Professional Documents

Culture Documents

Statement of Management Responsibility

Statement of Management Responsibility

Uploaded by

GERALD MADAMBACopyright:

Available Formats

You might also like

- E-Bill: How Can We Help?Document2 pagesE-Bill: How Can We Help?Alexandru IonescuNo ratings yet

- SMR For BIR-uploadDocument1 pageSMR For BIR-uploadRich Gatdula100% (7)

- SMR For Sole ProprietorsDocument1 pageSMR For Sole Proprietorsflordelei hocate100% (4)

- Portfolio Part 2: Practical Case Study InstructionsDocument4 pagesPortfolio Part 2: Practical Case Study InstructionsNour KhairallahNo ratings yet

- Sf1 With Auto Age Computation (No Password)Document6 pagesSf1 With Auto Age Computation (No Password)Arcee Ardiente Mondragon80% (5)

- Comparative Rhetorical Analysis FinalDocument7 pagesComparative Rhetorical Analysis Finalapi-296678382No ratings yet

- Sme1st Reso MaybankDocument9 pagesSme1st Reso MaybankAhmad HazwanNo ratings yet

- SMR2020Document2 pagesSMR2020G4 AMOYO ANGELICA NICOLENo ratings yet

- Madaum Resource Labor Service CooperativeDocument1 pageMadaum Resource Labor Service CooperativeProbinsyana KoNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityDonnie Ray DistajoNo ratings yet

- Statement of Management'S Responsibility For Financial StatementsDocument2 pagesStatement of Management'S Responsibility For Financial StatementsNicole AnditNo ratings yet

- 2022 Statement of Management's ResponsibilityDocument3 pages2022 Statement of Management's ResponsibilitymarabillonjanetNo ratings yet

- UntitledDocument3 pagesUntitledKim Patrice NavarraNo ratings yet

- Statement of Management'S Responsibility For Annual Income Tax ReturnDocument2 pagesStatement of Management'S Responsibility For Annual Income Tax ReturnRyan PazonNo ratings yet

- Flamen, Inc.: Statement of Management Responsibility For Annual Income Tax ReturnDocument2 pagesFlamen, Inc.: Statement of Management Responsibility For Annual Income Tax Returndaryl canozaNo ratings yet

- NTNI - Statement of Management Responsibility - 2022 PDFDocument2 pagesNTNI - Statement of Management Responsibility - 2022 PDFmario j padillaNo ratings yet

- SMR - BirDocument1 pageSMR - BirGideon HilardeNo ratings yet

- Statement of Management'S Responsibility For The Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For The Annual Income Tax ReturnSTYLEE CORPORATIONNo ratings yet

- Statement of Management Format 2020Document2 pagesStatement of Management Format 2020Noan SimanNo ratings yet

- DHN Construction & Development CorporationDocument5 pagesDHN Construction & Development CorporationBernadette BuanNo ratings yet

- SMR FOR BIR SampleDocument1 pageSMR FOR BIR SampleAnn Cristine Cabebe100% (1)

- SMR For ITRDocument1 pageSMR For ITRACYATAN & CO., CPAs 2020No ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementHarrah Daine Lilis NatividadNo ratings yet

- SMR Bir Gla Merch.2022Document1 pageSMR Bir Gla Merch.2022Paolo Martin Lagos AdrianoNo ratings yet

- Statement of Management'S ResponsibiilityDocument1 pageStatement of Management'S ResponsibiilityDianneNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityFrancisqueteNo ratings yet

- Sang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial StatementsDocument2 pagesSang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial Statementssangryul anNo ratings yet

- SMR For ITR 2022Document1 pageSMR For ITR 2022Micaela VillanuevaNo ratings yet

- Statement of ManagementDocument31 pagesStatement of ManagementSharmz SalazarNo ratings yet

- For Signature DoneDocument3 pagesFor Signature DoneJayson LeybaNo ratings yet

- WWCC 2022 SMR For BIRDocument1 pageWWCC 2022 SMR For BIRMisheru AlmarioNo ratings yet

- TenorioDocument1 pageTenorioGaddiel NasolNo ratings yet

- Auditors ReportDocument6 pagesAuditors ReportMayette VegaNo ratings yet

- xxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNDocument1 pagexxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNGlen JavellanaNo ratings yet

- Management ResponsibilityDocument1 pageManagement ResponsibilityShana Marie C. GañoNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument3 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceRicoNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrBaldovino VenturesNo ratings yet

- Statement of ManagementDocument4 pagesStatement of ManagementMaria Cristina VicenteNo ratings yet

- Statement of MNGT Responsibility For Annual Itr Sideco 2018Document1 pageStatement of MNGT Responsibility For Annual Itr Sideco 2018NERALENE DIAZ EBIONo ratings yet

- President/Chief Executive OfficerDocument2 pagesPresident/Chief Executive OfficerPatOcampoNo ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- RITCHARD A. ACAO, Complete and Correct in All Material RespectsDocument1 pageRITCHARD A. ACAO, Complete and Correct in All Material RespectsCrispaYojSalvaneraCabanasNo ratings yet

- AE114 CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS - Final-Exam - MERELOS, RAE JENINA E. BSA-1CDocument85 pagesAE114 CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS - Final-Exam - MERELOS, RAE JENINA E. BSA-1CRae Jeniña E.MerelosNo ratings yet

- Statement of Management'S ResponsibilityDocument1 pageStatement of Management'S ResponsibilityLizanne Gaurana100% (1)

- Statement of Management ResponsibilityDocument2 pagesStatement of Management ResponsibilityRENATO CAPUNONo ratings yet

- Statement of Management ResponsibilityDocument2 pagesStatement of Management ResponsibilityBee ThreeallNo ratings yet

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Balabat Statement of Management Responsibility-Income Tax No.4Document1 pageBalabat Statement of Management Responsibility-Income Tax No.4Ma. Consolacion TambaoanNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementDaisuke InoueNo ratings yet

- Auditing in CisDocument2 pagesAuditing in CisBelle B.No ratings yet

- Regional District of Central Kootenay Financial Statements For 2020Document46 pagesRegional District of Central Kootenay Financial Statements For 2020Lex AckerNo ratings yet

- New SMR For Income Tax ReturnDocument2 pagesNew SMR For Income Tax ReturnJoseph TordaNo ratings yet

- Statement of ManagementDocument2 pagesStatement of ManagementLembot TiqueNo ratings yet

- Statement of Management'S Responsibility For Financial StatementsDocument12 pagesStatement of Management'S Responsibility For Financial StatementsRonald Allan QuicayNo ratings yet

- SMR For Sole PropDocument1 pageSMR For Sole PropMarijune LetargoNo ratings yet

- Aj Salam Training Center: Statement of Management'S ResponsibilityDocument1 pageAj Salam Training Center: Statement of Management'S ResponsibilityJheza Mae PitogoNo ratings yet

- New Format SMR 2016Document4 pagesNew Format SMR 2016Joel RazNo ratings yet

- Statement of Management Responsibility For CorpDocument2 pagesStatement of Management Responsibility For CorpKevin Ray BajadoNo ratings yet

- Statement of MGMT ResponsibilityDocument1 pageStatement of MGMT Responsibilitykristdestination056No ratings yet

- AFS HardwareDocument32 pagesAFS HardwareThabiso MojakisaneNo ratings yet

- Management's Responsibilities TemplateDocument2 pagesManagement's Responsibilities TemplatePau SantosNo ratings yet

- Statement of Management's Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management's Responsibility For Annual Income Tax ReturnAlice Ordoño LedamaNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management Responsibilityariel jueves calditNo ratings yet

- Regional District of Central Kootenay SOFI 2020Document40 pagesRegional District of Central Kootenay SOFI 2020Lex AckerNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- INDIGODocument2 pagesINDIGOapi-19776105No ratings yet

- Endorsement For Issuance of Gate Pass Id Request FormDocument4 pagesEndorsement For Issuance of Gate Pass Id Request FormDOÑYA AVANo ratings yet

- Black and Blue Modern Startup Pitch Deck Presentation-2Document1 pageBlack and Blue Modern Startup Pitch Deck Presentation-2LAV•DAKNo ratings yet

- University of Calcutta: B.A. LL.B. (Hons.)Document3 pagesUniversity of Calcutta: B.A. LL.B. (Hons.)Shivendra SinghNo ratings yet

- AM No. 10-3-7-SC Rules On E-FilingDocument4 pagesAM No. 10-3-7-SC Rules On E-FilingNarciso Reyes Jr.No ratings yet

- 5Document2 pages5Navneet JainNo ratings yet

- Planning: Advantages and Disadvantages of MigrationDocument2 pagesPlanning: Advantages and Disadvantages of Migrationشاب مسلم سني لحما دماNo ratings yet

- Criminal Law 2 Quiz 3Document1 pageCriminal Law 2 Quiz 3Zubair BatuaNo ratings yet

- Incident Response Handling: Michael Trofi, CISSP, CISM, CGEIT, GPEN Trofi SecurityDocument34 pagesIncident Response Handling: Michael Trofi, CISSP, CISM, CGEIT, GPEN Trofi SecurityPanneerselvam KolandaivelNo ratings yet

- Application For Employment (Staff) v1Document2 pagesApplication For Employment (Staff) v1Hana DillaNo ratings yet

- TDS Fosroc Solvent 102 Saudi ArabiaDocument2 pagesTDS Fosroc Solvent 102 Saudi ArabiaShaikhRizwanNo ratings yet

- Land Administration in BangladeshDocument32 pagesLand Administration in BangladeshManjare Hassin RaadNo ratings yet

- 2014 HIPAA & OSHA HSD TrainingDocument2 pages2014 HIPAA & OSHA HSD TrainingKristi Tomlinson EdstromNo ratings yet

- Analysis of Doctrines: Sweat of The Brow' & Modicum of Creativity' VisDocument9 pagesAnalysis of Doctrines: Sweat of The Brow' & Modicum of Creativity' Vischristine jimenezNo ratings yet

- ComponentbuilderDocument3 pagesComponentbuilderChrétien KenfackNo ratings yet

- Plaintiff Elizabeth Kogucki Brief in Support of Complaint For Administrative ReviewDocument16 pagesPlaintiff Elizabeth Kogucki Brief in Support of Complaint For Administrative ReviewGregory J. Bueche100% (1)

- 6 - TRO-PI (Motion)Document47 pages6 - TRO-PI (Motion)tgillmanNo ratings yet

- Chapter 07 - Exercises - Part IDocument2 pagesChapter 07 - Exercises - Part IRawan YasserNo ratings yet

- App Iii Summer Midterm ExamDocument9 pagesApp Iii Summer Midterm ExamCharmaine PamintuanNo ratings yet

- 1782 SA IhalelerDocument29 pages1782 SA IhalelerKharisma Rahman FadillahNo ratings yet

- Risk and Opportunities Register Bulacan State UniversityDocument58 pagesRisk and Opportunities Register Bulacan State UniversityNiezel Sabrido100% (1)

- Notable Filipino +foreigner Graduates of HarvardDocument6 pagesNotable Filipino +foreigner Graduates of HarvardKielEzekielNo ratings yet

- IRCTC Next Generation ETicketing SystemDocument3 pagesIRCTC Next Generation ETicketing SystemVictoria LambertNo ratings yet

- E3h7 Financialreport enDocument7 pagesE3h7 Financialreport enperfilma2013No ratings yet

- Auditing Construction and Real Estate IndustryDocument10 pagesAuditing Construction and Real Estate IndustryBrafiel Claire Curambao LibayNo ratings yet

Statement of Management Responsibility

Statement of Management Responsibility

Uploaded by

GERALD MADAMBAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Management Responsibility

Statement of Management Responsibility

Uploaded by

GERALD MADAMBACopyright:

Available Formats

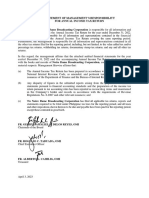

TAMDAGAN UNITED RURAL ENHANCE DEVELOPMENT ASSOCIATION INC.

Brgy. 25 Tamdagan, Vintar, Ilocos Norte

STATEMENT OF MANAGEMENT’S RESPONSIBILITY

FOR

ANNUAL INCOME TAX RETURN

The Management of TAMDAGAN UNITED RURAL ENHANCE DEVELOPMENT

ASSOCIATION INC. is responsible for all informations and representations contained in the

Annual Income Tax Return for the year ended December 31, 2020. Management is likewise

responsible for all informations and representations contained in the financial statements

accompanying the (Annual Income Tax Return or Annual Information Return) covering the same

reporting period. Furthermore, the Management is responsible for all informations and

representations contained in all the other tax returns filed for the reporting period, including, but not

limited, to the value added tax and/or percentage tax returns, withholding tax returns, documentary

stamp tax returns, and any and all other tax returns.

In this regard, the Management affirms that the attached audited financial statements for the

years ended December 31, 2020, the accompanying Annual Income Tax Return are in accordance

with the books and records of TAMDAGAN UNITED RURAL ENHANCE DEVELOPMENT

ASSOCIATION INC. complete and correct in all material respects. Management likewise affirms

that:

a) the Annual Income Tax Return has been prepared in accordance with the provisions

of the National Internal Revenue Code, as amended, and pertinent tax regulations and

other issuances of the Department of Finance and the Bureau of Internal Revenue;

b) any disparity of figures in the submitted reports arising from the preparation of financial

statements pursuant to financial accounting standards and the preparation of the income tax

return pursuant to tax accounting rules has been reported as reconciling items and maintained

in the company’s books and records in accordance with the requirements of Revenue

Regulations No. 8-2007 and other relevant issuances;

c) the TAMDAGAN UNITED RURAL ENHANCE DEVELOPMENT ASSOCIATION

INC. has filed all applicable tax returns, reports and statements required to be filed under

Philippine tax laws for the reporting period, and all taxes and other impositions shown

thereon to be due and payable have been paid for the reporting period, except those contested

in good faith.

FLORENTINO VEGA

President

ROGER RAMOS

Treasurer

Signed this 9th day of February 2021

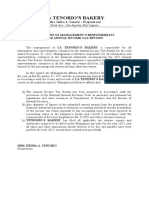

TAMDAGAN UNITED RURAL ENHANCE DEVELOPMENT ASSOCIATION INC.

Brgy. 25 Tamdagan, Vintar, Ilocos Norte

STATEMENT OF MANAGEMENT’S RESPONSIBILITY

FOR

FINANCIAL STATEMENTS

The management of TAMDAGAN UNITED RURAL ENHANCE DEVELOPMENT

ASSOCIATION INC. is responsible for all informations and representations contained in the financial

statements for the years ended December 31, 2020 and 2019 in accordance with the Philippine

Financial Reporting Standards. This responsibility includes designing and implementing internal

controls relevant to the preparation and fair presentation of financial statements that are free from

material misstatement, whether due to fraud or error, selecting and applying appropriate accounting

policies, and making accounting estimates that are reasonable in circumstances.

The Board of Trustees reviews and approves the financial statements and submits the same to the

members.

GERALD L. MADAMBA, CPA, the independent auditor appointed by the board for the periods

ended December 31, 2020 and December 31, 2019 has examined the financial statements of the

company in accordance with Philippine Standards on Auditing, and in his report to the members, has

expressed his opinion on the fairness of presentation upon completion of such examinations.

FLORENTINO VEGA

President

ROGER RAMOS

Treasurer

Signed this 9th day of February 2021

You might also like

- E-Bill: How Can We Help?Document2 pagesE-Bill: How Can We Help?Alexandru IonescuNo ratings yet

- SMR For BIR-uploadDocument1 pageSMR For BIR-uploadRich Gatdula100% (7)

- SMR For Sole ProprietorsDocument1 pageSMR For Sole Proprietorsflordelei hocate100% (4)

- Portfolio Part 2: Practical Case Study InstructionsDocument4 pagesPortfolio Part 2: Practical Case Study InstructionsNour KhairallahNo ratings yet

- Sf1 With Auto Age Computation (No Password)Document6 pagesSf1 With Auto Age Computation (No Password)Arcee Ardiente Mondragon80% (5)

- Comparative Rhetorical Analysis FinalDocument7 pagesComparative Rhetorical Analysis Finalapi-296678382No ratings yet

- Sme1st Reso MaybankDocument9 pagesSme1st Reso MaybankAhmad HazwanNo ratings yet

- SMR2020Document2 pagesSMR2020G4 AMOYO ANGELICA NICOLENo ratings yet

- Madaum Resource Labor Service CooperativeDocument1 pageMadaum Resource Labor Service CooperativeProbinsyana KoNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityDonnie Ray DistajoNo ratings yet

- Statement of Management'S Responsibility For Financial StatementsDocument2 pagesStatement of Management'S Responsibility For Financial StatementsNicole AnditNo ratings yet

- 2022 Statement of Management's ResponsibilityDocument3 pages2022 Statement of Management's ResponsibilitymarabillonjanetNo ratings yet

- UntitledDocument3 pagesUntitledKim Patrice NavarraNo ratings yet

- Statement of Management'S Responsibility For Annual Income Tax ReturnDocument2 pagesStatement of Management'S Responsibility For Annual Income Tax ReturnRyan PazonNo ratings yet

- Flamen, Inc.: Statement of Management Responsibility For Annual Income Tax ReturnDocument2 pagesFlamen, Inc.: Statement of Management Responsibility For Annual Income Tax Returndaryl canozaNo ratings yet

- NTNI - Statement of Management Responsibility - 2022 PDFDocument2 pagesNTNI - Statement of Management Responsibility - 2022 PDFmario j padillaNo ratings yet

- SMR - BirDocument1 pageSMR - BirGideon HilardeNo ratings yet

- Statement of Management'S Responsibility For The Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For The Annual Income Tax ReturnSTYLEE CORPORATIONNo ratings yet

- Statement of Management Format 2020Document2 pagesStatement of Management Format 2020Noan SimanNo ratings yet

- DHN Construction & Development CorporationDocument5 pagesDHN Construction & Development CorporationBernadette BuanNo ratings yet

- SMR FOR BIR SampleDocument1 pageSMR FOR BIR SampleAnn Cristine Cabebe100% (1)

- SMR For ITRDocument1 pageSMR For ITRACYATAN & CO., CPAs 2020No ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementHarrah Daine Lilis NatividadNo ratings yet

- SMR Bir Gla Merch.2022Document1 pageSMR Bir Gla Merch.2022Paolo Martin Lagos AdrianoNo ratings yet

- Statement of Management'S ResponsibiilityDocument1 pageStatement of Management'S ResponsibiilityDianneNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityFrancisqueteNo ratings yet

- Sang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial StatementsDocument2 pagesSang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial Statementssangryul anNo ratings yet

- SMR For ITR 2022Document1 pageSMR For ITR 2022Micaela VillanuevaNo ratings yet

- Statement of ManagementDocument31 pagesStatement of ManagementSharmz SalazarNo ratings yet

- For Signature DoneDocument3 pagesFor Signature DoneJayson LeybaNo ratings yet

- WWCC 2022 SMR For BIRDocument1 pageWWCC 2022 SMR For BIRMisheru AlmarioNo ratings yet

- TenorioDocument1 pageTenorioGaddiel NasolNo ratings yet

- Auditors ReportDocument6 pagesAuditors ReportMayette VegaNo ratings yet

- xxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNDocument1 pagexxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNGlen JavellanaNo ratings yet

- Management ResponsibilityDocument1 pageManagement ResponsibilityShana Marie C. GañoNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument3 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceRicoNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrBaldovino VenturesNo ratings yet

- Statement of ManagementDocument4 pagesStatement of ManagementMaria Cristina VicenteNo ratings yet

- Statement of MNGT Responsibility For Annual Itr Sideco 2018Document1 pageStatement of MNGT Responsibility For Annual Itr Sideco 2018NERALENE DIAZ EBIONo ratings yet

- President/Chief Executive OfficerDocument2 pagesPresident/Chief Executive OfficerPatOcampoNo ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- RITCHARD A. ACAO, Complete and Correct in All Material RespectsDocument1 pageRITCHARD A. ACAO, Complete and Correct in All Material RespectsCrispaYojSalvaneraCabanasNo ratings yet

- AE114 CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS - Final-Exam - MERELOS, RAE JENINA E. BSA-1CDocument85 pagesAE114 CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS - Final-Exam - MERELOS, RAE JENINA E. BSA-1CRae Jeniña E.MerelosNo ratings yet

- Statement of Management'S ResponsibilityDocument1 pageStatement of Management'S ResponsibilityLizanne Gaurana100% (1)

- Statement of Management ResponsibilityDocument2 pagesStatement of Management ResponsibilityRENATO CAPUNONo ratings yet

- Statement of Management ResponsibilityDocument2 pagesStatement of Management ResponsibilityBee ThreeallNo ratings yet

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Balabat Statement of Management Responsibility-Income Tax No.4Document1 pageBalabat Statement of Management Responsibility-Income Tax No.4Ma. Consolacion TambaoanNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementDaisuke InoueNo ratings yet

- Auditing in CisDocument2 pagesAuditing in CisBelle B.No ratings yet

- Regional District of Central Kootenay Financial Statements For 2020Document46 pagesRegional District of Central Kootenay Financial Statements For 2020Lex AckerNo ratings yet

- New SMR For Income Tax ReturnDocument2 pagesNew SMR For Income Tax ReturnJoseph TordaNo ratings yet

- Statement of ManagementDocument2 pagesStatement of ManagementLembot TiqueNo ratings yet

- Statement of Management'S Responsibility For Financial StatementsDocument12 pagesStatement of Management'S Responsibility For Financial StatementsRonald Allan QuicayNo ratings yet

- SMR For Sole PropDocument1 pageSMR For Sole PropMarijune LetargoNo ratings yet

- Aj Salam Training Center: Statement of Management'S ResponsibilityDocument1 pageAj Salam Training Center: Statement of Management'S ResponsibilityJheza Mae PitogoNo ratings yet

- New Format SMR 2016Document4 pagesNew Format SMR 2016Joel RazNo ratings yet

- Statement of Management Responsibility For CorpDocument2 pagesStatement of Management Responsibility For CorpKevin Ray BajadoNo ratings yet

- Statement of MGMT ResponsibilityDocument1 pageStatement of MGMT Responsibilitykristdestination056No ratings yet

- AFS HardwareDocument32 pagesAFS HardwareThabiso MojakisaneNo ratings yet

- Management's Responsibilities TemplateDocument2 pagesManagement's Responsibilities TemplatePau SantosNo ratings yet

- Statement of Management's Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management's Responsibility For Annual Income Tax ReturnAlice Ordoño LedamaNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management Responsibilityariel jueves calditNo ratings yet

- Regional District of Central Kootenay SOFI 2020Document40 pagesRegional District of Central Kootenay SOFI 2020Lex AckerNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- INDIGODocument2 pagesINDIGOapi-19776105No ratings yet

- Endorsement For Issuance of Gate Pass Id Request FormDocument4 pagesEndorsement For Issuance of Gate Pass Id Request FormDOÑYA AVANo ratings yet

- Black and Blue Modern Startup Pitch Deck Presentation-2Document1 pageBlack and Blue Modern Startup Pitch Deck Presentation-2LAV•DAKNo ratings yet

- University of Calcutta: B.A. LL.B. (Hons.)Document3 pagesUniversity of Calcutta: B.A. LL.B. (Hons.)Shivendra SinghNo ratings yet

- AM No. 10-3-7-SC Rules On E-FilingDocument4 pagesAM No. 10-3-7-SC Rules On E-FilingNarciso Reyes Jr.No ratings yet

- 5Document2 pages5Navneet JainNo ratings yet

- Planning: Advantages and Disadvantages of MigrationDocument2 pagesPlanning: Advantages and Disadvantages of Migrationشاب مسلم سني لحما دماNo ratings yet

- Criminal Law 2 Quiz 3Document1 pageCriminal Law 2 Quiz 3Zubair BatuaNo ratings yet

- Incident Response Handling: Michael Trofi, CISSP, CISM, CGEIT, GPEN Trofi SecurityDocument34 pagesIncident Response Handling: Michael Trofi, CISSP, CISM, CGEIT, GPEN Trofi SecurityPanneerselvam KolandaivelNo ratings yet

- Application For Employment (Staff) v1Document2 pagesApplication For Employment (Staff) v1Hana DillaNo ratings yet

- TDS Fosroc Solvent 102 Saudi ArabiaDocument2 pagesTDS Fosroc Solvent 102 Saudi ArabiaShaikhRizwanNo ratings yet

- Land Administration in BangladeshDocument32 pagesLand Administration in BangladeshManjare Hassin RaadNo ratings yet

- 2014 HIPAA & OSHA HSD TrainingDocument2 pages2014 HIPAA & OSHA HSD TrainingKristi Tomlinson EdstromNo ratings yet

- Analysis of Doctrines: Sweat of The Brow' & Modicum of Creativity' VisDocument9 pagesAnalysis of Doctrines: Sweat of The Brow' & Modicum of Creativity' Vischristine jimenezNo ratings yet

- ComponentbuilderDocument3 pagesComponentbuilderChrétien KenfackNo ratings yet

- Plaintiff Elizabeth Kogucki Brief in Support of Complaint For Administrative ReviewDocument16 pagesPlaintiff Elizabeth Kogucki Brief in Support of Complaint For Administrative ReviewGregory J. Bueche100% (1)

- 6 - TRO-PI (Motion)Document47 pages6 - TRO-PI (Motion)tgillmanNo ratings yet

- Chapter 07 - Exercises - Part IDocument2 pagesChapter 07 - Exercises - Part IRawan YasserNo ratings yet

- App Iii Summer Midterm ExamDocument9 pagesApp Iii Summer Midterm ExamCharmaine PamintuanNo ratings yet

- 1782 SA IhalelerDocument29 pages1782 SA IhalelerKharisma Rahman FadillahNo ratings yet

- Risk and Opportunities Register Bulacan State UniversityDocument58 pagesRisk and Opportunities Register Bulacan State UniversityNiezel Sabrido100% (1)

- Notable Filipino +foreigner Graduates of HarvardDocument6 pagesNotable Filipino +foreigner Graduates of HarvardKielEzekielNo ratings yet

- IRCTC Next Generation ETicketing SystemDocument3 pagesIRCTC Next Generation ETicketing SystemVictoria LambertNo ratings yet

- E3h7 Financialreport enDocument7 pagesE3h7 Financialreport enperfilma2013No ratings yet

- Auditing Construction and Real Estate IndustryDocument10 pagesAuditing Construction and Real Estate IndustryBrafiel Claire Curambao LibayNo ratings yet