Professional Documents

Culture Documents

Eco Textual Learning Material - Module 5

Eco Textual Learning Material - Module 5

Uploaded by

Jerry JohnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eco Textual Learning Material - Module 5

Eco Textual Learning Material - Module 5

Uploaded by

Jerry JohnCopyright:

Available Formats

78 Managerial Economics

Unit 5: Capital Budgeting and Risk and

Notes Uncertainty Analysis

Structure

5.1 Objectives

5.2 Introduction

5.3 Investment Analysis

5.3.1 Project valuation

5.3.2 Capital Budgeting Techniques

5.4 Risk and Investment Analysis- Decision Tree Analysis

5.5 Concept of Behavioral Economics

5.6 Summary

5.7 Check Your Progress

5.8 Questions and Exercises

5.9 Further Readings

5.1 Objectives

The primary objective of this chapter is to define and explain the Investment Analysis,

i.e., Project valuation and Capital Budgeting Techniques. The chapter also covers the

Risk and Investment Analysis part, which includes Decision Tree Analysis and Concept

of Behavioral Economics. A unique feature of this chapter is that it explains the very

important concept of economics, i.e., Behavioral Economics. In most of the cases,

explanations are incorporated with mathematical examples.

5.2 Introduction

Any type investment is risky and investment decision is also difficult to make. It

depends on availability of money and information of the economy, industry and company

and the share prices ruling and expectations of the market and also of the companies. For

making such decision the common investors may have to depend more upon a study of

fundamentals rather than technical, although technical is also important. Otherwise they

will burn their fingers as happened in 1992 following the Harshad Mehta Scam and in

2001 following Ketan Parekh Scam. For this purpose, a study of company’s performance,

past record and expected future performance are to be looked into. It is necessary for

a common investor to study the balance sheet and annual report of the company or

analyze the quarterly or half yearly results of the company and decide on whether to buy

that company’s share or not. This is called fundamental investment analysis.

5.3 Investment Analysis

5.3.1 Project valuation

Investment projects are classified as follows. According to project size, the investment

analysis is executed. Small projects may be approved by departmental managers. More

careful analysis and Board of Directors’ approval is needed for large projects of, say, half

a million dollars or more.

Similarly, according to type of benefit to the firm, they are as follows.

an increase in cash flow, ? a decrease in risk, and ? an indirect benefit (showers

for workers, etc).

According to degree of dependence, they are,

Amity Directorate of Distance & Online Education

Managerial Economics 79

mutually exclusive projects (can execute project A or B, but not both),

complementary projects: taking project A increases the cash flow of project B, Notes

substitute projects: taking project A decreases the cash flow of project B.

According to degree of statistical dependence,

Positive dependence,

Negative dependence

Statistical independence.

According to type of cash flow,

Conventional cash flow: only one change in the cash flow sign,

Non-conventional cash flows: more than one change in the cash flow sign,

Project valuation analysis stipulates a decision rule for accepting or rejecting

Investment projects

5.3.2 Capital Budgeting Techniques

Capital budgeting is the process most companies use to authorize capital spending

on long-term projects and on other projects requiring significant investments of capital.

Because capital is usually limited in its availability, capital projects are individually evaluated

using both quantitative analysis and qualitative information. Most capital budgeting

analysis uses cash inflows and cash outflows rather than net income calculated using

the accrual basis. Some companies simplify the cash flow calculation to net income plus

depreciation and amortization. Others look more specifically at estimated cash inflows

from customers, reduced costs, and proceeds from the sale of assets and salvage value,

and cash outflows for the capital investment, operating costs, interest, and future repairs

or overhauls of equipment.

The Cottage Gang is considering the purchase of $150,000 of equipment for its boat

rentals. The equipment is expected to last seven years and has a $5,000 salvage value

at the end of its life. The annual cash inflows are expected to be $250,000 and the annual

cash outflows are estimated to be $200,000.

Payback technique

The payback measures the length of time it takes a company to recover in cash

its initial investment. This concept can also be explained as the length of time it takes

the project to generate cash equal to the investment and pay the company back. It is

calculated by dividing the capital investment by the net annual cash flow. If the net annual

cash flow is not expected to be the same, the average of the net annual cash flows may

be used.

For the Cottage Gang, the cash payback period is three years. It was calculated by

Capital investment

Cash Payback Period =

Average annual net cash flow

dividing the $150,000 capital investment by the $50,000 net annual cash flow ($250,000

inflows - $200,000 outflows).

The shorter the payback period, the sooner the company recovers its cash investment.

Whether a cash payback period is good or poor depends on the company’s criteria for

evaluating projects. Some companies have specific guidelines for number of years,

$150,000

= 3.0 years

$50,000

Amity Directorate of Distance & Online Education

80 Managerial Economics

suchas two years, while others simply require the payback period to be less than the

asset’s useful life.

Notes

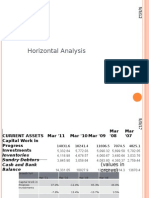

When net annual cash flows are different, the cumulative net annual cash flows are

used to determine the payback period. If the Turtles Co. has a project with a cost of

$150,000, and net annual cash inflows for the first seven years of the project are: $30,000

in year one, $50,000 in year two, $55,000 in year three, $60,000 in year four, $60,000 in

year five, $60,000 in year six, and $40,000 in year seven, then its cash payback period

would be 3.25 years. See the example that follows.

The cash payback period is easy to calculate but is actually not the only criteria for

choosing capital projects. This method ignores differences in the timing of cash flows

during the project and differences in the length of the project. The cash flows of two

projects may be the same in total but the timing of the cash flows could be very different.

For example, assume project LJM had cash flows of $3,000, $4,000, $7,000, $1,500, and

$1,500 and project MEM had cash flows of $6,000, $5,000, $3,000, $2,000, and $1,000.

Both projects cost $14,000 and have a payback of 3.0 years, but the cash flows are very

different. Similarly, two projects may have the same payback period while one project

lasts five years beyond the payback period and the second one lasts only one year.

Net present value

Considering the time value of money is important when evaluating projects with different

costs, different cash flows, and different service lives. Discounted cash flow techniques,

such as the net present value method, consider the timing and amount of cash flows.

To use the net present value method, you will need to know the cash inflows, the cash

outflows, and the company’s required rate of return on its investments. The required rate

of return becomes the discount rate used in the net present value calculation. For the

following examples, it is assumed that cash flows are received at the end of the period.

Using data for the Cottage Gang and assuming a required rate of return of 12%, the

net present value is $80,452. It is calculated by discounting the annual net cash flows

and salvage value using the 12% discount factors. The Cottage Gang has equal net

cash flows of $50,000 ($250,000 cash receipt minus $200,000 operating costs) so the

present value of the net cash flows is computed by using the present value of an annuity

of 1 for seven periods. Using a 12% discount rate, the factor is 4.5638 and the present

value of the net cash flows is $228,190. The salvage value is received only once, at the

end of the seven years (the asset’s life), so its present value of $2,262 is computed using

the Present Value of 1 table factor for seven periods and 12% discount rate factor of

.4523 times the $5,000 salvage value. The investment of $150,000 does not need to be

Amity Directorate of Distance & Online Education

Managerial Economics 81

discounted because it is already in today’s dollars (a factor value of 1.0000). To calculate

the net present value (NPV), the investment is subtracted from the present value of the

total cash inflows of $230,452. See the examples that follow. Because the net present

Notes

value (NPV) is positive, the required rate of return has been met.

Present Value of 1

Period 2% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% 22%

1 0.980 0.961 0.952 0.943 0.925 0.909 0.892 0.877 0.862 0.847 0.833 0.819

4 5 4 4 9 1 9 2 1 5 3 7

2 0.961 0.924 0.907 0.890 0.857 0.826 0.797 0.769 0.743 0.718 0.694 0.671

2 6 0 0 3 4 2 5 2 2 4 9

3 0.942 0.889 0.863 0.839 0.793 0.751 0.711 0.675 0.640 0.608 0.578 0.550

3 0 6 8 8 3 8 0 7 6 7 7

4 0.923 0.8548 0.8227 0.7921 0.7350 0.6830 0.6355 0.5921 0.5523 0.5158 0.4823 0.451

8 8 7 7 0 0 5 1 3 8 3 4

5 0.905 0.821 0.783 0.747 0.680 0.620 0.567 0.519 0.476 0.437 0.401 0.370

7 9 3 5 6 9 4 4 1 1 9 0

6 0.888 0.790 0.746 0.705 0.630 0.564 0.506 0.455 0.410 0.370 0.334 0.303

0 3 0 2 2 5 6 5 4 4 9 3

7 0.870 0.759 0.710 0.665 0.583 0.513 0.452 0.399 0.353 0.313 0.279 0.248

6 9 1 7 5 2 3 6 8 9 1 6

8 0.853 0.730 0.676 0.627 0.540 0.466 0.403 0.350 0.305 0.266 0.232 0.203

5 7 4 8 3 5 9 6 0 0 6 8

9 0.836 0.702 0.644 0.591 0.500 04 2 4 1 0.360 0.307 0.263 0.225 0.193 0.167

8 6 9 6 2 1 6 5 0 5 8 0

10 0.820 0.675 0.613 0.558 0.463 0.385 0.322 0.269 0.226 0.191 0.161 0.136

3 6 4 9 2 5 0 7 7 1 5 9

11 0.804 0.649 0.584 0.526 0.428 0.350 0.287 0.236 0.195 0.161 0.134 0.112

3 6 8 7 9 5 5 6 4 9 6 2

12 0.788 0.624 0.556 0.497 0.397 0.318 0.256 0.207 0.168 0.137 0.112 0.092

5 6 0 8 1 6 7 6 5 2 2 0

13 0.773 0 .600 0.530 0.468 0.367 0.289 0.229 0.182 0.145 0.116 0.093 0.075

0 6 8 3 7 7 2 1 2 3 5 4

14 0.757 0.577 0.505 0.442 0.340 0.263 0.204 0.159 0.125 0.098 0.077 0.061

9 5 3 1 5 3 6 7 2 5 9 8

15 0.743 0.555 0.481 0.417 0.315 0.239 0.182 0.140 0.107 0.083 0.064 0.050

0 3 3 0 2 4 7 1 9 5 9 7

16 0.728 0.533 0.458 0.393 0.291 0.217 0.163 0.122 0.093 0.070 0.054 0.041

4 9 6 1 9 6 1 9 0 8 1 5

17 0.714 0.513 0.436 0.371 0.270 0.197 0.145 0.107 0.080 0.060 0.045 0.034

2 4 4 3 3 8 6 8 2 0 1 0

18 0.700 0.493 0.415 0 .350 0.250 0.179 0.130 0.094 0.069 0.050 0.037 0.027

2 6 3 5 2 9 0 6 1 8 6 9

19 0.686 0.474 0.395 0.330 0.231 0.163 0.116 0.082 0.059 0.043 0.031 0.022

4 6 5 7 7 5 1 9 6 1 3 9

20 0.673 0.456 0.376 0.311 0.214 0.148 0.103 0.072 0.051 0.036 0.026 0.018

0 4 8 9 5 6 7 8 4 5 1 7

Amity Directorate of Distance & Online Education

82 Managerial Economics

Cash Outflows Cash Inflows

Notes

Project Cost $150,000 Cash from Customers (1) $250,000

Operating Costs (2) 200,000 Salvage Value 5,000

Estimated Useful Life 7 years

Minimum Required Rate of Return 12%

Annual Net Cash Flows ($250,000 - $200,000) $50,000

(1) - (2)

Present Value of Cash Flows

Annual Net Cash Flows ($50,000 × 4.5638) $228,190

Salvage Value ($5,000 × .4523) 2,262

Total Present Value of Net Cash Inflows 230,452

Less: Investment Cost (150,000)

Net Present Value $ 80,452

When net cash flows are not all the same, a separate present value calculation must

be made for each period’s cash flow. A financial calculator or a spreadsheet can be

used to calculate the present value. Assume the same project information for the Cottage

Gang’s investment except for net cash flows, which are summarized with their present

value calculations below.

Estimated Annual 12% Discount Present Value

Period

Net Cash Flow (1) Factor (2) (1) × (2)

1 $ 44,000 .8929 $ 39,288

2 $ 55,000 .7972 $ 43,846

3 $ 60,000 .7118 $ 42,708

4 $ 57,000 .6355 $ 36,224

5 $ 51,000 .5674 $ 28,937

6 $ 44,000 .5066 $ 22,290

7 $ 39,000 .4523 $ 17,640

Totals $350,000 $230,933

Amity Directorate of Distance & Online Education

Managerial Economics 83

The NPV of the project is $83,195, calculated as follows:

Present Value of Cash Flows

Notes

Annual Net Cash Flows $ 230,933

Salvage Value ($ 5,000 × .4523) 2,26

Total Present Value of Net Cash Inflows 233,195

Less: Investment Cost (150,000)

Net Present Value $ 83,195

The difference between the NPV under the equal cash flows example ($50,000 per

year for seven years or $350,000) and the unequal cash flows ($350,000 spread unevenly

over seven years) is the timing of the cash flows.

Most companies’ required rate of return is their cost of capital. Cost of capital is the

rate at which the company could obtain capital (funds) from its creditors and investors.

If there is risk involved when cash flows are estimated into the future, some companies

add a risk factor to their cost of capital to compensate for uncertainty in the project and,

therefore, in the cash flows.

Most companies have more project proposals than they do funds available for projects.

They also have projects requiring different amounts of capital and with different NPVs.

In comparing projects for possible authorization, companies use a profitability index.

The index divides the present value of the cash flows by the required investment. For the

Cottage Gang, the profitability index of the project with equal cash flows is 1.54, and the

profitability index for the project with unequal cash flows is 1.56.

Present Value of Cash Flows

Profitability Index =

Required Investment

Equal Cash Flows = $ 230,452 / $ 150,000 = 1.54, and

Unequal Cash Flows = $ 233,195 / $ 150,000 = 1.56

Internal rate of return

The internal rate of return also uses the present value concepts. The internal rate of

return (IRR) determines the interest yield of the proposed capital project at which the

net present value equals zero, which is where the present value of the net cash inflows

equals the investment. If the IRR is greater than the company’s required rate of return, the

project may be accepted. To determine the internal rate of return requires two steps. First,

the internal rate of return factor is calculated by dividing the proposed capital investment

amount by the net annual cash inflow. Then, the factor is found in the Present Value

of an Annuity of 1 table using the service life of the project for the number of periods.

The discount rate of the factor is the closest to is the internal rate of return. A project for

Knightsbridge, Inc., has equal net cash inflows of $50,000 over its seven-year life and a

project cost of $200,000. By dividing the cash flows into the project investment cost, the

factor of 4.00 ($200,000 ÷ $50,000) is found. The 4.00 is looked up in the Present Value

of an Annuity of 1 table on the seven-period line (it has a seven-year life), and the internal

rate of return of 16% is determined.

Period 2% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% 22%

1 0.980 0.961 0.952 0.943 0.92 0.90 0.89 0.87 0.86 0.84 0.83 0.81

4 5 4 4 59 91 29 72 21 75 33 97

2 1.941 1.886 1.859 1.833 1.78 1.73 1.69 1.64 1.60 1.56 1.52 1.49

6 1 4 4 33 55 01 67 52 56 78 15

Amity Directorate of Distance & Online Education

84 Managerial Economics

Period 2% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% 22%

Notes 3 2.883 2.775 2.723 2.673 2.57 2.48 2.40 2.32 2.24 2.17 2.10 2.04

9 1 2 0 71 69 18 16 59 43 65 22

4 3.807 3.629 3.546 3.465 3.31 3.16 3.03 2.91 2.79 2.69 2.58 2.49

7 9 0 1 21 99 73 37 82 01 87 36

5 4.713 4.451 4.329 4.212 3.99 3.79 3.60 3.43 3.27 3.12 2.99 2.86

5 8 5 4 27 08 48 31 43 72 06 36

6 5.601 5.242 5.075 4.917 4.62 4.35 4.11 3.88 3.68 3.49 3.32 3.16

4 1 7 3 29 53 14 87 47 76 55 69

7 6.472 6.002 5.786 5.582 5.20 4.86 4.56 4.28 4.03 3.81 3.60 3.41

0 1 4 4 64 84 38 83 86 15 46 55

8 7.325 6.732 6.463 6.209 5.74 5.33 4.96 4.63 4.34 4.07 3.83 3.61

2 8

5 7 66 49 76 89 36 76 72 93

9. 8.162 7.435 7.107 6.801 6.24 5.75 5.32 4.94 4.60 4.30 4.03 3.78

2 3 8 7 69 90 82 64 65 30 10 63

10. 8.982 8.110 7.721 7.360 6.71 6.14 5.65 5.21 4.83 4.49 4.19 3.92

6 9 7 1 01 46 02 61 32 41 25 32

11. 9.786 8.760 8.306 7.886 7.13 6.49 5.93 5.45 5.02 4.65 4.32 4.03

8 5 4 9 90 51 77 27 86 60 71 54

12 10.57 9.385 8.863 8.383 7.53 6.81 6.19 5.66 5.19 4.79 4.43 4.12

53 1 3 8 61 37 44 03 71 32 92 74

13 11.34 9.985 9.393 8.852 7.90 7.10 6.42 5.84 5.34 4.90 4.53 4.20

84 6 6 7 38 34 35 24 23 95 27 28

14 12.10 10.56 9.898 9.295 8.24 7.36 6.62 6.00 5.46 5.00 4.61 4.26

62 31 6 0 42 67 82 21 75 81 06 46

15 12.84 11.11 10.37 9.712 8.55 7.60 6.81 6.14 5.57 5.09 4.67 4.31

93 84 97 2 95 61 09 22 55 16 55 52

16 13.57 11.65 10.83 10.10 8.85 7.82 6.97 6.26 5.66 5.16 4.72 4.35

96

77 23 78 59 14 37 40 51 85 24 67

17 14.29 12.16 11.27 10.47 9.12 8.02 7.11 6.37 5.74 5.22 4.77 4.39

19 57 41 73 16 16 96 29 87 23 46 08

18 14.99 12.65 11.68 10.82 9.37 8.20 7.24 6.46 5.81 5.27 4.81 4.41

20 93 96 76 19 14 97 74 78 32 22 87

19 15.67 13.13 12.08 11.15 9.60 8.36 7.36 6.55 5.87 5.31 4.84 4.44

85 39 53 81 36 49 58 04 75 62 35 15

20 16.35 13.59 12.46 11.46 9.81 8.51 7.46 6.62 5.92 5.35 4.86 4.46

14 03 22 99 81 36 94 31 88 27 96 03

Annual rate of return method

The three previous capital budgeting methods were based on cash flows. The

annual rate of return uses accrual-based net income to calculate a project’s expected

profitability. The annual rate of return is compared to the company’s required rate of

return. If the annual rate of return is greater than the required rate of return, the project

may be accepted. The higher the rate of return, the higher the project would be ranked.

Amity Directorate of Distance & Online Education

Managerial Economics 85

The annual rate of return is a percentage calculated by dividing the expected annual

net income by the average investment. Average investment is usually calculated by

adding the beginning and ending project book values and dividing by two.

Notes

Estimated Annual Net Income

Annual Rate of Return =

Average Investment

Assume the Cottage Gang has expected annual net income of $5,572 with an

investment of $150,000 and a salvage value of $5,000. This proposed project has a 7.2%

annual rate of return ($5,572 net income ÷ $77,500 average investment).

Annual Rate of Return = Estimated Annual Net Income/Average Investment

7.2% = $5,572 / $77,500

(1) (2)

(1) Accrual Basis Income Statement

Revenues $310,000

Operating Expenses 280,000

Depreciation Expense (A) 20.714

Income before Taxes 9,286

Income Taxes (40%) 3.714

Net Income $ 5,572

(A) Straight-line with cosl of % 1 MMK.X). salvage value of SS.(XK). and a service life

of seven years.

$150,000 - $5,000

(2) Calculation of Average Investment

Beginning Investment $150,000

Ending Investment (Salvage Value) 5,000

155,000

Divide for Average ÷ 2

Average Investment $ 77.500

The annual rate of return should not be used alone in making capital budgeting

decisions, as its results may be misleading. It uses accrual basis of accounting and not

actual cash flows or time value of money.

5.4 Risk and Investment Analysis- Decision Tree Analysis

Decision Trees are useful tools for helping you to choose between several courses

of action. They provide a highly effective structure within which you can explore options,

Amity Directorate of Distance & Online Education

86 Managerial Economics

and investigate the possible outcomes of choosing those options. They also help you to

form a balanced picture of the risks and rewards associated with each possible course

Notes of action. This makes them particularly useful for choosing between different strategies,

projects or investment opportunities, particularly when your resources are limited.

Uses:

You start a Decision Tree with a decision that you need to make. Draw a small square

to represent this on the left hand side of a large piece of paper, half way down the page.

From this box draw out lines towards the right for each possible solution, and write a

short description of the solution along the line. Keep the lines apart as far as possible so

that you can expand your thoughts.

At the end of each line, consider the results. If the result of taking that decision is

uncertain, draw a small circle. If the result is another decision that you need to make, draw

another square. Squares represent decisions, and circles represent uncertain outcomes.

Write the decision or factor above the square or circle. If you have completed the solution

at the end of the line, just leave it blank.

Starting from the new decision squares on your diagram, draw out lines representing

the options that you could select. From the circles draw lines representing possible

outcomes. Again make a brief note on the line saying what it means. Keep on doing this

until you have drawn out as many of the possible outcomes and decisions as you can see

leading on from the original decisions.

Once you have done this, review your tree diagram. Challenge each square and circle

to see if there are any solutions or outcomes you have not considered. If there are, draw

them in. If necessary, redraft your tree if parts of it are too congested or untidy. You should

now have a good understanding of the range of possible outcomes of your decisions.

An example of the sort of thing you will end up with is shown in Figure 1:

Figure 1

5.5 Concept of Behavioral Economics

The main features of Concept of Behavioral Economics are as follows.

Fastest growing field in economics

Behavioral economics is concerned with the ways in which the actual decision-

making process influences the decisions that are made in practice; combines

psychology and economics

Assumes bounded rationality – meaning that people have limited time and

capacity to weigh all the relevant benefits and costs of a decision.

Decision making is less than fully rational. People are prone to make predictable

and avoidable mistakes.

Amity Directorate of Distance & Online Education

Managerial Economics 87

At the same time, decision making is systematic and amenable to scientific study.

Six Key Ideas from Behavioral Economics Notes

1. Framing. Allowing the way a decision is presented to affect the choice that is

selected even though the marginal benefit and marginal cost are unaffected.

2. Letting Sunk Costs Matter. Allowing sunk costs, which have already been paid

and do not affect marginal costs regardless of which option is chosen, to affect a

decision.

3. Faulty discounting. Being too impatient when it comes to decisions that involve

benefits that are received in the future or discounting future benefits inconsistently

depending on when the delay in receipt of benefits occurs.

4. Overconfidence. Believing you will know what will happen in the future to a

greater extent than is justified by available information.

5. Status Quo Bias. It is a tendency to make decisions by accepting the default

option instead of comparing the marginal benefit to the marginal cost.

6. Desire for Fairness and Reciprocity. It is also a tendency, to punish people

who treat you unfairly and to reward those who treat you fairly, even if you do

not directly benefit from those punishments and rewards. Behavioral Economics

recognizes that people respond to incentives, but their response is not always a

rational one.

5.6 Summary

Investment is very risky decision, so it needs priory analysis before finalizing. It

depends on availability of money and information of the economy, industry and company

and the share prices ruling and expectations of the market and also of the companies. For

making investment decision the investors are depend more on a study of fundamentals

rather than technical. It is necessary for a common investor to study the balance sheet

and annual report of the company or analyze the quarterly or half yearly results of the

company and decide on whether to buy that company’s share or not. This is called

fundamental investment analysis. Capital budgeting is the process of spending capital

on long-term projects and on other projects requiring significant investments of capital.

Capital is usually limited in its availability. So, capital budgeting is individually evaluated

using both quantitative analysis and qualitative information. Most of the capital budgeting

analysis uses cash inflows and cash outflows rather than net income calculated using the

accrual basis. Decision Trees analysis is also useful tools for choosing best one among

available several courses of actions. This makes them particularly useful for choosing

between different strategies, projects or investment opportunities, particularly when your

resources are limited.

Check Your Progress

1. Capital budgeting analysis uses

(a) Cash inflows, (b) Cash outflows,

(c) Cash inflows and cash outflows, (d) None of the above

2. Cost of capital is the rate at which the company could obtain

(a) Capital (funds) from its creditors and investors,

(b) Capital (funds) from its bankers,

(c) Capital (funds) from its employees, (d) All the above.

3. Decision Trees are useful tools for helping you to choose between several courses of

(a) Process, (b) Action,

Amity Directorate of Distance & Online Education

88 Managerial Economics

(c) Plan, (d) Management

Notes 4. Behavioral economics is concerned with the ways in which the actual decision-

making process influences

(a) Decisions that are made in practice; combines psychology and mathematical,

(b) Decisions that are made unpracticed; combines psychology and economics,

(c) The decisions that are made in practice,

(d) The decisions that are made in practice; combines psychology and economics.

Questions and Exercises

1. Explain how the investment analysis will help to achieve the target of the company.

2. What do you mean by capital budgeting? Explain with examples.

3. ‘The payback measures the length of time it takes a company to recover in cash

its initial investment’, comment on it.

4. ‘Most companies’ required rate of return is their cost of capital’, explain with

suitable example.

5. Why Decision Trees are useful tools for helping you to choose between several

courses of action?

6. Write down the main features of Behavioral Economics.

7. Explain Six Key Ideas of Behavioral Economics.

8. Explain with example the Internal Rate of Return.

Further Readings

Hirschey, Economics for Managers, Cengage Learning

Baumol, Microeconomics: Principles & Policies, 9th editions, Cengage Learning

Froeb, Managerial Economics: A Problem Solving Approach, Cengage Learning

Mankiw, Economics: Principles and Applications, Cengage Learning

Gupta, G.S. 2006, Managerial Economics, 2nd Edition,Tata McGraw Hill

Peterson, H.C and Lewis, W.C. 2005, Managerial Economics, 4th Edition, Prentice

Hall of India

R Ferguson, R., Ferguson, G.J and Rothschild,R.1993 Business Economics

Macmillan.

Varshney,R.Land Maheshwari, 1994 Manageriaql; Economics, S Chand and Co.

Chandra, P.2006, Project: Preparation Appraisal Selection Implementation and

Review, 6th Edition, Tata McGraw Hill.

Amity Directorate of Distance & Online Education

You might also like

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiadhrumilNo ratings yet

- YG BrandIndex User Guide 2Document35 pagesYG BrandIndex User Guide 2olivierNo ratings yet

- Assignment - Capital BudgetingDocument9 pagesAssignment - Capital BudgetingSahid KarimbanakkalNo ratings yet

- Chaptert 10 HW SolutionsDocument79 pagesChaptert 10 HW SolutionsJoanne Mendiola100% (1)

- Chapter 23 Project Review and Administrative AspectsDocument27 pagesChapter 23 Project Review and Administrative AspectsKeshav Gupta100% (4)

- Capital Budgeting Data CollectionDocument20 pagesCapital Budgeting Data CollectionalanNo ratings yet

- WEDP - Loan Policy & Procedures Manual - FinalDocument73 pagesWEDP - Loan Policy & Procedures Manual - Finalendale50% (2)

- CCSK Prep Guide V3Document4 pagesCCSK Prep Guide V3satish_networkerNo ratings yet

- Unit 3 - Scoman2Document10 pagesUnit 3 - Scoman2christian guile figueroaNo ratings yet

- Odule Apital Udgeting: 2. Learning Outcomes 3. Module Tasks 4. Module Overview and DiscussionDocument0 pagesOdule Apital Udgeting: 2. Learning Outcomes 3. Module Tasks 4. Module Overview and Discussionsilvi88No ratings yet

- 013 - CAMIST - CH11 - Amndd - HS - PP 277-310 - Branded BW - SecDocument34 pages013 - CAMIST - CH11 - Amndd - HS - PP 277-310 - Branded BW - Secsumaiazerin101No ratings yet

- Capital Budgeting and Cash Flow ProjectionDocument21 pagesCapital Budgeting and Cash Flow Projectionnira_110No ratings yet

- 35.1 What Is Meant by Investment Appraisal?Document11 pages35.1 What Is Meant by Investment Appraisal?Rokaia MortadaNo ratings yet

- Capital Budgeting TechniquesDocument10 pagesCapital Budgeting TechniqueslehnehNo ratings yet

- Module 6 - Capital Budgeting TechniquesDocument6 pagesModule 6 - Capital Budgeting Techniquesjay-ar dimaculanganNo ratings yet

- NPV and IRRDocument34 pagesNPV and IRRgurutherex100% (5)

- Lecturenote - 1762467632financial Management-Chapter ThreeDocument22 pagesLecturenote - 1762467632financial Management-Chapter ThreeJOHNNo ratings yet

- Unit 3: Capital Budgeting: Techniques & ImportanceDocument17 pagesUnit 3: Capital Budgeting: Techniques & ImportanceRahul kumarNo ratings yet

- UntitledDocument3 pagesUntitledhena_hasina100% (1)

- Readings - Capital Budgeting - 2Document12 pagesReadings - Capital Budgeting - 2Anish AdhikariNo ratings yet

- Unit 7Document26 pagesUnit 7Bedilu MesfinNo ratings yet

- Capital BudgetingDocument62 pagesCapital BudgetingtanyaNo ratings yet

- Investment AnalysisDocument12 pagesInvestment Analysisprecious turyamuhakiNo ratings yet

- Answers SssssssDocument9 pagesAnswers SssssssfibiNo ratings yet

- Project ReportDocument86 pagesProject Reportbunty.0991No ratings yet

- Capital Investment DecisionDocument16 pagesCapital Investment DecisionAbraham LinkonNo ratings yet

- 07 Capital+BudgetingDocument23 pages07 Capital+BudgetingSaidatul DihaNo ratings yet

- Financial Management SMHDocument73 pagesFinancial Management SMHswarna dasNo ratings yet

- Capital Budgeting Techniques PDFDocument11 pagesCapital Budgeting Techniques PDFGENELYN REGIONo ratings yet

- Project Report PDFDocument86 pagesProject Report PDFAkash KumarNo ratings yet

- Summer Training Report NewDocument79 pagesSummer Training Report NewAakash SinghNo ratings yet

- Finance Strategy PDFDocument8 pagesFinance Strategy PDFShahzaib AslamNo ratings yet

- Capital Budgeting AssignmentDocument6 pagesCapital Budgeting AssignmentAdnan SethiNo ratings yet

- SIFD 1st UnitDocument6 pagesSIFD 1st UnitRaaji BujjiNo ratings yet

- Understanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsDocument11 pagesUnderstanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check Questionssalehin1969No ratings yet

- Conventional Versus Non Conventional Cash4079Document10 pagesConventional Versus Non Conventional Cash4079Amna SaeedNo ratings yet

- LESSON 3 Capital BudgetingDocument10 pagesLESSON 3 Capital BudgetingNoel Salazar JrNo ratings yet

- Capital BudgetingDocument69 pagesCapital BudgetingMALLIKARJUNNo ratings yet

- Course Name-Financial Management Course Code-MBA-205 Lecture No - Topic - Introduction To Capital Budgeting DateDocument59 pagesCourse Name-Financial Management Course Code-MBA-205 Lecture No - Topic - Introduction To Capital Budgeting DatePubgnewstate keliyeNo ratings yet

- Investment EvaluationDocument44 pagesInvestment Evaluationagung prawiraNo ratings yet

- Mba Sem 2 Corporate Finance Capital BudgetingDocument17 pagesMba Sem 2 Corporate Finance Capital Budgetingekta mehtaNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingchabeNo ratings yet

- Project Appraisal and Financing: Dr. Sudhindra BhatDocument56 pagesProject Appraisal and Financing: Dr. Sudhindra Bhatgaurang1111No ratings yet

- FM Group AssignmentDocument11 pagesFM Group AssignmentHailemelekot TerefeNo ratings yet

- Cap Bud - HeroDocument13 pagesCap Bud - HeroMohmmedKhayyumNo ratings yet

- CHAPTER Three NDocument17 pagesCHAPTER Three Ntemedebere100% (1)

- CF Chapter 2 NotesDocument17 pagesCF Chapter 2 NotessdfghjkNo ratings yet

- Fundamentals of Financial Management 13th Ed M 333 339Document7 pagesFundamentals of Financial Management 13th Ed M 333 339Millenia AdiniraNo ratings yet

- Capital Budgeting MethodsDocument13 pagesCapital Budgeting MethodsAmit SinghNo ratings yet

- Capital Budgeting: A Mini Project Submitted in Fulfillment of The Requirement of The Internal AssessmentDocument28 pagesCapital Budgeting: A Mini Project Submitted in Fulfillment of The Requirement of The Internal AssessmentAarthi SivarajNo ratings yet

- Construction Economics Lecture EDocument23 pagesConstruction Economics Lecture Esmart muteroNo ratings yet

- Section 3A - Group 1 - Capital Budgeting HandoutDocument5 pagesSection 3A - Group 1 - Capital Budgeting HandoutYance LaxamanaNo ratings yet

- Bba FM Notes Unit IiiDocument7 pagesBba FM Notes Unit IiiSunita SehgalNo ratings yet

- Project Financing: Engineering Economic (BPK30902)Document50 pagesProject Financing: Engineering Economic (BPK30902)aoi_chiepNo ratings yet

- Capital BudgetingZuari CementsDocument74 pagesCapital BudgetingZuari CementsAnusha ReddyNo ratings yet

- Chapter 3 Part 2 Financial AppraisalDocument34 pagesChapter 3 Part 2 Financial Appraisalyohannesalemayehu019No ratings yet

- Capital BudgetingDocument62 pagesCapital Budgetingtanya100% (1)

- Ba05 Group 4 - BSMT 1B PDFDocument31 pagesBa05 Group 4 - BSMT 1B PDFMark David100% (1)

- Capital ExpenditureDocument19 pagesCapital ExpenditureRoshan PoudelNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Real Estate Management 5Document100 pagesReal Estate Management 5Jerry JohnNo ratings yet

- Unit 1: Introduction To Cost Accounting: StructureDocument38 pagesUnit 1: Introduction To Cost Accounting: StructureJerry JohnNo ratings yet

- Security AnalyisisDocument40 pagesSecurity AnalyisisJerry JohnNo ratings yet

- Textual Learning Material - Module 5Document62 pagesTextual Learning Material - Module 5Jerry JohnNo ratings yet

- Textual Learning Material - Module 1Document30 pagesTextual Learning Material - Module 1Jerry JohnNo ratings yet

- Textual Learning Material - Module 3Document33 pagesTextual Learning Material - Module 3Jerry JohnNo ratings yet

- Theory of Demand and Supply ARM - M1Document31 pagesTheory of Demand and Supply ARM - M1Jerry JohnNo ratings yet

- Textual Learning Material - Module 2Document34 pagesTextual Learning Material - Module 2Jerry JohnNo ratings yet

- Eco Textual Learning Material - Module 4Document17 pagesEco Textual Learning Material - Module 4Jerry JohnNo ratings yet

- Chapter 5 Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument5 pagesChapter 5 Consolidated Financial Statements - Subsequent To Date of AcquisitionMixx MineNo ratings yet

- Fundamentals of Business Statistics: Dr.P.K.ViswanathanDocument10 pagesFundamentals of Business Statistics: Dr.P.K.Viswanathanchetan suvarnaNo ratings yet

- Paper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaDocument14 pagesPaper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaMuraliNo ratings yet

- Ej Philip Turner and Elnora Turner Petitioners vs. Lorenzo Shipping Corporation Respondent.Document2 pagesEj Philip Turner and Elnora Turner Petitioners vs. Lorenzo Shipping Corporation Respondent.Ej Turingan50% (2)

- An Analysis of The Problems Facing The Banking Sector in ZimbabweDocument3 pagesAn Analysis of The Problems Facing The Banking Sector in ZimbabweMarvelous Ngundu80% (10)

- 10-Project Time Management (CH 6)Document22 pages10-Project Time Management (CH 6)umerNo ratings yet

- Food Services AgreementDocument78 pagesFood Services AgreementFitz BaniquedNo ratings yet

- AE321 Midterm Quiz 1: Multiple ChoiceDocument9 pagesAE321 Midterm Quiz 1: Multiple ChoiceChaermalyn Bao-idangNo ratings yet

- Nokia Form 20F 2020Document118 pagesNokia Form 20F 2020it4728No ratings yet

- Marketig PlanDocument11 pagesMarketig PlanKris Anne SamudioNo ratings yet

- Global Capital Partners Fund LLC Helps Businesses Across The United States With Its Accelerated Financing SolutionsDocument4 pagesGlobal Capital Partners Fund LLC Helps Businesses Across The United States With Its Accelerated Financing SolutionsPR.comNo ratings yet

- Global Capital MarketDocument42 pagesGlobal Capital MarketSunny MahirchandaniNo ratings yet

- Charting A Company'S Direction: Vision and Mission, Objectives, and StrategyDocument40 pagesCharting A Company'S Direction: Vision and Mission, Objectives, and StrategymeryefrinaNo ratings yet

- Responsibility Accounting and Transfer PricingDocument68 pagesResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaNo ratings yet

- Sree Anasuya Annual Report 03-04Document22 pagesSree Anasuya Annual Report 03-04api-19728905No ratings yet

- Asset Configuration SAP FICODocument23 pagesAsset Configuration SAP FICOJagjit97% (29)

- Submitted by - Siddharth Kumar (BFT/18/209)Document15 pagesSubmitted by - Siddharth Kumar (BFT/18/209)Siddharth JhaNo ratings yet

- ACC Cement SM Group Project XMBA 24Document30 pagesACC Cement SM Group Project XMBA 24XMBA 24 ITM Vashi86% (7)

- 1 s2.0 S2452414X22000176 MainDocument20 pages1 s2.0 S2452414X22000176 MainSwagata NagNo ratings yet

- MGT6370A - Strategic ManagementDocument148 pagesMGT6370A - Strategic Managementp67kn6kfjvNo ratings yet

- Ongc AnalysisDocument7 pagesOngc AnalysisPratik SinghaniaNo ratings yet

- Program Invite On Personal Branding 1Document5 pagesProgram Invite On Personal Branding 1John DemelloNo ratings yet

- Analysis of The Factors Affecting Devident PolicyDocument12 pagesAnalysis of The Factors Affecting Devident PolicyJung AuLiaNo ratings yet

- Price Theory: Demand and SupplyDocument8 pagesPrice Theory: Demand and SupplyMark Thomas DayagNo ratings yet

- Lecture 2 Values, Mission, Vision and ObjectivesDocument61 pagesLecture 2 Values, Mission, Vision and ObjectivesDavid Abbam AdjeiNo ratings yet

- JABPAPERFINALDocument16 pagesJABPAPERFINALPhilani HadebeNo ratings yet