Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

32 viewsBank Reconciliation Example

Bank Reconciliation Example

Uploaded by

AmsaluXYZ Company needs to reconcile its bank statement ending balance of $300,000 with its ledger ending balance of $260,900. The reconciliation includes a $100 bank service charge, $20 of interest income, $50,000 of outstanding checks, a $20,000 deposit in transit, a $100 error on a check amount, $9,800 from a collected note receivable, and a $520 NSF check. After adjusting journal entries, the adjusted bank and book balances are $270,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- DLL Travel Services FIRST GradingDocument118 pagesDLL Travel Services FIRST GradingMary Cherill Umali75% (8)

- WBS Creation in PS ModuleDocument145 pagesWBS Creation in PS ModuleSDOT Ashta100% (1)

- Bank Reconciliation Bank ReconciliationDocument9 pagesBank Reconciliation Bank Reconciliationmustafa_33No ratings yet

- Supply Chain Management Project SYBBA IB (SAKSHI GOYAL 77) - 4Document44 pagesSupply Chain Management Project SYBBA IB (SAKSHI GOYAL 77) - 4Sakshi GoyalNo ratings yet

- Rekonsiliasi 2Document3 pagesRekonsiliasi 2ahmed aliNo ratings yet

- 05 Quiz 1 - ARG - ZarateDocument2 pages05 Quiz 1 - ARG - ZarateYvan ZarateNo ratings yet

- What Is A Bank Reconciliation?Document4 pagesWhat Is A Bank Reconciliation?Mustaeen DarNo ratings yet

- Project AccDocument6 pagesProject AccAgha TamourNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- Bank Reconciliation Statement: Mushtaq NadeemDocument4 pagesBank Reconciliation Statement: Mushtaq NadeemMalik SalmanNo ratings yet

- Bank RecolonizationDocument1 pageBank Recolonizationasma100% (1)

- Cash - CRDocument14 pagesCash - CRpingu patwhoNo ratings yet

- Control AccountingDocument7 pagesControl AccountingAmir RuplalNo ratings yet

- Bank Recon DiscussionDocument6 pagesBank Recon DiscussionKrigfordNo ratings yet

- Chapter 7 Exercises With SolutionDocument5 pagesChapter 7 Exercises With Solutionmohammad khataybehNo ratings yet

- Bank Reconciliation StatementDocument2 pagesBank Reconciliation StatementSelvi balanNo ratings yet

- Illustrative Problem On Adjusted Bank MethodDocument15 pagesIllustrative Problem On Adjusted Bank MethodRyDNo ratings yet

- Accounting For Cash and ReceivableDocument7 pagesAccounting For Cash and ReceivableAbrha GidayNo ratings yet

- Bank Recon GoldDocument2 pagesBank Recon Goldcrisjay ramosNo ratings yet

- Bank Reconciliation Statement-Problem Making: Cash Book (Depositors Book) Taka Pass Book (Bank's Book) TakaDocument13 pagesBank Reconciliation Statement-Problem Making: Cash Book (Depositors Book) Taka Pass Book (Bank's Book) TakaIván RañaNo ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationXienaNo ratings yet

- 10 BANK RECONCILIATIONS (Questions)Document22 pages10 BANK RECONCILIATIONS (Questions)Zeeshan BakaliNo ratings yet

- Homework Chapter 7Document12 pagesHomework Chapter 7Trung Kiên NguyễnNo ratings yet

- Gavarra-Marie Joy-Bsais-2b-Problem3-No.3Document2 pagesGavarra-Marie Joy-Bsais-2b-Problem3-No.3Nikki Jean Hona50% (2)

- 9.2 BRS HomeDocument3 pages9.2 BRS HomeaneesgillaniNo ratings yet

- Debit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditDocument27 pagesDebit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditAsif AslamNo ratings yet

- ACCTG W09 Chapter 8Document15 pagesACCTG W09 Chapter 8kayla tsoiNo ratings yet

- Bank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaDocument18 pagesBank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaPSHNo ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document17 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation StatementAhmed DeoNo ratings yet

- Uas Pengakun 2Document4 pagesUas Pengakun 2Givania RahmadhaniNo ratings yet

- Principles of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashDocument12 pagesPrinciples of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashAli Zain Parhar100% (2)

- What Is Bank Reconciliation.Document11 pagesWhat Is Bank Reconciliation.Sabrena FennaNo ratings yet

- Bank Reconciliation Statement - Process - Format - ExampleDocument5 pagesBank Reconciliation Statement - Process - Format - ExampleCykee100% (1)

- Actg14 Activity Group4Document2 pagesActg14 Activity Group4anneNo ratings yet

- BA3 M KIT Chapter 16Document4 pagesBA3 M KIT Chapter 16Nivneth PeirisNo ratings yet

- Bank Reconciliation & Proof of CashDocument25 pagesBank Reconciliation & Proof of CashTanya MaxNo ratings yet

- Module 6 P2 Internal Control - BSA & BSMADocument14 pagesModule 6 P2 Internal Control - BSA & BSMAramosmikay0222No ratings yet

- 5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0Document14 pages5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0ramosmikay0222No ratings yet

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- Bank Reconciliation Statement PreparationDocument5 pagesBank Reconciliation Statement PreparationsteveNo ratings yet

- Bank Reconciliation Statement: Strictly ConfidentialDocument3 pagesBank Reconciliation Statement: Strictly Confidentialnegussie biruNo ratings yet

- Reviewer in Accounting - xlsx-3Document59 pagesReviewer in Accounting - xlsx-3Franchesca CortezNo ratings yet

- ABM FABM2 Q2 Wk3 LAS3Document11 pagesABM FABM2 Q2 Wk3 LAS3ayaNo ratings yet

- UntitledDocument6 pagesUntitledÂn LyNo ratings yet

- Bank Reconciliations Credit Memo PDF FormatDocument8 pagesBank Reconciliations Credit Memo PDF FormatGeorge MockNo ratings yet

- 2 BRSDocument20 pages2 BRSasadimohammadsameerNo ratings yet

- Bài-tập-bank-reconciliation MLDocument6 pagesBài-tập-bank-reconciliation MLMai Lâm LêNo ratings yet

- Simulation 1 - Financial Accounting - March 4Document4 pagesSimulation 1 - Financial Accounting - March 4Ednalyn PascualNo ratings yet

- F.A.B.M PortfolioDocument28 pagesF.A.B.M PortfolioLjoy Vlog SurvivedNo ratings yet

- Illustration 8-5 Bank Reconciliation FormatDocument7 pagesIllustration 8-5 Bank Reconciliation FormatAbrar ShaikhNo ratings yet

- A. Bank To Book MethodDocument5 pagesA. Bank To Book MethodDiane MagnayeNo ratings yet

- June Bank ReconciliationDocument1 pageJune Bank ReconciliationSteven SandersonNo ratings yet

- MG T 101 Short Notes Lectures 2345Document29 pagesMG T 101 Short Notes Lectures 2345Abdul wadoodNo ratings yet

- Lesson 5: Bank Reconciliation What Is A Bank Reconciliation?Document9 pagesLesson 5: Bank Reconciliation What Is A Bank Reconciliation?Reymark TalaveraNo ratings yet

- FA2 Revision Questions 2Document9 pagesFA2 Revision Questions 2miss ainaNo ratings yet

- Cash and Cash Equivalents Solved ProblemsDocument25 pagesCash and Cash Equivalents Solved ProblemsddalgisznNo ratings yet

- Unit 8 Cash: Balance Per BankDocument5 pagesUnit 8 Cash: Balance Per BankAnonymous Fn7Ko5riKTNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- 9 Core Elements of A Quality Management System: Ken CroucherDocument7 pages9 Core Elements of A Quality Management System: Ken CroucherTariq HashamiNo ratings yet

- Persuasive Speech OutlineDocument3 pagesPersuasive Speech OutlinehasanNo ratings yet

- Biocon India Case StudyDocument7 pagesBiocon India Case StudyAmit Jha100% (1)

- Nifty Reits and Invits Whitepaper For Dec 2023 - v1 (Final)Document9 pagesNifty Reits and Invits Whitepaper For Dec 2023 - v1 (Final)JackNo ratings yet

- Pakistan As A Tourist Destination & Tourism Industry in Pakistan-2011Document31 pagesPakistan As A Tourist Destination & Tourism Industry in Pakistan-2011tayyab_mir_488% (8)

- Cost Sheet ExercisesDocument2 pagesCost Sheet ExercisessivapriyakamatNo ratings yet

- RMK Akm 2-CH 21Document14 pagesRMK Akm 2-CH 21Rio Capitano0% (1)

- Istilah Akuntansi Dalam Bahasa InggrisDocument16 pagesIstilah Akuntansi Dalam Bahasa InggrisDhuny OctavianNo ratings yet

- Print - Udyam Registration Certificate 2Document4 pagesPrint - Udyam Registration Certificate 2DanishNo ratings yet

- Culture of The Container StoreDocument9 pagesCulture of The Container StoreSajib ChakrabortyNo ratings yet

- The Global Green Economy ReportDocument65 pagesThe Global Green Economy Reportlee jin huiNo ratings yet

- The Search For A Sound Business IdeaDocument46 pagesThe Search For A Sound Business IdeaMiguel JaralveNo ratings yet

- Chapter-10: Customer OrientationDocument16 pagesChapter-10: Customer Orientationtaranjeet singhNo ratings yet

- United Company For FoodDocument2 pagesUnited Company For FoodmshawkycnNo ratings yet

- Domestic Travel ReadingDocument3 pagesDomestic Travel ReadingBenian TuncelNo ratings yet

- Occupation of The Respondents: InterpretationDocument14 pagesOccupation of The Respondents: InterpretationArjun RajNo ratings yet

- Discussion DDocument2 pagesDiscussion DVarunNo ratings yet

- AFJ Annual 2022 FINAL PDFDocument104 pagesAFJ Annual 2022 FINAL PDFEdwin SinginiNo ratings yet

- Bridgeport CT Adopted Budget 2010-2011Document552 pagesBridgeport CT Adopted Budget 2010-2011BridgeportCTNo ratings yet

- Exploring Recent Long-Distance Passenger Travel Trends in EuropeDocument10 pagesExploring Recent Long-Distance Passenger Travel Trends in EuropeyrperdanaNo ratings yet

- BM2 Chapter 1Document23 pagesBM2 Chapter 1Lowela KasandraNo ratings yet

- FIN3403 Exam 4 PracticeDocument8 pagesFIN3403 Exam 4 Practicek10924No ratings yet

- Intraday: Trading With TheDocument4 pagesIntraday: Trading With Thepetefader100% (2)

- Icici BankDocument16 pagesIcici BankGulafsha AnsariNo ratings yet

- Lululemon Online CaseDocument7 pagesLululemon Online CaseEmil Hopkinson100% (1)

- Catherine Morris - Demystifying SustainabilityDocument34 pagesCatherine Morris - Demystifying SustainabilityshivalikaNo ratings yet

- ITASIA - 24.09.22 Itasia - Daily Sales Invoice & COD MonitoringDocument15 pagesITASIA - 24.09.22 Itasia - Daily Sales Invoice & COD MonitoringCharlene Martinez DeguzmanNo ratings yet

Bank Reconciliation Example

Bank Reconciliation Example

Uploaded by

Amsalu0 ratings0% found this document useful (0 votes)

32 views3 pagesXYZ Company needs to reconcile its bank statement ending balance of $300,000 with its ledger ending balance of $260,900. The reconciliation includes a $100 bank service charge, $20 of interest income, $50,000 of outstanding checks, a $20,000 deposit in transit, a $100 error on a check amount, $9,800 from a collected note receivable, and a $520 NSF check. After adjusting journal entries, the adjusted bank and book balances are $270,000.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentXYZ Company needs to reconcile its bank statement ending balance of $300,000 with its ledger ending balance of $260,900. The reconciliation includes a $100 bank service charge, $20 of interest income, $50,000 of outstanding checks, a $20,000 deposit in transit, a $100 error on a check amount, $9,800 from a collected note receivable, and a $520 NSF check. After adjusting journal entries, the adjusted bank and book balances are $270,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

32 views3 pagesBank Reconciliation Example

Bank Reconciliation Example

Uploaded by

AmsaluXYZ Company needs to reconcile its bank statement ending balance of $300,000 with its ledger ending balance of $260,900. The reconciliation includes a $100 bank service charge, $20 of interest income, $50,000 of outstanding checks, a $20,000 deposit in transit, a $100 error on a check amount, $9,800 from a collected note receivable, and a $520 NSF check. After adjusting journal entries, the adjusted bank and book balances are $270,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Bank Reconciliation Example

Example

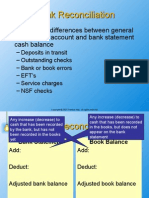

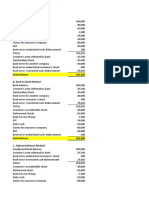

XYZ Company is closing its books and must prepare a bank reconciliation for

the following items:

Bank statement contains an ending balance of $300,000 on February 28,

2018, whereas the company’s ledger shows an ending balance of

$260,900

Bank statement contains a $100 service charge for operating the

account

Bank statement contains interest income of $20

XYZ issued checks of $50,000 that have not yet been cleared by the

bank

XYZ deposited $20,000 but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was

misreported in the cash payments journal as $370.

A note receivable of $9,800 was collected by the bank.

A check of $520 deposited by the company has been charged back as

NSF.

Amount Adjustment to Books

Ending Bank Balance $300,000

Deduct: Un cleared cheques – $50,000 None

Add: Deposit in transit + $20,000 None

Adjusted Bank Balance $270,000

Amount Adjustment to Books

Ending Book Balance $260,900

Deduct: Service charge – $100 Debit expense, credit

cash

Add: Interest income + $20 Debit cash, credit

interest income

Deduct: Error on check – $100 Debit expense, credit

cash

Add: Note receivable + $9,800 Debit cash, credit notes

receivable

Deduct: NSF check – $520 Debt accounts

receivable, credit cash

Adjusted Book Balance $270,000

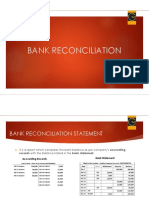

Bank Reconciliation Statement

After recording the journal entries for the company’s book adjustments, a

bank reconciliation statement should be produced to reflect all the changes to

cash balances for each month. This statement is used by auditors to perform

the company’s year-end auditing.

You might also like

- DLL Travel Services FIRST GradingDocument118 pagesDLL Travel Services FIRST GradingMary Cherill Umali75% (8)

- WBS Creation in PS ModuleDocument145 pagesWBS Creation in PS ModuleSDOT Ashta100% (1)

- Bank Reconciliation Bank ReconciliationDocument9 pagesBank Reconciliation Bank Reconciliationmustafa_33No ratings yet

- Supply Chain Management Project SYBBA IB (SAKSHI GOYAL 77) - 4Document44 pagesSupply Chain Management Project SYBBA IB (SAKSHI GOYAL 77) - 4Sakshi GoyalNo ratings yet

- Rekonsiliasi 2Document3 pagesRekonsiliasi 2ahmed aliNo ratings yet

- 05 Quiz 1 - ARG - ZarateDocument2 pages05 Quiz 1 - ARG - ZarateYvan ZarateNo ratings yet

- What Is A Bank Reconciliation?Document4 pagesWhat Is A Bank Reconciliation?Mustaeen DarNo ratings yet

- Project AccDocument6 pagesProject AccAgha TamourNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- Bank Reconciliation Statement: Mushtaq NadeemDocument4 pagesBank Reconciliation Statement: Mushtaq NadeemMalik SalmanNo ratings yet

- Bank RecolonizationDocument1 pageBank Recolonizationasma100% (1)

- Cash - CRDocument14 pagesCash - CRpingu patwhoNo ratings yet

- Control AccountingDocument7 pagesControl AccountingAmir RuplalNo ratings yet

- Bank Recon DiscussionDocument6 pagesBank Recon DiscussionKrigfordNo ratings yet

- Chapter 7 Exercises With SolutionDocument5 pagesChapter 7 Exercises With Solutionmohammad khataybehNo ratings yet

- Bank Reconciliation StatementDocument2 pagesBank Reconciliation StatementSelvi balanNo ratings yet

- Illustrative Problem On Adjusted Bank MethodDocument15 pagesIllustrative Problem On Adjusted Bank MethodRyDNo ratings yet

- Accounting For Cash and ReceivableDocument7 pagesAccounting For Cash and ReceivableAbrha GidayNo ratings yet

- Bank Recon GoldDocument2 pagesBank Recon Goldcrisjay ramosNo ratings yet

- Bank Reconciliation Statement-Problem Making: Cash Book (Depositors Book) Taka Pass Book (Bank's Book) TakaDocument13 pagesBank Reconciliation Statement-Problem Making: Cash Book (Depositors Book) Taka Pass Book (Bank's Book) TakaIván RañaNo ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationXienaNo ratings yet

- 10 BANK RECONCILIATIONS (Questions)Document22 pages10 BANK RECONCILIATIONS (Questions)Zeeshan BakaliNo ratings yet

- Homework Chapter 7Document12 pagesHomework Chapter 7Trung Kiên NguyễnNo ratings yet

- Gavarra-Marie Joy-Bsais-2b-Problem3-No.3Document2 pagesGavarra-Marie Joy-Bsais-2b-Problem3-No.3Nikki Jean Hona50% (2)

- 9.2 BRS HomeDocument3 pages9.2 BRS HomeaneesgillaniNo ratings yet

- Debit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditDocument27 pagesDebit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditAsif AslamNo ratings yet

- ACCTG W09 Chapter 8Document15 pagesACCTG W09 Chapter 8kayla tsoiNo ratings yet

- Bank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaDocument18 pagesBank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaPSHNo ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document17 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation StatementAhmed DeoNo ratings yet

- Uas Pengakun 2Document4 pagesUas Pengakun 2Givania RahmadhaniNo ratings yet

- Principles of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashDocument12 pagesPrinciples of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashAli Zain Parhar100% (2)

- What Is Bank Reconciliation.Document11 pagesWhat Is Bank Reconciliation.Sabrena FennaNo ratings yet

- Bank Reconciliation Statement - Process - Format - ExampleDocument5 pagesBank Reconciliation Statement - Process - Format - ExampleCykee100% (1)

- Actg14 Activity Group4Document2 pagesActg14 Activity Group4anneNo ratings yet

- BA3 M KIT Chapter 16Document4 pagesBA3 M KIT Chapter 16Nivneth PeirisNo ratings yet

- Bank Reconciliation & Proof of CashDocument25 pagesBank Reconciliation & Proof of CashTanya MaxNo ratings yet

- Module 6 P2 Internal Control - BSA & BSMADocument14 pagesModule 6 P2 Internal Control - BSA & BSMAramosmikay0222No ratings yet

- 5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0Document14 pages5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0ramosmikay0222No ratings yet

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- Bank Reconciliation Statement PreparationDocument5 pagesBank Reconciliation Statement PreparationsteveNo ratings yet

- Bank Reconciliation Statement: Strictly ConfidentialDocument3 pagesBank Reconciliation Statement: Strictly Confidentialnegussie biruNo ratings yet

- Reviewer in Accounting - xlsx-3Document59 pagesReviewer in Accounting - xlsx-3Franchesca CortezNo ratings yet

- ABM FABM2 Q2 Wk3 LAS3Document11 pagesABM FABM2 Q2 Wk3 LAS3ayaNo ratings yet

- UntitledDocument6 pagesUntitledÂn LyNo ratings yet

- Bank Reconciliations Credit Memo PDF FormatDocument8 pagesBank Reconciliations Credit Memo PDF FormatGeorge MockNo ratings yet

- 2 BRSDocument20 pages2 BRSasadimohammadsameerNo ratings yet

- Bài-tập-bank-reconciliation MLDocument6 pagesBài-tập-bank-reconciliation MLMai Lâm LêNo ratings yet

- Simulation 1 - Financial Accounting - March 4Document4 pagesSimulation 1 - Financial Accounting - March 4Ednalyn PascualNo ratings yet

- F.A.B.M PortfolioDocument28 pagesF.A.B.M PortfolioLjoy Vlog SurvivedNo ratings yet

- Illustration 8-5 Bank Reconciliation FormatDocument7 pagesIllustration 8-5 Bank Reconciliation FormatAbrar ShaikhNo ratings yet

- A. Bank To Book MethodDocument5 pagesA. Bank To Book MethodDiane MagnayeNo ratings yet

- June Bank ReconciliationDocument1 pageJune Bank ReconciliationSteven SandersonNo ratings yet

- MG T 101 Short Notes Lectures 2345Document29 pagesMG T 101 Short Notes Lectures 2345Abdul wadoodNo ratings yet

- Lesson 5: Bank Reconciliation What Is A Bank Reconciliation?Document9 pagesLesson 5: Bank Reconciliation What Is A Bank Reconciliation?Reymark TalaveraNo ratings yet

- FA2 Revision Questions 2Document9 pagesFA2 Revision Questions 2miss ainaNo ratings yet

- Cash and Cash Equivalents Solved ProblemsDocument25 pagesCash and Cash Equivalents Solved ProblemsddalgisznNo ratings yet

- Unit 8 Cash: Balance Per BankDocument5 pagesUnit 8 Cash: Balance Per BankAnonymous Fn7Ko5riKTNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- 9 Core Elements of A Quality Management System: Ken CroucherDocument7 pages9 Core Elements of A Quality Management System: Ken CroucherTariq HashamiNo ratings yet

- Persuasive Speech OutlineDocument3 pagesPersuasive Speech OutlinehasanNo ratings yet

- Biocon India Case StudyDocument7 pagesBiocon India Case StudyAmit Jha100% (1)

- Nifty Reits and Invits Whitepaper For Dec 2023 - v1 (Final)Document9 pagesNifty Reits and Invits Whitepaper For Dec 2023 - v1 (Final)JackNo ratings yet

- Pakistan As A Tourist Destination & Tourism Industry in Pakistan-2011Document31 pagesPakistan As A Tourist Destination & Tourism Industry in Pakistan-2011tayyab_mir_488% (8)

- Cost Sheet ExercisesDocument2 pagesCost Sheet ExercisessivapriyakamatNo ratings yet

- RMK Akm 2-CH 21Document14 pagesRMK Akm 2-CH 21Rio Capitano0% (1)

- Istilah Akuntansi Dalam Bahasa InggrisDocument16 pagesIstilah Akuntansi Dalam Bahasa InggrisDhuny OctavianNo ratings yet

- Print - Udyam Registration Certificate 2Document4 pagesPrint - Udyam Registration Certificate 2DanishNo ratings yet

- Culture of The Container StoreDocument9 pagesCulture of The Container StoreSajib ChakrabortyNo ratings yet

- The Global Green Economy ReportDocument65 pagesThe Global Green Economy Reportlee jin huiNo ratings yet

- The Search For A Sound Business IdeaDocument46 pagesThe Search For A Sound Business IdeaMiguel JaralveNo ratings yet

- Chapter-10: Customer OrientationDocument16 pagesChapter-10: Customer Orientationtaranjeet singhNo ratings yet

- United Company For FoodDocument2 pagesUnited Company For FoodmshawkycnNo ratings yet

- Domestic Travel ReadingDocument3 pagesDomestic Travel ReadingBenian TuncelNo ratings yet

- Occupation of The Respondents: InterpretationDocument14 pagesOccupation of The Respondents: InterpretationArjun RajNo ratings yet

- Discussion DDocument2 pagesDiscussion DVarunNo ratings yet

- AFJ Annual 2022 FINAL PDFDocument104 pagesAFJ Annual 2022 FINAL PDFEdwin SinginiNo ratings yet

- Bridgeport CT Adopted Budget 2010-2011Document552 pagesBridgeport CT Adopted Budget 2010-2011BridgeportCTNo ratings yet

- Exploring Recent Long-Distance Passenger Travel Trends in EuropeDocument10 pagesExploring Recent Long-Distance Passenger Travel Trends in EuropeyrperdanaNo ratings yet

- BM2 Chapter 1Document23 pagesBM2 Chapter 1Lowela KasandraNo ratings yet

- FIN3403 Exam 4 PracticeDocument8 pagesFIN3403 Exam 4 Practicek10924No ratings yet

- Intraday: Trading With TheDocument4 pagesIntraday: Trading With Thepetefader100% (2)

- Icici BankDocument16 pagesIcici BankGulafsha AnsariNo ratings yet

- Lululemon Online CaseDocument7 pagesLululemon Online CaseEmil Hopkinson100% (1)

- Catherine Morris - Demystifying SustainabilityDocument34 pagesCatherine Morris - Demystifying SustainabilityshivalikaNo ratings yet

- ITASIA - 24.09.22 Itasia - Daily Sales Invoice & COD MonitoringDocument15 pagesITASIA - 24.09.22 Itasia - Daily Sales Invoice & COD MonitoringCharlene Martinez DeguzmanNo ratings yet