Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsBuy & Hold Deal Analysisnewestfile

Buy & Hold Deal Analysisnewestfile

Uploaded by

NgaNguyenCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Enablers and Inhibitors of AI-Powered Voice Assistants A Dual-Factor Approach by Integrating The StaDocument22 pagesEnablers and Inhibitors of AI-Powered Voice Assistants A Dual-Factor Approach by Integrating The Stalive roseNo ratings yet

- Unit 3 The Principles of HACCPDocument3 pagesUnit 3 The Principles of HACCPGeidemar OliveiraNo ratings yet

- Team Leadership A1Document8 pagesTeam Leadership A1NataliaNo ratings yet

- Monsoon Train Time Tabel by SR 2023 PDF DownloadDocument33 pagesMonsoon Train Time Tabel by SR 2023 PDF DownloadPokemon GameNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- Enhancing Decision MakingDocument33 pagesEnhancing Decision MakingAllan KomosiNo ratings yet

- BSBLDR601 - Assessment Task 3 EnviarDocument37 pagesBSBLDR601 - Assessment Task 3 Enviardsharlie94No ratings yet

- Listado de ProductosDocument70 pagesListado de ProductosAlejandra VargasNo ratings yet

- Ve20-Tour - Iqp Final Report - 0Document86 pagesVe20-Tour - Iqp Final Report - 0donNo ratings yet

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

- Entrepreneurial Competencies As An Entrepreneurial Distinctive - ADocument66 pagesEntrepreneurial Competencies As An Entrepreneurial Distinctive - AAnaaNo ratings yet

- Project Outline: Oman Car Wash Mobile ApplicationDocument1 pageProject Outline: Oman Car Wash Mobile ApplicationUsama MunirNo ratings yet

- Sabi V SaharaDocument2 pagesSabi V SaharasahilNo ratings yet

- Chapter 12 Test Bank AnswersDocument3 pagesChapter 12 Test Bank AnswersYumna WafaNo ratings yet

- The Impact of Artificial Intelligence On SocietyDocument2 pagesThe Impact of Artificial Intelligence On SocietychristineNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima Yojana: Premium@rs.114.00Document3 pagesPradhan Mantri Jeevan Jyoti Bima Yojana: Premium@rs.114.00GIRISH R NNo ratings yet

- LEXUSDocument59 pagesLEXUSShubham KhuranaNo ratings yet

- Bjorkman - Talent or Not Employee Reactions To Talent IdentificationDocument20 pagesBjorkman - Talent or Not Employee Reactions To Talent IdentificationMei Gui AngNo ratings yet

- Key Information Document: What Type of Contract Will I Be Engaged In?Document74 pagesKey Information Document: What Type of Contract Will I Be Engaged In?Towfiquzzaman ShummoNo ratings yet

- Ostensible AuthorityDocument4 pagesOstensible AuthorityAgitha GunasagranNo ratings yet

- PDFFFFFDocument7 pagesPDFFFFFkyla manaloNo ratings yet

- SIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)Document2 pagesSIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)DeepakNo ratings yet

- Agabon v. NLRC DigestDocument3 pagesAgabon v. NLRC DigestHandeskyNo ratings yet

- Managing A Lean-Agile Leadership Transformation in A Traditional OrganizationDocument128 pagesManaging A Lean-Agile Leadership Transformation in A Traditional OrganizationAiouaz OthmenNo ratings yet

- American Fork & Hoe 1910 HDocument272 pagesAmerican Fork & Hoe 1910 HJay SNo ratings yet

- What's Wrong With Ariel - Marketing AssignmentDocument4 pagesWhat's Wrong With Ariel - Marketing AssignmentTaha JavaidNo ratings yet

- Master Plan Waswater Management JakartaDocument228 pagesMaster Plan Waswater Management JakartaRIKA ANGGRAININo ratings yet

- OBLICON Outline of TopicsDocument53 pagesOBLICON Outline of TopicsRyan Christian100% (1)

- Portfolio Management MMDocument31 pagesPortfolio Management MMTu DuongNo ratings yet

- Resume - Malak Al Abri - Version#6Document4 pagesResume - Malak Al Abri - Version#6malakalabri98No ratings yet

Buy & Hold Deal Analysisnewestfile

Buy & Hold Deal Analysisnewestfile

Uploaded by

NgaNguyen0 ratings0% found this document useful (0 votes)

15 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views1 pageBuy & Hold Deal Analysisnewestfile

Buy & Hold Deal Analysisnewestfile

Uploaded by

NgaNguyenCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

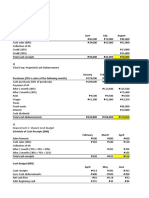

Property

Information Property Analysis

Purchase Price $ $ 700,000.00 Loan Amount $ 560,000.00

Up Front Rehab Costs $ $ - Down Payment $ 159,600.00

Monthly Income Up Front Rehab Costs $ -

Rental Income $ $ 2,500.00 Total Initial Investment $ 159,600.00

Vacancy Rate $ 250.00 ####

Other Income 0 Annual Gross Operating Income $ 27,000.00

Gross Operating Monthly Income $ 2,250.00 Annual Gross Operating Expenses $ 18,060.00

Annual NOI $ 8,940.00

Monthly Expenses Annual Loan Payments $29,245.86

CapEx Budget 5.0% Monthly Cash Flow $ (1,692.16)

Maintanance Budget 5.0% Annual Cash Flow Before Tax $ (20,305.86)

Annual Operating Expenses Principle Reduction In First Year $ 11,211.90

Property Taxes $ 12,000.00 Appreciation in First Year $ 28,000.00

Insurance $ 900.00

Annual CapEx Budget $ 1,500.00 Cap Rate 1.28 %

Maintanance Budget $ 1,500.00 Cash On Cash Return (12.72) %

Landlord Paid Utilites

Property Management $ 2,160.00 8.0% Returns With Principal and Appreciation Added

COC Return W/Principle added -5.70%

COC Return W/Appreciation

Total Annual Expenses $ 18,060.00 added 4.82%

COC Return W/Principle +

Appreciation 11.85%

Closing Cost Percentage 2 %

Loan Points Percentage 1 %

Percentage Down 20 % Light Grey highlight denotes cells in which to enter data

Interest Rate 3.25 % Yellow highlight denotes cells that contain the output data.

Amortization 30 yrs (Do not change the yellow cells)

Annual Appreciation % 4 %

Rev B 12 Jan 2020

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Enablers and Inhibitors of AI-Powered Voice Assistants A Dual-Factor Approach by Integrating The StaDocument22 pagesEnablers and Inhibitors of AI-Powered Voice Assistants A Dual-Factor Approach by Integrating The Stalive roseNo ratings yet

- Unit 3 The Principles of HACCPDocument3 pagesUnit 3 The Principles of HACCPGeidemar OliveiraNo ratings yet

- Team Leadership A1Document8 pagesTeam Leadership A1NataliaNo ratings yet

- Monsoon Train Time Tabel by SR 2023 PDF DownloadDocument33 pagesMonsoon Train Time Tabel by SR 2023 PDF DownloadPokemon GameNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- Enhancing Decision MakingDocument33 pagesEnhancing Decision MakingAllan KomosiNo ratings yet

- BSBLDR601 - Assessment Task 3 EnviarDocument37 pagesBSBLDR601 - Assessment Task 3 Enviardsharlie94No ratings yet

- Listado de ProductosDocument70 pagesListado de ProductosAlejandra VargasNo ratings yet

- Ve20-Tour - Iqp Final Report - 0Document86 pagesVe20-Tour - Iqp Final Report - 0donNo ratings yet

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

- Entrepreneurial Competencies As An Entrepreneurial Distinctive - ADocument66 pagesEntrepreneurial Competencies As An Entrepreneurial Distinctive - AAnaaNo ratings yet

- Project Outline: Oman Car Wash Mobile ApplicationDocument1 pageProject Outline: Oman Car Wash Mobile ApplicationUsama MunirNo ratings yet

- Sabi V SaharaDocument2 pagesSabi V SaharasahilNo ratings yet

- Chapter 12 Test Bank AnswersDocument3 pagesChapter 12 Test Bank AnswersYumna WafaNo ratings yet

- The Impact of Artificial Intelligence On SocietyDocument2 pagesThe Impact of Artificial Intelligence On SocietychristineNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima Yojana: Premium@rs.114.00Document3 pagesPradhan Mantri Jeevan Jyoti Bima Yojana: Premium@rs.114.00GIRISH R NNo ratings yet

- LEXUSDocument59 pagesLEXUSShubham KhuranaNo ratings yet

- Bjorkman - Talent or Not Employee Reactions To Talent IdentificationDocument20 pagesBjorkman - Talent or Not Employee Reactions To Talent IdentificationMei Gui AngNo ratings yet

- Key Information Document: What Type of Contract Will I Be Engaged In?Document74 pagesKey Information Document: What Type of Contract Will I Be Engaged In?Towfiquzzaman ShummoNo ratings yet

- Ostensible AuthorityDocument4 pagesOstensible AuthorityAgitha GunasagranNo ratings yet

- PDFFFFFDocument7 pagesPDFFFFFkyla manaloNo ratings yet

- SIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)Document2 pagesSIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)DeepakNo ratings yet

- Agabon v. NLRC DigestDocument3 pagesAgabon v. NLRC DigestHandeskyNo ratings yet

- Managing A Lean-Agile Leadership Transformation in A Traditional OrganizationDocument128 pagesManaging A Lean-Agile Leadership Transformation in A Traditional OrganizationAiouaz OthmenNo ratings yet

- American Fork & Hoe 1910 HDocument272 pagesAmerican Fork & Hoe 1910 HJay SNo ratings yet

- What's Wrong With Ariel - Marketing AssignmentDocument4 pagesWhat's Wrong With Ariel - Marketing AssignmentTaha JavaidNo ratings yet

- Master Plan Waswater Management JakartaDocument228 pagesMaster Plan Waswater Management JakartaRIKA ANGGRAININo ratings yet

- OBLICON Outline of TopicsDocument53 pagesOBLICON Outline of TopicsRyan Christian100% (1)

- Portfolio Management MMDocument31 pagesPortfolio Management MMTu DuongNo ratings yet

- Resume - Malak Al Abri - Version#6Document4 pagesResume - Malak Al Abri - Version#6malakalabri98No ratings yet