Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

23 viewsBonds - January 24 2022

Bonds - January 24 2022

Uploaded by

Lisle Daverin BlythThis document provides a summary of South African market and commodity figures for January 24, 2022. It includes statistics on total market turnover, foreign client market turnover, index levels for various bond indexes including the All Bond Index and inflation linked bond index, constituent bonds of the All Bond Index with their current and previous month-to-date returns, and other interest rates including JIBAR and retail bond rates. In summary, it presents an overview of activity and performance in the South African bond and money markets on this date.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Distressed Debt PresentationDocument16 pagesDistressed Debt PresentationDistressedDebtInvest92% (12)

- Intermediate Accounting 2 AnswersDocument18 pagesIntermediate Accounting 2 AnswersFery AnnNo ratings yet

- Intermediate Accounting 2 - SyllabusDocument14 pagesIntermediate Accounting 2 - SyllabusJennifer Rasonabe100% (1)

- Remedial Law 2 - Brondial Notes PDFDocument228 pagesRemedial Law 2 - Brondial Notes PDFAudrey100% (1)

- Bonds - January 18 2022Document3 pagesBonds - January 18 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - January 25 2019Document3 pagesBonds - January 25 2019Lisle Daverin BlythNo ratings yet

- Bonds - February 19 2019Document3 pagesBonds - February 19 2019Tiso Blackstar GroupNo ratings yet

- Bonds - August 30 2022Document3 pagesBonds - August 30 2022Lisle Daverin BlythNo ratings yet

- Bonds - February 22 2021Document3 pagesBonds - February 22 2021Lisle Daverin BlythNo ratings yet

- Bonds - March 29 2018Document6 pagesBonds - March 29 2018Tiso Blackstar GroupNo ratings yet

- Bonds - July 21 2022Document3 pagesBonds - July 21 2022Lisle Daverin BlythNo ratings yet

- Bonds - January 28 2019Document3 pagesBonds - January 28 2019Tiso Blackstar GroupNo ratings yet

- Bonds - January 16 2017Document3 pagesBonds - January 16 2017Tiso Blackstar GroupNo ratings yet

- Bonds - August 27 2019Document3 pagesBonds - August 27 2019Lisle Daverin BlythNo ratings yet

- Bonds - August 31 2021Document3 pagesBonds - August 31 2021Lisle Daverin BlythNo ratings yet

- Bonds - January 31 2022Document3 pagesBonds - January 31 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - March 13 2022Document3 pagesBonds - March 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 11 2017Document6 pagesBonds - April 11 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - January 13 2022Document3 pagesBonds - January 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - June 8 2022Document3 pagesBonds - June 8 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 22 2021Document3 pagesBonds - April 22 2021Lisle Daverin BlythNo ratings yet

- Bonds - April 10 2019Document3 pagesBonds - April 10 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 20 2019Document3 pagesBonds - February 20 2019Tiso Blackstar GroupNo ratings yet

- Bonds PDFDocument6 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Bonds - February 20 2018Document3 pagesBonds - February 20 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 20 2022Document3 pagesBonds - January 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - February 14 2019Document3 pagesBonds - February 14 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 15 2018Document3 pagesBonds - February 15 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 29 2019Document3 pagesBonds - January 29 2019Tiso Blackstar GroupNo ratings yet

- Bonds - April 12 2022Document3 pagesBonds - April 12 2022Lisle Daverin BlythNo ratings yet

- Bonds - August 21 2017Document3 pagesBonds - August 21 2017Tiso Blackstar GroupNo ratings yet

- Bonds - September 26 2022Document3 pagesBonds - September 26 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 17 2022Document3 pagesBonds - July 17 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 25 2021Document3 pagesBonds - July 25 2021Lisle Daverin BlythNo ratings yet

- Bonds - February 21 2019Document3 pagesBonds - February 21 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 10 2018Document3 pagesBonds - September 10 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 19 2022Document3 pagesBonds - January 19 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 9 2020Document3 pagesBonds - July 9 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 28 2019Document3 pagesBonds - April 28 2019Lisle Daverin BlythNo ratings yet

- Bonds - August 24 2020Document3 pagesBonds - August 24 2020Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 2 2021Document3 pagesBonds - September 2 2021Lisle Daverin BlythNo ratings yet

- Bonds - August 18 2021Document3 pagesBonds - August 18 2021Lisle Daverin BlythNo ratings yet

- Bonds - January 26 2022Document3 pagesBonds - January 26 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 17 2017Document3 pagesBonds - September 17 2017Tiso Blackstar GroupNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Bonds - May 4 2021Document3 pagesBonds - May 4 2021Lisle Daverin BlythNo ratings yet

- Bonds - February 6 2018Document3 pagesBonds - February 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 12 2021Document3 pagesBonds - January 12 2021Lisle Daverin BlythNo ratings yet

- Bonds - July 20 2022Document3 pagesBonds - July 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 24 2022Document3 pagesBonds - July 24 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 24 2021Document3 pagesBonds - February 24 2021Lisle Daverin BlythNo ratings yet

- Bonds - August 16 2018Document3 pagesBonds - August 16 2018Tiso Blackstar GroupNo ratings yet

- Modern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondFrom EverandModern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondRating: 4 out of 5 stars4/5 (2)

- Liberty - December 11 2022Document1 pageLiberty - December 11 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 11 2022Document1 pageFuel Prices - December 11 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 9 2022Document1 pageFuel Prices - December 9 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 6 2022Document1 pageFuel Prices - December 6 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 6 2022Document2 pagesSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 1 2022Document1 pageFuel Prices - December 1 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - December 5 2022Document2 pagesFairbairn - December 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 9 2022Document3 pagesBonds - December 9 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 6 2022Document3 pagesBonds - December 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 1 2022Document3 pagesBonds - December 1 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 1 2022Document2 pagesSanlam Stratus Funds - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 5 2022Document3 pagesBonds - December 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 30 2022Document3 pagesBonds - November 30 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 29 2022Document3 pagesBonds - November 29 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 1 2022Document1 pageLiberty - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 23 2022Document3 pagesBonds - November 23 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - November 29 2022Document2 pagesFairbairn - November 29 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 23 2022Document1 pageFuel Prices - November 23 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 29 2022Document1 pageFuel Prices - November 29 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 22 2022Document3 pagesBonds - November 22 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 22 2022Document1 pageFuel Prices - November 22 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 21 2022Document3 pagesBonds - November 21 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 21 2022Document1 pageFuel Prices - November 21 2022Lisle Daverin BlythNo ratings yet

- Bodie Investments CH03Document41 pagesBodie Investments CH03rafat.jalladNo ratings yet

- Group 3 - Cash and Marketable SecuritiesDocument71 pagesGroup 3 - Cash and Marketable SecuritiesNaia SNo ratings yet

- Invest in The PhilippinesDocument187 pagesInvest in The PhilippinesnonoyzNo ratings yet

- 16 International Portfolio Investment: Chapter ObjectivesDocument14 pages16 International Portfolio Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- FIMA 40023 Security Analysis FinalsDocument14 pagesFIMA 40023 Security Analysis FinalsPrincess ErickaNo ratings yet

- 6 - International Bond MarketDocument19 pages6 - International Bond MarketdarshanzamwarNo ratings yet

- AUD-FinPB 05.22Document14 pagesAUD-FinPB 05.22Luis Martin PunayNo ratings yet

- Valuation of Bonds PDFDocument6 pagesValuation of Bonds PDFMoud KhalfaniNo ratings yet

- MODULE 2 Lecture Notes (Jeff Madura)Document5 pagesMODULE 2 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- Financial Environment: Financial Markets of PakistanDocument26 pagesFinancial Environment: Financial Markets of PakistanMuneeb UmairNo ratings yet

- Issuance Process of Commercial Paper CPsDocument3 pagesIssuance Process of Commercial Paper CPsmohakbhutaNo ratings yet

- Mock Qualifying Exam PDFDocument21 pagesMock Qualifying Exam PDFAngel Madelene BernardoNo ratings yet

- Investors Conference 2013Document268 pagesInvestors Conference 2013Nitin Soni100% (1)

- Cooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5Document13 pagesCooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5My-Acts Of-SeditionNo ratings yet

- 8 - Financial Instruments - TUTORIAL 1Document3 pages8 - Financial Instruments - TUTORIAL 1Aina SaffiyahNo ratings yet

- Learning Activity Sheets in General Mathematics Week 5Document7 pagesLearning Activity Sheets in General Mathematics Week 5Aguila AlvinNo ratings yet

- Tianjin Plastics (China) : Maple EnergyDocument11 pagesTianjin Plastics (China) : Maple EnergySoraya ReneNo ratings yet

- Borrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashDocument7 pagesBorrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashSimply Debt SolutionsNo ratings yet

- Luzon Surety v. QuebrarDocument2 pagesLuzon Surety v. Quebrarkim_santos_20100% (1)

- FIN 102 Banking and Financial InstitutionsDocument10 pagesFIN 102 Banking and Financial Institutionsron aviNo ratings yet

- T Accounts For Common Transactions. Into To AccountngDocument23 pagesT Accounts For Common Transactions. Into To AccountngyajkrNo ratings yet

- Bonds and DepreciationDocument12 pagesBonds and DepreciationJayson Cuadra PagalaNo ratings yet

- Individual Assignem (Minyichel)Document16 pagesIndividual Assignem (Minyichel)samuel debebeNo ratings yet

- Intermediate Accounting Ii: ADM3340 A Fall 2016Document12 pagesIntermediate Accounting Ii: ADM3340 A Fall 2016divyaNo ratings yet

- Project Report - Vikas PatelDocument99 pagesProject Report - Vikas PatelArjun LakhaniNo ratings yet

- Dimensional Sustainability Models Portfolios BrochureDocument11 pagesDimensional Sustainability Models Portfolios Brochurealejandro315amNo ratings yet

Bonds - January 24 2022

Bonds - January 24 2022

Uploaded by

Lisle Daverin Blyth0 ratings0% found this document useful (0 votes)

23 views3 pagesThis document provides a summary of South African market and commodity figures for January 24, 2022. It includes statistics on total market turnover, foreign client market turnover, index levels for various bond indexes including the All Bond Index and inflation linked bond index, constituent bonds of the All Bond Index with their current and previous month-to-date returns, and other interest rates including JIBAR and retail bond rates. In summary, it presents an overview of activity and performance in the South African bond and money markets on this date.

Original Description:

Bonds - January 24 2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a summary of South African market and commodity figures for January 24, 2022. It includes statistics on total market turnover, foreign client market turnover, index levels for various bond indexes including the All Bond Index and inflation linked bond index, constituent bonds of the All Bond Index with their current and previous month-to-date returns, and other interest rates including JIBAR and retail bond rates. In summary, it presents an overview of activity and performance in the South African bond and money markets on this date.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

23 views3 pagesBonds - January 24 2022

Bonds - January 24 2022

Uploaded by

Lisle Daverin BlythThis document provides a summary of South African market and commodity figures for January 24, 2022. It includes statistics on total market turnover, foreign client market turnover, index levels for various bond indexes including the All Bond Index and inflation linked bond index, constituent bonds of the All Bond Index with their current and previous month-to-date returns, and other interest rates including JIBAR and retail bond rates. In summary, it presents an overview of activity and performance in the South African bond and money markets on this date.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Markets and Commodity figures

24 January 2022

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1,194 26.60 bn Rbn 27.39 210 56.90 bn Rbn 52.67

Week to Date 1,194 26.60 bn Rbn 27.39 210 56.90 bn Rbn 52.67

Month to Date 15,089 488.41 bn Rbn 488.11 3,789 791.17 bn Rbn 796.07

Year to Date 15,089 488.41 bn Rbn 488.11 3,789 791.17 bn Rbn 796.07

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 58 2.06 bn Rbn 2.00 14 2.16 bn Rbn 1.88

Current Day Sell 72 4.27 bn Rbn 3.99 32 11.35 bn Rbn 10.48

Net -14 -2.21 bn Rbn -1.99 -18 -9.19 bn Rbn -8.59

Buy 58 2.06 bn Rbn 2.00 14 2.16 bn Rbn 1.88

Week to Date Sell 72 4.27 bn Rbn 3.99 32 11.35 bn Rbn 10.48

Net -14 -2.21 bn Rbn -1.99 -18 -9.19 bn Rbn -8.59

Buy 1,023 81.24 bn Rbn 80.95 148 25.35 bn Rbn 22.89

Month to Date Sell 956 74.24 bn Rbn 72.07 284 102.69 bn Rbn 99.00

Net 67 7.00 bn Rbn 8.88 -136 -77.34 bn Rbn -76.11

Buy 1,023 81.24 bn Rbn 80.95 148 25.35 bn Rbn 22.89

Year to Date Sell 956 74.24 bn Rbn 72.07 284 102.69 bn Rbn 99.00

Net 67 7.00 bn Rbn 8.88 -136 -77.34 bn Rbn -76.11

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.456%

All Bond Index Top 832.542

20 Composite 836.122 1.19% 1.19%

GOVI 9.467%Split - 821.516

ALBI20 Issuer Class GOVI 825.011 1.19% 1.19%

OTHI 9.363%

ALBI20 Issuer Class Split - 882.579

OTHI 886.710 1.24% 1.24%

CILI15 3.402%

Composite Inflation 307.514

Linked Index Top 15 307.120 -1.71% -1.71%

ICOR 2.970%

CILI15 Issuer Class 382.745

Split - ICOR 382.667 -0.32% -0.32%

IGOV 3.407%

CILI15 Issuer Class 304.525

Split - IGOV 304.125 -1.78% -1.78%

ISOE 4.075%

CILI15 Issuer Class 330.794

Split - ISOE 330.357 0.00% 0.00%

MMI JSE Money Market Index

0 296.007 295.906 0.26% 0.26%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Feb 2023

AFRICA 5.210% 5.125% 5.07% 5.21%

R203 REPUBLIC OF SOUTH

Nov 2023

AFRICA 6.860% 6.775% 6.72% 6.86%

ES18 ESKOM HOLDINGSAugLIMITED

2025 8.485% 8.450% 8.45% 8.76%

R204 REPUBLIC OF SOUTH

Apr 2026

AFRICA 8.545% 8.510% 8.51% 8.88%

R207 REPUBLIC OF SOUTH

Dec 2026

AFRICA 7.645% 7.610% 7.61% 7.98%

R208 REPUBLIC OF SOUTH

Nov 2027

AFRICA 9.515% 9.480% 9.48% 9.85%

ES23 ESKOM HOLDINGS

NovLIMITED

2028 9.945% 9.910% 9.91% 10.28%

DV23 DEVELOPMENT JanBANK

2030

OF SOUTHERN

9.285% AFRICA 9.215% 9.22% 9.52%

R2023 REPUBLIC OF SOUTH

Feb 2031

AFRICA 9.555% 9.490% 9.49% 9.80%

ES26 ESKOM HOLDINGS

MarLIMITED

2032 9.745% 9.680% 9.68% 10.00%

R186 REPUBLIC OF SOUTH

Sep 2033

AFRICA 11.160% 11.085% 11.09% 11.45%

R2030 REPUBLIC OF SOUTH

Jul 2034

AFRICA 11.020% 10.945% 10.95% 11.35%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 10.235% 10.155% 10.16% 10.51%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 10.210% 10.135% 10.14% 10.50%

ES33 ESKOM HOLDINGSJanLIMITED

2037 10.415% 10.345% 10.35% 10.75%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 10.505% 10.420% 10.42% 10.84%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 10.505% 10.425% 10.43% 10.83%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 11.575% 11.495% 11.50% 11.90%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 10.550% 10.470% 10.47% 10.88%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 10.500% 10.415% 10.42% 10.83%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate3.580% 3.580% 3.58% 3.58%

JIBAR1 JIBAR 1 Month 3.742% 3.742% 3.74% 3.74%

JIBAR3 JIBAR 3 Month 3.892% 3.892% 3.89% 3.89%

JIBAR6 JIBAR 6 Month 4.783% 4.783% 4.66% 4.78%

RSA 2 year retail bond 5.75% 0 0 0

RSA 3 year retail bond 7.25% 0 0 0

RSA 5 year retail bond 9.25% 0 0 0

RSA 3 year inflation linked retail

3.50%

bond 0 0 0

RSA 5 year inflation linked retail

3.75%

bond 0 0 0

RSA 10 year inflation linked retail

4.50%

bond 0 0 0

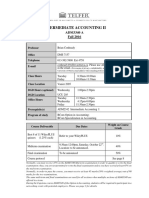

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Distressed Debt PresentationDocument16 pagesDistressed Debt PresentationDistressedDebtInvest92% (12)

- Intermediate Accounting 2 AnswersDocument18 pagesIntermediate Accounting 2 AnswersFery AnnNo ratings yet

- Intermediate Accounting 2 - SyllabusDocument14 pagesIntermediate Accounting 2 - SyllabusJennifer Rasonabe100% (1)

- Remedial Law 2 - Brondial Notes PDFDocument228 pagesRemedial Law 2 - Brondial Notes PDFAudrey100% (1)

- Bonds - January 18 2022Document3 pagesBonds - January 18 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - January 25 2019Document3 pagesBonds - January 25 2019Lisle Daverin BlythNo ratings yet

- Bonds - February 19 2019Document3 pagesBonds - February 19 2019Tiso Blackstar GroupNo ratings yet

- Bonds - August 30 2022Document3 pagesBonds - August 30 2022Lisle Daverin BlythNo ratings yet

- Bonds - February 22 2021Document3 pagesBonds - February 22 2021Lisle Daverin BlythNo ratings yet

- Bonds - March 29 2018Document6 pagesBonds - March 29 2018Tiso Blackstar GroupNo ratings yet

- Bonds - July 21 2022Document3 pagesBonds - July 21 2022Lisle Daverin BlythNo ratings yet

- Bonds - January 28 2019Document3 pagesBonds - January 28 2019Tiso Blackstar GroupNo ratings yet

- Bonds - January 16 2017Document3 pagesBonds - January 16 2017Tiso Blackstar GroupNo ratings yet

- Bonds - August 27 2019Document3 pagesBonds - August 27 2019Lisle Daverin BlythNo ratings yet

- Bonds - August 31 2021Document3 pagesBonds - August 31 2021Lisle Daverin BlythNo ratings yet

- Bonds - January 31 2022Document3 pagesBonds - January 31 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - March 13 2022Document3 pagesBonds - March 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 11 2017Document6 pagesBonds - April 11 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - January 13 2022Document3 pagesBonds - January 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - June 8 2022Document3 pagesBonds - June 8 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 22 2021Document3 pagesBonds - April 22 2021Lisle Daverin BlythNo ratings yet

- Bonds - April 10 2019Document3 pagesBonds - April 10 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 20 2019Document3 pagesBonds - February 20 2019Tiso Blackstar GroupNo ratings yet

- Bonds PDFDocument6 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Bonds - February 20 2018Document3 pagesBonds - February 20 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 20 2022Document3 pagesBonds - January 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - February 14 2019Document3 pagesBonds - February 14 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 15 2018Document3 pagesBonds - February 15 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 29 2019Document3 pagesBonds - January 29 2019Tiso Blackstar GroupNo ratings yet

- Bonds - April 12 2022Document3 pagesBonds - April 12 2022Lisle Daverin BlythNo ratings yet

- Bonds - August 21 2017Document3 pagesBonds - August 21 2017Tiso Blackstar GroupNo ratings yet

- Bonds - September 26 2022Document3 pagesBonds - September 26 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 17 2022Document3 pagesBonds - July 17 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 25 2021Document3 pagesBonds - July 25 2021Lisle Daverin BlythNo ratings yet

- Bonds - February 21 2019Document3 pagesBonds - February 21 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 10 2018Document3 pagesBonds - September 10 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 19 2022Document3 pagesBonds - January 19 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 9 2020Document3 pagesBonds - July 9 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 28 2019Document3 pagesBonds - April 28 2019Lisle Daverin BlythNo ratings yet

- Bonds - August 24 2020Document3 pagesBonds - August 24 2020Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 2 2021Document3 pagesBonds - September 2 2021Lisle Daverin BlythNo ratings yet

- Bonds - August 18 2021Document3 pagesBonds - August 18 2021Lisle Daverin BlythNo ratings yet

- Bonds - January 26 2022Document3 pagesBonds - January 26 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 17 2017Document3 pagesBonds - September 17 2017Tiso Blackstar GroupNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Bonds - May 4 2021Document3 pagesBonds - May 4 2021Lisle Daverin BlythNo ratings yet

- Bonds - February 6 2018Document3 pagesBonds - February 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - January 12 2021Document3 pagesBonds - January 12 2021Lisle Daverin BlythNo ratings yet

- Bonds - July 20 2022Document3 pagesBonds - July 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 24 2022Document3 pagesBonds - July 24 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 24 2021Document3 pagesBonds - February 24 2021Lisle Daverin BlythNo ratings yet

- Bonds - August 16 2018Document3 pagesBonds - August 16 2018Tiso Blackstar GroupNo ratings yet

- Modern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondFrom EverandModern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondRating: 4 out of 5 stars4/5 (2)

- Liberty - December 11 2022Document1 pageLiberty - December 11 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 11 2022Document1 pageFuel Prices - December 11 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 9 2022Document1 pageFuel Prices - December 9 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 6 2022Document1 pageFuel Prices - December 6 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 6 2022Document2 pagesSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 1 2022Document1 pageFuel Prices - December 1 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - December 5 2022Document2 pagesFairbairn - December 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 9 2022Document3 pagesBonds - December 9 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 6 2022Document3 pagesBonds - December 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 1 2022Document3 pagesBonds - December 1 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 1 2022Document2 pagesSanlam Stratus Funds - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 5 2022Document3 pagesBonds - December 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 30 2022Document3 pagesBonds - November 30 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 29 2022Document3 pagesBonds - November 29 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 1 2022Document1 pageLiberty - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 23 2022Document3 pagesBonds - November 23 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - November 29 2022Document2 pagesFairbairn - November 29 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 23 2022Document1 pageFuel Prices - November 23 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 29 2022Document1 pageFuel Prices - November 29 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 22 2022Document3 pagesBonds - November 22 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 22 2022Document1 pageFuel Prices - November 22 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 21 2022Document3 pagesBonds - November 21 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 21 2022Document1 pageFuel Prices - November 21 2022Lisle Daverin BlythNo ratings yet

- Bodie Investments CH03Document41 pagesBodie Investments CH03rafat.jalladNo ratings yet

- Group 3 - Cash and Marketable SecuritiesDocument71 pagesGroup 3 - Cash and Marketable SecuritiesNaia SNo ratings yet

- Invest in The PhilippinesDocument187 pagesInvest in The PhilippinesnonoyzNo ratings yet

- 16 International Portfolio Investment: Chapter ObjectivesDocument14 pages16 International Portfolio Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- FIMA 40023 Security Analysis FinalsDocument14 pagesFIMA 40023 Security Analysis FinalsPrincess ErickaNo ratings yet

- 6 - International Bond MarketDocument19 pages6 - International Bond MarketdarshanzamwarNo ratings yet

- AUD-FinPB 05.22Document14 pagesAUD-FinPB 05.22Luis Martin PunayNo ratings yet

- Valuation of Bonds PDFDocument6 pagesValuation of Bonds PDFMoud KhalfaniNo ratings yet

- MODULE 2 Lecture Notes (Jeff Madura)Document5 pagesMODULE 2 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- Financial Environment: Financial Markets of PakistanDocument26 pagesFinancial Environment: Financial Markets of PakistanMuneeb UmairNo ratings yet

- Issuance Process of Commercial Paper CPsDocument3 pagesIssuance Process of Commercial Paper CPsmohakbhutaNo ratings yet

- Mock Qualifying Exam PDFDocument21 pagesMock Qualifying Exam PDFAngel Madelene BernardoNo ratings yet

- Investors Conference 2013Document268 pagesInvestors Conference 2013Nitin Soni100% (1)

- Cooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5Document13 pagesCooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5My-Acts Of-SeditionNo ratings yet

- 8 - Financial Instruments - TUTORIAL 1Document3 pages8 - Financial Instruments - TUTORIAL 1Aina SaffiyahNo ratings yet

- Learning Activity Sheets in General Mathematics Week 5Document7 pagesLearning Activity Sheets in General Mathematics Week 5Aguila AlvinNo ratings yet

- Tianjin Plastics (China) : Maple EnergyDocument11 pagesTianjin Plastics (China) : Maple EnergySoraya ReneNo ratings yet

- Borrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashDocument7 pagesBorrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashSimply Debt SolutionsNo ratings yet

- Luzon Surety v. QuebrarDocument2 pagesLuzon Surety v. Quebrarkim_santos_20100% (1)

- FIN 102 Banking and Financial InstitutionsDocument10 pagesFIN 102 Banking and Financial Institutionsron aviNo ratings yet

- T Accounts For Common Transactions. Into To AccountngDocument23 pagesT Accounts For Common Transactions. Into To AccountngyajkrNo ratings yet

- Bonds and DepreciationDocument12 pagesBonds and DepreciationJayson Cuadra PagalaNo ratings yet

- Individual Assignem (Minyichel)Document16 pagesIndividual Assignem (Minyichel)samuel debebeNo ratings yet

- Intermediate Accounting Ii: ADM3340 A Fall 2016Document12 pagesIntermediate Accounting Ii: ADM3340 A Fall 2016divyaNo ratings yet

- Project Report - Vikas PatelDocument99 pagesProject Report - Vikas PatelArjun LakhaniNo ratings yet

- Dimensional Sustainability Models Portfolios BrochureDocument11 pagesDimensional Sustainability Models Portfolios Brochurealejandro315amNo ratings yet