Professional Documents

Culture Documents

21 11 16 Tastytrade Research

21 11 16 Tastytrade Research

Uploaded by

CSOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

21 11 16 Tastytrade Research

21 11 16 Tastytrade Research

Uploaded by

CSCopyright:

Available Formats

Nov 16, 2021

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized

Options before deciding to invest.

Tom 's Por t f olio Alph a Boost t o du plicat e Tom 's por t f olio.

Tr ades can be f ou n d by click in g HERE.

Sh or t : /NQ, Chip stocks, Bonds

Sign up to get 3x per week, trade ideas:

Neu t r al: Crude Oil, Nat Gas, Rut

https://info.quietfoundation.com/alphaboost

Lon g: China, IBM, ZM

Cr ypt o M oves All of these coins can be traded

Editor 's note. Chip stocks examples are AMD, on tasytworks. Here is the price movements:

MU, INTC or the Semiconductor ETF (SMH).

Bonds can be played with the 20+ year bond ETF

(TLT). Or futures /ZN or /ZB -- be careful with

size.

Crude Oil can be played using the oil ETF (USO),

or /SMO and /CL futures.

Natural Gas is /NG or the Natural Gas ETF (UNG).

Careful with size.

Rut can be played with the futures (/RTY) or the

ETF (IWM).

China can be played with the large caps (FXI) or

ASHR. Or individual stocks: BIDU, BABA, KWEB,

etc.

Bat 's Por t f olio

Sh or t BBY

Neu t r al TSLA, KWEB, FB, AMD and

short premium in all of these. Have a great week trading! Keep those positions small!

Lon g V, PTON (long by default M ich ael Rech en t h in , Ph D

from earnings)

Jam es Blakew ay

Pr of essor Clem en s Kow n at zk i, Ph D

Basic Dividen d Discou n t M odel

Ever wondered how financial analysts are valuing companies? To be fair, it is more of an art than a

science but there are some basic elements that all look at series of discounted cash flows expressed in

today's dollars. Before getting into the finer details of discounted cash flow valuation methods, here's a

neat shortcut to value a firm simply based on their dividends.

The formula is super simple: Dividen ds ÷ Discou n t Rat e = Est im at ed St ock Pr ice

where dividends are expressed in dollar amounts per year and the discount rate is an assumed cost of

capital for the firm in percentage terms.

Obviously, there are a ton of firms that don't pay dividends just look at your typical tech company that is

positioned for growth. And while this formula clearly isn't going to give you a perfect value for most

firms, it's a fast and dirty back of the envelope formula to get you somewhere in the ballpark (hint:

ballpark means that you can easily be 50% above or below their current stock price). Nevertheless, with

this caveat and the understanding of a rough approximation, let's take it for a quick spin.

An older tech company like IBM may be a good candidate. IBM is paying dividends of $6.56 per share

and let's assume a cost of capital of 6%. Ergo, $6.56÷0.06 = $109.33. As of today IBM is trading at $118

per share. We are indeed fairly close to their current stock price. Go ahead and try it with your favorite

dividend paying company and see what you get. Again, please be aware that your valuation based on

this model can be quite far from the current stock price. Then again, even the most sophisticated

valuation models currently show many stocks far away from their fundamental value based on realistic

assumptions.

Next week, we'll do an extension to this model and consider companies where dividends are expected to

grow in the future. We can then also look at the math that allows us to come up with such a super simple

formula.

Clem en s Kow n at zk i Ph .D. M BA

Depar t m en t Ch air of Accou n t in g,

Fin an ce & Real Est at e

Assist an t Pr of essor of Fin an ce

These Dow stocks

currently pay dividends

© tastytrade, 2021 Rechenthin | Blakeway | Kownatzki Page 2 of 5

Target (TGT) hit an all time high

yesterday. Earnings are expected

tomorrow morning. With an 81%

implied volatility for Nov options,

there's a ±$14.13 expected move by

Friday expiration.

Lowe's (LOW) is up 2.4% this

morning in solidarity with the Home

Depot (HD) move post-earnings.

LOW reports earningsbefore the

bell tomorrow. Expected move by

Friday is currently ±$10.55

Natural Gas is on the move again.

UNG still has an IVR over 70.

Traders should always keep in mind

that UNG is a futures based ETF and

does can exhibit drag and under

performance due to it's futures

exposure

© tastytrade, 2021 Rechenthin | Blakeway | Kownatzki Page 3 of 5

In t er est ed in join in g t h ou san ds of ot h er f in an ce geek s?

Sign up for a free weekly subscription at:

info.tastytrade.com/cherry-picks

Bu bbles, ou r

Ch er r y Pick s

m ascot

© tastytrade, 2021 Rechenthin | Blakeway | Kownatzki Page 4 of 5

Glossar y

IV. Implied Volatility is the estimated volatility of a security?s price derived from its option price; the higher the IV,

the more expensive the option and therefore the larger the expected price move. IV is an annualized number of

volatility, e.g. a IV of 27 means the option?s market is pricing in an annualized price range, either plus or minus, of

27%.

IV Ran k . IV by itself doesn?t tell us if if the volatility is high or low - but IV Rank does. An IV Rank of 70 means that

the IV is 70% between its low and high IV over the past year. The higher the IV Rank, the higher the security?s IV is

compared to its past year. We provide six levels to make evaluating easier

Opt ion Liqu idit y. At tastytrade we have our own theoretical measure of option liquidity, Poor, Moderate, Good,

or Great. It examines the options?bid/ask spread, open interest, and the number of strikes with non-zero bids

Cor r elat ion w it h S&P 500. Correlation is a statistical measure of how strong a relationship two securities have

with one another. A correlation of -1 means the stocks are perfectly negatively correlated (they move in opposite

directions), while a correlation of +1 means the stocks are perfectly positively correlated (they move in the same

direction). A correlation of 0 means there exist little relationship.

Ear n in gs. The earnings date of the security. In practice we tend to see stocks have a larger amount of implied

volatility (IV) nearer to earnings as the market is pricing in the fear of the upcoming earnings announcement. In

parenthesis, is BTO or AMC; "Before the Open" or "After Market Closes", respectively. Upcoming earnings dates do

sometimes change.

Disclosu r es

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized

Options before deciding to invest in options.

tastytrade content is provided solely by tastytrade, Inc. and is for informational and educational purposes only. It is not, nor is it

intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment

strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. tastytrade, through its

content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations.

Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor

financial sophistication, financial situation, investing time horizon or risk tolerance. tastytrade is not in the business of transacting

securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client?s

situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs),

comparison, statistics, or other technical data, if applicable, will be supplied upon request. Multi-leg option strategies incur higher

transaction costs as they involve multiple commission charges. tastytrade is not a licensed financial advisor, registered investment

advisor, or a registered broker-dealer. Options involve risk and are not suitable for all investors. Please read Characteristics and Risks

of Standardized Options before deciding to invest in options.

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC). All customer futures accounts' positions

and cash balances are segregated by Apex Clearing Corporation. Futures and futures options trading is speculative and is not suitable

for all investors. Please read the Risk Disclosure for Futures and Options prior to trading futures products found in Disclosures under

the Documents tab.

© tastytrade, 2021 Rechenthin | Blakeway | Kownatzki Page 5 of 5

You might also like

- 104 - TM Debate HandbookDocument18 pages104 - TM Debate HandbookCSNo ratings yet

- Reverse Discounted Cash FlowDocument11 pagesReverse Discounted Cash FlowSiddharthaNo ratings yet

- 23 03 21 Futures Cheat SheetDocument2 pages23 03 21 Futures Cheat SheetCSNo ratings yet

- Demand and Supply Multiple Choice QuestionsDocument2 pagesDemand and Supply Multiple Choice QuestionsMohanad Emad81% (26)

- Key Concepts in Fundamental Analysis For Forex TradersDocument3 pagesKey Concepts in Fundamental Analysis For Forex Tradershyba ben helal50% (2)

- Suggested Day Trading Plan - Fibonacciqueen: 8 Ema Crosses Above The 34 Ema and A Prior Swing High Is Taken OutDocument2 pagesSuggested Day Trading Plan - Fibonacciqueen: 8 Ema Crosses Above The 34 Ema and A Prior Swing High Is Taken Outbrent100% (1)

- CH An Ges in IV. More Volat IleDocument6 pagesCH An Ges in IV. More Volat IleCSNo ratings yet

- 22 01 11 Tastytrade ResearchDocument6 pages22 01 11 Tastytrade ResearchCSNo ratings yet

- 21 05 25 Tastytrade ResearchDocument5 pages21 05 25 Tastytrade ResearchwutthicsaNo ratings yet

- 4 Bond TerminologyDocument23 pages4 Bond TerminologynylaksinghNo ratings yet

- The Path Forward For Defi Fixed Income and Yield TokensDocument18 pagesThe Path Forward For Defi Fixed Income and Yield TokensTahima DevadalaNo ratings yet

- P1.T3. Financial Markets and Products Chapter 12. Options Markets Bionic Turtle FRM Practice QuestionsDocument19 pagesP1.T3. Financial Markets and Products Chapter 12. Options Markets Bionic Turtle FRM Practice QuestionsChristian Rey MagtibayNo ratings yet

- 21 12 14 Tastytrade ResearchDocument5 pages21 12 14 Tastytrade Researchpta123No ratings yet

- TH e S&P 500's Expect Ed M Ove For Now Until The End ofDocument6 pagesTH e S&P 500's Expect Ed M Ove For Now Until The End ofCSNo ratings yet

- Finance NotesDocument6 pagesFinance NotesGu Xin yuNo ratings yet

- 19 01 08 Tastytrade ResearchDocument6 pages19 01 08 Tastytrade ResearchoutlawyrNo ratings yet

- WH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsDocument4 pagesWH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsCSNo ratings yet

- Its Earning That Count SummaryDocument115 pagesIts Earning That Count SummaryTheda VeldaNo ratings yet

- Perry Capital MLP ThesisDocument5 pagesPerry Capital MLP ThesisWriteMyPaperCheapBillings100% (2)

- HNDL 7% DividenDocument5 pagesHNDL 7% DividenSamNo ratings yet

- DeFi Guide For Newbie (And How To Manage Risk)Document9 pagesDeFi Guide For Newbie (And How To Manage Risk)chitra limaNo ratings yet

- 2021-04-26-JPMorgan-Cross Asset Volatility Systematically Monetize B... - 92126713Document11 pages2021-04-26-JPMorgan-Cross Asset Volatility Systematically Monetize B... - 92126713brookpointNo ratings yet

- Save and Invest For What's Next WealthfrontDocument1 pageSave and Invest For What's Next WealthfrontDatboi AugustNo ratings yet

- Fu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidDocument5 pagesFu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidCSNo ratings yet

- Short Selling MY PRINCIPLESDocument13 pagesShort Selling MY PRINCIPLESCA Rajesh RaoNo ratings yet

- J.K. Financial, Inc.Document8 pagesJ.K. Financial, Inc.johnkvaleNo ratings yet

- Forex Qs AnsDocument5 pagesForex Qs AnsChoudhristNo ratings yet

- 21 12 07 Tastytrade ResearchDocument6 pages21 12 07 Tastytrade ResearchCSNo ratings yet

- Ear N in G Season "Officially" BeginsDocument14 pagesEar N in G Season "Officially" BeginsCSNo ratings yet

- Gicts PresentationDocument18 pagesGicts PresentationArif KhanNo ratings yet

- Clase VI - Discount Rates (Equity Risk Premium)Document25 pagesClase VI - Discount Rates (Equity Risk Premium)Miguel Vega OtinianoNo ratings yet

- Bitoisnot Asuitablelongterm Investment - TheDocument6 pagesBitoisnot Asuitablelongterm Investment - TheCSNo ratings yet

- Retire With A Smile Retire With A Smile: Investment Solutions Investment SolutionsDocument16 pagesRetire With A Smile Retire With A Smile: Investment Solutions Investment SolutionsParam SaxenaNo ratings yet

- Vanguard High Yield Bond Fund BogleheadsDocument12 pagesVanguard High Yield Bond Fund Bogleheadsambasyapare1No ratings yet

- Capital Market and Portfolio - AssignmentDocument7 pagesCapital Market and Portfolio - AssignmentAdrija ChakrabortyNo ratings yet

- False Signal of PV RatioDocument3 pagesFalse Signal of PV Ratiosameer1211No ratings yet

- Discounting Cash FlowDocument9 pagesDiscounting Cash FlowBhavinRamaniNo ratings yet

- Arnott Why Cap-Weighted Indexing Is FlawedDocument21 pagesArnott Why Cap-Weighted Indexing Is Flawedambasyapare1No ratings yet

- Negen PMS Presentation FebDocument15 pagesNegen PMS Presentation FebArchitGargNo ratings yet

- 9-14-2021 DoubleLine Total Return Webcast With Jeffrey Gundlach - Slide DeckDocument80 pages9-14-2021 DoubleLine Total Return Webcast With Jeffrey Gundlach - Slide DeckZerohedgeNo ratings yet

- Ultimate Income StrategyDocument7 pagesUltimate Income StrategyPyrantel Pamoate0% (1)

- S6&7 - EquitiesDocument31 pagesS6&7 - EquitiesGenesis mia Albornoz ochoaNo ratings yet

- Basic Techniques Payback ARR NPV IRR: SectionDocument24 pagesBasic Techniques Payback ARR NPV IRR: Sectionlavanya vsNo ratings yet

- Corporate Perpetual Bonds Education NoteDocument6 pagesCorporate Perpetual Bonds Education NoteSam RalstonNo ratings yet

- Investing 101: What New Investors Need To KnowDocument31 pagesInvesting 101: What New Investors Need To KnowaragonkaycyNo ratings yet

- Asset Allocation in A Low Yield EnvironmentDocument20 pagesAsset Allocation in A Low Yield EnvironmentNic PalarNo ratings yet

- The Halal Investment Checklist: A Step-By-Step Guide + 7 Great Places To Put Your Money To Build Your WealthDocument21 pagesThe Halal Investment Checklist: A Step-By-Step Guide + 7 Great Places To Put Your Money To Build Your WealthRmxNo ratings yet

- CA Inter FM Xpress Revision NotesDocument48 pagesCA Inter FM Xpress Revision NotesRaghav PrajapatiNo ratings yet

- Nergy Rading ISK Anagement: E T R MDocument16 pagesNergy Rading ISK Anagement: E T R MZaché le JusteNo ratings yet

- Chou LettersDocument90 pagesChou LettersLuke ConstableNo ratings yet

- 10 Factors To Consider When Selecting A Stock - ToughNickelDocument8 pages10 Factors To Consider When Selecting A Stock - ToughNickelAnkur ParshavNo ratings yet

- WORTH Magazine Article Issue 6Document4 pagesWORTH Magazine Article Issue 6trustman926750% (1)

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- Class Notes #2 Intro and Duff and Phelps Case StudyDocument27 pagesClass Notes #2 Intro and Duff and Phelps Case StudyJohn Aldridge Chew100% (1)

- P/E Ratio Tutorial: Stock BasicsDocument5 pagesP/E Ratio Tutorial: Stock BasicsAnuradha SharmaNo ratings yet

- MLP ArbDocument3 pagesMLP ArbclelanaeNo ratings yet

- Sure Retirement: April 2021 EditionDocument60 pagesSure Retirement: April 2021 EditionmarsveloNo ratings yet

- LBS - Massimo Fuggeta Investment Theory Vs PractuceDocument26 pagesLBS - Massimo Fuggeta Investment Theory Vs Practucegiorgiogarrido6No ratings yet

- Finance: The Cost of EquityDocument5 pagesFinance: The Cost of EquityBenjamin ChikeNo ratings yet

- Sales Handbook: For PartnersDocument44 pagesSales Handbook: For PartnersAnantha RamanNo ratings yet

- Lumen Tech, BGSF, Elevate Credit - 3 Deep Value Stocks - Low Prices and High Upside - Seeking AlphaDocument5 pagesLumen Tech, BGSF, Elevate Credit - 3 Deep Value Stocks - Low Prices and High Upside - Seeking AlphateppeiNo ratings yet

- Dollar Cost Averaging vs. Lump Sum Investing: Benjamin FelixDocument17 pagesDollar Cost Averaging vs. Lump Sum Investing: Benjamin FelixCláudioNo ratings yet

- Thinking in Bets (Homage To Annie Duke) : Greenhaven Road CapitalDocument9 pagesThinking in Bets (Homage To Annie Duke) : Greenhaven Road Capitall chanNo ratings yet

- The Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136From EverandThe Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136No ratings yet

- TM Pathways - Short - Path DescriptionsDocument1 pageTM Pathways - Short - Path DescriptionsCSNo ratings yet

- Suddenly Hybrid - c09Document2 pagesSuddenly Hybrid - c09CSNo ratings yet

- How To Build A Toastmasters ClubDocument20 pagesHow To Build A Toastmasters ClubCSNo ratings yet

- Security-Checklist - AllThingsSecuredDocument5 pagesSecurity-Checklist - AllThingsSecuredCSNo ratings yet

- L0629 - Koerners Ultrarunning - BonusPDFDocument5 pagesL0629 - Koerners Ultrarunning - BonusPDFCSNo ratings yet

- Advanced TM Legacy ManualsDocument1 pageAdvanced TM Legacy ManualsCSNo ratings yet

- Servant Leadership ThemesDocument1 pageServant Leadership ThemesCSNo ratings yet

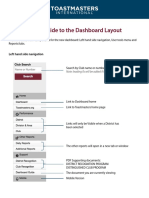

- TI Dashboard GuideDocument7 pagesTI Dashboard GuideCSNo ratings yet

- Let Your Stories Talk by Craig ValentineDocument2 pagesLet Your Stories Talk by Craig ValentineCSNo ratings yet

- Table Topics - 2022 EditionDocument11 pagesTable Topics - 2022 EditionCSNo ratings yet

- LL Hits & Miss Gen Eval FormDocument2 pagesLL Hits & Miss Gen Eval FormCSNo ratings yet

- Food & Nutrition For RunnersDocument13 pagesFood & Nutrition For RunnersCSNo ratings yet

- Condo ACT Changes 2017Document13 pagesCondo ACT Changes 2017CSNo ratings yet

- Topic:: Core Message: Catch Phrase (10 Words or Less) : Transition: 1. Hook: 2. Setup: 3. Main TakeawayDocument1 pageTopic:: Core Message: Catch Phrase (10 Words or Less) : Transition: 1. Hook: 2. Setup: 3. Main TakeawayCSNo ratings yet

- Critical Thinking ResourcesDocument1 pageCritical Thinking ResourcesCSNo ratings yet

- TABLE TOPICS - Inspriring QuotesDocument18 pagesTABLE TOPICS - Inspriring QuotesCSNo ratings yet

- TM Club-Officer - Nomination Committee - Pre-Election TimelineDocument1 pageTM Club-Officer - Nomination Committee - Pre-Election TimelineCSNo ratings yet

- Suddenly Hybrid - c12Document2 pagesSuddenly Hybrid - c12CSNo ratings yet

- Bitoisnot Asuitablelongterm Investment - TheDocument6 pagesBitoisnot Asuitablelongterm Investment - TheCSNo ratings yet

- TH e S&P 500's Expect Ed M Ove For Now Until The End ofDocument6 pagesTH e S&P 500's Expect Ed M Ove For Now Until The End ofCSNo ratings yet

- Pathways: Base Camp Manager DutiesDocument44 pagesPathways: Base Camp Manager DutiesCSNo ratings yet

- Ear N in G Season "Officially" BeginsDocument14 pagesEar N in G Season "Officially" BeginsCSNo ratings yet

- CH An Ges in IV. More Volat IleDocument6 pagesCH An Ges in IV. More Volat IleCSNo ratings yet

- Fu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidDocument5 pagesFu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidCSNo ratings yet

- WH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsDocument4 pagesWH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsCSNo ratings yet

- 21 12 07 Tastytrade ResearchDocument6 pages21 12 07 Tastytrade ResearchCSNo ratings yet

- 22 01 11 Tastytrade ResearchDocument6 pages22 01 11 Tastytrade ResearchCSNo ratings yet

- Jan U Ar Y 18, 2022: Earningseason, Birdsof A Feat H Er Flock Toget H ErDocument8 pagesJan U Ar Y 18, 2022: Earningseason, Birdsof A Feat H Er Flock Toget H ErCSNo ratings yet

- VWAP & Squeeze Momentum in Day TradingDocument12 pagesVWAP & Squeeze Momentum in Day TradingPuneet NandaniNo ratings yet

- ECS2608 Assignment 1Document6 pagesECS2608 Assignment 1Jason Warren BlandNo ratings yet

- Stock Portfolio Formation: BRK-B, CSCO & BADocument18 pagesStock Portfolio Formation: BRK-B, CSCO & BAsandeep shresthaNo ratings yet

- CHAPTER 4 - Typical Parameter For Intermediate TrendsDocument14 pagesCHAPTER 4 - Typical Parameter For Intermediate TrendsHirai GaryNo ratings yet

- MCQ On Commodity Derivatives - English-GeneralDocument12 pagesMCQ On Commodity Derivatives - English-GeneralSancia DsouzaNo ratings yet

- Quote: ITEM # NAS1100-4-11, PAN HEAD MACHINE SCREW - NAS1100-4-11Document3 pagesQuote: ITEM # NAS1100-4-11, PAN HEAD MACHINE SCREW - NAS1100-4-11Fred100% (1)

- Gann Course in India - GannAndWavesDocument9 pagesGann Course in India - GannAndWavesGann And Waves100% (1)

- Internship Report On Awareness About Stock Markets of India: Submitted By: Vaibhav Arora (MBA-2019) Roll No: 19020259Document38 pagesInternship Report On Awareness About Stock Markets of India: Submitted By: Vaibhav Arora (MBA-2019) Roll No: 19020259Vaibhav AroraNo ratings yet

- Commodities MarketDocument9 pagesCommodities MarketRutik ShrawankarNo ratings yet

- Chapter 3 - Consumer Behaviour and ChoiceDocument61 pagesChapter 3 - Consumer Behaviour and ChoicerbnbalachandranNo ratings yet

- 1-2-3 Wave Count Early Morning Activity Mining The Web Stock Evaluation Interview Review, Quick-ScanDocument68 pages1-2-3 Wave Count Early Morning Activity Mining The Web Stock Evaluation Interview Review, Quick-ScanJohn Green100% (1)

- Final Examination Principles of Finance (DPF 24153)Document9 pagesFinal Examination Principles of Finance (DPF 24153)USHA PERUMALNo ratings yet

- EMA TipsDocument13 pagesEMA TipsHugley BareNo ratings yet

- Prince Kumar RayDocument9 pagesPrince Kumar RayBittu MallikNo ratings yet

- Forex Price Action Scalping by Bob Volman 200 359Document160 pagesForex Price Action Scalping by Bob Volman 200 359sapthanhtien100% (1)

- Introduction To ForexDocument9 pagesIntroduction To ForexNor Ali AsmatNo ratings yet

- INtraday Trading Methods For NiftyDocument4 pagesINtraday Trading Methods For Niftymuddisetty umamaheswar100% (1)

- The CBOE Volatility Index - VIXDocument23 pagesThe CBOE Volatility Index - VIXayaNo ratings yet

- CT1P ComponentsDocument28 pagesCT1P ComponentsChirag ShahNo ratings yet

- Book Review: Investment Analysis and Management An Indonesian AdaptationDocument3 pagesBook Review: Investment Analysis and Management An Indonesian AdaptationRamadhani AwwaliaNo ratings yet

- LeatherDocument15 pagesLeatherSingh Nitin80% (5)

- Partha Ray: Professor of Economics IIM Calcutta March 24 2021Document55 pagesPartha Ray: Professor of Economics IIM Calcutta March 24 2021karanNo ratings yet

- Exercises Forward FuturesDocument1 pageExercises Forward FuturesNguyễn ThiNo ratings yet

- ECO111 - Test 01 - Individual Assignment 01Document2 pagesECO111 - Test 01 - Individual Assignment 01Hoang Phi Khanh QP2664No ratings yet

- Fertilizer - FFC - Urea Price Hike Clarifies Margin Outlook - KASBDocument3 pagesFertilizer - FFC - Urea Price Hike Clarifies Margin Outlook - KASBmuddasir1980No ratings yet

- Disadvantages of Harmonic by ArunDocument14 pagesDisadvantages of Harmonic by ArunMark PangantihonNo ratings yet

- Chaostheory1 FractalDocument191 pagesChaostheory1 FractalgigikozNo ratings yet