Professional Documents

Culture Documents

I JM Te Journal Full Paper

I JM Te Journal Full Paper

Uploaded by

Siddharth DixitCopyright:

Available Formats

You might also like

- Principles of Property Rating MR NonsoDocument44 pagesPrinciples of Property Rating MR NonsoHenry100% (2)

- Ayushi PatraDocument12 pagesAyushi PatraAdithya anilNo ratings yet

- A Study On Collection, Composition and Business-Wise Contribution of GST in IndiaDocument10 pagesA Study On Collection, Composition and Business-Wise Contribution of GST in IndiaAli NadafNo ratings yet

- Impact of GST (Goods and Service Tax) and Economic Growth in IndiaDocument9 pagesImpact of GST (Goods and Service Tax) and Economic Growth in IndiaSoham JainNo ratings yet

- 3 - 44 A Opportunities and Challenges and Its Impact of GST On Indian EconomyDocument5 pages3 - 44 A Opportunities and Challenges and Its Impact of GST On Indian EconomykesharimanaviNo ratings yet

- IJNRD2212241Document7 pagesIJNRD2212241Dharini Devi SNo ratings yet

- GST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Document8 pagesGST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Rashmi Ranjan PanigrahiNo ratings yet

- GST Final PaperDocument5 pagesGST Final PaperIjcams PublicationNo ratings yet

- GST Implication and Its Impact-A Public PerspectiveDocument9 pagesGST Implication and Its Impact-A Public PerspectiveIJRASETPublicationsNo ratings yet

- 2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Document6 pages2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Ayush singhNo ratings yet

- SYNOPSIS - Impact of GST On Small Traders!Document21 pagesSYNOPSIS - Impact of GST On Small Traders!Laxmi PriyaNo ratings yet

- Comparative Study of New Income Tax System With Old Tax SystemDocument6 pagesComparative Study of New Income Tax System With Old Tax Systemcasadegorrasfashionllp1No ratings yet

- Project On GST - Sristy Agarwal - 717Document23 pagesProject On GST - Sristy Agarwal - 717classybanana06No ratings yet

- Finance ProjectDocument33 pagesFinance Projectsarah IsharatNo ratings yet

- GST: An Economic Overview: Challenges and Impact AheadDocument4 pagesGST: An Economic Overview: Challenges and Impact AheadKaran Veer SinghNo ratings yet

- Merits and Demerits of Income Tax VDocument6 pagesMerits and Demerits of Income Tax VSayantika SenguptaNo ratings yet

- Impact of GST On E-Commerce OperatorsDocument60 pagesImpact of GST On E-Commerce Operatorsvarity100% (1)

- Analysing The Impact of GST On Tax Revenue in IndiDocument13 pagesAnalysing The Impact of GST On Tax Revenue in Indipriyankajadhav4264No ratings yet

- Principles of Taxation Law Reserach ProjectDocument16 pagesPrinciples of Taxation Law Reserach ProjectDivya BasanNo ratings yet

- Komal Tathod (Finance)Document54 pagesKomal Tathod (Finance)yashpal PatilNo ratings yet

- Research ProjectDocument23 pagesResearch ProjectBaivaw jainNo ratings yet

- Introduction of GoodDocument47 pagesIntroduction of GoodRaman TiwariNo ratings yet

- GST Sem 2 Parth Final Assignment 1Document15 pagesGST Sem 2 Parth Final Assignment 1ParthNo ratings yet

- 5yr of GSTDocument8 pages5yr of GSTSuraj PawarNo ratings yet

- Introduction of GoodDocument46 pagesIntroduction of GoodRaman TiwariNo ratings yet

- Literature Review of Taxation in IndiaDocument4 pagesLiterature Review of Taxation in Indiac5hzgcdj100% (1)

- Impact of GST On Manufacturer Distributors and RetailersDocument16 pagesImpact of GST On Manufacturer Distributors and RetailersShubham SinhaNo ratings yet

- Economics RP Kartik Goel BBA - LLBDocument21 pagesEconomics RP Kartik Goel BBA - LLBKartikNo ratings yet

- A Research Paper On 'Œimpact of GST On Service Sector of India'Document4 pagesA Research Paper On 'Œimpact of GST On Service Sector of India'Editor IJTSRDNo ratings yet

- Present State of Goods and Services Tax (GST) Reform in IndiaDocument24 pagesPresent State of Goods and Services Tax (GST) Reform in Indiashubham jagtapNo ratings yet

- Present State of Goods and Services Tax (GST) Reform in IndiaDocument24 pagesPresent State of Goods and Services Tax (GST) Reform in IndiaKuberNo ratings yet

- TAX FiDocument8 pagesTAX FiMđ ĞåùsNo ratings yet

- Impact of Tax Reforms in Government of Indias Indirect Tax Collections With Special Reference To Year 2000-2020Document11 pagesImpact of Tax Reforms in Government of Indias Indirect Tax Collections With Special Reference To Year 2000-2020IJRASETPublicationsNo ratings yet

- International Journal of Multidisciplinary Research Transactions Comparative Study On Change in ITR With Respect To Old Regime and New RegimeDocument7 pagesInternational Journal of Multidisciplinary Research Transactions Comparative Study On Change in ITR With Respect To Old Regime and New RegimeJ.P. Venu GopalNo ratings yet

- GST An OverviewDocument30 pagesGST An OverviewMadhavi MehtaNo ratings yet

- Analytical Study of GST Perspectives in India: Dr. AnshuDocument11 pagesAnalytical Study of GST Perspectives in India: Dr. Anshuchinmay gandhiNo ratings yet

- An Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in IndiaDocument7 pagesAn Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in Indiashyaan ramNo ratings yet

- Research Paper On Goods and Services Tax in IndiaDocument6 pagesResearch Paper On Goods and Services Tax in Indiazyfofohab0p2No ratings yet

- Present State of Goods and Services Tax (GST) Reform in IndiaDocument24 pagesPresent State of Goods and Services Tax (GST) Reform in IndiaResuf AhmedNo ratings yet

- The Impact of GST On Construction Industry: June 2019Document12 pagesThe Impact of GST On Construction Industry: June 2019AVS YASHWINNo ratings yet

- GST Implementation and Its Impact On Indian EconomyDocument4 pagesGST Implementation and Its Impact On Indian EconomyarcherselevatorsNo ratings yet

- TaxfairnesspaperDocument30 pagesTaxfairnesspaperakhileshyadav3794186No ratings yet

- Impact of GST On Retail Tailors 69 PagesDocument69 pagesImpact of GST On Retail Tailors 69 PagesTasmay EnterprisesNo ratings yet

- Impact F GST in Indian EconomyDocument20 pagesImpact F GST in Indian EconomyAKHIL H KRISHNANNo ratings yet

- Anadi Gupta Tax LawDocument7 pagesAnadi Gupta Tax LawAnadi GuptaNo ratings yet

- Chapter 7Document9 pagesChapter 7anshisinghnagar30No ratings yet

- GST Data CollectedDocument11 pagesGST Data CollectedtpplantNo ratings yet

- Implementation of Goods and Services Tax (GST)Document11 pagesImplementation of Goods and Services Tax (GST)NATIONAL ATTENDENCENo ratings yet

- Shodhsancharbulletinjanuarytomarch2020g P DangDocument12 pagesShodhsancharbulletinjanuarytomarch2020g P Dangakhileshyadav3794186No ratings yet

- Background of GSTDocument13 pagesBackground of GSTiamlegend988303No ratings yet

- Anadi Gupta Tax LawDocument7 pagesAnadi Gupta Tax LawAnadi GuptaNo ratings yet

- Envisioning Tax Policy: For Accelerated Development in IndiaDocument22 pagesEnvisioning Tax Policy: For Accelerated Development in IndiaArya SNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureInternational Journal in Management Research and Social ScienceNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureMoumita Mishra100% (1)

- Research Paper On GST in India PDFDocument4 pagesResearch Paper On GST in India PDFfysygx5kNo ratings yet

- Mohd Nazim SaifiDocument42 pagesMohd Nazim SaifiNazim SaifiNo ratings yet

- IJCRT2307572Document5 pagesIJCRT2307572meha jainNo ratings yet

- Original DocumentDocument55 pagesOriginal DocumentBADDAM PARICHAYA REDDYNo ratings yet

- Corporate Taxation Through The Indian Prism: Consequences of GST and DTCDocument36 pagesCorporate Taxation Through The Indian Prism: Consequences of GST and DTCIJAR JOURNALNo ratings yet

- A Study On Impact of GST On Indian EconomyDocument12 pagesA Study On Impact of GST On Indian Economyba7443789No ratings yet

- Siddharth Dixit WIP REPORTDocument42 pagesSiddharth Dixit WIP REPORTSiddharth DixitNo ratings yet

- Kastoori The Musk A Cinematic MasterpieceDocument9 pagesKastoori The Musk A Cinematic MasterpieceSiddharth DixitNo ratings yet

- Marksheet Final YearDocument1 pageMarksheet Final YearSiddharth DixitNo ratings yet

- Master TT For II Sem 2023-24 January 2024Document2 pagesMaster TT For II Sem 2023-24 January 2024Siddharth DixitNo ratings yet

- Aadhar Card..Document1 pageAadhar Card..Siddharth DixitNo ratings yet

- IIEBM Presenatiion WIPDocument18 pagesIIEBM Presenatiion WIPSiddharth DixitNo ratings yet

- Market Research Case StudyDocument3 pagesMarket Research Case StudySiddharth DixitNo ratings yet

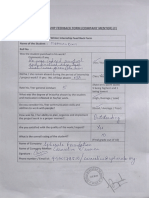

- Siddharth Dixit WIP Feedback FormDocument1 pageSiddharth Dixit WIP Feedback FormSiddharth DixitNo ratings yet

- Marketing Research Case Study - 2Document2 pagesMarketing Research Case Study - 2Siddharth DixitNo ratings yet

- Unit Deficit Financing: 14.0 ObjectivesDocument12 pagesUnit Deficit Financing: 14.0 ObjectivesSiddharth DixitNo ratings yet

- Policy Analysis On R.A. 10963 (TRAIN Law) of The Philippines - by Joyce Gem - MediumDocument12 pagesPolicy Analysis On R.A. 10963 (TRAIN Law) of The Philippines - by Joyce Gem - MediumKent Elmann CadalinNo ratings yet

- 12 Little Things Every Filipino Can DoDocument2 pages12 Little Things Every Filipino Can Dohlubuguin100% (2)

- Ch30 Money Growth and InflationDocument16 pagesCh30 Money Growth and InflationMộc TràNo ratings yet

- Tax Cases FinalDocument10 pagesTax Cases FinalBINAYAO NAIZA MAENo ratings yet

- Business Plan MbaDocument37 pagesBusiness Plan MbaDharmendraSharmaNo ratings yet

- Itr 23-24Document1 pageItr 23-24Ruloans VaishaliNo ratings yet

- Dona Ana Sample BallotDocument2 pagesDona Ana Sample BallotErika EsquivelNo ratings yet

- Batas Pambansa 232Document88 pagesBatas Pambansa 232Riza Mae Bayo100% (3)

- Object Types in SAP B1Document21 pagesObject Types in SAP B1guhandoss100% (1)

- Tax Planning For An NRI: Pratul JainDocument3 pagesTax Planning For An NRI: Pratul Jainjanardhan lalwaniNo ratings yet

- BAINCTAX Notes (REAL)Document2 pagesBAINCTAX Notes (REAL)Ashley BrevaNo ratings yet

- UNIT 4 - ECN - 1215 - Government - Sector - MACROECONOMICSDocument48 pagesUNIT 4 - ECN - 1215 - Government - Sector - MACROECONOMICSCM MukukNo ratings yet

- What Train LawDocument1 pageWhat Train LawJanlie GautaneNo ratings yet

- Philex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998Document8 pagesPhilex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998samaral bentesinkoNo ratings yet

- Film Devt Council V Colon HeritageDocument3 pagesFilm Devt Council V Colon HeritageAnonymous 5MiN6I78I0No ratings yet

- Industrial Attachment ReportDocument21 pagesIndustrial Attachment ReportCyril Ang-numbaala0% (1)

- Instructional Guide For Accountancy: Class: Xi-XiiDocument108 pagesInstructional Guide For Accountancy: Class: Xi-XiiYonten PhuntshoNo ratings yet

- Invoice M112306106252041397Document1 pageInvoice M112306106252041397android.samsung90No ratings yet

- Gratuity Withdrawal Form LicDocument2 pagesGratuity Withdrawal Form LicSarsij MishraNo ratings yet

- Economics 12th Edition Michael Parkin Solutions Manual 1Document36 pagesEconomics 12th Edition Michael Parkin Solutions Manual 1gregorydyercgspwbjekr100% (34)

- IndiaFilings Checkout PDFDocument3 pagesIndiaFilings Checkout PDFRitesh Kumar DubeyNo ratings yet

- PFDA v. CA DigestDocument3 pagesPFDA v. CA DigestJai HoNo ratings yet

- 1 Dio, RC, Tax Due. WorldDocument14 pages1 Dio, RC, Tax Due. WorldAngelou J. Delos ReyesNo ratings yet

- What Is SGST, CGST, IGST and UTGSTDocument17 pagesWhat Is SGST, CGST, IGST and UTGSTCA Naveen Kumar BalanNo ratings yet

- Sample Financial Aid Hardship LetterDocument4 pagesSample Financial Aid Hardship Letterlex tecNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- Eagle Manufacturing: Author Date PurposeDocument2 pagesEagle Manufacturing: Author Date Purposeanand sennNo ratings yet

I JM Te Journal Full Paper

I JM Te Journal Full Paper

Uploaded by

Siddharth DixitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I JM Te Journal Full Paper

I JM Te Journal Full Paper

Uploaded by

Siddharth DixitCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/357575928

Impact of Direct and Indirect Tax Reforms in India

Article · January 2022

CITATIONS READS

0 16

2 authors:

Beemabai Karumalai Krishnakumar Krishnasamy

Periyar University Periyar University

2 PUBLICATIONS 0 CITATIONS 50 PUBLICATIONS 2 CITATIONS

SEE PROFILE SEE PROFILE

All content following this page was uploaded by Beemabai Karumalai on 05 January 2022.

The user has requested enhancement of the downloaded file.

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

Impact of Direct and Indirect Tax Reforms in India

1

K.Beemabai 2 Dr.K.Krishnakumar

1

PhD Research Scholar (RGNF Fellow) Email id: beema.sun.90@gmail.com

2

Associate Professor of Commerce, Periyar University, Salem 636 011. Email id:

krishna30971@gmail.com

Abstract

Several anomalies have crept into the current direct tax system. These include dividend

distribution tax, MAT, surcharges / cess and interest rate arbitrage between delayed refunds and tax

payments. Further, as net income is taxed once, any gift, wealth or estate passing on to others from

the taxed net Income should not be taxed again. Being the Biggest tax reform in India, GST will allow

the real GDP growth of the Indian economy to hit 6.75 per cent in this fiscal year with expectations of

7 to 7:.5 per cent real GDP growth in the year 2018-19. SMEs and small taxpayers have benefitted

from the GST system with a number of relaxations. This tax reform will lead to creation of a single

national market, common tax base and common tax laws for the Centre and States. Another very

significant feature of GST will be that input tax credit will be available at every stage of supply for the

tax paid at the earlier stage of supply. This feature would mitigate cascading or double taxation in a

major way. This tax reform will be supported by extensive use of Information Technology through

Goods and Services Tax Network (GSTN), which will lead to greater transparency in tax burden,

accountability of the tax administrations of the Centre and the States and also improve compliance

levels at reduced cost of compliance for taxpayers. Studies indicate that introduction of GST would

instantly spur economic growth and can potentially lead to additional GDP growth in the range of

1% to 2%.

Key words: Tax Reforms, GDP, Economic Growth, Information Technology, GST.

Introduction

Tax system the world over have undergone significant changes during the last twenty years as

many countries across the ideological spectrum and with varying levels of development have

undertaken reforms. There have been major changes in Tax systems of countries with a wide variety

of economic systems and levels of development. The motivation for these reforms has varied from

one country to another and the trust of reforms has differed from time to time depending on

development strategy and philosophy of the times. In many developing countries, the immediate

reason for tax reforms has been the need requirement of a market economy to ensure international

competitiveness. After a decade-long journey, India’s Goods and Services Tax (GST) finally has been

implemented, effective

July 1, 2017.

The GST, which is essentially a destination/consumption-based tax, replaces of the world’s

most complicated origin-based indirect tax systems. India’s legacy system was plagued by a complex

tangle of national (or “Centre”) and state taxes, including a central excise duty, a service tax, a

countervailing custom duty (CVD), and a special additional duty (SAD) as part of the customs tax

structure, as well as value added tax (VAT) at the state level and state luxury taxes among numerous

others. This complexity often resulted in a cascading effect of tax upon tax.

Volume IX, Issue IV, APRIL/2019 Page No: 2152

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

Statement of the Problem

Every major Reform in India trends to be historic when it comes to be. The focus this year is

on long term Capital Gains Tax. There is the argument that the combination of lower interest rates and

Capital Gain Tax basis investment and growth. Goods and Services Tax (GST) replacing multiple

taxes the stage is now open for similar move on direct taxes. In direct taxes, corporate tax and Income

tax account for 51% of the total Revenue. The Current Income tax revenue and will reduce the budget

deficit. The chance of interest rate reduction is now remote with inflation edging beyond tax reduction

will encourage higher investment.

Scope of the Study

The Present study analyses the Impact of Direct and Indirect Tax Reforms in India. The study

gives some value able information to India tax system that they can help to improve Economic

Development as well Growth of India.

Review of Literature

Das Gupta eta (1995) reported that collection of income taxes is very low during the years

1979-1990 covering about 2.2% of GDP with an average per capita income below 35 dollars. He also

analyzed empirically the compliance development over time and found that compliance declined.

Over the period 1970-1990 controversy to the positive trend of the income tax revenue. An increase in

the average tax rate reduced tax compliance on the other hand, tax cuts done in 1975 and 1985 went I

line with a higher compliance. Interestingly they found the prosecution activities are ineffective for

increasing compliance.

Nagma Shadab (2011) the study mainly focused in Goods and Services Tax (GST) is a broad

based and a single comprehensive tax. In this tax levied o various stage of products. It is basically a

tax on final consumption integrate the all other taxes including excise duty custom duties, service tax

and state VAT. This tax contributing chain of product is applicable.

Khalid Mohmoed lodhi etal (2013) examine this study impact of capital gains tax on stocks

investment in Pakistan. Whenever there is an increase the value of capital asset realized over its cost

it is termed to as capital gain and tax imposed these off is call capital gain tax. The study find out that

levy of capital gain tax results in lower volume of stock investment and lesser growth in assets and

securities whereas the revenues have also declined as further investments have declined due to the

fears of documentation of small investors by the tax authorities.

Jai prakash (2014) in this study focused on improvement over the existing union excise duty

at the central level and over the sale tax at the state level while GST is a further improvement over the

existing VAT which is yet to be implemented most probably in the coming financial year as promise

made by our union finance minister. The new GST will ensure the greater uniformity in the tax rates

throughout the country and will end the cascading effects. The objective this paper is to trace the

progress of India’s tax reforms from and origin-based CST to a proposed destination based GST.

Volume IX, Issue IV, APRIL/2019 Page No: 2153

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

Monika Shearwater (2015) this study examine GST is one of the most crucial tax reforms in

India. Which has been long pending. It was supposed to be implemented from April 2010, but due to

political issues and conflicting interest of various stakeholders it is still pending. It is a comprehensive

tax system that will subsume all indirect taxes of states and central government and unified countries

economy into a seamless national market. It is expected to iron out wrinkles of existing indirect tax

system and a vital role in growth of India. This paper present an overview of GST Concept, explains

its features along with its time line of implementation in India.

Objectives

The present study is carried out with the following objectives

1. To study various aspects of Tax Reforms system in India and to analyze the aspects of Tax

Reforms in developed countries.

2. To examine response from the experts regarding implementation and administration of Tax

Reforms in Tamil Nadu.

3. To analyze the current Tax Reforms and its impact of administration of Direct Tax and

Indirect Tax.

4. To study the Problems and Prospects of administration of the Proposed Tax Reforms in the

years to come.

Reforms of Direct Exemptions

High rates are a recipe for low tax compliance. A lower rate for lower incomes and high rates

for higher incomes will ensure better balance. The threshold for income tax needs to be

revised periodically to counter the effects of inflation. A plethora of exemptions and

deductions, adding to litigation on these, needs to be removed.

For individuals, there should be simple formula for net income taxation. Assuming gross

income from all sources is Rs.100; allow 35% for savings, 32.5% of the remaining for

consumption. As a result, only Rs 32.5 of the gross income should be taxable.

For corporate, the calculation is as follows. For Rs 100 of profit before tax, add book

depreciation of 10%. Limit 35% for investments in assets for future business growth. Hence

income chargeable to tax is Rs 71.5%.

For individuals, those earning below Rs 5 laky need not be taxed. Those between this floor

and Rs 10 laky should be taxed at 5%, while income between Rs 10 laky and Rs 1 core should

be taxed at 10%. The next slab till Rs 10 core should see 15% tax. Anything above that

would be taxed at 20%.

For corporate, rate should be 10% up to Rs 100 core of chargeable income and 15% between

that floor and Rs 500 core. The next slab up to Rs 1,000 core should be taxed 20%. Those

above 1,000 cores should be taxed at 25%.Once audited accounts are as per accounting

Volume IX, Issue IV, APRIL/2019 Page No: 2154

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

standards, tax authorities should not have any discretion to review the basis of accounting.

This will ensure avoidance of unnecessary legal disputes.

Multi-stage

There are multiple change-of-hands an item goes through along its supply chain: from

manufacture to final sale to the consumer.

Let us consider the following case

Purchase of raw materials

Production or manufacture

Warehousing of finished goods

Sale to wholesaler

Sale of the product to the retailer

Sale to the end consumer.

Figure 1: Figure Label Source: Cleartax.in

Volume IX, Issue IV, APRIL/2019 Page No: 2155

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

Components of Goods and Services Tax (GST)

There are 3 taxes applicable under this system: CGST, SGST & IGST.

CGST: Collected by the Central Government on an intra-state sale (Egg: transaction

happening within Maharashtra)

SGST: Collected by the State Government on an intra-state sale (Egg: transaction happening

within Maharashtra)

IGST: Collected by the Central Government for inter-state sale (Egg: Maharashtra to Tamil

Nadu).

Destination-Based

Consider goods manufactured in Maharashtra and are sold to the final consumer in Karnataka.

Since Goods & Service Tax is levied at the point of consumption, in this case, Karnataka, the entire

tax revenue will go to Karnataka and not Maharashtra.

Goods and Service Tax, the pattern of tax levy was as follows

Figure 2: Figure Label Source: Cleartax.in

Under the GST regime, the tax will be levied at every point of sale. In case of intra-state sales,

Central GST and State GST will be charged. Inter-state sales will be chargeable to Integrated GST.

Now let us try to understand the definition of Goods and Service Tax – “GST is

a comprehensive, multi-stage, destination-based tax that will be levied on every value addition.”

Journey of GST in India

The GST journey began in the year 2000 when a committee was set up to draft law. It took 17

years from then for the Law to evolve. In 2017 the GST Bill was passed in the Look Sabah and Raja

Sabah. On 1st July 2017 the GST Law came into force.

Volume IX, Issue IV, APRIL/2019 Page No: 2156

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

Figure 3: Figure Label Source: Cleartax.in

Some of the Hits of Goods and Services Tax (GST)

GST Council plays principled diplomacy & and the statesmanship shown by the members is surely

a hit. Technological Support to the Structure of Goods and Services Tax GST law: The new GST

system runs under a canopy of strong technological support and we can expect more GST services

to be digitalized in the months to come.

GST -A boon to Micro, Small & Medium Enterprises: MSMS are now less dependent on tax

experts when compared to the earlier regime, due to a simplified return filing system in place.

Rationalisation of the composition scheme and introduction of quarterly filing option for taxpayers

having turnover below Rs 1.5 crores was a wise decision.

Advantages of Tax Reforms

One of the most immediate benefits business owners will notice the new tax code is a code is

decrease in the corporate tax rate from 35 % to 21%, which came into effect on January 1 2018.

While this tax cut does not just affect businesses, as it applies to all corporations functioning in the

U.S the people who will reap the greatest benefits of this decision are businesses.

As any business owner knows, the costs of starting a new business can be astronomical, so it

should come as a great relief that this burden will be somewhat mitigated in the nest fiscal year.

Other changes that business can take advantage of involve expenses that they can write off in order

to save even more money on taxes. This includes the full cost of law equipment, interest paid on

loans and charitable contributions. Tax cuts and jobs act increases the amount of money than can

be written off for these expenses and protects these write offs from being rescinded in the future.

Disadvantages of Tax Reforms

The Most pressing piece of bad news that comes with this tax cut is an increase in the government

deficit according to the tax foundation, fully implementation these changes to the tax code will

result in a loss of approximately decade.

While optimists believe that his loss of revenue will be offset by increased economic grow is

based on conjecture and may be subject to change what won’t change is the loss in revenue, and

Volume IX, Issue IV, APRIL/2019 Page No: 2157

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

failing to compensate for that can result in further escalation of American’s national debt crisis.

For a business owner, it may not be immediately apparent how an over expanding debt crisis with

affect them. However, this increasingly worrisome issue can have serious tangible consequences

for the future of their business.

This exact scenario was observed during the financial crisis in 2008. When the housing bubble

burst. Over the subsequent three years, bank loans to businesses decreased at a rate

disporporatinace to all firms by around 10%.

A lot of link has been spilled about the tax cuts and jobs act, with some praising the legislation

and many others condemning it. Only time will tell whether this decision was good or bad. The

best course of action for business looking to reap the benefits of this tax reforms is to excide

confidence. Confidence is the number once driver of Economic Growth with a confident

government working well with confident. Business to increase confidence in consumers.

Hoping and planning for the best seems to be the best way to make the most out of this exciting

and polarizing event.

Conclusion

In this Tax Reforms is Biggest in India. The Direct and Indirect Taxes are mainly income

generating source of every country. One country focusing on Tax is proper manner that country is

Economically Developed. Tax Evasion and avoid also reduce to be support to tax administration.

Goods and Services Tax (GST) is the boon to micro, small and medium enterprise are now less

dependent on tax experts when compared to the earlier regime, due to a simplified return on filling

system in place. This Tax Reform will lead to creation of a single market or common market tax laws,

for the central and states. Technology is main supported by extensive use of Tax Reforms of India. It

is lead to greater transparency in tax burden, accountability of tax administration to improve

compliance levels at reduce cost of compliance of Tax payers automatically increase of Economic and

also improve the GDP growth.

References

1. Das Gupta eta (1995) "Implementation of the Goods and Services Tax (GST) In the Singapore Construction

Industry", Journal of Property Finance, Vol-5, Iss- 3, Pp-41 – 58

2. Nagma Shadab (2011) Goods And Services Tax (GST) In India: Prospect For States” Vol-4, Iss-1, Pp-38-64.

3. Khalid Mohmoed lodhi etal (2013) ),”Elements of Compliance Costs: Lesson from Malaysian Companies

towards Goods And Services Tax (GST)”, Canadian Center of Science And Education, Vol-9, Iss- 11, Pp-153-147.

4. Jai prakash (2014) “The Impact of the Goods and Services Tax on Mortgage Costs: Evidence From Australian

Mortgage Corporations”, International Journal of Financial Research, Vol-4, Iss-1, Pp-54-6.

5. Monika Shearwater (2015) GST in India: A Key Tax Reform, International Journal of Research – Granthaalayah,

Vol.3, Iss.12, Pp-133-141.

6. Sulkanta Sarkar Rajib Mulik - Tax Reforms Demonetization and cashless Economy Strategy for Economic

Development of India.

7. Dr.Vinod K.Singhania Direct Tax Reforms in India AY 2018-2020 Ready Reckoner Indirect Tax System in

India, “Tactful Management Research Journal” Vol.1 Issue 10 July 2016.

Volume IX, Issue IV, APRIL/2019 Page No: 2158

International Journal of Management, Technology And Engineering ISSN NO : 2249-7455

8. Union Budget 2017-18.

9. World Bank Data base -World Development Indicators & Global Development Finance.

Web site

1. http://www.researchgate.net/publication/2543888312_Tax_Refroms_in_India_Achievements_and_Challenges.

2. The central Goods and Services Tax, 2017

3. The Integrated Goods and Services Tax, 2017

4. https://pvsassociates.com/gst/

5. https://cbec.gov.in/htdocs-cbec/gst/index

6. http://www.cbec.gov.in/resources//htdocs-cbec/deptt_offcr/faq-on-gst-second-edition.pdf.

Volume IX, Issue IV, APRIL/2019 Page No: 2159

View publication stats

You might also like

- Principles of Property Rating MR NonsoDocument44 pagesPrinciples of Property Rating MR NonsoHenry100% (2)

- Ayushi PatraDocument12 pagesAyushi PatraAdithya anilNo ratings yet

- A Study On Collection, Composition and Business-Wise Contribution of GST in IndiaDocument10 pagesA Study On Collection, Composition and Business-Wise Contribution of GST in IndiaAli NadafNo ratings yet

- Impact of GST (Goods and Service Tax) and Economic Growth in IndiaDocument9 pagesImpact of GST (Goods and Service Tax) and Economic Growth in IndiaSoham JainNo ratings yet

- 3 - 44 A Opportunities and Challenges and Its Impact of GST On Indian EconomyDocument5 pages3 - 44 A Opportunities and Challenges and Its Impact of GST On Indian EconomykesharimanaviNo ratings yet

- IJNRD2212241Document7 pagesIJNRD2212241Dharini Devi SNo ratings yet

- GST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Document8 pagesGST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Rashmi Ranjan PanigrahiNo ratings yet

- GST Final PaperDocument5 pagesGST Final PaperIjcams PublicationNo ratings yet

- GST Implication and Its Impact-A Public PerspectiveDocument9 pagesGST Implication and Its Impact-A Public PerspectiveIJRASETPublicationsNo ratings yet

- 2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Document6 pages2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Ayush singhNo ratings yet

- SYNOPSIS - Impact of GST On Small Traders!Document21 pagesSYNOPSIS - Impact of GST On Small Traders!Laxmi PriyaNo ratings yet

- Comparative Study of New Income Tax System With Old Tax SystemDocument6 pagesComparative Study of New Income Tax System With Old Tax Systemcasadegorrasfashionllp1No ratings yet

- Project On GST - Sristy Agarwal - 717Document23 pagesProject On GST - Sristy Agarwal - 717classybanana06No ratings yet

- Finance ProjectDocument33 pagesFinance Projectsarah IsharatNo ratings yet

- GST: An Economic Overview: Challenges and Impact AheadDocument4 pagesGST: An Economic Overview: Challenges and Impact AheadKaran Veer SinghNo ratings yet

- Merits and Demerits of Income Tax VDocument6 pagesMerits and Demerits of Income Tax VSayantika SenguptaNo ratings yet

- Impact of GST On E-Commerce OperatorsDocument60 pagesImpact of GST On E-Commerce Operatorsvarity100% (1)

- Analysing The Impact of GST On Tax Revenue in IndiDocument13 pagesAnalysing The Impact of GST On Tax Revenue in Indipriyankajadhav4264No ratings yet

- Principles of Taxation Law Reserach ProjectDocument16 pagesPrinciples of Taxation Law Reserach ProjectDivya BasanNo ratings yet

- Komal Tathod (Finance)Document54 pagesKomal Tathod (Finance)yashpal PatilNo ratings yet

- Research ProjectDocument23 pagesResearch ProjectBaivaw jainNo ratings yet

- Introduction of GoodDocument47 pagesIntroduction of GoodRaman TiwariNo ratings yet

- GST Sem 2 Parth Final Assignment 1Document15 pagesGST Sem 2 Parth Final Assignment 1ParthNo ratings yet

- 5yr of GSTDocument8 pages5yr of GSTSuraj PawarNo ratings yet

- Introduction of GoodDocument46 pagesIntroduction of GoodRaman TiwariNo ratings yet

- Literature Review of Taxation in IndiaDocument4 pagesLiterature Review of Taxation in Indiac5hzgcdj100% (1)

- Impact of GST On Manufacturer Distributors and RetailersDocument16 pagesImpact of GST On Manufacturer Distributors and RetailersShubham SinhaNo ratings yet

- Economics RP Kartik Goel BBA - LLBDocument21 pagesEconomics RP Kartik Goel BBA - LLBKartikNo ratings yet

- A Research Paper On 'Œimpact of GST On Service Sector of India'Document4 pagesA Research Paper On 'Œimpact of GST On Service Sector of India'Editor IJTSRDNo ratings yet

- Present State of Goods and Services Tax (GST) Reform in IndiaDocument24 pagesPresent State of Goods and Services Tax (GST) Reform in Indiashubham jagtapNo ratings yet

- Present State of Goods and Services Tax (GST) Reform in IndiaDocument24 pagesPresent State of Goods and Services Tax (GST) Reform in IndiaKuberNo ratings yet

- TAX FiDocument8 pagesTAX FiMđ ĞåùsNo ratings yet

- Impact of Tax Reforms in Government of Indias Indirect Tax Collections With Special Reference To Year 2000-2020Document11 pagesImpact of Tax Reforms in Government of Indias Indirect Tax Collections With Special Reference To Year 2000-2020IJRASETPublicationsNo ratings yet

- International Journal of Multidisciplinary Research Transactions Comparative Study On Change in ITR With Respect To Old Regime and New RegimeDocument7 pagesInternational Journal of Multidisciplinary Research Transactions Comparative Study On Change in ITR With Respect To Old Regime and New RegimeJ.P. Venu GopalNo ratings yet

- GST An OverviewDocument30 pagesGST An OverviewMadhavi MehtaNo ratings yet

- Analytical Study of GST Perspectives in India: Dr. AnshuDocument11 pagesAnalytical Study of GST Perspectives in India: Dr. Anshuchinmay gandhiNo ratings yet

- An Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in IndiaDocument7 pagesAn Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in Indiashyaan ramNo ratings yet

- Research Paper On Goods and Services Tax in IndiaDocument6 pagesResearch Paper On Goods and Services Tax in Indiazyfofohab0p2No ratings yet

- Present State of Goods and Services Tax (GST) Reform in IndiaDocument24 pagesPresent State of Goods and Services Tax (GST) Reform in IndiaResuf AhmedNo ratings yet

- The Impact of GST On Construction Industry: June 2019Document12 pagesThe Impact of GST On Construction Industry: June 2019AVS YASHWINNo ratings yet

- GST Implementation and Its Impact On Indian EconomyDocument4 pagesGST Implementation and Its Impact On Indian EconomyarcherselevatorsNo ratings yet

- TaxfairnesspaperDocument30 pagesTaxfairnesspaperakhileshyadav3794186No ratings yet

- Impact of GST On Retail Tailors 69 PagesDocument69 pagesImpact of GST On Retail Tailors 69 PagesTasmay EnterprisesNo ratings yet

- Impact F GST in Indian EconomyDocument20 pagesImpact F GST in Indian EconomyAKHIL H KRISHNANNo ratings yet

- Anadi Gupta Tax LawDocument7 pagesAnadi Gupta Tax LawAnadi GuptaNo ratings yet

- Chapter 7Document9 pagesChapter 7anshisinghnagar30No ratings yet

- GST Data CollectedDocument11 pagesGST Data CollectedtpplantNo ratings yet

- Implementation of Goods and Services Tax (GST)Document11 pagesImplementation of Goods and Services Tax (GST)NATIONAL ATTENDENCENo ratings yet

- Shodhsancharbulletinjanuarytomarch2020g P DangDocument12 pagesShodhsancharbulletinjanuarytomarch2020g P Dangakhileshyadav3794186No ratings yet

- Background of GSTDocument13 pagesBackground of GSTiamlegend988303No ratings yet

- Anadi Gupta Tax LawDocument7 pagesAnadi Gupta Tax LawAnadi GuptaNo ratings yet

- Envisioning Tax Policy: For Accelerated Development in IndiaDocument22 pagesEnvisioning Tax Policy: For Accelerated Development in IndiaArya SNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureInternational Journal in Management Research and Social ScienceNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureMoumita Mishra100% (1)

- Research Paper On GST in India PDFDocument4 pagesResearch Paper On GST in India PDFfysygx5kNo ratings yet

- Mohd Nazim SaifiDocument42 pagesMohd Nazim SaifiNazim SaifiNo ratings yet

- IJCRT2307572Document5 pagesIJCRT2307572meha jainNo ratings yet

- Original DocumentDocument55 pagesOriginal DocumentBADDAM PARICHAYA REDDYNo ratings yet

- Corporate Taxation Through The Indian Prism: Consequences of GST and DTCDocument36 pagesCorporate Taxation Through The Indian Prism: Consequences of GST and DTCIJAR JOURNALNo ratings yet

- A Study On Impact of GST On Indian EconomyDocument12 pagesA Study On Impact of GST On Indian Economyba7443789No ratings yet

- Siddharth Dixit WIP REPORTDocument42 pagesSiddharth Dixit WIP REPORTSiddharth DixitNo ratings yet

- Kastoori The Musk A Cinematic MasterpieceDocument9 pagesKastoori The Musk A Cinematic MasterpieceSiddharth DixitNo ratings yet

- Marksheet Final YearDocument1 pageMarksheet Final YearSiddharth DixitNo ratings yet

- Master TT For II Sem 2023-24 January 2024Document2 pagesMaster TT For II Sem 2023-24 January 2024Siddharth DixitNo ratings yet

- Aadhar Card..Document1 pageAadhar Card..Siddharth DixitNo ratings yet

- IIEBM Presenatiion WIPDocument18 pagesIIEBM Presenatiion WIPSiddharth DixitNo ratings yet

- Market Research Case StudyDocument3 pagesMarket Research Case StudySiddharth DixitNo ratings yet

- Siddharth Dixit WIP Feedback FormDocument1 pageSiddharth Dixit WIP Feedback FormSiddharth DixitNo ratings yet

- Marketing Research Case Study - 2Document2 pagesMarketing Research Case Study - 2Siddharth DixitNo ratings yet

- Unit Deficit Financing: 14.0 ObjectivesDocument12 pagesUnit Deficit Financing: 14.0 ObjectivesSiddharth DixitNo ratings yet

- Policy Analysis On R.A. 10963 (TRAIN Law) of The Philippines - by Joyce Gem - MediumDocument12 pagesPolicy Analysis On R.A. 10963 (TRAIN Law) of The Philippines - by Joyce Gem - MediumKent Elmann CadalinNo ratings yet

- 12 Little Things Every Filipino Can DoDocument2 pages12 Little Things Every Filipino Can Dohlubuguin100% (2)

- Ch30 Money Growth and InflationDocument16 pagesCh30 Money Growth and InflationMộc TràNo ratings yet

- Tax Cases FinalDocument10 pagesTax Cases FinalBINAYAO NAIZA MAENo ratings yet

- Business Plan MbaDocument37 pagesBusiness Plan MbaDharmendraSharmaNo ratings yet

- Itr 23-24Document1 pageItr 23-24Ruloans VaishaliNo ratings yet

- Dona Ana Sample BallotDocument2 pagesDona Ana Sample BallotErika EsquivelNo ratings yet

- Batas Pambansa 232Document88 pagesBatas Pambansa 232Riza Mae Bayo100% (3)

- Object Types in SAP B1Document21 pagesObject Types in SAP B1guhandoss100% (1)

- Tax Planning For An NRI: Pratul JainDocument3 pagesTax Planning For An NRI: Pratul Jainjanardhan lalwaniNo ratings yet

- BAINCTAX Notes (REAL)Document2 pagesBAINCTAX Notes (REAL)Ashley BrevaNo ratings yet

- UNIT 4 - ECN - 1215 - Government - Sector - MACROECONOMICSDocument48 pagesUNIT 4 - ECN - 1215 - Government - Sector - MACROECONOMICSCM MukukNo ratings yet

- What Train LawDocument1 pageWhat Train LawJanlie GautaneNo ratings yet

- Philex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998Document8 pagesPhilex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998samaral bentesinkoNo ratings yet

- Film Devt Council V Colon HeritageDocument3 pagesFilm Devt Council V Colon HeritageAnonymous 5MiN6I78I0No ratings yet

- Industrial Attachment ReportDocument21 pagesIndustrial Attachment ReportCyril Ang-numbaala0% (1)

- Instructional Guide For Accountancy: Class: Xi-XiiDocument108 pagesInstructional Guide For Accountancy: Class: Xi-XiiYonten PhuntshoNo ratings yet

- Invoice M112306106252041397Document1 pageInvoice M112306106252041397android.samsung90No ratings yet

- Gratuity Withdrawal Form LicDocument2 pagesGratuity Withdrawal Form LicSarsij MishraNo ratings yet

- Economics 12th Edition Michael Parkin Solutions Manual 1Document36 pagesEconomics 12th Edition Michael Parkin Solutions Manual 1gregorydyercgspwbjekr100% (34)

- IndiaFilings Checkout PDFDocument3 pagesIndiaFilings Checkout PDFRitesh Kumar DubeyNo ratings yet

- PFDA v. CA DigestDocument3 pagesPFDA v. CA DigestJai HoNo ratings yet

- 1 Dio, RC, Tax Due. WorldDocument14 pages1 Dio, RC, Tax Due. WorldAngelou J. Delos ReyesNo ratings yet

- What Is SGST, CGST, IGST and UTGSTDocument17 pagesWhat Is SGST, CGST, IGST and UTGSTCA Naveen Kumar BalanNo ratings yet

- Sample Financial Aid Hardship LetterDocument4 pagesSample Financial Aid Hardship Letterlex tecNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- Eagle Manufacturing: Author Date PurposeDocument2 pagesEagle Manufacturing: Author Date Purposeanand sennNo ratings yet