Professional Documents

Culture Documents

Usha Deep Academy of Insurance & Finance: PH: 0522-4000806 M: 9415080338 / 9335233798 / 9795367896 Email: Website

Usha Deep Academy of Insurance & Finance: PH: 0522-4000806 M: 9415080338 / 9335233798 / 9795367896 Email: Website

Uploaded by

Suresh KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Usha Deep Academy of Insurance & Finance: PH: 0522-4000806 M: 9415080338 / 9335233798 / 9795367896 Email: Website

Usha Deep Academy of Insurance & Finance: PH: 0522-4000806 M: 9415080338 / 9335233798 / 9795367896 Email: Website

Uploaded by

Suresh KumarCopyright:

Available Formats

USHA DEEP ACADEMY OF INSURANCE & FINANCE

(Academic Division of Usha Deep Insurance & Management Services P. Ltd. )

A-42, Indira Nagar, Lucknow-226016

Ph: 0522-4000806 M: 9415080338 / 9335233798 / 9795367896

Email: academy@ushadeep.com Website: www.ushadeep.com

An Accredited Learning Centre of Insurance Institute of India ,Mumbai

INSURANCE PROFESSIONAL EXAMINATIONS

1. Insurance Institute of India is the only professional institution in India devoted to insurance related

Education and Training (Life / Non- life / Health). It conducts different level of examinations leading to

award of Certificates, Diplomas and Fellowships which are recognized by Government of India, IRDA and

insurance industry in India and abroad for recruitment / promotions and licensing of agents / Brokers /

Surveyors & Loss Assessors. These professional examinations lead to two types of qualifications:

(a) Professional Qualifications – Licentiate, Associateship and Fellowship. These are core

qualifications for Insurance sector which signify the level of domain knowledge of the holder. These are

well recognized and respected in insurance industry in India and abroad.

(b) Specialized Diplomas – These certificates / diplomas provide specialization / expertise in a particular

subject / area. Currently the following specialized diplomas are being offered by III:

(i) Marine Insurance (ii) Fire Insurance (iii) Health Insurance (iv) Casualty Actuarial Science (v) Life

Insurance Underwriting (vi) Certificate in Advanced Insurance Marketing (vii) Certificate in Compliance,

Regulation & Governance in Insurance

2. Associate and Fellowship qualifications of the Institute are recognized by similar institutes outside India

e.g. Chartered Insurance Institute (CII) in UK, Life Office management association (LOMA), American

Institute of Chartered property and Casualty Underwriters (CPCU) and Insurance Institutes of America

(The Institutes) in USA and Insurance Institute of Canada. There is mutual recognition of III qualifications

and Associate / Fellowship Diploma holders are entitled to exemptions in the qualifications of these

international institutes.

3. The IRDA has recognized the Institute as the examining body to conduct pre – recruitment qualifying

examinations for insurance agents, both for life and non-life business, as well as for Surveyors and Loss

Assessors.

4. CURRICULUM FOR PROFESSIONAL QUALIFICATIONS

(Licentiate / Associateship / Fellowship)

III follows CREDIT POINT system wherein each subject is assigned credit points. The credit points are

assigned keeping in view the level of examination and the difficulty level of the subject.

The system will allow flexibility to the candidates to choose subjects of their choice from the list of

available subjects and accumulate credit points. Candidates will be allowed to appear only for a

maximum of six subjects in one examination. In addition, the candidate has to pass the

compulsory papers prescribed for each level of examination for getting the certificate / diploma.

Currently the examinations are conducted four times every year (March / June / September /

December) in ONLINE mode with MCQ type questions. Duration of each examination two hours.

Pass marks are 60% and there is no negative marking.

It is necessary to pass Licentiate Examination before registration for the compulsory subjects of the

Associateship. Similarly, only the candidates who have passed Associateship examination will be

allowed to register for the compulsory subjects at the Fellowship level.

The candidates may select additional compulsory (in excess of the minimum subjects) as optional

subjects for accumulation of credit points.

On passing the compulsory subjects and accumulation of minimum credit points required for the

qualification, the candidate is awarded the diploma.

The credit point validity of passed papers will remain for a period of 5 years from date of passing upto

Associate level. The candidates who have completed Associateship qualification will have permanent

250 credit points.

Candidates appearing for Fellowship examination have to complete within a period of 7 years from

passing first paper after completing Associateship qualification i.e. the credit point of Fellowship subject

will remain valid for a period of 7 years from passing the subject.

After completing Associate / Fellowship examination, the candidate has to apply separately for the

diploma which will awarded after his election which is done twice every year- April & October

The requirements for Licentiate / Associate / Fellowship are as under:

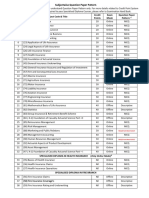

QUALIFICATION CREDIT POINTS REQUIRED COMPULSORY SUBJECTS

LICENTIATE 60 1. IC 01- Principles of Insurance

(40 points from compulsory 2. IC 02- Practice of Life Insurance

subjects and 20 or more points OR

from optional subjects selected IC11-Practice of General Insurance

from the list) (Both these subjects can also be taken)

ASSOCIATE 250 (including Licentiate) 1. IC 26 Life Assurance Underwriting, OR

(60 points from two compulsory IC 45 General Insurance Underwriting

subjects and remaining 130 points 2. IC 26 Life Assurance Finance, OR

from the list of optional subjects) IC 46 General Insurance Accounts & Regulation of

Investment

FELLOWSHIP 490 Any one subject from the following

(including Licentiate & Associate) IC 28 Foundation of Actuarial Science

(40 points from one compulsory IC 47 Foundation of Casualty Actuarial Science – I

subject and remaining 200 points IC 81 Mathematical Basis of Actuarial Science

from the list of optional subjects) IC 84 Foundation of Casualty Actuarial Science – II

IC 92 Actuarial Aspects of Product Development

5. LIST OF SUBJECTS AVAILABLE IN PROFESSIONAL EXAMINATIONS:

S NO. SUBJECT SUBJECT BRANCH CREDIT

CODE POINT

1 IC 14 Regulation of Insurance Business Common 20

2 IC 23 Application of Life Assurance Life 30

3 IC 24 Legal Aspects of Life Assurance Life 30

4 IC 27 Health Insurance Common 30

5 IC 57 Fire and Consequential Loss Insurance Non-life 30

6 IC 67 Marine Insurance Non-life 30

7 IC 71 Agriculture Insurance Non-life 30

8 IC 72 Motor Insurance Non-life 30

9 IC 74 Liability Insurance Non-life 30

10 IC-76 Aviation Insurance Non-life 30

11 IC 77 Engineering Insurance Non-life 30

12 IC 78 Miscellaneous Insurance Non-life 30

13 IC-82 Statistics Life 40

14 IC-83 Group Insurance and Retirement Benefit Schemes Life 30

15 IC-85 Re-Insurance Management Common 40

16 IC-86 Risk Management Common 40

17 IC-88 Marketing & Public Relations Common 30

18 IC-89 Management Accounting Common 40

19 IC-90 Human Resource Management Common 30

20. IC-99 Asset Management Common 30

You might also like

- CourseCompletion 1075832Document1 pageCourseCompletion 1075832Ryan HauckNo ratings yet

- Professional Examination PDFDocument35 pagesProfessional Examination PDFDeepak Gupta71% (7)

- SurveyorDocument2 pagesSurveyordtr170% (2)

- Financial Planning and Advice Edition 2Document332 pagesFinancial Planning and Advice Edition 2Droea Intimates100% (1)

- Question AnswerDocument2 pagesQuestion Answerpatel avaniNo ratings yet

- Interest Rate Modeling With Libor Market Model and Cva CalculationDocument30 pagesInterest Rate Modeling With Libor Market Model and Cva CalculationNemani Sri Harsha MBA KOL 2015-44No ratings yet

- Details of Subjectwise Question Paper PatternDocument2 pagesDetails of Subjectwise Question Paper PatternRishi Gourav ReddyNo ratings yet

- Ic 27 Health Insurance PDF DownloadDocument3 pagesIc 27 Health Insurance PDF Downloadharsha60% (5)

- Maha Raksha Supreme - LeafletDocument2 pagesMaha Raksha Supreme - LeafletsaurabNo ratings yet

- Bank Nifty Option Strategies BookletDocument28 pagesBank Nifty Option Strategies BookletMohit Jhanjee100% (1)

- Usha Deep Academy of Insurance & FinanceDocument2 pagesUsha Deep Academy of Insurance & FinanceAkshya ChoudharyNo ratings yet

- Updated-Credit Point System-15.06.2023Document5 pagesUpdated-Credit Point System-15.06.2023ParakhModyNo ratings yet

- Credit Point SystemDocument3 pagesCredit Point Systemshanmuga89No ratings yet

- Mock Test LinkDocument2 pagesMock Test LinkPRABIR MUKHERJEENo ratings yet

- List of Subjects/Papers & Question Paper Pattern: Examination HandbookDocument3 pagesList of Subjects/Papers & Question Paper Pattern: Examination HandbookAnilNo ratings yet

- III & CII Updated File As On 12.11.2021Document3 pagesIII & CII Updated File As On 12.11.2021yovir23790No ratings yet

- Pre-Licensing Test Info 17.03.2022Document1 pagePre-Licensing Test Info 17.03.2022Fear G9No ratings yet

- Details of Subjectwise Question Paper PatternDocument2 pagesDetails of Subjectwise Question Paper PatternRamalingam Chandrasekharan100% (1)

- Sales IllustrationDocument36 pagesSales IllustrationHaricharaanNo ratings yet

- Manimalar Plan 1 QuotationDocument36 pagesManimalar Plan 1 QuotationHemaNo ratings yet

- Professional Exam Sylabus IIIDocument37 pagesProfessional Exam Sylabus IIIRahul JaiswalNo ratings yet

- 2016Document8 pages2016AMIT KUMARNo ratings yet

- Ins II Assignments PGDMFCDocument2 pagesIns II Assignments PGDMFCKumar MayankNo ratings yet

- Government Service Insurance System: 2020 (2nd Edition)Document249 pagesGovernment Service Insurance System: 2020 (2nd Edition)RafaelAndreiLaMadridNo ratings yet

- Richard ToothDocument71 pagesRichard ToothbydmotorsportNo ratings yet

- III Survey - Post Covid-19 Strategic ConcernsDocument38 pagesIII Survey - Post Covid-19 Strategic ConcernsSadasivuni007No ratings yet

- PgdirmDocument8 pagesPgdirmAnuranjani DhivyaNo ratings yet

- Professional ExaminationDocument35 pagesProfessional ExaminationKarthic KeyanNo ratings yet

- An Analysis of The Retire Insurance Equity Pension Funds at Idbi Federal Insurance Company LimitedDocument74 pagesAn Analysis of The Retire Insurance Equity Pension Funds at Idbi Federal Insurance Company Limitedmukesh lingamNo ratings yet

- Exemption in Professional ExaminationsDocument3 pagesExemption in Professional ExaminationsRishabh RaiNo ratings yet

- 2006 07 EngDocument211 pages2006 07 EngPankaj BirlaNo ratings yet

- A Comparative Study of Ulip Plans Offered by Icici Prudential and Other Life Insurance CompaniesDocument11 pagesA Comparative Study of Ulip Plans Offered by Icici Prudential and Other Life Insurance Companiesdixit mittalNo ratings yet

- CII Level 6 Advanced Diploma in Insurance: Qualification SpecificationDocument5 pagesCII Level 6 Advanced Diploma in Insurance: Qualification Specificationgp_shortnsweetNo ratings yet

- Bilingual List-December-2023Document2 pagesBilingual List-December-2023kailasiyerNo ratings yet

- Term Plan 65yeras PDFDocument5 pagesTerm Plan 65yeras PDFRohit KhareNo ratings yet

- Indian Insurance Scenario Vs Global InsuranceDocument8 pagesIndian Insurance Scenario Vs Global InsuranceIJRASETPublicationsNo ratings yet

- Lalit Kumar Summer Traning Report (Life Insurence) 1Document39 pagesLalit Kumar Summer Traning Report (Life Insurence) 1Anish YadavNo ratings yet

- KSHITIJA SIP FinalDocument57 pagesKSHITIJA SIP Finalkshitija upadhyayNo ratings yet

- IC-38 - Short Notes (Life) & QPDocument135 pagesIC-38 - Short Notes (Life) & QPVenkatesh Kalburgi100% (1)

- Surveyors ExamsDocument4 pagesSurveyors ExamsPraveen Saini0% (1)

- Broker Licensing Provincial Guide - 02-2020Document6 pagesBroker Licensing Provincial Guide - 02-2020Alexandra YakoNo ratings yet

- Bmt1013 Banking-And-Insurance TH 1.2 47 Bmt1013 v1 2Document2 pagesBmt1013 Banking-And-Insurance TH 1.2 47 Bmt1013 v1 2vineeth kumarNo ratings yet

- Icici Project Report Abhishek 1Document49 pagesIcici Project Report Abhishek 1sumanNo ratings yet

- Oman Insurance Market Index Report 2020-2021Document66 pagesOman Insurance Market Index Report 2020-2021afrahNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- Income + Lump Sum Term Plan (Regular Pay, Cover Till The Age of 75)Document5 pagesIncome + Lump Sum Term Plan (Regular Pay, Cover Till The Age of 75)Ranjit ReddyNo ratings yet

- Recruitment Adv For Ao - Ammended As On 30-07-2013 PDFDocument7 pagesRecruitment Adv For Ao - Ammended As On 30-07-2013 PDFRam SinghNo ratings yet

- BCom - I INSURANCE SYLLABUS JUNE 2019 PDFDocument5 pagesBCom - I INSURANCE SYLLABUS JUNE 2019 PDFPiyush JainNo ratings yet

- Abstract InterimDocument10 pagesAbstract InterimHappy SinhaNo ratings yet

- Final IC-38 - Corporate Agent - Composite - EnglishDocument339 pagesFinal IC-38 - Corporate Agent - Composite - Englishyeswanth.lvsNo ratings yet

- IJCRT2103609Document8 pagesIJCRT2103609Darlord ytNo ratings yet

- Info - Iecfdis62443 2 1 (Ed2.0) enDocument12 pagesInfo - Iecfdis62443 2 1 (Ed2.0) enpharaohNo ratings yet

- Project Report On: "Problem and Prospects of Insurances Agencies "Document79 pagesProject Report On: "Problem and Prospects of Insurances Agencies "narpalchauhanNo ratings yet

- ISCC EU 204 Risk Management v4.1 January2024Document17 pagesISCC EU 204 Risk Management v4.1 January2024Nicole SmithNo ratings yet

- TL WC Policy Copy - Jan - 23Document3 pagesTL WC Policy Copy - Jan - 23ajay singhNo ratings yet

- United India Insurance Company (UIIC) Administrative Officer (AO) Syllabus and Exam PatternDocument16 pagesUnited India Insurance Company (UIIC) Administrative Officer (AO) Syllabus and Exam PatternSofia lourduNo ratings yet

- Numerica Probems On Schedule 3 & 4 of InuranceDocument4 pagesNumerica Probems On Schedule 3 & 4 of Inurancealka03923No ratings yet

- My Project On UlipsDocument84 pagesMy Project On UlipsVijay AttemNo ratings yet

- III AssociateDocument2 pagesIII Associateagupta_118177No ratings yet

- Courses List of KJSCE 6th SemDocument103 pagesCourses List of KJSCE 6th SemSUJAY TORVINo ratings yet

- Handbook On Indian Insurance Statistics 2015 16Document302 pagesHandbook On Indian Insurance Statistics 2015 16grazdNo ratings yet

- 52411ACA Life Insurance - Annuities in Canada Industry ReportDocument39 pages52411ACA Life Insurance - Annuities in Canada Industry Reportaditya.oberoi.meNo ratings yet

- Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 EquivalentDocument1 pageInsurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 EquivalentAnkit DasNo ratings yet

- SERIES 66 EXAM STUDY GUIDE 2023+ TEST BANKFrom EverandSERIES 66 EXAM STUDY GUIDE 2023+ TEST BANKNo ratings yet

- GMC PPTDocument26 pagesGMC PPTgaurav.20230rbNo ratings yet

- 92 Stokes Vs Malayan InsuranceDocument2 pages92 Stokes Vs Malayan InsuranceFrancise Mae Montilla MordenoNo ratings yet

- Atty. Migallos - Insurance - Course Outline (1st Sem AY 2018-2019)Document11 pagesAtty. Migallos - Insurance - Course Outline (1st Sem AY 2018-2019)Christine NarteaNo ratings yet

- Annuity DueDocument27 pagesAnnuity Duebayu fajarNo ratings yet

- Mba Project On Derivatives EditDocument49 pagesMba Project On Derivatives EditmanivamshiNo ratings yet

- Louise Bedford Trading InsightsDocument80 pagesLouise Bedford Trading Insightsartendu100% (3)

- BBA III Sem Risk and Insurance ManagementDocument2 pagesBBA III Sem Risk and Insurance ManagementAnswering WAITNo ratings yet

- Insurance Factbook 2012Document227 pagesInsurance Factbook 2012bdittrichNo ratings yet

- Payslip SRJDocument8 pagesPayslip SRJJaybee DelosoNo ratings yet

- Small Business Dilemma HedgingDocument18 pagesSmall Business Dilemma HedgingfaisalNo ratings yet

- Premium Receipt - View - Download Premium Receipt - ICICI PrulifeDocument13 pagesPremium Receipt - View - Download Premium Receipt - ICICI PrulifeJohnNo ratings yet

- DerivDocument47 pagesDerivMahesh SabharwalNo ratings yet

- Trident - Solution Last ClassDocument4 pagesTrident - Solution Last ClassDanish KhanNo ratings yet

- Credit Card DetailsDocument4 pagesCredit Card DetailscontatoguilhermegomessNo ratings yet

- Fundamental Concept IFRS 17 (PSAK 74) : Team Teaching: Dr. Ludovicus Sensi W, CPA, CADocument35 pagesFundamental Concept IFRS 17 (PSAK 74) : Team Teaching: Dr. Ludovicus Sensi W, CPA, CAAgusGunadiNo ratings yet

- Term Insurance PlansDocument7 pagesTerm Insurance PlansPratiksha KambleNo ratings yet

- Derivatives Managing Financial RiskDocument17 pagesDerivatives Managing Financial RiskbaboabNo ratings yet

- GILL v. ACE AMERICAN INSURANCE COMPANY Et Al Yachtsman PolicyDocument34 pagesGILL v. ACE AMERICAN INSURANCE COMPANY Et Al Yachtsman PolicyACELitigationWatchNo ratings yet

- Stefanica 2017 VolDocument24 pagesStefanica 2017 VolpukkapadNo ratings yet

- Training ReportDocument68 pagesTraining ReportJeena BajajNo ratings yet

- Insurance Acc - PPDocument72 pagesInsurance Acc - PPDhivyaNo ratings yet

- DeravativesDocument3 pagesDeravativesKavindi AponsuNo ratings yet

- Claim FormDocument1 pageClaim FormYANARA BURGOSNo ratings yet

- Deferred AnnuityDocument18 pagesDeferred AnnuityJaidelNo ratings yet

- Motor Cover Note SM No / Nota Lindung Kenderaan SM NoDocument2 pagesMotor Cover Note SM No / Nota Lindung Kenderaan SM NomistikarjunaNo ratings yet

- Project Report On LicDocument36 pagesProject Report On LicShruti VikramNo ratings yet