Professional Documents

Culture Documents

Engineering Economy Sheet 2

Engineering Economy Sheet 2

Uploaded by

SaudCopyright:

Available Formats

You might also like

- Largest Fintech Unicorns - CFTE Fintech RankingDocument52 pagesLargest Fintech Unicorns - CFTE Fintech RankingvivekinductusNo ratings yet

- Cost Accounting Hilton 15Document12 pagesCost Accounting Hilton 15Vin TenNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Home Assignment - 1Document2 pagesHome Assignment - 1Pankaj kumarNo ratings yet

- BFC 5926 - Week 3 Workshop Solutions - Financial MathsDocument2 pagesBFC 5926 - Week 3 Workshop Solutions - Financial MathsMengdi ZhangNo ratings yet

- Skkk4173 Assignment #4 2016Document4 pagesSkkk4173 Assignment #4 2016Fhairna BaharulraziNo ratings yet

- Tutorial 8 Time Value Money 2021Document8 pagesTutorial 8 Time Value Money 2021Hai Liang OngNo ratings yet

- Assig5 2010Document4 pagesAssig5 2010WK LamNo ratings yet

- 2nd Assignment 2021Document3 pages2nd Assignment 2021No NameNo ratings yet

- Assignment IIDocument4 pagesAssignment IIUtsav PathakNo ratings yet

- Sheet 2 Engineering EconomyDocument3 pagesSheet 2 Engineering Economywasem.1048No ratings yet

- Tutorial 7 Comparison and Selection Among AlternativesDocument7 pagesTutorial 7 Comparison and Selection Among AlternativesWen HanNo ratings yet

- Engineering Economics Assignment 2Document6 pagesEngineering Economics Assignment 2balkrishna7621No ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- Engg Econ QuestionsDocument7 pagesEngg Econ QuestionsSherwin Dela CruzzNo ratings yet

- Assignment 5 (Economics Exercises)Document5 pagesAssignment 5 (Economics Exercises)OlyvianurmaharaniNo ratings yet

- Math Economy Bibat 1Document14 pagesMath Economy Bibat 1Cams SenoNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Document7 pagesWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNo ratings yet

- Groups Assignment EcoDocument4 pagesGroups Assignment Ecorobel pop100% (1)

- WKT MFGDocument4 pagesWKT MFGGODNo ratings yet

- Ce 22 MWX HW4Document1 pageCe 22 MWX HW4Jonas Lemuel DatuNo ratings yet

- Homework ExerciseDocument4 pagesHomework Exerciseazhar0% (1)

- Problem SetDocument9 pagesProblem SetJasleneDimarananNo ratings yet

- Worksheet#3-MCQ-2018 .PDF Engineering EconomyDocument6 pagesWorksheet#3-MCQ-2018 .PDF Engineering EconomyOmar F'Kassar0% (1)

- Engineering Economics Assi-2SP2023Document2 pagesEngineering Economics Assi-2SP2023Abanob HanyNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 6Document4 pagesEngineering Management 3000/5039: Tutorial Set 6Sahan100% (1)

- Tutorial Sheet - 1 (UNIT-1)Document5 pagesTutorial Sheet - 1 (UNIT-1)Frederick DugayNo ratings yet

- CE 22 - Engineering Economy: General InstructionsDocument1 pageCE 22 - Engineering Economy: General InstructionsMarco ConopioNo ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- Worksheet#3 MCQ 2016Document6 pagesWorksheet#3 MCQ 2016YaserNo ratings yet

- Assignment 1 2019 PDFDocument2 pagesAssignment 1 2019 PDFAlice LaiNo ratings yet

- Assignment 4Document2 pagesAssignment 4Cheung HarveyNo ratings yet

- Inde301 Final ExamDocument4 pagesInde301 Final ExamLouay BaalbakiNo ratings yet

- Annual Worth IRR Capital Recovery CostDocument30 pagesAnnual Worth IRR Capital Recovery CostadvikapriyaNo ratings yet

- Final RecitationDocument2 pagesFinal Recitationorselmerve2001No ratings yet

- Captial Budgeting ExcercisesDocument3 pagesCaptial Budgeting ExcercisesPak CareerNo ratings yet

- Questions - Investment AppraisalDocument2 pagesQuestions - Investment Appraisalpercy mapetere100% (1)

- FM Lesson 3Document2 pagesFM Lesson 3asif iqbalNo ratings yet

- Economy OK.2022 MS.CDocument4 pagesEconomy OK.2022 MS.Cabdullah 3mar abou reashaNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Ma 2Document3 pagesMa 2123 123No ratings yet

- Final Managerial 2014 SolutionDocument8 pagesFinal Managerial 2014 SolutionRanim HfaidhiaNo ratings yet

- Exam2505 2012Document8 pagesExam2505 2012Gemeda GirmaNo ratings yet

- 452 Inclass Test 010424Document3 pages452 Inclass Test 010424Kudzaishe chigwaNo ratings yet

- Capital Budgeting CSTDDocument3 pagesCapital Budgeting CSTDSardar FaaizNo ratings yet

- Opman FinalsDocument3 pagesOpman FinalsJomarie BualNo ratings yet

- 3 Annual Worth MethodDocument29 pages3 Annual Worth MethodAngel NaldoNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- I0319005 - Adsa Alyaa Shafitri - Tugas 4Document20 pagesI0319005 - Adsa Alyaa Shafitri - Tugas 4Adsa Alyaa ShafitriNo ratings yet

- Previous Assignment 2Document2 pagesPrevious Assignment 2marryam nawazNo ratings yet

- CE 22 - Engineering Economics: Problem SetDocument1 pageCE 22 - Engineering Economics: Problem SetNathan TanNo ratings yet

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- ACCA F9 Revision Question Bank-49-51Document3 pagesACCA F9 Revision Question Bank-49-51rbaamba100% (1)

- Project Initial Cost Annual Benefit Life (Years)Document6 pagesProject Initial Cost Annual Benefit Life (Years)Octavio HerreraNo ratings yet

- Engineering 100 - Engineering Economics Homework #4 Due: September 29, 2020Document2 pagesEngineering 100 - Engineering Economics Homework #4 Due: September 29, 2020Rico BiggartNo ratings yet

- Capital Budgeting Practice ProblemDocument3 pagesCapital Budgeting Practice ProblemWaylee CheroNo ratings yet

- Applied Science University: Faculty of Engineering Mechanical and Industrial EngineeringDocument6 pagesApplied Science University: Faculty of Engineering Mechanical and Industrial EngineeringMahmoud AlswaitiNo ratings yet

- Capita Budgeting QuestionsDocument5 pagesCapita Budgeting QuestionsSULEIMANNo ratings yet

- Project EnggDocument30 pagesProject EnggGamechanger SreenivasanNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- PERCENTAGEDocument7 pagesPERCENTAGEPrakash KumarNo ratings yet

- Survey of Economics Principles Applications and Tools 7th Edition Osullivan Test BankDocument48 pagesSurvey of Economics Principles Applications and Tools 7th Edition Osullivan Test Bankanthonywilliamsfdbjwekgqm100% (28)

- 6 Financial Performance of Selected Automobile Companies 7156 1Document8 pages6 Financial Performance of Selected Automobile Companies 7156 1Rakthim Bikash DasNo ratings yet

- Group and Individual Exercises COTEM 6022Document12 pagesGroup and Individual Exercises COTEM 6022China AlemayehouNo ratings yet

- Invoice: Total Amount (INR) 13000 Amount With GST (INR) 15340Document1 pageInvoice: Total Amount (INR) 13000 Amount With GST (INR) 15340Harikrishan BhattNo ratings yet

- Unit 1.3 Enterprise, Business Growth and SizeDocument3 pagesUnit 1.3 Enterprise, Business Growth and SizegretNo ratings yet

- InvoiceDocument1 pageInvoicealok singhNo ratings yet

- Exercises For Practical DSGE Modelling: Alina Barnett Martin EllisonDocument36 pagesExercises For Practical DSGE Modelling: Alina Barnett Martin Ellisonengli abdelNo ratings yet

- Simple SAR Settings ReportDocument16 pagesSimple SAR Settings ReportThobib Otai100% (1)

- Presentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Document20 pagesPresentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Buddhapratap RathoreNo ratings yet

- 59 Why Nuts and Bolts Come Loose V1Document2 pages59 Why Nuts and Bolts Come Loose V1civicbladeNo ratings yet

- Esac 2021 Final ReportDocument54 pagesEsac 2021 Final Reportdbrannonmarktplaats2005No ratings yet

- Lecture Notes On ECO223 Labour Economics I TOPICSDocument25 pagesLecture Notes On ECO223 Labour Economics I TOPICSeldenpotNo ratings yet

- Thomas J. SargentDocument7 pagesThomas J. Sargentthomas555No ratings yet

- Quiz 1Document1 pageQuiz 1geraldabubopaduaNo ratings yet

- مكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةDocument30 pagesمكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةعبد الحميدNo ratings yet

- Factsheet February 2020 PDFDocument85 pagesFactsheet February 2020 PDFAshwini BhatNo ratings yet

- IFR Awards 2022 RoHDocument3 pagesIFR Awards 2022 RoHRonnie KurtzbardNo ratings yet

- Date:-11th MAR-2021: Asti Time Cab No. Direction LocationDocument23 pagesDate:-11th MAR-2021: Asti Time Cab No. Direction LocationjaswantNo ratings yet

- Pak Suzuki Ratio AnalysisDocument5 pagesPak Suzuki Ratio AnalysisNabil QaziNo ratings yet

- 60 In. Dia - Spool Detail-L-2 333333Document1 page60 In. Dia - Spool Detail-L-2 333333niko TanNo ratings yet

- Sujit Kumar LGF34-92Document3 pagesSujit Kumar LGF34-92doc purushottamNo ratings yet

- Oligopoly PresentationDocument36 pagesOligopoly PresentationFabian MtiroNo ratings yet

- IESBA Code of Ethics For AADocument10 pagesIESBA Code of Ethics For AAMuhammad YousafNo ratings yet

- Types of Financial ModelsDocument4 pagesTypes of Financial ModelsRohit BajpaiNo ratings yet

- CHP 26Document7 pagesCHP 26evelynNo ratings yet

- PF6000AGDocument1 pagePF6000AGJose MoralesNo ratings yet

- The Cost of Capital, Corporation Finance and The Theory of InvestmentDocument19 pagesThe Cost of Capital, Corporation Finance and The Theory of Investmentlinda zyongweNo ratings yet

Engineering Economy Sheet 2

Engineering Economy Sheet 2

Uploaded by

SaudOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economy Sheet 2

Engineering Economy Sheet 2

Uploaded by

SaudCopyright:

Available Formats

Engineering Economy

Sheet 2

1- A new street seeping equipment can be purchased for $ 75,000. its expected useful

life is 8 years, at which time its market value will be zero. Annual receipts less

expenses will approximately $20,000 per year over the 8 years study period. Use

the PW method and MARR of 15% to determine whether this is a good

investment?

2- You are faced with making a decision on a large investment proposal. The capital

investment amount is $640,000. Estimated annual revenue at the end of each year

in the eight years study period is $180,000. the estimated annual year end

expenses are $42,000 starting in year one. These expenses begin decreasing by

$4,000 per year at the end of year four and continue decreasing through end of

year eight. Assuming a $20,000 market value at the end of year eight and MARR =

20% per year, answer the following:

a- What is the PW of this proposal?

b- What your conclusion about the acceptability of this project?

3- Determine the FW of the following engineering project when MARR=12% per year.

Is this project attractive?

Investment Cost $15,000

Expected life time 6 years

Market (salvage) value - $2,000 *

Annual expenses $6,000

Annual receipt $11,000

* The negative market value means that the asset needs cost to dispose of an

asset.

4- A company is considering a plant to manufacture a proposed new product. The

land costs $300,000, building costs $600,000, the equipment costs $250,000,

$100,000 additional working capital is required. It is expected that the product will

result in sales of $750,000 per year for 10 years at which time the land can be sold

for $350,000, and the equipment for $50,000. The annual expenses for labor,

material and all other items are estimated to total $475,000. If the company

requires a MARR of 15% per year on the projects of comparable risk, determine if

it should invest in the new product line. Use AW method.

5- An assembly operation at a software Company now requires $115,000 per year in

labor costs. A robot can purchased and installed to automate this operation. The

robot will cost $250,000 and will have no market value at the end of the 10 years

study period. Maintenance and operation expenses of the robot are estimated to

be $68,000 per year. Invested capital must earn at least 12% per year. Use the AW

method to determine if the robot a justifiable investment.

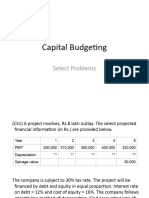

6- Calculate the pay bake period for the following project:

7- The pure Oil Company must install antipollution equipment in a new refinery to

meet the KSA clean air standards. Four designs alternatives are being considered,

which will capital investment and annual operating expenses as shown in the

table. Assuming a useful life of 10 years for each design, no market value, a

desired MARR of 10 % per year, and an analysis period of 10 years, determine

which design should be selected on the basis of PW method. Confirm your

selection by using the FW and AW methods.

Alternative Design

D1 D2 D3 D4

Capital Investment $650,000 $810,000 $1,290,000 $1,650,000

Annual expenses

Power cost $75,000 $75,000 $140,000 $146.000

Labor cost $50,000 $55,000 $75,000 $60,000

Maintenance cost $710,000 $650,000 $470,000 $420,000

Taxes and insurance cost $14,000 $17,000 $27,000 $30,000

8- A three design alternatives are being considered. The estimate sales and cost for

each alternative are given in the table. The MARR is 20% per year.

Alternative

A B C

Investment Cost $40,000 $70,000 $50,000

Estimated units to be sold 28,000

25,000 30,000

per year

Unit selling price ($/unit) $4.20 $5.50 $4.80

Variable cost ($/unit) $2.10 $2.50 $2.00

Annual expenses (fixed cost) $25.000 $40,000 $35,000

Market Value (Salvage $20,000

$20,000 $20,000

Value)

Useful Life (years) 10 10 10

Annual revenues are based on the number of units sold and selling price. Annual

expenses are based on fixed and variable costs. Determine which alternative is

preferable based on AW.

9- Two electrical motors are being considered to drive a centrifugal pump. One of the

motors must be selected. Each motor capable of driving 70 horse power (output)

to the pump operation. It is expected that the motor will be in use 1,000 hours per

year. The following data are available:

Motor A Motor B

Capital investment $1,400 $1,200

Electrical efficiency 0.9 0.8

Annual maintenance cost $180 $120

Useful life 3 years 5 years

10- A piece of production equipment is to be replaced immediately because it no

longer meets quality requirements for the end product. The two best alternatives

are a used piece of equipment (E1), an a new automatic model (E2). The economic

estimates for each are shown in the accompanying table.

Alternative

E1 E2

Capital cost $15,000 $66,000

Annual expenses $15,000 $10,000

Useful life 5 years 20 years

Market Value (Salvage Value) $20,000 $20,000

The MARR is 20% per year. Which alternative is preferred, based on the

repeatability assumption?

You might also like

- Largest Fintech Unicorns - CFTE Fintech RankingDocument52 pagesLargest Fintech Unicorns - CFTE Fintech RankingvivekinductusNo ratings yet

- Cost Accounting Hilton 15Document12 pagesCost Accounting Hilton 15Vin TenNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Home Assignment - 1Document2 pagesHome Assignment - 1Pankaj kumarNo ratings yet

- BFC 5926 - Week 3 Workshop Solutions - Financial MathsDocument2 pagesBFC 5926 - Week 3 Workshop Solutions - Financial MathsMengdi ZhangNo ratings yet

- Skkk4173 Assignment #4 2016Document4 pagesSkkk4173 Assignment #4 2016Fhairna BaharulraziNo ratings yet

- Tutorial 8 Time Value Money 2021Document8 pagesTutorial 8 Time Value Money 2021Hai Liang OngNo ratings yet

- Assig5 2010Document4 pagesAssig5 2010WK LamNo ratings yet

- 2nd Assignment 2021Document3 pages2nd Assignment 2021No NameNo ratings yet

- Assignment IIDocument4 pagesAssignment IIUtsav PathakNo ratings yet

- Sheet 2 Engineering EconomyDocument3 pagesSheet 2 Engineering Economywasem.1048No ratings yet

- Tutorial 7 Comparison and Selection Among AlternativesDocument7 pagesTutorial 7 Comparison and Selection Among AlternativesWen HanNo ratings yet

- Engineering Economics Assignment 2Document6 pagesEngineering Economics Assignment 2balkrishna7621No ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- Engg Econ QuestionsDocument7 pagesEngg Econ QuestionsSherwin Dela CruzzNo ratings yet

- Assignment 5 (Economics Exercises)Document5 pagesAssignment 5 (Economics Exercises)OlyvianurmaharaniNo ratings yet

- Math Economy Bibat 1Document14 pagesMath Economy Bibat 1Cams SenoNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Document7 pagesWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNo ratings yet

- Groups Assignment EcoDocument4 pagesGroups Assignment Ecorobel pop100% (1)

- WKT MFGDocument4 pagesWKT MFGGODNo ratings yet

- Ce 22 MWX HW4Document1 pageCe 22 MWX HW4Jonas Lemuel DatuNo ratings yet

- Homework ExerciseDocument4 pagesHomework Exerciseazhar0% (1)

- Problem SetDocument9 pagesProblem SetJasleneDimarananNo ratings yet

- Worksheet#3-MCQ-2018 .PDF Engineering EconomyDocument6 pagesWorksheet#3-MCQ-2018 .PDF Engineering EconomyOmar F'Kassar0% (1)

- Engineering Economics Assi-2SP2023Document2 pagesEngineering Economics Assi-2SP2023Abanob HanyNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 6Document4 pagesEngineering Management 3000/5039: Tutorial Set 6Sahan100% (1)

- Tutorial Sheet - 1 (UNIT-1)Document5 pagesTutorial Sheet - 1 (UNIT-1)Frederick DugayNo ratings yet

- CE 22 - Engineering Economy: General InstructionsDocument1 pageCE 22 - Engineering Economy: General InstructionsMarco ConopioNo ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- Worksheet#3 MCQ 2016Document6 pagesWorksheet#3 MCQ 2016YaserNo ratings yet

- Assignment 1 2019 PDFDocument2 pagesAssignment 1 2019 PDFAlice LaiNo ratings yet

- Assignment 4Document2 pagesAssignment 4Cheung HarveyNo ratings yet

- Inde301 Final ExamDocument4 pagesInde301 Final ExamLouay BaalbakiNo ratings yet

- Annual Worth IRR Capital Recovery CostDocument30 pagesAnnual Worth IRR Capital Recovery CostadvikapriyaNo ratings yet

- Final RecitationDocument2 pagesFinal Recitationorselmerve2001No ratings yet

- Captial Budgeting ExcercisesDocument3 pagesCaptial Budgeting ExcercisesPak CareerNo ratings yet

- Questions - Investment AppraisalDocument2 pagesQuestions - Investment Appraisalpercy mapetere100% (1)

- FM Lesson 3Document2 pagesFM Lesson 3asif iqbalNo ratings yet

- Economy OK.2022 MS.CDocument4 pagesEconomy OK.2022 MS.Cabdullah 3mar abou reashaNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Ma 2Document3 pagesMa 2123 123No ratings yet

- Final Managerial 2014 SolutionDocument8 pagesFinal Managerial 2014 SolutionRanim HfaidhiaNo ratings yet

- Exam2505 2012Document8 pagesExam2505 2012Gemeda GirmaNo ratings yet

- 452 Inclass Test 010424Document3 pages452 Inclass Test 010424Kudzaishe chigwaNo ratings yet

- Capital Budgeting CSTDDocument3 pagesCapital Budgeting CSTDSardar FaaizNo ratings yet

- Opman FinalsDocument3 pagesOpman FinalsJomarie BualNo ratings yet

- 3 Annual Worth MethodDocument29 pages3 Annual Worth MethodAngel NaldoNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- I0319005 - Adsa Alyaa Shafitri - Tugas 4Document20 pagesI0319005 - Adsa Alyaa Shafitri - Tugas 4Adsa Alyaa ShafitriNo ratings yet

- Previous Assignment 2Document2 pagesPrevious Assignment 2marryam nawazNo ratings yet

- CE 22 - Engineering Economics: Problem SetDocument1 pageCE 22 - Engineering Economics: Problem SetNathan TanNo ratings yet

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- ACCA F9 Revision Question Bank-49-51Document3 pagesACCA F9 Revision Question Bank-49-51rbaamba100% (1)

- Project Initial Cost Annual Benefit Life (Years)Document6 pagesProject Initial Cost Annual Benefit Life (Years)Octavio HerreraNo ratings yet

- Engineering 100 - Engineering Economics Homework #4 Due: September 29, 2020Document2 pagesEngineering 100 - Engineering Economics Homework #4 Due: September 29, 2020Rico BiggartNo ratings yet

- Capital Budgeting Practice ProblemDocument3 pagesCapital Budgeting Practice ProblemWaylee CheroNo ratings yet

- Applied Science University: Faculty of Engineering Mechanical and Industrial EngineeringDocument6 pagesApplied Science University: Faculty of Engineering Mechanical and Industrial EngineeringMahmoud AlswaitiNo ratings yet

- Capita Budgeting QuestionsDocument5 pagesCapita Budgeting QuestionsSULEIMANNo ratings yet

- Project EnggDocument30 pagesProject EnggGamechanger SreenivasanNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- PERCENTAGEDocument7 pagesPERCENTAGEPrakash KumarNo ratings yet

- Survey of Economics Principles Applications and Tools 7th Edition Osullivan Test BankDocument48 pagesSurvey of Economics Principles Applications and Tools 7th Edition Osullivan Test Bankanthonywilliamsfdbjwekgqm100% (28)

- 6 Financial Performance of Selected Automobile Companies 7156 1Document8 pages6 Financial Performance of Selected Automobile Companies 7156 1Rakthim Bikash DasNo ratings yet

- Group and Individual Exercises COTEM 6022Document12 pagesGroup and Individual Exercises COTEM 6022China AlemayehouNo ratings yet

- Invoice: Total Amount (INR) 13000 Amount With GST (INR) 15340Document1 pageInvoice: Total Amount (INR) 13000 Amount With GST (INR) 15340Harikrishan BhattNo ratings yet

- Unit 1.3 Enterprise, Business Growth and SizeDocument3 pagesUnit 1.3 Enterprise, Business Growth and SizegretNo ratings yet

- InvoiceDocument1 pageInvoicealok singhNo ratings yet

- Exercises For Practical DSGE Modelling: Alina Barnett Martin EllisonDocument36 pagesExercises For Practical DSGE Modelling: Alina Barnett Martin Ellisonengli abdelNo ratings yet

- Simple SAR Settings ReportDocument16 pagesSimple SAR Settings ReportThobib Otai100% (1)

- Presentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Document20 pagesPresentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Buddhapratap RathoreNo ratings yet

- 59 Why Nuts and Bolts Come Loose V1Document2 pages59 Why Nuts and Bolts Come Loose V1civicbladeNo ratings yet

- Esac 2021 Final ReportDocument54 pagesEsac 2021 Final Reportdbrannonmarktplaats2005No ratings yet

- Lecture Notes On ECO223 Labour Economics I TOPICSDocument25 pagesLecture Notes On ECO223 Labour Economics I TOPICSeldenpotNo ratings yet

- Thomas J. SargentDocument7 pagesThomas J. Sargentthomas555No ratings yet

- Quiz 1Document1 pageQuiz 1geraldabubopaduaNo ratings yet

- مكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةDocument30 pagesمكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةعبد الحميدNo ratings yet

- Factsheet February 2020 PDFDocument85 pagesFactsheet February 2020 PDFAshwini BhatNo ratings yet

- IFR Awards 2022 RoHDocument3 pagesIFR Awards 2022 RoHRonnie KurtzbardNo ratings yet

- Date:-11th MAR-2021: Asti Time Cab No. Direction LocationDocument23 pagesDate:-11th MAR-2021: Asti Time Cab No. Direction LocationjaswantNo ratings yet

- Pak Suzuki Ratio AnalysisDocument5 pagesPak Suzuki Ratio AnalysisNabil QaziNo ratings yet

- 60 In. Dia - Spool Detail-L-2 333333Document1 page60 In. Dia - Spool Detail-L-2 333333niko TanNo ratings yet

- Sujit Kumar LGF34-92Document3 pagesSujit Kumar LGF34-92doc purushottamNo ratings yet

- Oligopoly PresentationDocument36 pagesOligopoly PresentationFabian MtiroNo ratings yet

- IESBA Code of Ethics For AADocument10 pagesIESBA Code of Ethics For AAMuhammad YousafNo ratings yet

- Types of Financial ModelsDocument4 pagesTypes of Financial ModelsRohit BajpaiNo ratings yet

- CHP 26Document7 pagesCHP 26evelynNo ratings yet

- PF6000AGDocument1 pagePF6000AGJose MoralesNo ratings yet

- The Cost of Capital, Corporation Finance and The Theory of InvestmentDocument19 pagesThe Cost of Capital, Corporation Finance and The Theory of Investmentlinda zyongweNo ratings yet