Professional Documents

Culture Documents

Rating Rationale: Aerospace Materials Pvt. LTD

Rating Rationale: Aerospace Materials Pvt. LTD

Uploaded by

MohanCopyright:

Available Formats

You might also like

- Mechanical Vibrations 6th Edition Rao 013436130X Solution ManualDocument185 pagesMechanical Vibrations 6th Edition Rao 013436130X Solution Manualloretta97% (32)

- Case Study: Attention Millennials! Automobile Manufacturers Adapt For YouDocument15 pagesCase Study: Attention Millennials! Automobile Manufacturers Adapt For YouMy Le Thi Hoang100% (1)

- Bank Branch Internal Audit Work ProgramDocument31 pagesBank Branch Internal Audit Work Programozlem100% (1)

- ADITYA STEEL ROLLING MILLS 5april2021Document5 pagesADITYA STEEL ROLLING MILLS 5april2021jeyapriya vNo ratings yet

- SPG Infraprojects BL 23sep2019 PDFDocument6 pagesSPG Infraprojects BL 23sep2019 PDFChander ShekharNo ratings yet

- Anna Textile Spinning Mills 29sep2020Document4 pagesAnna Textile Spinning Mills 29sep2020nagulpranav614No ratings yet

- NBM Iron and Steel Trading 11dec2019Document5 pagesNBM Iron and Steel Trading 11dec2019Yasien ZaveriNo ratings yet

- Musaddilal Jewellers 5nov2019Document4 pagesMusaddilal Jewellers 5nov2019saahilsinghiNo ratings yet

- Digvijay Construction 4may2021Document7 pagesDigvijay Construction 4may2021hesham zakiNo ratings yet

- Vasavi Infrastructure Projects 20jan2020Document4 pagesVasavi Infrastructure Projects 20jan2020Gaurav VaswaniNo ratings yet

- Topline Infra Projects BL 96 78Cr Reaffirmation Rationale 18aug2017Document4 pagesTopline Infra Projects BL 96 78Cr Reaffirmation Rationale 18aug2017CAAkashSinghNo ratings yet

- Bir Horizons BL 28mar2019Document5 pagesBir Horizons BL 28mar2019Praful K RajuNo ratings yet

- Rating Rationale: Facilities Amount (Rs. CRS) Tenure Rating Previous Present Previous Present BWR B+Document4 pagesRating Rationale: Facilities Amount (Rs. CRS) Tenure Rating Previous Present Previous Present BWR B+Vishal NannaNo ratings yet

- Facility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)Document4 pagesFacility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)ShamNo ratings yet

- Sumeet Facilities 23jan2020Document6 pagesSumeet Facilities 23jan2020R GautamNo ratings yet

- Globe Capacitors 14nov2019Document6 pagesGlobe Capacitors 14nov2019Puneet367No ratings yet

- Devi 6nov2020Document4 pagesDevi 6nov2020jagadeeshNo ratings yet

- Rating Rationale: Facility Amount ( CR) Tenure RatingDocument4 pagesRating Rationale: Facility Amount ( CR) Tenure RatingNalla ThambiNo ratings yet

- ACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreDocument5 pagesACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreJai PhookanNo ratings yet

- PR Faridabad Steel 24jan23Document6 pagesPR Faridabad Steel 24jan23partoshsingh746No ratings yet

- Supertech Limited 11nov2020Document5 pagesSupertech Limited 11nov2020cubadesignstudNo ratings yet

- C&J Corporate Park 05dec2019Document3 pagesC&J Corporate Park 05dec2019Komal ParmarNo ratings yet

- PJS Credit Rating by Brickwork On On 26th Aug 2019Document4 pagesPJS Credit Rating by Brickwork On On 26th Aug 2019PJS OverseasNo ratings yet

- Pankaj Jewellers BankLoan - 18.35Cr Rationale 20jul2017Document3 pagesPankaj Jewellers BankLoan - 18.35Cr Rationale 20jul2017Techno Gamerz And EntertainerNo ratings yet

- Venkateshwara Power Project LimitedDocument3 pagesVenkateshwara Power Project Limited04 Sourabh BaraleNo ratings yet

- Entertainment-City-Jan 2019 BRICKWORKDocument6 pagesEntertainment-City-Jan 2019 BRICKWORKPuneet367No ratings yet

- Pondy Oxides and Chemicals 22apr2019Document6 pagesPondy Oxides and Chemicals 22apr2019DarshanNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Dhatarwal Construction Company Private LimitedDocument3 pagesDhatarwal Construction Company Private LimitedVipasha SanghaviNo ratings yet

- Asquare Food Beverages 27dec2018Document6 pagesAsquare Food Beverages 27dec2018Tanmay GuptaNo ratings yet

- Microlite Indsutries 30may2020Document3 pagesMicrolite Indsutries 30may2020utkarsh kumarNo ratings yet

- DR Datson Labs 22mar2021Document5 pagesDR Datson Labs 22mar2021office88kolNo ratings yet

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Ramnord Research Laboratories Pvt. LTDDocument6 pagesRamnord Research Laboratories Pvt. LTDraghavNo ratings yet

- CRISIL Rating Metro July19Document3 pagesCRISIL Rating Metro July19pankaj_xaviersNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- Balaji Steroids and Hormones 20mar2020Document4 pagesBalaji Steroids and Hormones 20mar2020ncsoni51473No ratings yet

- JSSI Hydraulics Credit RatingDocument2 pagesJSSI Hydraulics Credit RatingVibhu SinghNo ratings yet

- Ivax Paper Chemicals LimitedDocument6 pagesIvax Paper Chemicals LimitedAayush TekriwalNo ratings yet

- St. Johns Rajakumar Education & Research TrustDocument3 pagesSt. Johns Rajakumar Education & Research TrustSrikar tejNo ratings yet

- Kafila Forge BankLoan - 46.58Cr Reaffirmation Rationale 1mar2017Document4 pagesKafila Forge BankLoan - 46.58Cr Reaffirmation Rationale 1mar2017Saroj Kumar KaparNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- Haryana Steel Mongers 18june2019Document5 pagesHaryana Steel Mongers 18june2019partoshsingh746No ratings yet

- Mahima Real Estate 10apr2019Document5 pagesMahima Real Estate 10apr2019Reena GahlotNo ratings yet

- Cottony FashionsDocument6 pagesCottony FashionsHarishKumar JNo ratings yet

- Daund Sugar Private LimitedDocument5 pagesDaund Sugar Private Limitedkrushna.maneNo ratings yet

- VHM Industries Limited BL 25may2018Document5 pagesVHM Industries Limited BL 25may2018Aashutosh PatodiaNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- Rajesh Exports 20may2021Document6 pagesRajesh Exports 20may2021adhyan kashyapNo ratings yet

- Vikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesVikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating Actionvinay durgapalNo ratings yet

- Bhadreshwar Vidyut Private LimitedDocument5 pagesBhadreshwar Vidyut Private LimitedJaganNo ratings yet

- TVS Credit Services BL 5dec2018Document5 pagesTVS Credit Services BL 5dec2018Sujith DeepakNo ratings yet

- Shri Ram Autotech Private LimitedDocument3 pagesShri Ram Autotech Private LimitedAmanNo ratings yet

- Rating Rationale - ManikaranDocument2 pagesRating Rationale - ManikaranCA Rakesh JhaNo ratings yet

- Privilege Biksons Boilers Private Limited - Credit ReportDocument6 pagesPrivilege Biksons Boilers Private Limited - Credit ReportHarishKumar JNo ratings yet

- Credit Rating - Jun 2021 - Atmastco - LimitedDocument4 pagesCredit Rating - Jun 2021 - Atmastco - LimitedSaurav GanguliNo ratings yet

- Micromax Biofuels PVT Ltd.Document6 pagesMicromax Biofuels PVT Ltd.Kamlakar AvhadNo ratings yet

- PR Sheetal Coolproducts 4jul23Document5 pagesPR Sheetal Coolproducts 4jul23jay.futuretecNo ratings yet

- PR Sannverse Railtech 10nov23Document7 pagesPR Sannverse Railtech 10nov23Vijay DosapatiNo ratings yet

- Press Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionDocument3 pagesPress Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionData CentrumNo ratings yet

- Aryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresDocument67 pagesAryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresSwarna SinghNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Case OneDocument14 pagesCase OneAmeliasari BartenputriNo ratings yet

- Chapter06 - Polina Nalistia Irawan - 2010313220010Document5 pagesChapter06 - Polina Nalistia Irawan - 2010313220010Polina Nalistia IrawanNo ratings yet

- Maintenace Kits - Pavers-ScreedsDocument12 pagesMaintenace Kits - Pavers-ScreedsBruno TrindadeNo ratings yet

- Holistic Marketing Concept by Jikku JohnDocument19 pagesHolistic Marketing Concept by Jikku Johnjikku john100% (2)

- Documentation Technique Marquage CEDocument1 pageDocumentation Technique Marquage CEHyacinthe KOSSINo ratings yet

- Released FRQs On T-AccountsDocument4 pagesReleased FRQs On T-AccountsJenniferNo ratings yet

- Scams in India PDFDocument90 pagesScams in India PDFShubham GuptaNo ratings yet

- 1 - Economy of The Mauryan Period PDFDocument12 pages1 - Economy of The Mauryan Period PDFdrexter124100% (3)

- TITT - Consultancy Services - Prod OpsDocument74 pagesTITT - Consultancy Services - Prod OpsWale OyeludeNo ratings yet

- Sustainable Public Procurement: Research Trends and GapsDocument9 pagesSustainable Public Procurement: Research Trends and GapsApudjijonoNo ratings yet

- Leadership and Public Sector Reform in The Philippines PDFDocument29 pagesLeadership and Public Sector Reform in The Philippines PDFambiNo ratings yet

- Guide To The Markets Q3 2023 1688397991Document100 pagesGuide To The Markets Q3 2023 1688397991nicholasNo ratings yet

- Stellar One: GH-09, Sector-1, Greater Noida WestDocument7 pagesStellar One: GH-09, Sector-1, Greater Noida WestRavi BhattacharyaNo ratings yet

- Lanka Bangla FinanceDocument31 pagesLanka Bangla FinanceJacobHauheng0% (1)

- (EXCEL 2016) Mocktest 1Document9 pages(EXCEL 2016) Mocktest 1Huyền Trang NguyễnNo ratings yet

- A Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofDocument21 pagesA Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofGunveen AbrolNo ratings yet

- Fourth Section: Case of Beşleagă and Others V. RomaniaDocument9 pagesFourth Section: Case of Beşleagă and Others V. Romaniaasm_samNo ratings yet

- Consumer ProtectionDocument3 pagesConsumer ProtectionADITYA JOSHINo ratings yet

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- Reward System and Employee Performance in The Oil and Gas Industry in Rivers StateDocument19 pagesReward System and Employee Performance in The Oil and Gas Industry in Rivers StateInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- TDP Template FinalDocument9 pagesTDP Template Finaldeepak1007No ratings yet

- Disbursement Voucher (New Orence)Document4 pagesDisbursement Voucher (New Orence)user computerNo ratings yet

- Reference List Sample For ResumeDocument7 pagesReference List Sample For Resumec2yyr2c3100% (1)

- At1 Project Evalution - NusratDocument26 pagesAt1 Project Evalution - NusratNUSRAT JERINNo ratings yet

- d200 Users Manual v1 00 00 PDFDocument134 pagesd200 Users Manual v1 00 00 PDFMADHAVI MNo ratings yet

- Go To Market Strategy Primer For 2023Document12 pagesGo To Market Strategy Primer For 2023ceyejim807No ratings yet

- Local Government Report On MMCDocument60 pagesLocal Government Report On MMCLendel BethelmyNo ratings yet

Rating Rationale: Aerospace Materials Pvt. LTD

Rating Rationale: Aerospace Materials Pvt. LTD

Uploaded by

MohanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rating Rationale: Aerospace Materials Pvt. LTD

Rating Rationale: Aerospace Materials Pvt. LTD

Uploaded by

MohanCopyright:

Available Formats

RATING RATIONALE

18 Jan 2020

Aerospace Materials Pvt. Ltd.

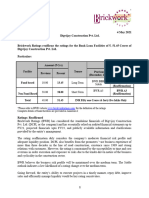

Brickwork Ratings Revises the ratings for the Bank Loan Facilities of ₹9.26 Cr of

Aerospace Materials Pvt. Ltd. based on best available information, as the issuer did not

cooperate.

Particulars

Amount (₹ Cr) Rating#

Facility Tenure

Previous Present Previous (Feb 2018) Present

BWR BB+

Long BWR BBB- (Stable) Issuer not

Fund based 2.76 2.76

Term (Stable) cooperating*

Downgraded

BWR A4+

Non Fund Short

6.50 6.50 BWR A3 Issuer not cooperating*

Based Term

Downgraded

Total 9.26 9.26 INR Nine Crores and Twenty Six Lakhs Only

# Please refer to BWR website www.brickworkratings.com/ for definition of the ratings

* Issuer did not cooperate, based on best available information.

Details of Bank facilities is provided in Annexure-I

RATING ACTION / OUTLOOK / NATURE OF NON-COOPERATION

Brickwork Ratings downgraded the ratings for the bank loan facilities of ₹9.26 Crs of

Aerospace Materials Pvt. Ltd. to BWR BB+/A4+ (Stable) Issuer Not Cooperating; based on

best available information. BWR had rated the bank loan facilities of Aerospace Materials Pvt.

Ltd. in Feb 2019 and assigned BWR BBB-/A3 (Stable).

BWR took up with the issuer to provide required complete information over emails. Despite the

best efforts of BWR to get at least the minimum required information for a review, the Company

has not provided the same. In the absence of adequate information from the issuer, BWR is

unable to assess the issuer’s financial performance and its ability to service its debt and maintain

a valid rating. Hence on account of inadequate information and lack of management cooperation,

BWR recommends placing the rating under the category of Issuer Not Cooperating.

LIMITATIONS OF THE RATING

Information availability risk is a key factor in the assessment of credit risk as generally,

noncooperation by the rated entities to provide required information for a review of the assigned

rating may also be accompanied by financial stress.

www.brickworkratings.com Page 1 of 4

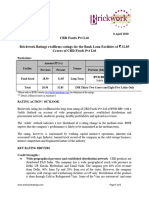

KEY FINANCIAL INDICATORS

Key Parameters Units FY16 FY17

Result Type Audited Audited

Net Sales In ₹ Crs 17.44 24.42

EBITDA In ₹ Crs 5.09 8.08

Net Profit In ₹ Crs 2.12 4.15

Tangible Net worth In ₹ Crs 21.11 24.11

Total debt/TNW Times 0.36 0.17

Current Ratio Times 1.66 1.95

COMPANY PROFILE

Incorporated in 1988, Aerospace Materials Private Limited (AMPL), Coimbatore, is engaged in

manufacturing of heat shield material for Rocket Nozzles. The company has three units located at Tamil

Nadu. AMPL is a family run business, which is managed by Mr. A. M. Palanisamy, Mr. N. Ramasamy,

Mr. K Palaniswamy, Mr. M. Thangaraj and Mr. S. Arul Senthil Kumar who possess over two decades of

experience in the industry. The company has reputed clients like Vikram Sarabhai Space Centre, Defence

Research & Development Laboratory, Resins & Allied Products, RR Industries and Larsen & Toubro

Limited in its portfolio.

NON-COOPERATION WITH PREVIOUS RATING AGENCY IF ANY: NA

RATING HISTORY

Facilities Current Rating Rating History

Amount

Rating 2019 16.02.2018 20.03.2017

Tenure (₹ Cr)

BWR BB+

Long BWR BBB- BWR BB+

Fund Based 2.76 (Stable)

Term (Stable) (Stable)

Issuer Not Cooperating Not

Rated

Non Fund Short BWR A4+ BWR A3 BWR A4+

6.50

Based Term Issuer Not Cooperating

Total 9.26 INR Nine Crores and Twenty Six Lakhs Only

COMPLEXITY LEVELS OF THE INSTRUMENTS

For more information, visit www.brickworkratings.com/download/ComplexityLevels.pdf

www.brickworkratings.com Page 2 of 4

Hyperlink/Reference to applicable Criteria

Analytical Contacts Investor and Media Relations

Dimple Bhut

Rating Analyst

+91 80 4040 9940 Ext: 334

dimple.b@brickworkratings.com

M : +91 7738875550

K Nagaraj B : +91 22 6745 6666

[Assoc. Director– Ratings] investordesk@brickworkratings.com

+91 80 4040 9940 Ext: 372

nagaraj.ks@brickworkratings.com

ANNEXURE I

Aerospace Materials Pvt. Ltd.

Details of Bank Facilities rated by BWR

Sl.No. Name of the Type of Facilities Long Term Short Term Total

Bank [₹ Cr] [₹ Cr] [₹ Cr]

1. Federal Bank Fund Based 2.76 - 2.76

2. Non Fund Based - 6.50 6.50

TOTAL 9.26

Total INR Nine Crores and Twenty Six Lakhs Only

For print and digital media The Rating Rationale is sent to you for the sole purpose of dissemination through your

print, digital or electronic media. While it may be used by you acknowledging credit to BWR, please do not change

the wordings in the rationale to avoid conveying a meaning different from what was intended by BWR. BWR alone

has the sole right of sharing (both direct and indirect) its rationales for consideration or otherwise through any print

or electronic or digital media.

About Brickwork Ratings :Brickwork Ratings (BWR), a SEBI registered Credit Rating Agency, accredited by RBI

and empaneled by NSIC, offers Bank Loan, NCD, Commercial Paper, MSME ratings and grading services.

NABARD has empaneled Brickwork for MFI and NGO grading. BWR is accredited by IREDA & the Ministry of

New and Renewable Energy (MNRE), Government of India. Brickwork Ratings has Canara Bank, a leading public

sector bank, as its promoter and strategic partner. BWR has its corporate office in Bengaluru and a country-wide

presence with its offices in Ahmedabad, Chandigarh, Chennai, Hyderabad, Kolkata, Mumbai and New Delhi along

with representatives in 150+ locations.

www.brickworkratings.com Page 3 of 4

DISCLAIMER Brickwork Ratings (BWR) has assigned the rating based on the information obtained from the

issuer and other reliable sources, which are deemed to be accurate. BWR has taken considerable steps to avoid any

data distortion; however, it does not examine the precision or completeness of the information obtained. And hence,

the information in this report is presented “as is” without any express or implied warranty of any kind. BWR does

not make any representation in respect to the truth or accuracy of any such information. The rating assigned by

BWR should be treated as an opinion rather than a recommendation to buy, sell or hold the rated instrument and

BWR shall not be liable for any losses incurred by users from any use of this report or its contents. BWR has the

right to change, suspend or withdraw the ratings at any time for any reasons

www.brickworkratings.com Page 4 of 4

You might also like

- Mechanical Vibrations 6th Edition Rao 013436130X Solution ManualDocument185 pagesMechanical Vibrations 6th Edition Rao 013436130X Solution Manualloretta97% (32)

- Case Study: Attention Millennials! Automobile Manufacturers Adapt For YouDocument15 pagesCase Study: Attention Millennials! Automobile Manufacturers Adapt For YouMy Le Thi Hoang100% (1)

- Bank Branch Internal Audit Work ProgramDocument31 pagesBank Branch Internal Audit Work Programozlem100% (1)

- ADITYA STEEL ROLLING MILLS 5april2021Document5 pagesADITYA STEEL ROLLING MILLS 5april2021jeyapriya vNo ratings yet

- SPG Infraprojects BL 23sep2019 PDFDocument6 pagesSPG Infraprojects BL 23sep2019 PDFChander ShekharNo ratings yet

- Anna Textile Spinning Mills 29sep2020Document4 pagesAnna Textile Spinning Mills 29sep2020nagulpranav614No ratings yet

- NBM Iron and Steel Trading 11dec2019Document5 pagesNBM Iron and Steel Trading 11dec2019Yasien ZaveriNo ratings yet

- Musaddilal Jewellers 5nov2019Document4 pagesMusaddilal Jewellers 5nov2019saahilsinghiNo ratings yet

- Digvijay Construction 4may2021Document7 pagesDigvijay Construction 4may2021hesham zakiNo ratings yet

- Vasavi Infrastructure Projects 20jan2020Document4 pagesVasavi Infrastructure Projects 20jan2020Gaurav VaswaniNo ratings yet

- Topline Infra Projects BL 96 78Cr Reaffirmation Rationale 18aug2017Document4 pagesTopline Infra Projects BL 96 78Cr Reaffirmation Rationale 18aug2017CAAkashSinghNo ratings yet

- Bir Horizons BL 28mar2019Document5 pagesBir Horizons BL 28mar2019Praful K RajuNo ratings yet

- Rating Rationale: Facilities Amount (Rs. CRS) Tenure Rating Previous Present Previous Present BWR B+Document4 pagesRating Rationale: Facilities Amount (Rs. CRS) Tenure Rating Previous Present Previous Present BWR B+Vishal NannaNo ratings yet

- Facility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)Document4 pagesFacility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)ShamNo ratings yet

- Sumeet Facilities 23jan2020Document6 pagesSumeet Facilities 23jan2020R GautamNo ratings yet

- Globe Capacitors 14nov2019Document6 pagesGlobe Capacitors 14nov2019Puneet367No ratings yet

- Devi 6nov2020Document4 pagesDevi 6nov2020jagadeeshNo ratings yet

- Rating Rationale: Facility Amount ( CR) Tenure RatingDocument4 pagesRating Rationale: Facility Amount ( CR) Tenure RatingNalla ThambiNo ratings yet

- ACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreDocument5 pagesACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreJai PhookanNo ratings yet

- PR Faridabad Steel 24jan23Document6 pagesPR Faridabad Steel 24jan23partoshsingh746No ratings yet

- Supertech Limited 11nov2020Document5 pagesSupertech Limited 11nov2020cubadesignstudNo ratings yet

- C&J Corporate Park 05dec2019Document3 pagesC&J Corporate Park 05dec2019Komal ParmarNo ratings yet

- PJS Credit Rating by Brickwork On On 26th Aug 2019Document4 pagesPJS Credit Rating by Brickwork On On 26th Aug 2019PJS OverseasNo ratings yet

- Pankaj Jewellers BankLoan - 18.35Cr Rationale 20jul2017Document3 pagesPankaj Jewellers BankLoan - 18.35Cr Rationale 20jul2017Techno Gamerz And EntertainerNo ratings yet

- Venkateshwara Power Project LimitedDocument3 pagesVenkateshwara Power Project Limited04 Sourabh BaraleNo ratings yet

- Entertainment-City-Jan 2019 BRICKWORKDocument6 pagesEntertainment-City-Jan 2019 BRICKWORKPuneet367No ratings yet

- Pondy Oxides and Chemicals 22apr2019Document6 pagesPondy Oxides and Chemicals 22apr2019DarshanNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Dhatarwal Construction Company Private LimitedDocument3 pagesDhatarwal Construction Company Private LimitedVipasha SanghaviNo ratings yet

- Asquare Food Beverages 27dec2018Document6 pagesAsquare Food Beverages 27dec2018Tanmay GuptaNo ratings yet

- Microlite Indsutries 30may2020Document3 pagesMicrolite Indsutries 30may2020utkarsh kumarNo ratings yet

- DR Datson Labs 22mar2021Document5 pagesDR Datson Labs 22mar2021office88kolNo ratings yet

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Ramnord Research Laboratories Pvt. LTDDocument6 pagesRamnord Research Laboratories Pvt. LTDraghavNo ratings yet

- CRISIL Rating Metro July19Document3 pagesCRISIL Rating Metro July19pankaj_xaviersNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- Balaji Steroids and Hormones 20mar2020Document4 pagesBalaji Steroids and Hormones 20mar2020ncsoni51473No ratings yet

- JSSI Hydraulics Credit RatingDocument2 pagesJSSI Hydraulics Credit RatingVibhu SinghNo ratings yet

- Ivax Paper Chemicals LimitedDocument6 pagesIvax Paper Chemicals LimitedAayush TekriwalNo ratings yet

- St. Johns Rajakumar Education & Research TrustDocument3 pagesSt. Johns Rajakumar Education & Research TrustSrikar tejNo ratings yet

- Kafila Forge BankLoan - 46.58Cr Reaffirmation Rationale 1mar2017Document4 pagesKafila Forge BankLoan - 46.58Cr Reaffirmation Rationale 1mar2017Saroj Kumar KaparNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- Haryana Steel Mongers 18june2019Document5 pagesHaryana Steel Mongers 18june2019partoshsingh746No ratings yet

- Mahima Real Estate 10apr2019Document5 pagesMahima Real Estate 10apr2019Reena GahlotNo ratings yet

- Cottony FashionsDocument6 pagesCottony FashionsHarishKumar JNo ratings yet

- Daund Sugar Private LimitedDocument5 pagesDaund Sugar Private Limitedkrushna.maneNo ratings yet

- VHM Industries Limited BL 25may2018Document5 pagesVHM Industries Limited BL 25may2018Aashutosh PatodiaNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- Rajesh Exports 20may2021Document6 pagesRajesh Exports 20may2021adhyan kashyapNo ratings yet

- Vikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesVikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating Actionvinay durgapalNo ratings yet

- Bhadreshwar Vidyut Private LimitedDocument5 pagesBhadreshwar Vidyut Private LimitedJaganNo ratings yet

- TVS Credit Services BL 5dec2018Document5 pagesTVS Credit Services BL 5dec2018Sujith DeepakNo ratings yet

- Shri Ram Autotech Private LimitedDocument3 pagesShri Ram Autotech Private LimitedAmanNo ratings yet

- Rating Rationale - ManikaranDocument2 pagesRating Rationale - ManikaranCA Rakesh JhaNo ratings yet

- Privilege Biksons Boilers Private Limited - Credit ReportDocument6 pagesPrivilege Biksons Boilers Private Limited - Credit ReportHarishKumar JNo ratings yet

- Credit Rating - Jun 2021 - Atmastco - LimitedDocument4 pagesCredit Rating - Jun 2021 - Atmastco - LimitedSaurav GanguliNo ratings yet

- Micromax Biofuels PVT Ltd.Document6 pagesMicromax Biofuels PVT Ltd.Kamlakar AvhadNo ratings yet

- PR Sheetal Coolproducts 4jul23Document5 pagesPR Sheetal Coolproducts 4jul23jay.futuretecNo ratings yet

- PR Sannverse Railtech 10nov23Document7 pagesPR Sannverse Railtech 10nov23Vijay DosapatiNo ratings yet

- Press Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionDocument3 pagesPress Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionData CentrumNo ratings yet

- Aryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresDocument67 pagesAryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresSwarna SinghNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Case OneDocument14 pagesCase OneAmeliasari BartenputriNo ratings yet

- Chapter06 - Polina Nalistia Irawan - 2010313220010Document5 pagesChapter06 - Polina Nalistia Irawan - 2010313220010Polina Nalistia IrawanNo ratings yet

- Maintenace Kits - Pavers-ScreedsDocument12 pagesMaintenace Kits - Pavers-ScreedsBruno TrindadeNo ratings yet

- Holistic Marketing Concept by Jikku JohnDocument19 pagesHolistic Marketing Concept by Jikku Johnjikku john100% (2)

- Documentation Technique Marquage CEDocument1 pageDocumentation Technique Marquage CEHyacinthe KOSSINo ratings yet

- Released FRQs On T-AccountsDocument4 pagesReleased FRQs On T-AccountsJenniferNo ratings yet

- Scams in India PDFDocument90 pagesScams in India PDFShubham GuptaNo ratings yet

- 1 - Economy of The Mauryan Period PDFDocument12 pages1 - Economy of The Mauryan Period PDFdrexter124100% (3)

- TITT - Consultancy Services - Prod OpsDocument74 pagesTITT - Consultancy Services - Prod OpsWale OyeludeNo ratings yet

- Sustainable Public Procurement: Research Trends and GapsDocument9 pagesSustainable Public Procurement: Research Trends and GapsApudjijonoNo ratings yet

- Leadership and Public Sector Reform in The Philippines PDFDocument29 pagesLeadership and Public Sector Reform in The Philippines PDFambiNo ratings yet

- Guide To The Markets Q3 2023 1688397991Document100 pagesGuide To The Markets Q3 2023 1688397991nicholasNo ratings yet

- Stellar One: GH-09, Sector-1, Greater Noida WestDocument7 pagesStellar One: GH-09, Sector-1, Greater Noida WestRavi BhattacharyaNo ratings yet

- Lanka Bangla FinanceDocument31 pagesLanka Bangla FinanceJacobHauheng0% (1)

- (EXCEL 2016) Mocktest 1Document9 pages(EXCEL 2016) Mocktest 1Huyền Trang NguyễnNo ratings yet

- A Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofDocument21 pagesA Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofGunveen AbrolNo ratings yet

- Fourth Section: Case of Beşleagă and Others V. RomaniaDocument9 pagesFourth Section: Case of Beşleagă and Others V. Romaniaasm_samNo ratings yet

- Consumer ProtectionDocument3 pagesConsumer ProtectionADITYA JOSHINo ratings yet

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- Reward System and Employee Performance in The Oil and Gas Industry in Rivers StateDocument19 pagesReward System and Employee Performance in The Oil and Gas Industry in Rivers StateInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- TDP Template FinalDocument9 pagesTDP Template Finaldeepak1007No ratings yet

- Disbursement Voucher (New Orence)Document4 pagesDisbursement Voucher (New Orence)user computerNo ratings yet

- Reference List Sample For ResumeDocument7 pagesReference List Sample For Resumec2yyr2c3100% (1)

- At1 Project Evalution - NusratDocument26 pagesAt1 Project Evalution - NusratNUSRAT JERINNo ratings yet

- d200 Users Manual v1 00 00 PDFDocument134 pagesd200 Users Manual v1 00 00 PDFMADHAVI MNo ratings yet

- Go To Market Strategy Primer For 2023Document12 pagesGo To Market Strategy Primer For 2023ceyejim807No ratings yet

- Local Government Report On MMCDocument60 pagesLocal Government Report On MMCLendel BethelmyNo ratings yet