Professional Documents

Culture Documents

Aerospace

Aerospace

Uploaded by

Sneha Dhamija0 ratings0% found this document useful (0 votes)

8 views3 pagesThis document outlines fiscal incentives for defence and aerospace manufacturing projects in Haryana as per the Enterprises Promotion Policy (EPP) 2020. It provides subsidies and exemptions on investment, employment generation, interest rates, stamp duty, electricity duty, and open access charges for micro, small and medium enterprises based on the location of the project in one of four designated blocks (A, B, C, or D). The incentives increase for projects located in blocks further from urban areas, with block D projects receiving the highest percentages of subsidies and longest exemption periods. The policy aims to incentivize investment, job creation, and industrial development in these strategic sectors.

Original Description:

aero

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines fiscal incentives for defence and aerospace manufacturing projects in Haryana as per the Enterprises Promotion Policy (EPP) 2020. It provides subsidies and exemptions on investment, employment generation, interest rates, stamp duty, electricity duty, and open access charges for micro, small and medium enterprises based on the location of the project in one of four designated blocks (A, B, C, or D). The incentives increase for projects located in blocks further from urban areas, with block D projects receiving the highest percentages of subsidies and longest exemption periods. The policy aims to incentivize investment, job creation, and industrial development in these strategic sectors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesAerospace

Aerospace

Uploaded by

Sneha DhamijaThis document outlines fiscal incentives for defence and aerospace manufacturing projects in Haryana as per the Enterprises Promotion Policy (EPP) 2020. It provides subsidies and exemptions on investment, employment generation, interest rates, stamp duty, electricity duty, and open access charges for micro, small and medium enterprises based on the location of the project in one of four designated blocks (A, B, C, or D). The incentives increase for projects located in blocks further from urban areas, with block D projects receiving the highest percentages of subsidies and longest exemption periods. The policy aims to incentivize investment, job creation, and industrial development in these strategic sectors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

FISCAL INCENTIVES FOR

Defence and Aerospace Manufacturing

AS PER EPP 2020

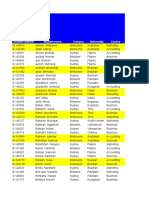

SR. Services A Block B Block C Block D Block

NO.

MICRO, SMALL MICRO, SMALL MICRO, SMALL

& MEDIUM & MEDIUM & MEDIUM

1 Investment 50% of net SGST 75% of net SGST 75% of net SGST

Subsidy in for 7 years in B for 8 Years in C for 10 Years in

Category blocks Category blocks D Category

lieu of SGST

with cap of with cap of blocks with cap

100% of FCI. 125% of FCI. of 150% of FCI.

MICRO, SMALL MICRO, SMALL MICRO, SMALL

& MEDIUM & MEDIUM & MEDIUM

2 Employment persons persons For all the

Generation belonging to belonging to persons

Haryana Haryana

Subsidy

(skilled/semi- (skilled/semi-

skilled) [having skilled) [having

Haryana Haryana Subsidy @ Rs

Resident Resident 48,000/- per

Certificate] Certificate] year for SC/

Subsidy @ Rs Subsidy @ Rs Women and Rs

48,000/- per 48,000/- per

year for SC/ year for SC/

Women and Rs Women and Rs

36,000/- per 36,000/- per 36,000/- per

year for general year for general year for general

category for 5 category for 5 category for 5

years years years

with ESI/PF with ESI/PF with ESI/PF

Number Number Number

MICRO & MICRO & MICRO &

SMALL SMALL SMALL

3 Interest 5% for Micro 6% for Micro 6% for Micro

Subsidy and Small and Small and Small

Enterprises on Enterprises on Enterprises on

term loan or term loan or term loan or

maximum up to maximum up to maximum up to

Rs. Rs. Rs.

10.00 lakh per 10.00 lakh per 10.00 lakh per

year for 3 years year for 5 years year for 5 years

in ‘B’ Categories in ‘C’ in ‘D’

Blocks Categories Categories

Blocks Blocks

MICRO, SMALL MICRO, SMALL MICRO, SMALL

& MEDIUM & MEDIUM & MEDIUM

4 Stamp Duty 80% in ‘B' 100% refund in 100% refund in

category blocks ‘C’ category ‘D’ category

on the land blocks on the blocks on the

land land

meant for meant for meant for

industrial use industrial use industrial use

after after after

commencement commencement commencement

of commercial of commercial of commercial

production, production, production,

within 5 within 5 within 5

years from the years from the years from the

date of date of date of

purchase of purchase of purchase of

land. land. land.

MICRO, SMALL MICRO, SMALL MICRO, SMALL

& MEDIUM & MEDIUM & MEDIUM

5 EDC Charges 50% exemption 50% exemption 50% exemption

of EDC of EDC of EDC

MICRO, SMALL MICRO, SMALL MICRO, SMALL

& MEDIUM & MEDIUM & MEDIUM

6 Electricity 100% 100% 100%

Duty exemption for exemption for exemption for

for 5 years in 'B' 7 years in ‘C’ 10 years in ‘D’

Exemption

category blocks category blocks category blocks

MICRO, SMALL MICRO, SMALL MICRO, SMALL

& MEDIUM & MEDIUM & MEDIUM

7 Open Access Exemption from Exemption from Exemption from

Charges open excess open excess open excess

charges charges charges

maximum up to maximum up to maximum up to

Rs. 1.00 per unit Rs. 1.00 per unit Rs. 1.00 per unit

(Wheeling (Wheeling (Wheeling

Charges, Charges, Charges,

Transmission Transmission Transmission

Charges, Cross Charges, Cross Charges, Cross

subsidy subsidy subsidy

Surcharge and Surcharge and Surcharge and

Additional Additional Additional

Surcharge in Surcharge in Surcharge in

case of Medium case of Medium case of Medium

and Large units and Large units and Large units

in Thrust in Thrust in Thrust

sectors sectors sectors

You might also like

- Steven Mark Tpu - A Detail Study of The Steven Mark Tpu - A Detail Study - Tpu-DsmithDocument473 pagesSteven Mark Tpu - A Detail Study of The Steven Mark Tpu - A Detail Study - Tpu-DsmithRoyNo ratings yet

- MS-700 Subsea Wellhead System Nov 11Document108 pagesMS-700 Subsea Wellhead System Nov 11New Auto TV100% (1)

- 12 SITHIND002 Assessment Task 3 Simulated Practical ObservationDocument31 pages12 SITHIND002 Assessment Task 3 Simulated Practical ObservationSneha DhamijaNo ratings yet

- 19 SITXHRM004 Student VersionDocument74 pages19 SITXHRM004 Student VersionSneha Dhamija100% (1)

- Module 2 Know Your TRADsDocument11 pagesModule 2 Know Your TRADsJun Reyes RamirezNo ratings yet

- Smart Shield BrochureDocument16 pagesSmart Shield BrochureRahul RautNo ratings yet

- Grand Launch of Lic'S New Ulips On 02 Grand Launch of Lic'S New Ulips On 02 March 2020 at Nav Rs.10/ March 2020 at Nav Rs.10Document2 pagesGrand Launch of Lic'S New Ulips On 02 Grand Launch of Lic'S New Ulips On 02 March 2020 at Nav Rs.10/ March 2020 at Nav Rs.10Rajendra PandaNo ratings yet

- Bima ShreeDocument3 pagesBima ShreeDhaval KotakNo ratings yet

- IDFC ABSLI Salaried Term Plan V01 BrochureDocument30 pagesIDFC ABSLI Salaried Term Plan V01 Brochuremantoo kumarNo ratings yet

- Module 3 Getting Ahead With VULDocument10 pagesModule 3 Getting Ahead With VULJun Reyes RamirezNo ratings yet

- LIC's New Jeevan Anand (T-915) : Benefit IllustrationDocument4 pagesLIC's New Jeevan Anand (T-915) : Benefit IllustrationAMAN SHARMANo ratings yet

- Personal Financing-I Application Form - V17Document10 pagesPersonal Financing-I Application Form - V17Rafiqin Nasir AliNo ratings yet

- Region Vi - Western Visayas: Republic of The Philippines Department of EducationDocument5 pagesRegion Vi - Western Visayas: Republic of The Philippines Department of EducationbabesNo ratings yet

- SoC Non Comfort August2018Document5 pagesSoC Non Comfort August2018Ashish KushwahNo ratings yet

- MSPP LeafletDocument4 pagesMSPP LeafletChayan MukherjeeNo ratings yet

- Health CompareDocument1 pageHealth CompareHasmukh patelNo ratings yet

- Updation A BR SbiDocument12 pagesUpdation A BR SbiragunathanNo ratings yet

- Child ProposalsDocument1 pageChild ProposalsannluvislamNo ratings yet

- LIC's New Money Back Plan - 20 Years (T-920) : Benefit IllustrationDocument3 pagesLIC's New Money Back Plan - 20 Years (T-920) : Benefit IllustrationSài TejaNo ratings yet

- Income BrochureDocument20 pagesIncome BrochureGaurav Mishra 23No ratings yet

- State Govt Scheme DetailsDocument9 pagesState Govt Scheme DetailsYogesh LNo ratings yet

- Jeevan Ankur: Mr. SundaramDocument3 pagesJeevan Ankur: Mr. SundaramKSNo ratings yet

- CoopCare PresentationDocument19 pagesCoopCare PresentationcyrusNo ratings yet

- Annexure 4Document19 pagesAnnexure 4Sneha DhamijaNo ratings yet

- LIC's Bima Shiromani (T-947) : Benefit IllustrationDocument3 pagesLIC's Bima Shiromani (T-947) : Benefit IllustrationVivek SharmaNo ratings yet

- Social Banking: CSR InitiativesDocument4 pagesSocial Banking: CSR InitiativesKomica KimsNo ratings yet

- Life Insurance Business 2023 by Benson LeeDocument31 pagesLife Insurance Business 2023 by Benson Leeepidata.unicefNo ratings yet

- Insurance and Investment OptionsDocument1 pageInsurance and Investment Optionsjane8midwatersNo ratings yet

- 01 2019 1 01182805 Fee VoucherDocument1 page01 2019 1 01182805 Fee VoucherImran KhanNo ratings yet

- Jan-Mar 18 Int Rates Pamphlet FrontDocument1 pageJan-Mar 18 Int Rates Pamphlet Frontmanjunath s javalkarNo ratings yet

- Regular Premium VUL Product VariantsDocument4 pagesRegular Premium VUL Product VariantsPorquez cantoNo ratings yet

- FHO, CHI, WC, ASSURE, Coparison One PagerDocument1 pageFHO, CHI, WC, ASSURE, Coparison One PagerLakshmikanth SNo ratings yet

- 10th Module ELearningDocument68 pages10th Module ELearningMahalingam RamasamyNo ratings yet

- 3 - Bu Mock Test Ans - 21.09.2023Document4 pages3 - Bu Mock Test Ans - 21.09.2023mukul.agrahariNo ratings yet

- Father Father, Rahul Father, Rahul IAS MPSC IES Todays Date Exam DateDocument7 pagesFather Father, Rahul Father, Rahul IAS MPSC IES Todays Date Exam DaterahulNo ratings yet

- Ecircular - 4030 - 2023 BREAK2 ChallengeDocument6 pagesEcircular - 4030 - 2023 BREAK2 Challengenabyll9008No ratings yet

- Dppo PremierDocument2 pagesDppo Premierapi-531507901No ratings yet

- Credit CardsDocument4 pagesCredit CardsOmNo ratings yet

- Hostel Challan For Existing StudentsDocument1 pageHostel Challan For Existing StudentsDarwesh Faqeer0% (1)

- Ministryofmicro, Small&Mediumenterprises: IDEMI Is A Govt. of India Society and Basically Service-to-Industry OrganizationDocument12 pagesMinistryofmicro, Small&Mediumenterprises: IDEMI Is A Govt. of India Society and Basically Service-to-Industry OrganizationSameer AgaleNo ratings yet

- 360 ONE Flexicap Fund - LeafletDocument2 pages360 ONE Flexicap Fund - Leafletsalman672003No ratings yet

- Bank Copy Account Copy Academic Copy StudentDocument2 pagesBank Copy Account Copy Academic Copy StudentAbdul MajeedNo ratings yet

- Lingi On Pir Data Collection ToolDocument1 pageLingi On Pir Data Collection ToolBecca LeizylleNo ratings yet

- Investment OppDocument13 pagesInvestment OppAnkit SinghNo ratings yet

- FWAP ULIP Leaflet RevisedDocument16 pagesFWAP ULIP Leaflet Revisedmantoo kumarNo ratings yet

- JkkjjijDocument2 pagesJkkjjijmarketbus12No ratings yet

- Fdjsfs Fhush F GeywDocument15 pagesFdjsfs Fhush F GeywIncubator AIMNo ratings yet

- Elite Advantage BrochureDocument17 pagesElite Advantage BrochureAshish BhangaleNo ratings yet

- Key Fact Sheet VisionDocument2 pagesKey Fact Sheet VisionAhmad AliNo ratings yet

- LIC's New Money Back Plan - 25 Years (T-921) : Benefit IllustrationDocument3 pagesLIC's New Money Back Plan - 25 Years (T-921) : Benefit IllustrationSài TejaNo ratings yet

- Moat Analysis Xyz 1 Xyz 2 Xyz 3 Xyz 4 Xyz 5 Xyz 6: QualitativeDocument24 pagesMoat Analysis Xyz 1 Xyz 2 Xyz 3 Xyz 4 Xyz 5 Xyz 6: QualitativeRaghuNo ratings yet

- Suitability Analysis FormDocument5 pagesSuitability Analysis FormshahnawazNo ratings yet

- Bajaj Allianz Isecure LoanDocument9 pagesBajaj Allianz Isecure LoanSuresh MouryaNo ratings yet

- HealthCompare PDFDocument1 pageHealthCompare PDFHasmukh patelNo ratings yet

- Comparison Quote - GPADocument7 pagesComparison Quote - GPAvisheshNo ratings yet

- Reach For The Stars With Guaranteed Benefits.: Exide LifeDocument10 pagesReach For The Stars With Guaranteed Benefits.: Exide LifeRajishkumar RadhakrishnanNo ratings yet

- ACL ListingDocument54 pagesACL ListingChino CabreraNo ratings yet

- Demand and Supply Analysis A. Demand Study A. Historical Demand DataDocument12 pagesDemand and Supply Analysis A. Demand Study A. Historical Demand DatagoerginamarquezNo ratings yet

- Pmjjby & Pmsby - Scheme Details: ST STDocument1 pagePmjjby & Pmsby - Scheme Details: ST STShruthapradha ParthasarathyNo ratings yet

- Smart Elite Brochure WebDocument16 pagesSmart Elite Brochure WebSaurabh RathodNo ratings yet

- Flexibility To Take Care of Your Ever-Changing Needs: Unit Plus IiiDocument16 pagesFlexibility To Take Care of Your Ever-Changing Needs: Unit Plus IiigkdodaNo ratings yet

- LIC's New Jeevan Anand (T-915) : Benefit IllustrationDocument3 pagesLIC's New Jeevan Anand (T-915) : Benefit IllustrationPrakash RajNo ratings yet

- Elite Advantage BrochureDocument17 pagesElite Advantage BrochureG.S.M.R BharathNo ratings yet

- Learn ReactJS TutorialDocument4 pagesLearn ReactJS TutorialSneha DhamijaNo ratings yet

- Java OOPs ConceptsDocument1 pageJava OOPs ConceptsSneha DhamijaNo ratings yet

- WhereDocument7 pagesWhereSneha DhamijaNo ratings yet

- Artificial IntelligenceDocument4 pagesArtificial IntelligenceSneha DhamijaNo ratings yet

- The Popular ObjectDocument3 pagesThe Popular ObjectSneha DhamijaNo ratings yet

- Object Oriented ProgrammingDocument2 pagesObject Oriented ProgrammingSneha DhamijaNo ratings yet

- Another Feature of Git That Makes It Apart From Other SCM Tools Is ThatDocument1 pageAnother Feature of Git That Makes It Apart From Other SCM Tools Is ThatSneha DhamijaNo ratings yet

- XampleDocument3 pagesXampleSneha DhamijaNo ratings yet

- AaaaaaaaaDocument5 pagesAaaaaaaaaSneha DhamijaNo ratings yet

- Machine Learning ExpertDocument2 pagesMachine Learning ExpertSneha DhamijaNo ratings yet

- Ata Science Tutorial For BeginnersDocument3 pagesAta Science Tutorial For BeginnersSneha DhamijaNo ratings yet

- Lockchain TutorialDocument5 pagesLockchain TutorialSneha DhamijaNo ratings yet

- Git TutorialDocument5 pagesGit TutorialSneha DhamijaNo ratings yet

- 19 SITXHRM004 Student Version 2 Practical PDFDocument27 pages19 SITXHRM004 Student Version 2 Practical PDFSneha DhamijaNo ratings yet

- Angular 7 TutorialDocument12 pagesAngular 7 TutorialSneha DhamijaNo ratings yet

- Trinabh Shridhar - Individual Quiz CompletedDocument11 pagesTrinabh Shridhar - Individual Quiz CompletedSneha DhamijaNo ratings yet

- Timesheet: Employer's Name: Employee's Name: Pay Period (Date/month/year) : To Pay Date (Date/month/year)Document1 pageTimesheet: Employer's Name: Employee's Name: Pay Period (Date/month/year) : To Pay Date (Date/month/year)Sneha DhamijaNo ratings yet

- Assignment Cover Sheet: Hlt54115 Diploma of NursingDocument18 pagesAssignment Cover Sheet: Hlt54115 Diploma of NursingSneha DhamijaNo ratings yet

- Algorithms To Solve Various ProblemsDocument2 pagesAlgorithms To Solve Various ProblemsSneha DhamijaNo ratings yet

- Achine Learning TutorialDocument3 pagesAchine Learning TutorialSneha DhamijaNo ratings yet

- BMS TutorialDocument4 pagesBMS TutorialSneha DhamijaNo ratings yet

- 2Document3 pages2Sneha DhamijaNo ratings yet

- Cloud Computing TutorialDocument6 pagesCloud Computing TutorialSneha DhamijaNo ratings yet

- 12 SITHIND002 Assessment Task 3 Simulated Practical ObservationDocument28 pages12 SITHIND002 Assessment Task 3 Simulated Practical ObservationSneha DhamijaNo ratings yet

- RecordDocument6 pagesRecordSneha DhamijaNo ratings yet

- SITXHRM004 Appendix B - Position DescriptionsDocument2 pagesSITXHRM004 Appendix B - Position DescriptionsSneha DhamijaNo ratings yet

- Annexure 8Document1 pageAnnexure 8Sneha DhamijaNo ratings yet

- Appendix C Coaching Session Plan TemplateDocument1 pageAppendix C Coaching Session Plan TemplateSneha DhamijaNo ratings yet

- Forward: Y96-1026S02 Y96-1026S02Document1 pageForward: Y96-1026S02 Y96-1026S02Gonzalo GalvezNo ratings yet

- Reverse OsmosisDocument7 pagesReverse Osmosiszekariyasa3No ratings yet

- Ausa Forklift c350h Parts ManualDocument10 pagesAusa Forklift c350h Parts Manualshirley100% (60)

- Carbparts CatalogDocument54 pagesCarbparts Cataloggtxl hondaNo ratings yet

- SETC2014 PaperListDocument24 pagesSETC2014 PaperListRenish GhetiaNo ratings yet

- AES - MountainView - CUP - Waiver - 13may2022 REDACTEDDocument827 pagesAES - MountainView - CUP - Waiver - 13may2022 REDACTEDseyedamir mohammadiNo ratings yet

- RDSO - PE - SPEC - AC - 0177 (Rev-1) 2013 Dated 29-11-2021Document124 pagesRDSO - PE - SPEC - AC - 0177 (Rev-1) 2013 Dated 29-11-2021Chiller PartyNo ratings yet

- On-Load Tap-Changer OILTAP® G: Technical Data TD 48Document34 pagesOn-Load Tap-Changer OILTAP® G: Technical Data TD 48Ravindra AngalNo ratings yet

- 2006-2008 Honda Civic Si A/C System Testing ProcedureDocument1 page2006-2008 Honda Civic Si A/C System Testing ProcedureBill NucleusNo ratings yet

- TUV Manual German Codes 2022 01 21 Jan PDFDocument32 pagesTUV Manual German Codes 2022 01 21 Jan PDFFriedrichNo ratings yet

- Report PV1 F3Document16 pagesReport PV1 F3iddin ismail0% (1)

- Chapter 22 TestDocument8 pagesChapter 22 Testnava2002No ratings yet

- UntitledrewyDocument1 pageUntitledrewyUros DrazicNo ratings yet

- 2 and Upto 3Document4 pages2 and Upto 3Sibin CherianNo ratings yet

- Water Pump : Auger LeverDocument3 pagesWater Pump : Auger LeverEslamAldenAbdoNo ratings yet

- Kane 458s ManualDocument36 pagesKane 458s ManualAnresNo ratings yet

- Dis GPR Bro 001 e Rev.1Document2 pagesDis GPR Bro 001 e Rev.1Nazrul IslamNo ratings yet

- LEED v4 For Interior Design and Construction ChecklistDocument3 pagesLEED v4 For Interior Design and Construction Checklisttarek.abbas8598No ratings yet

- Computer Modeling and Analysis of A Hybrid Renewable Energy System Grid-Connected Using Homer ProDocument6 pagesComputer Modeling and Analysis of A Hybrid Renewable Energy System Grid-Connected Using Homer ProHmaedNo ratings yet

- Phillips India: Bidding For Floodlighting Eden Gardens: DisclaimerDocument3 pagesPhillips India: Bidding For Floodlighting Eden Gardens: DisclaimerShreshtha SinhaNo ratings yet

- Lumina 15 - 25KTL3X Data SheetDocument2 pagesLumina 15 - 25KTL3X Data SheetArun SasidharanNo ratings yet

- Ehane Project SaipemDocument156 pagesEhane Project SaipemAdarsh SreekumarNo ratings yet

- SF6 What Is All The Gassing About - Pringle - McMahonDocument14 pagesSF6 What Is All The Gassing About - Pringle - McMahonChing ChingNo ratings yet

- Capacities and Specifications GDP25MXDocument14 pagesCapacities and Specifications GDP25MXvicmart3030No ratings yet

- ATI Inc - Parekh ResidenceDocument14 pagesATI Inc - Parekh ResidenceH A I K U S T U D I ONo ratings yet

- Ad Series 130-180kva 3PHDocument6 pagesAd Series 130-180kva 3PHMohammed AlomaryNo ratings yet

- Heat Exchanger Specification Sheet Thermal NEC UnitsDocument1 pageHeat Exchanger Specification Sheet Thermal NEC Unitsmohsen ranjbarNo ratings yet

- CSEC Physics P2 2016 JanuaryDocument19 pagesCSEC Physics P2 2016 JanuaryBill BobNo ratings yet