Professional Documents

Culture Documents

MScFE 560 FM Video Transcript Lecture1 M1 U1

MScFE 560 FM Video Transcript Lecture1 M1 U1

Uploaded by

Hon Ming ChanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MScFE 560 FM Video Transcript Lecture1 M1 U1

MScFE 560 FM Video Transcript Lecture1 M1 U1

Uploaded by

Hon Ming ChanCopyright:

Available Formats

MScFE 560 Financial Markets - Video Transcript (Lecture 1) Module 1: Unit 1

Unit 1: A Brief History of Financial Markets

Hello and welcome to Financial Markets, the first course in the WorldQuant University Master’s

in Financial Engineering program. My name is Bryony Ortlepp, I am your lecturer for this course,

and in this – the first video of Module 1 – I’d like to introduce you to the subject of financial

markets.

We’ll begin this module by taking a brief look at the origins of financial markets and the various

key elements within a financial market. This will lay the foundation for us to launch into the

fundamental principles of risk and risk management. Overall, this module will set a theoretical

platform for the rest of the financial market content that form part of this course. So, with that in

mind, let’s begin.

Ask ten people to define financial markets and it’s likely you’ll get ten different answers. The name

may conjure thoughts of Wall Street billionaires in suits, the great recession, big banking or frantic

trading floors. But when pushed, it’s not an easy thing to define, even though all of us are subject

to its influence.

For this reason, we’ll begin by spending some time unpacking the foundational principles and

processes that constitute the vast interconnected web that is global financial markets.

The pre-cursor to our modern-day financial markets had its roots in necessity. In other words,

someone had a good or service they could render, and at the same time had a need to fulfil. For

example, a person who had a boat and was able to fish was able to supply their surplus fish to

someone who did not have a boat yet needed to eat.

Let us suppose the person without a boat was a strong and skilled builder. The fisherman would be

able to trade their catch – a good – in exchange for the builder building them shelter – a service.

This may be a very crude example, but it highlights the underlying, foundational principles of a

market system. First, there must be a need or a want. Second, there must be an ability and

willingness to meet that need. And lastly, there must be an agreed-upon value attributed to the

good or service.

© 2019 - WorldQuant University – All rights reserved.

3

MScFE 560 Financial Markets - Video Transcript (Lecture 1) Module 1: Unit 1

This illustrates what today is known as a barter system. However, as the complexities of trade

grew, and economies expanded, it became necessary to create a universally accepted tender for

the trade of goods and services against which the value of these items could be benchmarked. This

led to the introduction of money as recognized legal tender. There was suddenly a way for those

with more highly valued skills or goods to store up surplus tender, and thereby increase their

access to other goods and services. The development of legal tender gave rise to an explosion of

trade in goods and services that resulted in a plethora of systems, processes and technologies

which today constitute our global financial system.

As the means to acquire evolved, so did the methods that we use to spend, save, invest and trade.

Markets – centralized places of trade – were created to enable people to advertise their needs and

offerings in a more public domain. Through markets, forces of supply and demand determine the

prices of goods and services. As technologies have improved, isolated marketplaces have also

begun adapting and integrating into a globalized, regulated and ultimately digitized arena.

Modern day financial markets are ever-functioning, ever-expanding, and deeply interconnected –

even to the point that this interconnectedness can sometimes be to the detriment of the system as

a whole, as we will learn in the second module which concerns market regulation.

With this historic context in mind, it is now necessary to understand the key functions of financial

markets, as well as the major players that operate within the system. For this, please refer to the

first set of supplementary notes. If you have any questions, remember to post and up-vote them

on the forums so they can be addressed in the next live lecture.

© 2019 - WorldQuant University – All rights reserved.

4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Champion Legal Ads 04-29-21Document40 pagesThe Champion Legal Ads 04-29-21Donna S. SeayNo ratings yet

- GLP 100 Astrata DeviceDocument4 pagesGLP 100 Astrata DeviceAbrar HussainNo ratings yet

- Harry Lorayne - Impromptu Out of This WorldDocument4 pagesHarry Lorayne - Impromptu Out of This WorldGiuseppe Di Bianco100% (2)

- The Savings and Loan Crisis and Its Relationship To BankingDocument22 pagesThe Savings and Loan Crisis and Its Relationship To Bankingmanepalli vamsiNo ratings yet

- SL Crisis Why and Why NotDocument2 pagesSL Crisis Why and Why Notmanepalli vamsiNo ratings yet

- EE2019 Analog Systems Lab: Last Updated On: 19 January 2018 at 2:02 PMDocument36 pagesEE2019 Analog Systems Lab: Last Updated On: 19 January 2018 at 2:02 PMmanepalli vamsiNo ratings yet

- NF RegistrationDocument18 pagesNF Registrationmanepalli vamsiNo ratings yet

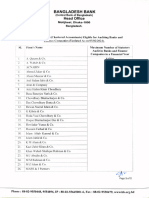

- List of Audit Firms 2024Document2 pagesList of Audit Firms 2024ahibadhaka2020No ratings yet

- FortiSIEM 5.2 Course Description-OnlineDocument2 pagesFortiSIEM 5.2 Course Description-OnlineHajjiNizarNo ratings yet

- Contemporary ArtsDocument2 pagesContemporary ArtsKess MontallanaNo ratings yet

- Counselling Approaches To Psychological Disorders - Humanistic Approach - Client Centered Therapy, Existential Therapy, Gestalt TherapyDocument17 pagesCounselling Approaches To Psychological Disorders - Humanistic Approach - Client Centered Therapy, Existential Therapy, Gestalt Therapyjoshita.guptaNo ratings yet

- Chapter 10Document54 pagesChapter 10ChristianNo ratings yet

- MBA 706 Mod 2Document35 pagesMBA 706 Mod 2Kellie ParendaNo ratings yet

- Aaliyahs Updated ResumeDocument1 pageAaliyahs Updated Resumeapi-457759233No ratings yet

- Crimes (Sentencing Procedure) Act 1999 No 92 Section 21ADocument4 pagesCrimes (Sentencing Procedure) Act 1999 No 92 Section 21AReza PatriaNo ratings yet

- Impact of Dividend Policy On Share PricesDocument16 pagesImpact of Dividend Policy On Share PricesAli JarralNo ratings yet

- Battle of Badr - Assignment 1Document3 pagesBattle of Badr - Assignment 1Runa KasiNo ratings yet

- 11 English PDFDocument4 pages11 English PDFPoonam DhimanNo ratings yet

- Module 3 - NSDI Case Studies - v4Document91 pagesModule 3 - NSDI Case Studies - v4thegpcgroup100% (1)

- Gradable and Ungradable Adjectives ExercisesDocument2 pagesGradable and Ungradable Adjectives ExercisesVictor YaconoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument47 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRobert Paul A MorenoNo ratings yet

- 01 The Rough Guide Pharsebook PolishDocument292 pages01 The Rough Guide Pharsebook Polishamaliab100% (6)

- Alsaada, Et Al vs. City of Columbus, Et Al.Document81 pagesAlsaada, Et Al vs. City of Columbus, Et Al.Chanda Brown33% (3)

- 2023 Memo On Annual Physical Examination of DepEd PersonnelDocument3 pages2023 Memo On Annual Physical Examination of DepEd PersonnelJoy Valerie100% (1)

- DRK New GamesDocument17 pagesDRK New Gamesala eddine henchiriNo ratings yet

- Gma v. Comelec DigestDocument4 pagesGma v. Comelec DigestTon RiveraNo ratings yet

- China Construction Wood Wooden Sets Mfg. Industry Profile Cic2031Document8 pagesChina Construction Wood Wooden Sets Mfg. Industry Profile Cic2031AllChinaReports.comNo ratings yet

- Grade Separated Intersections ﺓﺮـــــــــــــــﺴﺠﻤﻟﺍ ﺕﺎﻌﻁﺎﻘﺘﻟﺍDocument10 pagesGrade Separated Intersections ﺓﺮـــــــــــــــﺴﺠﻤﻟﺍ ﺕﺎﻌﻁﺎﻘﺘﻟﺍDr Firas Asad100% (2)

- Ex Nihilo CreationDocument3 pagesEx Nihilo CreationAnonymous b7ccvQSQpNo ratings yet

- Iroquois ConfederacyDocument12 pagesIroquois ConfederacyrideauparkNo ratings yet

- National Bookstore's Founder Maria Socorro "Nanay Coring" Cancio RamosDocument12 pagesNational Bookstore's Founder Maria Socorro "Nanay Coring" Cancio RamosRyan Joshua FloresNo ratings yet

- 3d2n Queen of The South Cebu 6Document3 pages3d2n Queen of The South Cebu 6Jaycee PagadorNo ratings yet

- Credit Market Equilibrium Theory and Evidence Revisiting The Structural Versus Reduced Form Credit Risk Model DebateDocument6 pagesCredit Market Equilibrium Theory and Evidence Revisiting The Structural Versus Reduced Form Credit Risk Model Debatedbr trackdNo ratings yet

- Biagtan V Insular LifeDocument2 pagesBiagtan V Insular LifemendozaimeeNo ratings yet