Professional Documents

Culture Documents

Fixed Income Market Report - 31.01.2022

Fixed Income Market Report - 31.01.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

You might also like

- Phrasal Verbs 2 41 Check ToeicDocument2 pagesPhrasal Verbs 2 41 Check ToeicTang Tatchaya0% (1)

- The 1877 Genocide of 30 Million Hindus by The Christian British Ruler1Document2 pagesThe 1877 Genocide of 30 Million Hindus by The Christian British Ruler1ripestNo ratings yet

- Fixed Income Market Report - 28.02.2022Document1 pageFixed Income Market Report - 28.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 21.02.2022Document1 pageFixed Income Market Report - 21.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 08.08.2022Document1 pageFixed Income Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.07.2022Document1 pageFixed Income Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 17.01.2022Document1 pageFixed Income Market Report - 17.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 29.08.2022Document1 pageFixed Income Market Report - 29.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 20.06.2022Document1 pageFixed Income Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.07.2022Document1 pageFixed Income Market Report - 04.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 13.06.2022Document1 pageFixed Income Market Report - 13.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.09.2022Document1 pageFixed Income Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 01.08.2022Document1 pageFixed Income Market Report - 01.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 06.06.2022Document1 pageFixed Income Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.07.2022Document1 pageFixed Income Market Report - 25.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

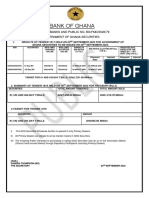

- BOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Document1 pageBOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Payroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Document2 pagesPayroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Janine Leigh BacalsoNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Premium Statement: For The Period Sept 1 2022 To Sept 30 2022Document9 pagesPremium Statement: For The Period Sept 1 2022 To Sept 30 2022bsablanchardNo ratings yet

- Daily Equity Market Report - 22.06.2022Document1 pageDaily Equity Market Report - 22.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.08.2022Document1 pageDaily Equity Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

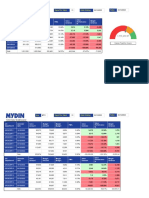

- Site Daily Dashboard: Today Report For Week Site Week EndingDocument19 pagesSite Daily Dashboard: Today Report For Week Site Week EndingSHIEVANESAAN RAVEENo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.07.2022Document1 pageDaily Equity Market Report - 26.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Info Edge (India) LTD: Tax Invoice Original For RecipientDocument3 pagesInfo Edge (India) LTD: Tax Invoice Original For RecipientGanesh GodaseNo ratings yet

- Control and Conclusion of InflationDocument7 pagesControl and Conclusion of Inflationsushantgawali100% (1)

- Agricultural Parity, Trade Parity, and Monetary Reform - Maintaining Purchasing Power Over Time (Via Geraldine Perry)Document2 pagesAgricultural Parity, Trade Parity, and Monetary Reform - Maintaining Purchasing Power Over Time (Via Geraldine Perry)GeorgeMaxwellObiohaKanuNo ratings yet

- Dashboard & Gantt ChartDocument9 pagesDashboard & Gantt Chartarief spartaNo ratings yet

- Economic GlobalizationDocument40 pagesEconomic GlobalizationKyla Yssabelle DolorNo ratings yet

- Different Letter FormetDocument14 pagesDifferent Letter FormetShuvro PaulNo ratings yet

- Case 6 - JCB in IndiaDocument3 pagesCase 6 - JCB in IndiaMauricio Bedon100% (1)

- Ey Recai 56 Country IndexDocument3 pagesEy Recai 56 Country IndexIman AshrafNo ratings yet

- RÃ Soãt US 2018 BanThukiDocument240 pagesRÃ Soãt US 2018 BanThukiAn Sapphire100% (1)

- Tax Invoice: Sudarshan Syndicate 4334/20-21 23-Feb-21Document1 pageTax Invoice: Sudarshan Syndicate 4334/20-21 23-Feb-21ziyan skNo ratings yet

- 31ST July 19 Pending Caling 27.06.2019Document25 pages31ST July 19 Pending Caling 27.06.2019AMIT AMBRENo ratings yet

- By Mukhisa Kituyi, Secretary-General, UNCTAD: Backing Up Globalization With Military MightDocument3 pagesBy Mukhisa Kituyi, Secretary-General, UNCTAD: Backing Up Globalization With Military MightTashNo ratings yet

- Ass1 Macro sp20Document3 pagesAss1 Macro sp20NoorNo ratings yet

- Fair TaxDocument1 pageFair TaxMerritt MarcellaNo ratings yet

- Eco 404 Slides 2022Document27 pagesEco 404 Slides 2022Abane Jude yenNo ratings yet

- 7 Lang Sa Ako Pa I Edit 8Document2 pages7 Lang Sa Ako Pa I Edit 8Dar GeonzonNo ratings yet

- 2.4 Contemporary Issues of International TradeDocument18 pages2.4 Contemporary Issues of International TradeBiraj GhimireNo ratings yet

- Invoice: Anugerah Makmur Tour and TravelDocument1 pageInvoice: Anugerah Makmur Tour and TravelArwin BacharNo ratings yet

- Paparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisDocument29 pagesPaparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisBobby KusumoNo ratings yet

- Zrzut Ekranu 2022-11-20 o 23.44.07Document74 pagesZrzut Ekranu 2022-11-20 o 23.44.07Bartek SalahNo ratings yet

- RMO No. 19-2021 Annex ADocument5 pagesRMO No. 19-2021 Annex AEarl PatrickNo ratings yet

- 111Document6 pages111Claire SolisNo ratings yet

- 5 Year Plan, 21Document7 pages5 Year Plan, 21Lariza PakmaNo ratings yet

- Portugal Trade in Value Added and Global Value ChainsDocument1 pagePortugal Trade in Value Added and Global Value ChainsIrvan FadilaNo ratings yet

- Budget Priorities Framework: Briefer On TheDocument2 pagesBudget Priorities Framework: Briefer On TheNilo C. VillarubiaNo ratings yet

- Tutorial 3 - Basis Period (Continue)Document2 pagesTutorial 3 - Basis Period (Continue)Chan Ying100% (1)

- Coir Udyami YojanaDocument3 pagesCoir Udyami YojanaShalin KapdiNo ratings yet

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet

Fixed Income Market Report - 31.01.2022

Fixed Income Market Report - 31.01.2022

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fixed Income Market Report - 31.01.2022

Fixed Income Market Report - 31.01.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

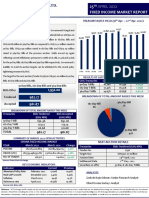

31st JANUARY 2022

FIXED INCOME MARKET REPORT

TENDER #1783 TREASURY RATES YIELD (24th Jan. – 28th Jan. 2022)

FIXED INCOME MARKET HIGHLIGHTS

At last week’s auction a total of GH¢721.96 million was raised in 91-Day Bills,

GH¢186.00 million in 182-Day Bills and GH¢310.32 million in 364-Day Bills as

compared to GH¢859.73 million raised in 91-Day Bills, GH¢185.11 million in 182-

Day Bills, GH¢99.92 million in 364-Day Bills and GH¢1,320.66 million in the 6

Year FXR Bond at the previous auction. Yields for the 91-Day Bills inched up by

0.72% to close at 12.63%, the 182-Day also increased by 0.15% to settle at 13.23%

and the 364-Day Bills also increased by 0.24% to settle at 16.74%

The target for the next auction (Tender #1784) is GH¢932.00 million in 91-Day

Bills and 182-Day Bills.

91-Day bills ,182-Day bills & 364-Day bills RESULTS OF LAST WEEK’S TREASURY BILL AUCTION

GOG Treasuries Current Previous Change (%)

91-Day T-Bill 12.63 12.54 0.72%

182-Day T-Bill 13.23 13.21 0.15%

1,221.59 1,218.28 364-Day T-Bill 16.74 16.70 0.24%

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

1,191.00

BOG Offer Tendered Accepted

364-Day Bill

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK 26%

Treasuries Bids Tendered Bids Accepted

(GH¢ MN) (GH¢ MN) 91-Day Bill

91-Day T-Bill 723.14 721.96 59%

182-Day T-Bill 188.13 186.00 182-Day Bill

364-Day T-Bill 310.32 310.32 15%

TOTAL 1,221.59 1,218.28

SUMMARY OF DEC. 2021 GFIM ACTIVITIES

GHANA FIXED INCOME MARKET NEXT AUCTION DETAILS

YEAR Jan.-Dec. 2021 Jan.-Dec. 2020 Change Treasuries Bids Tendered (GH¢ MN)

VOLUME 208,807,923,727 108,405,308,494 92.62% Tender No. 1784

VALUE (GH¢) 216,036,673,370.80 110,671,477,866.04 95.21%% Target Size GH¢932.00 million

NO. OF TRADES 347,143 182,044 90.70% Auction Date 04th February, 2022

Source: Ghana Stock Exchange Settlement Date 07th February, 2022

Securities on offer 91-Day & 182 Day bills

KEY ECONOMIC INDICATORS

Indicator Current Previous ANALYSTS

Monetary Policy Rate January 2022 14.50% 14.50%

Godwin Kojo Odoom: Senior Research Analyst

Real GDP Growth Q3 2021 6.60% 3.90%

Inflation December 2021 12.60% 12.20% Nelson Cudjoe Kuagbedzi: Analyst

Reference rate December 2021 13.89% 13.46%

Source: GSS, BOG, GBA

Obed Owusu Sackey: Analyst

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Phrasal Verbs 2 41 Check ToeicDocument2 pagesPhrasal Verbs 2 41 Check ToeicTang Tatchaya0% (1)

- The 1877 Genocide of 30 Million Hindus by The Christian British Ruler1Document2 pagesThe 1877 Genocide of 30 Million Hindus by The Christian British Ruler1ripestNo ratings yet

- Fixed Income Market Report - 28.02.2022Document1 pageFixed Income Market Report - 28.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 21.02.2022Document1 pageFixed Income Market Report - 21.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 08.08.2022Document1 pageFixed Income Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.07.2022Document1 pageFixed Income Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 17.01.2022Document1 pageFixed Income Market Report - 17.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 29.08.2022Document1 pageFixed Income Market Report - 29.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 20.06.2022Document1 pageFixed Income Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.07.2022Document1 pageFixed Income Market Report - 04.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 13.06.2022Document1 pageFixed Income Market Report - 13.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.09.2022Document1 pageFixed Income Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 01.08.2022Document1 pageFixed Income Market Report - 01.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 06.06.2022Document1 pageFixed Income Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.07.2022Document1 pageFixed Income Market Report - 25.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- BOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Document1 pageBOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Payroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Document2 pagesPayroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Janine Leigh BacalsoNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Premium Statement: For The Period Sept 1 2022 To Sept 30 2022Document9 pagesPremium Statement: For The Period Sept 1 2022 To Sept 30 2022bsablanchardNo ratings yet

- Daily Equity Market Report - 22.06.2022Document1 pageDaily Equity Market Report - 22.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.08.2022Document1 pageDaily Equity Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Site Daily Dashboard: Today Report For Week Site Week EndingDocument19 pagesSite Daily Dashboard: Today Report For Week Site Week EndingSHIEVANESAAN RAVEENo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.07.2022Document1 pageDaily Equity Market Report - 26.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Info Edge (India) LTD: Tax Invoice Original For RecipientDocument3 pagesInfo Edge (India) LTD: Tax Invoice Original For RecipientGanesh GodaseNo ratings yet

- Control and Conclusion of InflationDocument7 pagesControl and Conclusion of Inflationsushantgawali100% (1)

- Agricultural Parity, Trade Parity, and Monetary Reform - Maintaining Purchasing Power Over Time (Via Geraldine Perry)Document2 pagesAgricultural Parity, Trade Parity, and Monetary Reform - Maintaining Purchasing Power Over Time (Via Geraldine Perry)GeorgeMaxwellObiohaKanuNo ratings yet

- Dashboard & Gantt ChartDocument9 pagesDashboard & Gantt Chartarief spartaNo ratings yet

- Economic GlobalizationDocument40 pagesEconomic GlobalizationKyla Yssabelle DolorNo ratings yet

- Different Letter FormetDocument14 pagesDifferent Letter FormetShuvro PaulNo ratings yet

- Case 6 - JCB in IndiaDocument3 pagesCase 6 - JCB in IndiaMauricio Bedon100% (1)

- Ey Recai 56 Country IndexDocument3 pagesEy Recai 56 Country IndexIman AshrafNo ratings yet

- RÃ Soãt US 2018 BanThukiDocument240 pagesRÃ Soãt US 2018 BanThukiAn Sapphire100% (1)

- Tax Invoice: Sudarshan Syndicate 4334/20-21 23-Feb-21Document1 pageTax Invoice: Sudarshan Syndicate 4334/20-21 23-Feb-21ziyan skNo ratings yet

- 31ST July 19 Pending Caling 27.06.2019Document25 pages31ST July 19 Pending Caling 27.06.2019AMIT AMBRENo ratings yet

- By Mukhisa Kituyi, Secretary-General, UNCTAD: Backing Up Globalization With Military MightDocument3 pagesBy Mukhisa Kituyi, Secretary-General, UNCTAD: Backing Up Globalization With Military MightTashNo ratings yet

- Ass1 Macro sp20Document3 pagesAss1 Macro sp20NoorNo ratings yet

- Fair TaxDocument1 pageFair TaxMerritt MarcellaNo ratings yet

- Eco 404 Slides 2022Document27 pagesEco 404 Slides 2022Abane Jude yenNo ratings yet

- 7 Lang Sa Ako Pa I Edit 8Document2 pages7 Lang Sa Ako Pa I Edit 8Dar GeonzonNo ratings yet

- 2.4 Contemporary Issues of International TradeDocument18 pages2.4 Contemporary Issues of International TradeBiraj GhimireNo ratings yet

- Invoice: Anugerah Makmur Tour and TravelDocument1 pageInvoice: Anugerah Makmur Tour and TravelArwin BacharNo ratings yet

- Paparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisDocument29 pagesPaparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisBobby KusumoNo ratings yet

- Zrzut Ekranu 2022-11-20 o 23.44.07Document74 pagesZrzut Ekranu 2022-11-20 o 23.44.07Bartek SalahNo ratings yet

- RMO No. 19-2021 Annex ADocument5 pagesRMO No. 19-2021 Annex AEarl PatrickNo ratings yet

- 111Document6 pages111Claire SolisNo ratings yet

- 5 Year Plan, 21Document7 pages5 Year Plan, 21Lariza PakmaNo ratings yet

- Portugal Trade in Value Added and Global Value ChainsDocument1 pagePortugal Trade in Value Added and Global Value ChainsIrvan FadilaNo ratings yet

- Budget Priorities Framework: Briefer On TheDocument2 pagesBudget Priorities Framework: Briefer On TheNilo C. VillarubiaNo ratings yet

- Tutorial 3 - Basis Period (Continue)Document2 pagesTutorial 3 - Basis Period (Continue)Chan Ying100% (1)

- Coir Udyami YojanaDocument3 pagesCoir Udyami YojanaShalin KapdiNo ratings yet

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet