Professional Documents

Culture Documents

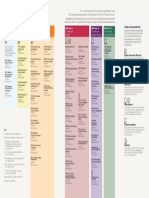

Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 Equivalent

Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 Equivalent

Uploaded by

Ankit DasCopyright:

Available Formats

You might also like

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- Cips Level 2 Cert SyllabusDocument16 pagesCips Level 2 Cert SyllabusThiha BoBo100% (4)

- Certpay Qualification SpecificationDocument18 pagesCertpay Qualification SpecificationGopi Krishna ReddyNo ratings yet

- Financial Management & Policy by James C. Van Horne 12th EditionDocument832 pagesFinancial Management & Policy by James C. Van Horne 12th EditionKashif Mirza80% (35)

- Certpay Qualification SpecificationDocument8 pagesCertpay Qualification SpecificationBalakrishna RaoNo ratings yet

- Clinical Documentation Improvement (CDI) TrainingDocument6 pagesClinical Documentation Improvement (CDI) Trainingmaricel bismani0% (1)

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkContentsNo ratings yet

- Ciin SyllabusDocument61 pagesCiin SyllabusejoghenetaNo ratings yet

- IC38 Concise-1Document30 pagesIC38 Concise-1Swanand VlogsNo ratings yet

- CACI Insurance Qualifications FrameworkDocument1 pageCACI Insurance Qualifications FrameworkAshwin PrakashNo ratings yet

- Personal Finance Qualifications FrameworkDocument1 pagePersonal Finance Qualifications FrameworkbimNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkWill SackettNo ratings yet

- Level 4 SRM Qualification SpecificationDocument19 pagesLevel 4 SRM Qualification Specification360channels720No ratings yet

- Unit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016Document32 pagesUnit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016vantrang0310No ratings yet

- 2934Audit & Assurance (2021)-FinalDocument340 pages2934Audit & Assurance (2021)-Finalvaskarmitra20No ratings yet

- 4 International Advanced LevelDocument14 pages4 International Advanced LevelBonaventure MasekoNo ratings yet

- Nasscom RPL Program - 05nov'23Document10 pagesNasscom RPL Program - 05nov'23sudhir kumarNo ratings yet

- CII Level 6 Advanced Diploma in Insurance: Qualification SpecificationDocument5 pagesCII Level 6 Advanced Diploma in Insurance: Qualification Specificationgp_shortnsweetNo ratings yet

- Skillsfirst DIploma in Adult Care HandbookDocument119 pagesSkillsfirst DIploma in Adult Care HandbookLiza Gomez100% (1)

- 2016Document8 pages2016AMIT KUMARNo ratings yet

- Academic Award Regulations Postgraduate RegulationsDocument25 pagesAcademic Award Regulations Postgraduate Regulationsk.vishnu vardhan100% (2)

- NSQF - Basic CosmetologyDocument13 pagesNSQF - Basic CosmetologyBalaji Pvt ITINo ratings yet

- Qspec Certificate in Regulated Financial Services OperationsDocument5 pagesQspec Certificate in Regulated Financial Services OperationsbimNo ratings yet

- Qual Spec Advanced Diploma in Insurance Qsadi2021Document9 pagesQual Spec Advanced Diploma in Insurance Qsadi2021mandyNo ratings yet

- ProQual L3 Award in Emergency Rescue and Recovery of Casulaties From Confined Spaces October 2018 1Document13 pagesProQual L3 Award in Emergency Rescue and Recovery of Casulaties From Confined Spaces October 2018 1GermimeeNo ratings yet

- QD2.14 Qualifications Specification Incident CommandDocument6 pagesQD2.14 Qualifications Specification Incident CommandMarlon FordeNo ratings yet

- BTEC Ent3Lvl1 ITusers Issue 4Document533 pagesBTEC Ent3Lvl1 ITusers Issue 4Muhammad AkhtarNo ratings yet

- Id Learner Guide v2 FinalDocument11 pagesId Learner Guide v2 FinalSachin SahooNo ratings yet

- 4 International A LevelDocument14 pages4 International A LevelJavaria MajidNo ratings yet

- UCP Exam Review Consolidated Final (PDF) March 2023Document193 pagesUCP Exam Review Consolidated Final (PDF) March 2023enirhtacdiyezNo ratings yet

- Creative Industries Syllabus DocumentDocument41 pagesCreative Industries Syllabus DocumentAgung HydroNo ratings yet

- 1106-02 L2 Qualification Handbook v3Document60 pages1106-02 L2 Qualification Handbook v3Atif MahmoodNo ratings yet

- Ourse Utline: Urchasing Upply AnagementDocument3 pagesOurse Utline: Urchasing Upply AnagementPaul GichureNo ratings yet

- Lead Auditor Certification KitDocument4 pagesLead Auditor Certification Kitfer0% (2)

- IMI Candidate AssessmentDocument18 pagesIMI Candidate AssessmentTrevorNo ratings yet

- Jobpack Retail Assistant Apprentice 2023Document14 pagesJobpack Retail Assistant Apprentice 2023PaulEMoseNo ratings yet

- 603 2379 6 Nocn - Cskills Awards Level 2 NVQ Certificate in Insulation and Building Treatments Construction Cavity Wall Insulation 1Document22 pages603 2379 6 Nocn - Cskills Awards Level 2 NVQ Certificate in Insulation and Building Treatments Construction Cavity Wall Insulation 1tudorNo ratings yet

- NSDC - An Overview and Opportunities in Skill FinancingDocument21 pagesNSDC - An Overview and Opportunities in Skill Financingarchish10No ratings yet

- SAVE International Certification Examination Study GuideDocument43 pagesSAVE International Certification Examination Study Guidem.kalifardiNo ratings yet

- MOSQ Division or MLVKDocument6 pagesMOSQ Division or MLVKsulya2004No ratings yet

- IMC Unit 1 Mock Exam 2 V17 June 2020 Final Version 11Document25 pagesIMC Unit 1 Mock Exam 2 V17 June 2020 Final Version 11SATHISH SNo ratings yet

- QMS LA Course Brochure Ver 2 Rev 3Document2 pagesQMS LA Course Brochure Ver 2 Rev 3ARINDAM SETTNo ratings yet

- 1 STARS Introduction Issue1.0 Jan 2019Document2 pages1 STARS Introduction Issue1.0 Jan 2019amitNo ratings yet

- IMC Unit 1 Mock Exam 1 V15Document25 pagesIMC Unit 1 Mock Exam 1 V15SATHISH SNo ratings yet

- Global: Personnel Certification SchemeDocument36 pagesGlobal: Personnel Certification SchemeJadson FerreiraNo ratings yet

- Level 3 NVQ Certificate in Management QCF MC03 V3Document133 pagesLevel 3 NVQ Certificate in Management QCF MC03 V3Dreana MarshallNo ratings yet

- BA Security Management Final PDFDocument103 pagesBA Security Management Final PDFJULI KUMARI 220354No ratings yet

- Training Module Aiag Cqi Licensed Training Partner Topqm Systems Overview enDocument3 pagesTraining Module Aiag Cqi Licensed Training Partner Topqm Systems Overview enjpaulNo ratings yet

- Guide To AssessmentDocument67 pagesGuide To Assessmentmark rien albotraNo ratings yet

- Chcadv002 Tag SampleDocument9 pagesChcadv002 Tag SampleSongtta NicoleNo ratings yet

- Working As A CCTV Operator Scotland SpecificationDocument54 pagesWorking As A CCTV Operator Scotland Specificationcecil swartNo ratings yet

- 6317 - Faqs - v1-7-pdf - Copy - AshxDocument15 pages6317 - Faqs - v1-7-pdf - Copy - AshxyasirNo ratings yet

- British Safety Council Certificate in Risk AssessmentDocument8 pagesBritish Safety Council Certificate in Risk AssessmentSYED HAIDER ABBAS KAZMINo ratings yet

- Qual Spec Diploma in Insurance Qsdi202101Document6 pagesQual Spec Diploma in Insurance Qsdi202101mandyNo ratings yet

- NCCEDU - L5DC Unit Specification With Specialisms SUMMER 2021 Onward v03 1 PDFDocument71 pagesNCCEDU - L5DC Unit Specification With Specialisms SUMMER 2021 Onward v03 1 PDFFadika Malick Christ ElyséeNo ratings yet

- Mscnur 002 - 2022 23Document53 pagesMscnur 002 - 2022 23pramod kumarNo ratings yet

- Tech Cert Beauty v1 Lowres 1Document28 pagesTech Cert Beauty v1 Lowres 1Alexis O'SullivanNo ratings yet

- Qualification HandbookDocument132 pagesQualification HandbookAtif MahmoodNo ratings yet

- Trade Finance Academy Outline - 030414 PDFDocument42 pagesTrade Finance Academy Outline - 030414 PDFRezaul Hasan RumonNo ratings yet

- (25082020 1353) Highfield Level 1 Award in Health and Safety Awareness Qualification Specification v1 August 2020Document11 pages(25082020 1353) Highfield Level 1 Award in Health and Safety Awareness Qualification Specification v1 August 2020NISARNo ratings yet

- NEBOSH ND in Occupational HS Syllabus Guide (NEW)Document11 pagesNEBOSH ND in Occupational HS Syllabus Guide (NEW)Anushka SeebaluckNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- Liam Annual2009Document42 pagesLiam Annual2009L.b. ChanNo ratings yet

- Faculty Accountancy 2022 Session 1 - Diploma Maf253Document9 pagesFaculty Accountancy 2022 Session 1 - Diploma Maf253mohdazimrmleNo ratings yet

- A Project Report On "A Study of Internet Banking of State Bank of India''Document73 pagesA Project Report On "A Study of Internet Banking of State Bank of India''Aarti MalikNo ratings yet

- INS 21 Chapters 2-Insurers and How They Are RegulatedDocument22 pagesINS 21 Chapters 2-Insurers and How They Are Regulatedvenki_hinfotechNo ratings yet

- Pra Sets Out Banking Supervisory Priorities For 2023Document2 pagesPra Sets Out Banking Supervisory Priorities For 2023leewaisingNo ratings yet

- Life Cycle and Wealth Cycle in Financial PlanningDocument4 pagesLife Cycle and Wealth Cycle in Financial Planningaman27jaiswalNo ratings yet

- Q4 Business Finance Module 2Document10 pagesQ4 Business Finance Module 2Alexis John LegaspiNo ratings yet

- Nomer 8 Ujian MKDocument5 pagesNomer 8 Ujian MKnoortiaNo ratings yet

- Reading 31 Valuation of Contingent Claims - Answers.Document48 pagesReading 31 Valuation of Contingent Claims - Answers.NeerajNo ratings yet

- KFD New09092023212937773 E32Document5 pagesKFD New09092023212937773 E32SanjeetNo ratings yet

- IRDA - Economic CapitalDocument10 pagesIRDA - Economic Capitalamitd06No ratings yet

- 09 Chapter 2Document76 pages09 Chapter 2Roshan RahejaNo ratings yet

- Industry Profile: Meaning of Life InsuranceDocument72 pagesIndustry Profile: Meaning of Life InsuranceArchana AdavihallimathNo ratings yet

- Underwriting For MBA Students For Insurance and Risk ManagementDocument10 pagesUnderwriting For MBA Students For Insurance and Risk Managementshweta deepakNo ratings yet

- Math For Business and Finance An Algebraic Approach 1St Edition Slater Solutions Manual Full Chapter PDFDocument27 pagesMath For Business and Finance An Algebraic Approach 1St Edition Slater Solutions Manual Full Chapter PDFfinndanielidm51t100% (11)

- 2020 Registered Insurance Intermediaries As at 7th July 2020-MergedDocument192 pages2020 Registered Insurance Intermediaries As at 7th July 2020-MergedJohn GogoNo ratings yet

- If1 Examination Guide For Exams From 1 January 2020 Until 31 December 2020Document28 pagesIf1 Examination Guide For Exams From 1 January 2020 Until 31 December 2020J FernsNo ratings yet

- Corporate Finance - MRF CompanyDocument24 pagesCorporate Finance - MRF CompanyAneesh GargNo ratings yet

- Solutions For Credit RiskDocument3 pagesSolutions For Credit RiskTuan Tran VanNo ratings yet

- HBC 2109 Insurance and Risk ManagementDocument2 pagesHBC 2109 Insurance and Risk Managementcollostero6No ratings yet

- Titanium Plus Plan Web FlyerDocument1 pageTitanium Plus Plan Web FlyerPooja MishraNo ratings yet

- (Form 51 of The Central Motor Vehicle Rules, 1989) : Tenure Total IDVDocument1 page(Form 51 of The Central Motor Vehicle Rules, 1989) : Tenure Total IDVik62299No ratings yet

- Fima 40053 - Risk Management Module 1: Overview of Risk ManagementDocument4 pagesFima 40053 - Risk Management Module 1: Overview of Risk ManagementPamela Anne LasolaNo ratings yet

- Reinsurance ProjectDocument114 pagesReinsurance ProjectDattu Boga75% (12)

- Treasury and Cash ManagementDocument8 pagesTreasury and Cash ManagementkocherlakotapavanNo ratings yet

- Policy Coverage Premium Inclusion Exclusio N How Good in ComparisonDocument5 pagesPolicy Coverage Premium Inclusion Exclusio N How Good in ComparisonAnjali AllureNo ratings yet

- Over View of Rupali Insurance Company LimitedDocument24 pagesOver View of Rupali Insurance Company LimitedSumona Akther RichaNo ratings yet

Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 Equivalent

Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 Equivalent

Uploaded by

Ankit DasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 Equivalent

Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 Equivalent

Uploaded by

Ankit DasCopyright:

Available Formats

Insurance units This is the framework for our insurance qualification units.

They are grouped according to their difficulty, from level 2 through to level 7.

Depending on the qualification you want to achieve, you’ll need to study a number of

these units. Some of our qualifications require just one unit while others require several.

Study and assessment key

RQF level: 2 RQF level: RQF level: 3 RQF level: 4 RQF level: 6 RQF level: 7

CII credit level: 3 equivalent CII credit level: CII credit level: CII credit level: CII credit level: Assessment methods vary depending

on the unit’s level and subject matter.

Award CII credit level: Certificate Diploma Advanced Diploma Advanced Diploma

Each unit within the framework has

Certificate

been assigned an icon, to identify

the assessment method from the

options below.

(FIT) Foundation Not available in the UK (IF1) Insurance, Legal (LM1) London Market (M05) Insurance Law (M94) Motor Insurance (530) Economics (993) Advances

Insurance Test and Regulatory Insurance Essentials 25 credits 25 credits and Business in Strategic Risk

6 credits The following units are 15 credits 10 credits 120 study hours 100 study hours 30 credits Management in

40 study hours not registered as part 60 study hours 40 study hours 150 study hours Insurance

of the UK’s Regulated Multiple choice question (MCQ) exam

(M21) Commercial (M96) Liability 50 credits Study is based on a specified enrolment period,

Qualifications 180 study hours

(PL1) Introduction to Framework (RQF). (IF2) General Insurance (LM2) London Market Insurance Contract Wording Insurances (820) Advanced Claims from 01 January–31 December for UK exams,

Motor Insurance 1 Business Insurance Principles 20 credits 25 credits 30 credits and 01 May–30 April for non-UK exams. MCQ

0 credits (IMP) Motor Insurance 15 credits and Practices 100 study hours 100 study hours 150 study hours exams can be sat at UK and international online

20 study hours Products and Policies 60 study hours 15 credits exam centres, subject to availability, or via

(India) 60 study hours remote invigilation.

(M66) Delegated Authority (M97) Reinsurance (930) Advanced

(PL2) Introduction to 15 credits (IF3) Insurance Insurance Broking (991) London Market

60 study hours 25 credits 30 credits Insurance Specialisation

Travel Insurance 1 Underwriting Process (LM3) London 100 study hours 120 study hours 30 credits

0 credits 15 credits Market Underwriting 150 study hours 50 credits

20 study hours (IMU) Motor 60 study hours Principles 180 study hours

Insurance Claims and (M67) Fundamentals (M98) Marine Hull and Written exam

15 credits of Risk Management Associated Liabilities (945) Marketing

Underwriting (India) 60 study hours (994) Insurance Study is based on a 12 month enrolment period

(PL3) Introduction to (IF4) Insurance Claims 25 credits 30 credits Insurance Products from the date of purchase. Most exams are

15 credits Handling Process and Services Market Specialisation

Home Insurance 1 60 study hours 100 study hours 100 study hours on-screen written exams and some may be

15 credits 30 credits 50 credits

0 credits 180 study hours available by remote invigilation.

20 study hours 60 study hours (M80) Underwriting 150 study hours

(IN7) Indian Healthcare

Insurance Products 2 Practice

(PL4) Introduction to (IF5) Motor Insurance 20 credits (960) Advanced

15 credits Products Underwriting

Pet Insurance 1 50 study hours 80 study hours

0 credits 15 credits 30 credits Mixed assessment

20 study hours 60 study hours (M81) Insurance 150 study hours Study is based on an 18 month enrolment period

(W01) Award in from the date of purchase. Candidates must pass

General Insurance Broking Practice

(IF6) Household 20 credits (990) Insurance a coursework assignment within the first six

Notes (non-UK) 3

Insurance Products 80 study hours Corporate Management months and a MCQ exam within 18 months.

1. Completion of three of 15 credits

50 study hours 15 credits 30 credits

the four Personal Lines 60 study hours 150 study hours

Awards (PL1, PL2, PL3 (M85) Claims Practice

and PL4) contributes 15 (WH1) Award in 20 credits

CII credits towards the General Insurance (IF7) Healthcare 80 study hours (992) Risk Management Coursework assignments

unit requirement of the (Hong Kong) 4 Insurance Products in Insurance

Study is based on a 12 month enrolment period

Certificate in Insurance. 15 credits 15 credits (M86) Personal Insurances 30 credits from the date of purchase. Candidates must pass

50 study hours 60 study hours 150 study hours

20 credits three written assignments, each typically

2. Unit IN7 has been

withdrawn from new 80 study hours 2,000-3,000 words.

(W04) Award in (IF8) Packaged (995) Strategic

enrolments. Final exam Commercial Insurances Underwriting

sessions will be in Customer Service in (M90) Cargo and Goods

December 2021. Insurance (non-UK) 15 credits 30 credits

60 study hours in Transit Insurances 150 study hours

15 credits 25 credits

3. Unit W01 is also available 50 study hours Dissertation

in Arabic (W02) and 100 study hours

(IF9) Customer Service (996) Strategic Study is based on an 18 month enrolment period

in Simplified Chinese (WCE) Insurance in Insurance Claims Management from the date of purchase. Candidates must

(WM1). Claims Handling 15 credits (M91) Aviation and Space 30 credits submit a dissertation, typically 10,000-11,000

(non-UK) 5 60 study hours Insurance 150 study hours words, on an agreed subject.

4. Unit WH1 is also 30 credits

available in Traditional 15 credits

60 study hours 120 study hours

Chinese (HGT). Both (I10) Insurance Broking (997) Advanced Risk

WH1 and HGT are Fundamentals Financing and Transfer

available to candidates (WUE) Insurance (M92) Insurance

Underwriting 15 credits 30 credits

in Hong Kong only. 60 study hours Business and Finance 150 study hours

(non-UK) 6 25 credits

5. Unit WCE is also 15 credits 100 study hours

available in Arabic 60 study hours (I11) Introduction to

(WCA) and Traditional Risk Management

Chinese (WCT). 15 credits (M93) Commercial

60 study hours Property and Business (590) Principles

6. Unit WUE is also Interruption Insurances of Takaful 7

available in Arabic 25 credits 30 credits

(WUA) and Traditional 100 study hours 120 study hours

Chinese (WUT).

7. Unit 590 is also available

in Arabic (595).

2022 qualifications

You might also like

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- Cips Level 2 Cert SyllabusDocument16 pagesCips Level 2 Cert SyllabusThiha BoBo100% (4)

- Certpay Qualification SpecificationDocument18 pagesCertpay Qualification SpecificationGopi Krishna ReddyNo ratings yet

- Financial Management & Policy by James C. Van Horne 12th EditionDocument832 pagesFinancial Management & Policy by James C. Van Horne 12th EditionKashif Mirza80% (35)

- Certpay Qualification SpecificationDocument8 pagesCertpay Qualification SpecificationBalakrishna RaoNo ratings yet

- Clinical Documentation Improvement (CDI) TrainingDocument6 pagesClinical Documentation Improvement (CDI) Trainingmaricel bismani0% (1)

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkContentsNo ratings yet

- Ciin SyllabusDocument61 pagesCiin SyllabusejoghenetaNo ratings yet

- IC38 Concise-1Document30 pagesIC38 Concise-1Swanand VlogsNo ratings yet

- CACI Insurance Qualifications FrameworkDocument1 pageCACI Insurance Qualifications FrameworkAshwin PrakashNo ratings yet

- Personal Finance Qualifications FrameworkDocument1 pagePersonal Finance Qualifications FrameworkbimNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkWill SackettNo ratings yet

- Level 4 SRM Qualification SpecificationDocument19 pagesLevel 4 SRM Qualification Specification360channels720No ratings yet

- Unit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016Document32 pagesUnit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016vantrang0310No ratings yet

- 2934Audit & Assurance (2021)-FinalDocument340 pages2934Audit & Assurance (2021)-Finalvaskarmitra20No ratings yet

- 4 International Advanced LevelDocument14 pages4 International Advanced LevelBonaventure MasekoNo ratings yet

- Nasscom RPL Program - 05nov'23Document10 pagesNasscom RPL Program - 05nov'23sudhir kumarNo ratings yet

- CII Level 6 Advanced Diploma in Insurance: Qualification SpecificationDocument5 pagesCII Level 6 Advanced Diploma in Insurance: Qualification Specificationgp_shortnsweetNo ratings yet

- Skillsfirst DIploma in Adult Care HandbookDocument119 pagesSkillsfirst DIploma in Adult Care HandbookLiza Gomez100% (1)

- 2016Document8 pages2016AMIT KUMARNo ratings yet

- Academic Award Regulations Postgraduate RegulationsDocument25 pagesAcademic Award Regulations Postgraduate Regulationsk.vishnu vardhan100% (2)

- NSQF - Basic CosmetologyDocument13 pagesNSQF - Basic CosmetologyBalaji Pvt ITINo ratings yet

- Qspec Certificate in Regulated Financial Services OperationsDocument5 pagesQspec Certificate in Regulated Financial Services OperationsbimNo ratings yet

- Qual Spec Advanced Diploma in Insurance Qsadi2021Document9 pagesQual Spec Advanced Diploma in Insurance Qsadi2021mandyNo ratings yet

- ProQual L3 Award in Emergency Rescue and Recovery of Casulaties From Confined Spaces October 2018 1Document13 pagesProQual L3 Award in Emergency Rescue and Recovery of Casulaties From Confined Spaces October 2018 1GermimeeNo ratings yet

- QD2.14 Qualifications Specification Incident CommandDocument6 pagesQD2.14 Qualifications Specification Incident CommandMarlon FordeNo ratings yet

- BTEC Ent3Lvl1 ITusers Issue 4Document533 pagesBTEC Ent3Lvl1 ITusers Issue 4Muhammad AkhtarNo ratings yet

- Id Learner Guide v2 FinalDocument11 pagesId Learner Guide v2 FinalSachin SahooNo ratings yet

- 4 International A LevelDocument14 pages4 International A LevelJavaria MajidNo ratings yet

- UCP Exam Review Consolidated Final (PDF) March 2023Document193 pagesUCP Exam Review Consolidated Final (PDF) March 2023enirhtacdiyezNo ratings yet

- Creative Industries Syllabus DocumentDocument41 pagesCreative Industries Syllabus DocumentAgung HydroNo ratings yet

- 1106-02 L2 Qualification Handbook v3Document60 pages1106-02 L2 Qualification Handbook v3Atif MahmoodNo ratings yet

- Ourse Utline: Urchasing Upply AnagementDocument3 pagesOurse Utline: Urchasing Upply AnagementPaul GichureNo ratings yet

- Lead Auditor Certification KitDocument4 pagesLead Auditor Certification Kitfer0% (2)

- IMI Candidate AssessmentDocument18 pagesIMI Candidate AssessmentTrevorNo ratings yet

- Jobpack Retail Assistant Apprentice 2023Document14 pagesJobpack Retail Assistant Apprentice 2023PaulEMoseNo ratings yet

- 603 2379 6 Nocn - Cskills Awards Level 2 NVQ Certificate in Insulation and Building Treatments Construction Cavity Wall Insulation 1Document22 pages603 2379 6 Nocn - Cskills Awards Level 2 NVQ Certificate in Insulation and Building Treatments Construction Cavity Wall Insulation 1tudorNo ratings yet

- NSDC - An Overview and Opportunities in Skill FinancingDocument21 pagesNSDC - An Overview and Opportunities in Skill Financingarchish10No ratings yet

- SAVE International Certification Examination Study GuideDocument43 pagesSAVE International Certification Examination Study Guidem.kalifardiNo ratings yet

- MOSQ Division or MLVKDocument6 pagesMOSQ Division or MLVKsulya2004No ratings yet

- IMC Unit 1 Mock Exam 2 V17 June 2020 Final Version 11Document25 pagesIMC Unit 1 Mock Exam 2 V17 June 2020 Final Version 11SATHISH SNo ratings yet

- QMS LA Course Brochure Ver 2 Rev 3Document2 pagesQMS LA Course Brochure Ver 2 Rev 3ARINDAM SETTNo ratings yet

- 1 STARS Introduction Issue1.0 Jan 2019Document2 pages1 STARS Introduction Issue1.0 Jan 2019amitNo ratings yet

- IMC Unit 1 Mock Exam 1 V15Document25 pagesIMC Unit 1 Mock Exam 1 V15SATHISH SNo ratings yet

- Global: Personnel Certification SchemeDocument36 pagesGlobal: Personnel Certification SchemeJadson FerreiraNo ratings yet

- Level 3 NVQ Certificate in Management QCF MC03 V3Document133 pagesLevel 3 NVQ Certificate in Management QCF MC03 V3Dreana MarshallNo ratings yet

- BA Security Management Final PDFDocument103 pagesBA Security Management Final PDFJULI KUMARI 220354No ratings yet

- Training Module Aiag Cqi Licensed Training Partner Topqm Systems Overview enDocument3 pagesTraining Module Aiag Cqi Licensed Training Partner Topqm Systems Overview enjpaulNo ratings yet

- Guide To AssessmentDocument67 pagesGuide To Assessmentmark rien albotraNo ratings yet

- Chcadv002 Tag SampleDocument9 pagesChcadv002 Tag SampleSongtta NicoleNo ratings yet

- Working As A CCTV Operator Scotland SpecificationDocument54 pagesWorking As A CCTV Operator Scotland Specificationcecil swartNo ratings yet

- 6317 - Faqs - v1-7-pdf - Copy - AshxDocument15 pages6317 - Faqs - v1-7-pdf - Copy - AshxyasirNo ratings yet

- British Safety Council Certificate in Risk AssessmentDocument8 pagesBritish Safety Council Certificate in Risk AssessmentSYED HAIDER ABBAS KAZMINo ratings yet

- Qual Spec Diploma in Insurance Qsdi202101Document6 pagesQual Spec Diploma in Insurance Qsdi202101mandyNo ratings yet

- NCCEDU - L5DC Unit Specification With Specialisms SUMMER 2021 Onward v03 1 PDFDocument71 pagesNCCEDU - L5DC Unit Specification With Specialisms SUMMER 2021 Onward v03 1 PDFFadika Malick Christ ElyséeNo ratings yet

- Mscnur 002 - 2022 23Document53 pagesMscnur 002 - 2022 23pramod kumarNo ratings yet

- Tech Cert Beauty v1 Lowres 1Document28 pagesTech Cert Beauty v1 Lowres 1Alexis O'SullivanNo ratings yet

- Qualification HandbookDocument132 pagesQualification HandbookAtif MahmoodNo ratings yet

- Trade Finance Academy Outline - 030414 PDFDocument42 pagesTrade Finance Academy Outline - 030414 PDFRezaul Hasan RumonNo ratings yet

- (25082020 1353) Highfield Level 1 Award in Health and Safety Awareness Qualification Specification v1 August 2020Document11 pages(25082020 1353) Highfield Level 1 Award in Health and Safety Awareness Qualification Specification v1 August 2020NISARNo ratings yet

- NEBOSH ND in Occupational HS Syllabus Guide (NEW)Document11 pagesNEBOSH ND in Occupational HS Syllabus Guide (NEW)Anushka SeebaluckNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- Liam Annual2009Document42 pagesLiam Annual2009L.b. ChanNo ratings yet

- Faculty Accountancy 2022 Session 1 - Diploma Maf253Document9 pagesFaculty Accountancy 2022 Session 1 - Diploma Maf253mohdazimrmleNo ratings yet

- A Project Report On "A Study of Internet Banking of State Bank of India''Document73 pagesA Project Report On "A Study of Internet Banking of State Bank of India''Aarti MalikNo ratings yet

- INS 21 Chapters 2-Insurers and How They Are RegulatedDocument22 pagesINS 21 Chapters 2-Insurers and How They Are Regulatedvenki_hinfotechNo ratings yet

- Pra Sets Out Banking Supervisory Priorities For 2023Document2 pagesPra Sets Out Banking Supervisory Priorities For 2023leewaisingNo ratings yet

- Life Cycle and Wealth Cycle in Financial PlanningDocument4 pagesLife Cycle and Wealth Cycle in Financial Planningaman27jaiswalNo ratings yet

- Q4 Business Finance Module 2Document10 pagesQ4 Business Finance Module 2Alexis John LegaspiNo ratings yet

- Nomer 8 Ujian MKDocument5 pagesNomer 8 Ujian MKnoortiaNo ratings yet

- Reading 31 Valuation of Contingent Claims - Answers.Document48 pagesReading 31 Valuation of Contingent Claims - Answers.NeerajNo ratings yet

- KFD New09092023212937773 E32Document5 pagesKFD New09092023212937773 E32SanjeetNo ratings yet

- IRDA - Economic CapitalDocument10 pagesIRDA - Economic Capitalamitd06No ratings yet

- 09 Chapter 2Document76 pages09 Chapter 2Roshan RahejaNo ratings yet

- Industry Profile: Meaning of Life InsuranceDocument72 pagesIndustry Profile: Meaning of Life InsuranceArchana AdavihallimathNo ratings yet

- Underwriting For MBA Students For Insurance and Risk ManagementDocument10 pagesUnderwriting For MBA Students For Insurance and Risk Managementshweta deepakNo ratings yet

- Math For Business and Finance An Algebraic Approach 1St Edition Slater Solutions Manual Full Chapter PDFDocument27 pagesMath For Business and Finance An Algebraic Approach 1St Edition Slater Solutions Manual Full Chapter PDFfinndanielidm51t100% (11)

- 2020 Registered Insurance Intermediaries As at 7th July 2020-MergedDocument192 pages2020 Registered Insurance Intermediaries As at 7th July 2020-MergedJohn GogoNo ratings yet

- If1 Examination Guide For Exams From 1 January 2020 Until 31 December 2020Document28 pagesIf1 Examination Guide For Exams From 1 January 2020 Until 31 December 2020J FernsNo ratings yet

- Corporate Finance - MRF CompanyDocument24 pagesCorporate Finance - MRF CompanyAneesh GargNo ratings yet

- Solutions For Credit RiskDocument3 pagesSolutions For Credit RiskTuan Tran VanNo ratings yet

- HBC 2109 Insurance and Risk ManagementDocument2 pagesHBC 2109 Insurance and Risk Managementcollostero6No ratings yet

- Titanium Plus Plan Web FlyerDocument1 pageTitanium Plus Plan Web FlyerPooja MishraNo ratings yet

- (Form 51 of The Central Motor Vehicle Rules, 1989) : Tenure Total IDVDocument1 page(Form 51 of The Central Motor Vehicle Rules, 1989) : Tenure Total IDVik62299No ratings yet

- Fima 40053 - Risk Management Module 1: Overview of Risk ManagementDocument4 pagesFima 40053 - Risk Management Module 1: Overview of Risk ManagementPamela Anne LasolaNo ratings yet

- Reinsurance ProjectDocument114 pagesReinsurance ProjectDattu Boga75% (12)

- Treasury and Cash ManagementDocument8 pagesTreasury and Cash ManagementkocherlakotapavanNo ratings yet

- Policy Coverage Premium Inclusion Exclusio N How Good in ComparisonDocument5 pagesPolicy Coverage Premium Inclusion Exclusio N How Good in ComparisonAnjali AllureNo ratings yet

- Over View of Rupali Insurance Company LimitedDocument24 pagesOver View of Rupali Insurance Company LimitedSumona Akther RichaNo ratings yet