available Formats

Governor Chris Gregoire 2011 LEGISLATIVE BRIEF

Transforming Washington’s Government through Fiscal Responsibility – Efficiency – Performance – to Prepare for the 21st Century

WORKERS’ COMPENSATION:

GETTING WORKERS HEALTHY FASTER AND AT LESS COST

Washington’s workers’ compensation system is 100 years old. The system that will take us into the

next century must boost the quality of care for injured workers,

return them to work as quickly as possible, reduce the incidence

of long-term disability and lower system costs. The legislation

supported by Governor Gregoire incorporates the following

features that significantly improve the soundness of the system

while workers regain health. On balance, pension benefits for

those who earned more modest wages are less affected by these

reforms than those who earned more generous salaries.

Statewide provider network

The legislation focuses on getting the highest quality care to injured workers. Doctors who treat

injured workers are required to possess certain credentials to do so. Health care providers are

encouraged to follow occupational health practices to return workers to work as safely and quickly

as possible.

Savings: Fiscal Year 2012: $41 million; Fiscal Years 2012–15: $164 million

Centers of Occupational Health and Education

These centers offer proven and effective treatment of injured workers. The legislation expands

the number of these specialized facilities so services are available to all injured workers, no matter

where they live.

Savings: FY 2012: $0; FY 2012–15: $55 million

Washington Stay-at-Work Program

The Stay-at-Work program offers wage subsidies to employers who bring workers back to a job

quickly. Under the legislation, half of an injured worker’s wages would be covered for up to 66

days when an employer immediately offers transitional or light-duty work.

Savings: FY 2012: $16 million; FY 2012–15: $111 million

Prior disability awards

Benefits for prior disability awards paid to a worker are deducted from the worker’s pension award.

When permanent partial disability awards are paid over time, interest on the unpaid balance will no

longer be included. This will help keep costs down and make payments fair.

Savings: FY 2012: $99 million; FY 2012–15: $133 million

WWW.GOVERNOR.WA.GOV MAY 2011

Cost-of-living adjustments Alternative 1: Dollar-for-dollar offset

COLA payments would be frozen in the

of Social Security retirement benefits

2011–13 biennium and delayed thereafter. This

change affects the cash-funded, pay-as-you-go Our time-loss and pension benefits are now capped

Supplemental Pension Fund. COLAs that would for workers who receive Social Security so the

be effective July 1, 2011, and July 1, 2012, are combined benefits don’t exceed 80 percent of

eliminated. The first COLA payment following their highest year’s earnings. The legislation will

an injury would be delayed until the second July replace this cap with an offset of their workers’

1 following an injury. These changes reduce the compensation benefits by the amount of their initial

amount of premiums charged to employers and Social Security retirement. In total, retired workers

workers. Taken together, these actions will cut the would receive the same amount as their workers’

$12.8 billion unfunded liability by roughly $3 billion. compensation pension. They would also receive

Savings: FY 2012: $31 million; future COLAs from both programs.

FY 2012–15: $259 million Savings: FY 2012: $187 million;

FY 2012–15: $247 million

Rainy Day Fund

The purpose of insurance is to protect Alternative 2: Claims Resolution Option

employers from huge swings in the economy and Currently, many injured workers 55 and above never

unpredictable rate increases. This is why a fund in return to the work force. Many of these workers

addition to the State Fund’s contingency reserve have another form of regular monthly income other

makes sense. It will require the transfer of workers’ than their workers’ compensation benefits, and under

compensation funds whenever the reserves are this proposal they would be eligible for a claims

greater than 110 percent of liabilities. These resolution option. This option would allow them to

funds would be available to reduce rate increases resolve their claim by choosing to take a lump sum

during economic downturns or when liabilities or a structured settlement. It would exclude medical

unexpectedly increase. and could only be initiated after 180 days from the

Savings: No fiscal impact. receipt of the claim.

Savings: FY 2012: $307 million;

FY 2012–15: $498 million

You might also like

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- Fake by Robert Kiyosaki PDFDocument31 pagesFake by Robert Kiyosaki PDFLimJohnvynNo ratings yet

- Intermediate Accounting Testbank 2Document419 pagesIntermediate Accounting Testbank 2SOPHIA97% (30)

- Phase Three CARES Act Summary 3.23.20Document4 pagesPhase Three CARES Act Summary 3.23.20mdshoppNo ratings yet

- Connecticut 2014.01.09 Opm Debt Reduction ReportDocument17 pagesConnecticut 2014.01.09 Opm Debt Reduction ReportHelen BennettNo ratings yet

- SEBAC Agreement Summary: Pension ChangesDocument8 pagesSEBAC Agreement Summary: Pension ChangesHour NewsroomNo ratings yet

- Committee On Finance CARES Act DocumentDocument12 pagesCommittee On Finance CARES Act DocumentAmanda RojasNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- Twelve Point Pension Reform PlanDocument4 pagesTwelve Point Pension Reform PlanGregory Flap ColeNo ratings yet

- Employee BenefitsDocument20 pagesEmployee BenefitsSophieNo ratings yet

- Chapter 20Document21 pagesChapter 20Diana SantosNo ratings yet

- Accounting For Pensions and Postretirement BenefitsDocument3 pagesAccounting For Pensions and Postretirement BenefitsDhivena JeonNo ratings yet

- HB 12-1127 - Unemployment Insurance Rate Reduction New EmployersDocument2 pagesHB 12-1127 - Unemployment Insurance Rate Reduction New EmployersSenator Mike JohnstonNo ratings yet

- Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Document50 pagesDouglas W. Elmendorf, Director U.S. Congress Washington, DC 20515josephragoNo ratings yet

- Legislative Digest - The Middle Class Tax Relief Job Creation Act of 2011 - FinalDocument7 pagesLegislative Digest - The Middle Class Tax Relief Job Creation Act of 2011 - FinalTEA_Party_RockwallNo ratings yet

- Healthcare Reform ActDocument3 pagesHealthcare Reform Actpeterlouisanthony7859No ratings yet

- Summary of Health Care Reform SeminarDocument8 pagesSummary of Health Care Reform SeminarTheFedeliGroupNo ratings yet

- Letters Urging Support of Multi-Employer Pension ReformDocument19 pagesLetters Urging Support of Multi-Employer Pension ReformLaborUnionNews.comNo ratings yet

- Chapter 12 Employee BenefitsDocument8 pagesChapter 12 Employee Benefitsroyalroy_313027733No ratings yet

- Pita Amendment March 2012Document3 pagesPita Amendment March 2012Mark allenNo ratings yet

- ERC DescriptionDocument3 pagesERC Descriptionjasonoutfleet1No ratings yet

- Healthcare Reform TimelineDocument16 pagesHealthcare Reform TimelinenfibNo ratings yet

- AlamedaCourtyReportonPensions February 2010Document5 pagesAlamedaCourtyReportonPensions February 2010btmurrellNo ratings yet

- UFCW Local 1262 - Redacted Bates HWDocument13 pagesUFCW Local 1262 - Redacted Bates HWAnonymous kprzCiZNo ratings yet

- Social Security Solvency and ReformDocument5 pagesSocial Security Solvency and Reformapi-242431676No ratings yet

- 11 - Eva Nur Asyifa - 40121100075 - Resume - Tugas 8 AIKDocument4 pages11 - Eva Nur Asyifa - 40121100075 - Resume - Tugas 8 AIKevanurasyifa2002No ratings yet

- Transitioning From Defined Benefit Plans To Defined Contribution PlansDocument9 pagesTransitioning From Defined Benefit Plans To Defined Contribution PlansCamille TilghmanNo ratings yet

- Spending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)Document6 pagesSpending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)tvanootNo ratings yet

- COVID-19 Paycheck Protection Program 4.7.20 - FINALDocument25 pagesCOVID-19 Paycheck Protection Program 4.7.20 - FINALJonathan FoxNo ratings yet

- Superannuation Update 2012/13: ContributionsDocument4 pagesSuperannuation Update 2012/13: Contributionsapi-140871676No ratings yet

- A Win-Win Approach To Financing Health Care ReformDocument2 pagesA Win-Win Approach To Financing Health Care ReformanggiNo ratings yet

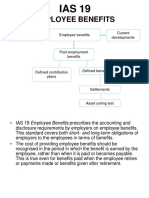

- IAS 19 - Employee BenefitDocument33 pagesIAS 19 - Employee BenefitlaaybaNo ratings yet

- Fringe Benefit GuideDocument91 pagesFringe Benefit GuideJeff MartinsonNo ratings yet

- Chapter 14Document23 pagesChapter 14YolandaNo ratings yet

- House-Senate Comparison of Key ProvisionsDocument11 pagesHouse-Senate Comparison of Key Provisionsapi-25909546No ratings yet

- Lesson 1: Employee CompensationDocument22 pagesLesson 1: Employee Compensationwilhelmina romanNo ratings yet

- Quiz 5 - CH 11 & 12Document48 pagesQuiz 5 - CH 11 & 12Sahar HamzehNo ratings yet

- Defined Benefit Pension Schemes: Questions and Answers: GuidanceDocument8 pagesDefined Benefit Pension Schemes: Questions and Answers: GuidanceSewale AbateNo ratings yet

- Social Security Trustees Report 2010Document20 pagesSocial Security Trustees Report 2010Beverly TranNo ratings yet

- Ias 19Document43 pagesIas 19Reever RiverNo ratings yet

- Enspecial Series On Covid19pension Schemes in The Covid19 Crisis Impacts and Policy ConsiderationsDocument8 pagesEnspecial Series On Covid19pension Schemes in The Covid19 Crisis Impacts and Policy Considerationspedro perezNo ratings yet

- Employee Benefits in ChinaDocument12 pagesEmployee Benefits in ChinamickozaraNo ratings yet

- PEF Contract SummaryDocument10 pagesPEF Contract SummaryJimmyVielkindNo ratings yet

- Employee Provident Fund Scheme: Boon or BaneDocument8 pagesEmployee Provident Fund Scheme: Boon or BaneAkash PanigrahiNo ratings yet

- Target Benefit Pension Plans Are Our Future by Robert L. BrownDocument2 pagesTarget Benefit Pension Plans Are Our Future by Robert L. BrownEvidenceNetwork.caNo ratings yet

- Essay 2 - Employee BenefitsDocument3 pagesEssay 2 - Employee BenefitsSeiniNo ratings yet

- No3 PolicyprimerDocument6 pagesNo3 PolicyprimerChirag PrajapatiNo ratings yet

- Sample Policy MemosDocument21 pagesSample Policy MemosIoannis Kanlis100% (1)

- Monika Rehman Roll No 10Document19 pagesMonika Rehman Roll No 10Monika RehmanNo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- CRS Summary of Penalties On EmployersDocument7 pagesCRS Summary of Penalties On EmployersTim McGheeNo ratings yet

- Employer Mandate Transmittal Letter To Mayor and CouncilDocument4 pagesEmployer Mandate Transmittal Letter To Mayor and CouncilMartin AustermuhleNo ratings yet

- Health Care Reform White PaperDocument5 pagesHealth Care Reform White Papervanessa_parks_1No ratings yet

- Employee BenefitDocument32 pagesEmployee BenefitnatiNo ratings yet

- Compensation Management Mod 1Document36 pagesCompensation Management Mod 1Nikita SangalNo ratings yet

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- Defined Benefit Pension PlanDocument8 pagesDefined Benefit Pension Planhenok AbebeNo ratings yet

- Session 1 Notes:: Monetary Compensation Package of Employees Generally Consists of The FollowingDocument4 pagesSession 1 Notes:: Monetary Compensation Package of Employees Generally Consists of The FollowingShivali MNo ratings yet

- Tax On Compensation Income: Activi TY SheetDocument14 pagesTax On Compensation Income: Activi TY SheetJudylyn SakitoNo ratings yet

- U.K. Annuity Volumes Will Suffer Until Greater Clarity Emerges On Policyholder Response To BudgetDocument7 pagesU.K. Annuity Volumes Will Suffer Until Greater Clarity Emerges On Policyholder Response To Budgetapi-228714775No ratings yet

- A Message To The PublicDocument24 pagesA Message To The Publicthe kingfishNo ratings yet

- Family Pension Guidelines W 18 AmendDocument2 pagesFamily Pension Guidelines W 18 AmendMian Tahir WaseemNo ratings yet

- Assignment Notes PayableDocument3 pagesAssignment Notes PayableLourdios EdullantesNo ratings yet

- Types of Loan Offered by SBIDocument88 pagesTypes of Loan Offered by SBIArvi SunNo ratings yet

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- Confirmation For Booking ID # 345159389 Check-In April 27 2019Document1 pageConfirmation For Booking ID # 345159389 Check-In April 27 2019Hajilulung100% (1)

- 12 Igcse - Accounting - Ratios - Unlocked PDFDocument47 pages12 Igcse - Accounting - Ratios - Unlocked PDFshivom talrejaNo ratings yet

- Assignment MakeupDocument21 pagesAssignment MakeupUmme Laila JatoiNo ratings yet

- India Fintech Opportunities 2020Document56 pagesIndia Fintech Opportunities 2020Piyush Kulkarni100% (3)

- Max Life Insurance Launches Savings Advantage PlanDocument3 pagesMax Life Insurance Launches Savings Advantage PlanVarshik FlashNo ratings yet

- Promissory NoteDocument4 pagesPromissory NoteJuricoAlonzoNo ratings yet

- Inherent and Constitutional LimitationsDocument3 pagesInherent and Constitutional LimitationsJoseph CameronNo ratings yet

- VALUATION PROFESSIONAL FEES of Various BanksDocument12 pagesVALUATION PROFESSIONAL FEES of Various BanksArunKumarVerma100% (2)

- F2 International Monetary Fund Assignment CompleteDocument9 pagesF2 International Monetary Fund Assignment Completehamza tariqNo ratings yet

- Assessment of Working Capital Requirements Form Ii: Operating StatementDocument6 pagesAssessment of Working Capital Requirements Form Ii: Operating Statementmonirba48No ratings yet

- Session 9 - Partnerships (Compatibility Mode) PDFDocument21 pagesSession 9 - Partnerships (Compatibility Mode) PDFKirondeNo ratings yet

- 1, 2Document94 pages1, 2Gopi NathNo ratings yet

- Individual TaxpayerDocument3 pagesIndividual TaxpayerJovie Ann RamiloNo ratings yet

- Essence of Walters ModelDocument2 pagesEssence of Walters ModelNasef Mohd100% (1)

- NBSM Nepal Budget 2073 PDFDocument20 pagesNBSM Nepal Budget 2073 PDFnabin shresthaNo ratings yet

- KSL Commercial Law NotesDocument47 pagesKSL Commercial Law Noteslittle missNo ratings yet

- Numericals HPDocument3 pagesNumericals HPPriyanka PanigrahiNo ratings yet

- ACCT504 Case Study 1Document15 pagesACCT504 Case Study 1sinbad97100% (1)

- Tax Return Receipt ConfirmationDocument1 pageTax Return Receipt Confirmationcastillonestor100% (1)

- Financial Sector Reforms - Meaning and ObjectivesDocument9 pagesFinancial Sector Reforms - Meaning and ObjectivesAmrit Kaur100% (1)

- Excercises For Transaction AnalysisDocument4 pagesExcercises For Transaction AnalysisAhmed Muhamed AkrawiNo ratings yet

- A Project Study Report On Training Undertaken At: Deepshikha College of Technical Education, JaipurDocument78 pagesA Project Study Report On Training Undertaken At: Deepshikha College of Technical Education, JaipurLaxmikant Sharma100% (2)

- Structure of Banking in IndiaDocument14 pagesStructure of Banking in IndiaHimani DhingraNo ratings yet