Professional Documents

Culture Documents

Magic Timber - Case 1

Magic Timber - Case 1

Uploaded by

Rachna TomarCopyright:

Available Formats

You might also like

- Hospitality Financial Accounting 2nd Edition Weygandt Solutions ManualDocument12 pagesHospitality Financial Accounting 2nd Edition Weygandt Solutions Manualasbestinepalama3rzc6100% (23)

- Assignment# 3 Magic TimberDocument5 pagesAssignment# 3 Magic TimberASAD ULLAH0% (2)

- Finm1416 Individual Compenent 4Document5 pagesFinm1416 Individual Compenent 4Ma HiNo ratings yet

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- Case 1 Ocean Carriers Spreadsheet AnswerDocument9 pagesCase 1 Ocean Carriers Spreadsheet Answerpiyush aroraNo ratings yet

- Circular Flow SimulationDocument5 pagesCircular Flow Simulationsamira2702No ratings yet

- Deed of Sale With Assumption of Mortgage ADocument3 pagesDeed of Sale With Assumption of Mortgage AIbetchay100% (2)

- Nissan - Resilience StrategyDocument2 pagesNissan - Resilience StrategyRachna Tomar0% (1)

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- Ocean Carriers - Case (Final)Document18 pagesOcean Carriers - Case (Final)Namit LalNo ratings yet

- Iron Ore Cost CurvesDocument32 pagesIron Ore Cost CurvesMartin EchevarriaNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Latihan Balance SheetDocument10 pagesLatihan Balance SheetULAN BATAWENNo ratings yet

- Hospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFDocument33 pagesHospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFJeremyMitchellkgaxp100% (13)

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Dynamic Charting Index: Income Charts Balance Sheet Charts Forecast Charts Ratio ChartsDocument17 pagesDynamic Charting Index: Income Charts Balance Sheet Charts Forecast Charts Ratio ChartsEt. MensahNo ratings yet

- Dynamic ChartingDocument17 pagesDynamic ChartingHemanthaJayamaneNo ratings yet

- Cost Benefit Analysis Dashboard Template: Employee SalariesDocument10 pagesCost Benefit Analysis Dashboard Template: Employee SalariesKarthik HegdeNo ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- Cost Benefit AnalysisDocument4 pagesCost Benefit AnalysisswapnilNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Book 1Document3 pagesBook 1Moetassem billah MikatiNo ratings yet

- CH SolutionsDocument6 pagesCH SolutionsPink MagentaNo ratings yet

- Ms. Excel International Brews: Income StatementDocument9 pagesMs. Excel International Brews: Income StatementAphol Joyce MortelNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- CashFlow Exercise NoansDocument5 pagesCashFlow Exercise Noansarwa_mukadam03No ratings yet

- Case Study - Caribbean Internet CaféDocument7 pagesCase Study - Caribbean Internet CaféANo ratings yet

- A1 Strategic Profit ModelDocument5 pagesA1 Strategic Profit ModelMia JacobsonNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- FKGHDDKDocument2 pagesFKGHDDKKennedy HarrisNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- DepreciationDocument3 pagesDepreciationDreamer_ShopnoNo ratings yet

- NPV Caselet Project AssessmentDocument4 pagesNPV Caselet Project AssessmentFurqanTariqNo ratings yet

- Cost Benefit Analysis of Likely Hearing AidsDocument4 pagesCost Benefit Analysis of Likely Hearing Aidsarun neupaneNo ratings yet

- A-09.21.051 D .NAKUL Holmes BFDocument14 pagesA-09.21.051 D .NAKUL Holmes BFAustin GomesNo ratings yet

- Soal BaruDocument14 pagesSoal BaruDella Lina50% (2)

- United Metal: Initial Outlay (IO) CalculationDocument3 pagesUnited Metal: Initial Outlay (IO) CalculationMarjina Binte Abbas BrishtiNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- Capital Budgeting WorkShop 2 2020-1Document3 pagesCapital Budgeting WorkShop 2 2020-1Valentina Barreto Puerta0% (1)

- Profit Analysis Worksheet: ProductionDocument18 pagesProfit Analysis Worksheet: ProductionhariveerNo ratings yet

- BSBFIM501 Project Steps 1,2 4 Excel Assessment Template V1.0819Document5 pagesBSBFIM501 Project Steps 1,2 4 Excel Assessment Template V1.0819Amanda PiresNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument36 pagesRisk Analysis, Real Options, and Capital BudgetingBussines LearnNo ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- CH 13 Wiley Kimmel Quiz HomeworkDocument8 pagesCH 13 Wiley Kimmel Quiz HomeworkmkiNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Truman Company Acquired A 70 Percent Interest in Atlanta CompanyDocument4 pagesTruman Company Acquired A 70 Percent Interest in Atlanta CompanyKailash KumarNo ratings yet

- Blue Ridge Spain ExcelDocument5 pagesBlue Ridge Spain Excelsanchi virmaniNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- WBS Code Activity Start Date Finish Date Duration (Days) : Works CommenceDocument9 pagesWBS Code Activity Start Date Finish Date Duration (Days) : Works CommenceDollyNo ratings yet

- Equipment Purchase Costs V2 07112014Document81 pagesEquipment Purchase Costs V2 07112014Tom GoodladNo ratings yet

- BD21060 Aman Assignment5Document6 pagesBD21060 Aman Assignment5Aman KundraBD21060No ratings yet

- Chapter 9 Case Question Finance SolvedDocument1 pageChapter 9 Case Question Finance SolvedOwais Khan KhattakNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Forum ACC Sesi 12 - WM RevisiDocument4 pagesForum ACC Sesi 12 - WM RevisiWindy MartaputriNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Trade UnionDocument1 pageTrade UnionRachna TomarNo ratings yet

- AdvantageDocument1 pageAdvantageRachna TomarNo ratings yet

- Factors Affecting The Strength of A Trade UnionDocument1 pageFactors Affecting The Strength of A Trade UnionRachna TomarNo ratings yet

- The Basis of Wage ClaimsDocument1 pageThe Basis of Wage ClaimsRachna TomarNo ratings yet

- The Role of The Trade UnionsDocument2 pagesThe Role of The Trade UnionsRachna TomarNo ratings yet

- Types of Trade UnionsDocument1 pageTypes of Trade UnionsRachna TomarNo ratings yet

- Trade Union - DisadvantagesDocument1 pageTrade Union - DisadvantagesRachna TomarNo ratings yet

- Trade Union - Dis WagesDocument1 pageTrade Union - Dis WagesRachna TomarNo ratings yet

- What Is MoneyDocument2 pagesWhat Is MoneyRachna TomarNo ratings yet

- Trade Union & GovernmentDocument1 pageTrade Union & GovernmentRachna TomarNo ratings yet

- What Is Legal TenderDocument1 pageWhat Is Legal TenderRachna TomarNo ratings yet

- Accept DepositsDocument2 pagesAccept DepositsRachna TomarNo ratings yet

- LonasDocument1 pageLonasRachna TomarNo ratings yet

- The Functions of MoneyDocument3 pagesThe Functions of MoneyRachna TomarNo ratings yet

- Standard of Deferred PaymentsDocument2 pagesStandard of Deferred PaymentsRachna TomarNo ratings yet

- The Role and Importance of Commercial BanksDocument2 pagesThe Role and Importance of Commercial BanksRachna TomarNo ratings yet

- OverdraftsDocument3 pagesOverdraftsRachna TomarNo ratings yet

- Characteristic of MoneyDocument2 pagesCharacteristic of MoneyRachna TomarNo ratings yet

- Diff Forms of Money in Bank AccountDocument1 pageDiff Forms of Money in Bank AccountRachna TomarNo ratings yet

- Nissan - BCPDocument1 pageNissan - BCPRachna TomarNo ratings yet

- Mindtree Aptitude Questions and AnswersDocument10 pagesMindtree Aptitude Questions and AnswersSùsiñdérNo ratings yet

- Category ManagementDocument7 pagesCategory ManagementAlan Veeck100% (1)

- Carlsson Flyer C Klasse W S204 ENGDocument12 pagesCarlsson Flyer C Klasse W S204 ENGFaUs0No ratings yet

- MenuDocument38 pagesMenuEtor MaloNo ratings yet

- Q1 - What Kind of Person Is Sarah Talley - Do A Character Profile?Document8 pagesQ1 - What Kind of Person Is Sarah Talley - Do A Character Profile?Kartik MehrotraNo ratings yet

- Internationalization StrategyDocument40 pagesInternationalization StrategyEric Luis CabridoNo ratings yet

- CH 8 and 9Document37 pagesCH 8 and 9hamdanmakNo ratings yet

- Parle G WordDocument2 pagesParle G WordKshitij SharmaNo ratings yet

- Interview Questions (TFK)Document3 pagesInterview Questions (TFK)tgjhrtjNo ratings yet

- Sales Force Training at Arrow ElectronicsDocument7 pagesSales Force Training at Arrow ElectronicsVibhav RoyNo ratings yet

- Tamwood Careers Digital Marketing Prices Dates 2020Document1 pageTamwood Careers Digital Marketing Prices Dates 2020Bryan TVNo ratings yet

- Cambridge IGCSE Economics 0455 Complete Notes PDocument5 pagesCambridge IGCSE Economics 0455 Complete Notes Pครูพิเศษ EFLNo ratings yet

- Nclts Appointment Rps FeesDocument30 pagesNclts Appointment Rps FeesvbsreddyNo ratings yet

- Business Plan: "A Lamp That Will Make Your Future BrighterDocument19 pagesBusiness Plan: "A Lamp That Will Make Your Future BrighterJobert MampustiNo ratings yet

- Assignment 2 PSCDocument4 pagesAssignment 2 PSCreda rashwanNo ratings yet

- FM Summary CH13Document6 pagesFM Summary CH13Khalil KannaNo ratings yet

- Break Even Analysis and MarkupDocument4 pagesBreak Even Analysis and Markupbenaoumeur benounaNo ratings yet

- Business Plan: Omega Designs 1Document18 pagesBusiness Plan: Omega Designs 1api-335664543No ratings yet

- Chapter 5 - Modern Portfolio ConceptsDocument41 pagesChapter 5 - Modern Portfolio ConceptsShahriar HaqueNo ratings yet

- 24th May SBI PO Pre Quant Daily MockDocument6 pages24th May SBI PO Pre Quant Daily MockMarvinScottNo ratings yet

- Unit 2 - The Allocation of Resources Chapter 2.1 - Microeconomics and Macroeconomics MicroeconomicsDocument3 pagesUnit 2 - The Allocation of Resources Chapter 2.1 - Microeconomics and Macroeconomics MicroeconomicsK. Udhai CharanNo ratings yet

- Free Cash Flow Analysis - FedEx Vs UPSDocument16 pagesFree Cash Flow Analysis - FedEx Vs UPSJessica Marie100% (2)

- Preparation of Financial Documents For Student F1 VISA For Education in USDocument3 pagesPreparation of Financial Documents For Student F1 VISA For Education in USHarikrishnan RajendranNo ratings yet

- Wind Energy Cost and Feasibility of A 2 MW Wind Power ProjectDocument7 pagesWind Energy Cost and Feasibility of A 2 MW Wind Power ProjectJigneshSaradavaNo ratings yet

- Investment in Swiftlet Hotels in Malaysia - Does ROI Compensate Investment Risks?Document8 pagesInvestment in Swiftlet Hotels in Malaysia - Does ROI Compensate Investment Risks?Harrys PurnamaNo ratings yet

- AWN OctoberPortfolioUpdateDocument10 pagesAWN OctoberPortfolioUpdateCraig CannonNo ratings yet

Magic Timber - Case 1

Magic Timber - Case 1

Uploaded by

Rachna TomarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Magic Timber - Case 1

Magic Timber - Case 1

Uploaded by

Rachna TomarCopyright:

Available Formats

Case 1 - Magic Timber

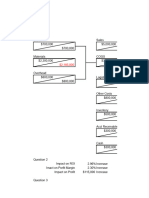

Tax Rate 30.0%

Cost of Capital 11.0%

Replace Mathix with Delta

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Tax Calculation

Matrix Maintenance (savings) $ 28,000 $ 7,000 $ 7,000 $ 11,000 $ 7,000 $ 7,000

Labour (savings) $ 5,250 $ 5,500 $ 5,750 $ 6,000 $ 6,250

Electricity (savings) $ 4,725 $ 4,800 $ 4,875 $ 4,950 $ 5,025

Matrix sell Depreciation $ 6,000 $ 6,000 $ 6,000 $ 6,000 $ 6,000

Delta Regular Maintenance (cost) $ (2,000) $ (3,000) $ (4,000) $ (5,000) $ (6,000)

Delta Depreciation (cost) $ (14,000) $ (14,000) $ (14,000) $ (14,000) $ (14,000)

Taxable Income $ 28,000 $ 6,975 $ 6,300 $ 9,625 $ 4,950 $ 4,275

Tax Payable $ 8,400 $ 2,093 $ 1,890 $ 2,888 $ 1,485 $ 1,283

Cash Flow

Delta Cost "Outflows" $ (140,000)

Delta Maintenance "Outflows" $ (2,000) $ (3,000) $ (4,000) $ (5,000) $ (6,000)

Matrix Scrap forgone "Outflows" $ (5,000)

Tax Payable "Outflows" $ (8,400) $ (2,093) $ (1,890) $ (2,888) $ (1,485) $ (1,283)

Matrix Sale Price "Inflows" $ 35,000

Maintenance Matrix "Inflows" $ 28,000 $ 7,000 $ 7,000 $ 11,000 $ 7,000 $ 7,000

Labour savings "Inflows" $ 5,250 $ 5,500 $ 5,750 $ 6,000 $ 6,250

Electricity savings "Inflows" $ 4,725 $ 4,800 $ 4,875 $ 4,950 $ 5,025

Delta Sale Price "Inflows" $ 60,000

Total Cash Flow "Total Cash Flow" $ (85,400) $ 12,883 $ 12,410 $ 14,738 $ 11,465 $ 65,993

Net Present Value

NPV $ (5,612.87)

Note: 1. The – 5613 NPV indicates that Davidson should not

replace Matrix with Delta because it will consume the cash

flows of the company but there is one thing to be

considered and that is; this calculations only provides the

information regarding the replacement of old machine

(Matrix) into the new machine (Delta). These calculations

do not contain the information regarding the increase in

capacity of production and to meet the future expectations

of market demand for magic timber.

2.While calculating the NPV, we have assumed that the

revenue will remain same. If the revenue is increased with

the increased production capacity, it will have positive

impact on NPV.

3. We have considered 11% cost of capital however if the

cost of capital is less than 11%, it will also have positive

impact on NPV.

You might also like

- Hospitality Financial Accounting 2nd Edition Weygandt Solutions ManualDocument12 pagesHospitality Financial Accounting 2nd Edition Weygandt Solutions Manualasbestinepalama3rzc6100% (23)

- Assignment# 3 Magic TimberDocument5 pagesAssignment# 3 Magic TimberASAD ULLAH0% (2)

- Finm1416 Individual Compenent 4Document5 pagesFinm1416 Individual Compenent 4Ma HiNo ratings yet

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- Case 1 Ocean Carriers Spreadsheet AnswerDocument9 pagesCase 1 Ocean Carriers Spreadsheet Answerpiyush aroraNo ratings yet

- Circular Flow SimulationDocument5 pagesCircular Flow Simulationsamira2702No ratings yet

- Deed of Sale With Assumption of Mortgage ADocument3 pagesDeed of Sale With Assumption of Mortgage AIbetchay100% (2)

- Nissan - Resilience StrategyDocument2 pagesNissan - Resilience StrategyRachna Tomar0% (1)

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- Ocean Carriers - Case (Final)Document18 pagesOcean Carriers - Case (Final)Namit LalNo ratings yet

- Iron Ore Cost CurvesDocument32 pagesIron Ore Cost CurvesMartin EchevarriaNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Latihan Balance SheetDocument10 pagesLatihan Balance SheetULAN BATAWENNo ratings yet

- Hospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFDocument33 pagesHospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFJeremyMitchellkgaxp100% (13)

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Dynamic Charting Index: Income Charts Balance Sheet Charts Forecast Charts Ratio ChartsDocument17 pagesDynamic Charting Index: Income Charts Balance Sheet Charts Forecast Charts Ratio ChartsEt. MensahNo ratings yet

- Dynamic ChartingDocument17 pagesDynamic ChartingHemanthaJayamaneNo ratings yet

- Cost Benefit Analysis Dashboard Template: Employee SalariesDocument10 pagesCost Benefit Analysis Dashboard Template: Employee SalariesKarthik HegdeNo ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- Cost Benefit AnalysisDocument4 pagesCost Benefit AnalysisswapnilNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Book 1Document3 pagesBook 1Moetassem billah MikatiNo ratings yet

- CH SolutionsDocument6 pagesCH SolutionsPink MagentaNo ratings yet

- Ms. Excel International Brews: Income StatementDocument9 pagesMs. Excel International Brews: Income StatementAphol Joyce MortelNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- CashFlow Exercise NoansDocument5 pagesCashFlow Exercise Noansarwa_mukadam03No ratings yet

- Case Study - Caribbean Internet CaféDocument7 pagesCase Study - Caribbean Internet CaféANo ratings yet

- A1 Strategic Profit ModelDocument5 pagesA1 Strategic Profit ModelMia JacobsonNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- FKGHDDKDocument2 pagesFKGHDDKKennedy HarrisNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- DepreciationDocument3 pagesDepreciationDreamer_ShopnoNo ratings yet

- NPV Caselet Project AssessmentDocument4 pagesNPV Caselet Project AssessmentFurqanTariqNo ratings yet

- Cost Benefit Analysis of Likely Hearing AidsDocument4 pagesCost Benefit Analysis of Likely Hearing Aidsarun neupaneNo ratings yet

- A-09.21.051 D .NAKUL Holmes BFDocument14 pagesA-09.21.051 D .NAKUL Holmes BFAustin GomesNo ratings yet

- Soal BaruDocument14 pagesSoal BaruDella Lina50% (2)

- United Metal: Initial Outlay (IO) CalculationDocument3 pagesUnited Metal: Initial Outlay (IO) CalculationMarjina Binte Abbas BrishtiNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- Capital Budgeting WorkShop 2 2020-1Document3 pagesCapital Budgeting WorkShop 2 2020-1Valentina Barreto Puerta0% (1)

- Profit Analysis Worksheet: ProductionDocument18 pagesProfit Analysis Worksheet: ProductionhariveerNo ratings yet

- BSBFIM501 Project Steps 1,2 4 Excel Assessment Template V1.0819Document5 pagesBSBFIM501 Project Steps 1,2 4 Excel Assessment Template V1.0819Amanda PiresNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument36 pagesRisk Analysis, Real Options, and Capital BudgetingBussines LearnNo ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- CH 13 Wiley Kimmel Quiz HomeworkDocument8 pagesCH 13 Wiley Kimmel Quiz HomeworkmkiNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Truman Company Acquired A 70 Percent Interest in Atlanta CompanyDocument4 pagesTruman Company Acquired A 70 Percent Interest in Atlanta CompanyKailash KumarNo ratings yet

- Blue Ridge Spain ExcelDocument5 pagesBlue Ridge Spain Excelsanchi virmaniNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- WBS Code Activity Start Date Finish Date Duration (Days) : Works CommenceDocument9 pagesWBS Code Activity Start Date Finish Date Duration (Days) : Works CommenceDollyNo ratings yet

- Equipment Purchase Costs V2 07112014Document81 pagesEquipment Purchase Costs V2 07112014Tom GoodladNo ratings yet

- BD21060 Aman Assignment5Document6 pagesBD21060 Aman Assignment5Aman KundraBD21060No ratings yet

- Chapter 9 Case Question Finance SolvedDocument1 pageChapter 9 Case Question Finance SolvedOwais Khan KhattakNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Forum ACC Sesi 12 - WM RevisiDocument4 pagesForum ACC Sesi 12 - WM RevisiWindy MartaputriNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Trade UnionDocument1 pageTrade UnionRachna TomarNo ratings yet

- AdvantageDocument1 pageAdvantageRachna TomarNo ratings yet

- Factors Affecting The Strength of A Trade UnionDocument1 pageFactors Affecting The Strength of A Trade UnionRachna TomarNo ratings yet

- The Basis of Wage ClaimsDocument1 pageThe Basis of Wage ClaimsRachna TomarNo ratings yet

- The Role of The Trade UnionsDocument2 pagesThe Role of The Trade UnionsRachna TomarNo ratings yet

- Types of Trade UnionsDocument1 pageTypes of Trade UnionsRachna TomarNo ratings yet

- Trade Union - DisadvantagesDocument1 pageTrade Union - DisadvantagesRachna TomarNo ratings yet

- Trade Union - Dis WagesDocument1 pageTrade Union - Dis WagesRachna TomarNo ratings yet

- What Is MoneyDocument2 pagesWhat Is MoneyRachna TomarNo ratings yet

- Trade Union & GovernmentDocument1 pageTrade Union & GovernmentRachna TomarNo ratings yet

- What Is Legal TenderDocument1 pageWhat Is Legal TenderRachna TomarNo ratings yet

- Accept DepositsDocument2 pagesAccept DepositsRachna TomarNo ratings yet

- LonasDocument1 pageLonasRachna TomarNo ratings yet

- The Functions of MoneyDocument3 pagesThe Functions of MoneyRachna TomarNo ratings yet

- Standard of Deferred PaymentsDocument2 pagesStandard of Deferred PaymentsRachna TomarNo ratings yet

- The Role and Importance of Commercial BanksDocument2 pagesThe Role and Importance of Commercial BanksRachna TomarNo ratings yet

- OverdraftsDocument3 pagesOverdraftsRachna TomarNo ratings yet

- Characteristic of MoneyDocument2 pagesCharacteristic of MoneyRachna TomarNo ratings yet

- Diff Forms of Money in Bank AccountDocument1 pageDiff Forms of Money in Bank AccountRachna TomarNo ratings yet

- Nissan - BCPDocument1 pageNissan - BCPRachna TomarNo ratings yet

- Mindtree Aptitude Questions and AnswersDocument10 pagesMindtree Aptitude Questions and AnswersSùsiñdérNo ratings yet

- Category ManagementDocument7 pagesCategory ManagementAlan Veeck100% (1)

- Carlsson Flyer C Klasse W S204 ENGDocument12 pagesCarlsson Flyer C Klasse W S204 ENGFaUs0No ratings yet

- MenuDocument38 pagesMenuEtor MaloNo ratings yet

- Q1 - What Kind of Person Is Sarah Talley - Do A Character Profile?Document8 pagesQ1 - What Kind of Person Is Sarah Talley - Do A Character Profile?Kartik MehrotraNo ratings yet

- Internationalization StrategyDocument40 pagesInternationalization StrategyEric Luis CabridoNo ratings yet

- CH 8 and 9Document37 pagesCH 8 and 9hamdanmakNo ratings yet

- Parle G WordDocument2 pagesParle G WordKshitij SharmaNo ratings yet

- Interview Questions (TFK)Document3 pagesInterview Questions (TFK)tgjhrtjNo ratings yet

- Sales Force Training at Arrow ElectronicsDocument7 pagesSales Force Training at Arrow ElectronicsVibhav RoyNo ratings yet

- Tamwood Careers Digital Marketing Prices Dates 2020Document1 pageTamwood Careers Digital Marketing Prices Dates 2020Bryan TVNo ratings yet

- Cambridge IGCSE Economics 0455 Complete Notes PDocument5 pagesCambridge IGCSE Economics 0455 Complete Notes Pครูพิเศษ EFLNo ratings yet

- Nclts Appointment Rps FeesDocument30 pagesNclts Appointment Rps FeesvbsreddyNo ratings yet

- Business Plan: "A Lamp That Will Make Your Future BrighterDocument19 pagesBusiness Plan: "A Lamp That Will Make Your Future BrighterJobert MampustiNo ratings yet

- Assignment 2 PSCDocument4 pagesAssignment 2 PSCreda rashwanNo ratings yet

- FM Summary CH13Document6 pagesFM Summary CH13Khalil KannaNo ratings yet

- Break Even Analysis and MarkupDocument4 pagesBreak Even Analysis and Markupbenaoumeur benounaNo ratings yet

- Business Plan: Omega Designs 1Document18 pagesBusiness Plan: Omega Designs 1api-335664543No ratings yet

- Chapter 5 - Modern Portfolio ConceptsDocument41 pagesChapter 5 - Modern Portfolio ConceptsShahriar HaqueNo ratings yet

- 24th May SBI PO Pre Quant Daily MockDocument6 pages24th May SBI PO Pre Quant Daily MockMarvinScottNo ratings yet

- Unit 2 - The Allocation of Resources Chapter 2.1 - Microeconomics and Macroeconomics MicroeconomicsDocument3 pagesUnit 2 - The Allocation of Resources Chapter 2.1 - Microeconomics and Macroeconomics MicroeconomicsK. Udhai CharanNo ratings yet

- Free Cash Flow Analysis - FedEx Vs UPSDocument16 pagesFree Cash Flow Analysis - FedEx Vs UPSJessica Marie100% (2)

- Preparation of Financial Documents For Student F1 VISA For Education in USDocument3 pagesPreparation of Financial Documents For Student F1 VISA For Education in USHarikrishnan RajendranNo ratings yet

- Wind Energy Cost and Feasibility of A 2 MW Wind Power ProjectDocument7 pagesWind Energy Cost and Feasibility of A 2 MW Wind Power ProjectJigneshSaradavaNo ratings yet

- Investment in Swiftlet Hotels in Malaysia - Does ROI Compensate Investment Risks?Document8 pagesInvestment in Swiftlet Hotels in Malaysia - Does ROI Compensate Investment Risks?Harrys PurnamaNo ratings yet

- AWN OctoberPortfolioUpdateDocument10 pagesAWN OctoberPortfolioUpdateCraig CannonNo ratings yet