Professional Documents

Culture Documents

Stock Market Analysis Project Overview: Part 1: Getting The Data

Stock Market Analysis Project Overview: Part 1: Getting The Data

Uploaded by

Rhea Joy OrcioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Market Analysis Project Overview: Part 1: Getting The Data

Stock Market Analysis Project Overview: Part 1: Getting The Data

Uploaded by

Rhea Joy OrcioCopyright:

Available Formats

Stock Market Analysis Project Overview

Welcome to your first Python Project! This project introduces the basics of Financial Modeling Using Python.

You will be analyzing stock data related to a few car companies, from January 1, 2012, to Jan 1, 2017. Keep in mind that this project is mainly just to practice your skills with matplotlib, pandas, and

numpy. Do not infer financial trading advice from it.

Part 0: Import

Import the various libraries you will need. You can always just come back up here or import as you go along.

In [1]:

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

%matplotlib inline

In [4]:

pip install pandas_datareader

Requirement already satisfied: pandas_datareader in /srv/conda/envs/notebook/lib/python3.6/site-packages (0.10.0)

Requirement already satisfied: pandas>=0.23 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from pandas_datareader) (1.1.5)

Requirement already satisfied: requests>=2.19.0 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from pandas_datareader) (2.26.0)

Requirement already satisfied: lxml in /srv/conda/envs/notebook/lib/python3.6/site-packages (from pandas_datareader) (4.7.1)

Requirement already satisfied: python-dateutil>=2.7.3 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from pandas>=0.23->pandas_datareader) (2.8.2)

Requirement already satisfied: pytz>=2017.2 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from pandas>=0.23->pandas_datareader) (2021.3)

Requirement already satisfied: numpy>=1.15.4 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from pandas>=0.23->pandas_datareader) (1.19.5)

Requirement already satisfied: charset-normalizer~=2.0.0 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from requests>=2.19.0->pandas_datareader)

(2.0.0)

Requirement already satisfied: certifi>=2017.4.17 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from requests>=2.19.0->pandas_datareader) (2021.5.3

0)

Requirement already satisfied: idna<4,>=2.5 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from requests>=2.19.0->pandas_datareader) (3.1)

Requirement already satisfied: urllib3<1.27,>=1.21.1 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from requests>=2.19.0->pandas_datareader) (1.26.

7)

Requirement already satisfied: six>=1.5 in /srv/conda/envs/notebook/lib/python3.6/site-packages (from python-dateutil>=2.7.3->pandas>=0.23->pandas_datareader)

(1.16.0)

Note: you may need to restart the kernel to use updated packages.

Part 1: Getting the Data

Tesla Stock (Ticker: TSLA on the NASDAQ)

Use pandas_datareader to obtain the historical stock information for Tesla from Jan 1, 2012 to Jan 1, 2017.

In [3]:

import pandas_datareader

import datetime

In [5]:

import pandas_datareader.data as web

In [6]:

start = datetime.datetime(2012, 1, 1)

end = datetime.datetime(2017, 1, 1)

tesla = web.DataReader("TSLA", 'yahoo', start, end)

In [7]:

tesla.head()

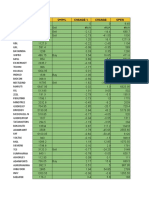

Out[7]: High Low Open Close Volume Adj Close

Date

2012-01-03 5.900 5.530 5.788 5.616 4640500 5.616

2012-01-04 5.734 5.500 5.642 5.542 3150500 5.542

2012-01-05 5.586 5.370 5.552 5.424 5027500 5.424

2012-01-06 5.558 5.282 5.440 5.382 4931500 5.382

2012-01-09 5.498 5.224 5.400 5.450 4485000 5.450

In [8]:

tesla.to_csv('Tesla_Stock.csv')

Other Car Companies

Repeat the same steps to grab data for Ford and General Motors (GM).

In [9]:

ford = web.DataReader("F", 'yahoo' , start, end)

gm = web.DataReader("GM", 'yahoo' , start, end)

In [10]:

ford.head()

Out[10]: High Low Open Close Volume Adj Close

Date

2012-01-03 11.25 10.99 11.00 11.13 45709900.0 7.506939

2012-01-04 11.53 11.07 11.15 11.30 79725200.0 7.621601

2012-01-05 11.63 11.24 11.33 11.59 67877500.0 7.817202

2012-01-06 11.80 11.52 11.74 11.71 59840700.0 7.898139

2012-01-09 11.95 11.70 11.83 11.80 53981500.0 7.958842

In [11]:

ford.to_csv('Ford_Stock.csv')

In [12]:

gm.head()

Out[12]: High Low Open Close Volume Adj Close

Date

2012-01-03 21.180000 20.750000 20.830000 21.049999 9321300.0 16.269413

2012-01-04 21.370001 20.750000 21.049999 21.150000 7856700.0 16.346706

2012-01-05 22.290001 20.959999 21.100000 22.170000 17880600.0 17.135052

2012-01-06 23.030001 22.240000 22.260000 22.920000 18234500.0 17.714722

2012-01-09 23.430000 22.700001 23.200001 22.840000 12084500.0 17.652893

In [ ]:

gm.to_csv('GM_Stock.csv')

Part 2: Visualizing the Data

Time to visualize the data. Follow along and recreate the plots below according to the instructions and explanations.

Recreate the linear plot of all the stocks' Open price! Hint: For the legend, use label parameter and plt.legend().

In [14]:

from matplotlib import pyplot as plt

tesla['Open'].plot(label='Tesla',figsize=(16,8),title='Open Price')

gm['Open'].plot(label='GM')

ford['Open'].plot(label='Ford')

plt.legend()

Out[14]: <matplotlib.legend.Legend at 0x7f2285a8bbe0>

Plot the Volume of stock traded each day.

In [15]:

tesla['Volume'].plot(label='Tesla',figsize=(16,8),title='Volume Traded')

gm['Volume'].plot(label='gm')

ford['Volume'].plot(label='ford')

plt.legend()

Out[15]: <matplotlib.legend.Legend at 0x7f2285ab20b8>

As can be observed, Ford had a really big spike somewhere in late 2013. What was the date of this maximum trading volume for Ford?

In [17]:

ford['Volume'].argmax()

Out[17]: 493

The Open Price Time Series Visualization makes Tesla look like its always been much more valuable as a company than GM and Ford. But to understand this, one would need to look at the total

market cap of the company, not just the stock price. Unfortunately, the current data does not have that information of total units of the stock present. But a simple calculation can be done to represent

the total money traded. It is by multiplying the Volume column with the Open price. Remember that this still is not the actual Market Cap, it is just a visual representation of the total amount of money

being traded around using the time series.

To do the above, create a new column for each dataframe called "Total Traded" which is the Open Price multiplied by the Volume Traded.

In [19]:

tesla['Total Traded'] = tesla['Open']*tesla['Volume']

ford['Total Traded'] = ford['Open']*ford['Volume']

gm['Total Traded'] = gm['Open']*gm['Volume']

Plot the "Total Traded" against the time index.

In [20]:

tesla['Total Traded'].plot(label='Tesla',figsize=(16,8))

gm['Total Traded'].plot(label='GM')

ford['Total Traded'].plot(label='Ford')

plt.legend()

plt.ylabel('Total Traded')

Out[20]: Text(0, 0.5, 'Total Traded')

As can be observed, there was a huge amount of money traded for Tesla somewhere in early 2014. What date was that and what happened?

In [21]:

tesla['Total Traded'].argmax()

Out[21]: 538

Let us practice plotting a sample moving average (MA) of one of the cars. Plot out the MA50 and MA200 for GM.

In [22]:

gm['MA50'] = gm['Open'].rolling(50).mean()

gm['MA200'] = gm['Open'].rolling(200).mean()

gm[['Open','MA50','MA200']].plot(label='gm' ,figsize=(16,8))

Out[22]: <AxesSubplot:xlabel='Date'>

You might also like

- Red Light Camera Effectiveness EvaluationDocument33 pagesRed Light Camera Effectiveness EvaluationRochester Democrat and ChronicleNo ratings yet

- Fibo - Gann SqureDocument50 pagesFibo - Gann SqureTHIRUNAVUKKARASU ENo ratings yet

- LSTM Stock PredictionDocument38 pagesLSTM Stock PredictionKetan Ingale100% (1)

- New Age Wealth AlgoDocument12 pagesNew Age Wealth AlgoAnsh SinghNo ratings yet

- Forecasting Volatility in Stock Market Using GARCH ModelsDocument43 pagesForecasting Volatility in Stock Market Using GARCH ModelsramziNo ratings yet

- TestplanDocument18 pagesTestplanprayas_taraniNo ratings yet

- Stock FutureDocument7 pagesStock Futureapi-219943859No ratings yet

- GoogleFinance APIDocument1 pageGoogleFinance APIViral BakhadaNo ratings yet

- Azmat S&P CNX NIFTY Inc Shariah LIVE Exponential Moving AveragesDocument2 pagesAzmat S&P CNX NIFTY Inc Shariah LIVE Exponential Moving Averagesc806No ratings yet

- 7 India Stock Market TrackerDocument8 pages7 India Stock Market TrackerVijayakumar SubramaniamNo ratings yet

- StockDocument6 pagesStockLalit mohan PradhanNo ratings yet

- Siddharth Deora: Global IndicesDocument5 pagesSiddharth Deora: Global IndicesskuttamNo ratings yet

- Stock Profit Loss CalculatorDocument36 pagesStock Profit Loss CalculatorkkhgkhggkhsssaNo ratings yet

- Pivot CEDocument25 pagesPivot CEdoddyNo ratings yet

- Hexagon ChartDocument19 pagesHexagon Chartapeksha patilNo ratings yet

- Company Name Symbol Chart Link Crisil RatingDocument6 pagesCompany Name Symbol Chart Link Crisil RatingSweety DasNo ratings yet

- Pivot Point CalculatorDocument2 pagesPivot Point Calculatorrsa_9No ratings yet

- Share Khan Option CalculatorDocument2 pagesShare Khan Option CalculatorquickutNo ratings yet

- Currency Pair Eur/Usd Usd/Jpy Gbp/Usd Chf/Usd Usd/ChfDocument11 pagesCurrency Pair Eur/Usd Usd/Jpy Gbp/Usd Chf/Usd Usd/ChfTimothy T McginnisNo ratings yet

- Top 10 Article Submission SitesDocument3 pagesTop 10 Article Submission SitesAli HusnainNo ratings yet

- Gann Multi Trend - mq4Document3 pagesGann Multi Trend - mq4Denis IvanovNo ratings yet

- Moving Average Trading SystemDocument3 pagesMoving Average Trading SystemrajaNo ratings yet

- Share Khan Option CalculatorDocument2 pagesShare Khan Option Calculatorabhi1nema0% (1)

- Excellent Money Advisor: Date Script LOT Position Level TG-1 TG-2 TG3Document3 pagesExcellent Money Advisor: Date Script LOT Position Level TG-1 TG-2 TG3excellentmoneyNo ratings yet

- Support and Resistance LevelDocument2 pagesSupport and Resistance LevelSyed KhalidNo ratings yet

- Intraday Gann Calculator: Input PriceDocument1 pageIntraday Gann Calculator: Input PriceMayank ChandrakarNo ratings yet

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Document38 pagesNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNo ratings yet

- Multiple Hedging 08042017Document170 pagesMultiple Hedging 08042017Mohamed RizwanNo ratings yet

- Doji Technical ScannerDocument2 pagesDoji Technical ScannerRikNo ratings yet

- 200 DMA StocksDocument6 pages200 DMA Stockspmishra3No ratings yet

- Ratio Analysis Calculator: Particulars Current Year Previous YearDocument14 pagesRatio Analysis Calculator: Particulars Current Year Previous Yearnarasi64No ratings yet

- Stochastic Oscillator: Created by Mreinstein - Xls by HuangDocument6 pagesStochastic Oscillator: Created by Mreinstein - Xls by HuangFirdausNo ratings yet

- Amba Canslim1Document9 pagesAmba Canslim1api-266993521No ratings yet

- Future and Options in Forex TradingDocument9 pagesFuture and Options in Forex TradingBearStreetNo ratings yet

- TryDocument7 pagesTrysagar guptaNo ratings yet

- Crude and Currency CalculatorDocument5 pagesCrude and Currency CalculatorsathyasonyNo ratings yet

- Day Trading AlgorithmDocument11 pagesDay Trading AlgorithmSonia SheikhNo ratings yet

- Financial SectorDocument38 pagesFinancial SectorKshitijNo ratings yet

- Nifty ProjectionDocument4 pagesNifty ProjectiondhaneshNo ratings yet

- ASCII Character Codes CheatSheetDocument3 pagesASCII Character Codes CheatSheetPeriNo ratings yet

- $1000 Forex Plan: Primary Account Size Profit Per Month (%) Months: BalanceDocument2 pages$1000 Forex Plan: Primary Account Size Profit Per Month (%) Months: BalanceKumaran SgNo ratings yet

- Trend Formula For Bank Nifty: Open Price Low HighDocument3 pagesTrend Formula For Bank Nifty: Open Price Low HighsrivardanNo ratings yet

- Technical Analysis Signals Summary Sheet 2-10-10 11Document5 pagesTechnical Analysis Signals Summary Sheet 2-10-10 11LBTodayNo ratings yet

- Enter 8: Currencies With 4 Decimal Places Swing 1.6550 E5 E6 E7 E8 E10 E11 E12Document7 pagesEnter 8: Currencies With 4 Decimal Places Swing 1.6550 E5 E6 E7 E8 E10 E11 E12viresh333No ratings yet

- Nippon India Nifty 50 Bees ETFDocument10 pagesNippon India Nifty 50 Bees ETFAshis MingalaNo ratings yet

- Important AnalysisDocument32 pagesImportant AnalysisSandeep KumarNo ratings yet

- Nifty Premium Trading Track Record: Exit at Cost Grand TotalDocument12 pagesNifty Premium Trading Track Record: Exit at Cost Grand TotalNvrao RaoNo ratings yet

- Date Stock Date Entry Entry # of Shares Date Exit Exit Filled? Shares SoldDocument12 pagesDate Stock Date Entry Entry # of Shares Date Exit Exit Filled? Shares SoldhfjiNo ratings yet

- Option Calc v1.0Document2 pagesOption Calc v1.0mr_gauravNo ratings yet

- Commander 081212Document2 pagesCommander 081212billy100100% (1)

- Stocks ShortlistDocument24 pagesStocks Shortlistallly100% (1)

- Ticker Date/Time Close Change Pix1 Pix2 Pix3 RemarksDocument5 pagesTicker Date/Time Close Change Pix1 Pix2 Pix3 Remarksfajaraljogja100% (1)

- Ticker LTP O H L Change % Change OpenDocument22 pagesTicker LTP O H L Change % Change OpenPrasanna PharaohNo ratings yet

- AWS Marketplace DevOps Workshop Series Module 1 SlidesDocument90 pagesAWS Marketplace DevOps Workshop Series Module 1 Slidesdeniz bayraktarNo ratings yet

- Technidex: Stock Futures IndexDocument3 pagesTechnidex: Stock Futures IndexRaya DuraiNo ratings yet

- Fibonacci Buy Sell Zones: Close Degree 22.5Document11 pagesFibonacci Buy Sell Zones: Close Degree 22.5Krishnamoorthy SubramaniamNo ratings yet

- Money Management CalculatorDocument3 pagesMoney Management CalculatorjpamcicNo ratings yet

- Stock AnalysisDocument16 pagesStock AnalysisAbhisek KeshariNo ratings yet

- 27 Jupyter NotebookDocument42 pages27 Jupyter NotebookJonathan VillanuevaNo ratings yet

- 05 Data Loading, Storage and Wrangling-1Document22 pages05 Data Loading, Storage and Wrangling-1FucKerWengieNo ratings yet

- "Ang Magandang Buhay Ay Makakamtan Sa Pamamagitan NG Husay Sa Trabaho at Sakripisyo." The Good Life Is To Be Earned With Hard Work and SacrificeDocument8 pages"Ang Magandang Buhay Ay Makakamtan Sa Pamamagitan NG Husay Sa Trabaho at Sakripisyo." The Good Life Is To Be Earned With Hard Work and SacrificeRhea Joy OrcioNo ratings yet

- Part 1 General PrincipleDocument26 pagesPart 1 General PrincipleRhea Joy OrcioNo ratings yet

- Answers in Module 1Document6 pagesAnswers in Module 1Rhea Joy OrcioNo ratings yet

- Module 5Document11 pagesModule 5Rhea Joy OrcioNo ratings yet

- Geocentricity TodayDocument1 pageGeocentricity TodayRhea Joy OrcioNo ratings yet

- I. Audit of Inventories of Retail and E-CommerceDocument4 pagesI. Audit of Inventories of Retail and E-CommerceRhea Joy OrcioNo ratings yet

- Orcio FMD 08lab1.2Document54 pagesOrcio FMD 08lab1.2Rhea Joy OrcioNo ratings yet

- Module 1: Personal Development: 1.1: Examples of Values, Beliefs & Desirable QualitiesDocument8 pagesModule 1: Personal Development: 1.1: Examples of Values, Beliefs & Desirable QualitiesRhea Joy Orcio100% (2)

- Module 3: Leadership & Teamwork: "Ang Mga Lider Ay Tinuturing Na Huwaran."Document2 pagesModule 3: Leadership & Teamwork: "Ang Mga Lider Ay Tinuturing Na Huwaran."Rhea Joy OrcioNo ratings yet

- Module 2: Interpersonal Communication: The First Impression You Give Is Important in CommunicationDocument11 pagesModule 2: Interpersonal Communication: The First Impression You Give Is Important in CommunicationRhea Joy OrcioNo ratings yet

- Business Finance - 02 Worksheet 1 - ARGDocument1 pageBusiness Finance - 02 Worksheet 1 - ARGRhea Joy OrcioNo ratings yet

- Business Finance - 02 Quiz 1Document1 pageBusiness Finance - 02 Quiz 1Rhea Joy OrcioNo ratings yet

- VIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFDocument83 pagesVIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFOsamaAliMoussaNo ratings yet

- Consumer Behavior, Market Research, and AdvertisementDocument37 pagesConsumer Behavior, Market Research, and AdvertisementMohamed AbdelazizNo ratings yet

- Form Service A40gDocument1 pageForm Service A40gBrando ImanuelNo ratings yet

- BNVD Eaufrance Metadonnees Vente 20230130Document16 pagesBNVD Eaufrance Metadonnees Vente 20230130moussaouiNo ratings yet

- English Upsr: English Paper 2 - Section B 2 (B) - How To Write Your Reasons - SamplesDocument6 pagesEnglish Upsr: English Paper 2 - Section B 2 (B) - How To Write Your Reasons - SamplesAhmad Firdaus IdrisNo ratings yet

- Web Lab PDFDocument6 pagesWeb Lab PDFDevesh PandeyNo ratings yet

- HS-PS201: Simple ManualDocument6 pagesHS-PS201: Simple ManualCambiando CaminosNo ratings yet

- Western Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterDocument4 pagesWestern Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterMaria Julia DenustaNo ratings yet

- Deodorization - W. de Greyt and M. KellensDocument43 pagesDeodorization - W. de Greyt and M. KellensGabriel VoglarNo ratings yet

- g8 With Answer SheetDocument4 pagesg8 With Answer SheetMICHAEL REYESNo ratings yet

- OptiMix - Manual - EN - Rev.03.05 (Mixer)Document89 pagesOptiMix - Manual - EN - Rev.03.05 (Mixer)Đức Nguyễn100% (2)

- 4final Examination Prof Ed 10Document7 pages4final Examination Prof Ed 10Danelle EsparteroNo ratings yet

- Abyssinian Ground HornbillDocument4 pagesAbyssinian Ground HornbillEmilio Lecaros BustamanteNo ratings yet

- Health The Basics 11th Edition Donatelle Test BankDocument19 pagesHealth The Basics 11th Edition Donatelle Test BankJosephWilliamsinaom100% (6)

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- Solution Techniques For Models Yielding Ordinary Differential Equations (ODE)Document67 pagesSolution Techniques For Models Yielding Ordinary Differential Equations (ODE)Nikhil DewalkarNo ratings yet

- SD Hackman Leading TeamsDocument13 pagesSD Hackman Leading TeamsIliana SanmartinNo ratings yet

- Unit Iv Secondary and Auxilary Motions 12Document3 pagesUnit Iv Secondary and Auxilary Motions 129043785763No ratings yet

- Ged Test Accom App AdhdDocument7 pagesGed Test Accom App AdhdJeannette DorfmanNo ratings yet

- PR m1Document15 pagesPR m1Jazmyn BulusanNo ratings yet

- Moxa PT g7728 Series Manual v1.4Document128 pagesMoxa PT g7728 Series Manual v1.4Walter Oluoch OtienoNo ratings yet

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- Uji Chi SquareDocument5 pagesUji Chi Squareeldiya yuliSNo ratings yet

- SkillsDocument7 pagesSkillsRufus RajNo ratings yet

- Worksheet Research-Title FINALDocument3 pagesWorksheet Research-Title FINALJierroe EvangelistaNo ratings yet

- Support/downloads or Scan Above QR Code For Detailed Policy WordingDocument10 pagesSupport/downloads or Scan Above QR Code For Detailed Policy Wordingraj VenkateshNo ratings yet

- WRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkDocument2 pagesWRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkFatmah El WardagyNo ratings yet

- Glumac Shanghai Office Fall 2016Document4 pagesGlumac Shanghai Office Fall 2016NagaraniNo ratings yet

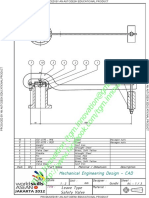

- Task 6 - Leave Type Safety ValveDocument3 pagesTask 6 - Leave Type Safety ValveTeguh RaharjoNo ratings yet