Professional Documents

Culture Documents

Identifying Money Management Philosophy: Learning

Identifying Money Management Philosophy: Learning

Uploaded by

De Nev OelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Identifying Money Management Philosophy: Learning

Identifying Money Management Philosophy: Learning

Uploaded by

De Nev OelCopyright:

Available Formats

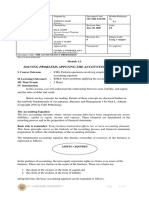

MISAMIS UNIVERSITY Prepared by: Document Code: Module Reference

Ozamiz City MU-SHS-LM-031 No.

Office of the Vice President MARTHY D. DALID, MBA, LPT 7.1

for Academic Affairs Instructor

Checked by: Revision Date: Units:

BASIC EDUCATION June 30, 2020 4.0

DEPARTMENT ROJ Z. COMPO

Associate Principal

Reviewed by: Revision No.: Subject Code:

LEARNING 0 Fin. 1

MODULE ANALYN S. CLARIN, MAEd-ELT

Principal, Basic Ed. Dept.

Approved by: Prerequisite: Co-requisite:

Fundamentals of Fundamentals of

ARIEL R. CLARIN, PhD-Ed ABM 1 ABM 2

Director for Instruction

Descriptive Title: Business Finance

MU-ACA-041A/30May2020

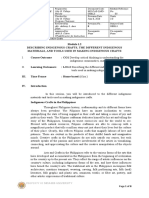

Module 7.1

Identifying Money Management Philosophy

I. Course Outcome : CO7: Demonstrate an understanding of the philosophy and

practices in personal finance.

II. Learning Outcome/s : LO7.1: Identify money management philosophy.

III. Time Frame : 4.5 Hours

IV. Introduction/Outline : In this session, you will understand the concept of inflation; and

the value of savings and investments.

Below are key concepts for reading. Details of these concepts are discussed further in the

textbook “Exploring Small Business and Personal Finance” by Yumang, K. L., Chan Pao, T. P.

L., Benito, P.P. Phoenix Publishing House 2016.

As the golden rule of personal finance, you need to save a portion of your allowance or salary

for your future needs. Mathematically, this is expressed as follows.

INCOME-SAVINGS= EXPENSE

Do not do what most people do, which is :

INCOME_EXPENSE= SAVINGS

The two equation are one and the same. However, what sets them apart is the mindset that

comes into the situation. In the first equation, savings is thought of as planned expense. That is

why saving is also called “paying yourself first.” In the second equation, it is thought of as a

leftover from expense.

INFLATION happens with the general rise in the prices of goods and commodities. This

occurs when spending increases relative to the supply of goods.

Inflation affects purchasing power. Purchasing power is the amount of goods and services

money can buy.

V. Learning Materials : 1. A. Handouts (printed copy)

Module 7.1: Identifying Money Management Philosophy

B. Word-file Document (soft copy)

Filename 1: Identifying Money Management

Philosophy.docx

2. Powerpoint Presentation

PROPERTY OFMISAMIS UNIVERSITY Page 1 of 2

Filename: Managing Personal Finance.ppt

This file can also be accessed online through our MU-OLE or

Group Page.

3. Screencast Video

Filename: How to Manage Your Money.mp4

This file can also be accessed online through our MU-OLE or

Group Page.

4. Writing Materials: Pen and paper

VI. Supplementary

Learning Resources : A. Books:

R1: Aduana, Nick L. Business Finance in the

Philippine Settings. C&E Publishing. 2017

R2: Yumang, K.L., Chan Pao T.Y.L., Benito, P. P.

Exploring Small Business and Personal Finance. The

Phoenix Publishing House, Inc. 2016

R3: Ross, S. A. Fundamentals of Corporate Finance.

McGraw-Hill Companies, Inc. 2006.

R4:Mejorada, N. D. Business Finance. Goodwill

Trading Co., Inc. 2003.

B. Website Address/URL:

https://t.co/sKh0mVY9AG

VII. Learning Activities : 1. School-based Activities

1. Discussion on managing personal finance.

2. Watch the powerpoint presentation on managing personal

finance.

2. Homed-based Activities

1. Watch and listen to the screencast video uploaded on our

MU-OLE/Group Page to go back to the discussion on

how to manage your money.

2. Do “Activity 1: Discussion” on page 3 of this module.

3. School-Based Activities

1. Do “Activity 2: Modified True or False/Enumeration” on

page 4 of this module.

VIII. Equipment : Laptop & TV Projector

IX. Student Feedback : Your feedback is important. Please do not leave this blank. This

portion will allow us to evaluate how this module is going. Your

feedback will help improve this module for future revision.

1. Which part of this module did you find interesting? Why?

2. Which part of this module did you consider challenging? Why?

PROPERTY OFMISAMIS UNIVERSITY Page 2 of 2

You might also like

- Marketing Management: Defining Marketing For The New RealitiesDocument31 pagesMarketing Management: Defining Marketing For The New Realitiesnavid abedinNo ratings yet

- Chapter 7 Managing Personal FinanceDocument34 pagesChapter 7 Managing Personal FinanceLala BubNo ratings yet

- Measurement Levels ABM BF12 IIIb 7Document2 pagesMeasurement Levels ABM BF12 IIIb 7Victorino PinawinNo ratings yet

- DLL Fabm1 Week 7 - 4TH - WEEKDocument4 pagesDLL Fabm1 Week 7 - 4TH - WEEKRosanno DavidNo ratings yet

- Business Finance - Money Management PhilosophiesDocument19 pagesBusiness Finance - Money Management PhilosophiesDivina Grace Rodriguez - LibreaNo ratings yet

- BusFin12 Q1 Mod2 Financial Planning Tools and Concepts v2Document28 pagesBusFin12 Q1 Mod2 Financial Planning Tools and Concepts v2Alma A CernaNo ratings yet

- FABM2 Module 1Document14 pagesFABM2 Module 1Rea Mariz Jordan100% (1)

- ABM 12 - Accounting - Module 3 - SCEDocument4 pagesABM 12 - Accounting - Module 3 - SCEWella LozadaNo ratings yet

- Tos in FABM2 Second QuarterDocument2 pagesTos in FABM2 Second QuarterLAARNI REBONGNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM1)Document11 pagesFundamentals of Accountancy, Business and Management 1 (FABM1)trek boiNo ratings yet

- Performance Task Week 5Document2 pagesPerformance Task Week 5nats pamplonaNo ratings yet

- Business Finance Lesson-Exemplar - Module 3Document7 pagesBusiness Finance Lesson-Exemplar - Module 3Divina Grace Rodriguez - LibreaNo ratings yet

- Dll. Business Finance Week 1Document9 pagesDll. Business Finance Week 1Mariz Bolongaita AñiroNo ratings yet

- Abm Basic DocumentsDocument6 pagesAbm Basic DocumentsAmimah Balt GuroNo ratings yet

- DLL Fabm2Document2 pagesDLL Fabm2Dimple Grace AstorgaNo ratings yet

- DLL April 3-5, 2023 CotDocument6 pagesDLL April 3-5, 2023 CotJEANNE PAULINE OABELNo ratings yet

- ABM - BF12 IIIc D 12Document3 pagesABM - BF12 IIIc D 12Raffy Jade Salazar0% (1)

- Business Finance (Soft Copy of Chapter 7 Managing Personal Finance)Document7 pagesBusiness Finance (Soft Copy of Chapter 7 Managing Personal Finance)KOUJI N. MARQUEZNo ratings yet

- 1FABM1 DLL Nov 6-9Document3 pages1FABM1 DLL Nov 6-9Marilyn Nelmida TamayoNo ratings yet

- DLL - Abm Aug 21 - 25Document2 pagesDLL - Abm Aug 21 - 25Michelle Vinoray PascualNo ratings yet

- Learning Area Grade Level Quarter Date I. Lesson Title Ii. Most Essential Learning Competencies (Melcs) Iii. Content/Core ContentDocument4 pagesLearning Area Grade Level Quarter Date I. Lesson Title Ii. Most Essential Learning Competencies (Melcs) Iii. Content/Core ContentKim VpsaeNo ratings yet

- Fabm1 LPDocument2 pagesFabm1 LPRaul Soriano CabantingNo ratings yet

- DLL Fabm1 Week 4Document4 pagesDLL Fabm1 Week 4reverewh ouyNo ratings yet

- Instructional Planning: I. ObjectivesDocument4 pagesInstructional Planning: I. ObjectivesRaffy Jade SalazarNo ratings yet

- DLP Fundamentals of Accounting 1 - Q3 - W5Document10 pagesDLP Fundamentals of Accounting 1 - Q3 - W5Daisy PaoNo ratings yet

- Detailed Lesson Plan EDITEDDocument6 pagesDetailed Lesson Plan EDITEDJoylen AcopNo ratings yet

- DLL FabmDocument4 pagesDLL FabmjoanNo ratings yet

- Business-Finance Q4 LAS-and-Lectures SchoolFormat 2Document6 pagesBusiness-Finance Q4 LAS-and-Lectures SchoolFormat 2Rachel Santos100% (1)

- DLP FABM 2 For OBSERVATIONDocument42 pagesDLP FABM 2 For OBSERVATIONFRANCESNo ratings yet

- Lesson Title: Most Essential Learning Competencies (Melcs)Document4 pagesLesson Title: Most Essential Learning Competencies (Melcs)Maria Lutgarda Tumbaga100% (2)

- Business Finance Quarter 2 Week 2Document5 pagesBusiness Finance Quarter 2 Week 2Von Violo BuenavidesNo ratings yet

- Business Finance Lesson-Exemplar - Module 1Document7 pagesBusiness Finance Lesson-Exemplar - Module 1Divina Grace Rodriguez - LibreaNo ratings yet

- Quiz Business FiannceDocument4 pagesQuiz Business FianncePepotVicenteNo ratings yet

- ABM - BF12 IIIb 8Document4 pagesABM - BF12 IIIb 8Raffy Jade SalazarNo ratings yet

- ABM 1 LP COT Aug 29Document6 pagesABM 1 LP COT Aug 29ßella DC Reponoya100% (1)

- Business Ethics Week 5Document8 pagesBusiness Ethics Week 5Jethro OrejuelaNo ratings yet

- Fabm2 Learning-Activity-1Document7 pagesFabm2 Learning-Activity-1Cha Eun WooNo ratings yet

- Dll-Funda 1 Jan 22-26Document2 pagesDll-Funda 1 Jan 22-26Michelle Vinoray Pascual100% (1)

- Business Finance: Quarter 1 - Module 3 Types of InvestmentDocument11 pagesBusiness Finance: Quarter 1 - Module 3 Types of Investmentalmira calaguioNo ratings yet

- FABM 1 LAS Quarter 4 Week 3..Document14 pagesFABM 1 LAS Quarter 4 Week 3..Jonalyn DicdicanNo ratings yet

- Week 5 SCEDocument4 pagesWeek 5 SCEAngelicaHermoParas100% (1)

- Final TOS BUSINESS FINANCEDocument2 pagesFinal TOS BUSINESS FINANCEIan Varela100% (1)

- ABM - Business Finance CGDocument7 pagesABM - Business Finance CGJames FulgencioNo ratings yet

- Fabm SUMMATIVE TESTDocument2 pagesFabm SUMMATIVE TESTPep Atienza0% (1)

- Dailly Lesson Log For Class ObservationDocument8 pagesDailly Lesson Log For Class ObservationWilhelmina L. RomanNo ratings yet

- Lesson Plan Forms of Business Organization Statement of Changes in EquityDocument5 pagesLesson Plan Forms of Business Organization Statement of Changes in EquityJulieanne OrtiolaNo ratings yet

- Module 5 Business EthicsDocument1 pageModule 5 Business EthicsPaupauNo ratings yet

- Lesson PlanDocument5 pagesLesson PlanMa. Katrina BusaNo ratings yet

- G12 Buss Finance W5 LASDocument16 pagesG12 Buss Finance W5 LASEvelyn DeliquinaNo ratings yet

- Business Finance - Midterm Exams Problem 3Document2 pagesBusiness Finance - Midterm Exams Problem 3Rina Lynne BaricuatroNo ratings yet

- Activity Sheet in Business Enterprise SimulationDocument4 pagesActivity Sheet in Business Enterprise SimulationAimee LasacaNo ratings yet

- FABM2 Q2 FinalsDocument3 pagesFABM2 Q2 FinalsZeus Malicdem100% (1)

- DLL #9 ACCTG. - Trial BalanceDocument3 pagesDLL #9 ACCTG. - Trial BalanceCab Vic100% (1)

- FABM1 Q4 Module 15Document17 pagesFABM1 Q4 Module 15Earl Christian BonaobraNo ratings yet

- A Detailed Lesson Plan in FABM 1Document6 pagesA Detailed Lesson Plan in FABM 1Rey Kian Miguel Mengullo100% (1)

- Learning Activity Sheets Week 2: Applied EconomicsDocument8 pagesLearning Activity Sheets Week 2: Applied EconomicsRodj Eli Mikael Viernes-IncognitoNo ratings yet

- ADACUNA DLP FABM1 WK2 JULY 3, 2017 Types of Business According To ActivitiesDocument4 pagesADACUNA DLP FABM1 WK2 JULY 3, 2017 Types of Business According To ActivitiesALMA ACUNANo ratings yet

- CHAPTER 2 July 8-12Document4 pagesCHAPTER 2 July 8-12Francesnova B. Dela PeñaNo ratings yet

- Finance1 Final Module 6.1Document3 pagesFinance1 Final Module 6.1De Nev OelNo ratings yet

- Acctg. 1 (Major) Prelim Module 3.1Document4 pagesAcctg. 1 (Major) Prelim Module 3.1Zandara ReyesNo ratings yet

- Written Work No. 2 - Establishing Your Financial FoundationsDocument2 pagesWritten Work No. 2 - Establishing Your Financial Foundationsbitefree.acuaplanetNo ratings yet

- Silicon 1.3Document3 pagesSilicon 1.3De Nev OelNo ratings yet

- GEEL 3 Module 1.1Document7 pagesGEEL 3 Module 1.1De Nev OelNo ratings yet

- GEEL 3 Module 2.1Document7 pagesGEEL 3 Module 2.1De Nev OelNo ratings yet

- GEEL 3 Module 1.2Document8 pagesGEEL 3 Module 1.2De Nev OelNo ratings yet

- GEEL 3 Module 1.0Document3 pagesGEEL 3 Module 1.0De Nev OelNo ratings yet

- Finance1 Final Module 6.1Document3 pagesFinance1 Final Module 6.1De Nev OelNo ratings yet

- Dela Pena, C. Marygold Bank Recon AnswerDocument6 pagesDela Pena, C. Marygold Bank Recon AnswerDe Nev OelNo ratings yet

- Dela Pena, C. Sci2 ElectronegativityDocument2 pagesDela Pena, C. Sci2 ElectronegativityDe Nev OelNo ratings yet

- Add: Deposits in Transit (DIT) Subtotal Less: Outstanding Check (OC)Document6 pagesAdd: Deposits in Transit (DIT) Subtotal Less: Outstanding Check (OC)De Nev OelNo ratings yet

- Summary From RapplerDocument4 pagesSummary From RapplerDe Nev OelNo ratings yet

- Ralph Lorenz Tolentino ResumeDocument4 pagesRalph Lorenz Tolentino ResumeRalph Lorenz TolentinoNo ratings yet

- BPO Report Final 1Document44 pagesBPO Report Final 1shivam.sahniNo ratings yet

- Assistant Manager ProcruementDocument1 pageAssistant Manager ProcruementFaisalSoNo ratings yet

- SIWES REPORT 2 MATTHEW ImprovisedDocument23 pagesSIWES REPORT 2 MATTHEW ImprovisedadeNo ratings yet

- Batchno 83Document41 pagesBatchno 83Shakes MatholeNo ratings yet

- FABM2 - Q1 - Module 3 Statement of Changes in EquityDocument19 pagesFABM2 - Q1 - Module 3 Statement of Changes in EquityEly BNo ratings yet

- Gokhale College Final BBDocument95 pagesGokhale College Final BBJatin PoojariNo ratings yet

- CXC Principles of Business Exam Guide: Section 5: ProductionDocument2 pagesCXC Principles of Business Exam Guide: Section 5: ProductionAvril CarbonNo ratings yet

- Module 1 Overview of Management Consultancy Services by CPAsDocument4 pagesModule 1 Overview of Management Consultancy Services by CPAscha11No ratings yet

- Cambridge International Examinations: Accounting 0452/11 May/June 2017Document11 pagesCambridge International Examinations: Accounting 0452/11 May/June 2017Ayman ZarifNo ratings yet

- MR Mohsin Raza Report (Acp) Final COMPLETE PDFDocument8 pagesMR Mohsin Raza Report (Acp) Final COMPLETE PDFAdeel ChaudhryNo ratings yet

- CH 2 Sectors of Indian Economy Practice MSDocument6 pagesCH 2 Sectors of Indian Economy Practice MSARSHAD JAMILNo ratings yet

- Dissertation On Higher Education in IndiaDocument6 pagesDissertation On Higher Education in IndiaPaperWritingHelpEverett100% (1)

- ABM - FABM11 IIIa 5Document4 pagesABM - FABM11 IIIa 5Kayelle BelinoNo ratings yet

- Shell Graduate Programme Interactive GuideDocument27 pagesShell Graduate Programme Interactive GuideKanjeng PempekNo ratings yet

- PDF Doing Business in Chile and Peru Challenges and Opportunities John E Spillan Ebook Full ChapterDocument53 pagesPDF Doing Business in Chile and Peru Challenges and Opportunities John E Spillan Ebook Full Chapterlauretta.fonceca951100% (4)

- Management of Small Scale Industries (A 3.6) : Kaviyatri Bahinabai Chaudhari North Maharashtra University, JalgaonDocument5 pagesManagement of Small Scale Industries (A 3.6) : Kaviyatri Bahinabai Chaudhari North Maharashtra University, JalgaonKhanNo ratings yet

- University of Mindanao Bansalan College Department of Business Administration Education Bus 5ADocument3 pagesUniversity of Mindanao Bansalan College Department of Business Administration Education Bus 5Aaileen tabay riveraNo ratings yet

- Department of Management Studies BMS Semester 3 Syllabus June 2019 OnwardsDocument20 pagesDepartment of Management Studies BMS Semester 3 Syllabus June 2019 OnwardsAleena Clare ThomasNo ratings yet

- National Teachers College: Student Registration FormDocument1 pageNational Teachers College: Student Registration FormKaren Nicole Borreo MaddelaNo ratings yet

- IGK Profile v3.1Document3 pagesIGK Profile v3.1Abdel Rafee HamsirajiNo ratings yet

- University of Rajasthan Admit CardDocument2 pagesUniversity of Rajasthan Admit Cardnaughty amanNo ratings yet

- Humanities 1Document48 pagesHumanities 1Kumar RahulNo ratings yet

- Advanced Financial Accounting: Solutions ManualDocument12 pagesAdvanced Financial Accounting: Solutions ManualIntan PermatasariNo ratings yet

- Financial Goal Simulator Whitepaper: AmountDocument5 pagesFinancial Goal Simulator Whitepaper: AmountnekkmattNo ratings yet

- Supervisory Management n4 2018 CombinedDocument204 pagesSupervisory Management n4 2018 Combinedrrdhttv4smNo ratings yet

- Marketing An Introduction 11th Edition Armstrong Test BankDocument25 pagesMarketing An Introduction 11th Edition Armstrong Test BankMarkHopkinsjbri100% (62)

- Consumers' Perception Towards Patanjali Products' With SpecialDocument5 pagesConsumers' Perception Towards Patanjali Products' With SpecialAnirudh Singh ChawdaNo ratings yet

- Detailed Lesson Plan EDITEDDocument6 pagesDetailed Lesson Plan EDITEDJoylen AcopNo ratings yet