Professional Documents

Culture Documents

Singapore Appendix 8B For YA2021

Singapore Appendix 8B For YA2021

Uploaded by

DavidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Singapore Appendix 8B For YA2021

Singapore Appendix 8B For YA2021

Uploaded by

DavidCopyright:

Available Formats

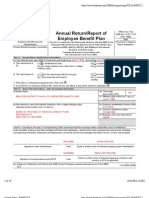

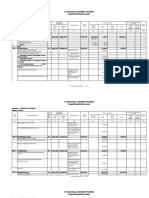

2021 APPENDIX 8B

Details of Gains or Profits from Employee Stock Option (ESOP)/Other Forms of Employee Share Ownership (ESOW) Plans For The Year Ended 31 DEC 2020

Fill in this form and give it to your employee / submit to IRAS by 1 Mar 2021. Please read the explanatory notes when completing this form.

Tax Ref. (NRIC/FIN): ___________ Full Name of Employee as per NRIC / FIN:________________________________

Exercise Open Open Gains from ESOP/ESOW Plans

Indicate Date of exercise of ESOP or

Price of Market Market Gross Amount Qualifying for Income Tax

Type of date of vesting of ESOW

ESOP/or Value Per Value Per Exemption under: - ****Gross

Company Plan Plan (if applicable). If Gross Amount

Price Paid/ share as at Share as at Number Amount not

Registration Name of Company Granted: Date moratorium (i.e. selling of gains from

Payable per the Date of the Date of Shares Qualifying

Number / of grant restriction) is imposed, state ESOP/

Share under Grant of Reflected at Acquired *ERIS **ERIS ***ERIS for Tax

UEN 1) ESOP the date the moratorium is ESOW Plans

ESOW ESOP/ Column (d) (SMEs) (All Corporations) (Start-ups) Exemption

or lifted for the ESOP/ESOW ($)

Plan ESOW Plan of this form ($)

2) ESOW Plans

($) ($) ($)

(a) (b) (c1) (c2) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m)

SECTION A: EMPLOYEE EQUITY-BASED REMUNERATION (EEBR) SCHEME (l) = (g-e) x h (m) = (l)

(I) TOTAL OF GROSS ESOP/ESOW GAINS IN SECTION A

SECTION B: EQUITY REMUNERATION INCENTIVE SCHEME (ERIS) SMEs (i) = (g-f) x h (l) = (f-e) x h (m) = (i) + (l)

(II) TOTAL OF GROSS ESOP/ESOW GAINS IN SECTION B

SECTION C: EQUITY REMUNERATION INCENTIVE SCHEME (ERIS) ALL CORPORATIONS (j) = (g-f) x h (l) = (f-e) x h (m) = (j) + (l)

(III) TOTAL OF GROSS ESOP/ESOW GAINS IN SECTION C

SECTION D: EQUITY REMUNERATION INCENTIVE SCHEME (ERIS) START-UPs (k) = (g-f) x h (l) = (f-e) x h (m) = (k) + (l)

(IV) TOTAL OF GROSS ESOP/ESOW GAINS IN SECTION D

SECTION E : TOTAL GROSS AMOUNT OF ESOP/ESOW GAINS (I+II+III+IV) (THIS AMOUNT IS TO BE REFLECTED IN ITEM d8 OF FORM IR8A)

*ERIS (SMEs) – This is only applicable to gains derived from the exercise of ESOP granted on or after 1 June 2000 and on or before 31 Dec 2013/restricted ESOW granted on or after 1 Jan 2002 and on or before 31 Dec 2013 by a qualifying company under the ERIS (SMEs) #

** ERIS (All CORPORATIONs) – This is only applicable to gains derived from the exercise of ESOP granted on or after 1 April 2001 and on or before 31 Dec 2013/restricted ESOW granted on or after 1 Jan 2002 and on or before 31 Dec 2013 by a qualifying company under the ERIS (ALL CORPORATIONS) #

***ERIS (START-UPs) – This is only applicable to gains derived from the exercise of ESOP/restricted ESOW granted on or after 16 Feb 2008 and on or before 15 Feb 2013 and within 3 years’ of the qualifying company’s incorporation. # #

See Explanatory Note 4 of Appendix 8B

****Including any amount of discount enjoyed by an employee on ESOP/ESOW Plan.#

DECLARATION

We certify that on the date of grant of ESOP/ESOW plan, all the conditions (with reference to each respective scheme) stated in paragraphs 4 & 5 of the Explanatory Notes for Completion of Appendix 8B were met.

Company Registration No. :__________________ Name of Employer :__________________________________________________ Date of incorporation [For ERIS (Start-ups only)] :_______________

Name of authorised person making the declaration: _____________________________________ Signature :______________ Designation : _____________________ Tel :___________ Date : ________________

App8B(1/2021) There are penalties for failing to give a return or furnishing an incorrect or late return.

You might also like

- Ratios Analysis Case For FNFMDocument3 pagesRatios Analysis Case For FNFMsaikumarNo ratings yet

- Chapter 14 Sol StudentsDocument4 pagesChapter 14 Sol StudentsAllen Grce100% (2)

- PEZA Cost Benefit Analysis FormDocument2 pagesPEZA Cost Benefit Analysis FormMark Kevin SamsonNo ratings yet

- 1604C Alphalist Format Jan 2018 Final2Document2 pages1604C Alphalist Format Jan 2018 Final2Mikho RaquelNo ratings yet

- Nism NotesDocument456 pagesNism NotesVetri M Konar100% (4)

- Dividend Policy at FPL Case 4Document4 pagesDividend Policy at FPL Case 4Ankur280475% (4)

- Account Statement 20230726 073553Document1 pageAccount Statement 20230726 073553Sanjeev AnnigeriNo ratings yet

- Scheme Features: Quantum Long Term Equity FundDocument3 pagesScheme Features: Quantum Long Term Equity FundSacred MindNo ratings yet

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormDocument2 pagesCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharNo ratings yet

- Sbi Etf SensexDocument1 pageSbi Etf Sensexpratik panchalNo ratings yet

- Pybom00469130000000399 2020Document1 pagePybom00469130000000399 2020mohit thapliyalNo ratings yet

- US Internal Revenue Service: F5500se - 1993Document2 pagesUS Internal Revenue Service: F5500se - 1993IRSNo ratings yet

- (Name of Agency) Annual Procurement Plan For FYDocument7 pages(Name of Agency) Annual Procurement Plan For FYRuss TuazonNo ratings yet

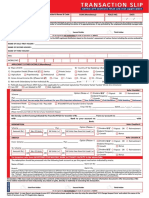

- Kotak - Transaction SlipDocument2 pagesKotak - Transaction SlipJephiasNo ratings yet

- US Internal Revenue Service: F5500se - 1994Document2 pagesUS Internal Revenue Service: F5500se - 1994IRSNo ratings yet

- US Internal Revenue Service: F5500se - 1996Document2 pagesUS Internal Revenue Service: F5500se - 1996IRSNo ratings yet

- 20240429132130NAL0014058224001Document10 pages20240429132130NAL0014058224001Sherloc HolmesNo ratings yet

- Please Accomplishment 5 (Five) Copies of This FormDocument34 pagesPlease Accomplishment 5 (Five) Copies of This FormRhoda Ivy Ulep Ilin-TandaanNo ratings yet

- Disclosure Under Sebi Share Based Employee Benefits Regulations 2014 For The Year Ended March 31 2021Document6 pagesDisclosure Under Sebi Share Based Employee Benefits Regulations 2014 For The Year Ended March 31 2021Esha ChaudharyNo ratings yet

- PDSF Ar EngDocument25 pagesPDSF Ar EngSeudonim SatoshiNo ratings yet

- Jurnal April 2023 (1) .Id - enDocument10 pagesJurnal April 2023 (1) .Id - enRizki PutraNo ratings yet

- Pension PlanDocument49 pagesPension PlanPriscilla TranNo ratings yet

- FORM 23-B: Statement of Changes in Beneficial Ownership of SecuritiesDocument4 pagesFORM 23-B: Statement of Changes in Beneficial Ownership of SecuritiesPaulNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- Finance Formula BankDocument2 pagesFinance Formula BankMELISSA ANN COLOMANo ratings yet

- Capex Request SheetDocument10 pagesCapex Request SheetChuck AnsphilNo ratings yet

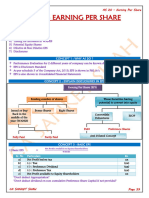

- PAS 33 - Earnings Per ShareDocument17 pagesPAS 33 - Earnings Per ShareKrizzia DizonNo ratings yet

- DOL RDWSU 2020 Form 5500Document205 pagesDOL RDWSU 2020 Form 5500seanredmondNo ratings yet

- Ir56b (Unlocked by WWW - Freemypdf.com)Document1 pageIr56b (Unlocked by WWW - Freemypdf.com)InmaNo ratings yet

- Form CapexDocument1 pageForm CapexsatriawanNo ratings yet

- School Annual Gender and Development (Gad) Plan and Budget BP 400/ FY 20Document5 pagesSchool Annual Gender and Development (Gad) Plan and Budget BP 400/ FY 20DAVID TITAN JR.No ratings yet

- Liquidation Report: Payee: Dept./UnitDocument2 pagesLiquidation Report: Payee: Dept./UnitClotheshoppe ForhimherNo ratings yet

- FORM 6 Register of EmployeesDocument2 pagesFORM 6 Register of Employeessiddharth JoshiNo ratings yet

- Aip FormDocument80 pagesAip FormNelette JumawanNo ratings yet

- Goldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVDocument3 pagesGoldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVIgnat FrangyanNo ratings yet

- Vinay Overseas IntroductionDocument9 pagesVinay Overseas Introductionorangetomelon100% (1)

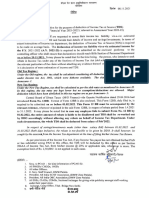

- DLCPM00411180000000085 2021Document2 pagesDLCPM00411180000000085 2021Ankit GuptaNo ratings yet

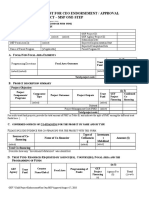

- 04GEF 7 CEO Endorsement - Approval - Child Projects-MSP One-Step - 8-17-2018 - 0Document6 pages04GEF 7 CEO Endorsement - Approval - Child Projects-MSP One-Step - 8-17-2018 - 0EMMANUEL SEGNOUNo ratings yet

- Southeast Europe Hydropower Database March 2018 For PublicationDocument35 pagesSoutheast Europe Hydropower Database March 2018 For PublicationTeto ScheduleNo ratings yet

- 2007 Form 5500 Carpenter Pension PlanDocument21 pages2007 Form 5500 Carpenter Pension PlanLatisha WalkerNo ratings yet

- University of Oxford Staff Pension Scheme (OSPS) : Confirmation of Death in ServiceDocument1 pageUniversity of Oxford Staff Pension Scheme (OSPS) : Confirmation of Death in ServiceMehran SameNo ratings yet

- PINNACLE - Two Year Integrated School Program For JEE (Main & Advanced), 2024Document4 pagesPINNACLE - Two Year Integrated School Program For JEE (Main & Advanced), 2024Arya MandweNo ratings yet

- Certificate of Collection or Deduction of Income Tax (Including Salary)Document1 pageCertificate of Collection or Deduction of Income Tax (Including Salary)4Ever VideosNo ratings yet

- Carpenters Vacation Fund 2007Document8 pagesCarpenters Vacation Fund 2007Latisha WalkerNo ratings yet

- Retirement Plan of Trustees 2007Document14 pagesRetirement Plan of Trustees 2007Latisha WalkerNo ratings yet

- PayrollForm GeneralUse UtahDOTDocument7 pagesPayrollForm GeneralUse UtahDOTJoshua RodriguezNo ratings yet

- GLMRF - 2023 Template - Ver Sept2023v1 SignedDocument4 pagesGLMRF - 2023 Template - Ver Sept2023v1 SignedKevin BesaNo ratings yet

- Carpenters Vacation Fund 2006Document14 pagesCarpenters Vacation Fund 2006Latisha WalkerNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- Carpenters Annuity Fund 2006Document20 pagesCarpenters Annuity Fund 2006Latisha WalkerNo ratings yet

- Carpenters Welfare Fund 2007Document18 pagesCarpenters Welfare Fund 2007Latisha WalkerNo ratings yet

- ITR-7 Notified Form PDFDocument24 pagesITR-7 Notified Form PDFgurpreet06No ratings yet

- Fixed Deposit FormDocument3 pagesFixed Deposit FormNikita JainNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- Capital Gain Statement 8043912 23062024153232Document2 pagesCapital Gain Statement 8043912 23062024153232arpit sharmaNo ratings yet

- TSSD-EFIS02-001 DILP CHECKLIST OF PRE-DOCS Rev05 Eff71521Document2 pagesTSSD-EFIS02-001 DILP CHECKLIST OF PRE-DOCS Rev05 Eff71521NeQuie TripNo ratings yet

- As 20 - Earning Per Share CH-4Document5 pagesAs 20 - Earning Per Share CH-4lucifersdevil68No ratings yet

- Emerging Issues in Employee Stock Option Plan ( ESOP') Taxation DimensionsDocument17 pagesEmerging Issues in Employee Stock Option Plan ( ESOP') Taxation DimensionsjagpritNo ratings yet

- Ind As 33 Material For VC 26 28 August 2021Document69 pagesInd As 33 Material For VC 26 28 August 2021Khawaish MittalNo ratings yet

- Carpenters Annuity Fund 2007Document19 pagesCarpenters Annuity Fund 2007Latisha WalkerNo ratings yet

- Obligation 2024Document1 pageObligation 2024Lovelyn SeverinoNo ratings yet

- Revised Establishment Report Form v3 1Document5 pagesRevised Establishment Report Form v3 1Sai GuyoNo ratings yet

- 34 Veterinary Aip 2022 09 - 15 - 21Document23 pages34 Veterinary Aip 2022 09 - 15 - 21Budget OfficeNo ratings yet

- Peru, BOP Analytic Presentation (Millions of U.S. Dollars)Document13 pagesPeru, BOP Analytic Presentation (Millions of U.S. Dollars)Oscar MontufarNo ratings yet

- Course: BMT5112 Financial Accounting and AnalysisDocument2 pagesCourse: BMT5112 Financial Accounting and AnalysisKishore MurugananthamNo ratings yet

- Group 13 - HP - CompaqDocument13 pagesGroup 13 - HP - CompaqAkis MalamidisNo ratings yet

- Pas 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument2 pagesPas 20 Accounting For Government Grants and Disclosure of Government AssistanceR.A.No ratings yet

- Answer AnswerDocument9 pagesAnswer Answerbatoonrussel61No ratings yet

- Investment+Planning+Module (1)Document137 pagesInvestment+Planning+Module (1)jayaram_polaris100% (1)

- Module 3 Transactions Processing CyclesDocument25 pagesModule 3 Transactions Processing CyclesMaricar PinedaNo ratings yet

- SMU LGST201 Final NotesDocument33 pagesSMU LGST201 Final NotesOng LayLiNo ratings yet

- Ama Bank Business CaseDocument4 pagesAma Bank Business Caserogimel trinidadNo ratings yet

- 3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczDocument1 page3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczRajib Dahal50% (2)

- HUL CapitalineDocument25 pagesHUL CapitalineOMANSHU YADAVNo ratings yet

- AC13.4.1 Module 4 Income TaxesDocument23 pagesAC13.4.1 Module 4 Income TaxesRenelle HabacNo ratings yet

- Chapter 3 - Chapter 3: Financial Forecasting and PlanningDocument35 pagesChapter 3 - Chapter 3: Financial Forecasting and PlanningAhmad Ridhuwan AbdullahNo ratings yet

- Accounting & Excel Assignment - ExperiencedDocument21 pagesAccounting & Excel Assignment - Experienceddivyaparashar10No ratings yet

- Q Part 6Document10 pagesQ Part 6kajkargroupNo ratings yet

- Assignment 4.1 Partnership Dissolution Part I (MG2)Document6 pagesAssignment 4.1 Partnership Dissolution Part I (MG2)Abigail ConstantinoNo ratings yet

- An Introduction To Consolidated Financial StatementDocument27 pagesAn Introduction To Consolidated Financial StatementKelvin Febriansyah PratamaNo ratings yet

- Taxation of Income Earned From Selling SharesDocument5 pagesTaxation of Income Earned From Selling Sharesphani raja kumarNo ratings yet

- Discussion On Preferential Issue of Shares Under Companies Act 2013 10th 13th December 2021 - Cs Nilesh PradhanDocument50 pagesDiscussion On Preferential Issue of Shares Under Companies Act 2013 10th 13th December 2021 - Cs Nilesh PradhanKartik PathaniaNo ratings yet

- Basic and Expanded Accounting EquationDocument2 pagesBasic and Expanded Accounting EquationnelieNo ratings yet

- Notes Chapter 6Document2 pagesNotes Chapter 6syafaNo ratings yet

- ExamDocument6 pagesExamNaga Kiran V HNo ratings yet

- Lse Asl 2011Document56 pagesLse Asl 2011Bijoy AhmedNo ratings yet

- Enterprise Value ThesisDocument6 pagesEnterprise Value ThesisPedro Craggett100% (2)

- Capital Structure Analysis of Hero Honda, For The Year 2005 To 2010Document7 pagesCapital Structure Analysis of Hero Honda, For The Year 2005 To 2010pushpraj rastogiNo ratings yet

- ZZXXDocument81 pagesZZXXKokila ThangamNo ratings yet