Professional Documents

Culture Documents

A Study of Financial Performance of NBFCS: Davinder Kaur

A Study of Financial Performance of NBFCS: Davinder Kaur

Uploaded by

Ubaid DarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study of Financial Performance of NBFCS: Davinder Kaur

A Study of Financial Performance of NBFCS: Davinder Kaur

Uploaded by

Ubaid DarCopyright:

Available Formats

International Journal of Management, IT & Engineering

Vol. 8 Issue 10, October 2018,

ISSN: 2249-0558 Impact Factor: 7.119

Journal Homepage: http://www.ijmra.us, Email: editorijmie@gmail.com

Double-Blind Peer Reviewed Refereed Open Access International Journal - Included in the International Serial

Directories Indexed & Listed at: Ulrich's Periodicals Directory ©, U.S.A., Open J-Gage as well as in Cabell’s

Directories of Publishing Opportunities, U.S.A

A STUDY OF FINANCIAL PERFORMANCE OF

NBFCs

DAVINDER KAUR*

ABSTRACT

NBFCs (Non-bank financial companies) play a very vital role in participating in the development

of an economy by providing a fillip to transportation, employment generation, wealth creation,

bank credit in rural segments and to support financially weaker sections of the society. NBFCs

are financial intermediaries engaged in the business of accepting deposits delivering credit and

play an important role in channelizing the scarce financial resources to capital formation. In

India, despite being different from banks, NBFC are bound by the Indian banking industry rules

and regulations. Present paper aims at studying the financial performance of NBFCs and its

comparison with previous years. Financial performance of NBFCs has been studied from

different parameters viz expenses, incomes, taxes, profits, assets etc.

KEYWORDS

NBFCs, intermediaries, capital formation, financial performance, channelizing

*

ASSISTANT PROFESSOR IN COMMERCE,PUNJABI UNIVERSITY CONSTITUENT COLLEGE

GHUDDA (BATHINDA),PUNJAB, INDIA

48 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

INTRODUCTION

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act,

1956 engaged in the business of loans and advances, acquisition of

shares/stocks/bonds/debentures/securities issued by Government or local authority or other

marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business

but does not include any institution whose principal business is that of agriculture activity,

industrial activity, purchase or sale of any goods (other than securities) or providing any services

and sale/purchase/construction of immovable property. A non-banking institution which is a

company and has principal business of receiving deposits under any scheme or arrangement in

one lump sum or in installments by way of contributions or in any other manner, is also a non-

banking financial company (Residuary non-banking company).

The different types of NBFCs are as follows:

Asset Finance Company (AFC) : An AFC is a company which is a financial institution

carrying on as its principal business the financing of physical assets supporting

productive/economic activity, such as automobiles, tractors, lathe machines, generator sets, earth

moving and material handling equipments, moving on own power and general purpose industrial

machines. Principal business for this purpose is defined as aggregate of financing real/physical

assets supporting economic activity and income arising there from is not less than 60% of its

total assets and total income respectively.

Investment Company (IC): IC means any company which is a financial institution carrying on

as its principal business the acquisition of securities,

Loan Company (LC): LC means any company which is a financial institution carrying on as its

principal business the providing of finance whether by making loans or advances or otherwise

for any activity other than its own but does not include an Asset Finance Company.

Infrastructure Finance Company (IFC): IFC is a non-banking finance company a) which

deploys at least 75 per cent of its total assets in infrastructure loans, b) has a minimum Net

49 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

Owned Funds of Rs 300 crore, c) has a minimum credit rating of ‘A ‘or equivalent d) and a

CRAR of 15%.

Core Investment Company (CIC-ND-SI): CIC-ND-SI is an NBFC carrying on the business of

acquisition of shares and securities.

Infrastructure Debt Fund: Non- Banking Financial Company (IDF-NBFC): IDF-NBFC is a

company registered as NBFC to facilitate the flow of long term debt into infrastructure projects.

IDF-NBFC raise resources through issue of Rupee or Dollar denominated bonds of minimum 5

year maturity. Only Infrastructure Finance Companies (IFC) can sponsor IDF-NBFCs.

Non-Banking Financial Company - Micro Finance Institution (NBFC-MFI): NBFC-MFI is

a non-deposit taking NBFC having not less than 85% of its assets in the nature of qualifying

assets which satisfy the following criteria:

a. loan disbursed by an NBFC-MFI to a borrower with a rural household annual income not

exceeding Rs 1,00,000 or urban and semi-urban household income not exceeding Rs 1,60,000;

Loan amount does not exceed Rs 50,000 in the first cycle and Rs 1, 00,000 in subsequent cycles;

Total indebtedness of the borrower does not exceed Rs 1, 00,000;

tenure of the loan not to be less than 24 months for loan amount in excess of Rs 15,000 with

prepayment without penalty;

Loan to be extended without collateral;

Aggregate amount of loans, given for income generation, is not less than 50 per cent of the total

loans given by the MFIs;

Loan is repayable on weekly, fortnightly or monthly installments at the choice of the borrower

Non-Banking Financial Company – Factors (NBFC-Factors): NBFC-Factor is a non-deposit

taking NBFC engaged in the principal business of factoring. The financial assets in the factoring

business should constitute at least 50 percent of its total assets and its income derived from

factoring business should not be less than 50 percent of its gross income.

50 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

Mortgage Guarantee Companies (MGC) - MGC are financial institutions for which at least

90% of the business turnover is mortgage guarantee business or at least 90% of the gross income

is from mortgage guarantee business and net owned fund is Rs 100 crore.

NBFC- Non-Operative Financial Holding Company (NOFHC) is financial institution through

which promoter / promoter groups will be permitted to set up a new bank .It’s a wholly-owned

Non-Operative Financial Holding Company (NOFHC) which will hold the bank as well as all

other financial services companies regulated by RBI or other financial sector regulators, to the

extent permissible under the applicable regulatory prescriptions.

LITERATURE REVIEWs

For the purpose of current study, the following literature is reviewed:

Akanksha Goel in her article in ‘ELK Asia Pacific Journal’ studied the growth prospects of

NBFCs in India.

Sunita yadav in her article in ‘International journal of recent scientific research’ studied the

financial performance of selected NBFCs on parameters like Net profit ratio, Return on

Investment, Annual growth rate etc.

Ranjan kshetrimayum in his article in ‘A journal of Radix International educational and

research consortium’ studied the evolution, growth and development of NBFCs in India.

OBJECTIVES OF STUDY

1. To study the financial performance of NBFCs

2. To compare the performance with previous years.

RESEARCH METHODOLOGY

The secondary data has been collected from RBI's data warehouse and other related journals.

51 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

DATA ANALYSIS

Data has been presented and analyzed using tables, graphs and statistical tools. The various

indicators of financial performance of NBFCs viz income, expenses, tax provisions, operating

profit, net profit, total assets have been taken and analyzed for last 4 financial years. Apart from

this various ratios are also analyzed. The following table shows the various financial indicators

from the financial year 2013-14 to financial year 2016-17:

(Amount in Rs. Billions)

Indicator/year 2013-14 2014-15 2015-16 2016-17

Income 257 246 355 401

expenditure 195 189 287 324

Tax provisions 20 17 23 27

Operating profit 62 57 68 77

(profit before

tax)

Net profit (profit 42 40 45 50

after tax)

(Source: RBI database on Indian economy)

income (in billions) Expenditure (in

450 billions)

400

350 350

300 300

250 250

200 200

150 income (in 150 Expenditur

100 billions) 100 e (in

50 50 billions)

0 0

2013-14

2014-15

2015-16

2016-17

52 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

Profit before tax (in profit after tax (in

billions) billions)

100 60

80 50

40

60

30

40 Profit before profit after

20

20 tax (in tax (in

billions) 10

billions)

0 0

The following table shows the ratio of various financial indicators to total assets:

(Rupees in billions)

Ratios / Year 2013-14 2014-15 2015-16 2016-17

Total assets 1615 1925 2386 2755

Income to total 15.9 12.8 14.9 14.5

assets

Expenditure to 12.1 9.8 12.0 11.8

total assets

Tax provisions to 1.2 0.9 1.0 1.0

total assets

Net profit to total 2.6 2.1 1.9 1.8

assets

(Source: RBI database on Indian economy)

53 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

Income to Assets Expenditure to Assets

ratio (in percentage) ratio (in percentage)

18 14

16 12

14

10

12

10 8

income to expenditur

8 assets 6 e to assets

6 ratio (in (in

percentaa 4 percentag

4

ge) 2 e)

2

0 0

Tax provisions to Net profit to assets

assets ratio (in ratio (in percentage)

percentage) 3

1.4 2.5

1.2 2

1

Tax 1.5 Net profit

0.8

provisions to assets

0.6 1 ratio (in

to assets

0.4 percentag

ratio (in 0.5

0.2 percentag e)

0 e) 0

FINDINGS

The Income of NBFCs from various sources decreased in the financial year 2014-15 as

compared to the year 2013-14 but it is increasing in the year 2015-16 and 2016-17.

The expenditures of NBFCs also decreased in the financial year 2014-15 as compared to

the year 2013-14 but it is increasing in the year 2015-16 and 2016-17.

54 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

NBFCs are contributing in the economic development of country in form of taxes.

However their tax provisions fall in the year 2014-15 as compared to the year 2013-14 but tax

provisions are increasing in the year 2015-16 and 2016-17.

Both profit before taxes and profit after taxes fall in the year 2014-15 as compared to

2013-14 but rise in the year 2015 onwards.

Total Assets of NBFCs are continuously increasing from 2013-14 till 2016-17.

The ratio of Income to total assets fall in the year 2014-15 as compared to 2013-14, it

rises in the year 2015-16 and again fall a bit in the year 2016-17.

The ratio of expenditure to total assets fall in the year 2014-15 as compared to 2013-14, it

rises in the year 2015-16 and again fall in the year 2016-17.

The ratio of tax provisions to total assets fall in the year 2014-15 as compared to 2013-

14, it rises in the year 2015-16 and remain constant in the year 2016-17.

The ratio of Net profit to total assets is falling from the year 2014-15 onwards

CONCLUSION

To sum up, the financial performance of NBFCs is quiet satisfactory. All the parameters like

Incomes, expenditure, taxes, PBT, PAT, various ratios fall in the year 2014-15 but all these

parameters are rising from the year 20115-16 onwards. The total assets of NBFCs are also

continuously rising which is a good indicator of sound financial position. With this sound

financial position and good financial performance NBFCs can and are contributing in the

economic growth of country.

REFERNCES

www.rbi.org

www.google.com

www.scholar.google.co.in

www.reserchgate.net

www.elkjournals.com

www.recentscietific.com

55 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

You might also like

- Capital Budgeting of ITC Company LimitedDocument12 pagesCapital Budgeting of ITC Company LimitedRama Sardesai50% (2)

- 02 de Leon v. RodriguezDocument2 pages02 de Leon v. Rodriguezrobby100% (2)

- An Analytical Study On Financial Performance of The ICICI BankDocument4 pagesAn Analytical Study On Financial Performance of The ICICI Bankvidhya vijayanNo ratings yet

- A Project Report ON Working Capital Management Icici Bank LTDDocument64 pagesA Project Report ON Working Capital Management Icici Bank LTDMukesh Prabhakar67% (3)

- (51,52) SEBI Controlled NBFCsDocument43 pages(51,52) SEBI Controlled NBFCsYadwinder SinghNo ratings yet

- NBFC Edelweise Retail FinanceDocument14 pagesNBFC Edelweise Retail FinancesunitaNo ratings yet

- A Comparative Study of Growth Analysis oDocument3 pagesA Comparative Study of Growth Analysis oKirti GorivaleNo ratings yet

- Icici BankDocument16 pagesIcici BankGulafsha AnsariNo ratings yet

- 09p165 Mbfi Swot AnalysisDocument9 pages09p165 Mbfi Swot AnalysisrudranilsterNo ratings yet

- New Financial Performance of Icici BankDocument10 pagesNew Financial Performance of Icici BankcityNo ratings yet

- B.B.A., L.L.B. (Hons.) / Third Semester-2021Document17 pagesB.B.A., L.L.B. (Hons.) / Third Semester-2021Anoushka SudNo ratings yet

- NBFC Project Report by MS. Sonia JariaDocument34 pagesNBFC Project Report by MS. Sonia JariaSonia SoniNo ratings yet

- NBFC in IndaDocument26 pagesNBFC in Indajuvi_kNo ratings yet

- Finance ProjectDocument64 pagesFinance Projectshayandas357No ratings yet

- NBFC PDFDocument44 pagesNBFC PDFayushi guptaNo ratings yet

- Export Factoring in IndiaDocument3 pagesExport Factoring in IndiawrqNo ratings yet

- Financial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)Document6 pagesFinancial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)International Journal of Innovative Science and Research Technology100% (1)

- NBFC - Vinay Kumar MouryaDocument8 pagesNBFC - Vinay Kumar Mouryamadhurkj1512No ratings yet

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- Comparison of Bajaj Finance Limited and It's NBFC CompetitorsDocument7 pagesComparison of Bajaj Finance Limited and It's NBFC CompetitorsMukund DixitNo ratings yet

- Term Paper On Financial Performance Analysis of Southeast Bank LimitedDocument14 pagesTerm Paper On Financial Performance Analysis of Southeast Bank LimitedMasuma Binte SakhawatNo ratings yet

- Idbi Bank: Presented By: Chetan Goel Meenakshi Surbhi Agarwal Pallavi TikooDocument15 pagesIdbi Bank: Presented By: Chetan Goel Meenakshi Surbhi Agarwal Pallavi TikooChetan GoelNo ratings yet

- Data 2010Document9 pagesData 2010krittika03No ratings yet

- Performance Analysis - NBFCS - IndiaDocument55 pagesPerformance Analysis - NBFCS - IndiaRajeev RsNo ratings yet

- Woking CapitalDocument91 pagesWoking CapitalSanthosh SomaNo ratings yet

- DESARTETION Project 2022 EIILMDocument27 pagesDESARTETION Project 2022 EIILMDebajit DasNo ratings yet

- WCFDocument19 pagesWCFAnkita DasNo ratings yet

- BANK INDUSTRY ANALYSIS (AutoRecovered)Document9 pagesBANK INDUSTRY ANALYSIS (AutoRecovered)AntraNo ratings yet

- Company Name:Itc: Business Finance Assignment Sectio NCDocument13 pagesCompany Name:Itc: Business Finance Assignment Sectio NCDIVYANG AGARWAL 2023291No ratings yet

- ICICI Bank Annual Report FY2021Document318 pagesICICI Bank Annual Report FY2021SAKSHI KANOJIANo ratings yet

- Bank Industry AnalysisDocument9 pagesBank Industry AnalysisAntraNo ratings yet

- Index: Sr. No. Chapters Page NoDocument21 pagesIndex: Sr. No. Chapters Page NogrishiNo ratings yet

- Investment Report - IDBIDocument3 pagesInvestment Report - IDBIAnubrata_MullickNo ratings yet

- Group 05Document18 pagesGroup 05Shifat ShahriarNo ratings yet

- Encl. As Above I. Role of NbfcsDocument6 pagesEncl. As Above I. Role of NbfcsAnkur PandeyNo ratings yet

- Final Project of Financial AccountingDocument41 pagesFinal Project of Financial AccountingakshataNo ratings yet

- Genesis Institute of Business ManagementPuneDocument22 pagesGenesis Institute of Business ManagementPunemanoj jaiswalNo ratings yet

- Financial Performance AnalysisDocument9 pagesFinancial Performance AnalysisNelson MandelaNo ratings yet

- DuPont AnalysisDocument14 pagesDuPont AnalysisManika AggarwalNo ratings yet

- Shraddha ProjectDocument70 pagesShraddha ProjectAkshay Harekar50% (2)

- Public Bank & Private BankDocument97 pagesPublic Bank & Private BankHimangini Singh100% (2)

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocument13 pagesNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way Forwardshubham moonNo ratings yet

- Module 6 - NBFCDocument31 pagesModule 6 - NBFCSonali JagathNo ratings yet

- AFM Assignment 1Document7 pagesAFM Assignment 1mahima.manjupadma2000No ratings yet

- Ajay Pillai Finanacial Report-1Document10 pagesAjay Pillai Finanacial Report-1Ajay PillaiNo ratings yet

- "Reforms in Financial System": Submitted To Nisarg Joshi Submitted byDocument25 pages"Reforms in Financial System": Submitted To Nisarg Joshi Submitted byChirag PugaliyaNo ratings yet

- Final SidbiDocument19 pagesFinal SidbiSahil TrehanNo ratings yet

- Financial PlanDocument22 pagesFinancial PlanVenkatesh EpNo ratings yet

- Edelvise ProjectDocument21 pagesEdelvise ProjectsunitaNo ratings yet

- Financial Performance of Icici Bank LTDDocument116 pagesFinancial Performance of Icici Bank LTDRicardo Nitish KumarNo ratings yet

- NBFC in IndiaDocument19 pagesNBFC in IndiaBharath ReddyNo ratings yet

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalNo ratings yet

- Cash Management of Icici BankDocument19 pagesCash Management of Icici BankBassam QureshiNo ratings yet

- Title of Project-Credit Risk Management in Banks Name of CompanyDocument12 pagesTitle of Project-Credit Risk Management in Banks Name of CompanyAarti GuptaNo ratings yet

- Research Paper On NBFC in IndiaDocument5 pagesResearch Paper On NBFC in Indiaafnkhqqbzoeckk100% (1)

- Najmus Sahar Sayed Gazia SayedDocument16 pagesNajmus Sahar Sayed Gazia SayedRohit AroraNo ratings yet

- Name: Kirti-S-DodejaDocument15 pagesName: Kirti-S-DodejaMUKESH MANWANINo ratings yet

- Analysis of Icici Bank A Report On Business Strategy: Submitted To: Prof. Vikas ChandraDocument22 pagesAnalysis of Icici Bank A Report On Business Strategy: Submitted To: Prof. Vikas ChandraIshu GoelNo ratings yet

- Mahindra Finance Project PDFDocument60 pagesMahindra Finance Project PDFIMAM JAVOORNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Hotstar: Decoding The Enigma: Key Words: Hotstar, 3-Tranche Model, OTT IndustryDocument18 pagesHotstar: Decoding The Enigma: Key Words: Hotstar, 3-Tranche Model, OTT IndustryUbaid DarNo ratings yet

- Chapter 12. The Term Structure of Interest RatesDocument37 pagesChapter 12. The Term Structure of Interest RatesUbaid DarNo ratings yet

- Amity College of Commerce & Finance Weekly Progress Report For The Week Commencing: 18 OCTOBER 2021 OCTOBER 2021Document1 pageAmity College of Commerce & Finance Weekly Progress Report For The Week Commencing: 18 OCTOBER 2021 OCTOBER 2021Ubaid DarNo ratings yet

- Risk and Return: DR Amit KR SinhaDocument88 pagesRisk and Return: DR Amit KR SinhaUbaid DarNo ratings yet

- Behavioural Finance Case StudyDocument5 pagesBehavioural Finance Case StudyUbaid DarNo ratings yet

- Single Index Model: Prof Mahesh Kumar Amity Business SchoolDocument9 pagesSingle Index Model: Prof Mahesh Kumar Amity Business SchoolUbaid DarNo ratings yet

- Mutual FDSDocument21 pagesMutual FDSUbaid DarNo ratings yet

- Module I: Introduction To Business AnalyticsDocument17 pagesModule I: Introduction To Business AnalyticsUbaid DarNo ratings yet

- Basics of Corporate Re-Structuring, Mergers and AcquisitionsDocument13 pagesBasics of Corporate Re-Structuring, Mergers and AcquisitionsUbaid DarNo ratings yet

- Case Study On Exchange Rate RiskDocument2 pagesCase Study On Exchange Rate RiskUbaid DarNo ratings yet

- Cognitive Analytics & Social Skills For Professional DevelopmentDocument53 pagesCognitive Analytics & Social Skills For Professional DevelopmentUbaid DarNo ratings yet

- IFRS Adoption and Capital Markets: Elkana K. KimeliDocument12 pagesIFRS Adoption and Capital Markets: Elkana K. KimeliUbaid DarNo ratings yet

- PE ScaleDocument4 pagesPE ScaleUbaid DarNo ratings yet

- Capital Asset Pricing ModelDocument12 pagesCapital Asset Pricing ModelUbaid DarNo ratings yet

- Indian Capital Market: Current Scenario & Road AheadDocument45 pagesIndian Capital Market: Current Scenario & Road AheadUbaid DarNo ratings yet

- Course Title: Credit Units: 3 Course Code: ECON605Document3 pagesCourse Title: Credit Units: 3 Course Code: ECON605Ubaid DarNo ratings yet

- Vidya Jyoti Assignment Sheet 2021Document2 pagesVidya Jyoti Assignment Sheet 2021Ubaid DarNo ratings yet

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocument13 pagesNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardUbaid DarNo ratings yet

- Time Value of Money - ProblemsDocument11 pagesTime Value of Money - ProblemsUbaid Dar100% (1)

- Organization BehaviorDocument6 pagesOrganization BehaviorUbaid DarNo ratings yet

- B. CommunicationDocument5 pagesB. CommunicationUbaid DarNo ratings yet

- Associates: Case 24Document3 pagesAssociates: Case 24Ubaid DarNo ratings yet

- Impact of Behavioral Finance & Traditional Finance On Financial Decision Making ProcessDocument8 pagesImpact of Behavioral Finance & Traditional Finance On Financial Decision Making ProcessUbaid DarNo ratings yet

- People v. Kintanar, CTA EB Crim No. 006, December 3, 2010Document32 pagesPeople v. Kintanar, CTA EB Crim No. 006, December 3, 2010Kriszan ManiponNo ratings yet

- WORC Medical Declaration Cover Letter 2024Document2 pagesWORC Medical Declaration Cover Letter 2024Guilbert CimeneNo ratings yet

- CAT LectureDocument4 pagesCAT LectureAlphie Laureta PeraltaNo ratings yet

- Child Protection in EmergenciesDocument80 pagesChild Protection in Emergencieskristi_hariNo ratings yet

- Juan v. Juan, 837 SCRA 613 (2017)Document5 pagesJuan v. Juan, 837 SCRA 613 (2017)Aisaia Jay ToralNo ratings yet

- Legal Ethics Case Topic PDFDocument5 pagesLegal Ethics Case Topic PDFKristel Alyssa MarananNo ratings yet

- Topic 5 Overvier of Forensic AccountingDocument32 pagesTopic 5 Overvier of Forensic AccountingRuth NyawiraNo ratings yet

- RU TIGER Template PolygonalPaperBoatDocument32 pagesRU TIGER Template PolygonalPaperBoatJose Vigil GuevaraNo ratings yet

- Problem of VAT AdministrationDocument78 pagesProblem of VAT AdministrationshimelisNo ratings yet

- Instructions For Form W-8BEN-E: (Rev. October 2021)Document20 pagesInstructions For Form W-8BEN-E: (Rev. October 2021)Samuel Albert PedroNo ratings yet

- Life and Works of Rizal - Prelim Module. S.Y. 2022 2023Document56 pagesLife and Works of Rizal - Prelim Module. S.Y. 2022 2023james.caones11No ratings yet

- States of IndiaDocument2 pagesStates of IndiaCh Dileep VarmaNo ratings yet

- Yale University PressDocument20 pagesYale University PressHospodar VibescuNo ratings yet

- Audit Reports Multiple ChoiceDocument7 pagesAudit Reports Multiple Choicecharmsonin12No ratings yet

- 1848-49 Massacres in TransylvaniaDocument4 pages1848-49 Massacres in TransylvaniaPaul CerneaNo ratings yet

- BBA - VTH - INDUSTRIAL LAW - UNIT1 - FACTORY ACT, 1948 - PROVISIONS REGARDING WELFAREDocument5 pagesBBA - VTH - INDUSTRIAL LAW - UNIT1 - FACTORY ACT, 1948 - PROVISIONS REGARDING WELFARERupali Singh0% (1)

- Elieza Zacharia Mtemi & Others Vs Attorney General & Others CivilDocument15 pagesElieza Zacharia Mtemi & Others Vs Attorney General & Others CivilRANDAN SADIQNo ratings yet

- UPSC Textile Processing (ORA) Vacancy NoticeDocument1 pageUPSC Textile Processing (ORA) Vacancy NoticeMd Danish RazaNo ratings yet

- NCHE Payment RefDocument1 pageNCHE Payment RefIsaac100% (2)

- Case Studies 1Document4 pagesCase Studies 1Usman GhaniNo ratings yet

- Shake, Rattle and Roll Horror Franchise and The Specter of Nation-Formation in The PhilippinesDocument20 pagesShake, Rattle and Roll Horror Franchise and The Specter of Nation-Formation in The PhilippinesJoanna Angela LeeNo ratings yet

- Role of Language in The Filipino CultureDocument26 pagesRole of Language in The Filipino CulturePatricia Alexis ChanNo ratings yet

- EDITTED Chapter 2 Finalss 1Document16 pagesEDITTED Chapter 2 Finalss 1aplez banuelosNo ratings yet

- MODULE BLR301 BusinessLawsandRegulations1Document141 pagesMODULE BLR301 BusinessLawsandRegulations1Jr Reyes PedidaNo ratings yet

- What Are The Reasons Why Rizal Decided To Go To SpainDocument2 pagesWhat Are The Reasons Why Rizal Decided To Go To SpainAaron LaroyaNo ratings yet

- Legal Research What Is Legal Research?Document15 pagesLegal Research What Is Legal Research?SLV LEARNINGNo ratings yet

- 114-Article Text-420-1-10-20200306Document11 pages114-Article Text-420-1-10-20200306AnditaShintaNo ratings yet

- HW 2.10 - CollocationsDocument4 pagesHW 2.10 - Collocationslongcnttvn1404No ratings yet

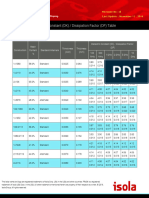

- FR406 Laminate TablesDocument4 pagesFR406 Laminate TablesasdNo ratings yet