Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsFinancial Performance Trend: Sno. Particulars

Financial Performance Trend: Sno. Particulars

Uploaded by

ASHOK JAINThe document shows financial performance trends for a company from 2017-18 to 2020-21. Several key financial ratios declined from 2019-20 to 2020-21, with return on net worth at -9.62%, return on capital employed at -14.45%, and EBIDTA margin at -16.97%. Revenue also declined, with the power segment dropping from ₹14,960 crore in 2019-20 to ₹11,386 crore in 2020-21. Per-share metrics like earnings per share and net worth per share also declined in 2020-21 compared to the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- ACC106 Financial Statements Worked ExampleDocument4 pagesACC106 Financial Statements Worked Examplegiafazirah100% (6)

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- The Colombo Fort Land & Building PLC: Annual Report 2020/21Document156 pagesThe Colombo Fort Land & Building PLC: Annual Report 2020/21sandun suranjanNo ratings yet

- Factsheet q4 2016 FinalDocument9 pagesFactsheet q4 2016 FinaltambreadNo ratings yet

- Group 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Document20 pagesGroup 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Reeja Mariam MathewNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Tar2016e FRDocument84 pagesTar2016e FRAchmad Rifaie de JongNo ratings yet

- Ferozsons Annual Report 2018Document191 pagesFerozsons Annual Report 2018Muhammad YamanNo ratings yet

- 2023 07 q1-2024 Investor PresentationDocument73 pages2023 07 q1-2024 Investor PresentationtsasidharNo ratings yet

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Document62 pagesConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILNo ratings yet

- Revenues & Earnings: All Figures in US$ MillionDocument4 pagesRevenues & Earnings: All Figures in US$ MillionenzoNo ratings yet

- QR September 2009 VILDocument3 pagesQR September 2009 VILsamarth6665No ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Performance of Infosys For The Third Quarter Ended December 31Document33 pagesPerformance of Infosys For The Third Quarter Ended December 31ubmba06No ratings yet

- Persistent Systems - 33rd Annual Report 2022-23Document2 pagesPersistent Systems - 33rd Annual Report 2022-23Ashwin GophanNo ratings yet

- Inari Financial Result Q2 FY2024Document18 pagesInari Financial Result Q2 FY2024GZHNo ratings yet

- Financial Section - Annual2019-08Document11 pagesFinancial Section - Annual2019-08AbhinavHarshalNo ratings yet

- Standalone Profit & Loss Account: Profitability On Stock Price With Reference To NiftyDocument3 pagesStandalone Profit & Loss Account: Profitability On Stock Price With Reference To Niftyneekuj malikNo ratings yet

- Investor Presentation 30.09.2023Document30 pagesInvestor Presentation 30.09.2023amitsbhatiNo ratings yet

- Financial HighlightsDocument4 pagesFinancial HighlightsmomNo ratings yet

- Shoppers Stop Financial Model - 24july2021Document23 pagesShoppers Stop Financial Model - 24july2021ELIF KOTADIYANo ratings yet

- Aptech Equity Research: Key Financial FiguresDocument7 pagesAptech Equity Research: Key Financial FiguresshashankNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Analyst Presentation (Mar 10)Document32 pagesAnalyst Presentation (Mar 10)agarwalomNo ratings yet

- Dividend Payout Ration On EPS CalculationDocument2 pagesDividend Payout Ration On EPS CalculationvanishaNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Sunpharma EditedDocument6 pagesSunpharma EditedBerkshire Hathway coldNo ratings yet

- Persistent Systems - 31st Annual Report 2020-21Document2 pagesPersistent Systems - 31st Annual Report 2020-21Ashwin GophanNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Ratio Analysis - CEAT Tyres LTDDocument18 pagesRatio Analysis - CEAT Tyres LTDagrawal.ace911450% (2)

- CFLB Annual Report 31 03 2020Document172 pagesCFLB Annual Report 31 03 2020pasanNo ratings yet

- 2023 1 q2 2024 Investor PresentationDocument73 pages2023 1 q2 2024 Investor Presentationjyotiguptapr7991No ratings yet

- Icici 1Document2 pagesIcici 1AishwaryaSushantNo ratings yet

- Sag Annual Report 2016 e Data PDFDocument184 pagesSag Annual Report 2016 e Data PDFÁkos SlezákNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- H1 / Q2-Fy19 Earnings Presentation: Everest Industries LimitedDocument27 pagesH1 / Q2-Fy19 Earnings Presentation: Everest Industries LimitedMahamadali DesaiNo ratings yet

- Team7 FMPhase2 Trent SENIORSDocument75 pagesTeam7 FMPhase2 Trent SENIORSNisarg Rupani100% (1)

- Fact Sheet Q1 2022Document10 pagesFact Sheet Q1 2022VijayNo ratings yet

- Ind-Swift LabsDocument44 pagesInd-Swift Labssingh66222No ratings yet

- Cipla Financial RatiosDocument2 pagesCipla Financial RatiosNEHA LALNo ratings yet

- Lloyds Banking Group PLC 2017 Q1 RESULTSDocument33 pagesLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- Q2 2001 02 Presentation FinalDocument34 pagesQ2 2001 02 Presentation Finalnemi90No ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- 1 - BK - Can Fin HomesDocument9 pages1 - BK - Can Fin HomesGirish Raj SankunnyNo ratings yet

- Company DataDocument10 pagesCompany DataAvengers HeroesNo ratings yet

- Profitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089Document19 pagesProfitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089PradeepNo ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- Verbio GB 2019 ENDocument132 pagesVerbio GB 2019 ENNitin KurupNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- Balkrishna Industries LTD: Investor Presentation February 2020Document30 pagesBalkrishna Industries LTD: Investor Presentation February 2020PIBM MBA-FINANCENo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Financial Performance Trend: Sno - ParticularsDocument2 pagesFinancial Performance Trend: Sno - ParticularsASHOK JAINNo ratings yet

- Employee Sentiment Analysis During Divestment of Public Sector Enterprises: A Case Study of Bharat Pumps & Compressors LTDDocument14 pagesEmployee Sentiment Analysis During Divestment of Public Sector Enterprises: A Case Study of Bharat Pumps & Compressors LTDASHOK JAINNo ratings yet

- Unit: in Crores Civil Total Shop Production Sub Contracting Including OS Purchase Resold/ Dd/Boi Erection/ Services/ Engineering/ SAS PVC/ AS/OtrsDocument10 pagesUnit: in Crores Civil Total Shop Production Sub Contracting Including OS Purchase Resold/ Dd/Boi Erection/ Services/ Engineering/ SAS PVC/ AS/OtrsASHOK JAINNo ratings yet

- Fundamental of Statistics Lecture-IDocument14 pagesFundamental of Statistics Lecture-IASHOK JAINNo ratings yet

- Turnover Programme (Physical)Document17 pagesTurnover Programme (Physical)ASHOK JAINNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- International Public Sector Accounting Standard 32 Service Concession Arrangements: Grantor IPSASB Basis For ConclusionsDocument8 pagesInternational Public Sector Accounting Standard 32 Service Concession Arrangements: Grantor IPSASB Basis For ConclusionsJoeJoeyNo ratings yet

- Bingo Year 2008 FinancialsDocument436 pagesBingo Year 2008 FinancialsMike DeWineNo ratings yet

- Firestone Ans-MergedDocument18 pagesFirestone Ans-MergedVincent ChanNo ratings yet

- Overview of Hospitality IndustryDocument18 pagesOverview of Hospitality IndustryArinj MathurNo ratings yet

- Moam - Info - Dutch Lady Milk Industries BHD Fundamental Company - 5a2b9a751723ddd761d6833bDocument6 pagesMoam - Info - Dutch Lady Milk Industries BHD Fundamental Company - 5a2b9a751723ddd761d6833bImran KhaniNo ratings yet

- 2022 - ISB-MADM-Session 1-Chapters 1-3, 4 (P. 116-118, 132-133) - RevisedDocument41 pages2022 - ISB-MADM-Session 1-Chapters 1-3, 4 (P. 116-118, 132-133) - Revisedtushar gsNo ratings yet

- ReflectionDocument1 pageReflectionLindbergh SyNo ratings yet

- Ratio Analysis Al Anwar Ceramic Tiles SAOG CoDocument16 pagesRatio Analysis Al Anwar Ceramic Tiles SAOG CoDevender SharmaNo ratings yet

- Jbie Patrick,+37+ +IBA+Sahni+JasrianiDocument11 pagesJbie Patrick,+37+ +IBA+Sahni+JasrianiGina AnindithaNo ratings yet

- R25 Financial Reporting Quality IFT NotesDocument20 pagesR25 Financial Reporting Quality IFT Notesmd mehmoodNo ratings yet

- Cost ManagementDocument41 pagesCost ManagementKang JoonNo ratings yet

- 7 Final Accounts of CompaniesDocument15 pages7 Final Accounts of CompaniesAakshi SharmaNo ratings yet

- Company Analysis Report On (Hindustan Oil Exploration Company LTD)Document33 pagesCompany Analysis Report On (Hindustan Oil Exploration Company LTD)balaji bysaniNo ratings yet

- Multiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationDocument34 pagesMultiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationJay GalleroNo ratings yet

- Annual Report AnalysisDocument257 pagesAnnual Report AnalysisvinaymathewNo ratings yet

- Chapter 6 NotesDocument3 pagesChapter 6 NotesJay-P100% (1)

- Coursepack Basic AccountingDocument61 pagesCoursepack Basic Accountingdeepak singhalNo ratings yet

- The Siaya County Finance Bill Draft, 2024Document83 pagesThe Siaya County Finance Bill Draft, 2024inyasiNo ratings yet

- Fcma - 2011Document85 pagesFcma - 2011Ashish Kumar AnnepuNo ratings yet

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocument13 pagesCHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDanica PobleteNo ratings yet

- 1 Roxas Vs CTA Tax CaseDocument12 pages1 Roxas Vs CTA Tax CaseMargarette Pinkihan SarmientoNo ratings yet

- A Conceptual Framework For Financial Accounting and ReportingDocument37 pagesA Conceptual Framework For Financial Accounting and ReportingIsfanda DeviNo ratings yet

- Analysis Paper iBizSimDocument19 pagesAnalysis Paper iBizSimcharu.chopra3237No ratings yet

- Prepared For: Lecturer's Name: Ms. Najwatun Najah BT Ahmad SupianDocument8 pagesPrepared For: Lecturer's Name: Ms. Najwatun Najah BT Ahmad SupianBrute1989No ratings yet

- Banking Primer 1Document54 pagesBanking Primer 1vouzvouz7127100% (1)

- Practical Accounting Two PDFDocument35 pagesPractical Accounting Two PDFDea Lyn Bacula100% (1)

- Module 33.1 - MAS - Management AccountingDocument39 pagesModule 33.1 - MAS - Management AccountingRafael Renz DayaoNo ratings yet

- Retail 50 FreeDocument11 pagesRetail 50 FreeCassandra Stapelberg100% (1)

Financial Performance Trend: Sno. Particulars

Financial Performance Trend: Sno. Particulars

Uploaded by

ASHOK JAIN0 ratings0% found this document useful (0 votes)

7 views2 pagesThe document shows financial performance trends for a company from 2017-18 to 2020-21. Several key financial ratios declined from 2019-20 to 2020-21, with return on net worth at -9.62%, return on capital employed at -14.45%, and EBIDTA margin at -16.97%. Revenue also declined, with the power segment dropping from ₹14,960 crore in 2019-20 to ₹11,386 crore in 2020-21. Per-share metrics like earnings per share and net worth per share also declined in 2020-21 compared to the previous year.

Original Description:

Original Title

dxdx

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows financial performance trends for a company from 2017-18 to 2020-21. Several key financial ratios declined from 2019-20 to 2020-21, with return on net worth at -9.62%, return on capital employed at -14.45%, and EBIDTA margin at -16.97%. Revenue also declined, with the power segment dropping from ₹14,960 crore in 2019-20 to ₹11,386 crore in 2020-21. Per-share metrics like earnings per share and net worth per share also declined in 2020-21 compared to the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesFinancial Performance Trend: Sno. Particulars

Financial Performance Trend: Sno. Particulars

Uploaded by

ASHOK JAINThe document shows financial performance trends for a company from 2017-18 to 2020-21. Several key financial ratios declined from 2019-20 to 2020-21, with return on net worth at -9.62%, return on capital employed at -14.45%, and EBIDTA margin at -16.97%. Revenue also declined, with the power segment dropping from ₹14,960 crore in 2019-20 to ₹11,386 crore in 2020-21. Per-share metrics like earnings per share and net worth per share also declined in 2020-21 compared to the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

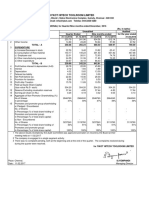

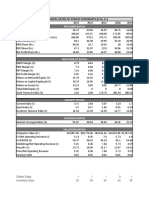

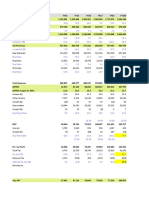

Financial Performance Trend

Sno. Particulars Units 2020-21 2019-20 2018-19 2017-18

XII Financial Performance Ratios

1 Return on Net worth % (9.62) (4.82) 3.76 2.48

2 Return on capital Employed % (14.45) (0.59) 8.43 6.38

3 EBIDTA margin % (16.97) 1.70 9.55 9.43

4 Operating Profit margin % (23.01) (5.79) 4.50 3.09

5 Revenue per employee ₹ in lakh 51 61 83 74

6 Revenue per rupee of employee benefit expenses ₹ 3.03 3.78 5.35 4.71

XIII Balance Sheet Ratios

1 Current ratio Ratio 1.39 1.45 1.67 1.92

2 Cash Collection as % of Revenue (excl. Advances) % 123 120 91 85

3 % liquidation of current year net billing % 82 73 59 56

4 Trade receivable (no. of days) Days 134 175 165 192

5 Inventory (no. of days) Days 161 159 97 79

6 Assets Turnover Times 0.29 0.34 0.46 0.44

XIV Contribution to exchequer ₹ in crore 2948 3999 5732 4682

XV Per Share data

1 Earning per share (₹) (7.80) (4.23) 3.33 2.20

2 Net worth per share (₹) 76.06 83.80 90.27 88.90

3 Market Price per share (BSE) as at year end (₹) 48.75 20.80 74.90 81.40

4 Market Price to Book Value Ratio 0.64 0.25 0.83 0.92

XVI Segment Revenue

Power Segment ₹ in crore 11386 14960 23474 22881

Industry Segment ₹ in crore 4910 5530 5949 4969

Total ₹ in crore 16296 20491 29423 27850

Segment Share

Power Segment % 70 73 80 82

Industry Segment % 30 27 20 18

I Previous year's figures have been regrouped / rearranged, wherever considered necessary.

II Turnover and Revenue from operations excludes Goods & Services Tax.

III year.

IV Equity share capital at the end of FY 2018-19 is post buyback in January

Bonus shares were issued in 2017-18 in the ratio of 1:2. Earning per share & Net worth per share for 2016-17 have been reinstated

V post bonus issue.

Notes:

1 EBIT = PBT+Finance cost

2 EBITDA = EBIT+Depreciation & Amortisation

3 Capital employed=Net Worth-capital WIP & Intangible Assets under development -Deferred tax

Return on Net worth = (PAT/Average Net Worth excld.

4 OCI)*100

5 Return on capital Employed = EBIT/Capital Employed*100

6 EBIDTA Margin % = EBIDTA/Revenue *100

7 Operating Profit Margin = Operating profit/Revenue from operations*100

8 Cash Collection as % of Revenue = Cash Collection excl. Advances/

9 Revenue

10 GST)

11 Inventory (no. of days) = Inventory *365/Revenue

12 Assets Turnover = Revenue/Total Assets

You might also like

- ACC106 Financial Statements Worked ExampleDocument4 pagesACC106 Financial Statements Worked Examplegiafazirah100% (6)

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- The Colombo Fort Land & Building PLC: Annual Report 2020/21Document156 pagesThe Colombo Fort Land & Building PLC: Annual Report 2020/21sandun suranjanNo ratings yet

- Factsheet q4 2016 FinalDocument9 pagesFactsheet q4 2016 FinaltambreadNo ratings yet

- Group 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Document20 pagesGroup 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Reeja Mariam MathewNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Tar2016e FRDocument84 pagesTar2016e FRAchmad Rifaie de JongNo ratings yet

- Ferozsons Annual Report 2018Document191 pagesFerozsons Annual Report 2018Muhammad YamanNo ratings yet

- 2023 07 q1-2024 Investor PresentationDocument73 pages2023 07 q1-2024 Investor PresentationtsasidharNo ratings yet

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Document62 pagesConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILNo ratings yet

- Revenues & Earnings: All Figures in US$ MillionDocument4 pagesRevenues & Earnings: All Figures in US$ MillionenzoNo ratings yet

- QR September 2009 VILDocument3 pagesQR September 2009 VILsamarth6665No ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Performance of Infosys For The Third Quarter Ended December 31Document33 pagesPerformance of Infosys For The Third Quarter Ended December 31ubmba06No ratings yet

- Persistent Systems - 33rd Annual Report 2022-23Document2 pagesPersistent Systems - 33rd Annual Report 2022-23Ashwin GophanNo ratings yet

- Inari Financial Result Q2 FY2024Document18 pagesInari Financial Result Q2 FY2024GZHNo ratings yet

- Financial Section - Annual2019-08Document11 pagesFinancial Section - Annual2019-08AbhinavHarshalNo ratings yet

- Standalone Profit & Loss Account: Profitability On Stock Price With Reference To NiftyDocument3 pagesStandalone Profit & Loss Account: Profitability On Stock Price With Reference To Niftyneekuj malikNo ratings yet

- Investor Presentation 30.09.2023Document30 pagesInvestor Presentation 30.09.2023amitsbhatiNo ratings yet

- Financial HighlightsDocument4 pagesFinancial HighlightsmomNo ratings yet

- Shoppers Stop Financial Model - 24july2021Document23 pagesShoppers Stop Financial Model - 24july2021ELIF KOTADIYANo ratings yet

- Aptech Equity Research: Key Financial FiguresDocument7 pagesAptech Equity Research: Key Financial FiguresshashankNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Analyst Presentation (Mar 10)Document32 pagesAnalyst Presentation (Mar 10)agarwalomNo ratings yet

- Dividend Payout Ration On EPS CalculationDocument2 pagesDividend Payout Ration On EPS CalculationvanishaNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Sunpharma EditedDocument6 pagesSunpharma EditedBerkshire Hathway coldNo ratings yet

- Persistent Systems - 31st Annual Report 2020-21Document2 pagesPersistent Systems - 31st Annual Report 2020-21Ashwin GophanNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Ratio Analysis - CEAT Tyres LTDDocument18 pagesRatio Analysis - CEAT Tyres LTDagrawal.ace911450% (2)

- CFLB Annual Report 31 03 2020Document172 pagesCFLB Annual Report 31 03 2020pasanNo ratings yet

- 2023 1 q2 2024 Investor PresentationDocument73 pages2023 1 q2 2024 Investor Presentationjyotiguptapr7991No ratings yet

- Icici 1Document2 pagesIcici 1AishwaryaSushantNo ratings yet

- Sag Annual Report 2016 e Data PDFDocument184 pagesSag Annual Report 2016 e Data PDFÁkos SlezákNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- H1 / Q2-Fy19 Earnings Presentation: Everest Industries LimitedDocument27 pagesH1 / Q2-Fy19 Earnings Presentation: Everest Industries LimitedMahamadali DesaiNo ratings yet

- Team7 FMPhase2 Trent SENIORSDocument75 pagesTeam7 FMPhase2 Trent SENIORSNisarg Rupani100% (1)

- Fact Sheet Q1 2022Document10 pagesFact Sheet Q1 2022VijayNo ratings yet

- Ind-Swift LabsDocument44 pagesInd-Swift Labssingh66222No ratings yet

- Cipla Financial RatiosDocument2 pagesCipla Financial RatiosNEHA LALNo ratings yet

- Lloyds Banking Group PLC 2017 Q1 RESULTSDocument33 pagesLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- Q2 2001 02 Presentation FinalDocument34 pagesQ2 2001 02 Presentation Finalnemi90No ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- 1 - BK - Can Fin HomesDocument9 pages1 - BK - Can Fin HomesGirish Raj SankunnyNo ratings yet

- Company DataDocument10 pagesCompany DataAvengers HeroesNo ratings yet

- Profitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089Document19 pagesProfitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089PradeepNo ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- Verbio GB 2019 ENDocument132 pagesVerbio GB 2019 ENNitin KurupNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- Balkrishna Industries LTD: Investor Presentation February 2020Document30 pagesBalkrishna Industries LTD: Investor Presentation February 2020PIBM MBA-FINANCENo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Financial Performance Trend: Sno - ParticularsDocument2 pagesFinancial Performance Trend: Sno - ParticularsASHOK JAINNo ratings yet

- Employee Sentiment Analysis During Divestment of Public Sector Enterprises: A Case Study of Bharat Pumps & Compressors LTDDocument14 pagesEmployee Sentiment Analysis During Divestment of Public Sector Enterprises: A Case Study of Bharat Pumps & Compressors LTDASHOK JAINNo ratings yet

- Unit: in Crores Civil Total Shop Production Sub Contracting Including OS Purchase Resold/ Dd/Boi Erection/ Services/ Engineering/ SAS PVC/ AS/OtrsDocument10 pagesUnit: in Crores Civil Total Shop Production Sub Contracting Including OS Purchase Resold/ Dd/Boi Erection/ Services/ Engineering/ SAS PVC/ AS/OtrsASHOK JAINNo ratings yet

- Fundamental of Statistics Lecture-IDocument14 pagesFundamental of Statistics Lecture-IASHOK JAINNo ratings yet

- Turnover Programme (Physical)Document17 pagesTurnover Programme (Physical)ASHOK JAINNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- International Public Sector Accounting Standard 32 Service Concession Arrangements: Grantor IPSASB Basis For ConclusionsDocument8 pagesInternational Public Sector Accounting Standard 32 Service Concession Arrangements: Grantor IPSASB Basis For ConclusionsJoeJoeyNo ratings yet

- Bingo Year 2008 FinancialsDocument436 pagesBingo Year 2008 FinancialsMike DeWineNo ratings yet

- Firestone Ans-MergedDocument18 pagesFirestone Ans-MergedVincent ChanNo ratings yet

- Overview of Hospitality IndustryDocument18 pagesOverview of Hospitality IndustryArinj MathurNo ratings yet

- Moam - Info - Dutch Lady Milk Industries BHD Fundamental Company - 5a2b9a751723ddd761d6833bDocument6 pagesMoam - Info - Dutch Lady Milk Industries BHD Fundamental Company - 5a2b9a751723ddd761d6833bImran KhaniNo ratings yet

- 2022 - ISB-MADM-Session 1-Chapters 1-3, 4 (P. 116-118, 132-133) - RevisedDocument41 pages2022 - ISB-MADM-Session 1-Chapters 1-3, 4 (P. 116-118, 132-133) - Revisedtushar gsNo ratings yet

- ReflectionDocument1 pageReflectionLindbergh SyNo ratings yet

- Ratio Analysis Al Anwar Ceramic Tiles SAOG CoDocument16 pagesRatio Analysis Al Anwar Ceramic Tiles SAOG CoDevender SharmaNo ratings yet

- Jbie Patrick,+37+ +IBA+Sahni+JasrianiDocument11 pagesJbie Patrick,+37+ +IBA+Sahni+JasrianiGina AnindithaNo ratings yet

- R25 Financial Reporting Quality IFT NotesDocument20 pagesR25 Financial Reporting Quality IFT Notesmd mehmoodNo ratings yet

- Cost ManagementDocument41 pagesCost ManagementKang JoonNo ratings yet

- 7 Final Accounts of CompaniesDocument15 pages7 Final Accounts of CompaniesAakshi SharmaNo ratings yet

- Company Analysis Report On (Hindustan Oil Exploration Company LTD)Document33 pagesCompany Analysis Report On (Hindustan Oil Exploration Company LTD)balaji bysaniNo ratings yet

- Multiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationDocument34 pagesMultiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationJay GalleroNo ratings yet

- Annual Report AnalysisDocument257 pagesAnnual Report AnalysisvinaymathewNo ratings yet

- Chapter 6 NotesDocument3 pagesChapter 6 NotesJay-P100% (1)

- Coursepack Basic AccountingDocument61 pagesCoursepack Basic Accountingdeepak singhalNo ratings yet

- The Siaya County Finance Bill Draft, 2024Document83 pagesThe Siaya County Finance Bill Draft, 2024inyasiNo ratings yet

- Fcma - 2011Document85 pagesFcma - 2011Ashish Kumar AnnepuNo ratings yet

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocument13 pagesCHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDanica PobleteNo ratings yet

- 1 Roxas Vs CTA Tax CaseDocument12 pages1 Roxas Vs CTA Tax CaseMargarette Pinkihan SarmientoNo ratings yet

- A Conceptual Framework For Financial Accounting and ReportingDocument37 pagesA Conceptual Framework For Financial Accounting and ReportingIsfanda DeviNo ratings yet

- Analysis Paper iBizSimDocument19 pagesAnalysis Paper iBizSimcharu.chopra3237No ratings yet

- Prepared For: Lecturer's Name: Ms. Najwatun Najah BT Ahmad SupianDocument8 pagesPrepared For: Lecturer's Name: Ms. Najwatun Najah BT Ahmad SupianBrute1989No ratings yet

- Banking Primer 1Document54 pagesBanking Primer 1vouzvouz7127100% (1)

- Practical Accounting Two PDFDocument35 pagesPractical Accounting Two PDFDea Lyn Bacula100% (1)

- Module 33.1 - MAS - Management AccountingDocument39 pagesModule 33.1 - MAS - Management AccountingRafael Renz DayaoNo ratings yet

- Retail 50 FreeDocument11 pagesRetail 50 FreeCassandra Stapelberg100% (1)