Professional Documents

Culture Documents

INCOME TAXATION Syllabus

INCOME TAXATION Syllabus

Uploaded by

markbagzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INCOME TAXATION Syllabus

INCOME TAXATION Syllabus

Uploaded by

markbagzCopyright:

Available Formats

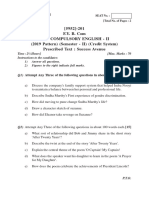

COURSE SYLLABUS IN

INCOME TAXATION

By: Atty. MARK ANTHONY F. BAGUAL

A. GENERAL CONCEPTS AND PRINCIPLES OF TAXATION

TAXATION vs. TAXES

3 INHERENT POWERS OF THE STATE

1. Police Power-

2. Power of Taxation –

3. Power of Eminent Domain

PURPOSES OF TAXATION

1. Primary: Revenue or Fiscal Purpose

2. Secondary: Regulatory Purpose

THEORIES OF TAXATION

1. Necessity Theory

2. Lifeblood Theory

3. Benefits-Protection / Reciprocity Theories (Doctrine of Symbiotic

Relationship)

MANIFESTATIONS OF LIFEBLOOD THEORY

NATURE, SCOPE AND LIMITATIONS OF TAXATION

ESSENTIAL ELEMENTS OF TAX

ASPECTS OF TAXATION

a) Levying or imposition of tax

b) Assessment or determination of the correct amount

c) Collection of tax

CHARTACTERISTICS OF TAXATION

a) Complete

b) Unlimited

c) Plenary

d) Supreme

NATURE OF THE STATE’S POWER OF TAX

CLASSIFICATION OF TAXES

BASIC PRINCIPLES OF A SOUND TAX SYSTEM

ELEMENTS OF SOUND TAX SYSTEM

LIMITATIONS ON THE STATE’S POWER TO TAX

SITUS OF TAXATION

Course Syllabus in Income Taxation by Atty. Mark Anthony Bagual 1

FACTORS IN DETERMINING THE SITUS OF TAXATION

OTHER DOCTRINES IN TAXATION

DIRECT DOUBLE TAXATION

MEANS OF AVOIDING THE BURDEN OF TAXATION

SOURCES OF TAX LAWS

B. CONCEPTS OF INCOME

A. INDIVIDUAL

Income

Sources of Income

Classifications of Income for Individuals

Taxable income

Requisites for Income to be taxable

Gross Income. -

Exclusions from Gross Income.

Special Treatment of Fringe Benefit. -

Fringe Benefit Defined. –

Fringe Benefits Not Taxable. –

Taxable and Non-Taxable Gross Income

B. CORPORATE INCOME

Determination of Taxable Income

Domestic Corporation

Sources of Income:

1. Sale of Goods

2. Sale of Services

Other Income

Dividends and Profit Remittances

Interest and Royalties

Other Passive Income

Other Capital Assets

Deductions from Income

Course Syllabus in Income Taxation by Atty. Mark Anthony Bagual 2

Withholding of Tax at Source

Final Withholding Tax

What and When to File and Pay Final Withholding Tax?

Income Payments to Individuals that are Subject to Final Withholding Tax (FWT).

Income Payments to Corporations that are Subject to Final Withholding Tax.

Income Payments on Interest Paid to Bank Deposits, Amount withdrawn on Decedent’s

Deposit Account, etc.

Income Payments from the Government that are Subject to Withholding of 5% to 12% VAT

and 3% Percentage Tax.

Creditable Withholding Tax Rates on Certain Payments

C. ALLOWABLE DEDUCTIONS

INDIVIDUAL

Deductions from Gross Income. –

Employment expenses

Personal deductions

Business deductions

Business rentals.

Taxes. Losses.

Bad debts.

Depreciation.

Charitable and other contributions, subject to certain limitations.

Research and development (R&D) expenditures.

Course Syllabus in Income Taxation by Atty. Mark Anthony Bagual 3

CORPORATION

Corporate – Deductions and Optional Standard Deduction

1. Depreciation and Depletion

2. Goodwill

3. Start-up expenses

4. Interest expenses

5. Bad debts

6. Charitable contributions

7. Entertainment expenses.

Special deductions - Special deductions are allowed for certain businesses (e.g.

insurance, mining, petroleum, and real estate investment trust).

1. Fines and penalties

2. Taxes

3. Net operating losses

4. Loss carrybacks are not allowed.

5. Payments to foreign affiliates

6. Head office expense allocations

Expenses.

Items not Deductible.

D. INCOME TAX ON INDIVIDUALS

Persons Subject to Income Tax

Individual taxpayers - It may be either (a) Citizens or (b) Aliens.

Classification of Individual Taxpayers

1. Citizens

a. Resident Citizen (RC)

b. Nonresident Citizen (NRC)

2. Aliens

a. Resident Alien (RA)

b. Nonresident Alien (NRA)

3. Special Taxpayers

a. NRANETB

b. Special Aliens/Filipino Workers (SAFE)

c. Minimum Wage Earners (MWE)

d.

Special Aliens/Filipino Workers (SAFE)

Regional Area Headquarters (RAH)

Course Syllabus in Income Taxation by Atty. Mark Anthony Bagual 4

Regional Operating Headquarters (ROH)

Offshore Banking Unit (OBU)

Minimum Wage Earners (MWE)

Types of Individual Taxpayers

1. Employed

2. Self-employed or Professionals

3. Mixed Income Earners

Fringe benefits tax (FBT)

Tax rates for income subject to final tax

Tax rates for business income

Tax Rates for Self-employed Individuals and Professionals

A. If annual gross sales or income is ₱3 Million or below

B. If annual gross sales or income is above ₱3 Million

E. CORPORATE INCOME TAX

Corporations Subject to Income Tax

Domestic corporation

Types of Corporation:

Stock Corporation

Non-Stock Corporation

Tax Base and Tax Rates of Corporation

Taxability of Corporation

1. NIT – Normal Income Tax – 30% of Net Income

2. MCIT – Minimum Corporate Income Tax - 2% of gross income

3. IAT – Improperly Accumulate Tax – 10% based on improperly accumulated earnings

Course Syllabus in Income Taxation by Atty. Mark Anthony Bagual 5

Resident foreign corporations

Non-resident foreign corporations

F. TAX RETURN PREPARATION AND TAX PAYMENTS

How to Prepare and Submit Your Income Tax Returns in the Philippines

Who Are Required to File Income Taxes?

Who Are Not Required to File Income Taxes?

Substituted Filing of Income Tax Returns

Methods of Filing

Manual Filing-

Electronic Filing and Payment System (eFPS) –

Electronic BIR Forms (eBIRForms)-

Deadline of Submission

G. PENALTIES AND REMEDIES OF THE TAXPAYER

Penalties for Late Filing of Tax Returns

A. For late filing of Tax Returns with Tax Due to be paid, the following penalties will be

imposed upon filing, in addition to the tax due:

B. Civil Penalties.

1. Surcharge - twenty-five percent (25%) of the amount due

2. Interest- twenty percent (20%) per annum

3. Compromise

REMEDIES OF THE TAXPAYERS

Remedies of the taxpayer

o Prescriptive periods

o Administrative remedies against:

1. Preliminary assessment notice

2. Formal letter of demand

o Reinvestigation

o Reconsideration

3. Final decision on disputed assessment

o Request for refund or credit of taxes

Summary remedies

(collection) o Garnishment

Course Syllabus in Income Taxation by Atty. Mark Anthony Bagual 6

o Seizure

o Levy

Compromise and abatement of tax liabilities

Course Syllabus in Income Taxation by Atty. Mark Anthony Bagual 7

You might also like

- Definition or Concept of TaxationDocument24 pagesDefinition or Concept of TaxationJustine DagdagNo ratings yet

- Lab Exercise 2Document4 pagesLab Exercise 2arisuNo ratings yet

- Taxation Law Review SyllabusDocument14 pagesTaxation Law Review SyllabusRoxanne Peña100% (2)

- Value Chain Analysis-Mentha Farming & Processing Development ProgrammeDocument16 pagesValue Chain Analysis-Mentha Farming & Processing Development ProgrammeSatyendra Nath PandeyNo ratings yet

- Taxation 1 Carag SyllabusDocument4 pagesTaxation 1 Carag SyllabusdiwalikhaNo ratings yet

- Income Tax Topic 2Document33 pagesIncome Tax Topic 2Jenebyb SeraficaNo ratings yet

- Adzu Tax02 A Learning Packet 1 Orientation and Business TaxesDocument4 pagesAdzu Tax02 A Learning Packet 1 Orientation and Business TaxesJustine Paul Pangasi-anNo ratings yet

- Taxes Tax and Tax AdministrationDocument20 pagesTaxes Tax and Tax AdministrationHoney OmosuraNo ratings yet

- Final Module 2 TaxationDocument20 pagesFinal Module 2 TaxationJulius Earl MarquezNo ratings yet

- Black Panther Notes Income Taxation Part1Document27 pagesBlack Panther Notes Income Taxation Part1Malvin Aragon BalletaNo ratings yet

- Tax101 Module 02 - Taxes, Tax Laws and Tax Administration V 1.0Document10 pagesTax101 Module 02 - Taxes, Tax Laws and Tax Administration V 1.0Genevieve AnoreNo ratings yet

- Taxation Law: Asia Pacific College of Advanced StudiesDocument14 pagesTaxation Law: Asia Pacific College of Advanced StudiesIsabelita PavettNo ratings yet

- Income Taxation: Basic Priciples: 1. As To Subject Matter or ObjectDocument8 pagesIncome Taxation: Basic Priciples: 1. As To Subject Matter or ObjectcesalyncorillaNo ratings yet

- Law 124 Common Outline 1st Sem 15-16 (AAM Approved)Document10 pagesLaw 124 Common Outline 1st Sem 15-16 (AAM Approved)Arrah Mae DavinNo ratings yet

- Income TaxationDocument5 pagesIncome Taxationᜊ᜔ᜎᜀᜈ᜔ᜃ᜔ ᜃᜈ᜔ᜊᜐ᜔No ratings yet

- Income Tax Procedure PracticeU 12345 RB1Document20 pagesIncome Tax Procedure PracticeU 12345 RB1Chakram SirishaNo ratings yet

- US Taxation - Outline: I. Types of Tax Rate StructuresDocument12 pagesUS Taxation - Outline: I. Types of Tax Rate Structuresvarghese2007No ratings yet

- Taxation Material 1Document11 pagesTaxation Material 1Shaira Bugayong100% (1)

- Portfolio in Income Taxation: Submitted byDocument15 pagesPortfolio in Income Taxation: Submitted byVERINO, SUNSHINE N. 19-0243No ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Gacer, Ann Mariellene L. (Assignment No.2) TaxDocument6 pagesGacer, Ann Mariellene L. (Assignment No.2) TaxAnn Mariellene Gacer50% (2)

- Income Taxation: Laws, Principles and Applications 2014 Edition Tax Teacher'S ManualDocument39 pagesIncome Taxation: Laws, Principles and Applications 2014 Edition Tax Teacher'S ManualBusiness MatterNo ratings yet

- The Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationDocument8 pagesThe Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationBiniamNo ratings yet

- Taxpayer RemediesDocument22 pagesTaxpayer RemediesRussell Stanley Que GeronimoNo ratings yet

- Tax, Taxes and Laws, Law AdministrationDocument22 pagesTax, Taxes and Laws, Law AdministrationTricia Sta TeresaNo ratings yet

- 2019 Bar Examinations TAXATION LAWDocument10 pages2019 Bar Examinations TAXATION LAWEric RamilNo ratings yet

- Tax Recit With AnswersDocument8 pagesTax Recit With AnswersEnrique Legaspi IVNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document14 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)TatianaNo ratings yet

- Income Tax Part IIDocument7 pagesIncome Tax Part IImary jhoyNo ratings yet

- Bar 2020 TaxDocument13 pagesBar 2020 TaxRon de GuzmanNo ratings yet

- BAC-103-SG-1 Module 1 TaxationDocument8 pagesBAC-103-SG-1 Module 1 TaxationEmmanuel DalioanNo ratings yet

- Siena College of Taytay Inc. Taxation 1 - Income Taxation College of Business and AccountancyDocument2 pagesSiena College of Taytay Inc. Taxation 1 - Income Taxation College of Business and AccountancyDonnan OreaNo ratings yet

- Answer Public Finance & TaxationDocument12 pagesAnswer Public Finance & TaxationkiduseNo ratings yet

- Part III. Income Taxation: Nirc)Document10 pagesPart III. Income Taxation: Nirc)paul_jurado18No ratings yet

- Taxation ReportDocument79 pagesTaxation ReportkimNo ratings yet

- Module Chapter 2Document15 pagesModule Chapter 2Mitchie FaustinoNo ratings yet

- Keown Perfin5 Im 04Document23 pagesKeown Perfin5 Im 04a_hslr100% (1)

- Tax by DimaampaoDocument90 pagesTax by Dimaampaoamun din100% (5)

- Dimaampao Tax NotesDocument69 pagesDimaampao Tax NotestinctNo ratings yet

- Inc Tax Chapter 2Document27 pagesInc Tax Chapter 2Noeme LansangNo ratings yet

- Far Eastern University: An Institute of Accounts Business and FinanceDocument5 pagesFar Eastern University: An Institute of Accounts Business and FinanceAcademic StuffNo ratings yet

- Dimaampao Tax NotesDocument63 pagesDimaampao Tax Notesnia coline mendozaNo ratings yet

- Taxation Notes - DimaampaoDocument115 pagesTaxation Notes - DimaampaoNLainie OmarNo ratings yet

- Income TaxationDocument22 pagesIncome TaxationMorano, Angeline G.No ratings yet

- TX102 Topic 1 Module 3Document21 pagesTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Income Taxation Last PartDocument12 pagesIncome Taxation Last PartRienalyn Dumlao Duldulao-DaligconNo ratings yet

- Income and Business TaxationDocument69 pagesIncome and Business TaxationRhealyn MarananNo ratings yet

- LM Tax AdministrationDocument26 pagesLM Tax AdministrationDennis PlacerNo ratings yet

- Income Taxation - Topic 2Document4 pagesIncome Taxation - Topic 2jessamaepinas5No ratings yet

- Taxation Notes (Dimaampao)Document115 pagesTaxation Notes (Dimaampao)dorothy92105100% (2)

- Qualifying Exam Taxation SET ADocument11 pagesQualifying Exam Taxation SET AChina ReyesNo ratings yet

- Module 3.2 - Preferential Taxation Keyworded Lecture NotesDocument8 pagesModule 3.2 - Preferential Taxation Keyworded Lecture NotesGabs SolivenNo ratings yet

- Aaa TAXDocument13 pagesAaa TAXLeyy De GuzmanNo ratings yet

- Taxation-Not CompleteDocument13 pagesTaxation-Not CompleteLouie De La TorreNo ratings yet

- What Are The Stages of Taxation ?Document15 pagesWhat Are The Stages of Taxation ?Federico Dipay Jr.No ratings yet

- Lesson 1Document10 pagesLesson 1laica cauilanNo ratings yet

- Tax Hacks The Tax Survival Tournament With Answers 1 PDFDocument23 pagesTax Hacks The Tax Survival Tournament With Answers 1 PDFjane dillanNo ratings yet

- A. General Concepts and Principles of TaxationDocument25 pagesA. General Concepts and Principles of TaxationMarinella GonzalesNo ratings yet

- TAX OutlineDocument42 pagesTAX Outlineabmo33No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Top 10 (Income Tax)Document8 pagesTop 10 (Income Tax)markbagzNo ratings yet

- Taxation UPDocument28 pagesTaxation UPmarkbagzNo ratings yet

- Preliminary Examinations - Google FormsDocument25 pagesPreliminary Examinations - Google FormsmarkbagzNo ratings yet

- Module in Income Taxation by Jewelyn C. Espares-CioconDocument33 pagesModule in Income Taxation by Jewelyn C. Espares-CioconmarkbagzNo ratings yet

- Data Privacy ActDocument12 pagesData Privacy ActmarkbagzNo ratings yet

- Auditing PayrollDocument45 pagesAuditing PayrollRowena AlidonNo ratings yet

- Chart of Accounts 666: Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document12 pagesChart of Accounts 666: Fundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica ParasNo ratings yet

- Lesson-7 Basic Principles of Preparing Final Account (Capital and Revenue)Document8 pagesLesson-7 Basic Principles of Preparing Final Account (Capital and Revenue)ranjan1491No ratings yet

- Earns CodeDocument2 pagesEarns Codejbone918No ratings yet

- Allowable Deductible Expenses in The PhilippinesDocument2 pagesAllowable Deductible Expenses in The PhilippinesmtscoNo ratings yet

- 07 Segment ReportingDocument5 pages07 Segment ReportingHaris IshaqNo ratings yet

- Amity Business School: MBA Class of 2012, Semester IDocument24 pagesAmity Business School: MBA Class of 2012, Semester ITejasvi SharmaNo ratings yet

- Tax File Memorandum and Research EssayDocument7 pagesTax File Memorandum and Research EssayAssignmentLab.com0% (1)

- AOM 2023-001 CabulisanDocument21 pagesAOM 2023-001 CabulisanKen BocsNo ratings yet

- Acctg 115 - CH 5 SolutionsDocument11 pagesAcctg 115 - CH 5 SolutionsSharadPanchal100% (1)

- Vodafone Target CostingDocument10 pagesVodafone Target CostingGopalNo ratings yet

- Oracle Project AccountingDocument76 pagesOracle Project AccountingRajasekhar Reddy Adam100% (5)

- Maths Specimen Paper 1 2014 2017Document16 pagesMaths Specimen Paper 1 2014 2017NgestiRPNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- Chapter 6 Discussion QuestionsDocument3 pagesChapter 6 Discussion QuestionsS1NL3SS PA1NNo ratings yet

- Salary and Interest On SecuritiesDocument27 pagesSalary and Interest On SecuritiesShamsuzzaman SazuNo ratings yet

- Project Report On Human Resource ManagemDocument17 pagesProject Report On Human Resource ManagemBhagyashreeNo ratings yet

- RFBT Reviewer For SalesDocument3 pagesRFBT Reviewer For SalesJerah Marie PepitoNo ratings yet

- Arab Bank SwitzerlandDocument7 pagesArab Bank Switzerlandumar sohailNo ratings yet

- IGCSE Revision-2024.Document72 pagesIGCSE Revision-2024.TaNo ratings yet

- Income From Business: (A Quick Introduction)Document4 pagesIncome From Business: (A Quick Introduction)haroonameerNo ratings yet

- Vertical Balance SheetDocument6 pagesVertical Balance SheetNikhil Karkhanis100% (1)

- (Sem. - II) 2019 PatternDocument118 pages(Sem. - II) 2019 Patternfrendlyfire432No ratings yet

- Ratios Point To Trouble at KrogerDocument50 pagesRatios Point To Trouble at KrogerThanh HàNo ratings yet

- F003 NPO Exam TeachersDocument7 pagesF003 NPO Exam TeachersbhumikaaNo ratings yet

- Liabilities and Equity Alastoy Bsa 2 CompressDocument91 pagesLiabilities and Equity Alastoy Bsa 2 CompressChrystal Mae PitocNo ratings yet

- Final Project of Indusind BankDocument104 pagesFinal Project of Indusind Banknikhil chikhaleNo ratings yet

- Appropriation Ordinance No. 02-A Series 2020Document4 pagesAppropriation Ordinance No. 02-A Series 2020Jaylord Suyu CarodanNo ratings yet