Professional Documents

Culture Documents

Ofr Per Share While Share.: The of

Ofr Per Share While Share.: The of

Uploaded by

Mahika SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ofr Per Share While Share.: The of

Ofr Per Share While Share.: The of

Uploaded by

Mahika SharmaCopyright:

Available Formats

Mustration: 5 (EPS)

CompanyX is contemplating to purchase Company Y. Company X has 3,00,000 shares havinga market

price ofR 30pershare while Company Y has 2,00,000 shares selling at 20 pershare. The EPS are4

and

2.25 for X and Y respectively.

Managements of both the

Companies are discussing two alternative proposals for exchange of shares as

indicated below :

In proportion to the relative earning per share of two companies.

Calculate EPS after merger.

Tlustration:6(EPS)

ABC Ltd is intending to acquire XYZ Ltd by

merger and the following information is availaoie

ABC LtdXYZ Ltd.

No. of Equity Shares

EAT 10,00,000 6,00,000

M.V. per share

50,00,000 18,00,000

42 28

Required

1. Calculate present EPS of both the

Companies.

2 Calculate EPS after merger.

vraukeTTTICe)

Following information is extracted from the books of Mark Ltd., acquiring firm and Mask Lid., targe

fim.

Mark Ltd. Mask Ltd.

Earning after tax 7400 lakhs

72,000 lakhs

No. of shares 100 lakhs

200 lakhs

P/E Ratio (times 10 5

Requiredd:

1. Calculate market price of shares of both the companies.

2. Find out swap ratio based on market price.

3. What is present EPS?

What is EPS of Mark Ltd. after acquisition?

5. Decide the market value of the mergedfirm.

Solution

=

30

lustration: 9 (EPS)

Sunny Ltd. 15Studyingthe possible acquisition of Rainy Ltd.the following informationRainy

isavailabic

Ltd.

Sunny Ltd.

Profit After Tax 75,000

3,00,00o

Equity Shares Outstanding 50,000 10,000

P/EMultiple 2

If mergertakes place by exchange of equity shares based on marketprice, what is EPS of the new ni

Solution

EPS

Sunny Ltd. = 3,00,000

dcquis10

cquls1on)

A Ltd. wanus to

acquire T Ltd. and has offered swan

Id Following information is

ratio of 1:2 (0.5 shares for eveTy one

sila

supplied.

B Ltd.

Profit After Tax A Ltd.

18,00,000 3,60,000

No. of Equity Shares 1,80,000D

6,00,00o

EPS 3 2

P/E Ratio

10

14

Market Price Per Share 30

Calculate:

i) No. of equity shares to be issued by A Ltd. for acquisition of T Ltd.

ii) EPS after acquisition.

ii) Equivalent EPS of T Ltd. P/E ratio remains unchanged.

iv) Expected price per share of A Ltd. after acquisition assuming

market

v) Market value of the merged firm.

one share n YZ Ltd. O0,UUU Of

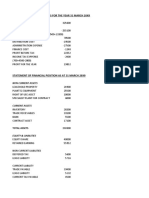

ifustrátio 18 (Net Asset Value

Ltd. wants to takeover YLtd. andEPS)

the financial details are as

Particulars folows Y Ltd.

X Ltd.

Preference share Capital

Eauity Share Capital of F 10 each 20,000

Securities Premiuim 1,00,000 50,000

Profit and Loss Account 2,000

10% Debentures 38,000 4,000

15,000 5,000

Fixed Assets 173,000 61,000

Current Assets 1,22,000 35,000

51,000 26,000

Profit After Tax and Preference 173.000 61,000

Market Price Dividend 24,000 15,000

24 27

Set

e t value

val

Value.EPs)

X Ltd. wants EPS)

to takeover Y Ltd. and the financial

details are as follows

Particulars X Ltd. YLtd.

Preference Share Capital 20,000

Equity Share Capital of 10 each 1,00,000 50,000

Securities Premium 2,000

Profit and Loss Account

38,000 4,000

10% Debentures

15,000 5,000

1,73,000 61,000

Fixed Assets 1,22,000 35,000

Current Assets 51,000 26,000

1,73.000 61,000

Profit After Tax and Preference Dividend 24,000 15,000

Market Price 24 27

Eschenge Rato Baged on NAY, EPS MPS

llustration: 27 (Value of Synergy

Ltd. operate indeperndently and had the following financial statement

statement

and SmithParticulars

.

Two firms Ankit Ltd.

Ankit Ltd. | Smith Ltd.

Revenues

4,400 3,000

3,850 2,670

Cost of Goods Sold

550 330

EBIT

Expected Growth Rate 5% 6%

Cost of Equity 10% | 12%

Cost of Debt (Pre-Tax) 9% 9%

Debt-Equity Ratio 1:2 2:3

Both firms are in a steady state and working capital requirements for both firms are nil. Both firms have

tax rate of 35%. Combining the two firms will

create in form of shared distribution

economies of scale the

and advertising costs which will increase its future growh to 7% and reduce the cost of goods sold to 85% of

revenues.

Requirements:

i) Estimate the value of both fims separate entitles.

as

ii) Estimate the value of combined firm with no synergy efect.

il) Estimate the value of combined firm with synergy effect.

iv) Compute the value of synergy

You might also like

- Practical Questions: Strategic Financial ManagementDocument50 pagesPractical Questions: Strategic Financial ManagementRITZ BROWNNo ratings yet

- BKM9e-Answers-Chap003-Margin and Short Extra QuestionsDocument3 pagesBKM9e-Answers-Chap003-Margin and Short Extra QuestionsLê Chấn PhongNo ratings yet

- Merger and AcquisitionDocument6 pagesMerger and AcquisitionfatemaNo ratings yet

- Mergers & AcquisitionsDocument5 pagesMergers & Acquisitionsharesh100% (2)

- Exchange Ratio - Assignment - 2Document6 pagesExchange Ratio - Assignment - 2Priyanka DargadNo ratings yet

- University of Mumbai - Bachelor of Management Studies - 2016-2017 - March - Operations ResearchDocument6 pagesUniversity of Mumbai - Bachelor of Management Studies - 2016-2017 - March - Operations ResearchHola GamerNo ratings yet

- Paper18b PDFDocument47 pagesPaper18b PDFAnonymous SgD5u8R100% (1)

- Mergers and AcquisitionsDocument34 pagesMergers and Acquisitionsmeet daftaryNo ratings yet

- 01 Merger and Acquisition QADocument5 pages01 Merger and Acquisition QApijiyo78No ratings yet

- Amounting 5,00,000.: Exelusively Ordinary Company Equity Capital. Debentures. Can Raise Capital FinancingDocument10 pagesAmounting 5,00,000.: Exelusively Ordinary Company Equity Capital. Debentures. Can Raise Capital FinancingMohit RanaNo ratings yet

- Business ValuationDocument15 pagesBusiness ValuationOm MansattaNo ratings yet

- Corporate Valuation & Financial Modelling - 2020: A Co. B CoDocument3 pagesCorporate Valuation & Financial Modelling - 2020: A Co. B CoRakshith PsNo ratings yet

- Mergers and Acquisition PDFDocument82 pagesMergers and Acquisition PDFSayantanKandarNo ratings yet

- 02 Solution To Merger and AcquistionDocument25 pages02 Solution To Merger and Acquistionpijiyo78No ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- M & A Solutions PDFDocument28 pagesM & A Solutions PDFayushmehtha7No ratings yet

- Question SFM GMDocument10 pagesQuestion SFM GMPraDeepMspNo ratings yet

- Acct 1Document4 pagesAcct 1Susovan SirNo ratings yet

- SFM DJB - Icai New Questions May 21Document146 pagesSFM DJB - Icai New Questions May 21kunal kumarNo ratings yet

- M&A Problms - ClassDocument14 pagesM&A Problms - ClassSeemaNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Board of Studies Academic Assignment Morning 12 14 17 01 22 1646725843Document13 pagesBoard of Studies Academic Assignment Morning 12 14 17 01 22 1646725843CATHARINENo ratings yet

- Valuation of SharesDocument15 pagesValuation of Sharesbharatipaul42No ratings yet

- Ratio Analysis Liquidity Ratios Solvency RatiosDocument55 pagesRatio Analysis Liquidity Ratios Solvency Ratiossarika gurjarNo ratings yet

- Shareholder Value Practice QuestionsDocument6 pagesShareholder Value Practice Questionsavinashchoudhary2043No ratings yet

- Leverage - Financial ManagementDocument7 pagesLeverage - Financial Managementyogeshjhanwar402No ratings yet

- Set. 2. Test No.1 Answer KeyDocument5 pagesSet. 2. Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Endterm Mergers 21170Document7 pagesEndterm Mergers 21170suraj nairNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- M and A ExercisesDocument4 pagesM and A ExercisesSweet tripathiNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Cases, Investment in SharesDocument5 pagesCases, Investment in SharesGemmalyn BautistaNo ratings yet

- SFM 2.1Document3 pagesSFM 2.1likithaggowdaaNo ratings yet

- Adobe Scan 04 Aug 2023Document11 pagesAdobe Scan 04 Aug 2023preritverma3No ratings yet

- M&ADocument69 pagesM&ASiddhant GujarNo ratings yet

- Merger Acquisition CADocument24 pagesMerger Acquisition CAYogesh NeupaneNo ratings yet

- Amalgamation Dec 2020Document46 pagesAmalgamation Dec 2020binu100% (2)

- LEVERAGE - Hons.Document7 pagesLEVERAGE - Hons.BISHAL ROYNo ratings yet

- FR - Questions 3Document6 pagesFR - Questions 36dzk78g2vyNo ratings yet

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- E-Book Perfect Practice BooksDocument36 pagesE-Book Perfect Practice BooksSavit Bansal100% (1)

- Exercices + Answers (Capital Structure) PDFDocument4 pagesExercices + Answers (Capital Structure) PDFSonal RathhiNo ratings yet

- Paper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementDocument30 pagesPaper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementNirupa ChoppaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Test Your Knowledge: Theoretical QuestionsDocument30 pagesTest Your Knowledge: Theoretical QuestionsRITZ BROWN33% (3)

- MEFA R20 Civil Question PaperDocument2 pagesMEFA R20 Civil Question PaperKARTHIK RNo ratings yet

- Leverages PDFDocument7 pagesLeverages PDFVaishnavi ShigvanNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Capital Structure and LeverageDocument11 pagesCapital Structure and Leverageyashnagra6452yNo ratings yet

- Purchase Consideration - SolutionDocument16 pagesPurchase Consideration - Solutionsarthak mendirattaNo ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- M&A Practice ProblemsDocument3 pagesM&A Practice ProblemsAditi KhaitanNo ratings yet

- TEST Paper 2Document10 pagesTEST Paper 2Pools KingNo ratings yet

- CAA CH 2 Questions Pt.1Document4 pagesCAA CH 2 Questions Pt.1JohnNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- SBAProject FinalsDocument5 pagesSBAProject Finalsjoy mesanaNo ratings yet

- May-June 2011Document10 pagesMay-June 2011Usuf JabedNo ratings yet

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinFrom EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinNo ratings yet

- DLL FABM Week6Document3 pagesDLL FABM Week6sweetzelNo ratings yet

- Accounting Cycle: Service BusinessDocument16 pagesAccounting Cycle: Service BusinessMavie PhotographyNo ratings yet

- Financial Markets (Chapter 8)Document4 pagesFinancial Markets (Chapter 8)Kyla DayawonNo ratings yet

- Client Assistance ScheduleDocument9 pagesClient Assistance SchedulesefanitNo ratings yet

- Accounting For Debt Srvice FundDocument10 pagesAccounting For Debt Srvice FundsenafteshomeNo ratings yet

- Test Bank For Forensic Accounting Robert Rufus 0133050475Document19 pagesTest Bank For Forensic Accounting Robert Rufus 0133050475AnitaSchwartzorzdg100% (46)

- Impact of Financial Management To Small Enterprises in San Jose CityDocument27 pagesImpact of Financial Management To Small Enterprises in San Jose Cityrovelyn CabicoNo ratings yet

- Problems: Set C: InstructionsDocument2 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- Nestle Income Statement & Balance SheetDocument10 pagesNestle Income Statement & Balance SheetDristi SinghNo ratings yet

- Private Equity ExplainedDocument27 pagesPrivate Equity Explainedleonnox100% (2)

- Issue of Shares and DebenturesDocument3 pagesIssue of Shares and DebenturesAarya KhedekarNo ratings yet

- Textile Industry. Cotton Fabric Manufacturing Business-805667Document51 pagesTextile Industry. Cotton Fabric Manufacturing Business-805667risikumar100% (1)

- IA2 20 Shareholders' EquityDocument61 pagesIA2 20 Shareholders' EquityLawrence NarvaezNo ratings yet

- Chapter:-1: Introduction To Company AccountsDocument15 pagesChapter:-1: Introduction To Company AccountsVishal KNo ratings yet

- 02 Conceptual Framework - RevisedDocument13 pages02 Conceptual Framework - RevisedRazel MhinNo ratings yet

- PT Petrosea TBK - Annual Report 2014Document185 pagesPT Petrosea TBK - Annual Report 2014Sri Reskiawati SyamNo ratings yet

- 2022Q3 Alphabet Earnings ReleaseDocument9 pages2022Q3 Alphabet Earnings ReleaseAdam BookerNo ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Financial Results - IOI GroupDocument3 pagesFinancial Results - IOI Groupcao tinghuiNo ratings yet

- Exercises Set B 1 Exercises Set B CompressDocument7 pagesExercises Set B 1 Exercises Set B CompressHoèn Hoèn100% (1)

- Unit Viii - Audit of Equity Accounts T1 2014-2015 PDFDocument9 pagesUnit Viii - Audit of Equity Accounts T1 2014-2015 PDFSed ReyesNo ratings yet

- Full Download Test Bank For Financial Accounting in An Economic Context 10th by Pratt PDF Full ChapterDocument28 pagesFull Download Test Bank For Financial Accounting in An Economic Context 10th by Pratt PDF Full Chapterasidemiscovet.hxnit100% (19)

- Barclays 2013 Annual ReportDocument436 pagesBarclays 2013 Annual ReportCraftNo ratings yet

- StreamDocument5 pagesStreamIrsaIpanNo ratings yet

- Final Presentation On Bank Al-HabibDocument25 pagesFinal Presentation On Bank Al-Habibimran50No ratings yet

- Financial Statements and ManagementReportsDocument325 pagesFinancial Statements and ManagementReportsBOCMANAGERNo ratings yet

- CRQS Final AccountsDocument54 pagesCRQS Final AccountsAtka FahimNo ratings yet

- Linapacan2014 Audit Report-UnlockedDocument168 pagesLinapacan2014 Audit Report-UnlockedJ JaNo ratings yet

- Accounts AmalgamationDocument6 pagesAccounts AmalgamationscarunamarNo ratings yet