Professional Documents

Culture Documents

BANK 201 Course Outline

BANK 201 Course Outline

Uploaded by

EmshaitaCopyright:

Available Formats

You might also like

- The Music in Stanley Kubrick's 2001: A Space OdysseyDocument27 pagesThe Music in Stanley Kubrick's 2001: A Space OdysseyJoris Daniel100% (1)

- Fin 464Document4 pagesFin 464Zihad Al AminNo ratings yet

- CERTIFICATEDocument31 pagesCERTIFICATEShanawaz ArifNo ratings yet

- Naveen MBA ProjectDocument57 pagesNaveen MBA ProjectNaveen DasNo ratings yet

- Project Report For Bank Loan - Format, Details - AKT AssociatesDocument13 pagesProject Report For Bank Loan - Format, Details - AKT AssociatesCatch a starNo ratings yet

- Prachi BlackbookDocument65 pagesPrachi BlackbookSapan ShahNo ratings yet

- Intro To Banking MGMT 1022Document5 pagesIntro To Banking MGMT 1022Josiah D'angelo LyonsNo ratings yet

- Sandra Luka Report Project Bba 3Document40 pagesSandra Luka Report Project Bba 3Sandra LasuNo ratings yet

- A Project Report On Analysis of Credit Appraisal at Bandhan BankDocument100 pagesA Project Report On Analysis of Credit Appraisal at Bandhan Bankmba08061 DEEPAK TRIPATHINo ratings yet

- 2511-Jeet Chetan GadaDocument64 pages2511-Jeet Chetan GadaMontu SinghNo ratings yet

- Project Report: Honours of SEMESTER VI, 2021 in Accounting & Finance Under The University of Calcutta ONDocument20 pagesProject Report: Honours of SEMESTER VI, 2021 in Accounting & Finance Under The University of Calcutta ONBishal AdakNo ratings yet

- A Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"Document80 pagesA Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"sanjay carNo ratings yet

- IBS Hyderabad (Document169 pagesIBS Hyderabad (Adil D CoolestNo ratings yet

- New Asit Ekka, Mba-Project Report @ucbDocument71 pagesNew Asit Ekka, Mba-Project Report @ucbASIT EKKANo ratings yet

- DI Questions For IBPS Exam 2017Document534 pagesDI Questions For IBPS Exam 2017Abhishek KrNo ratings yet

- De An Ngan Hang - Vu Thu Hien - 11201450Document40 pagesDe An Ngan Hang - Vu Thu Hien - 11201450Vũ Tiến HiếuNo ratings yet

- Internship Report: Chapter 1: Introduction of Agribank - Phu Nhuan BranchDocument14 pagesInternship Report: Chapter 1: Introduction of Agribank - Phu Nhuan BranchNgô NgọcNo ratings yet

- Financial Analysis To Landing To BusinessDocument60 pagesFinancial Analysis To Landing To BusinessAshwin ThoratNo ratings yet

- Indian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersDocument4 pagesIndian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersS Dharam SinghNo ratings yet

- Pooja Yadav Full Sip Project Roll No. 84Document152 pagesPooja Yadav Full Sip Project Roll No. 84Shruti MhatreNo ratings yet

- Credit Appraisal in Banks and Financial Institutions PDFDocument6 pagesCredit Appraisal in Banks and Financial Institutions PDFJaiganesh M SNo ratings yet

- Mitesh ProjectDocument67 pagesMitesh ProjectMitesh Prajapati 7765No ratings yet

- A Study On Influence of Covid-19 On Financal Institutions of IndiaDocument32 pagesA Study On Influence of Covid-19 On Financal Institutions of IndiaAkshathNo ratings yet

- Final Project Kyc FinalDocument70 pagesFinal Project Kyc FinalAnonymous HackerNo ratings yet

- PATELJAYKUMARDILIPBHAIDocument87 pagesPATELJAYKUMARDILIPBHAIPatel MehulNo ratings yet

- Table of Content: Topic: Impact of Liquidity On Profitability Banking Sector in PakistanDocument9 pagesTable of Content: Topic: Impact of Liquidity On Profitability Banking Sector in PakistanAbdussalam gillNo ratings yet

- Non Performing Assets in SBI GroupDocument59 pagesNon Performing Assets in SBI GroupNavjinder Kaur67% (6)

- Kathmandu University: February-July 2020 SessionDocument2 pagesKathmandu University: February-July 2020 SessionRubina AryalNo ratings yet

- Summer Internship ProjectDocument75 pagesSummer Internship ProjectVargeesu GamingYTNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- IT & BPO Companies-Low-240518Document7 pagesIT & BPO Companies-Low-240518Tej ShahNo ratings yet

- MBA - 1st - Yr - Banking & Financial Services - 2022 - 23 - FinalDocument40 pagesMBA - 1st - Yr - Banking & Financial Services - 2022 - 23 - FinalAnanya GargNo ratings yet

- Foreign Exchange Report ShankarDocument85 pagesForeign Exchange Report ShankarTipu khanNo ratings yet

- Business Correspondence ModelDocument85 pagesBusiness Correspondence ModelAmruta Patil100% (1)

- MaybankDocument40 pagesMaybankSHIAO WEI CHINNo ratings yet

- AML KYC-Low PDFDocument6 pagesAML KYC-Low PDFParul Tripathi0% (1)

- Mousami DuttaDocument64 pagesMousami DuttaSukalyan JanaNo ratings yet

- Kanu 12Document82 pagesKanu 12Naman KandpalNo ratings yet

- Kanu 12Document87 pagesKanu 12Naman KandpalNo ratings yet

- Aml Kyc Notice PDFDocument4 pagesAml Kyc Notice PDFabhishek50% (2)

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)iqra zafarNo ratings yet

- Comparative Analysis of Customer Behaviour in Standard Chartered Bank & Barclays BankDocument72 pagesComparative Analysis of Customer Behaviour in Standard Chartered Bank & Barclays Bankyash guptaNo ratings yet

- Internship Report On Credit Policy of Dutch-Bangla Bank LimitedDocument94 pagesInternship Report On Credit Policy of Dutch-Bangla Bank LimitedSifat Shahriar Shakil80% (10)

- Anisur Report (Repaired)Document49 pagesAnisur Report (Repaired)Nafiz IntiazNo ratings yet

- Marouf Fazili JK BANK PROJECT PDFDocument38 pagesMarouf Fazili JK BANK PROJECT PDFMarouf FaziliNo ratings yet

- Banking and Finance: Bharathiar University: Coimbatore - 641 046Document7 pagesBanking and Finance: Bharathiar University: Coimbatore - 641 046Aswathy S RNo ratings yet

- Vaishnavi Dandekar - Financial Performance Commercial BankDocument67 pagesVaishnavi Dandekar - Financial Performance Commercial BankMitesh Prajapati 7765No ratings yet

- A Project Report On " ": Comparative Analysis of Corporate Salary Accounts With Respect To HDFC BankDocument78 pagesA Project Report On " ": Comparative Analysis of Corporate Salary Accounts With Respect To HDFC BankPari TripathyNo ratings yet

- Softcopy DOCUNMENT NPADocument63 pagesSoftcopy DOCUNMENT NPAAditi KedariNo ratings yet

- "Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal OnDocument14 pages"Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal Onrk shahNo ratings yet

- Proposal A 2222151049 ABSDocument6 pagesProposal A 2222151049 ABSmehrin mostofa addritaNo ratings yet

- Finance 2nd Year Revised SyllabusDocument4 pagesFinance 2nd Year Revised Syllabusmanishnewar1996337135No ratings yet

- International School of Management and EconomicsDocument28 pagesInternational School of Management and EconomicsLê Thái HàNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesFrom EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisNo ratings yet

- Public Financial Management Systems—Myanmar: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Myanmar: Key Elements from a Financial Management PerspectiveNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- Viet Nam Secondary Education Sector Assessment, Strategy, and Road MapFrom EverandViet Nam Secondary Education Sector Assessment, Strategy, and Road MapNo ratings yet

- Fundamental ParticlesDocument8 pagesFundamental ParticlesDon Amaru SarmaNo ratings yet

- Hydrology Training Course: Geographic Information SystemDocument24 pagesHydrology Training Course: Geographic Information SystemCosminNo ratings yet

- Eee-III-Analog Electronic Circuits m1Document52 pagesEee-III-Analog Electronic Circuits m1My WritingsNo ratings yet

- 111 Veterinary Gross Anatomy - I (Osteology, Arthrology & Biomechanics)Document161 pages111 Veterinary Gross Anatomy - I (Osteology, Arthrology & Biomechanics)Vaidika YadavNo ratings yet

- School Education and Literacy Department Government of Sindh Office of The District Education Officer (E, S&H.S) District Central KarachiDocument15 pagesSchool Education and Literacy Department Government of Sindh Office of The District Education Officer (E, S&H.S) District Central KarachiNaya PakistanNo ratings yet

- RLG203 Week 5Document3 pagesRLG203 Week 5Abbigal KamalovaNo ratings yet

- Difference Between Institute and University - Difference Between - Institute Vs UniversityDocument5 pagesDifference Between Institute and University - Difference Between - Institute Vs Universitytapar.dashNo ratings yet

- SGC Web SocketsDocument171 pagesSGC Web SocketsMarceloMoreiraCunhaNo ratings yet

- Unwto Tourism Highlights: 2011 EditionDocument12 pagesUnwto Tourism Highlights: 2011 EditionTheBlackD StelsNo ratings yet

- Anusha Dadwani - ResumeDocument2 pagesAnusha Dadwani - Resumeapi-458585393No ratings yet

- Zelio Control Relays - RM22TG20 DatasheetDocument7 pagesZelio Control Relays - RM22TG20 DatasheetMinh NhậtNo ratings yet

- 02 Prelim PagesDocument383 pages02 Prelim Pageshamzah.masoodNo ratings yet

- Seminar Report On AutomationDocument32 pagesSeminar Report On AutomationDusmanta moharanaNo ratings yet

- ME 220 Measurements & SensorsDocument10 pagesME 220 Measurements & SensorsMohamed MaherNo ratings yet

- Fyba Foundtion Course PDFDocument252 pagesFyba Foundtion Course PDFrusa websiteNo ratings yet

- Set LP - 114719Document9 pagesSet LP - 114719Beverly SombiseNo ratings yet

- Group 2 Ied 126 Charmedimsure Designbriefand RubricDocument4 pagesGroup 2 Ied 126 Charmedimsure Designbriefand Rubricapi-551027316No ratings yet

- PurushottamSureshGadekar - Netsuite Technical Consultant - PuneDocument4 pagesPurushottamSureshGadekar - Netsuite Technical Consultant - PuneSeenuNo ratings yet

- Ron Feldman DissertationDocument404 pagesRon Feldman DissertationRichard RadavichNo ratings yet

- Cheat Sheet Common Wireless Issues: Components UsedDocument31 pagesCheat Sheet Common Wireless Issues: Components UsedblablaNo ratings yet

- 13-02-2019 - WinGD - Article - Volatile Organic Comp As FuelDocument4 pages13-02-2019 - WinGD - Article - Volatile Organic Comp As FuelAVINASH ANAND RAONo ratings yet

- Heat Transfer in Staggered Tube BanksDocument9 pagesHeat Transfer in Staggered Tube BanksMohammed Bate'eNo ratings yet

- Breaking The Power of DebtDocument3 pagesBreaking The Power of DebtClifford NyathiNo ratings yet

- Fluke 123 User ManualDocument86 pagesFluke 123 User ManualRobNo ratings yet

- Schneider Activa Pricelist Jan2011 PDFDocument4 pagesSchneider Activa Pricelist Jan2011 PDFSona SunilNo ratings yet

- Get Growing Packages 15k CommercialDocument10 pagesGet Growing Packages 15k CommercialRodrigo Urcelay MontecinosNo ratings yet

- Avaya SBCE Deploying On An AWS Platform 8.1.x December 2020Document64 pagesAvaya SBCE Deploying On An AWS Platform 8.1.x December 2020Vicky NicNo ratings yet

- Functional Pattern (System Review)Document2 pagesFunctional Pattern (System Review)Nursing FilesNo ratings yet

- 3.4.6 Excretory System H 3.4.8Document9 pages3.4.6 Excretory System H 3.4.8Joy FernandezNo ratings yet

BANK 201 Course Outline

BANK 201 Course Outline

Uploaded by

EmshaitaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BANK 201 Course Outline

BANK 201 Course Outline

Uploaded by

EmshaitaCopyright:

Available Formats

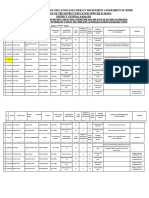

EASTERN MEDITERRANEAN UNIVERSITY/ FACULTY OF BUSINESS AND ECONOMICS

DEPARTMENT OF BANKING AND FINANCE

2020-2021/ FALL SEMESTER

BANK COURSE

COURSE CODE 2nd year - Undergraduate

201 LEVEL

COURSE TITLE Commercial Bank Management

COURSE TYPE Area Core

LECTURER(S) Eralp Bektas, BE 144 (FBE Building II), ( Email : eralp.bektas@emu.edu.tr )

CREDIT VALUE 3 Credit Hrs. ECTS VALUE 6

TUTORIAL ASSISTANT Mugabil Isayev, BE 113 (RD Building), ( Email: mugabil.isayev@emu.edu.tr)

PREREQUISITES None

COREQUISITES None

DURATION OF COURSE One Semester

WEB LINK http://fbemoodle.emu.edu.tr

CATALOGUE DESCRIPTION

The course aims to introduce students to the banks and their services; organization and structure of banks; financial

statements of banks; measuring and evaluation of bank performance;

AIMS & OBJECTIVES

The main aim of this course is to provide students with an introductory yet comprehensive overview of banking services

and organizational structure of the banks. Students are also expected to learn bank financial statement analysis and

performance evaluation. Asset and liability management techniques, like GAP and DURATION analysis are also among

the teaching and learning objectives of this course

GENERAL LEARNING OUTCOMES (COMPETENCES)

On successful completion of this course, all students will have developed knowledge and understanding of:

- Financial services offered by banks

- Regulatory environment of banks

- Organizational forms of banks

- Financial statements and performance evaluation of banks

- Asset and liability management of banks

On successful completion of this course, all students will have developed their skills in:

- Understanding and developing banking services

- Analytical thinking in performance evaluation of banks

- Using asset and liability management as a tool to maximize profit and hedge against interest rate risk

On successful completion of this course, all students will have developed their appreciation of and respect for values

and attitudes regarding the issues of:

- The role of banks as financial service provider

- Organizational form of banks and economic development

- Financial reporting and performance evaluation

- Understanding the role of financial knowledge in bank management

RELATIONSHIP WITH OTHER COURSES

This is a foundation course in banking where students learn the basic banking concepts and prepare themselves for more

advance courses such as Money and Banking, Bank Accounting, Asset and Liability Management and Financial

Management.

LEARNING / TEACHING METHOD

Lectures, application exercises by topic in tutorials and assignments.

ASSIGNMENTS

- projects and presentations

METHOD OF ASSESSMENT

Quizzes 15% ,

Project 15%,

Mid Term Exam 30%,

Final Exam 40%

ATTENDANCE

Attendance is compulsory by school regulations. Students are strongly advised not to miss lecture hours since success is

closely related with attendance. Absence over 20% will be penalized with an NG.

ACADEMIC HONESTY

Academic honesty is the cornerstone of the development and acquisition of knowledge. Academic honesty demands

that the contribution of others be acknowledged. To do less is to cheat. To pass off contributions and ideas of another as

one’s own is to deprive oneself of the opportunity and challenge to learn and to participate in the scholarly process of

acquisition and development of knowledge. Not only will the cheater or intellectually dishonest individual be ultimately

his/her own victim, but also the general quality of scholarly activity will be seriously undermined. It is for these reasons

that Eastern Mediterranean University insists on intellectual honesty in scholarship. The control of intellectual

dishonesty begins with the individual’s recognition of standards of honesty expected generally and compliance with

those expectations. Plagiarism, cheating and other misconduct are not acceptable. Individual work must reflect an

individual’s own effort. Plagiarism is an offense and will be dealt with according to University regulations.A single

offence of cheating, plagiarism or other academic misconduct on assignments, term projects or examinations etc. may

lead to disciplinary probation or a student’s suspension or expulsion from the University. Note that “CUT AND

PASTE” IS A FORM OF PLAGIARISM.

TEXTBOOK

Rose S. Peter and Hudgins C. Sylvia, Bank Management and Financial Services, 9th Edition, Mc Graw Hill.

INDICATIVE BASIC READING LIST

Students are advised to read the financial news at www.ft.com and “The Economist” weekly journal regularly.

SEMESTER OFFERRED

Fall and Spring Semesters.

CONTENT & SCHEDULE

Lectures for group1 will be held on Tuesdays at 08:30-10:20 in BEA-6, and Thursdays at 8:30-10:20 in RD303. And

for group2 will be held on Mondays at 08:30-10:20 in BEA-1, and Tuesdays at 12:30-14:20 in RD206.

Lectures will be given according to the following schedule.

WEEK DATE CHP. TOPICS

1 12 - 16 October, 1 An Overview of the Changing Financial Services Sector (Chp.1)

2020 What is a bank?

The services banks offer;

The Financial system

2 19 - 23 October, 2 The Impact of Government Policy and Regulation on the

2020 Financial Services Industry (Chp.2)

Banking Regulation

Major Banking Laws

The Central Banking System

3 26 - 30 October, 3 The Organization and Structure of Banking and the Financial

2020 Services Industry (Chp.3)

Internal organization of Banking Firm

Organizational Structures

Alternative types of Banking Organzations

4 2 - 6 November, 3 The Organization and Structure of Banking and the Financial

2020 Services Industry (Chp.3)

Internal organization of Banking Firm

Organizational Structures

Alternative types of Banking Organzations

5 9 - 13 November, 5 The Financial Statement of Banks and Their Principal

2020 Competitors (Cpt. 5)

The key features of financial statements of banks

The balance sheet of banks

The Income statement of banks

6 5 The Financial Statement of Banks and Their Principal

16 - 20 November, Competitors (Cpt. 5)

2020 The key features of financial statements of banks

The balance sheet of banks

The Income statement of banks

7 23 - 27 November, 6 Measuring and Evaluating the Performance of Banks and Their

2020 Principal Competitors (Chp. 6)

Evaluating performance

Performance indicators of banks and their competitors

The impact of size on performance

8 30 Nov. – 12 Dec. MIDTERM WEEK

2020

9 14 - 18 December, 6 Measuring and Evaluating the Performance of Banks and Their

2020 Principal Competitors (Chp.6)

Evaluating performance

Performance indicators of banks and their competitors

The impact of size on performance

10 21 Dec. - 25 4 Establishing New Banks, Branches, ATMs, Telephone Services,

December, 2020 and Web Sites(Chp.4)

Requirements to open banks in USA

Choosing locations and designing new branches

Home and office banking-telphone banking, internet

banking

11 28 Dec. 2020 - 1 4 Establishing New Banks, Branches, ATMs, Telephone Services,

Jan., 2021 and Web Sites (Chp.4)

Opening new banks in the USA

Requirements to open banks

Choosing locations and designing new branches

Home and office banking-telphone banking, internet

banking

Group Presentations

Group Presentations

15 23 Jan. - 5 Feb., FINAL EXAMS PERIOD

2021

PLAGIARISM

This is intentionally failing to give credit to sources used in writing regardless of whether they are published or

unpublished. Plagiarism (which also includes any kind of cheating in exams) is a disciplinary offence and will be dealt

with accordingly.

MAKE-UP EXAMS

Students, who have valid excuses, will be allowed to take make-up examinations for mid-term and final exams. No

make-up exams for quiz.

IMPORANT DATES

26 October The last day for add and drop

30 Nov. – 12 Dec. 2020 Midterm exams

29 December The last day for course withdrawal

29 December The last day for applying leave of absence

19 January The last day of classes

23 Jan. - 5 Feb., 2021 The final exams period

You might also like

- The Music in Stanley Kubrick's 2001: A Space OdysseyDocument27 pagesThe Music in Stanley Kubrick's 2001: A Space OdysseyJoris Daniel100% (1)

- Fin 464Document4 pagesFin 464Zihad Al AminNo ratings yet

- CERTIFICATEDocument31 pagesCERTIFICATEShanawaz ArifNo ratings yet

- Naveen MBA ProjectDocument57 pagesNaveen MBA ProjectNaveen DasNo ratings yet

- Project Report For Bank Loan - Format, Details - AKT AssociatesDocument13 pagesProject Report For Bank Loan - Format, Details - AKT AssociatesCatch a starNo ratings yet

- Prachi BlackbookDocument65 pagesPrachi BlackbookSapan ShahNo ratings yet

- Intro To Banking MGMT 1022Document5 pagesIntro To Banking MGMT 1022Josiah D'angelo LyonsNo ratings yet

- Sandra Luka Report Project Bba 3Document40 pagesSandra Luka Report Project Bba 3Sandra LasuNo ratings yet

- A Project Report On Analysis of Credit Appraisal at Bandhan BankDocument100 pagesA Project Report On Analysis of Credit Appraisal at Bandhan Bankmba08061 DEEPAK TRIPATHINo ratings yet

- 2511-Jeet Chetan GadaDocument64 pages2511-Jeet Chetan GadaMontu SinghNo ratings yet

- Project Report: Honours of SEMESTER VI, 2021 in Accounting & Finance Under The University of Calcutta ONDocument20 pagesProject Report: Honours of SEMESTER VI, 2021 in Accounting & Finance Under The University of Calcutta ONBishal AdakNo ratings yet

- A Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"Document80 pagesA Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"sanjay carNo ratings yet

- IBS Hyderabad (Document169 pagesIBS Hyderabad (Adil D CoolestNo ratings yet

- New Asit Ekka, Mba-Project Report @ucbDocument71 pagesNew Asit Ekka, Mba-Project Report @ucbASIT EKKANo ratings yet

- DI Questions For IBPS Exam 2017Document534 pagesDI Questions For IBPS Exam 2017Abhishek KrNo ratings yet

- De An Ngan Hang - Vu Thu Hien - 11201450Document40 pagesDe An Ngan Hang - Vu Thu Hien - 11201450Vũ Tiến HiếuNo ratings yet

- Internship Report: Chapter 1: Introduction of Agribank - Phu Nhuan BranchDocument14 pagesInternship Report: Chapter 1: Introduction of Agribank - Phu Nhuan BranchNgô NgọcNo ratings yet

- Financial Analysis To Landing To BusinessDocument60 pagesFinancial Analysis To Landing To BusinessAshwin ThoratNo ratings yet

- Indian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersDocument4 pagesIndian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersS Dharam SinghNo ratings yet

- Pooja Yadav Full Sip Project Roll No. 84Document152 pagesPooja Yadav Full Sip Project Roll No. 84Shruti MhatreNo ratings yet

- Credit Appraisal in Banks and Financial Institutions PDFDocument6 pagesCredit Appraisal in Banks and Financial Institutions PDFJaiganesh M SNo ratings yet

- Mitesh ProjectDocument67 pagesMitesh ProjectMitesh Prajapati 7765No ratings yet

- A Study On Influence of Covid-19 On Financal Institutions of IndiaDocument32 pagesA Study On Influence of Covid-19 On Financal Institutions of IndiaAkshathNo ratings yet

- Final Project Kyc FinalDocument70 pagesFinal Project Kyc FinalAnonymous HackerNo ratings yet

- PATELJAYKUMARDILIPBHAIDocument87 pagesPATELJAYKUMARDILIPBHAIPatel MehulNo ratings yet

- Table of Content: Topic: Impact of Liquidity On Profitability Banking Sector in PakistanDocument9 pagesTable of Content: Topic: Impact of Liquidity On Profitability Banking Sector in PakistanAbdussalam gillNo ratings yet

- Non Performing Assets in SBI GroupDocument59 pagesNon Performing Assets in SBI GroupNavjinder Kaur67% (6)

- Kathmandu University: February-July 2020 SessionDocument2 pagesKathmandu University: February-July 2020 SessionRubina AryalNo ratings yet

- Summer Internship ProjectDocument75 pagesSummer Internship ProjectVargeesu GamingYTNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- IT & BPO Companies-Low-240518Document7 pagesIT & BPO Companies-Low-240518Tej ShahNo ratings yet

- MBA - 1st - Yr - Banking & Financial Services - 2022 - 23 - FinalDocument40 pagesMBA - 1st - Yr - Banking & Financial Services - 2022 - 23 - FinalAnanya GargNo ratings yet

- Foreign Exchange Report ShankarDocument85 pagesForeign Exchange Report ShankarTipu khanNo ratings yet

- Business Correspondence ModelDocument85 pagesBusiness Correspondence ModelAmruta Patil100% (1)

- MaybankDocument40 pagesMaybankSHIAO WEI CHINNo ratings yet

- AML KYC-Low PDFDocument6 pagesAML KYC-Low PDFParul Tripathi0% (1)

- Mousami DuttaDocument64 pagesMousami DuttaSukalyan JanaNo ratings yet

- Kanu 12Document82 pagesKanu 12Naman KandpalNo ratings yet

- Kanu 12Document87 pagesKanu 12Naman KandpalNo ratings yet

- Aml Kyc Notice PDFDocument4 pagesAml Kyc Notice PDFabhishek50% (2)

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)iqra zafarNo ratings yet

- Comparative Analysis of Customer Behaviour in Standard Chartered Bank & Barclays BankDocument72 pagesComparative Analysis of Customer Behaviour in Standard Chartered Bank & Barclays Bankyash guptaNo ratings yet

- Internship Report On Credit Policy of Dutch-Bangla Bank LimitedDocument94 pagesInternship Report On Credit Policy of Dutch-Bangla Bank LimitedSifat Shahriar Shakil80% (10)

- Anisur Report (Repaired)Document49 pagesAnisur Report (Repaired)Nafiz IntiazNo ratings yet

- Marouf Fazili JK BANK PROJECT PDFDocument38 pagesMarouf Fazili JK BANK PROJECT PDFMarouf FaziliNo ratings yet

- Banking and Finance: Bharathiar University: Coimbatore - 641 046Document7 pagesBanking and Finance: Bharathiar University: Coimbatore - 641 046Aswathy S RNo ratings yet

- Vaishnavi Dandekar - Financial Performance Commercial BankDocument67 pagesVaishnavi Dandekar - Financial Performance Commercial BankMitesh Prajapati 7765No ratings yet

- A Project Report On " ": Comparative Analysis of Corporate Salary Accounts With Respect To HDFC BankDocument78 pagesA Project Report On " ": Comparative Analysis of Corporate Salary Accounts With Respect To HDFC BankPari TripathyNo ratings yet

- Softcopy DOCUNMENT NPADocument63 pagesSoftcopy DOCUNMENT NPAAditi KedariNo ratings yet

- "Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal OnDocument14 pages"Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal Onrk shahNo ratings yet

- Proposal A 2222151049 ABSDocument6 pagesProposal A 2222151049 ABSmehrin mostofa addritaNo ratings yet

- Finance 2nd Year Revised SyllabusDocument4 pagesFinance 2nd Year Revised Syllabusmanishnewar1996337135No ratings yet

- International School of Management and EconomicsDocument28 pagesInternational School of Management and EconomicsLê Thái HàNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesFrom EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisNo ratings yet

- Public Financial Management Systems—Myanmar: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Myanmar: Key Elements from a Financial Management PerspectiveNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- Viet Nam Secondary Education Sector Assessment, Strategy, and Road MapFrom EverandViet Nam Secondary Education Sector Assessment, Strategy, and Road MapNo ratings yet

- Fundamental ParticlesDocument8 pagesFundamental ParticlesDon Amaru SarmaNo ratings yet

- Hydrology Training Course: Geographic Information SystemDocument24 pagesHydrology Training Course: Geographic Information SystemCosminNo ratings yet

- Eee-III-Analog Electronic Circuits m1Document52 pagesEee-III-Analog Electronic Circuits m1My WritingsNo ratings yet

- 111 Veterinary Gross Anatomy - I (Osteology, Arthrology & Biomechanics)Document161 pages111 Veterinary Gross Anatomy - I (Osteology, Arthrology & Biomechanics)Vaidika YadavNo ratings yet

- School Education and Literacy Department Government of Sindh Office of The District Education Officer (E, S&H.S) District Central KarachiDocument15 pagesSchool Education and Literacy Department Government of Sindh Office of The District Education Officer (E, S&H.S) District Central KarachiNaya PakistanNo ratings yet

- RLG203 Week 5Document3 pagesRLG203 Week 5Abbigal KamalovaNo ratings yet

- Difference Between Institute and University - Difference Between - Institute Vs UniversityDocument5 pagesDifference Between Institute and University - Difference Between - Institute Vs Universitytapar.dashNo ratings yet

- SGC Web SocketsDocument171 pagesSGC Web SocketsMarceloMoreiraCunhaNo ratings yet

- Unwto Tourism Highlights: 2011 EditionDocument12 pagesUnwto Tourism Highlights: 2011 EditionTheBlackD StelsNo ratings yet

- Anusha Dadwani - ResumeDocument2 pagesAnusha Dadwani - Resumeapi-458585393No ratings yet

- Zelio Control Relays - RM22TG20 DatasheetDocument7 pagesZelio Control Relays - RM22TG20 DatasheetMinh NhậtNo ratings yet

- 02 Prelim PagesDocument383 pages02 Prelim Pageshamzah.masoodNo ratings yet

- Seminar Report On AutomationDocument32 pagesSeminar Report On AutomationDusmanta moharanaNo ratings yet

- ME 220 Measurements & SensorsDocument10 pagesME 220 Measurements & SensorsMohamed MaherNo ratings yet

- Fyba Foundtion Course PDFDocument252 pagesFyba Foundtion Course PDFrusa websiteNo ratings yet

- Set LP - 114719Document9 pagesSet LP - 114719Beverly SombiseNo ratings yet

- Group 2 Ied 126 Charmedimsure Designbriefand RubricDocument4 pagesGroup 2 Ied 126 Charmedimsure Designbriefand Rubricapi-551027316No ratings yet

- PurushottamSureshGadekar - Netsuite Technical Consultant - PuneDocument4 pagesPurushottamSureshGadekar - Netsuite Technical Consultant - PuneSeenuNo ratings yet

- Ron Feldman DissertationDocument404 pagesRon Feldman DissertationRichard RadavichNo ratings yet

- Cheat Sheet Common Wireless Issues: Components UsedDocument31 pagesCheat Sheet Common Wireless Issues: Components UsedblablaNo ratings yet

- 13-02-2019 - WinGD - Article - Volatile Organic Comp As FuelDocument4 pages13-02-2019 - WinGD - Article - Volatile Organic Comp As FuelAVINASH ANAND RAONo ratings yet

- Heat Transfer in Staggered Tube BanksDocument9 pagesHeat Transfer in Staggered Tube BanksMohammed Bate'eNo ratings yet

- Breaking The Power of DebtDocument3 pagesBreaking The Power of DebtClifford NyathiNo ratings yet

- Fluke 123 User ManualDocument86 pagesFluke 123 User ManualRobNo ratings yet

- Schneider Activa Pricelist Jan2011 PDFDocument4 pagesSchneider Activa Pricelist Jan2011 PDFSona SunilNo ratings yet

- Get Growing Packages 15k CommercialDocument10 pagesGet Growing Packages 15k CommercialRodrigo Urcelay MontecinosNo ratings yet

- Avaya SBCE Deploying On An AWS Platform 8.1.x December 2020Document64 pagesAvaya SBCE Deploying On An AWS Platform 8.1.x December 2020Vicky NicNo ratings yet

- Functional Pattern (System Review)Document2 pagesFunctional Pattern (System Review)Nursing FilesNo ratings yet

- 3.4.6 Excretory System H 3.4.8Document9 pages3.4.6 Excretory System H 3.4.8Joy FernandezNo ratings yet