Professional Documents

Culture Documents

Apparel Costing and Documentation

Apparel Costing and Documentation

Uploaded by

Indrajeet PanditOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apparel Costing and Documentation

Apparel Costing and Documentation

Uploaded by

Indrajeet PanditCopyright:

Available Formats

SN Program Code: Course Title L T P C CH Course Type*

BS205

41 Course Code: Apparel Costing and Documentation 2 0 0 2 2 Core

Year of 2021

publication

PREREQUISITE NA

CO-REQUISITE NA

ANTI-REQUISITE NA

a. Course Description

The course has been introduced in the program to acquaint students about the financial aspects of the fashion

industry. The process of gaining profit by controlling other variables in the manufacturing and marketing.

b. Course Objectives

To examine the basic pricing factors used in buying and merchandising decisions and present the mathematical

calculations needed to price in stock merchandise, logistics and documentation

c. Course Outcomes

CO1 Students will be able to understand the meaning and use of costing in fashion industry

CO2 Students will be able to apply the costing guidelines in different departments of Fashion industry

CO3 Student will be able to develop cost effective products

CO4 Understanding of Budgeting process

CO5 Apply the costing knowledge in industry

d. Syllabus

Unit-1 Unit I: Basic Terminology of costing Contact Hours:10

Direct material, Direct Labour, Factory Overheads

Cost volume profit Analysis

Breakeven Analysis

Determining Pricing of Apparel Products

Calculation of margins

Calculation of Freight Element

Cost plus pricing

Direct Cost Pricing

Currency Conversions

Types of costing: Marginal costing, absorption costing, standard costing, historical costing

UNIT-2 Unit II: Costing Methods Contact Hours:10

Calculation of Operational Cost of : Cutting Room Sewing Room & Finishing Room

a) Basis of manufacturing, time and management process.

b) Unit costing, job costing, contract costing, batch costing, service or operating costing, multiple

costing, product costing, job costing, process costing, inventory costing

fifo (first in first out) & lifo (last in first out)

Material control in cost accounting

Department involved in controlling labor cost

Classification of overhead costs

Unit-3 Unit III: Costing Classification Contact Hours:10

Calculation of the Garment Cost

• Basic Men's Shirt

• Trouser

• Skirt

• T Shirt

Process costing

Motor transport costing

Integrated accounting system

Reconciliation of cost & financial accounts

Cost volume & Profit analysis

Standard costing

e. Textbooks Books

T1Costing for Fashion Industry- Michael Jaffery and Nathalie Evans

f. Reference Books

A-Z Glossary on Apparel Costing- Anjuli Gopalakrishna

g. Assessment Pattern - Internal and External

The performance of students is evaluated as follows:

Theory Practical

Internal Mid Term End Term Continuous Mid Term End Term

Components

Assessment Assessment Examination Assessment Assessment Examination

Marks 20 20 60 40 20 40

Total Marks 100 100

Weightage 75% 25%

Internal Evaluation Component

Final Weightage

S. Type of Weightage of Frequency of Remarks

in Internal

No. Assessment actual conduct Task

Assessment

As applicable to

10 marks of

1 Assignment One Per Unit 10 marks course types depicted

each assignment

above.

As applicable to

Time Bound

2 12 marks each 1 per unit 4 marks course types depicted

Surprise Test

above.

As applicable to

Mid Semester 20 marks for one

3 2 per semester 20 marks course types depicted

Test** MST

above.

Non-Graded Only self-study MNG

4 Presentation***

Engagement Task Courses

5 Homework NA One per lecture Non-Graded: As applicable to

topic (of 2 course types depicted

Engagement Task

questions) above.

As applicable to

Non-Graded:

6 Discussion Forum NA One per Chapter course types depicted

Engagement Task

above.

Attendance and

7 Engagement Score NA NA 2 marks

on BB

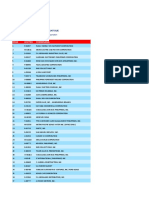

h. CO-PO Mapping

Course PO PO PO PO PO PO PO PO PO PO1

PO10 PO11 PSO1 PSO2 PSO3

Outcome 1 2 3 4 5 6 7 8 9 2

CO1 1 1 2 3 1 1 1 2 1

CO2 2 1 1 1 1

CO3 3 2 1 1 2

CO4 1 1 1

CO5 1 1 1

You might also like

- 9 Smart Money Concepts That Every Trader Must KnowDocument19 pages9 Smart Money Concepts That Every Trader Must Knowclrgwa86% (7)

- Pricing and CostingDocument107 pagesPricing and CostingWella Platero100% (2)

- QSPII Assignment Question April 2021Document7 pagesQSPII Assignment Question April 2021WEIQIN CHANNo ratings yet

- Forces Influencing Working and LearningDocument20 pagesForces Influencing Working and LearningPoojaIsrani77% (13)

- Apparel Quality Procedures and PracticesDocument4 pagesApparel Quality Procedures and PracticesIndrajeet PanditNo ratings yet

- Apparel Quality Assurance and TestingDocument4 pagesApparel Quality Assurance and TestingIndrajeet PanditNo ratings yet

- Fdo 355Document4 pagesFdo 355Daksh RawalNo ratings yet

- Pointers and Virtual Functions Final 2Document33 pagesPointers and Virtual Functions Final 2Abhishek GoswamiNo ratings yet

- Institute - Uie Department-Academic Unit-2Document27 pagesInstitute - Uie Department-Academic Unit-2ajay chauhanNo ratings yet

- Exception Handling Try Throw Catch (T)Document22 pagesException Handling Try Throw Catch (T)Verbala RastogiNo ratings yet

- Lecture 5 Input Output FunctionsDocument27 pagesLecture 5 Input Output Functionsajay chauhanNo ratings yet

- Institute - Uie Department-Academic Unit-2Document27 pagesInstitute - Uie Department-Academic Unit-2Gaurav RajputNo ratings yet

- Apparel EngineeringDocument3 pagesApparel EngineeringIndrajeet PanditNo ratings yet

- Lecture 6 Data Types and VariablesDocument28 pagesLecture 6 Data Types and VariablesGaurav RajputNo ratings yet

- Advance Mobile App Development - Sem-III-MC305-1Document4 pagesAdvance Mobile App Development - Sem-III-MC305-1Tarun saraswatNo ratings yet

- Costing Peter Clarke 33 OutlineDocument6 pagesCosting Peter Clarke 33 OutlinesptaraNo ratings yet

- GROUP 3 Report Sir GervinDocument18 pagesGROUP 3 Report Sir GervinRhea Antiola GolesNo ratings yet

- Lecture 1 ConstructorDocument28 pagesLecture 1 ConstructorSuraj JeenaNo ratings yet

- SN Program Code BS201 Food Science and Technology L T P C CH Course Type Course Code 20BTO349 Pre-Requisite Co-Requisite Anti-RequisiteDocument4 pagesSN Program Code BS201 Food Science and Technology L T P C CH Course Type Course Code 20BTO349 Pre-Requisite Co-Requisite Anti-RequisiteĀlok KrNo ratings yet

- P1 1d.0a14eb8 NotesDocument140 pagesP1 1d.0a14eb8 Notesyahoo2008No ratings yet

- Institute - Uie Department-Academic Unit-2Document32 pagesInstitute - Uie Department-Academic Unit-2ajay chauhanNo ratings yet

- Sho 441Document3 pagesSho 441Daksh RawalNo ratings yet

- CM665 CMTT AH Even2023 SBENDocument8 pagesCM665 CMTT AH Even2023 SBENnikhil dasNo ratings yet

- Apparel Production TechnqiuesDocument3 pagesApparel Production TechnqiuesIndrajeet PanditNo ratings yet

- Acounting PDFDocument3 pagesAcounting PDFashishNo ratings yet

- TOS 1 of 2Document1 pageTOS 1 of 2Diana Ann F. AganNo ratings yet

- SYLLABUS-Cost & Management AccountingDocument3 pagesSYLLABUS-Cost & Management AccountinglakshmiNo ratings yet

- Assessment Rubric - TASK 2Document13 pagesAssessment Rubric - TASK 2ayesha rehmanNo ratings yet

- Form For Incorporating Relevant Parametres For Inclusion in Evaluation MethodolgyDocument4 pagesForm For Incorporating Relevant Parametres For Inclusion in Evaluation MethodolgyHarry SNo ratings yet

- University Institute of Legal Studies Department of Law: Entrepreneurship Development CMT - 211Document18 pagesUniversity Institute of Legal Studies Department of Law: Entrepreneurship Development CMT - 211Gauri MittalNo ratings yet

- Mechh 224 Tos - Exam 1Document1 pageMechh 224 Tos - Exam 1Michelle DaarolNo ratings yet

- Course Title: Mathematics For Economics Credit Units: 4 Course Code: ECON626Document5 pagesCourse Title: Mathematics For Economics Credit Units: 4 Course Code: ECON626rashiNo ratings yet

- Institute - Uis DEPARTMENT-Mathematics DivisionDocument18 pagesInstitute - Uis DEPARTMENT-Mathematics DivisionAbhishek GoswamiNo ratings yet

- 1 IntroductionDocument13 pages1 IntroductionPradumn KumarNo ratings yet

- Bce 222 Tos Exam - 1Document1 pageBce 222 Tos Exam - 1Michelle DaarolNo ratings yet

- Learning Plan For Direct CurrentDocument3 pagesLearning Plan For Direct CurrentMarianell S. TorinoNo ratings yet

- CA Instructional MaterialsDocument71 pagesCA Instructional Materialshellokittysaranghae100% (1)

- IM For ACCO 20073 Cost Accounting and ControlDocument102 pagesIM For ACCO 20073 Cost Accounting and ControlkianamarieNo ratings yet

- Assignment 2-Checklist 441Document2 pagesAssignment 2-Checklist 441SANDEEP GAWANDENo ratings yet

- RI MES3053 - Sem220142015Document8 pagesRI MES3053 - Sem220142015mujahadahNo ratings yet

- MI1016 Calculus1 Syllabus123Document6 pagesMI1016 Calculus1 Syllabus123Quốc Đạt ĐồngNo ratings yet

- Name: Section: Schedule: Class Number: DateDocument10 pagesName: Section: Schedule: Class Number: DateJestine Franz GironNo ratings yet

- 2016-17 Practicum Course Report Final 11 28 16Document5 pages2016-17 Practicum Course Report Final 11 28 16api-376348596No ratings yet

- MAT101 Mathematics For Business - UEH-ISB - S1 2022 - Unit GuideDocument12 pagesMAT101 Mathematics For Business - UEH-ISB - S1 2022 - Unit GuideNgân Nguyễn0% (1)

- CA Outline 2020 Latest 21092020 011145pm 1 07032022 063646pmDocument7 pagesCA Outline 2020 Latest 21092020 011145pm 1 07032022 063646pmsikander jalalNo ratings yet

- Section 1 - General Information: Course Outline Course Name Course CodeDocument8 pagesSection 1 - General Information: Course Outline Course Name Course CodeSakshi Singh YaduvanshiNo ratings yet

- Table of Specifications (TOS) : Course: Date Completed: College: Term: Sem: SY: Exam Date: Total PointsDocument1 pageTable of Specifications (TOS) : Course: Date Completed: College: Term: Sem: SY: Exam Date: Total PointsJoeNo ratings yet

- Course File FIN 8702Document10 pagesCourse File FIN 8702Anu JainNo ratings yet

- Orientation On The New Syllabus: Sub: Financial AccountingDocument8 pagesOrientation On The New Syllabus: Sub: Financial Accountingsubashrao5522No ratings yet

- Tos and Test Results - PRESENTATION 1.ppsxDocument64 pagesTos and Test Results - PRESENTATION 1.ppsxMaria Teresa Bonos MarasiganNo ratings yet

- SFM E1.1 - 6.12.21Document8 pagesSFM E1.1 - 6.12.21Phương HoàiNo ratings yet

- Test Construction 2 With Item AnalysisDocument61 pagesTest Construction 2 With Item Analysisjayric atayan100% (1)

- ENGD3120S - Design For 3D PrintingDocument2 pagesENGD3120S - Design For 3D Printingambandu74No ratings yet

- e- Syllabus الجديدةDocument7 pagese- Syllabus الجديدةHBHNo ratings yet

- General Comments: ©the Chartered Institute of Management AccountantsDocument13 pagesGeneral Comments: ©the Chartered Institute of Management Accountantspaul sagudaNo ratings yet

- Acc 123Document2 pagesAcc 123CharlesNo ratings yet

- Group 5 Mathematics SLDocument14 pagesGroup 5 Mathematics SLboostoberoiNo ratings yet

- Course Slides: For Exams in June 2010Document175 pagesCourse Slides: For Exams in June 2010TaariqAMNo ratings yet

- Faculty Name: Rabia SharifDocument7 pagesFaculty Name: Rabia SharifHercules EdenNo ratings yet

- Strategic Cost PDFDocument73 pagesStrategic Cost PDFivan anonuevoNo ratings yet

- Apparel Production TechnqiuesDocument3 pagesApparel Production TechnqiuesIndrajeet PanditNo ratings yet

- B.Voc in AMTDocument54 pagesB.Voc in AMTIndrajeet PanditNo ratings yet

- Apparel EngineeringDocument3 pagesApparel EngineeringIndrajeet PanditNo ratings yet

- Apparel Quality Assurance and TestingDocument4 pagesApparel Quality Assurance and TestingIndrajeet PanditNo ratings yet

- Body Measurement For MensDocument4 pagesBody Measurement For MensIndrajeet PanditNo ratings yet

- Apparel Quality Procedures and PracticesDocument4 pagesApparel Quality Procedures and PracticesIndrajeet PanditNo ratings yet

- DecathlonDocument2 pagesDecathlonIndrajeet PanditNo ratings yet

- Blackberry End Term JuryDocument92 pagesBlackberry End Term JuryIndrajeet PanditNo ratings yet

- Contract Between Laive and Bere Dairy en-GBDocument4 pagesContract Between Laive and Bere Dairy en-GBARYÚ DIEGO VILLANUEVA CAPARÓNo ratings yet

- Asset Issuance SlipDocument105 pagesAsset Issuance SlipMuneer HussainNo ratings yet

- FULL Download Ebook PDF International Logistics The Management of International Trade Operations 5th Edition PDF EbookDocument42 pagesFULL Download Ebook PDF International Logistics The Management of International Trade Operations 5th Edition PDF Ebookapril.odum147100% (41)

- Media Management Dissertation TopicsDocument6 pagesMedia Management Dissertation TopicsIWillPayYouToWriteMyPaperWilmington100% (1)

- AbstractDocument18 pagesAbstractRAYENE MERDACINo ratings yet

- CH 5Document12 pagesCH 5Gaming champNo ratings yet

- OB AssignmentDocument5 pagesOB AssignmentMuhammad Haseeb HassanNo ratings yet

- Iloilo City: Top Business Establishment by AMOUNT DUEDocument9 pagesIloilo City: Top Business Establishment by AMOUNT DUEnick quiblatinNo ratings yet

- Corporate HistoryDocument5 pagesCorporate HistoryishaNo ratings yet

- Case Study - ITM Summer 2021Document3 pagesCase Study - ITM Summer 2021hien cung100% (1)

- Classification of Government Accounting in India For A Specific Treatment of Government Accounts in IndiaDocument49 pagesClassification of Government Accounting in India For A Specific Treatment of Government Accounts in Indiasheelamethu75% (4)

- Parker Wheel & Brake IPCDocument297 pagesParker Wheel & Brake IPCTerry Lee67% (3)

- Exercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseDocument15 pagesExercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseVõ Kim loanNo ratings yet

- Ez Terms and Conditions-V1.6 02september2022-1Document36 pagesEz Terms and Conditions-V1.6 02september2022-1Petros JosephidesNo ratings yet

- Annual Report 2019-20 - GICReDocument404 pagesAnnual Report 2019-20 - GICReRajeev RsNo ratings yet

- Analisis Technology Acceptance Model Pada Pengguna Dompet Digital Di Daerah Istimewa YogyakartaDocument11 pagesAnalisis Technology Acceptance Model Pada Pengguna Dompet Digital Di Daerah Istimewa YogyakartaiqbalsetionugrohoNo ratings yet

- IIM Kashipur: A Valuation: Group 21Document7 pagesIIM Kashipur: A Valuation: Group 21Rehan TyagiNo ratings yet

- FootwearDocument2 pagesFootwearmawada.nasefNo ratings yet

- Cost Acc Chapter 5Document7 pagesCost Acc Chapter 5ElleNo ratings yet

- Locke Jeffrey CV v1Document3 pagesLocke Jeffrey CV v1HARSHANo ratings yet

- TC BR 38 Discussion of OffersDocument7 pagesTC BR 38 Discussion of OffersIES-GATEWizNo ratings yet

- LVXJ E23 PDocument24 pagesLVXJ E23 PYOONSEOB BOONo ratings yet

- Atlas Copco Market SegmentationDocument12 pagesAtlas Copco Market SegmentationahmedalgaloNo ratings yet

- Course Outline - Managerial EconomicsDocument2 pagesCourse Outline - Managerial EconomicsMan TKNo ratings yet

- Business Functions, Processes, and ERP: INFS 5024 - Enterprise Systems Using SAPDocument43 pagesBusiness Functions, Processes, and ERP: INFS 5024 - Enterprise Systems Using SAPPhuoc HuynhNo ratings yet

- Case 4 MKTDocument2 pagesCase 4 MKTAyesha jamesNo ratings yet

- Public - Private PartnershipDocument5 pagesPublic - Private PartnershipJhon Russel Cruz AntonioNo ratings yet

- CHAPTER 9 Without AnswerDocument6 pagesCHAPTER 9 Without AnswerlenakaNo ratings yet